|

As Singapore eases border restrictions, the high-end market could see a return of buying activity judging by two project launches in the prime area. By Khalil Adis If 2021 is the year for HDB resale flats and mass market condominiums, 2022 could finally see Singapore’s high-end market picking up. That is the prediction among property developer TSky Cairnhill Pte Ltd who will officially launch Cairnhill 16 to prospective homebuyers and investors on 27 November 2021. This comes as Singapore eases border restrictions for quarantine-free travel and as the country adjusts to a “new normal” of living with Covid-19. “We believe that demand for Singapore residential property will gradually return as the country remains a safe haven for property investment,” said Edward Ang, executive chairman, Ocean Sky International. As such, next year could possibly see the return of buying activity among wealthy foreign investors in the somewhat lacklustre prime area of Singapore. Located on the former site of Cairnhill Heights at 16 Cairnhill Rise, Cairnhill 16 was sold through a collective sale to TSky in 2018. TSky Cairnhill is owned by TSky Development Pte Ltd, Ocean City Global Limited, Seacare Property Development Pte Ltd and Min Ghee Investment (2018) Pte Ltd. TSky Development is, in turn, a joint-venture between Singapore-listed Tiong Seng Holdings and Ocean Sky International. Two new launches in the CCR in the fourth quarter of 2021 Cairnhill 16, a freehold development, is among one of two noteworthy launches in the fourth quarter of 2021 that are located within the Core Central Region (CCR). The other project is Canninghill Piers, a 99-year-leasehold development located within the Clarke Quay area that is jointly developed by CapitaLand and City Developments Limited (CDL). Both projects start from more than $2,500 per sq ft, the bench mark price for the top-end of the property market, appears to signify that developers are somewhat confident in an upswing in buying activities in the luxury market. Cairnhill 16’s indicative launch prices are expected to start from around $2,789 per sq ft. Nestled within the tranquil Cairnhill area, Cairnhill 16 will feature 39 limited hilltop luxury residences that will be served with private lift access and smart home features. Sited within a 15-storey residential tower at a quiet cul-de-sac, Cairnhill 16 will comprise 13 two-bedroom units, 13 three-bedroom units, 9 three-bedroom plus study units and 4 four-bedroom units. At the media preview, held on 11 November 2021, the developer showcased the high-end finishes prospective buyers can expect as seen at its sales gallery such as imported kitchen cabinets and designer appliances from V-Zug and Grohe. With a minimum ceiling height of 3.6 metres and up to 4.6 metres on the top floor, Cairnhill 16 is all about making a grand entrance. Cairnhill 16's unit sizes will range from 775 sq ft to 1,744 sq ft. The indicative launch prices for a two-bedroom unit will start from $2.2 million while its three-bedroom, three-bedroom plus study and four-bedroom units will start from $2.9 million, $3.6 and $5.7 million respectively. Located within a stone throw’s away from Orchard Road, Newton MRT station, the medical hub of Mount Elizabeth Hospital and Paragon Medical Centre as well as several good schools such as Anglo-Chinese School (Junior) and St Margaret’s Primary School, Cairnhill has always been a perennial favourite among wealthy local and foreign investors who are attracted to its unparalleled location. This is exactly the niche market that TSky Cairnhill Pte Ltd is hoping to bank on. “I am positive on the property market. With our vaccination plans all fully executed and our policy of opening up the borders, this will certainly help. The Cairnhill area has been traditionally known to be an Indonesian area. Of late, we have seen many Chinese buyers come in and regional buyers,” said Ang. With the easing of travel restrictions and the introduction of more Vaccinated Travel Lanes (VTLs) being introduced, Ang is confident many of such buyers will return to the market. “Singapore has positioned itself as a stable and safe haven for investment, whether it is for financial or real estate investment. I think this will attract foreigners to really have the confidence to put their investment dollar in Singapore,” he said. Meanwhile, Canninghill Piers is an integrated development that will start from around $2,721 per sq ft. Located on the former Liang Court site, Canninghill Piers will feature a hotel, commercial units, a serviced residence and two residential towers comprising around 700 apartments. However, unlike Cairnhill 16, Canninghill Piers will enjoy direct connectivity to Fort Canning MRT station linking residents to the Downtown Line (DTL). Buying activity in prime areas have been lagging behind other areas on the island The exodus of expatriates and border closure arising from the pandemic had impacted the high-end market. Meanwhile, other areas on the island continued to remain resilient. Data from the Urban Redevelopment Authority (URA) appears to confirm this. For instance, its third quarter of 2021 data showed that prices of non-landed properties in the Core Central Region (CCR) decreased by 0.5 per cent in the third quarter, compared with the 1.1 per cent increase in the previous quarter. In comparison, prices of non-landed properties in the Rest of Central Region (RCR) increased by 2.6 per cent, compared with the 0.1 per cent increase in the previous quarter. Meanwhile, prices of non-landed properties in the Outside Central Region (OCR) decreased by 0.1 per cent, compared with the 1.9 per cent increase in the previous quarter. This suggests that buying activity in the prime areas of Orchard, Newton and the core city centre had remained somewhat lukewarm. Echoing a similar sentiment is Pek Zhi Kai, executive director, for Tiong Seng Group. “Buying in the luxury market segment, particularly within the Core Central Region, has not been as exciting as the Outside Central Region. That’s why so far the measures that we have heard of largely, they come in the form that public housing remains affordable and mass market housing remains affordable. Whereas, the Core Central Region has been somewhat muted over the last couple of years or so. It is not going to attract that many measures. It is just making sure that this market will still remain buoyant rather than depressed,” he said. Cooling measure unlikely Overall, the Private Property Index (PPI) is now at a record high of 165.1 points with prices of private residential properties increasing by 1.1 per cent in the third quarter of 2021, compared with the 0.8 per cent increase in the previous quarter.

This will likely surge ahead in the fourth quarter of 2021 as borders start to reopen. Moving forward, market watchers say despite the record-breaking index, they do not think the government will likely announce cooling measures. “I think cooling measures may not kick in. I think it will be a more targeted approach whereby housing remains sustainable and within reach for Singaporeans. With this as an end goal, for the current market itself, I don’t necessarily think the cooling measures will be coming in now,” said Pek. Meanwhile, investors say while they welcome the anticipated return of the luxury market, ultimately, they are still looking for the best deals. One such investor is Singaporean James Tan who is watching the market closely. “The price point at above $2,500 per sq ft is similar or almost higher to the level we saw before Covid-19. Although I am looking to pay in cash, I think the price right now is rather high. I may wait further till I see a good deal in the market,” he said. Ang also agrees that the property market has defied expectations despite Covid-19 noting that construction costs had increased significantly “due to rising construction and commodities costs." “In terms of prices, we can see that even during the Covid-19 period, prices have been steadily climbing. We hope that prices will continue to see a steady yet sustainable climb,” he said.

0 Comments

Resale private property and HDB flat prices continue to surge ahead as demand outstrips supply. Meanwhile, rentals are also on the rise. By Khalil Adis Like most first-time property buyers in Singapore, Farhan (not his real name) and his wife are frustrated with the long delays in the construction sector brought about by COVID-19. The couple got married in 2018 and booked their HDB flat in 2019. However, when COVID-19 struck, they were informed by HDB there is now a possibility they will have to wait up to seven years for the keys to their flat. Cancelling their HDB flat is also not an option as they stand to lose $1,000 in their option fee. “We are stuck in a catch-22 situation. On the one hand, the waiting time of seven years is too long and we do not want to inconvenience my in-laws. On the other hand, prices of HDB resale flats have gone up so much that we have to factor in the cash-over-valuation (COV) which may be up to $50,000. If we include renovation cost, our first home may set us back by up to $100,000,” said Faris. Construction sector buckled under COVID-19 pressure Indeed, COVID-19 has impacted the construction sector with several contractors going under due to travel restrictions and high construction costs. In August 2021, for instance, Greatearth Corporation and Greatearth Construction were among the several contractors that went bust due to financial difficulties. This has resulted in delays of several Built-To-Order (BTO) projects. To minimise the impact, HDB has rolled out various measures to support the construction industry and minimise delays to its projects. “HDB has been working closely with our building contractors, to secure the necessary resources they need to complete their projects, including manpower and material supply. We have also recently introduced additional assistance measures to ease the financial pressures brought about by the pandemic-induced spikes in construction costs, including both manpower and non-manpower costs,” said HDB in a statement. Faris and his wife are among those affected as they had booked an HDB flat in Woodlands. “We surveyed around Woodlands where the resale HDB prices are within our budget. However, most sellers are now asking for COV of up to $50,000,” said Faris. Strong pent-up demand pushing prices upwards for resale HDB and private properties As demand far outstrips supply, this has resulted in record prices in both the HDB and private property markets, surpassing the record prices seen during the peak in the third quarter of 2013. Data from HDB showed that the Resale Price Index (RPI) for the third quarter of 2021 is now 150.6 points. This is an increase of 2.9 per cent over that in the second quarter. Meanwhile, resale transactions rose by 19.4 per cent from 7,063 cases in the second quarter to 8,433 cases in the third quarter of 2021. When compared to the third quarter of 2020, the resale transactions in the third quarter of 2021 were 8.3 per cent higher. 4-room HDB flats in the central area fetched the highest price on the island, transacting at a median price of $950,000 while those in Sembawang was the lowest (at a median transacted price of $417,000). Woodlands, where Faris and his wife, were on the lookout for a 4-room HDB resale flat, recorded a median price of $420,000 - the second-lowest median price for a 4-room HDB flat on the island. Still, as Faris can attest to, the asking price even in the far-flung area of Woodlands is sky-high. “On hindsight, that cash component could be better utilised for our renovation cost as we do not intend to take a loan. After much discussion, we decided to stay put at my in-laws. Thankfully, they were very understanding,” said Faris. Meanwhile, data from the Urban Redevelopment Authority (URA), showed that prices of private residential properties increased by 1.1 per cent in the third quarter of 2021, compared with the 0.8 per cent increase in the previous quarter. Landed properties saw a higher price increase when compared to non-landed properties. They increased by 2.6 per cent in the third quarter of 2021, compared with the 0.3 per cent decrease in the previous quarter. Meanwhile, prices of non-landed properties increased by 0.7 per cent in the third quarter of 2021, compared with the 1.1 per cent increase in the previous quarter. Rentals for HDB flats and private properties are also on the rise The supply crunch has also seen rentals for HDB flats and condominiums rising.

