|

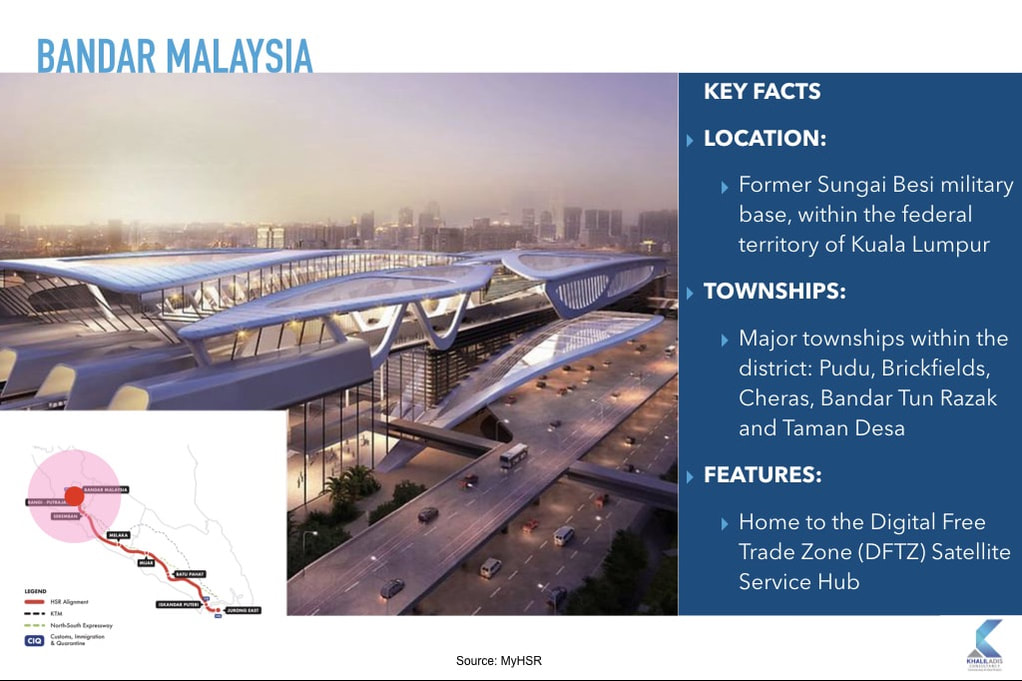

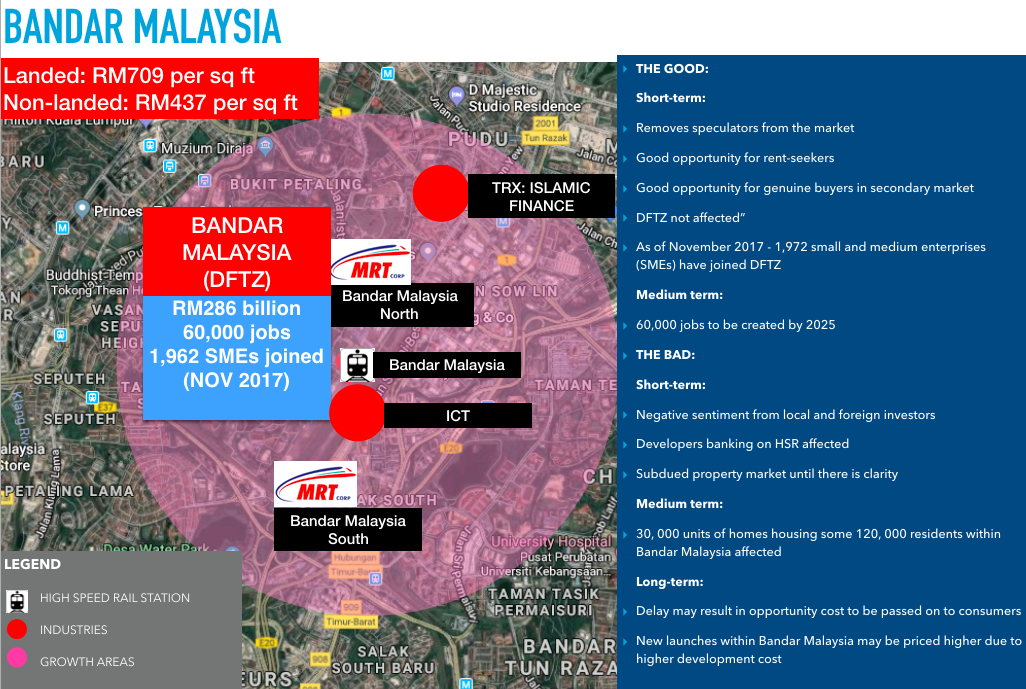

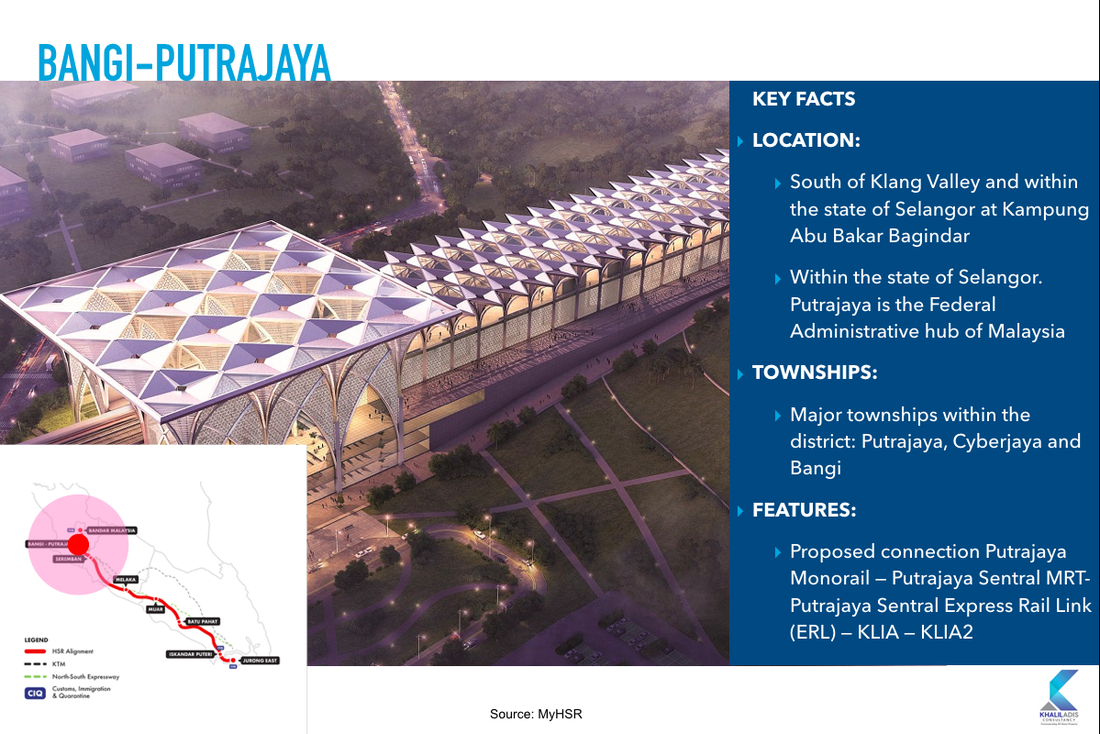

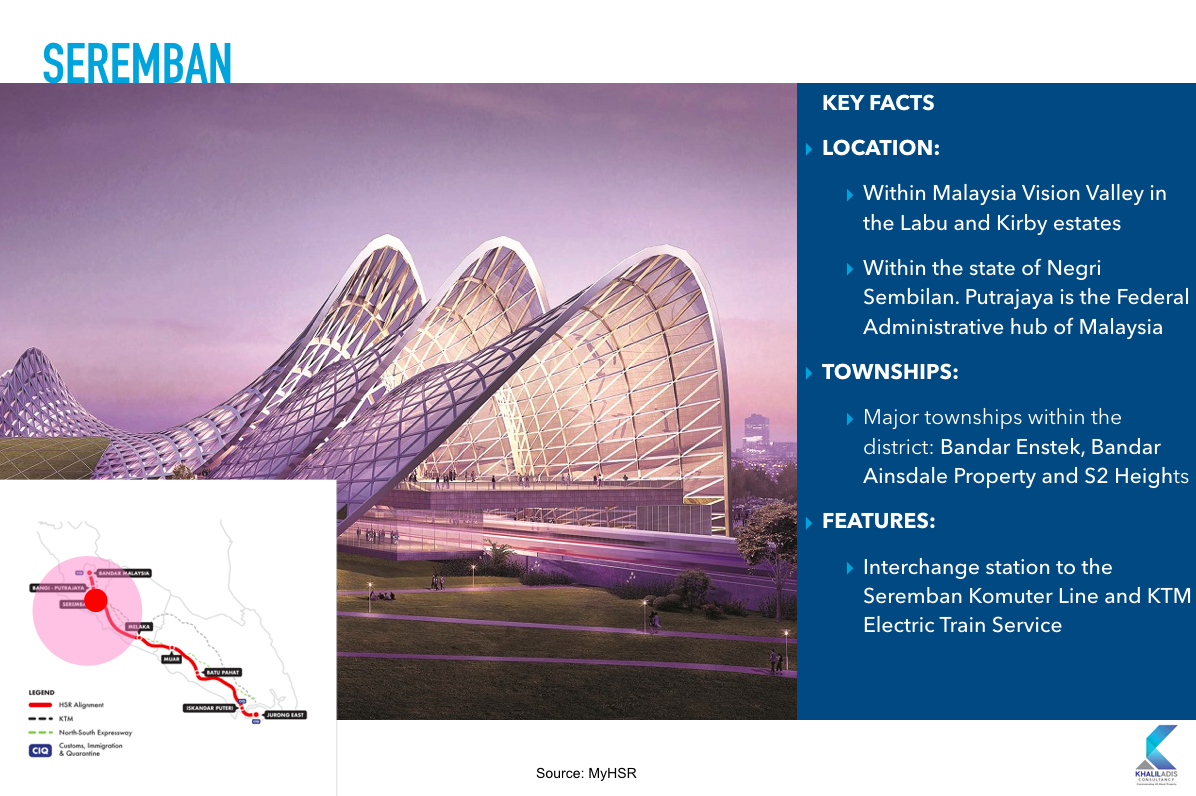

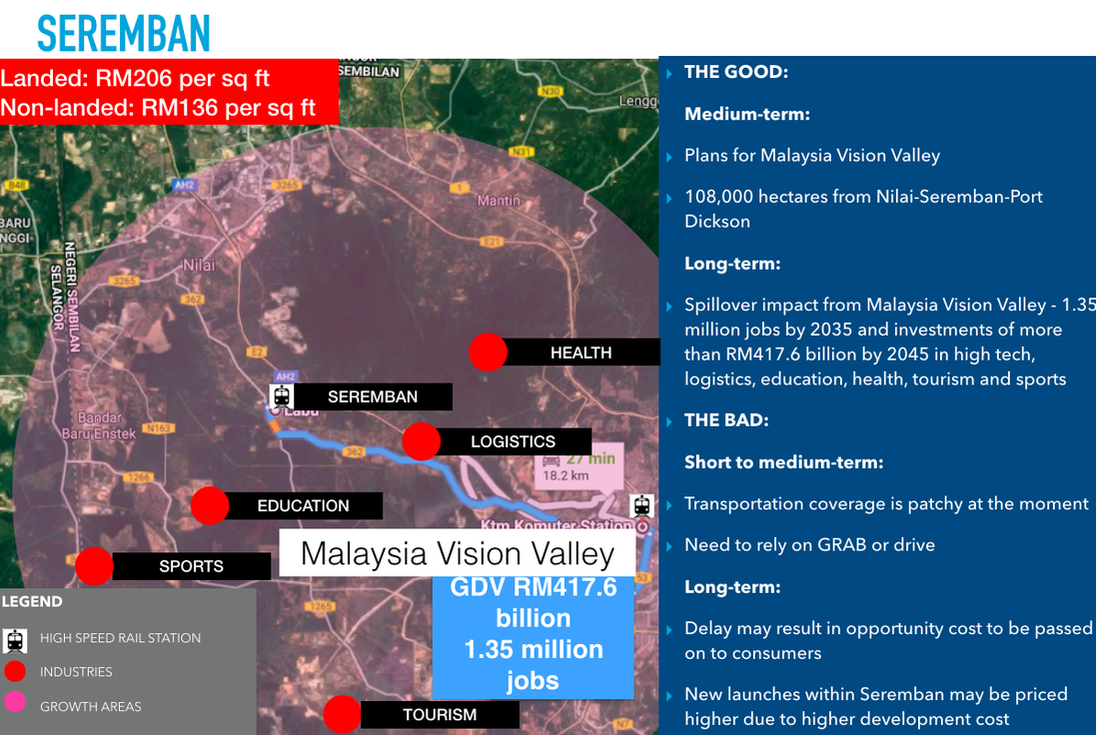

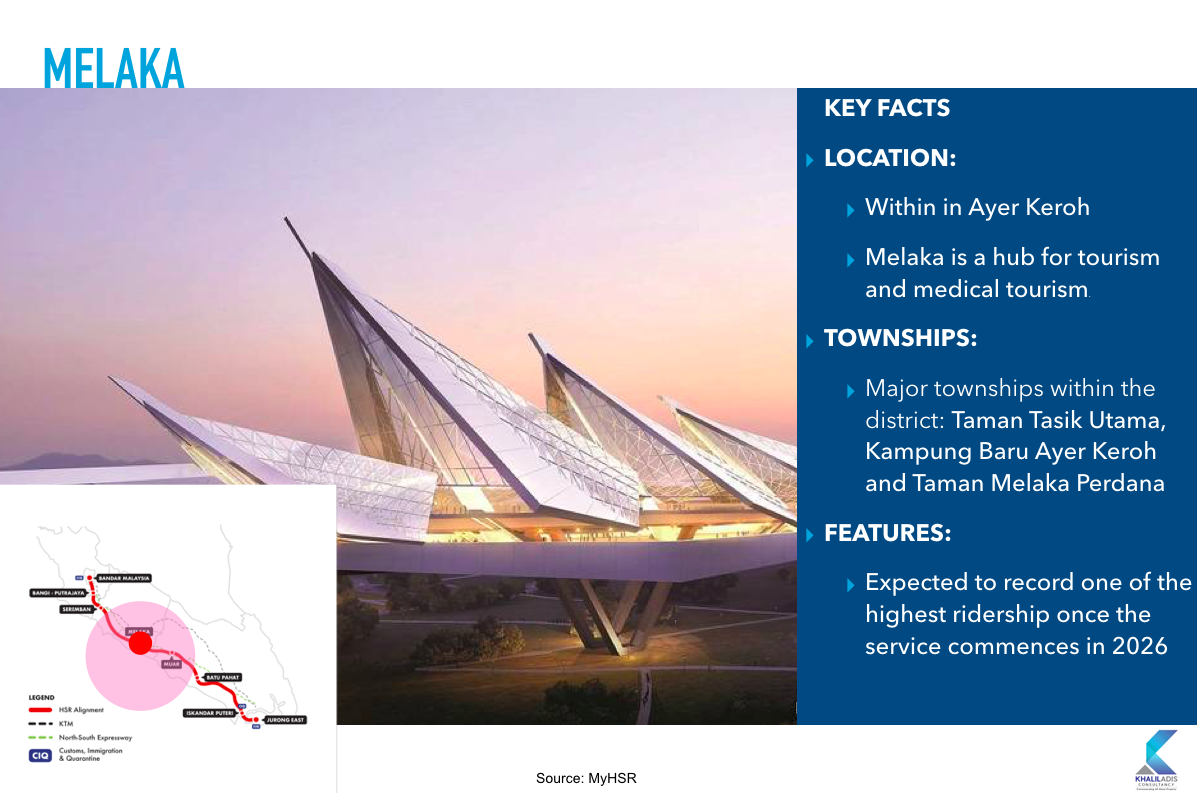

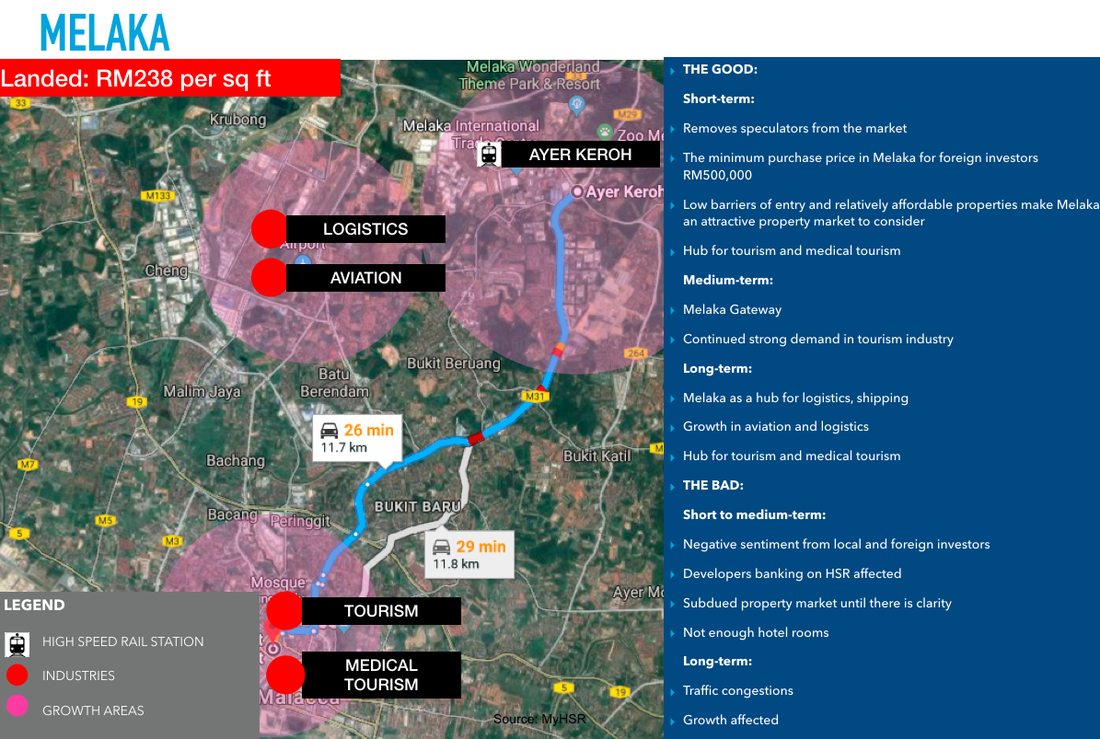

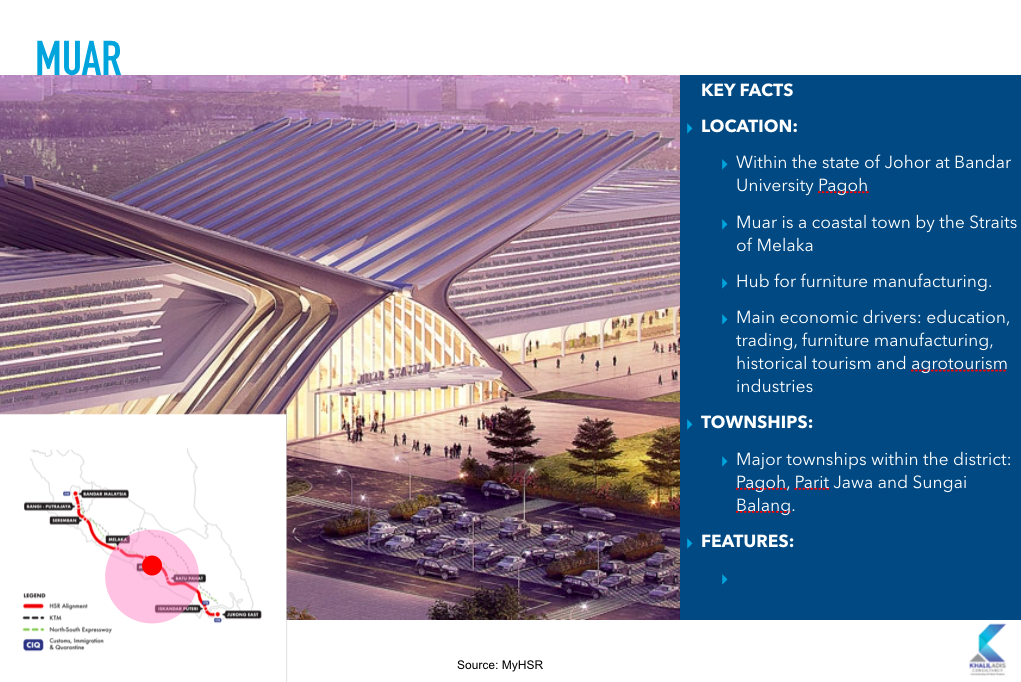

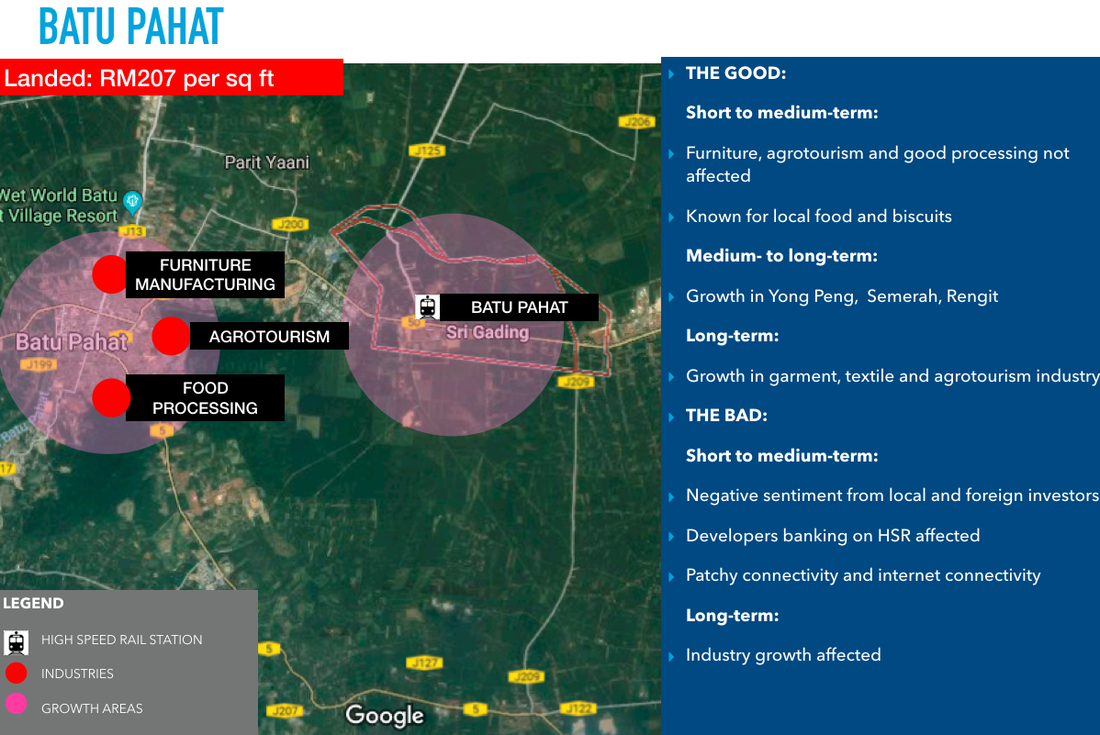

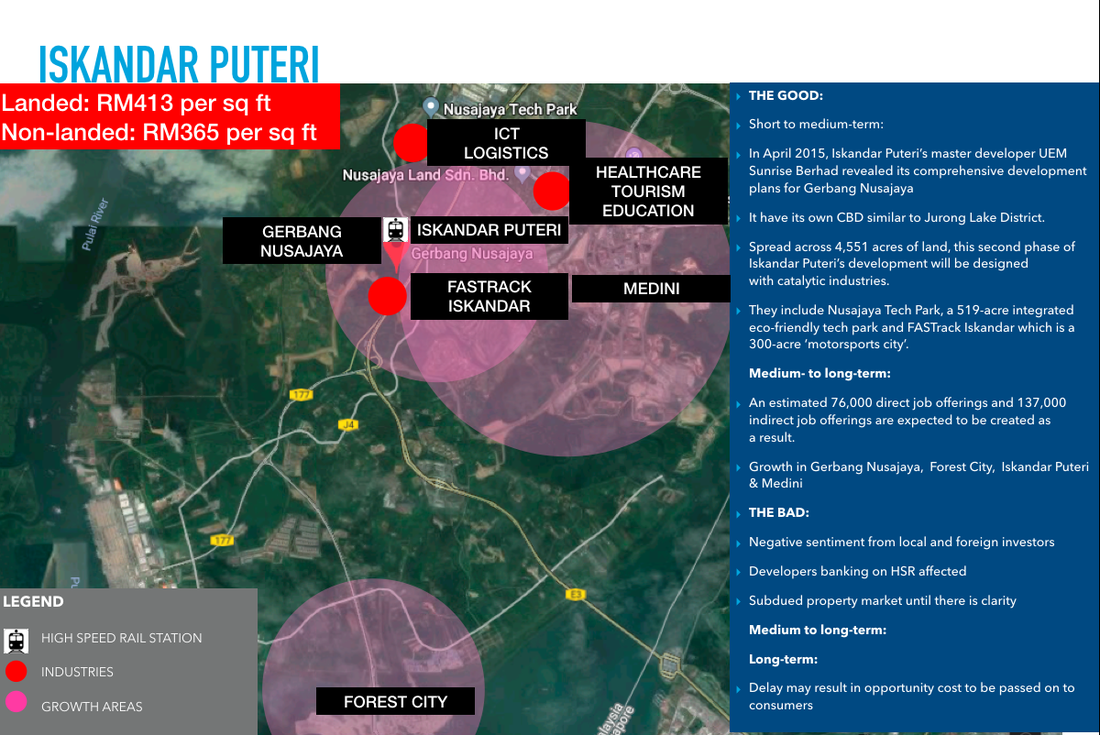

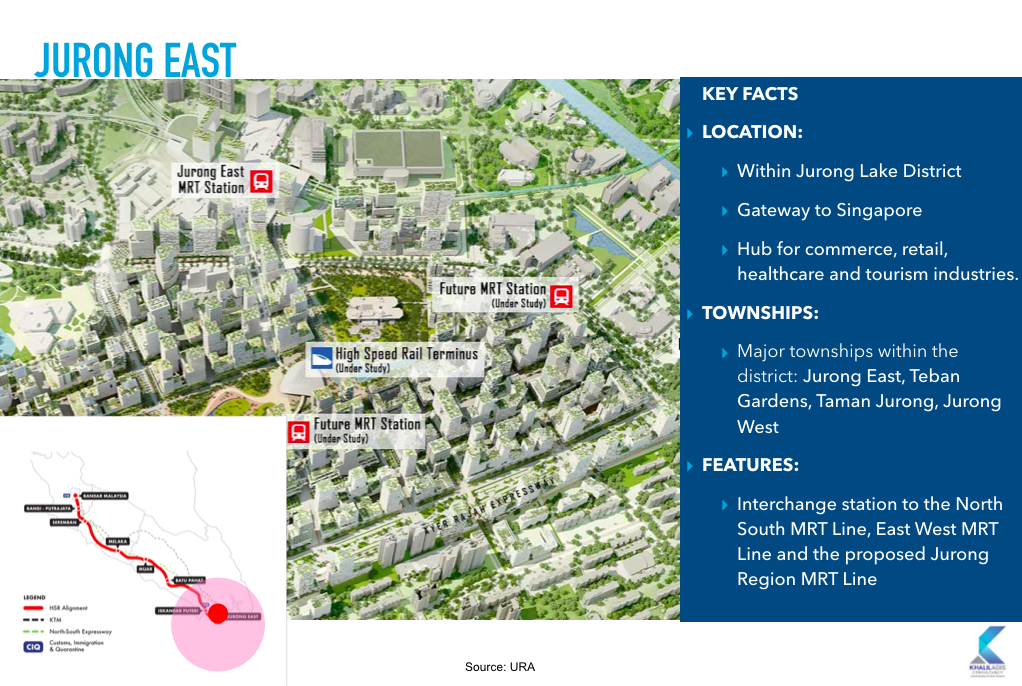

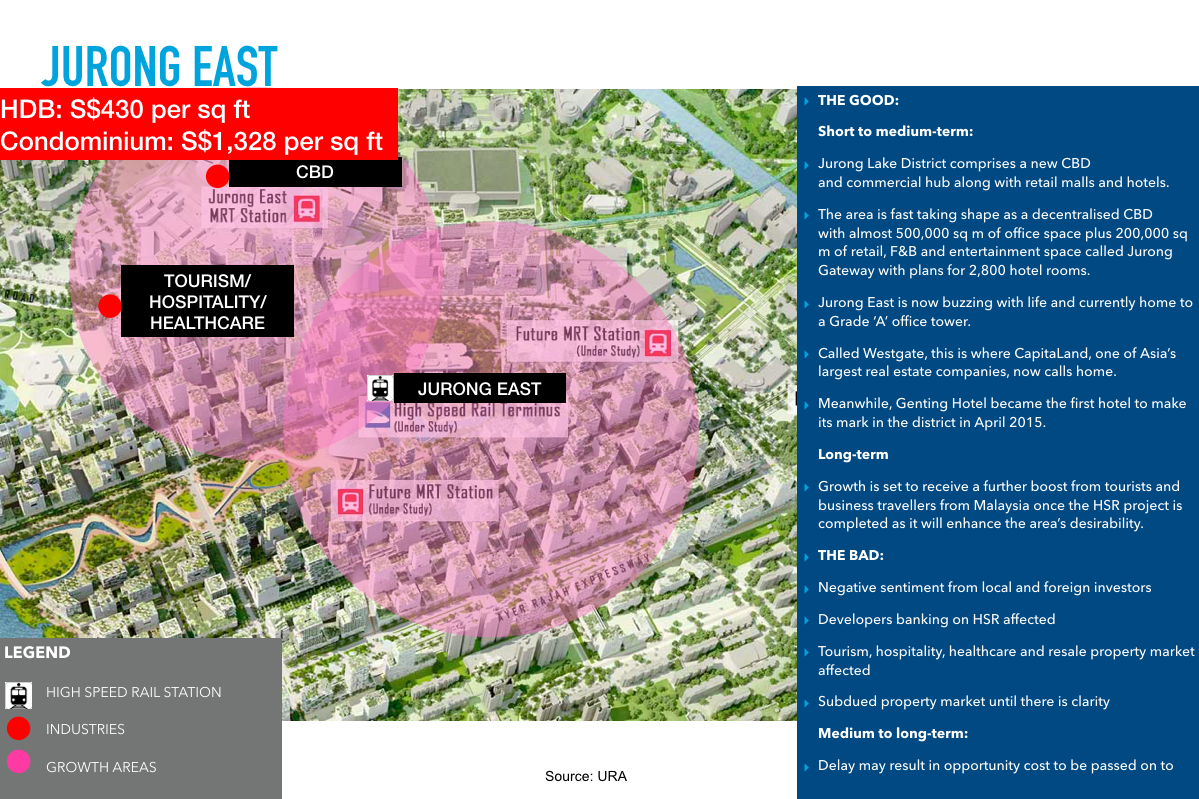

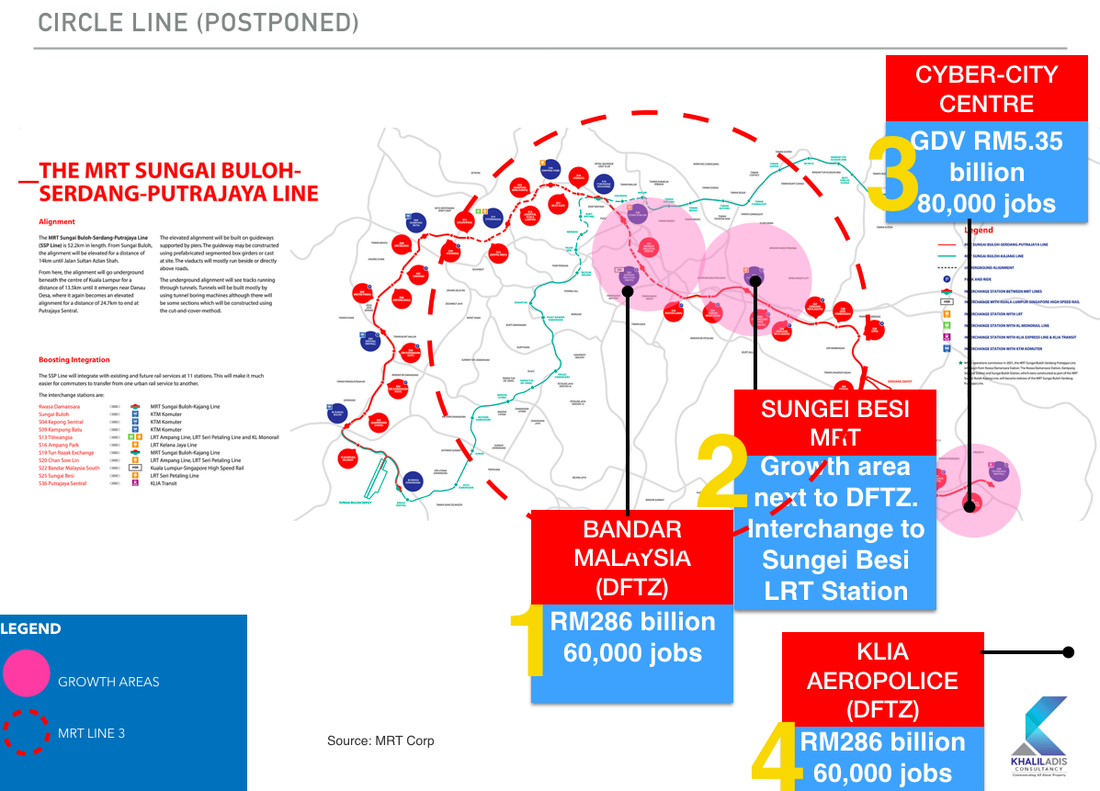

Is it on of off? We study each station and list down the good and the bad from the possible impact of its postponement in their surrounding areas.   