|

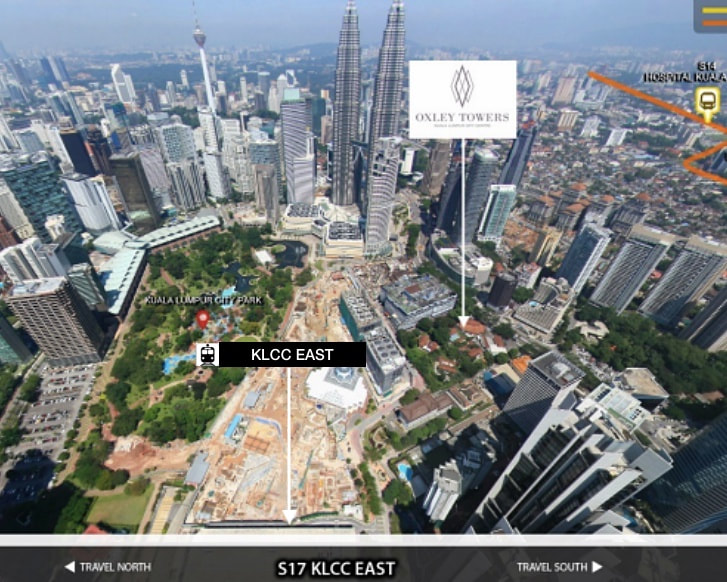

With the dust from the 14th Malaysian general election now settled, the newly minted Pakatan Harapan government has renewed investors’ confidence and sparked hope in the otherwise lull property market. We list down six reasons why KLCC is now attractive to foreign investors. By Khalil Adis Walk around Kuala Lumpur and you cannot help but feel a renewed sense of hope in the air among Malaysians post the 14th Malaysian general election. In fact, Malaysians appear to be smiling more than usual that even the notorious KL traffic has failed to put a dampener on their faces. Call it a new Malaysia, if you will. However, this is indeed a watershed moment which saw a newly minted Pakatan Harapan government taking power and effectively putting an end to 61 years of uninterrupted rule under UMNO. With the promise to weed out corruption, the return of the rule of law by the Mahathir administration has ignited business confidence and renewed interest in the property market. One area which has always been a perennial favourite among foreign investors is KLCC. Home to the iconic Petronas Twin Towers, it was Prime Minister Tun Mahathir Mohamad who had the foresight to build it that has led to Kuala Lumpur being known all over the world. As if signalling a new dawn for Malaysia, KLCC’s skyline is set to welcome a new iconic landmark come 2023. Here are our findings why properties in KLCC are now ripe for picking. #1: A new iconic landmark Oxley Towers Kuala Lumpur City Centre is a freehold mixed-use development that is located within walking distance to the the Petronas Twin Tower and Kuala Lumpur Convention Centre. Comprising an office tower, Kuala Lumpur Hotel with residences, SO/ Sofitel Kuala Lumpur Hotel with residences, and a retail podium, Oxley Towers Kuala Lumpur City Centre is set to be the next iconic skyline in KLCC with its sleek, ultra-modern architecture. At our recent site visit, construction work has already started and is making good progress with an expected completion date in 2023. #2: Reputable Singaporean developer with a strong track record When buying a property in Malaysia, the track record of a developer is of utmost importance. Oxley Towers Kuala Lumpur City Centre is being built by Oxley Holdings Limited. This home-grown Singaporean property developer has a wide and diverse property portfolio comprising development and investment projects in Singapore, the United Kingdom, Ireland, Cyprus, Cambodia, Malaysia, Indonesia, China, Myanmar, Australia, Japan and Vietnam. Some of its notable developments in Singapore include Oxley Tower, Oxley Bizhub and Oxley Edge. The EdgeProp cites Oxley Holdings as having S$2 billion worth of land last year including en bloc site. This makes it one of the biggest landbanks held by a property developer in Singapore. Despite the recent cooling measures, Oxley Holdings is going ahead to launch at breakneck speed this year with a total of 3,000 units already launched during the first six months of the year. And another 900 units underway. Not only is Oxley Holdings rich in landbanks, it is also financially strong. For 2018, so far, Oxley Holdings has sold a total of 948 units and delivered $1 billion in residential sales in Singapore. #3: First SO/ Sofitel residence in the world If you like fashion and enjoy the buzz of city life, then you are in for a real treat. The SO/ Sofitel hotel and brand is a playful mix of sophistication and the dynamic style of each locale. Highly creative and fashion-led, the SO/ Sofitel residences in KL will reflect the rich, multi-cultural tapestry that Kuala Lumpur is known for. The SO/ Sofitel tower is set to offer 210 hotel rooms and 590 residences. Designed for those who break the rules and are ahead of the curve, this is the place to see and be seen. To ensure your ultimate privacy, the hotel and residences lobbies will be separated. Did we also mention that SO/ Sofitel Kuala Lumpur Residences will feature the highest residential swimming pool in Malaysia overlooking KLCC? #4: Get more bang on your bucks in a branded residence The difference between staying in a branded versus a non-branded residence is as different as day and night. In keeping with its lifestyle luxury and playful theme, investors can expect only the best while living life at the top. Staying at SO/ Sofitel Kuala Lumpur Residences will mean access to a plethora of luxury services and some of the most happening parties the city has to offer. For starters, residents will enjoy 24-hour residence concierge, bell/valet services and the Mixo Resident’s Lounge. This is where you can let your hair down with its resident DJ or take those #OOTD Instagram-worthy shots with complimentary Wifi access overlooking the famed twin towers as you sip a cocktail or two from its Resident Mixologist. It’s not all about partying though. SO/ Sofitel Kuala Lumpur Residences will also offer fitness enthusiast access to its SoFIT residence fitness centre, including personal attendant, towel service and water. To ensure you stay ahead of the curve, residents also get a press reader subscription with digital access to 2,000 plus daily newspapers and magazines. AccorHotels offers an Industry Leading Ownership Benefits Program, including top-tier status in Le Club AccorHotels Loyalty program. #5: Good tenant pool Buying a unit at SO/ Sofitel Kuala Lumpur is not just about all play. This is the address for those who have arrived that is within walking distance to Pavilion Bukit Bintang, Suria KLCC, KLCC Park and The Petronas Twin Towers, just to name a few. Shopping, entertainment and dining options are also aplenty ranging from the award-winning Nobu’s to your local mamak coffeeshops. For investors, this is where you can have access to some of the most sophisticated tenants at your feet. There are a high number of industries here ranging from government offices and embassies at the nearby Embassy Row to the petrochemical and MICE industries within KLCC. Take your pick. #6: Enhanced connectivity via KLCC East MRT station Located approximately just 200 metres away, KLCC East MRT station is part of the RM32.5 billion Sungei Buloh-Serdang-Putrajaya (SSP Line) MRT project that was announced under Budget 2015. Measuring some 52.2km spanning from Sungai Buloh to Putrajaya MRT station, the SSP Line comprises 24 elevated and 11 underground stations (including KLCC East) When completed in 2022, the SSP Line is expected to generate a daily ridership of 529,000 while enhancing property values within its immediate vicinity. Investment talk by Khalil AdisJoin Khalil Adis this weekend to find out what is in store in the Malaysian property market post GE-14.

