|

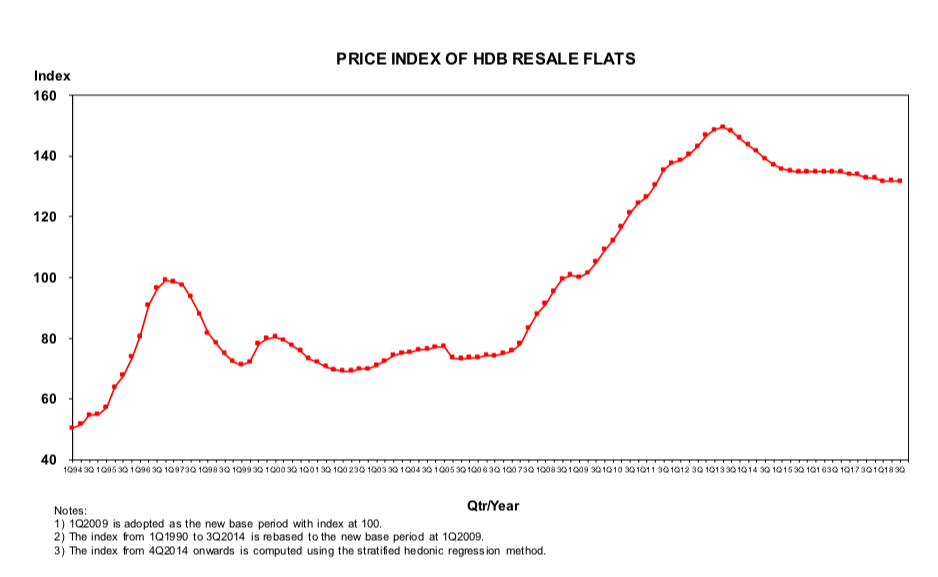

Singapore's private property market experienced robust growth but was muted midway by property cooling measures. We list down the key highlights in our 2018 property market roundups and our outlook for 2019. By Khalil Adis Singapore's private property market saw a steep rebound from the fourth quarter of 2017 after many quarters of decline in its Property Price Index (PPI) since the fourth quarter of 2013. Figures from the Urban Redevelopment Authority (URA) showed that the Lion City's PPI surged by 11.0 points from 138.7 in the fourth quarter of 2017 to 149.7 points in the third quarter of 2018. However, the market softened from July onwards post the new property cooling measures. Here are the top five property market roundups for 2018 and our top five outlooks for 2019. Roundups: #1: En-bloc fever Singapore's property market was off to a fiery start with several collective sales deal that was concluded during the first half of the year. They included the iconic Pearl Bank Apartments which was sold for S$728 million sales to CapitaLand and Park West which was sold for S$840.89 million to SingHaiyi Gold Pte Ltd. Data from Cushman & Wakefield Inc showed that the collective sales market recorded S$3.8 billion of en-bloc transactions in the second quarter. #2: New property cooling measures introduced To douse the red-hot residential property market, the government announced a slew of property cooling measures in July. This included increasing the Additional Buyer's Stamp Duty (ABSD) rates and tightening loan-to-value (LTV) limits on residential property purchases. The new ABSD rates and LTV limits are as above. As a result, the collective sales market declined with S$353 million worth of transactions recorded in the third quarter, data from Cushman & Wakefield Inc showed. #3: Industrial property market picks up steam While Singapore's residential property sector has taken quite a hit, its industrial and commercial property sectors are seeing an uptrend in investment sales. According to data from Cushman & Wakefield Inc, industrial property deals soared 73 per cent to S$1.2 billion in the third quarter while office sales increased by 54 per cent to S$2.1 billion. Meanwhile, Jones Lang Lasalle Singapore, citing data from JTC statistics said islandwide all-industrial rental correction stayed modest at 0.1 per cent quarter-on-quarter for three consecutive quarters since the fourth quarter of 2017, while the second quarter of 2018 all-industrial price index flat-lined for the first time since trending down in the third quarter of 2014. #4: HDB resale values are declining HDB is a hot bread and butter issue among Singaporeans as 80 per cent of the population lives in public housing flat. Public interest in HDB dominated the headlines in 2018 as government officials warned that their values could decline, especially those that are more than 40 years with around 50 years left on their 99-year lease. This marked a stark contrast during Lee Kuan Yew's era when he assured Singaporeans that HDB flats are an asset. Property agents who specialise in HDB flats in mature estates such as Toa Payoh say they are already seeing prices of older resale flats declining as many buyers are staying clear from such properties following the ongoing debate. For example, according to the third quarter data from the HDB in 2018, a 3-bedroom flat in the estate was transacted for S$279, 000. In contrast, the median price during the same period in 2016 was transacted for S$300,000. Having said that, other factors do come into play such as the supply of new Built-to-Order (BTO) flats which has influenced the