|

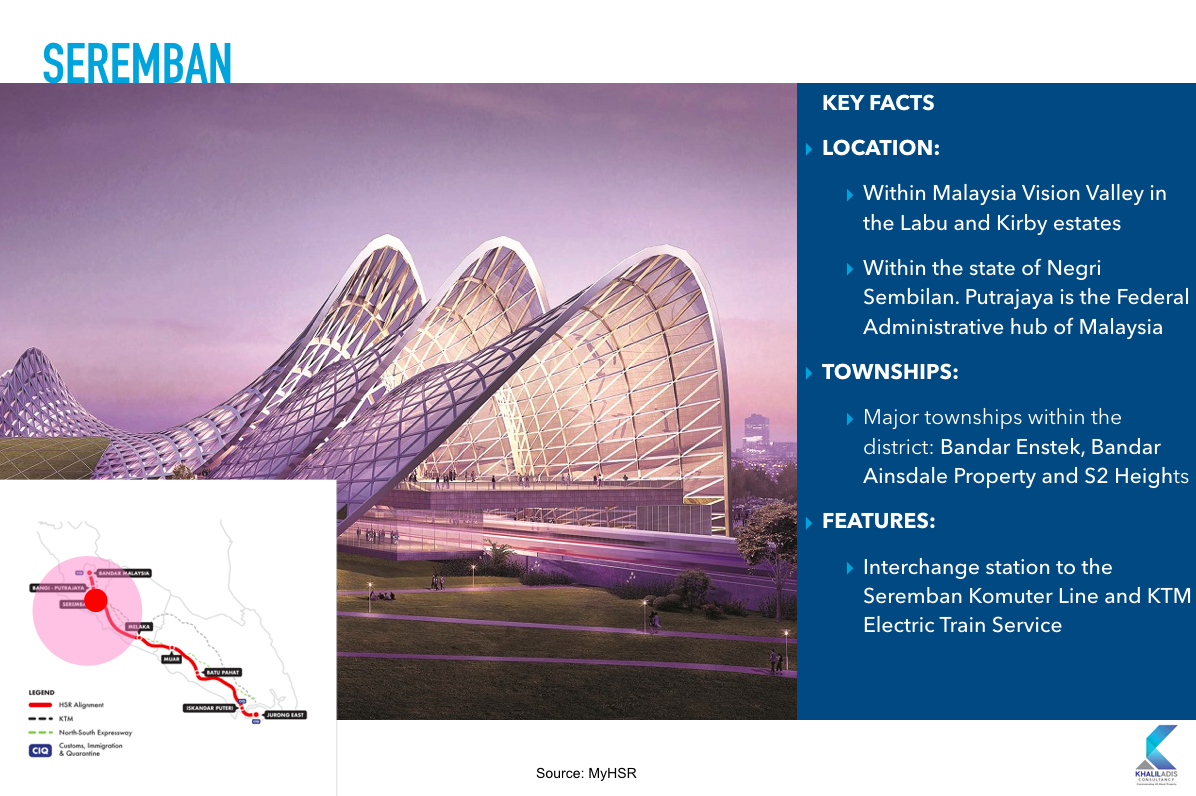

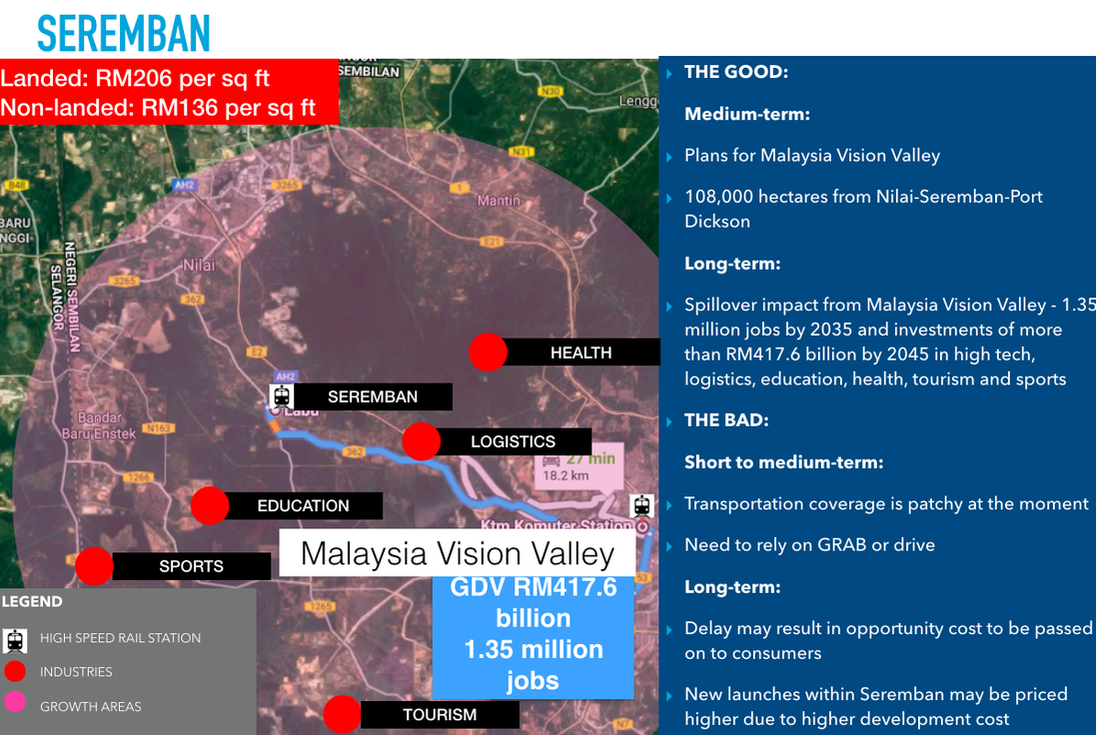

Infrastructure spending along these lines will act as property boosters for selected areas in Kuala Lumpur and Greater Kuala Lumpur By Khalil Adis The last time I was in KL was in January 2020 where I shared the growth areas along the different train lines at Havoc Hartanah. Despite not being able to physically be present in Kuala Lumpur now due to the Restricted Movement Control Order (RMCO), I wish to point out that there are growth area that prospective buyers and investors should watch out for. Here are the eight growth areas along the different train lines ranked from the least to most affordable*: *Note: 1. Property transactions are based on data captured on Brickz. 2. Monthly mortgage is based on a loan tenure of 35 years with an interest rate of 4.25%. 3. Affordability is based on the mortgage servicing ratio (MSR) capped at 30% of a borrower's gross monthly income of RM3,000. 4. A monthly mortgage of above RM900 is considered unaffordable. #1: Pusat Bandar Damansara Median transacted price: RM4,000,000 Monthly mortgage: RM16,484.18 Verdict: Least affordable Dubbed "the Beverly Hills of Malaysia", Damansara Heights is the most desired address in the country. This is a home among Malaysia's who's who and the address for those who have arrived. Pusat Bandar Damansara is also a growth area as it is located next to Damansara City. Comprising Menara Hong Leong, Wisma GuocoLand, DC Residency, DC Mall and Sofitel Kuala Lumpur Damansara, Damansara City is an Entry Point Project (EPP) which the Malaysian government had announced in September 2010 to take Kuala Lumpur to even greater heights under its Economic Transformation Programme (ETP) roadmap. Soon, it will be home to Pavilion Damansara Heights. Set to open its doors come 2020, the mall will feature 