Details below: Date: 18 & 19 August 2018 Time: 3pm Venue: Oxley Gallery, 30 Stevens Road #02-01 RSVP here *First 10 to RSVP on each day (10 copies on Saturday, 10 copies on Sunday) will each receive a copy of Khalil Adis's best-selling book 'Property Buying for Gen Y

0 Comments

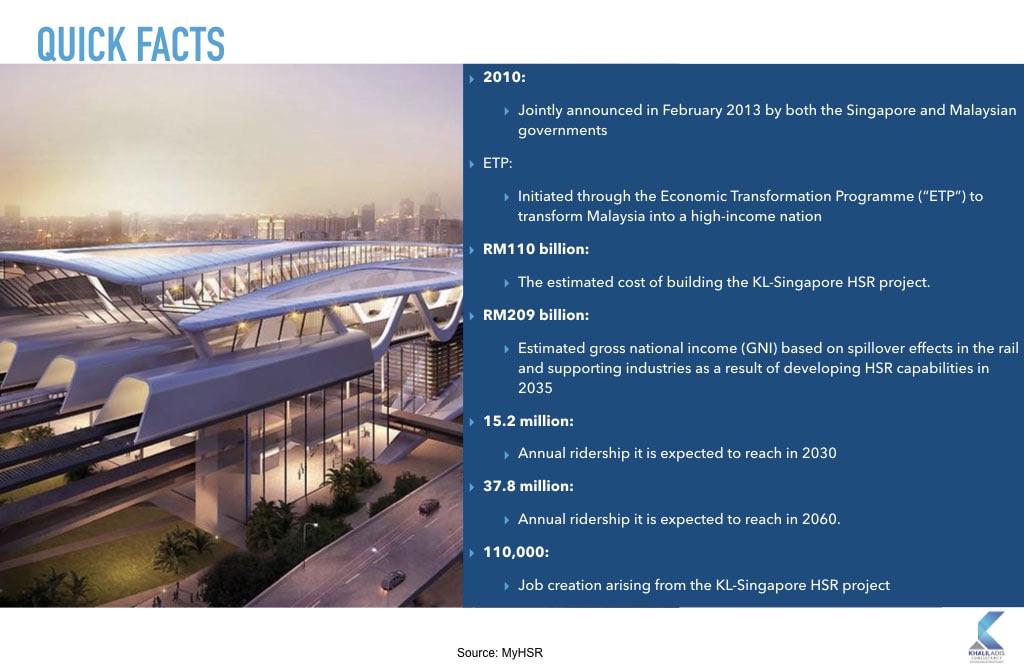

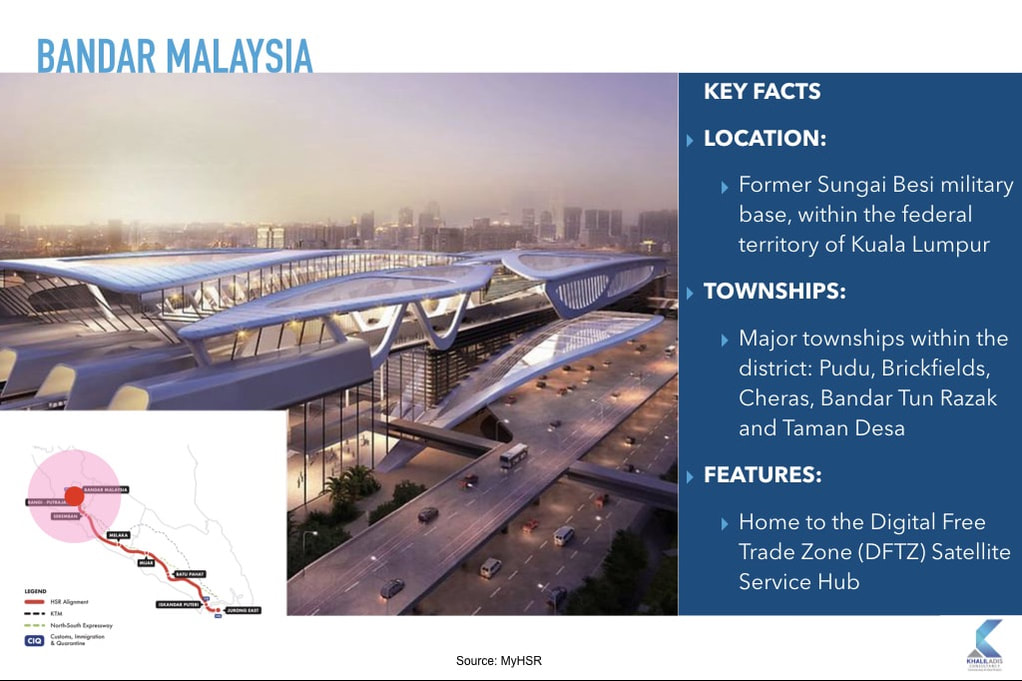

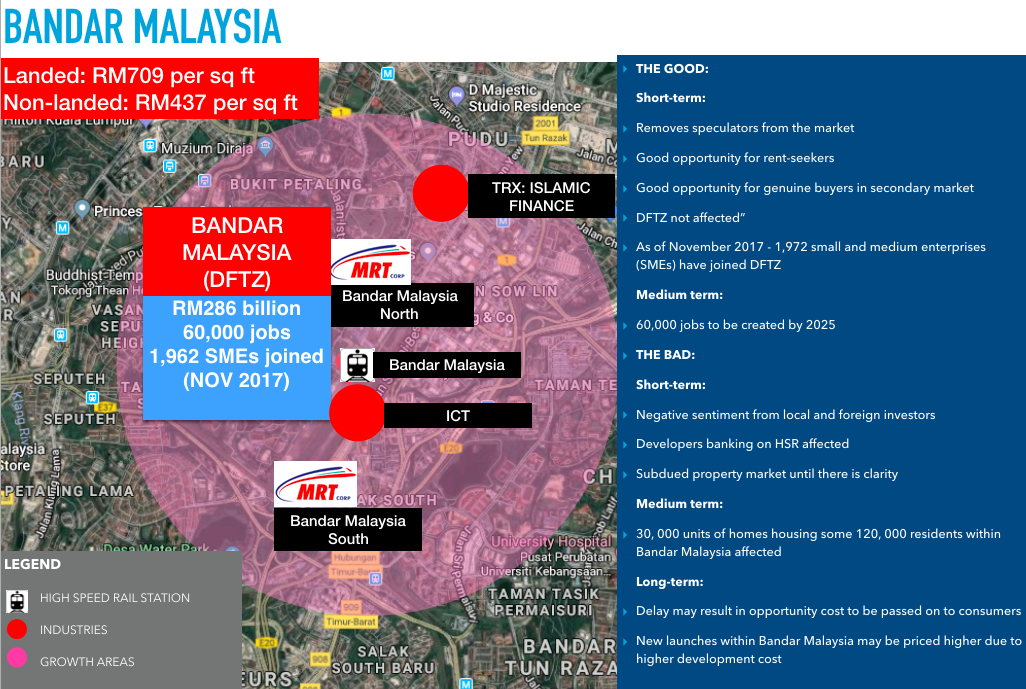

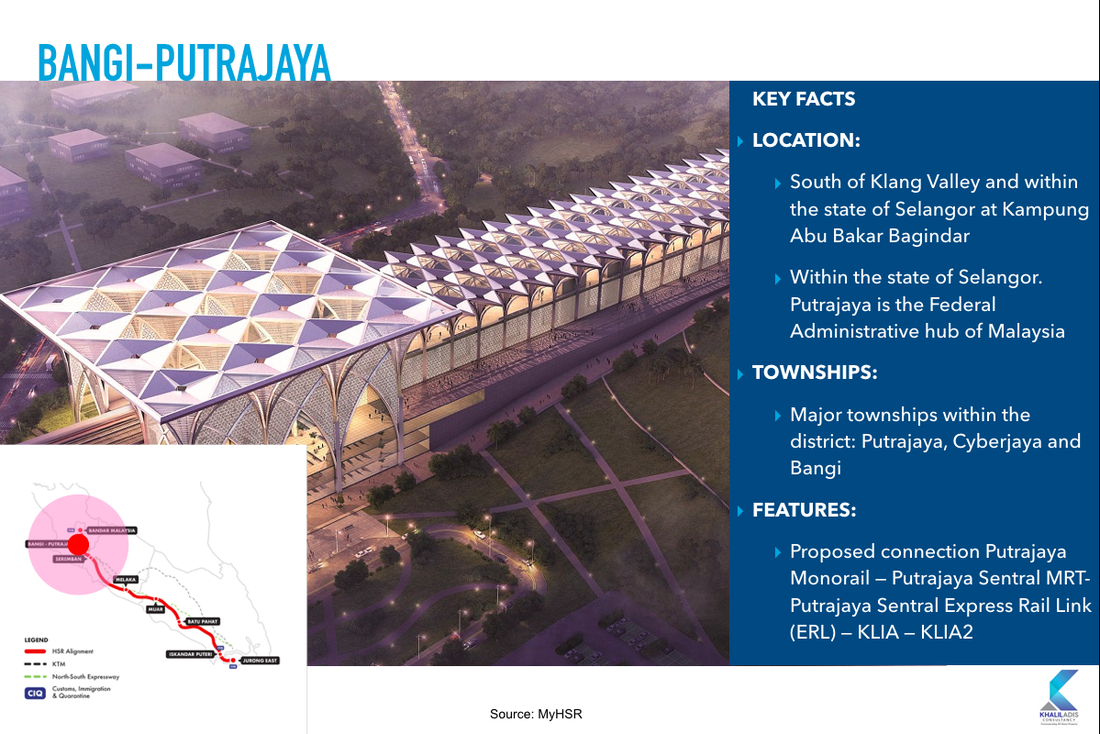

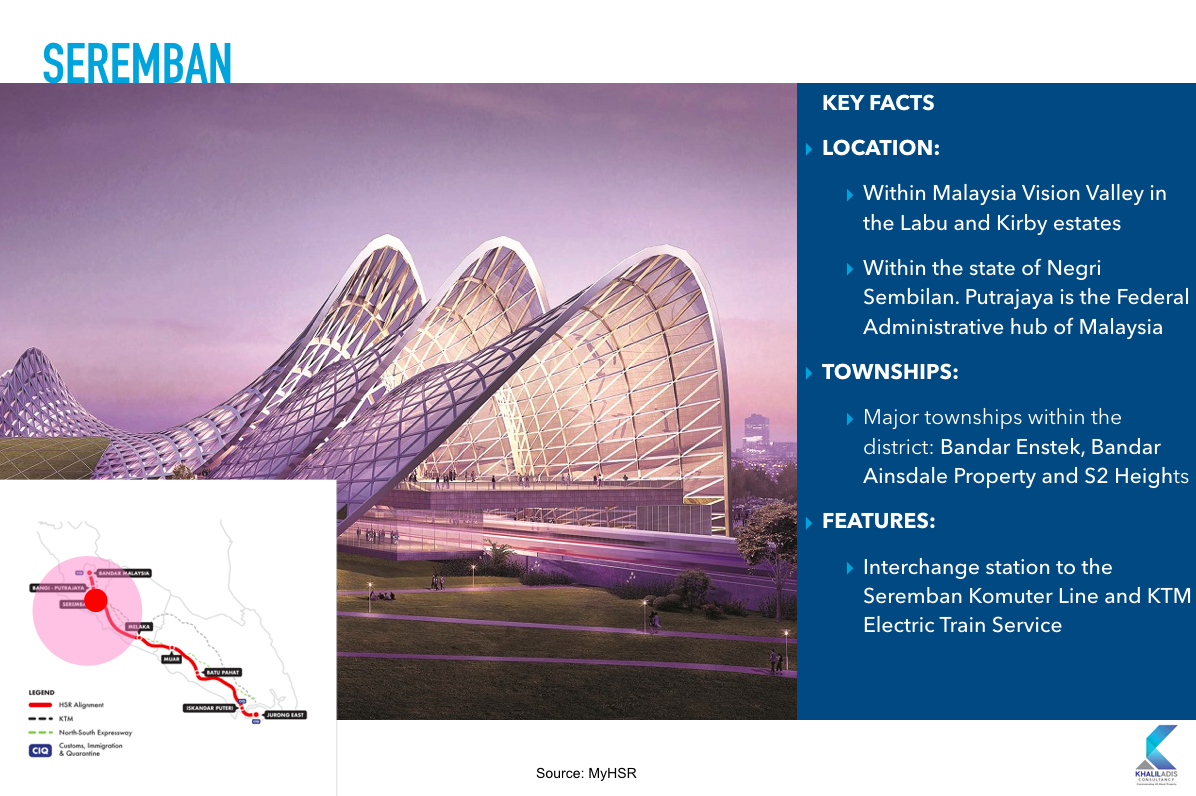

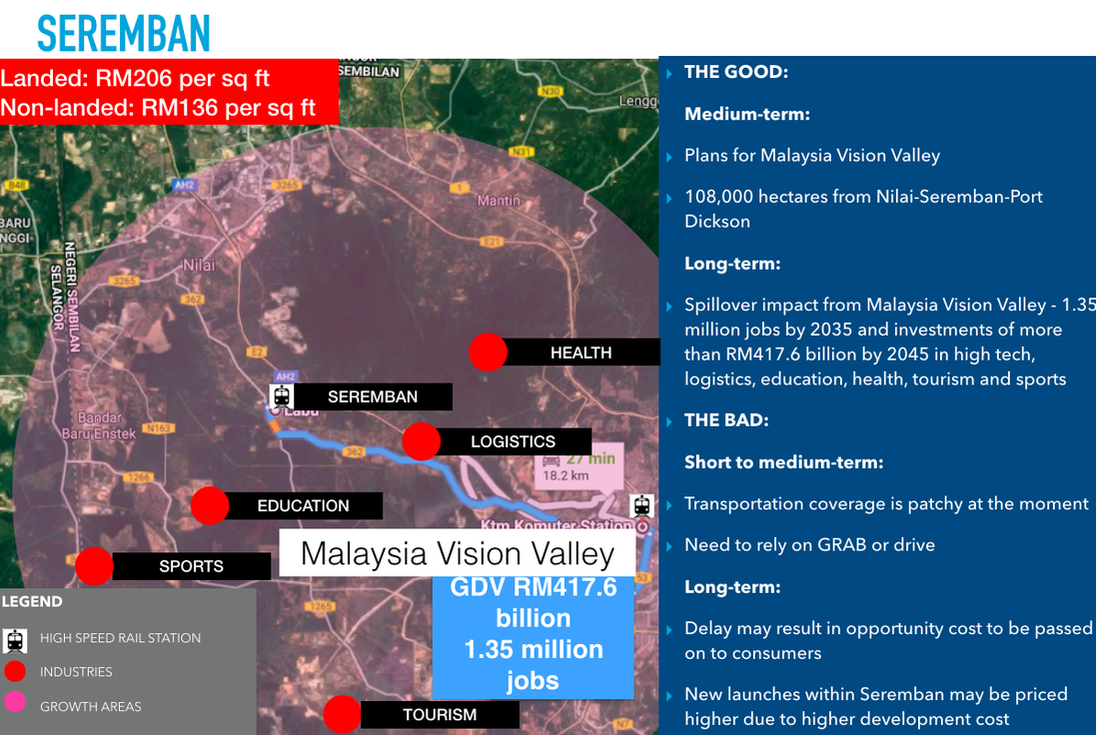

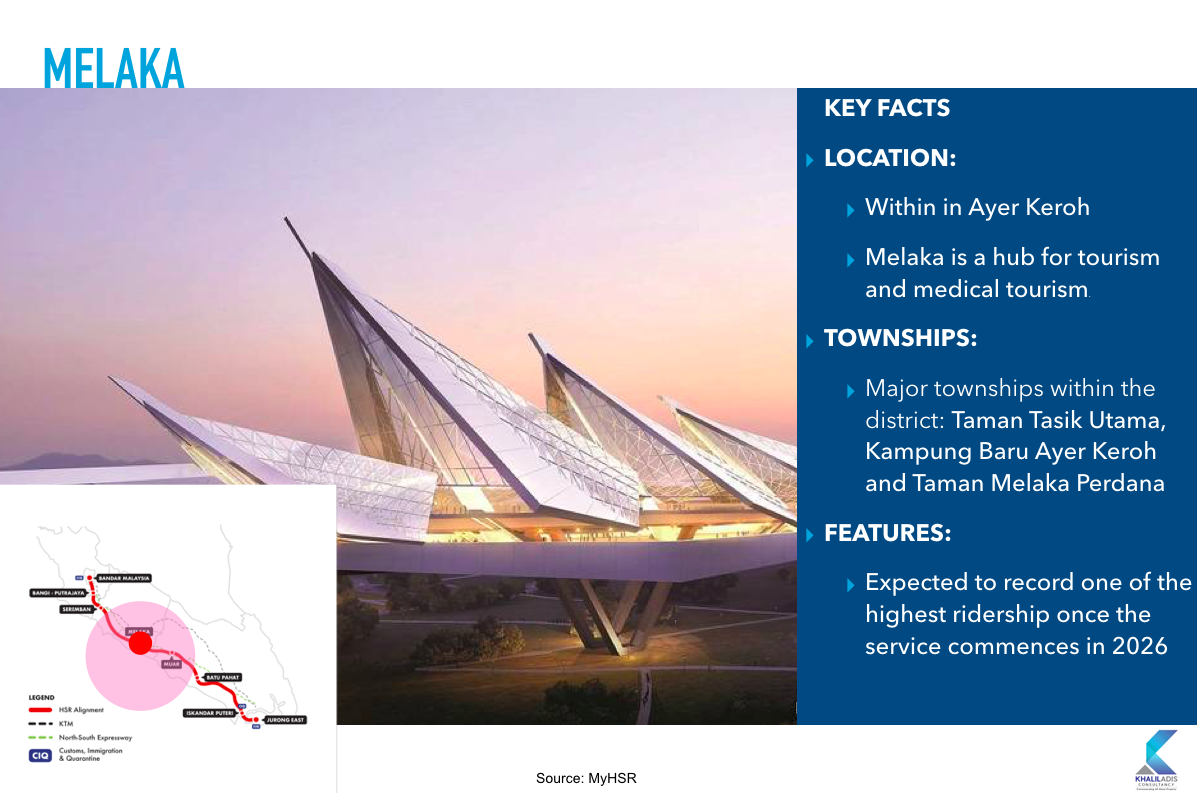

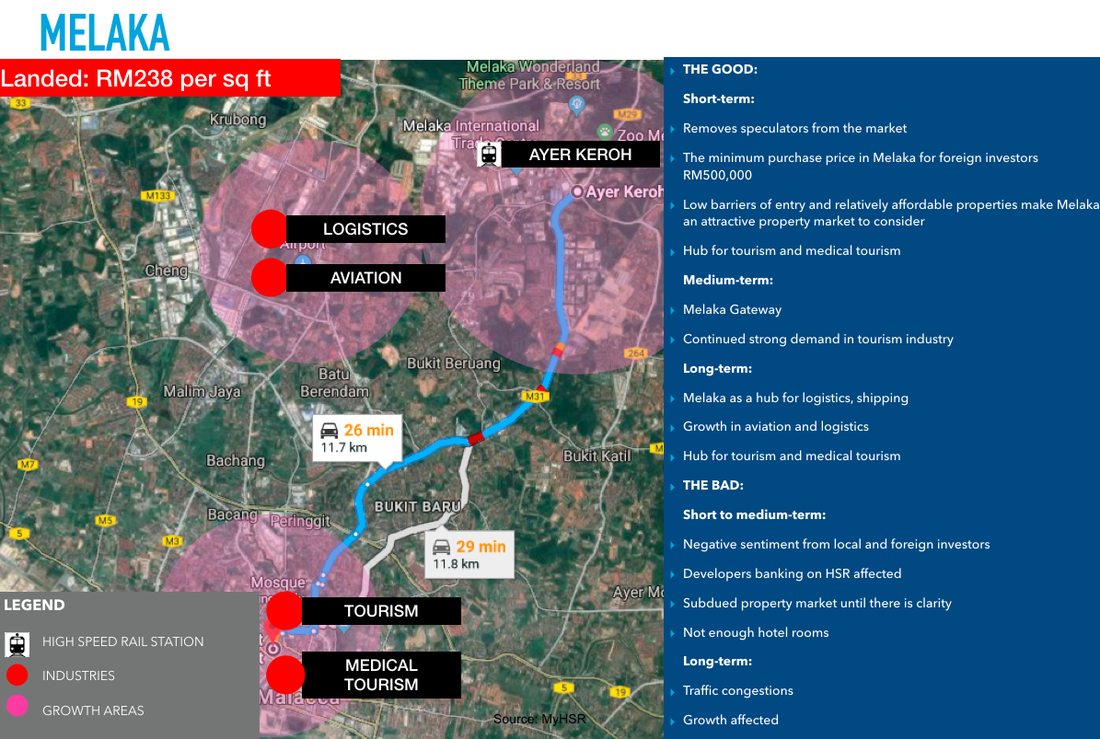

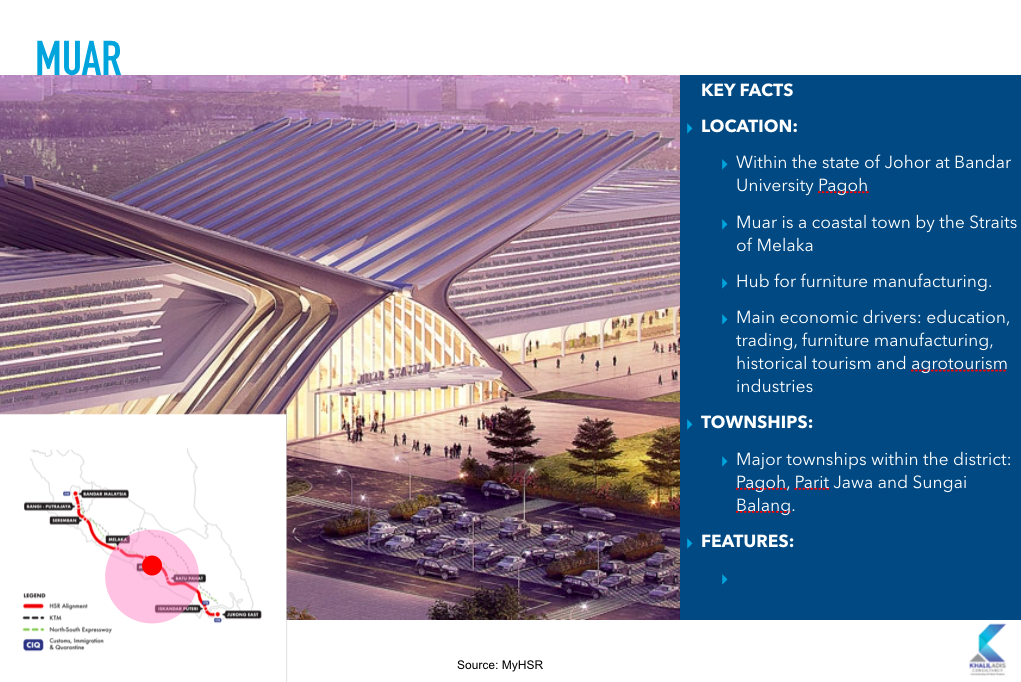

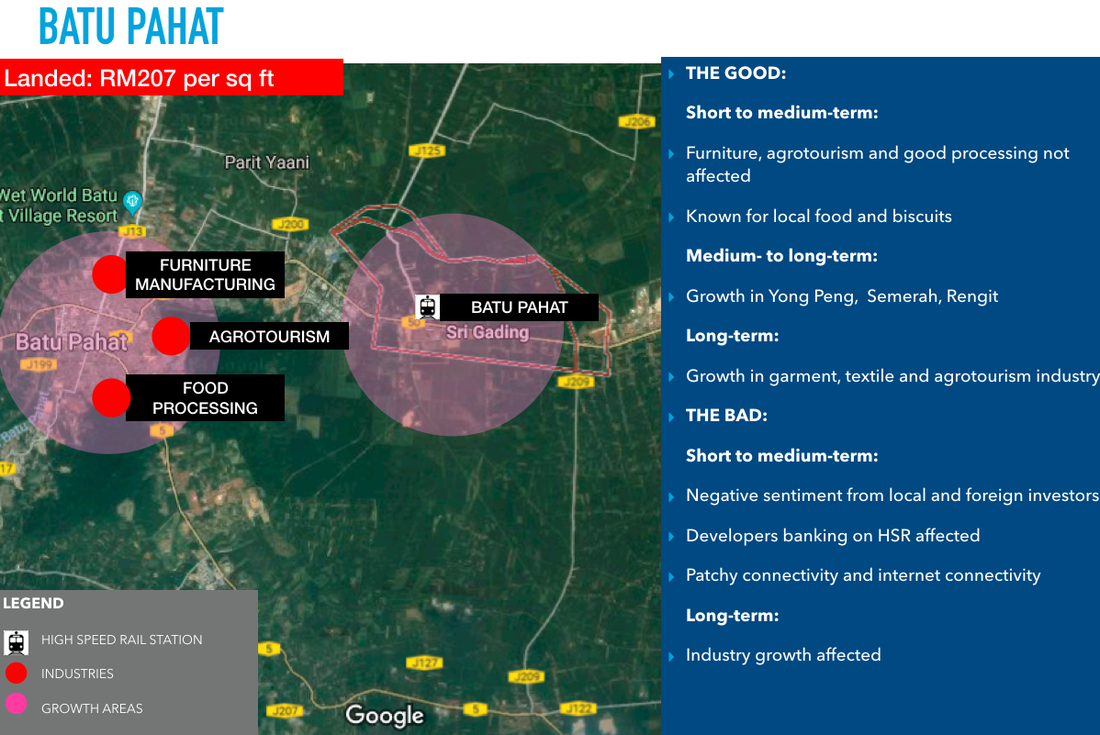

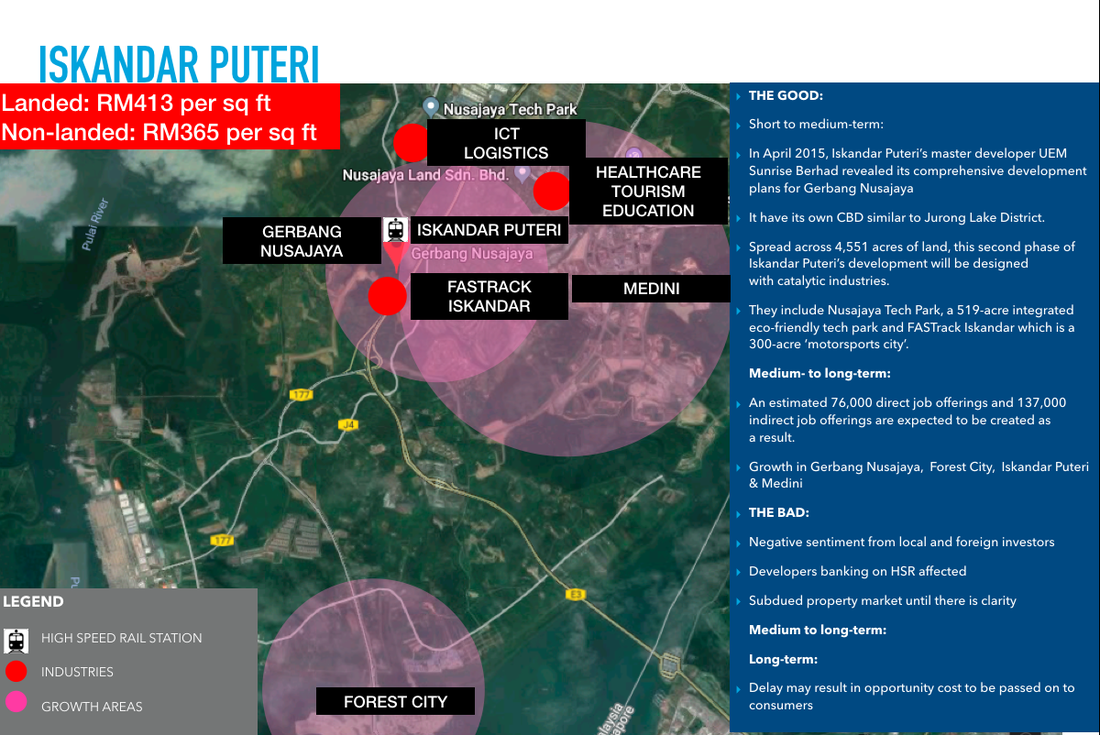

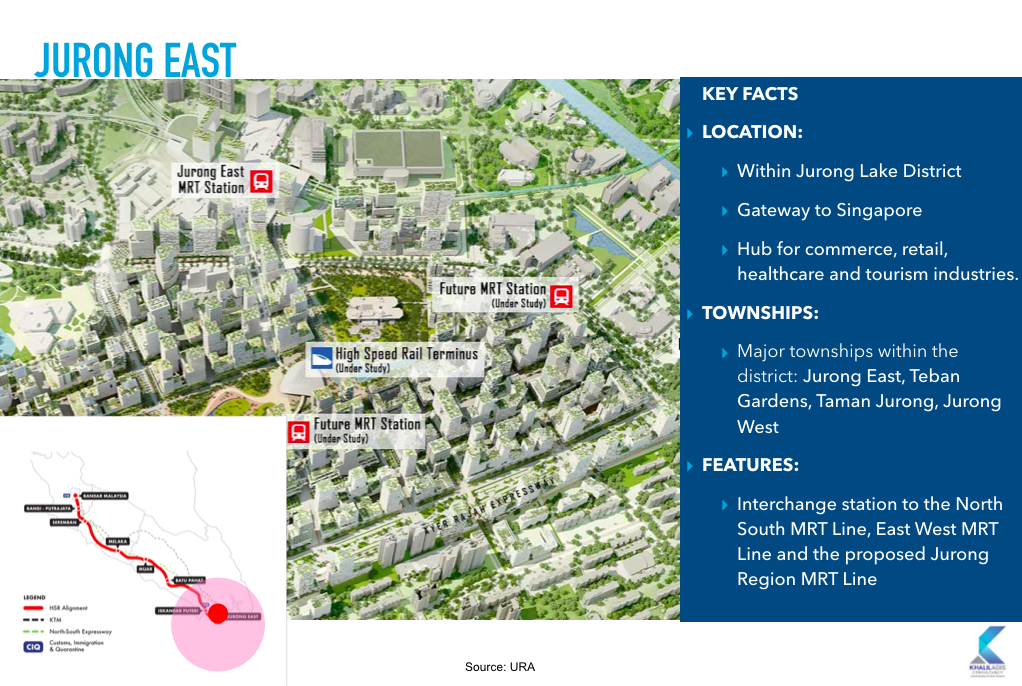

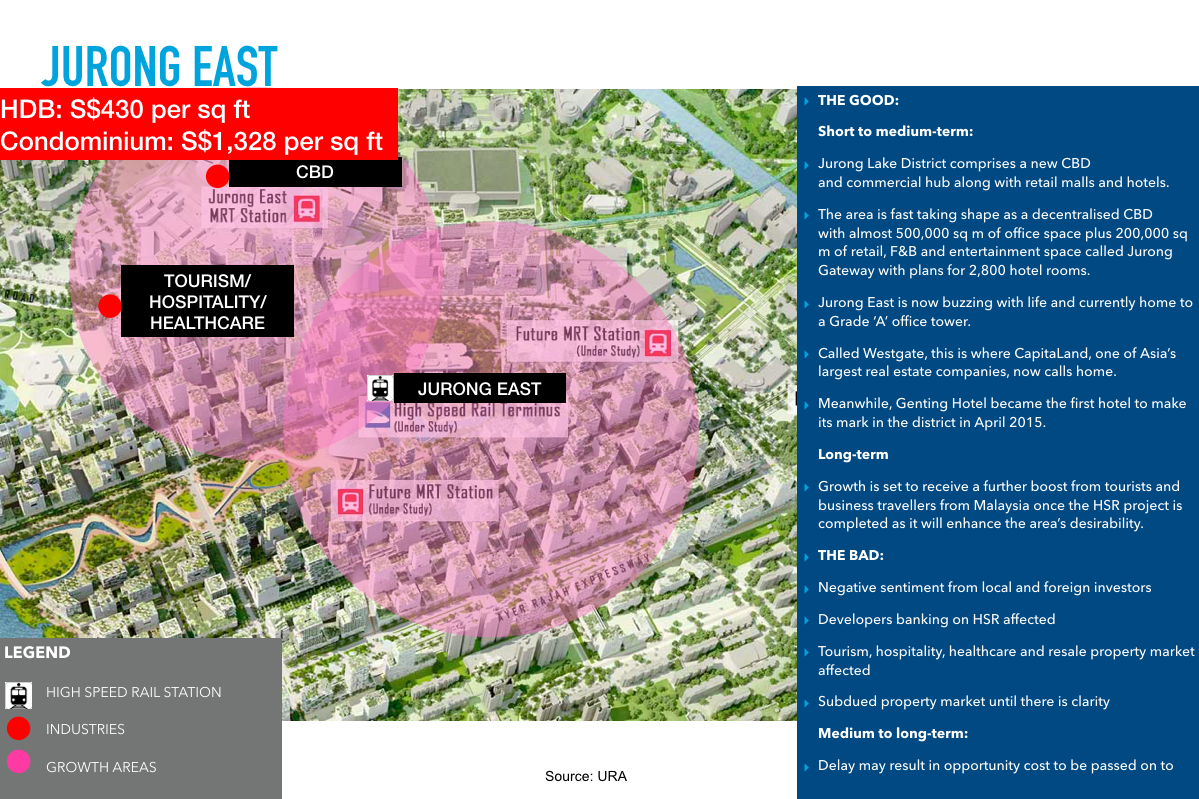

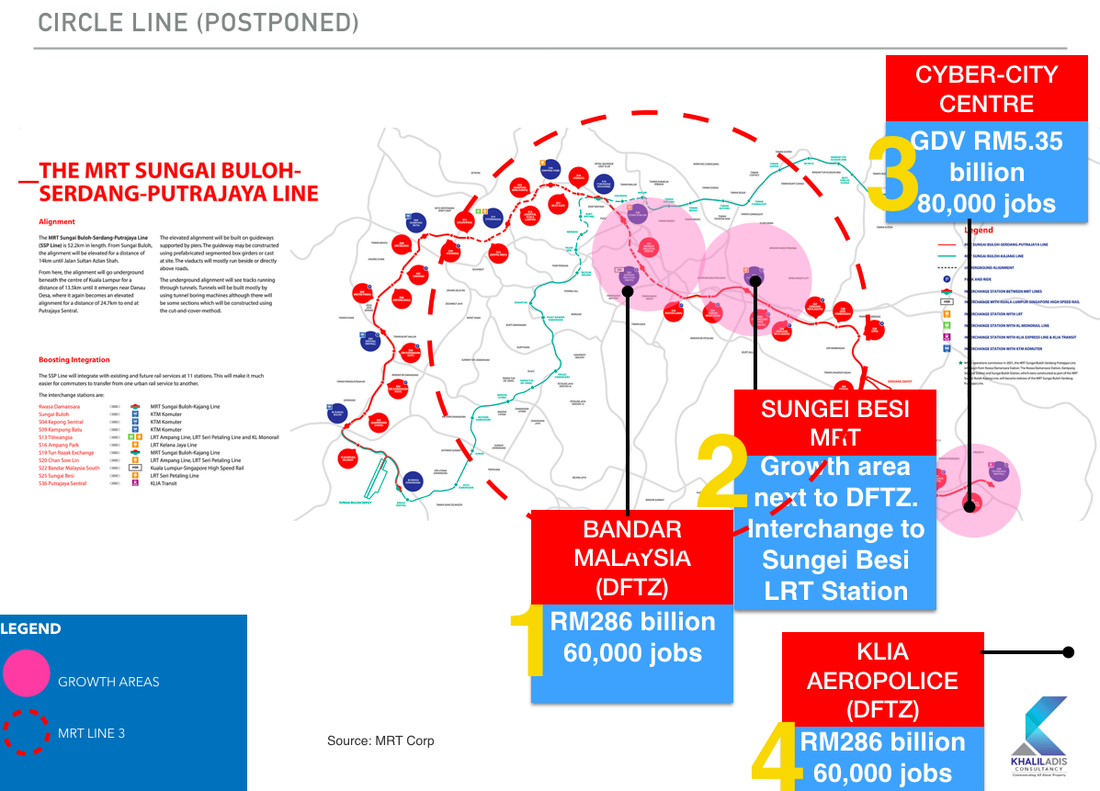

