|

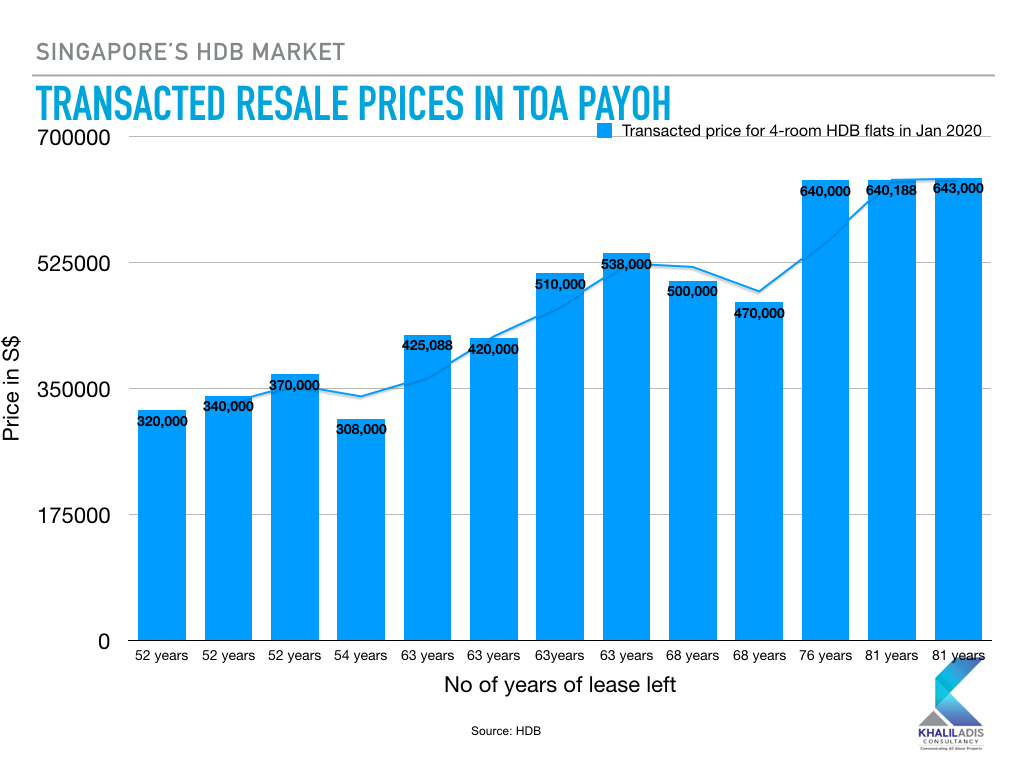

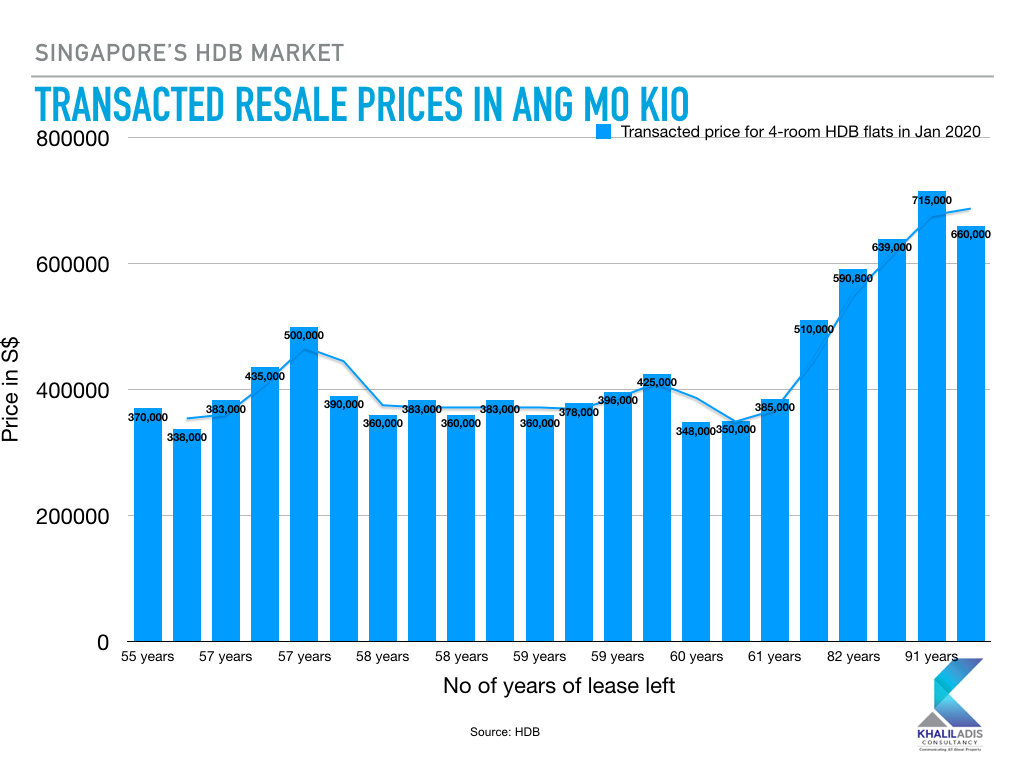

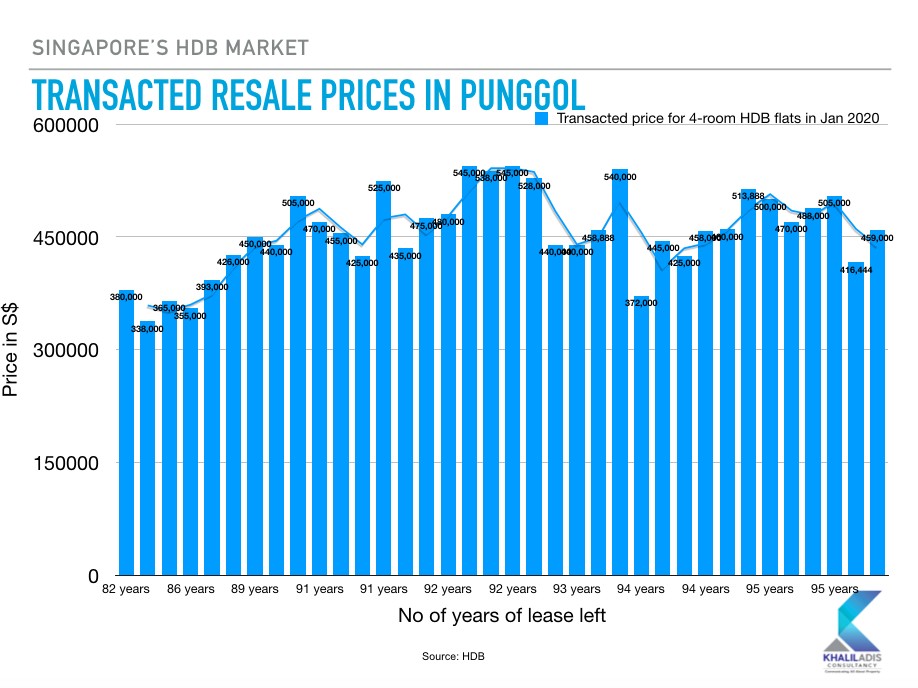

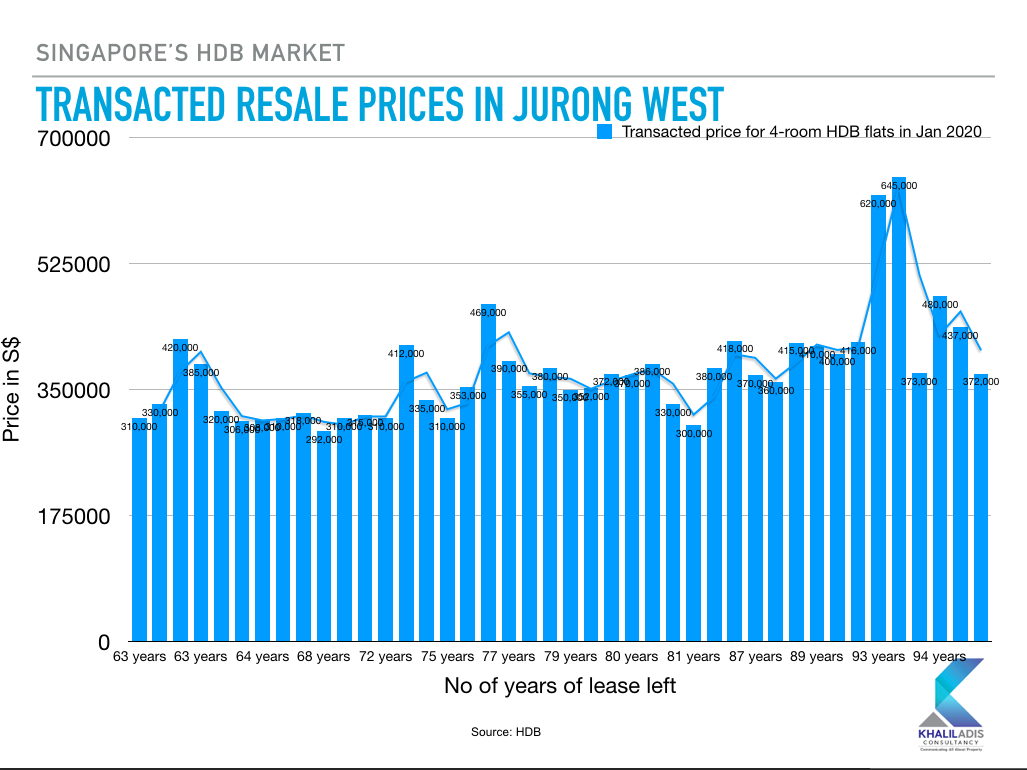

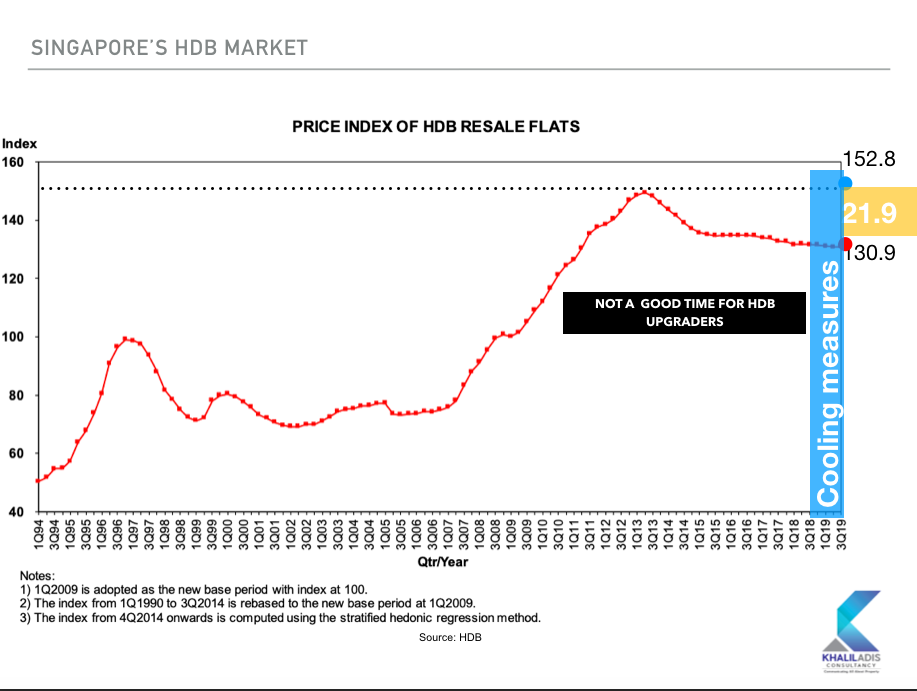

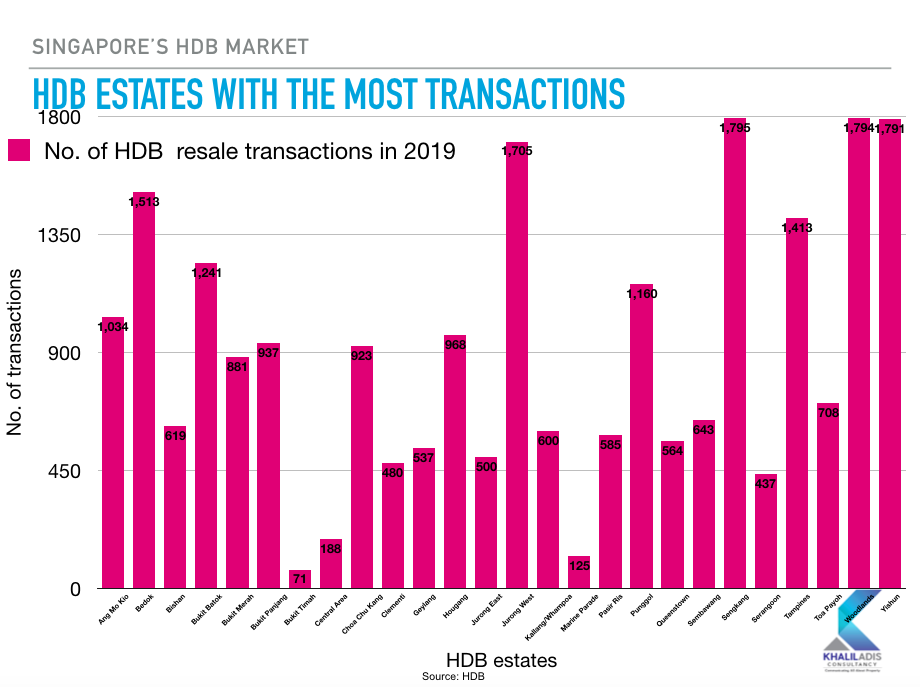

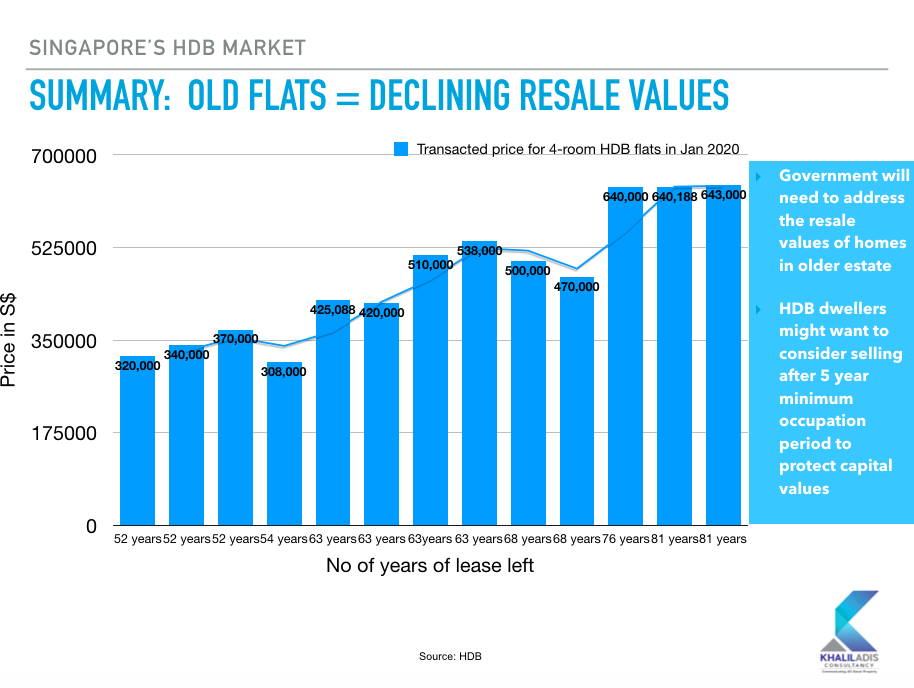

Strong correlation seen between transacted property price and remaining lease. By Khalil Adis Since the Lee Kuan Yew era, Singaporeans have been ingrained with the idea that our HDB flat is an asset. While you can make a profit from your HDB flat, this depends on the lease that is remaining on your property. Based on our research and analysis, we found that HDB flats in older estates with a remaining lease of fewer than 60 years saw their property values diminish. Meanwhile, those that have around 80 years of lease left were able to fetch far higher prices. This is according to data captured on HDB’s website. On the other end of the spectrum, HDB flats that are located in newer estates did not see that much price variation. In conducting this study, we had looked into HDB transactions for 4-room flats that were recorded as of 21 January 2020 and then compared it with the remaining lease. The estates chosen included the mature estates of Toa Payoh and Ang Mo Kio as well as the