1.17 million sq ft of retail therapy. Amenities here are aplenty to cater to the discerning tastes of the affluent. From high-end grocers at Ben's Independent Grocer to organic restaurants, the lifestyle choices to live the good life here are endless. #2: Bandar Utama Median transacted price: RM1,050,000 Monthly mortgage: RM4,327.10 Verdict: Least affordable Bandar Utama needs no introduction. Home to 1 Utama Shopping Centre, The Curve, IKEA, AEON Bandar Utama, One World Hotel and KPMG Tower, this bustling township comprises mainly landed homes making it ideal for those who prefer a low-density living environment. Previously, Bandar Utama was very inaccessible. However, since the commencement of the Sungai Buloh - Kajang Line (SBK Line) on 16 December 2016, accessibility to Bandar Utama has been greatly enhanced. In addition, a new 35-metre pedestrian link-bridge now connects the station's Entrance B to One World Hotel near the newly relocated Zuan Yuan Chinese Restaurant and the Ground Floor of 1 Utama. By November 2023, Bandar Utama MRT Station will serve as an interchange station to the LRT Bandar Utama-Klang Line (Klang Valley LRT Line 3). Costing RM16.63 billion, this 37km line will span from Bandar Utama to Johan Setia station with a total of 19 stations. When completed, it is expected to serve 2 million commuters residing in the Western Corridor of Klang Valley. #3: Subang Jaya Median transacted price: RM585,000 Monthly mortgage: RM4,327.81 Verdict: Medium affordable Before the advent of Transit Oriented Developments (TODs), Sime Darby has been actively promoting this concept in its township development spanning from Subang Jaya to Ara Damansara. Subang Jaya is a bustling township that is served by the Kelana Jaya LRT Extension Line which became fully operational in 2016. This extension is part of the government's initiative to