With recent news of the High Speed cancellation, much remains to be seen if Bandar Malaysia will succeed or not. However, Bandar Malaysia North MRT station’s alignment has already been confirmed. Initially, Bandar Malaysia has been planned with a gross development value (GDV) of RM150 billion with a dedicated commercial district to support new start-ups as well as small and medium-sized enterprises (SMEs). In addition, Kuala Lumpur City Hall (DBKL) has said 30, 000 units of homes will be delivered housing some 120, 000 residents within Bandar Malaysia. Whether or not this will go ahead, remains unclear. The only glimmer of hope here is the Digital Free Trade Zone by Jack Ma which so far has not been canned by the new government. #1: Impact: The Bangi-Putrajaya HSR station is located in the south of Klang Valley and within the state of Selangor at Kampung Abu Bakar Bagindar. Putrajaya is the Federal Administrative hub of Malaysia. Major townships include Putrajaya, Cyberjaya and Bangi. There is a proposed connection to the Putrajaya Monorail that will connect this station to Putrajaya Sentral which will serve as an interchange station to the MRT station and the Putrajaya Sentral Express Rail Linl (ERL). The latter links you to KLIA and KLIA2. #2: Impact: The Seremban HSR station is located within the Malaysia Vision Valley area within the state of Negeri Sembilan. Sited within the Labu and Kirby estates, major townships in the vicinity include Bandar Enstek, Bandar Ainsdale Property and S2 Height. Seremban will be an interchange station to the Seremban Komuter Line and KTM Electric Train Service . #3: Impact The Melaka HSR station is located in