In the past, one can rent a 4-room HDB flat for below $2,000 per month. However, as third quarter data from HDB showed, the median transacted price for 4-room HDB flats in most HDB estates are now above $2,000 per month except for Sembawang ($1,900) and Woodlands ($1,900). In Jurong West, for instance, the median transacted price per month for 4-room HDB flats now stands at $2,150 when it was previously transacted at $2,050 per month in the second quarter of 2021. Meanwhile, in the private property market, URA’s data showed that rentals for private residential properties increased by 1.8 per cent in the third quarter of 2021, compared with the 2.9 per cent increase in the previous quarter. This is also something Ed (not his real name), who is also married, can confirm. He is currently looking for a common room to rent in a condominium was surprised by the high asking price from landlords. “It does not make any sense as people are losing jobs and we do not have many expats coming in yet rentals are going up,” he laments. Ed is also looking to buy an HDB flat but is put off by the high asking price and the long waiting period for BTO flats. “I think I may just rent for one year and wait out till the property market stabilises. However, buying an HDB flat is something definitely on my mind. The timing and pricing are just not right at the moment,” he said. Another couple, Ali and his wife say their landlord is looking to increase their rent for the 2-bedroom condominium they are currently renting in eastern Singapore from $3,000 to $3,200 a month. “Our lease is up for renewal soon. We are still deciding if we should stay put or move on. We love this place as it is close to East Coast Beach. Everywhere else that we looked, landlords are similarly asking for between $3,200 to $3,500,” said Ali. For now, first-time homebuyers like Farhan will have to wait out while rent-seekers like Ed and Ali will have to pay what landlords are currently asking for. While paying for your property using your CPF Ordinary Account (OA) is the default way to finance your home purchase, there are implications that you need to be aware of. By Khalil Adis Buying a property is perhaps the single big-ticket item that we will possibly purchase in our lifetime. As such, it is no wonder most Singaporeans will use their CPF Ordinary Account (OA) towards their property purchase. It makes sense since we have worked so hard and set aside a tidy sum in our CPF. However, there are implications if you wish to use your CPF OA. Here are six things you need to know before committing. #1: Your CPF OA will be (almost) wiped out when you buy an HDB flat While you can get up to 90 per cent financing when buying an HDB flat, HDB will usually use up your CPF OA towards your flat's purchase. This is to reduce your loan amount and therefore, your monthly mortgage. The good news is you do have the option of keeping $20,000 in your OA to pay for your flat purchase. If you do not have enough, then you will have to pay for it in cash. This is a better option in my opinion which I shall explain later in point number 6. #2: You will be subjected to the MSR and Valuation Limit when buying a resale HDB flat (for HDB loan) If you are taking an HDB loan, do note you will be subjected to the Mortgage Service Ratio (MSR) and Valuation Limit. MSR refers to the portion of a borrower’s gross monthly income that goes towards repaying all property loans. Your MSR is capped at 30 per cent of a borrower's gross monthly income. If your gross monthly income is $5,000, your MSR will be $1,500. Therefore, your monthly mortgage cannot exceed this amount. Your Valuation Limit is the lower of the purchase price or valuation at the time of purchase. Assuming the valuation for the flat and purchase price are the same at $500,000 (which means there is no cash-over-valuation), you can use up to $500,000 in your CPF OA. If you are unable to meet your Basic Retirement Sum (BSR), you will need to pay for your mortgage in cash. You can use CPF's Housing Limit Calculator here. #3: You will be subjected to the MSR, Valuation Limit and Withdrawal Limit when buying a resale HDB flat (for a bank loan) If you are taking a bank loan, do note you will be subjected to the Mortgage Service Ratio (MSR), Valuation Limit and Withdrawal Limit. Assuming the valuation for the flat and purchase price are the same at $500,000 (which means there is no cash-over-valuation), your Valuation Limit is $500,000. For a bank loan, you will be subjected to Withdrawal Limit which is 120 per cent of the Valuation Limit. This means you can use up to $600,000 in your CPF OA towards your flat purchase. If you are unable to meet your BSR, you will need to pay for your mortgage in cash. #4: You will be subjected to the TDSR, Valuation Limit and Withdrawal Limit when buying a private property If you are taking a bank loan, do note you will be subjected to the Total Debt Service Ratio (TDSR), Valuation Limit and Withdrawal Limit. Your TDSR should be less than or equal to 60 per cent. Assuming you have a gross monthly income of $5,000 with a total monthly debt of $1,000, this is your TDSR: $1,000/$5,000 x 100% = 20% Assuming the valuation for the private property and purchase price are the same at $1 million (which means there is no cash-over-valuation), your Valuation Limit is $1 million. For a bank loan, you will be subjected to Withdrawal Limit which is 120 per cent of the Valuation Limit. This means you can use up to $1.2 million in your CPF OA towards your private property purchase. If you are unable to meet your BSR, you will need to pay your mortgage in cash. Do note, your monthly mortgage and monthly debt cannot exceed more than 60 per cent of your TDSR. #5: Pro-rated CPF usage for properties with less than 60 years of lease Why are older HDB flats or private properties seeing their value diminishing? This is because their value will revert to zero towards the end of the lease. They are also subjected to a pro-rated CPF usage if their lease is less than 60 years. This makes them harder to sell as it limits the pool of buyers who can buy such properties. Let us assume the following: Remaining Lease: 50 years Youngest Buyer Age: 35 years old HDB Flat Price: $400,000 The formula to calculate the pro-rated CPF usage is as follows: Remaining Lease of Property – 20 / 95 - Age of Youngest Buyer Using CPF - 20 50 - 20 / 95 - 35 - 20 = 30/40 Valuation Limit = 0.75 CPF Usage = 75% x $400,000 = $300,000 For a bank loan, you will be subjected to Withdrawal Limit which is 120 per cent of the Valuation Limit which is $360,000. #6: CPF amount used with accrued interest needs to be refunded to your Ordinary Account when selling your property Most people prefer to use their CPF OA when paying for their monthly mortgage.

In fact, this seems to be the default way to finance our home purchase. However, there are some repercussions that you need to be aware of. When you sell your property, the CPF amount used with accrued interest needs to be refunded to your CPF OA. As such, this may result in fewer cash proceeds or even a negative sale when you sell your property. Let us assume the following: Property’s selling price: $600,000 Property’s purchase price: $500,000 CPF amount used with accrued interest: $300,000 Outstanding loan:$200,000 Sales proceeds: $600,000 - $300,000 - $200,000 = $100,000 Do note, this does not include your legal/conveyancing fees, agent’s commission and other miscellaneous costs. Conclusion As you can see, paying for your property using your CPF OA may reduce your cash proceeds or even result in a negative sale when deducting all the expenses. They say cash is king. So perhaps paying for your monthly mortgage in cash is not such a bad thing after all. Cooling measures may be implemented if the trend were to continue. Here are 5 things consumers should watch out for. By Khalil Adis Singapore’s property market continued to defy expectations in both the private and public sectors increasing by 3.0 and 3.3 per cent quarter-on-quarter respectively in the first quarter of 2021, data from the Urban Redevelopment Authority (URA) and Housing & Development Board (HDB) showed. Private residential prices soared for the third consecutive quarter growth since the third quarter of 2020 to reach 162.2 percentage points, while resale HDB prices have been on the uptrend since the second quarter of 2020 at 142.2 percentage points. If this trend were to continue, the prices for resale HDB flats may soon hit or surpass the peak that was recorded in the second quarter of 2013. Meanwhile, in the private property sector, the landed property segment has bucked the trend registering a price increase of 6.7 per cent in the first quarter of 20201 compared with the 1.6 per cent decrease in the previous quarter. For the non-landed segment, properties that are located in the Rest of Central Region (RCR) took the lead, increasing by 6.1 per cent followed by those that are located in Outside Central Region (OCR) and Core Central Region (CCR) registering a 1.1 per cent and 0.5 per cent increase respectively. For the rental market, rentals of private residential properties increased by 2.2 per cent in the first quarter of 2021, compared with the 0.1 per cent increase in the previous quarter. Meanwhile, in the HDB rental market, the number of approved applications to rent out HDB flats rose by 26.0 per cent, from the 8,472 cases recorded in the fourth quarter of 2020 to 10,676 cases in the first quarter of 2021. The upbeat market has prompted speculations that property cooling measures may be announced this year should prices continue to reach an unsustainable level. We dissect Singapore’s property market data for the first quarter of 2021 and what they will mean for you as a consumer. #1: Sellers’ market with potentially high cash-over-valuation in the HDB market Built-To-Order (BTO) flats now have a waiting period of up to seven years due to construction delays brought upon by Covid-19. As 80 per cent of Singapore’s population live in HDB flats, the tight supply for new launches will divert potential homebuyers to look for resale HDB flats instead. This explains why the HDB Resale Price Index (RPI) has been on the uptrend for the fourth consecutive quarter. Looking ahead, this could drive up the cash-over-valuation (COV) and may see the RPI surpassing the peak that was recorded in the second quarter of 2013. For prospective home sellers, this could be an opportune time to sell your property. HDB resale flats from newly MOP-ed (met their 5-year Minimum Occupation Period) such as those in Punggol and Sengkang are expected to see brisk demand. We are also likely to see potential homebuyers having to shell out more cash for the COV as demand far outstrips supply. #2: HDB upgraders may want to think twice With the buoyant HDB resale market, many might be thinking of cashing out and moving up the property ladder. However, this may not necessarily mean it is a good time to upgrade to a private property. This is because the RPI and the Private Property Index (PPI) have been on the upward trend and are not likely to see their price gap narrowing anytime soon. HDB’s RPI now stands at 142.2 percentage points while the PPI is at 162.2 percentage points. With the tight supply for new launches in the BTO and private property markets, the price indexes for both HDB and private resale properties are likely to surge ahead in the next quarter. So unless you have sufficient cash and/or CPF to finance your next property purchase, it is best to wait out until the new supply for launches come on stream. For those who will still like to take the plunge, do ensure you do a detailed financial calculation as you will be required to come up with a minimum 5 per cent cash downpayment and another 20 per cent in cash and/or CPF. You will also need to take into account the Buyer’s Stamp Duty, conveyancing and agent’s fee. The Buyer’s Stamp Duty will have to paid for in cash first before you can use your CPF Ordinary Account (OA). Also, for those who are hitting 55-years-old this year, do remember that you will have to set aside a Basic Retirement Sum of $93,000 in your Retirement Account before you can touch the rest of your CPF OA. Should the government impose new cooling measures, it may also impact your ability to obtain financing. Last but not least, when buying a private property, you will be subjected to the Total Debt Service Ratio (TDSR), Valuation Limit and Withdrawal Limit. #3: Bright spots ahead for private properties located in the RCR and OCR Why are private properties that are located in the RCR and suburbs (OCR) doing relatively better when compared to those that are in the central region? This is because the profile of buyers here comprises mainly local and HDB upgraders. As the pandemic has shown, the local market has remained fairly resilient due to the tight supply excess liquidity and changes in employment policies to encourage local businesses to hire Singaporeans first as part of the post-pandemic economic recovery. Meanwhile, properties that are located in the central region have been badly affected due to the exodus of expatriates and the Ministry of Manpower’s tightening their criteria when hiring foreign employees. As such, the pool of potential tenants and prospective homebuyers will likely shift towards the local market. This is good news for prospective sellers and landlords. Meanwhile, potential homebuyers will likely see prices for private resale properties increasing at outside the central region and within the suburbs. However, not all is bad. Those thinking of snapping up prized properties on Sentosa Cove or Orchard Road may find some good deals in the market. #4: Tight supply in new launches may favour landlords The rental index of private residential properties has been on the uptrend since the fourth quarter of 2021, data from URA showed. Rentals for private residential properties increased by 2.2 per cent in the first quarter of 2021, compared with the 0.1 per cent increase in the previous quarter. This may suggest that rent-seekers far outnumber landlords. As of the end of the first quarter of 2021, there was a total supply of 48,139 uncompleted private residential units (excluding ECs) in the pipeline with planning approvals, compared with the 49,307 units in the previous quarter. Of this, 21,602 units remained unsold as at the end of the first quarter of 2021, compared with the 24,296 units in the previous quarter. Rent-seekers who are looking for properties in the RCR and OCR may face stiff competition from both locals and foreign tenants. Meanwhile, private properties that are located in the central area may likely see their asking price being reduced as this market has been severely impacted by Covid-19. This is good news for tenants but not for landlords. #5: HDB landlords may want to revise their rental rate for 2021 Likewise, the HDB rental market has seen a spike in their median rents possibly due to the tight supply of new BTO launches and their relative affordability when compared to the private sector.