Is it on of off? We study each station and list down the good and the bad from the possible impact of its postponement in their surrounding areas.   With recent news of the High Speed cancellation, much remains to be seen if Bandar Malaysia will succeed or not. However, Bandar Malaysia North MRT station’s alignment has already been confirmed. Initially, Bandar Malaysia has been planned with a gross development value (GDV) of RM150 billion with a dedicated commercial district to support new start-ups as well as small and medium-sized enterprises (SMEs). In addition, Kuala Lumpur City Hall (DBKL) has said 30, 000 units of homes will be delivered housing some 120, 000 residents within Bandar Malaysia. Whether or not this will go ahead, remains unclear. The only glimmer of hope here is the Digital Free Trade Zone by Jack Ma which so far has not been canned by the new government. #1: Impact: The Bangi-Putrajaya HSR station is located in the south of Klang Valley and within the state of Selangor at Kampung Abu Bakar Bagindar. Putrajaya is the Federal Administrative hub of Malaysia. Major townships include Putrajaya, Cyberjaya and Bangi. There is a proposed connection to the Putrajaya Monorail that will connect this station to Putrajaya Sentral which will serve as an interchange station to the MRT station and the Putrajaya Sentral Express Rail Linl (ERL). The latter links you to KLIA and KLIA2. #2: Impact: The Seremban HSR station is located within the Malaysia Vision Valley area within the state of Negeri Sembilan. Sited within the Labu and Kirby estates, major townships in the vicinity include Bandar Enstek, Bandar Ainsdale Property and S2 Height. Seremban will be an interchange station to the Seremban Komuter Line and KTM Electric Train Service . #3: Impact The Melaka HSR station is located in Ayer Keroh within the state