Ayer Keroh within the state of Melaka. Melaka is a hub for tourism and medical tourism. Major townships in the vicinity include Taman Tasik Utama, Kampung Baru Ayer Keroh and Taman Melaka Perdana. Many Indonesians and Singaporeans flock to hospitals such as Mahkota Medical Centre for medical treatment. #4: Impact The Muar HSR station is located within the state of Johor at Bandar University Pagoh. Muar is a coastal town by the Straits of Melaka that is a hub for furniture manufacturing. Major townships in the vicinity Pagoh, Parit Jawa and Sungai Balang. The main economic drivers here are those in the education, trading, furniture manufacturing, historical tourism and agrotourism industries. #5: Impact The Batu Pahat HSR station is located within the state of Johor at Pura Kencana, Seri Gading. Batu Pahat is a hub for garment and textile factories. Major townships in the vicinity include include Rengit, Yong Peng and Semerah. The main economic drivers here are those in the the furniture manufacturing, food processing and agrotourism. However, isnce 20011, there has been a notable growth in small and medium industries such as textiles, garments and electronics. #6: Impact The Iskandar Puteri HSR station is located within Gerbang Nusajaya in the state of Johor It is the gateway to Iskandar Malaysia and covers an area of 1,841-hectare. Gerbang Nusajaya features a number of catalytic developments including Nusajaya Tech Park and FASTrack Iskandar. Major townships in the vicinity include Gerbang Nusajaya, Iskandar Puteri and Medini. This will be the final