non-mature HDB estates of Punggol and Jurong West. Here are some quick snapshots based on our findings. #1: Toa Payoh: Older HDB flats changed hands at lower prices When it comes to buying an HDB flat, most Singaporeans will prefer to buy in a mature estate such as in Toa Payoh or Ang Mo Kio. However, if you have a flat with a remaining lease of fewer than 54 years this may have an impact on your resale value. According to data captured on HDB’s website, there were 14 transactions for 4-room HDB flats in Toa Payoh during this period. The data showed a strong correlation between the price versus the remaining lease. For instance, older HDB flats (4) with 54 years or less of the remaining lease were transacted at an average price of S$334,500. Meanwhile, newer HDB flats (4) with 76 to 81 years of the remaining lease were transacted at an average price of S$641,062. This represents a price difference of 91.6 per cent. #2: Ang Mo Kio: Newer HDB flats fetched higher selling prices Ang Mo Kio is also another favourite estate among buyers explaining why Built-To-Order (BTO) launches have always been oversubscribed. Like Toa Payoh, Ang Mo Kio also witnessed a strong correlation between price versus the remaining lease. According to data captured on HDB’s website, there were 24 transactions for 4-room HDB flats in the estate during this period. Newer HDB flats (5) with 80 to 91 years of the remaining lease were transacted at an average price of S$622,960. On the other hand, older HDB flats (14) with 59 years or less of the remaining lease were transacted at an average price of S$390,071. This represents a price difference of 59.7 per cent. #2: Punggol: A non-mature estate where capital values experience fewer fluctuations Punggol is a non-mature estate with a relatively young population. While it may seem far-flung, Punggol is among the top ten estates in Singapore where HDB resale homes have changed hands. According to data captured on HDB’s website, there were 36 transactions for 4-room HDB flats in the estate during this period. The remaining lease in Punggol ranges from 82 to 95 years. As such, there is not much price variation as seen in the case of Toa Payoh and Ang Mo Kio. For example, HDB flats (7) with between 82 to 89 years of the remaining lease were transacted at an average price of S$334,500. Meanwhile, newer HDB flats (29) with 90 years or more of the remaining lease were transacted at an average price of S$477,002. This represents a price difference of 42.6 per cent. This suggests that newer estates like Punggol may be ideal