According to data from HBD, in the first quarter of 2021, the median rents for HDB flats, in general, have seen an increase across the board when compared to the fourth quarter of last year. For landlords that are renewing their lease for 2021, this may be a good time to renegotiate your tenancy agreement with your tenants. Meanwhile, tenants may have to increase their budget slightly in light of the exuberant rental market. Cooling measures could be introduced in both the HDB and private property markets to ensure prices remain in tandem with wages. By Khalil Adis Singapore’s HDB and private property markets have defied expectations amid the pandemic soaring by 5.0 per cent and 2.2 per cent respectively for the whole of 2020, data from HDB and URA showed. In the HDB market, the Resale Price Index (RPI) for the fourth quarter of 2020 is 138.1 representing an increase of 3.1 per cent over the third quarter. HDB flats in the resale market saw transactions fall by 1.9 per cent, from 7,787 cases in the third quarter of 2020 to 7,642 cases in the fourth quarter. However, when compared to the fourth quarter of 2019, the resale transactions in the fourth quarter of this year were 20.6 per cent higher. For the whole year of 2020, HDB’s data showed that resale transactions increased by 4.4 per cent from 23,714 cases to 24,748 cases. Meanwhile, the Property Price Index (PPI) for private residential properties increased by 2.1 per cent in the fourth quarter of 2020, compared with the 0.8 per cent increase in the previous quarter. The resale private property market saw an increase in transactions in the fourth quarter of 2020 with 4,249 homes changing hands compared with the 3,467 units transacted in the previous quarter. Market exuberance was seen for the whole of 2020, with 10,729 resale transactions compared with the 8,949 resale transactions in 2019. For the whole of 2020, prices of private residential properties increased by 2.2 per cent, compared with the 2.7 per cent increase in 2019. Islandwide, for the whole of 2020, non-landed properties proved to be far more resilient increasing by 2.5 per cent while landed properties rose by 1.2 per cent. Non-landed properties in the prime areas which are defined by the Core Central Region (CCR) were the worst performing for the entire 2020, decreasing by 0.4 per cent followed by those in the Rest of Central Region (RCR) and Outside Central Region (OCR) which increased by 4.7 per cent and 3.2 per cent respectively. With this in mind, here are the property market outlook and predictions for 2021: #1: Cooling measures may be introduced The pandemic has seen both the HDB and private property markets performing better than expected. If the trend were to continue, property prices could reach an unsustainable level. As such, the government may introduce a slew of cooling measures to ensure property prices are in line with wages so that buying property remains within reach. This is especially so for first-time homebuyers. The cooling measures could include reducing the loan-to-value (LTV) limit, tweaking the Seller’s Stamp Duty and Additional Buyer’s Stamp Duty (ABSD) and revising the Mortgage Servicing Ratio (MSR) and Total Debt Service Ratio (TDSR). #2: Supply glut in the private property market could soften the resale market URA’s data showed that as at the end of the fourth quarter of 2020, there was a total supply of 49,307 uncompleted private residential units (excluding ECs) in the pipeline with planning approvals compared with the 50,369 units in the previous quarter. Of this number, 24,296 units remained unsold as at the end of the fourth quarter, compared with the 26,483 units in the previous quarter. Such unsold units may result in the softening of the resale market as buyers are spoilt for choice. Sellers who are desperate to offload their properties may cut prices in a bid to draw buyers. #3: Buyers’ market especially in the prime areas In such a scenario, the prime areas located within the CCR as well as in Sentosa Cove will be where the good deals are as these areas are price sensitive and volatile during an economic downturn. This is already confirmed in URA’s fourth quarter of 2020 data which showed that the CCR was the only region which recorded a 0.4 per cent price decline. Meanwhile, the suburban areas in the OCR will remain resilient as the homes here are relatively affordable and dominated by local buyers and HDB upgraders. #4: HDB resale market will remain resilient Speaking of HDB, the resale market is expected to continue remaining fairly resilient. This is because HDB flats are seen as an essential need and is home to 80 per cent of the population. The resale market, particular newly MOP-ed flats (those that have already met the 5-year Minimum Occupation Period), will see strong demand. Sengkang and Punggol will be among the popular estates for HDB resale transactions. #5: New BTO launches in mature estates will be oversubscribed According to HDB, it will offer about 3,700 Build-To-Order (BTO) flats in Bukit Batok, Kallang Whampoa, Tengah and Toa Payoh in its February launch.