leg of the Malaysian station before it enters Singapore, terminating at Jurong East. While the station in Nusajaya has not yet been announced, government officials have indicated that it will be located close to Motorsports City near East Ledang. #7: Impact The Jurong East HSR station is located within the Jurong Lake District in Singapore. It is the gateway to Singapore and covers an area of 67-hectare. Jurong Lake District is the hub for commerce, retail, healthcare and tourism industries. Major townships in the vicinity include Jurong East, Teban Gardens, Lakeside and Taman Jurong. Jurong East will be an interchange station to the North South MRT Line, East West MRT Line and the proposed Jurong Region MRT Line. #8: Impact Also known as MRT Line 3, this is the final line that will comprise of a “wheel and spoke” system to connect to MRT Line 1 and SSP. Line 3 is expected to be completed in 2025. Collectively, all three lines will be integrated with the current trains systems forming the Klang Valley Integrated Train System. However, this project has been postponed by the new federal government when it took power in May 2018 owing to budget cuts.

#9: Impact The impact for this postponement will be marginal as this MRT Line will still need to be constructed to connect the SBK Line and SSP Line. We will most likely see speculators staying away from the market. This presents good opportunity for genuine homebuyers to start looking in and around the station. Homes in the secondary market will be the most ideal as they are priced cheaper than new launches.