if you want to protect the capital values of your property. #3: Jurong West: A semi-mature estate with a price gap similar to Punggol Jurong West is a semi-mature area and as such the remaining lease here is between 63 and 94 years. According to data captured on HDB’s website, there were 41 transactions for 4-room HDB flats in the estate during this period. Similar to Punggol, there is not much price variation as seen in the case of Toa Payoh and Ang Mo Kio. For example, HDB flats (11) with less than 70 years of the remaining lease were transacted at an average price of S$328,090. Meanwhile, newer HDB flats (8) with 93 years or more of the remaining lease were transacted at an average price of S$467,875. This represents a price difference of 42.6 per cent. #4: Price gap is widest in Toa Payoh Toa Payoh makes an interesting case study. We decided to zoom into this estate as property agents have long complained that they have had a hard time selling older HDB flats in the area. Our analysis seems to concur with our findings on the ground when speaking to agents as they appear to diminish in value nearing the end of the lease. In the case of Toa Payoh, the price gap is a whopping 91.6 per cent compared to Ang Mo Kio, Punggol and Jurong West at 59.7 per cent and 42.6 per cent respectively. #5: Widening price gap between HDB and private property market According to the third quarter of 2019 data from the HDB and the Urban Redevelopment Authority (URA), the Resale Price Index (RPI) and the Private Property Index (PPI) are at 130.9 and 152,8 percentage points respectively. This means a price gap of 21.9 percentage points. The widening price gap is bad news for HDB upgraders thinking of buying a condominium. As such, this may not be an opportune time for you to do so. Should Singapore enter into a recession this year, we are likely to see the PPI drop further narrowing the price gap between the HDB and private property markets. Good things come to those who wait so wait out. #6: Sengkang is the most popular estate for resale HDB flats in 2019 Rounding of the top 10 HDB estates, Sengkang is the most popular with 1,795 resale transactions recorded in 2019, followed by Woodlands (1,794), Yishun (1,791), Jurong West (1,705), Bedok (1,513), Tampines (1,413), Bukit Batok (1,241), Punggol (1,160), Ang Mo Kio (1,034), Hougang (968) and Bukit Merah (937). #7: Summary: Capital values appear to be better protected in non-mature estates While HDB is an asset, older HDB flats in mature estates will likely see their value decline as the data showed.