extend public transportation to residents living in the southwestern part of Selangor such as Subang Jaya and to Puchong. Comprising 13 new stations and covering a distance of 17.4 km, this new extension will bring the total length of the Kelana Jaya LRT Line from 29 km to 46.4 km. The LRT extension line spans from Lembah Subang to Putra Heights and costs RM8 billion to construct. Connectivity to the airport was recently enhanced in May 2018 via the Skypark Link service that you can catch from Subang Jaya LRT station to Terminal Skypark station. Costing RM533 million to build, the Skypark Link spans some 24km from KL Sentral to Terminal Skypark. #4: Jalan Pudu Median transacted price: RM824,585 Monthly mortgage: RM3,398.15 Verdict: Medium affordable Smacked in between Tun Razak Exchange and Bandar Malaysia, Jalan Pudu is located within KL's "Golden Triangle". The former is almost completed and is served by the Tun Razak Exchange (TRX) MRT station while the latter will be served by Bandar Malaysia (North) MRT station. TRX will be Malaysia's first dedicated financial district with a gross development value (GDV) of RM40 billion and with a total gross floor area of 20 million square feet. This iconic project is part of the Malaysian government's Economic Transformation Programme (ETP) to strengthen Kuala Lumpur as the country's financial capital. Bandar Malaysia will have a gross development value (GDV) of RM150 billion. It will house the High Speed Rail station and two MRT stations - Bandar Malaysia North and Bandar Malaysia South. Bandar Malaysian North will be an MRT station on its own serving the huge mixed-use development. The site area is around 196 hectares and will comprise 27,000 quality and affordable homes. There will also be a dedicated commercial district to support new start-ups as well as small and medium-sized enterprises (SMEs). #5: Cyberjaya Median transacted price: RM512,000 Monthly mortgage: RM2,109.98 Verdict: Medium affordable Located on the southernmost tip of Puchong, Cyberjaya is poised to enjoy the economic spillover benefits from three major government projects - KLIA Aeropolis, Malaysia Vision Valley and Cyber City Centre in Cyberjaya. The growth areas here will be near Sierra and Cyberjaya City Centre MRT stations. Being a relatively new township development, Sierra holds the most promise for capital appreciation of property values as many infrastructure projects (including the Sierra MRT station) are still underway. It also with 10 minutes drive to the bustling township of Puchong where it is home to many mega malls and trendy cafes. Sierra is home to only landed homes at the moment. Meanwhile, Cyberjaya City Centre MRT station is a transit-oriented development (TOD) project to be developed by Malaysian Resources Corp Bhd (MRCB). With its experience in building the transport hub in KL Sentral, MRCB will be developing a new city that will be integrated with the MRT station. Phase one is expected to generate a gross development value (GDV) of RM5.35 billion. It will feature a 200,000 sq ft convention centre, a 300- to 400-room business hotel, low and high-rise office buildings and a retail podium. Cyberjaya City Centre will have a development plan spanning 20 years. The MRT station is located just opposite Lim Kok Wing University of Creative Technology. #6: Sungai Besi Median transacted price: RM510,000 Monthly mortgage: RM2,101.73 Verdict: Medium affordable Sungai Besi is located in a growth area in between Bandar Malaysia and Cyberjaya City Centre. There are still homes in the secondary market priced below RM500,000 here. Home to NSK Kuchai Lama and Terminal Bersepadu Bandar Tasek Selatan, Sungai Besi will be served by the upcoming Sungai Besi