This includes the new Community Care Apartments in Bukit Batok. In May 2021, HDB will offer another 3,800 BTO flats in Bukit Merah, Geylang, Tengah and Woodlands. The BTO projects in Kallang Whampoa, Toa Payoh, Bukit Merah and Geylang are expected to be eagerly snapped up and oversubscribed as these are mature estates that are located close to the central area. Punggol and Sengkang are tied at the top spot with 116 transactions recorded last month, followed by Yishun and Tampines trailing behind at 80 and 76 transactions respectively. By Khalil Adis Homeowners in Punggol and Sengkang, hold on tight to your HDB flats (until you get a better offer, that is) as they are the most in-demand HDB estates for September 2020, data from HDB showed. According to 4-room transactions captured on HDB's website, Punggol and Sengkang are tied at number one with 116 transactions recorded last month, followed by Yishun and Tampines in the second and third place at 80 and 76 transactions respectively. In terms of the median transacted price, 4-room HDB flats in Punggol fetched far higher prices at $468,514.97 while Sengkang's figures were $436,909.17. Other HDB estates that made the cut included Bukit Panjang, Hougang, Bedok, Jurong West, Woodlands, Pasir Ris and Ang Mo Kio. Of the 11, six (Punggol, Sengkang, Yishun, Bukit Panjang, Jurong West and Woodlands) are non-mature and five (Tampines, Hougang, Bedok, Pasir Ris and Ang Mo Kio) are mature HDB estates. 4-room flats in Woodlands fetched the lowest median average price at $352,380.60 while those in Punggol fetched the highest at $468,514.97, representing a price difference of 32.96 per cent. HDB estate in northern Singapore (Yishun, Bukit Panjang, Woodlands and Ang Mo Kio) proved to be popular, followed by the north-east (Punggol, Sengkang and Hougang), east (Tampines, Bedok, Pasir Ris) and west (Jurong West). Here is the ranking from the most to least popular HDB estates. #1: Punggol and Sengkang Flat Type: 4 Room HDB Town: Punggol Resale Registration Date: Sep 2020 Total number of records found: 116 (Data as at 4 Oct 2020) Median transacted price: $468,514.97 Flat Type: 4 Room HDB Town: Sengkang Resale Registration Date: Sep 2020 Total number of records found: 116 (Data as at 4 Oct 2020) Median transacted price: $436,909.17 Punggol and Sengkang continue to be popular in the resale market as some sellers seek to offload their HDB flats once they have hit the 5-year Minimum Occupation Period (MOP) while buyers are attracted to the relatively new and better-designed flats. Accessible via the North East Line (NEL), LRT and Tampines Expressway (TPE), both estates have a relatively young population. Data from SingStats showed that Punggol and Sengkang had the highest proportion of children aged below 5 years at 9.9 per cent in 2019. Despite falling to the hands of the opposition during the recently concluded general elections Sengkang has not lost its lustre as HDB's data showed. Meanwhile, Punggol is set to welcome the extension of the Cross Island Line (CRL) that will link it to Pasir Ris by 2031. The 7.3 km line will comprise four stations – Punggol, Riviera, Elias and Pasir Ris. Punggol MRT station will be an interchange station to the CRL that will connect residents to the North East Line (NEL) and Punggol Digital District via Punggol Coast MRT station. Rivieria and Pasir Ris MRT stations will be connected to the Punggol LRT line and East West Line (EWL) respectively. #2: Yishun Flat Type: 4 Room HDB Town: Yishun Resale Registration Date: Sep 2020 Total number of records found: 80 (Data as at 4 Oct 2020) Median transacted price: $365,638.15 While Yishun may conjure images of the morbid and macabre, data from HDB showed that it is the second most popular estate on the island in September 2020 with 80 transactions recorded. So what gives? Perhaps, it is the recent rejuvenation programme that Yishun had undergone under the URA's master plan. The estate is now home to the new Yishun Integrated Transport Hub and Northpoint City. Other infrastructure projects in the pipeline include the upcoming $7 to $8 billion North-South Expressway (NSE) by 2023. This will allow residents to travel to the city in just 20 minutes flat. It will also offer better connectivity to neighbourhoods located in the north-south corridor such as Woodlands, Sembawang, Yishun, Ang Mo Kio, Bishan and Toa Payoh. #3: Tampines Flat Type: 4 Room HDB Town: Tampines Resale Registration Date: Sep 2020 Total number of records found: 76 (Data as at 4 Oct 2020) Median transacted price: $444,814.16 Tampines is the top-ranking mature estate ranking third in place. A perennial favourite due to the abundance of shopping malls like Tampines One, Tampines Mall and Century Square, the opening of IKEA Tampines has certainly upped the hip quotient to live within this self-sufficient estate. Served by the East West Line (EWL) and Downtown Line (DTL) via Tampines, Tampines West and Tampines East MRT stations, connectivity will be further enhanced when the Downtown Line (DTL) connects Tampines to the Thomson East Coast Line (TEL) by 2024 via Expo interchange station. Malls aside, Tampines is conveniently located next to Changi Business Park where jobs abound. The business park serves as a hub for data centre, banks and knowledge-intensive industries. #4: Bukit Panjang Flat Type: 4 Room HDB Town: Bukit Panjang Resale Registration Date: Sep 2020 Total number of records found: 65 (Data as at 4 Oct 2020) Median transacted price: $414,172.08 Meaning "long hill" in Malay, Bukit Panjang is a hilly estate that was once only accessible via bus and LRT. However, since the opening of the Downtown Line (DTL), Bukit Panjang is now served by a dedicated MRT line that links it to downtown Singapore in 30 minutes. Comprising a mixture of flats, condominiums and private housing, residents can now enjoy a seamless transfer to the MRT and LRT stations via the Bukit Panjang Integrated Transport Hub within Hillion Mall. Located next to Bukit Timah Hill and the water catchment area of Upper Seletar Reservoir, nature lovers can look forward to the park connectors linking Bukit Panjang Park and Zhenghua Park. #5: Hougang Flat Type: 4 Room HDB Town: Hougang Resale Registration Date: Sep 2020 Total number of records found: 64 (Data as at 4 Oct 2020) Median transacted price: $414,482.05 What's there not to love about the mature estate of Hougang? Known for its rich heritage and delicious hawker fares, Hougang is also home to several good schools such as Montfort Junior School, Holy Innocents' High School, Xinghua Primary School and Xinmin Primary School and Xinmin Secondary School. This has perhaps explained why Hougang is the fifth most transacted HDB estate in September 2020. Hougang is served by Hougang MRT station via the North East Line (NEL). By 2031, this station will be upgraded to an interchange station linking it to the Cross Island Line (CRL) spanning from Jurong Industrial Estate to Changi. Amenities wise, Hougang Central features two shopping centres, namely, Hougang Mall and Kang Kar Mall. #6: Bedok Flat Type: 4 Room HDB Town: Bedok Resale Registration Date: Sep 2020 Total number of records found: 55 (Data as at 4 Oct 2020) Median transacted price: $419,888.73 Bedok is the third mature HDB estate to make the list placing it at number 6. Home to an estimated 289,000 residents, Bedok is the largest planning area on the island offering a mix of HDB flats and private housing options. Accessible by Bedok MRT station on the East West Line (EWL), residents are now served by three more MRT stations namely, Kaki Bukit, Bedok North and Bedok Reservoir via the Downtown Line (DTL). By 2023, Bedok will welcome five more MRT stations via the Thomson East Coast Line (TEL) - Marine Terrace, Siglap, Bayshore, Bedok South and Sungei Bedok. The estate counts Bedok Mall, Bedok Interchange Hawker Centre, Bedok Point, Bedok Public Library and Bedok Polyclinic as among some of the amenities that can be found within the town centre. Food-wise, Bedok Interchange Hawker Centre is a foodie treasure trove known for its delightful but affordable cuisines ranging from chicken rice to Mee Rebus. #7: Jurong West Flat Type: 4 Room HDB Town: Jurong West Resale Registration Date: Sep 2020 Total number of records found: 51 (Data as at 4 Oct 2020) Median transacted price: $397,957.73 Ranking seventh is Jurong West which is home to Nanyang Technological University (NTU) and Jurong Industrial Estate. Currently accessible by MRT via Lakeside, Boon Lay, Pioneer and Joo Koon MRT stations on the East West Line (EWL), Jurong West will get its own dedicated MRT line by 2026. Called Jurong Region Line (JRL), this will be Singapore's seventh MRT line to serve both existing and future development in the western part of Singapore. When opened, it will connect Jurong Lake District to Jurong Industrial Estate, Jurong Innovation District, and the Nanyang Technological University (NTU). Comprising 24 stations over 24 km, JRL will have three interchange stations at Boon Lay, Choa Chu Kang and Jurong East MRT stations. Jurong Town Hall MRT station, in particular, will be an interchange station to the Kuala Lumpur - Singapore High Speed Rail line. #8: Woodlands Flat Type: 4 Room HDB Town: Woodlands Resale Registration Date: Sep 2020 Total number of records found: 47 (Data as at 4 Oct 2020) Median transacted price: $352,380.60 If you are looking for affordable housing options on the island that is in demand, then Woodlands should be on your bucket list. Under URA's Master Plan 2019, Woodlands is set to transform in the next 15 years via Woodlands Regional Centre. When completed, it is poised to take its place as the largest economic hub in northern Singapore. Some of the industry clusters that are envisioned to take shape here include business, industry, research & development, and learning & innovation. As we