of Melaka. Melaka is a hub for tourism and medical tourism. Major townships in the vicinity include Taman Tasik Utama, Kampung Baru Ayer Keroh and Taman Melaka Perdana. Many Indonesians and Singaporeans flock to hospitals such as Mahkota Medical Centre for medical treatment. #4: Impact The Muar HSR station is located within the state of Johor at Bandar University Pagoh. Muar is a coastal town by the Straits of Melaka that is a hub for furniture manufacturing. Major townships in the vicinity Pagoh, Parit Jawa and Sungai Balang. The main economic drivers here are those in the education, trading, furniture manufacturing, historical tourism and agrotourism industries. #5: Impact The Batu Pahat HSR station is located within the state of Johor at Pura Kencana, Seri Gading. Batu Pahat is a hub for garment and textile factories. Major townships in the vicinity include include Rengit, Yong Peng and Semerah. The main economic drivers here are those in the the furniture manufacturing, food processing and agrotourism. However, isnce 20011, there has been a notable growth in small and medium industries such as textiles, garments and electronics. #6: Impact The Iskandar Puteri HSR station is located within Gerbang Nusajaya in the state of Johor It is the gateway to Iskandar Malaysia and covers an area of 1,841-hectare. Gerbang Nusajaya features a number of catalytic developments including Nusajaya Tech Park and FASTrack Iskandar. Major townships in the vicinity include Gerbang Nusajaya, Iskandar Puteri and Medini. This will be the final leg of the Malaysian station before it enters Singapore, terminating at Jurong East. While the station in Nusajaya has not yet been announced, government officials have indicated that it will be located close to Motorsports City near East Ledang. #7: Impact The Jurong East HSR station is located within the Jurong Lake District in Singapore. It is the gateway to Singapore and covers an area of 67-hectare. Jurong Lake District is the hub for commerce, retail, healthcare and tourism industries. Major townships in the vicinity include Jurong East, Teban Gardens, Lakeside and Taman Jurong. Jurong East will be an interchange station to the North South MRT Line, East West MRT Line and the proposed Jurong Region MRT Line. #8: Impact Also known as MRT Line 3, this is the final line that will comprise of a “wheel and spoke” system to connect to MRT Line 1 and SSP. Line 3 is expected to be completed in 2025. Collectively, all three lines will be integrated with the current trains systems forming the Klang Valley Integrated Train System. However, this project has been postponed by the new federal government when it took power in May 2018 owing to budget cuts.