MRT station via the Sungai Buloh-Serdang-Putrajaya (SSP Line ). Meanwhile, Sungai Besi LRT station will be upgraded to an interchange station to connect commuters to this MRT station built adjacent to it. When completed, it will also serve as an interchange to the upcoming High Speed Rail station. Sungai Besi is strategically located and is highly accessible up north to downtown KL and down south to Putrajaya and Cyberjaya via the Sungai Besi Highway. #7: Nilai Median transacted price: RM215,000 Monthly mortgage: RM886.03 Verdict: Most affordable Nilai is poised for further growth as it is located within the Malaysia Vision Valley. Covering Nilai to Port Dickson, it will have a proposed area of 108,000 hectares. The upcoming industries include high tech, logistics, education, health, tourism and sports. The Malaysia Vision Valley is expected to create some 1.35 million jobs by 2035 and investments of more than RM417.6 billion by 2045. To support the Malaysia Vision Valley, the Seremban HSR station will be sited in Nilai within the Labu and Kirby estates. Seremban HSR station will also be an interchange station to the Seremban Komuter Line and KTM Electric Train Service. #8: Bandar Baru Nilai Median transacted price: RM166,955

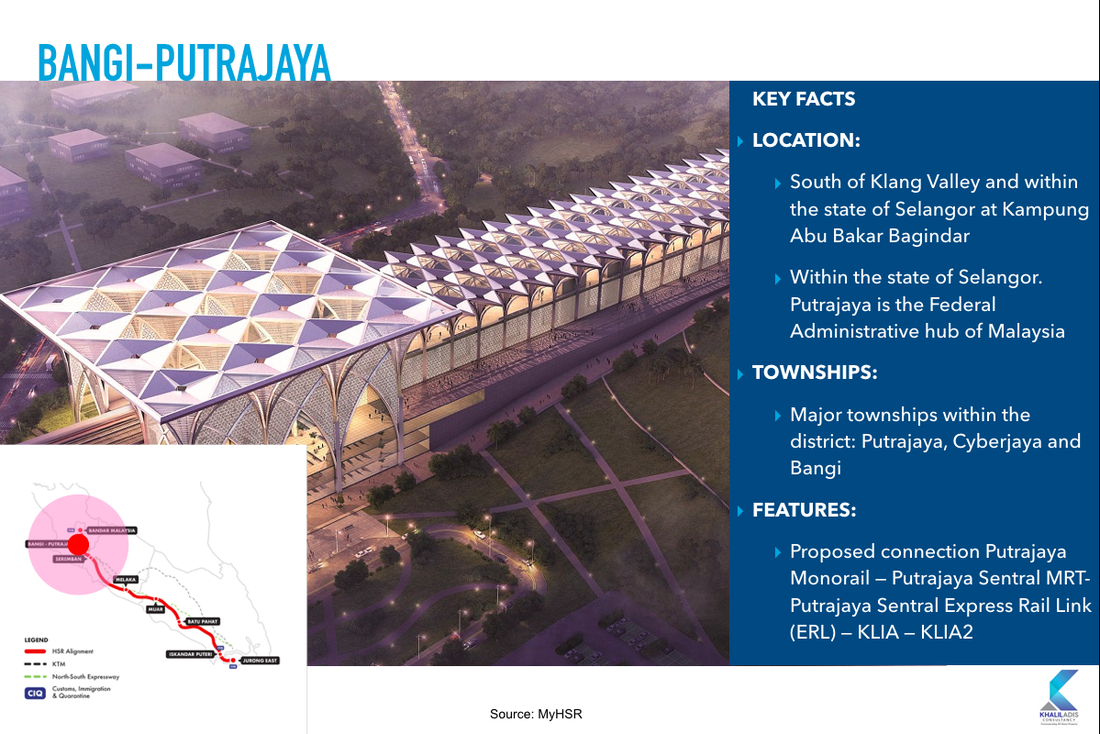

Monthly mortgage: RM688.03 Verdict: Most affordable Bandar Baru Nilai is a growth area as it is located near to upcoming economic drivers in the pipeline that will include the Malaysia Vision Valley, KLIA Aeropolis and Cyberjaya City Centre. It also close to KLIA and KLIA2 that is served by Express Rail Link (ERL) comprising KLIA Express and KLIA Transit. Soon, connectivity will be further enhanced via the Bangi-Putrajaya HSR station. The station will be located in the south of Klang Valley and within the state of Selangor at Kampung Abu Bakar Bagindar. There is also a proposed connection to the Putrajaya Monorail that will connect this station to Putrajaya Sentral MRT station. When completed, it will serve as an interchange station to Putrajaya Sentral Express Rail Link (ERL) and link commuters to KLIA and KLIA2.