speak, Woodlands last year witnessed the opening of Woodlands North and Woodlands South MRT stations on the Thomson-East Coast Line (TEL). This is especially good news for those who need to commute to Johor Bahru regularly. When it is ready at the end of 2026, Woodlands North will allow commuters to transfer to the Rapid Transit System (RTS) link. #9: Pasir Ris Flat Type: 4 Room HDB Town: Pasir Ris Resale Registration Date: Sep 2020 Total number of records found: 46 (Data as at 4 Oct 2020) Median transacted price: $448,130.43 Located on the other end of the island, Pasir Ris conjures up images of rustic and laid back Singapore thanks to the numerous chalets and resorts that can be found here. Home to Lorong Halus Wetland and Pasir Ris Beach, the estate is currently served by Pasir Ris MRT station on the East West Line (EWL) that is integrated with the bus interchange. By 2031, however, the MRT station will be upgraded to an interchange station to the Cross Island Line (CRL) linking Pasir Ris to Punggol. Offering a good mix of HDB flats, condominiums and landed homes, Pasir Ris is home to two malls namely, White Sands and Elias Mall. Despite its far-flung location, prices for 4-room HDB flats here are the third most expensive after Punggol and Sengkang reflecting strong demand. #10: Ang Mo Kio Flat Type: 4 Room HDB Town: Ang Mo Kio Resale Registration Date: Sep 2020 Total number of records found: 39 (Data as at 4 Oct 2020) Median transacted price: $407,904.51 Ang Mo Kio is among one of the very first housing estates in Singapore making it the final mature neighbourhood to make it on the top ten list. Known for its delicious hawker food, Ang Mo Kio has a relatively older population with approximately one in five residents were aged 65 years and over in 2019, data from SingStats showed. The heart of Ang Mo Kio lies at its vibrant town centre located just next to the MRT station. Home to Ang Mo Kio Community Library, Ang Mo Kio Polyclinic and Market & Hawker Centre, the town centre has been rejuvenated over the years to cater to the younger generation. A new shopping mall called AMK Hub is now integrated with the transportation hub linking residents from the MRT station to Ang Mo Kio Bus Interchange. To make the transfer a seamless experience, residents can look forward to a wide array of amenities ranging from NTUC FairPrice to banking options at Bank of China and UOB. Meanwhile, further down the road, a new mall called Djitsun Mall offers four levels of dining, retail and edutainment and fitness experience. To meet the demands of the upwardly mobile, a private condominium called Centro Residences has also been built just across AMK Hub. There's more to come that will increase the attractiveness of Ang Mo Kio. Under the URA Draft Master Plan 2019, the estate will be rejuvenated with new housing precincts and amenities while retaining its current charms. In terms of connectivity, Ang Mo Kio will witness the additions of four new stations - Lentor and Mayflower MRT stations on the Thomson East Coast Line (TEL) and Bright Hill and Teck Ghee MRT stations on the Cross Island Line (CRL). Bright Hill will be an interchange station to the TEL and Cross Island Line (CRL). Meanwhile, Ang Mo Kio MRT station will be upgraded to an interchange station to the North South Line (NSL) and Cross Island Line (CRL). A top neighbourhood in the HDB resale market, Sengkang is a good indicator of the changing mood and aspirations of young Singaporeans. By Khalil Adis Having a newly carved GRC and heavy weight political office holders are generally the necessary ingredients to ensure a clean sweep during Singapore's General Election. However, that does not appear to be the case in 2020. As seen during the recently concluded election, even having the labour chief and a Senior Minister of State in the Ministry of Health and the Ministry of Transport could not save Sengkang GRC from its electoral defeat. Helmed by Ng Chee Meng together with Dr. Lam Pin Min, Amrin Amin and Raymond Lye, the election witnessed Sengkang GRC falling into the hands of the relatively young and inexperienced team from The Workers' Party. Comprising He Ting Ru, Jamus Lim, Raeesah Khan and Louis Chua, The Workers' Party emerged victorious with a 52.13 per cent win against the PAP's 47.87 per cent. The rejection of both the NTUC chief and transport minister speaks volume on how the electorate feels about employment and transportation issues. In Sengkang GRC's case, they are both intertwined. Last November, Dr. Lam announced in Parliament the banning e-scooters which saw the livelihoods of many food delivery drivers affected overnight. The ban appeared to be the last straw that broke the camel's back. Despite a closed-door session at Sengkang West constituency with Dr. Lam himself and a S$7 million assistance package, the session was reportedly a tense one. Elsewhere in other constituencies, many PMD riders had also expressed their disappointment with their respective MPs. Meanwhile, the younger team from The Workers’ Party was a breath of fresh air and appeared closer to the ground. They were humble and earnest yet are backed with a strong track record in their respective fields. Jamus Lim, in particular, won over many Singaporeans’ heart during his live televised debate. Even the police report filed against Raeesah Khan could not sway voters' opinion. So what gives? Young neighbourhood As a district, Sengkang has a relatively young population. According to data from SingStats, the total population of Sengkang was 244,600 in 2019. Of this, 159,840 or 65.34 per cent were aged 45 and below. If we were to break this down further, 213,380 or 87.23 per cent live in HDB flats. Of this, the majority of them (99,640 or 46.69 per cent) live in four-room flats. The young population is worried about bread-and-butter issues such as jobs and social mobility. A segment of these HDB dwellers were food delivery drivers trying to supplement their incomes. That is until the ban of e-scooters affected their livelihoods. Amid the COVID-19 pandemic, this has helped further exacerbate the unhappiness on the ground which has perhaps translated to protest votes on the ballot box. The 'Jamus Lim' effect Then, there is also the 'Jamus Lim' effect. A newcomer to the political arena, he mesmerised Singaporeans by being able to hold his own when pitted against the more experienced and senior politician, Dr. Vivian Balakrishan. His message of not wanting to give the PAP "a blank cheque", seemed to resonate with many Singaporeans. He subsequently became a trending topic on social media - a medium that is highly popular among young voters . This, plus the rejection of gutter politics, as seen in the Raeesah Khan case, suggests that young and educated voters appreciate a clean fight and want checks and balances. It also suggests that they are looking beyond municipal issues such as social inequality. Clearly, character assasination and dangling carrots no longer work. Sengkang is the most popular estate for HDB resale flats Politics aside, Sengkang is the most popular HDB estate where 1,795 resale flats changed hands in 2019, according to data from the HDB. This was followed by Woodlands and Yishun at 1,794 and 1,791 transactions respectively. According to HDB's first quarter of 2020 data, resale HDB flats in Sengkang were transacted at a median resale price of S$340,000, S$425,000, S$480,000 and S$565,000 for three-, four- and five-room flats respectively. While there are other attractive mature estates with better amenities such as Toa Payoh and Ang Mo Kio, their resale value have nose-dived in recent years due to their diminishing number of leases left. Meanwhile, the resale value of homes in newer estates like Sengkang appear to be better protected. This has perhaps explained why Sengkang is a popular neighbourhood among young families. The lure of living in Sengkang One such person who is currently looking for a home here is property agent Ady Ahmari. “The flats in Sengkang are younger but cheaper, especially in Anchorvale,” he said. Another reason is their generous sizes which is something he can attest to. The property agent sold a 1,130 sq ft four-room flat in the area two months ago for S$350,000. “The units are very big and comparable to five-room Built-To-Order (BTO) flats which are around 1,184 sq ft,” he said. Perhaps one surprising intangible reason that he is lured to looking for a home here is the parks. “Sengkang has a big garden where my family can enjoy the outdoors,” he said. Indeed, Sengkang Riverside Park is popular among residents here featuring a constructed wetland and is rich in biodiversity. In fact, the Sengkang ActiveSG Gym which is located within Anchorvale Community Club is the only such gym of its kind in Singapore offering a scenic river view of the Sengkang Riverside Park. Amenities aside, Ahmari said having an opposition party there has also influenced his decision. “I need an alternative voice,” he said. Swing towards opposition could be due to declining resale value of HDB homes Homeownership and their property value are closely tied to voters sentiment. Let's look into the case of Toa Payoh HDB estate which falls under the Bishan - Toa Payoh GRC. In the 2015 General Election, the PAP scored a victory with 73.59 per cent of the vote share against the Singapore People's Party (SPP). However, the recently concluded election saw a vote swing of 6.33 per cent towards the SPP at 32.74 per cent. While the PAP won by 67.27 per cent, its support saw a decline of 6.33 per cent. Likewise, in other mature estates such as Ang Mo Kio GRC and Tanjong Pagar GRC, the PAP witnessed a vote swing towards the opposition at 6.72 per cent and 14.58 per cent respectively. Conclusion The endorsement of Sengkang GRC of The Workers' Party is reflective of the changing mood and aspirations of young Singaporeans.