#9: Impact The impact for this postponement will be marginal as this MRT Line will still need to be constructed to connect the SBK Line and SSP Line. We will most likely see speculators staying away from the market. This presents good opportunity for genuine homebuyers to start looking in and around the station. Homes in the secondary market will be the most ideal as they are priced cheaper than new launches. Navigating the Malaysian property market can be daunting affair, especially for those just starting out. We list 8 property trends that every investor should watch out for in 2017.

By Khalil Adis The property market outlook for next year is daunting with a general slowdown expected across all the property markets. From residential to commercial, experts at the recently concluded PropertyGuru 2017 Property Outlook Forum echoed similar sentiment. “Based on the combined data from the PropertyGuru Property Price Index and official statistics, 2017 is expected to be another slow year for the property market. With the completion of many new developments flooding the market in 2017, there is likely to be a drop in selling price due to the lack of demand; and some may be motivated to move their units quickly due to their lack of holding power,” said Sheldon Fernandez, country manager of PropertyGuru Malaysia. Indeed, the property market in Malaysia faces various challenges such as loan rejection by banks, rising costs of living and high unemployment rate among fresh graduates due mainly to their lack of proficiency in the English language. In the first case, the loan rejections rate in Malaysia stands at around 40 per cent arising mainly due to non-payment of PTPTN (the National Higher Education Fund Corporation) and credit card loans. In the second case, cost of basic good and necessities in Malaysia have gone up. Data from the Statistics Department showed that the country’s consumer price index increased 1.4 per cent in October year-on-year. This is slightly slower than the previous month's pace. Government data also showed that there were increase in prices for food, alcoholic and non-alcoholic beverages, tobacco and housing. Finally, according to the Malaysian Employers Federation (MEF), unemployment among fresh graduates as of February 2016 stands at around 200, 000. This does not include those who have just completed their diplomas, certificate programmes and Sijil Pelajaran Malaysia (SPM). Collectively, these factors have had a huge impact on the property sector. Despite the bleak outlook, not all is gloom and doom in the Malaysian property market. In fact, there are still pocket of opportunities to be sought after by savvy investors. Here, we list down our top ten property trends to watch out for in 2017. Trend 1: Below market value homes One man’s loss is another man’s gain. With the sluggish economy, rising cost of living and tighter bank guidelines, home repossessions are on the rise. While there is no official data avialable, agents specialising in below market value (BMV) properties are enjoying brisk business as the supply of such homes come on stream. This presents a very good buying opportunity for the cash rich buyers as below market value homes come under the hammer. BMV properties are typically those in the low-cost and medium cost segments From an investment point of view, buying such properties makes sense as you can buy multiple of distressed assets equivalent to buying one from the primary or resale market. Due to the lower acquisition costs, your rental yield is higher which ensures you can cover your mortgage (if you are taking a loan) or positive cash flow if you are buying it in cash. However, due diligence is important so hire a good solicitor and agent to help you buy BMV properties. Be prepared to cough up extra monies for unpaid maintenance fees, utility bills and quit rent (cukai pintu) Trend 2: Transit oriented development I had covered this extensively from my recent article on Propwall. For more information, please click here Trend 3: Hotel suites The shringgit (shrinking ringgit), as what my Malaysian friends call it, does not necessarily spell bad new for the Malaysian economy. In fact, the falling ringgit has helped to boost tourism arrivals and spendings, especially from my fellow countrymen in Singapore. One product you may want to look into is hotel suites. Good markets to focus on include Melaka, Iskandar Malaysia, Kuala Lumpur and Penang. Make sure the hotel suites have a proper management arm and are located close to places of attractions and shopping centres. Trend 4: Retail units Retail units are closely intertwined with the shringgit and hotel suites as tourists flock to Malaysia as the get more bang for their bucks. When investing in retail units, make sure you go for reputable developers with a property management arm. The best development to go for are mixed-use development comprising residences, hotels and retail. This ensures maximum human traffic patronising your stores. Again, the good markets to focus on are similar to the one I mentioned above under hotel suites. Trend 5: Smart and connected liveable townships Malaysian Gen Ys are a discerning lot and they demand a lot more than just a roof over their heads. As such, smart and connected (and by that, we mean Wifi) liveable townships are the way to go. Developers also need to come up with more creative ways to differentiate and add value to their developments by creating a vibrant community. For example, in 2014, UMLand’s Taman Seri Austin became the first urban community to be selected for the Smart and HealthyCity and Community Programme by Iskandar Regional Development Authority (IRDA). Taman Seri Austin features cycling lanes, pedestrian pathways, and two recreation parks. Another example is Albury @ Mahkota Hills which features Gen Y friendly facilities like a gym, clubhouse and park connectors. The development recently hosted a wedding over the weekend at its clubhouse which creates a sense of belonging and camaraderie among its residents. Trend 6: Short term stays Airbnb and student accommodations are in demand due to the shringgit and lack of suitable hostels respectively. When looking at Airbnb, the ideal size would be at least 500 sq ft with a myriad of facilities like cooking, washing machines, microwave oven and so on. For this concept to work, your property must be located close to tourism attractions like Bukit Bintang, Georgetown and JB Sentral. One Singaporean friend of mine earns RM10, 000 a month just by renting out his loft unit located within 8 minutes walk from Bukit Bintang MRT station. Do bear in mind thought that not all management committee in condominiums approve of such short-stay rentals. Trend 7: Flexible work spaces Malaysian Gen Ys are an entrepreneurial lot. Thanks to government mooted agencies like Cradle Fund and Magix, the start-up culture here is alive and kicking. Some of the most notable Malaysian start-ups include Kaodim and iFlix. With this trend in mind, flexible work spaces have become ubiquitous. Generally referred to as “hot-desking”, this trend is especially suited for those just starting out, are cash-sensitive and require computer access with printing and scanning facilities. In Singapore, hot-desking has become such a brisk business. If you have a spare office space, why not convert some of your area for hot-desking activities and help fellow entrepreneurs? You can rent it to on a monthly basis on a per head basis. Trend 8: Resale homes If you need a home urgently, a resale unit is the way to go as they are priced significantly cheaper, at around 30 per cent lower, compared than new launches. This is due to the massive supply in the market that has contributed to a glut in the market, resulting in softening property prices. This has made it a buyers market. Be prepared though to have extra cash in hand as you will need to pay a deposit, legals fees and other costs. The great thing is this - sellers are more willing to negotiate with you. As such, if you have difficulties in your 10 per cent deposit, you can negotiate your payment terms with the landlord. Here’s wishing you a prosperous 2017 ahead! |

Khalil AdisAn independent analysis from yours truly Archives

July 2023

Categories

All

|

100 Peck Seah Street

|

|

RSS Feed

RSS Feed