0 Comments

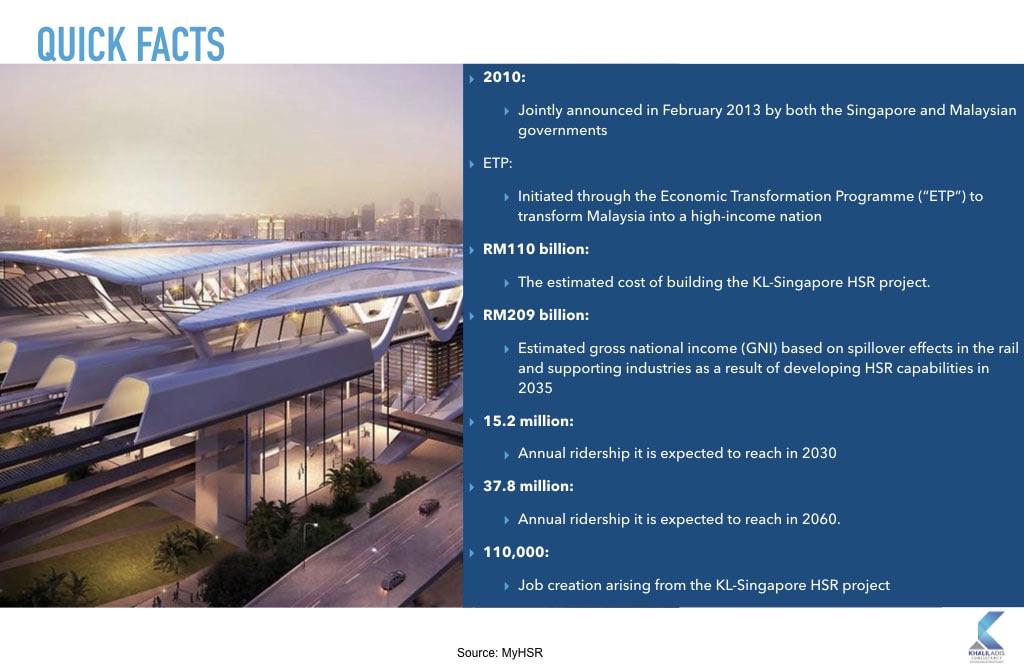

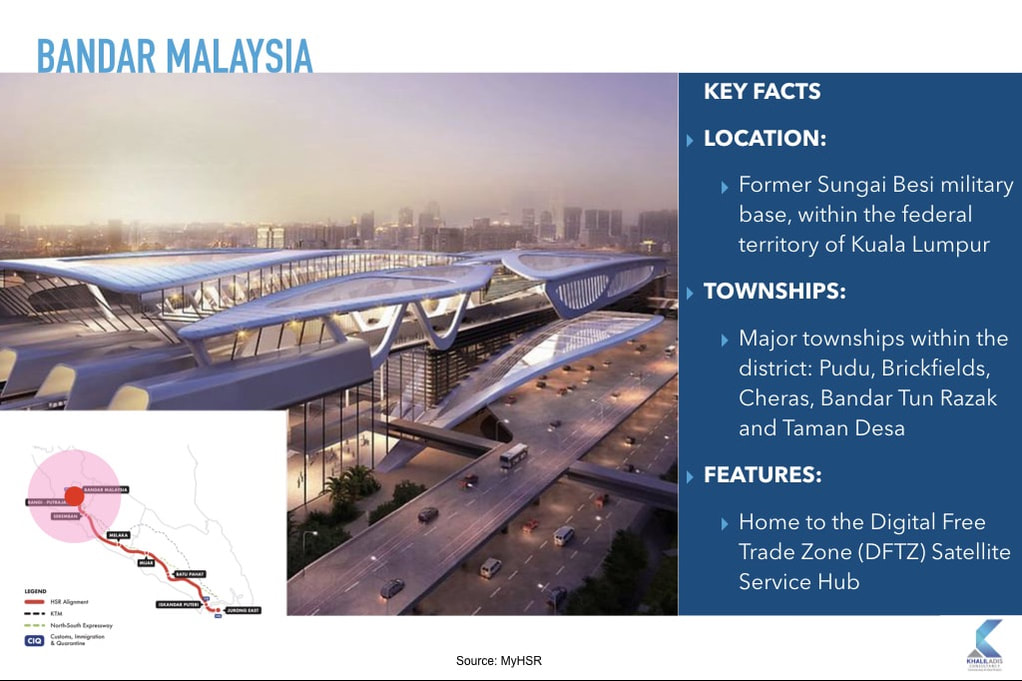

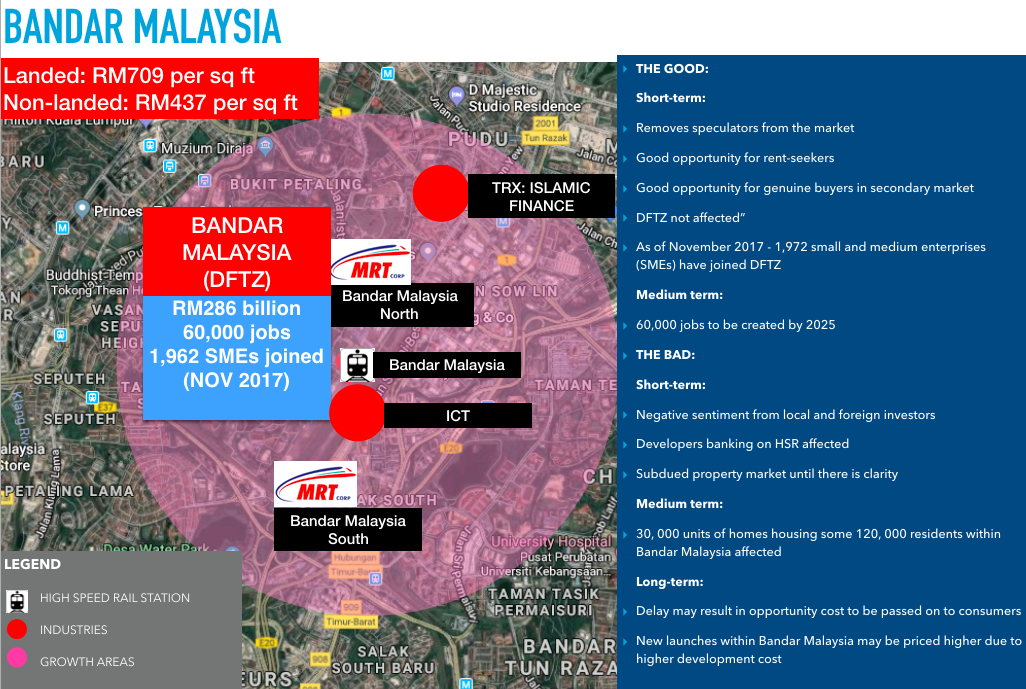

With 10,000 affordable homes in the pipeline, Bandar Malaysia is both a boon and a bane for Kuala Lumpur’s sluggish property sector. We analyse how this development will impact the market. By Khalil Adis The recent announcement by the Malaysian government that it is reviving the shelved Bandar Malaysia project is a piece of welcome news as it gives some clarity to investors on the status of the Kuala Lumpur-Singapore High Speed Rail (HSR) project. Since winning the 14th general election, Prime Minister Mahathir Mohamad had reviewed several mega infrastructure projects including Bandar Malaysia and the HSR. In the face of the country’s mounting debt, both projects were at first announced as cancelled in May 2018. This prompted Singapore’s Ministry of Transport to issue a statement stating that it “will wait for official communication from Malaysia”. However, the Malaysian government backtracked on this subsequently. Instead, it announced in June 2018 that the project was “postponed”. This created a lot of confusion on both sides of the causeway. After many months of speculation, the market finally received some clarity in September 2018 when representatives from both governments met in Putrajaya. In a joint-statement, both Singapore and Malaysia announced that they had signed an agreement to suspend the project until 31 May 2020 “Malaysia will bear the agreed costs in suspending the HSR Project. If by 31 May 2020, Malaysia does not proceed with the HSR