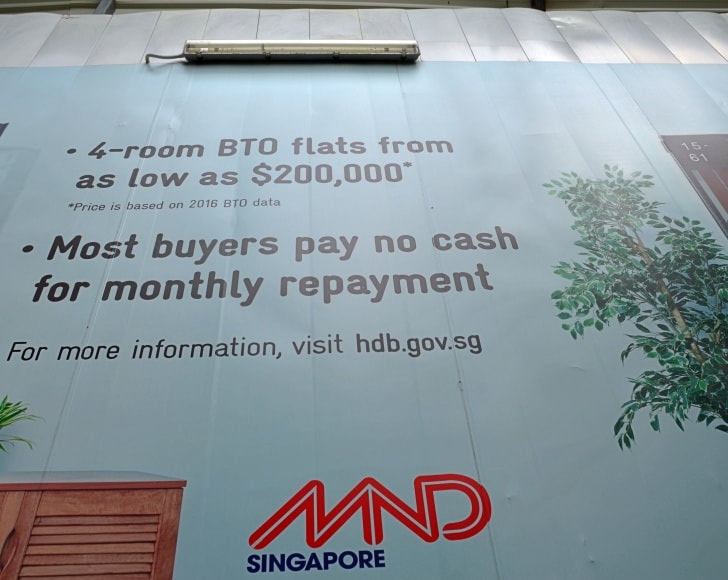

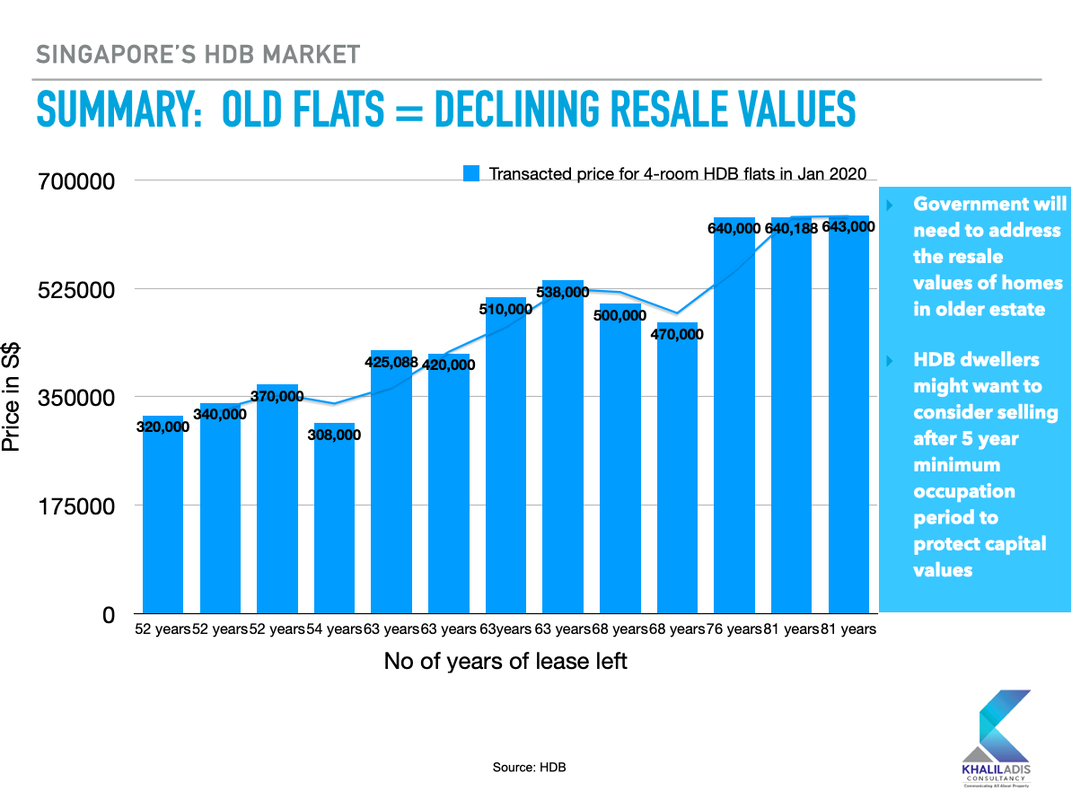

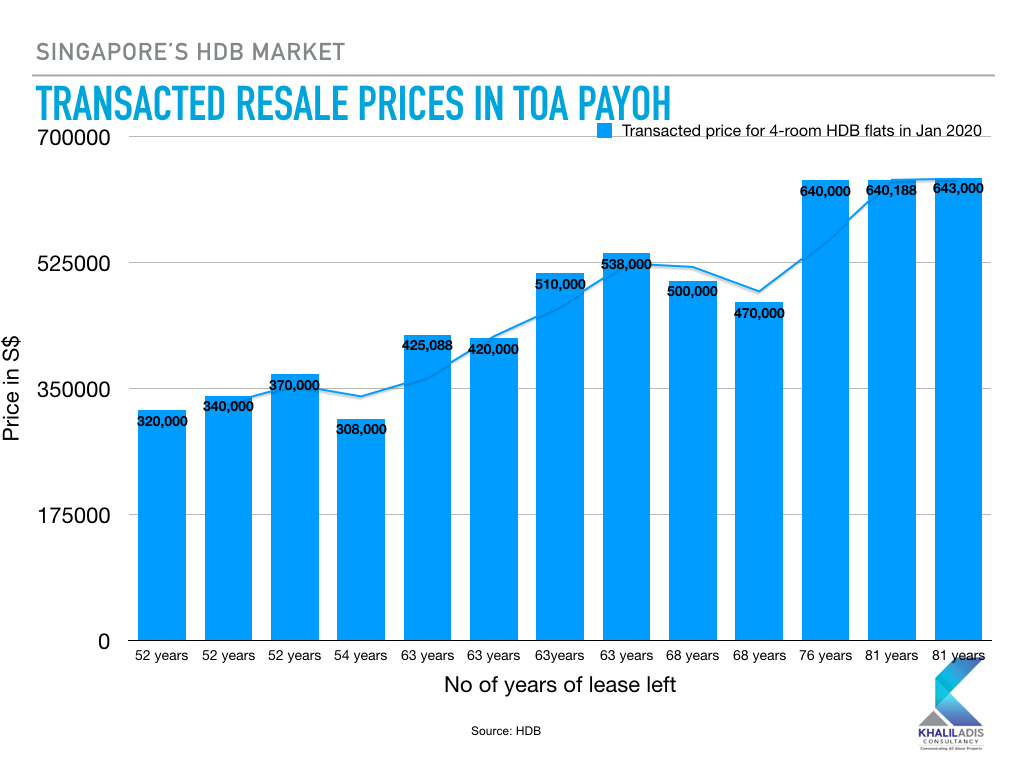

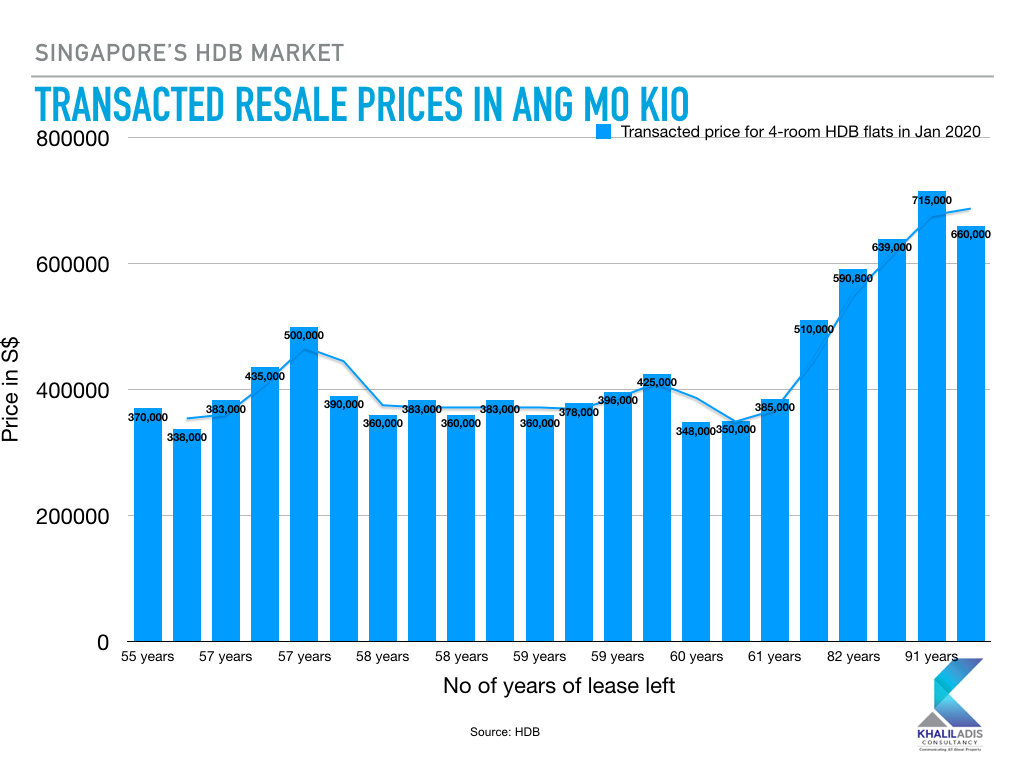

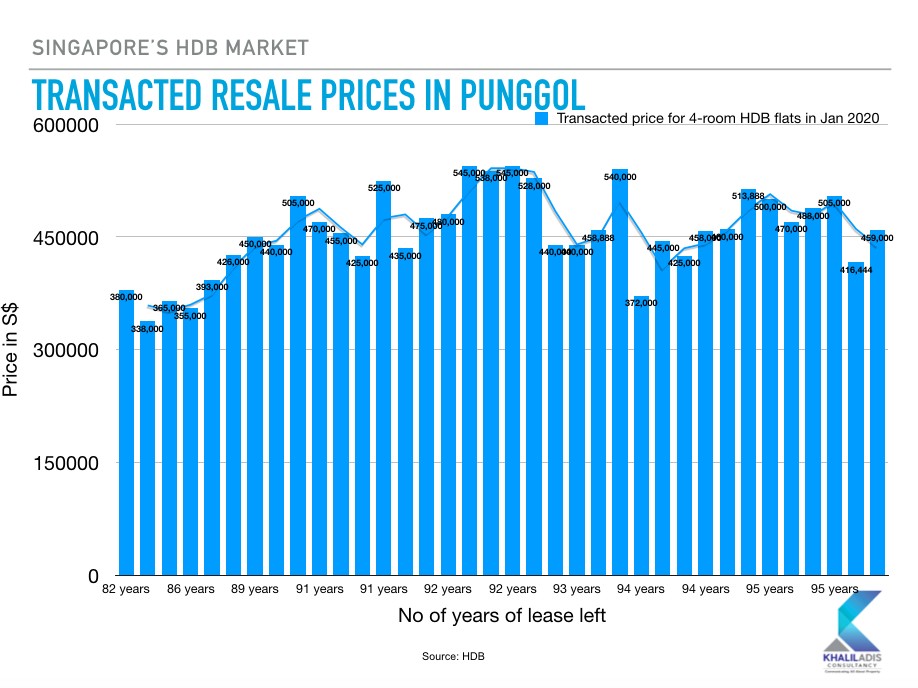

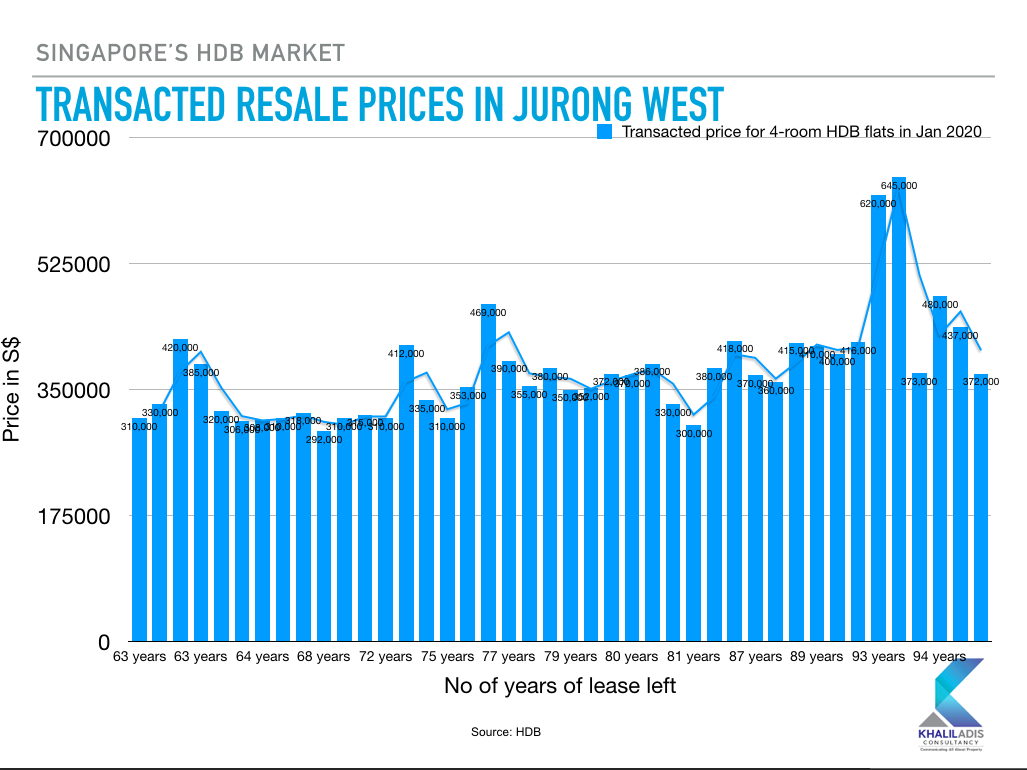

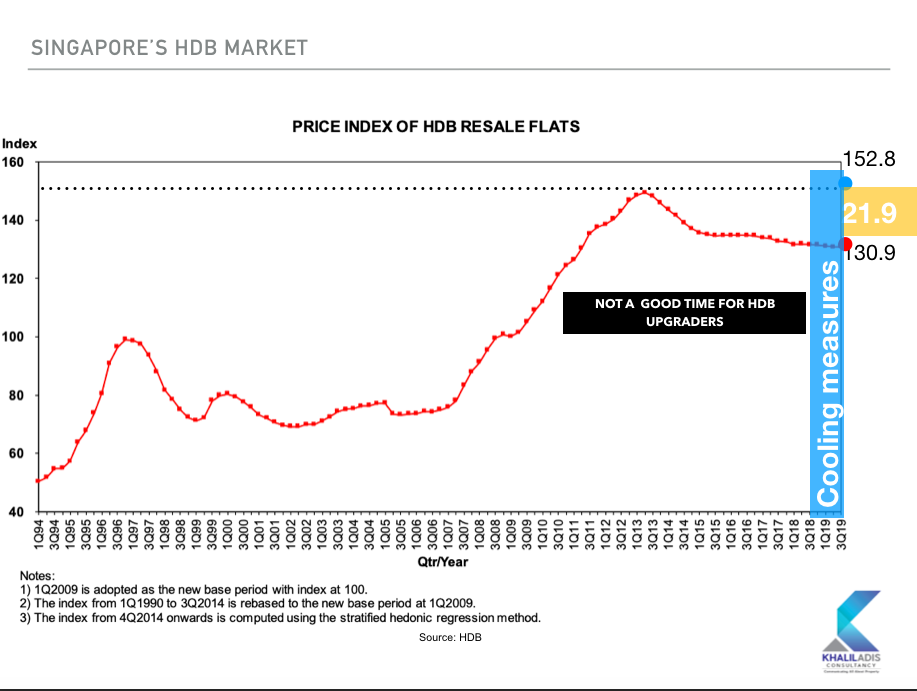

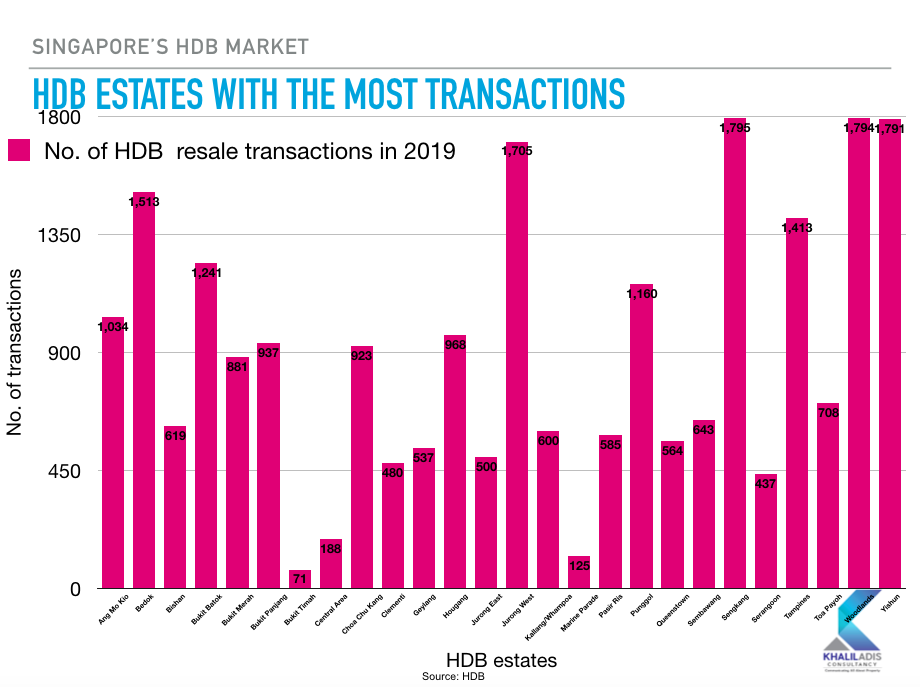

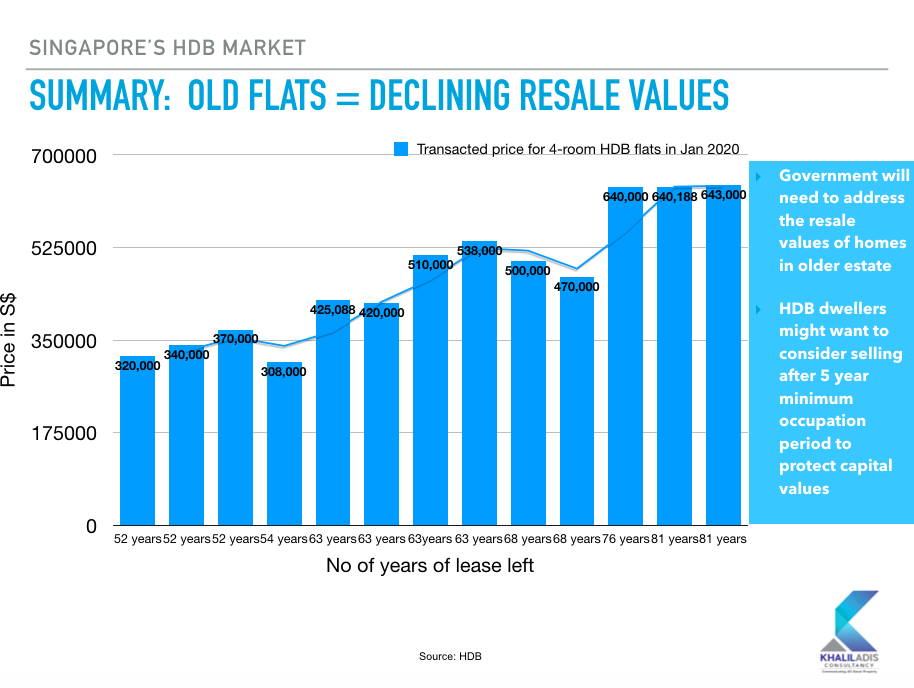

Yes, they want a strong and capable government. However, they also want a government who listens to them and not one who bulldozes through policies. Some of these policies include the India-Singapore Comprehensive Economic Cooperation Agreement (CECA) which they believe have contributed to social inequalities (CECA became a hot-button national topic last year when Erramalli Ramesh was caught on video verbally abusing a Singaporean security guard at a condominium). They also want a government that does not resort to hitting below-the-belt when it comes to their political opponents. While the PAP has retained power in many estates, the vote swing towards the opposition could also suggest that older voters want the diminishing value of their homes addressed. As one elderly person that I spoke to puts it: “This is not what was promised by Lee Kuan Yew”. Strong correlation seen between transacted property price and remaining lease. By Khalil Adis Since the Lee Kuan Yew era, Singaporeans have been ingrained with the idea that our HDB flat is an asset. While you can make a profit from your HDB flat, this depends on the lease that is remaining on your property. Based on our research and analysis, we found that HDB flats in older estates with a remaining lease of fewer than 60 years saw their property values diminish. Meanwhile, those that have around 80 years of lease left were able to fetch far higher prices. This is according to data captured on HDB’s website. On the other end of the spectrum, HDB flats that are located in newer estates did not see that much price variation. In conducting this study, we had looked into HDB transactions for 4-room flats that were recorded as of 21 January 2020 and then compared it with the remaining lease. The estates chosen included the mature estates of Toa Payoh and Ang Mo Kio as well as the non-mature HDB estates of Punggol and Jurong West. Here are some quick snapshots based on our findings. #1: Toa Payoh: Older HDB flats changed hands at lower prices When it comes to buying an HDB flat, most Singaporeans will prefer to buy in a mature estate such as in Toa Payoh or Ang Mo Kio. However, if you have a flat with a remaining lease of fewer than 54 years this may have an impact on your resale value. According to data captured on HDB’s website, there were 14 transactions for 4-room HDB flats in Toa Payoh during this period. The data showed a strong correlation between the price versus the remaining lease. For instance, older HDB flats (4) with 54 years or less of the remaining lease were transacted at an average price of S$334,500. Meanwhile, newer HDB flats (4) with 76 to 81 years of the remaining lease were transacted at an average price of S$641,062. This represents a price difference of 91.6 per cent. #2: Ang Mo Kio: Newer HDB flats fetched higher selling prices Ang Mo Kio is also another favourite estate among buyers explaining why Built-To-Order (BTO) launches have always been oversubscribed. Like Toa Payoh, Ang Mo Kio also witnessed a strong correlation between price versus the remaining lease. According to data captured on HDB’s website, there were 24 transactions for 4-room HDB flats in the estate during this period. Newer HDB flats (5) with 80 to 91 years of the remaining lease were transacted at an average price of