resale price. However, until the government addresses the uncertainty surrounding older estates, we are likely to see the values declining as it is very much influenced by market sentiment. #5: Widening price gap between a private property and an HDB flat While the private property market has seen the price index picking up by some 11.0 points, the HDB Resale Price Index (RPI) has been on a decline. According to data from the HDB, the RPI has been on a decline since the second quarter of 2013 as it continues to launch BTO flats in the market. This is the biggest price gap in over 10 years and will likely be a contentious issue when the general election is expected to be called in 2019. Predictions: #1: HDB to become a hot-button issue 2019 is expected to be an election year. As such, HDB will be a hot-button issue as 80 per cent of the population lives in HDB flats. As we have discussed above, HDB resale prices are already on the decline while the price gap between a private property and an HDB flat has widened considerably. The government will need to address the ongoing debate on the value of older HDB flats moving forward. #2: Fewer BTO flats to be launched In November, the HDB said it launched 7,214 flats for sale under the Build-To-Order (BTO) and Sale of Balance Flats (SBF) exercise. This comprises 3,802 BTO units and 3,412 SBF units across various towns estates such as Sembawang, Sengkang, Tengah, Yishun and Tampines. However, there will be fewer units being offered in the next BTO launch exercise in February 2019. The HDB said it will offer about 3,100 flats in Jurong West, Kallang Whampoa and Sengkang. #3: A sellers' market With fewer BTO flats on the offering, this could possibly divert some of the buyers to the resale market and prop up the resale prices which have been falling since the second quarter of 2013. As such 2019 could likely be a sellers' market. Sellers should watch the market closely while buyers should opt for a BTO quickly. #4: Five growth areas As outlined in the URA Master Plan 2014, the five growth areas are located at Woodlands Regional Centre, Jurong Lake District, City Centre, Paya Lebar Central and Punggol Digital District. Woodlands Regional Centre will be a transportation hub which will connect the Thomson-East Coast Line (TEL) to the Johor-Singapore Rapid Transit System (RTS) via Woodlands North MRT station. Meanwhile, Jurong Lake District will house the High Speed Rail station linking Singapore to Kuala Lumpur in 90 minutes flat. The development of the project has been postponed to two years and will now commence construction in 2020 instead of 2018. Meanwhile, the express service will only commence by 1 January 2031 instead of 31 December 2026, as originally planned. You can read more about URA Master Plan 2014 here. #5: Opening of TEL will provide a price booster for properties along the line The TEL is a 43km MRT Line that will add 31 new stations to the existing rail network, with 7 interchange stations.

It will link to the East-West Line, North-South Line, North-East Line, Circle Line and the Downtown Line. Spanning from Woodlands North to Sungei Bedok, the line will be opened in stages next year. Stage one will comprise stations from Woodlands North to Woodlands South. As such, properties in the Woodland Regional Centre as highlighted above will be among the first to enjoy the price booster when the stations commence service next year. This will definitely be much to cheer about in the north amid the muted HDB resale market.

0 Comments

|

Khalil AdisAn independent analysis from yours truly Archives

July 2023

Categories

All

|

100 Peck Seah Street

|

|

RSS Feed

RSS Feed