As such, prospective homebuyers might want to think twice before purchasing such flats. On the other hand, the data suggests that the capital values of your HDB flat are better protected in non-mature estates like Punggol and Jurong West. As such, you may want to consider selling your property after five years once you have fulfilled your MOP and then upgrade to private property or downsize according to your lifestyle needs. Having said that, I would like to stress that your HDB flats are for long-term occupation and not for you to make a quick profit. In closing, housing is a delicate issue. The government will need to address their diminishing value sensitively especially to the older generation who are currently living in mature estates.

3 Comments

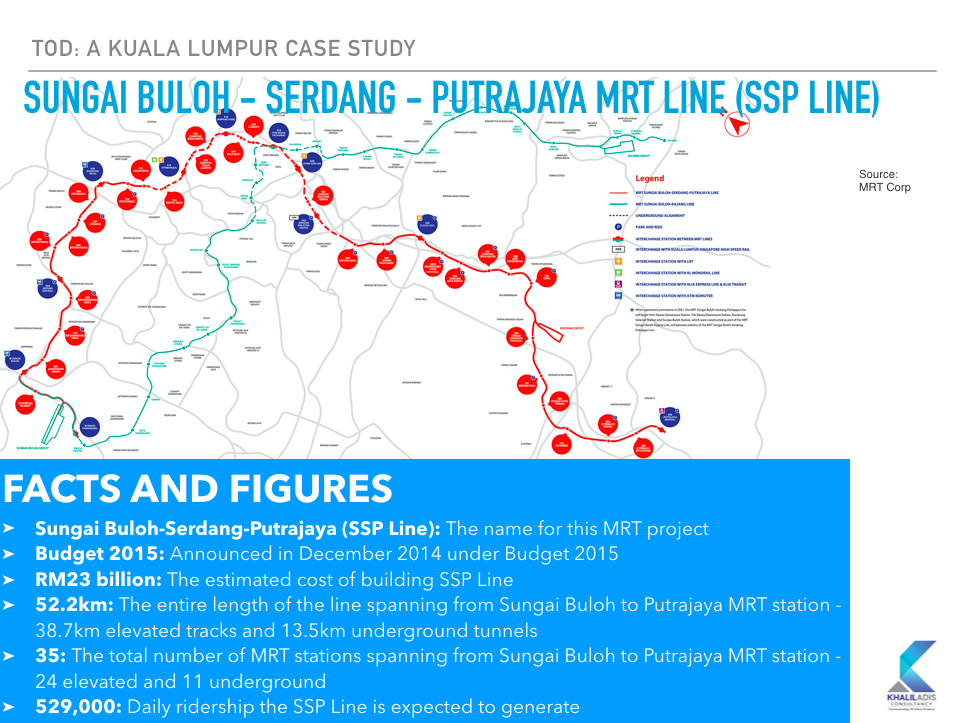

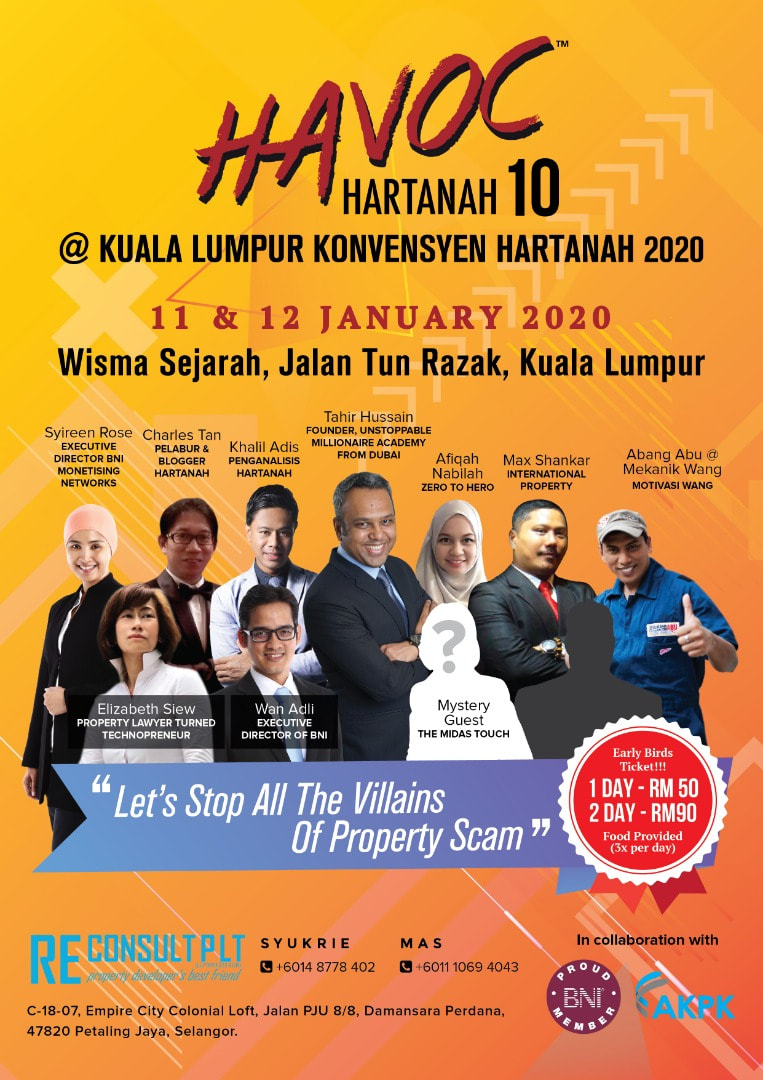

From map reading to identifying growth areas, this easy-to-understand session aims to assist first-time homebuyers looking for homes along the different train lines in KL/Greater KL. By Khalil Adis If you had enjoyed reading 'Property Buying for Gen Y', then you are in for a special treat. For my upcoming talk on January 11 at Havoc Hartanah 10, I will be including new materials that will cover newly completed as well as upcoming train lines in greater detail. Take this as 'Property Buying for Gen Y' part two - this time with more emphasis on one of the 5Cs I had mentioned in my book which is to check for transport masterplan. Here are five things you can expect during my lesson: #1: A combination of 'Property Buying for Gen Y' and 'Connectivity & Your Property' I had spent an enormous amount of time to write, conduct research and take photos for my upcoming book. For this lesson, I will place more emphasis on transportation, specifically the Sungai Buloh - Kajang Line (SBK Line), Sungai Buloh-Serdang-Putrajaya (SSP Line), Ampang LRT Extension Line, Kelana Jaya LRT Extension Line and LRT Bandar Utama-Klang Line (Klang Valley LRT Line 3). We will then dive deep into each line before identifying the growth areas. #2: Learn how to read transportation masterplan This is part of the diving deep process that you will