S$622,960. On the other hand, older HDB flats (14) with 59 years or less of the remaining lease were transacted at an average price of S$390,071. This represents a price difference of 59.7 per cent. #2: Punggol: A non-mature estate where capital values experience fewer fluctuations Punggol is a non-mature estate with a relatively young population. While it may seem far-flung, Punggol is among the top ten estates in Singapore where HDB resale homes have changed hands. According to data captured on HDB’s website, there were 36 transactions for 4-room HDB flats in the estate during this period. The remaining lease in Punggol ranges from 82 to 95 years. As such, there is not much price variation as seen in the case of Toa Payoh and Ang Mo Kio. For example, HDB flats (7) with between 82 to 89 years of the remaining lease were transacted at an average price of S$334,500. Meanwhile, newer HDB flats (29) with 90 years or more of the remaining lease were transacted at an average price of S$477,002. This represents a price difference of 42.6 per cent. This suggests that newer estates like Punggol may be ideal if you want to protect the capital values of your property. #3: Jurong West: A semi-mature estate with a price gap similar to Punggol Jurong West is a semi-mature area and as such the remaining lease here is between 63 and 94 years. According to data captured on HDB’s website, there were 41 transactions for 4-room HDB flats in the estate during this period. Similar to Punggol, there is not much price variation as seen in the case of Toa Payoh and Ang Mo Kio. For example, HDB flats (11) with less than 70 years of the remaining lease were transacted at an average price of S$328,090. Meanwhile, newer HDB flats (8) with 93 years or more of the remaining lease were transacted at an average price of S$467,875. This represents a price difference of 42.6 per cent. #4: Price gap is widest in Toa Payoh Toa Payoh makes an interesting case study. We decided to zoom into this estate as property agents have long complained that they have had a hard time selling older HDB flats in the area. Our analysis seems to concur with our findings on the ground when speaking to agents as they appear to diminish in value nearing the end of the lease. In the case of Toa Payoh, the price gap is a whopping 91.6 per cent compared to Ang Mo Kio, Punggol and Jurong West at 59.7 per cent and 42.6 per cent respectively. #5: Widening price gap between HDB and private property market According to the third quarter of 2019 data from the HDB and the Urban Redevelopment Authority (URA), the Resale Price Index (RPI) and the Private Property Index (PPI) are at 130.9 and 152,8 percentage points respectively. This means a price gap of 21.9 percentage points. The widening price gap is bad news for HDB upgraders thinking of buying a condominium. As such, this may not be an opportune time for you to do so. Should Singapore enter into a recession this year, we are likely to see the PPI drop further narrowing the price gap between the HDB and private property markets. Good things come to those who wait so wait out. #6: Sengkang is the most popular estate for resale HDB flats in 2019 Rounding of the top 10 HDB estates, Sengkang is the most popular with 1,795 resale transactions recorded in 2019, followed by Woodlands (1,794), Yishun (1,791), Jurong West (1,705), Bedok (1,513), Tampines (1,413), Bukit Batok (1,241), Punggol (1,160), Ang Mo Kio (1,034), Hougang (968) and Bukit Merah (937). #7: Summary: Capital values appear to be better protected in non-mature estates While HDB is an asset, older HDB flats in mature estates will likely see their value decline as the data showed.