1 Comment

Yay for first-time home buyers but nay for multiple Singaporean property investors, Singapore Permanent Residents and foreigners By Khalil Adis The Urban Redevelopment Authority’s (URA) flash estimate of the price index for private residential property for the second quarter of 2018 showed that Singapore’s private property index has increased 4.9 points from 144.1 points in the first quarter 2018 to 149.0 points in the second quarter. This represents an increase of 3.4 per cent, compared to the 3.9 per cent increase in the previous quarter. URA’a data showed that private properties in the Rest of Central Region (RCR) increased the most in Singapore - by 5.7 per cent, after registering an increase of 1.2 per cent in the previous quarter. Meanwhile, those in the Core Central Region (CCR) increased by 1.4 per cent compared to the 5.5 per cent increase while those in the Outside Central Region (OCR) increased by 2.9 per cent after registering a 5.6 per cent increase in the previous quarter respectively. The Monetary Authority of Singapore (MAS) in a statement said the adjustments to the Additional Buyer’s Stamp Duty (ABSD) rates and Loan-to-Value (LTV) limits on residential property purchases were needed “to cool the property market and keep price increases in line with economic fundamentals.” Additional, MAS said private residential prices have increased sharply by 9.1 per cent over the past year after declining gradually for close to four years. See table below for the summary: Here are five ways the new ABSD rate will impact you

#1: First time Singaporean private home buyers can heave a sigh of relief The ABSD measures are aimed at second and multiple property owners to ensure they do not engage in excessive speculation which may bring property prices to unsustainable levels. Therefore, first time private home buyers will not be penalised as they are deemed as genuine homeowners. #2: However, bank loan margins for first-timers has been decreased Be prepared to cough up more cash upfront. The loan-to-value limit has been decreased from 80 per cent or 60 per cent if the loan tenure is more than 30 years or extends to more than age 65 to 75 per cent or 55 per cent if the loan tenure is more than 30 years or extends to more than age 65. This means you will need to pay 5 per cent in cash upfront if your loan tenure is 30 years or 10 per cent if it extends to more than age 65. While the remaining will need to be paid in cash and/or CPF. #3: Be prepared to pay an additional 5 per cent ABSD for second and/or subsequent properties for Singaporeans ABSD rate for second property has been increased from 7 to 12 per cent. Meanwhile, the ABSD rate for third and subsequent properties has been increased from 10 to 15 per cent. #4: Lower LTV ratio for a second property The loan-to-value limit has been decreased from 50 per cent or 30 per cent if the loan tenure is more than 30 years or extends to more than age 65 to 45 per cent or 25 per cent if the loan tenure is more than 30 years or extends to more than age 65. The minimum cash downpayment is now 25 per cent. #5: More cash upfront makes buying in Iskandar Malaysia more attractive You get more bang for your bucks investing in Iskandar Malaysia than in Singapore with the new ABSD rates. Assuming you are buying a second property for your own occupation, that 25 per cent cash downpayment for an S$1 million condominium translates to S$250,000 which could easily buy you a freehold landed or condominium development across the causeway. With a minimum purchase price of RM1 million and a 70 per cent loan margin, you might as well convert it to your RM300,000 downpayment, not including stamp duty, state levy, legal fees and so on. The downside is you will have to make to with the daily commute and traffic congestions until the Johor-Singapore Rapid Transit System (RTS) is ready in 2024. While blood is thicker than water, it is best to establish clear boundaries with a toxic family member when it comes to property matters

By Khalil Adis Everyone has that one family member. You know, that elephant in the room that nobody really wants to talk about. That one who constantly argues and causes problems in the family. Yup, that one. What complicates matter is when other family members try to intervene in the name of religion. Most often than not, religion can blind everyone to the bullying and toxic behaviour this family member is doing. Unfortunately, I have that one family member. It all started rather harmlessly from that name-calling for getting good grades to pinching you till you are left bruised. From emotional blackmail, gas-lighting to downright rude behaviour, all this was done as this family member was finding means and ways to wriggle her way out of paying the home mortgage when she is clearly the legal owner. Their message is often typical - everyone else is the problem, except them. Psychologist call this kind of behaviour projection where they will unconsciously project their innermost thoughts in their communication. In my case, this family member was saying that I had planned to move overseas for good and abandon my responsibilities. Well, guess what? That family member is the one who ended up uprooting herself overseas and is now no longer contactable. The question is, should you as a family member, bail this person out from their mortgage responsibilities? The answer is no. Here are three reasons why #1: Recognise the problem is them, not you Most often this comes up during arguments where they will project all their unconscious thoughts to you. This person is only interested in their own point of view to make you feel guilty and bully you into admission so you will bail them out. They are often emotionally manipulative to convince you that you are the problem. When dealing with a toxic family member, it is best to walk out of the conversation as no amount of reasoning will make them see things your way. #2: Legally speaking, you have no recourse Unless you have a very good lawyer and documents to back up that you have been bailing this person out, your chances of getting your money back are close to zero. Also, legally speaking, the one that will end up in trouble with the banks and income tax department is them, not you. So save yourself the heartache. You are better off saving that money for your own home. #3: The family member needs to take responsibility The reason this family member took out a home mortgage is precisely that - they made a commitment to buy a home. If there are any changes in plans along the way, that family member needs to communicate that out in a healthy family discussion and not via threatening emails miles away in a foreign country. Bailing this person out is not only unhealthy but enabling such bad behaviour. Establish clear boundaries with such person that you will not tolerate their toxic behaviour and will only communicate with them when they treat everyone with respect. If all else fail, cut off ties. While this may seem taboo in a religious family setting, you will need to especially if the other person's behaviour is erratic and demands legal or police action. Do it for the sake of your sanity and well-being. You deserve so much better. |

Khalil AdisAn independent analysis from yours truly Archives

July 2023

Categories

All

|

100 Peck Seah Street

|

|

RSS Feed

RSS Feed