undergo. This is where you will learn some of the key facts and figures of each line. Understanding transportation masterplan is part of the process in one of the 5Cs in my book - check for budget allocation from the government. We will then analyse how such budget allocation will have an impact on property prices along the lines. #3: Find the sweet spot in terms of distance to train stations While you may want to buy close to train stations, you also want to be careful not to buy to close, especially for elevated train stations. Also, there are certain requirements that developers will have to adhere to qualify for transit-oriented development (TOD). Learn what the sweet spots are and how they may impact on your resale and rental value. #4: Not all growth areas are created equally During the lesson, we will identify growth areas along the lines. However, not all areas are suitable for you as some are located in mature areas. For example, while Tun Razak Exchange MRT station will serve the upcoming Tun Razak Exchange, the properties around the area will not be affordable for first-time homebuyers. On the other hand, such an area will be suitable for investors looking to buy their second home or for rental income. These are some of the due diligence points we will cover. #5: Identify areas where you can find affordable properties The key to finding affordable properties along the lines mentioned is to identify areas where there are new or upcoming train stations and where the government has announced plans to create upcoming economic zones.

Such areas will have to be away from the city centre but close enough to train stations and dedicated hubs mentioned so you can experience price appreciation over the long-term. Learn where they are along the lines mentioned. Don’t forget to bring your notebook along and ask questions after the lesson. Details of my talk below: Topic: Connecting the dots and finding the hot spots Date: 11 January 2020 Time: 3.30pm Venue: Wisma Sejarah, Jalan Tun Razak, Kuala Lumpur See you there! |

Khalil AdisAn independent analysis from yours truly Archives

July 2023

Categories

All

|

100 Peck Seah Street

|

|

RSS Feed

RSS Feed