As such, prospective homebuyers might want to think twice before purchasing such flats. On the other hand, the data suggests that the capital values of your HDB flat are better protected in non-mature estates like Punggol and Jurong West. As such, you may want to consider selling your property after five years once you have fulfilled your MOP and then upgrade to private property or downsize according to your lifestyle needs. Having said that, I would like to stress that your HDB flats are for long-term occupation and not for you to make a quick profit. In closing, housing is a delicate issue. The government will need to address their diminishing value sensitively especially to the older generation who are currently living in mature estates. Here are our top five predictions as the Lion City braces for slower economic growth and the possibility of a recession next year. By Khalil Adis Singapore had narrowly missed a technical recession in the third quarter of 2013 growing by 0.1 per cent on a year-on-year basis according to advance estimates from the Ministry of Trade and Industry (MTI). Still, the economy remains muted as the labour market continues to soften while retrenchments are on the rise. We are already seeing firms asking employees to take a shorter workweek, particularly in the manufacturing sector as this is most affected by the ongoing global headwinds. Given the trade war will likely persist in 2020 combined with a bleak job market ahead, here are the possible impacts on Singapore’s property market. #1: High-end properties will likely take the first hit High-end properties are those that are located in Districts 1, 2, 9, 10 and 11. These properties are first to take the hit should a recession occur next year as they are the most volatile - they are the first to rebound during an upturn but also the first to see the largest decline in capital values. Why is this so? This is because this market segment is driven generally by speculators and foreign investors. As the economy takes a hit, they are likely to offload the properties once they are unable to finance their mortgage or secure tenants. During the 2008 crisis, for instance, we saw properties in prime areas declining by as much as 30 per cent. Also, the cooling measures that were announced last year will likely see such buyers staying away from this market. The only exception is the ultra-high-net-worth individuals as seen in the penthouse unit at Wallich Residence that was purchase by British billionaire James Dyson in April this year. However, such buyers are far and few between. #2: Vacancy rates for high-end units will likely increase The soft job market and increase in retrenchments will see expatriates either being repatriated or a cut in their housing allowance. As such tenants generally favour renting homes in the prime areas, we are likely to see vacancy rates increase as they exit from the market or opt for cheaper housing options in the city fringe and heartland areas of Singapore. With an increase in vacancy rates, this will likely trigger a price war among landlords as they reduce their asking price in the hope of securing a tenant. As a result, rentals in the prime areas will likely decline as well. Again, this was seen during the 2008 crisis. #3: Mass market segment will be resilient Mass market homes are those that are located in the Outside Central Region (0CR) as defined by the Urban Redevelopment Authority (URA). Why are such homes more resilient compared to those located in the Core Central Region (CCR) and Rest of Central Region (RCR)? This is because the OCR is driven by genuine homebuyers and where the rentals are more affordable. While we will likely see a price decline in the secondary market due, it will not be as much as the prime areas. For instance, during the 2008 crisis, prices in the OCR declined by around 10 to 15 per cent. #4: Flight to safety in the mass market rental segment Having said that, the mass market segment is not immune to the economic slowdown and soft labour market. We are already seeing workers being retrenched or told to take a pay cut, particularly among those in the manufacturing sector. As the manufacturing sector takes a hit, so will the rental market. However, this market is still considered relatively affordable for the expatriate worker albeit with a reduced budget. Therefore, this market will see a flight to safety among the white-collar workers who do not mind living in the heartlands. Landlords will also likely to lower their asking price in a bid to continue attracting tenants. #5: Affordable homes will be in demand The property market is very much sentiment-driven.

However, the affordable home segment is different as it is driven by buyers who genuinely need a roof over their heads. As such, the HDB market will see good take-up rates particularly for homes that are being offered under the Build-To-Order (BTO) and Sale of Balance Flats (SBF) exercises. In November, for instance, the HDB launched 4,571 BTO units and 3,599 SBF units. The BTO units are located in Tengah, Tampines and Ang Mo Kio while the SBF units are located in both mature and non-mature estates. The Enhanced CPF Housing Grant (EHG) of up to $80,000 that was announced in September this year will provide a much-needed help for homebuyers in acquiring their first home and ease their property journey. The latest data from various Singapore’s government agencies do not look good suggesting a sluggish property market ahead. By Khalil Adis If you are feeling the heat from the sluggish economy, you are not alone. In fact, chances are if you are running a business, you would have noticed more businesses rolling down their shutters since the beginning of 2019. Meanwhile, workers are worried about job security. Coupled with the current China-US trade war, this will have a significant impact on Singapore’s export-dependent economy and the job market. As such Singapore’s property market is expected to be in the doldrums this year. Here are three key indicators: #1: Non-oil domestic exports (NODX) decreased by 15.9% in May 2019 The latest figure from Singapore’s trade agency, Enterprise Singapore, do not look good with a decline recorded in non-oil domestic exports (NODX) due to China, Taiwan and Hong Kong in May 2019. The drop was partly due to a sharp decline in shipments to China, following the 10.0 per cent decline in April 2019. The national trade agency said both electronic and non-electronic exports decreased. On a month-on-month seasonally adjusted basis, NODX rose by 6.2 per cent in May 2019, after the previous month’s 0.7 per cent decrease. Non-electronic NODX grew while electronics declined. On a year-on-year basis, total trade decreased by 2.1 per cent in May 2019. This was after the 3.2 per cent growth in the preceding month. Meanwhile, total imports declined by 0.5 per cent in May 2019, after the 7.6 per cent rise in the previous month. Total exports decreased by 3.4 per cent in May 2019, following the 0.5 per cent decline in April 2019. The largest contributors to the NODX decrease were China (-23.3 per cent), Taiwan (-34.7 per cent) and Hong Kong (-24.8 per cent). Overall, exports to the majority of Singapore's top markets decreased in May, except to the US. #2: More workers were retrenched in the first quarter of 2019 With trade declining, it has had a knock-off impact on the job market. According to a report released by the Ministry of Manpower on Thursday (June 13), more workers were retrenched in the first quarter of this year compared to the previous quarter and a year ago. The ministry’s latest report said this increase was driven by manufacturing and affected workers in production and electronics. For example, as of the first quarter of this year, 3,230 workers were retrenched. This was higher than the quarter before with 2,510 workers affected and a year ago (2,320). The top reason cited for retrenchments was business restructuring and reorganisation. Meanwhile, the number of job vacancies declined following seven quarters of increase. According to the ministry, it declined from 62,300 in December 2018 to 57,100 in March 2019. #3: Government to reduce the supply of private residential units for the second half of 2019 According to the Urban Redevelopment Authority (URA), there is a large supply of around 44,000 private housing units in the pipeline. This comprises around 39,000 unsold units from the Government Land Sales (GLS) Programme and en-bloc sale sites with planning approval, and an additional 5,000 units from sites that are pending planning approval. In addition, there are around 24,000 existing private housing units that remain vacant. “Given these factors, the Government has decided to reduce the supply of private residential units on the Confirmed List for the GLS Programme,” the URA said in its statement. As such, the GLS Programme for the second half of 2019 will comprise five Confirmed List sites and eight Reserve List sites. According to the URA, these sites can yield about 6,430 private residential units, 92,000 sq m gross floor area (GFA) of commercial space and 1,100 hotel rooms The five Confirmed List sites are private residential sites (including one Executive Condominium site) which can yield about 1,715 private residential units (including 480 EC units). Summary Singapore is a very open economy and will be the first in the region to experience the shocks arising from the ongoing trade wars.

However, this will be mitigated by government spendings in building infrastructure projects such as the upcoming Thomson East Coast Line (TEL) and the Cross Island Line (CRL). Meanwhile, the large supply of private residential units will favour tenants and buyers as they will be spoilt for choice. It will also mean the rental and resale private property market will likely see a price decline due to the supply in the pipeline. Vacancy rates for private properties will also increase. As such, landlords will likely drop their rentals as more units come on-stream. |

Khalil AdisAn independent analysis from yours truly Archives

July 2023

Categories

All

|

100 Peck Seah Street

|

|

RSS Feed

RSS Feed