Project, Malaysia will also bear the agreed costs incurred by Singapore in fulfilling the HSR Bilateral Agreement. During the suspension period, Malaysia and Singapore will continue to discuss on the best way forward for the HSR Project with the aim of reducing costs,” the statement read. The HSR project is now expected to commence service by 1 January 2031, instead of the original commencement date of 31 December 2026. With Bandar Malaysia now being revived, we list down the possible implications on Kuala Lumpur’s property market. #1: Boost for the construction sector The construction sector is currently in the doldrums due to the lacklustre property market in Malaysia. Loan rejections from buyers and the demand-supply mismatch mean developers are faced with unsold inventory leading to cash flow problems with contractors. In March, for instance, Bursa listed engineering and construction company, Zeland Berhad filed a statement with the Malaysian stock exchange that it was initiating arbitration proceedings against NRY Architects for RM305.4mil and other contract breaches for the construction of buildings of International Islamic University Malaysia in Kuantan. It also announced that it is claiming RM3.34mil in outstanding payment for construction works from BBCC Development Sdn Bhd located at the former Pudu jail near Hang Tuah monorail station. With Bandar Malaysia now back on track, contractors will be willing to bid at a much lower price to stay afloat amid the challenging market condition. Subcontractors will also benefit. #2: 10,000 new housing units will likely worsen overhang in Kuala Lumpur’s property market Initially, DBKL had announced that Bandar Malaysia will house around 30,000 affordable homes. However, a recent announcement puts the figures to 10,000 units. Kuala Lumpur City Hall (DBKL) had previously indicated that it has set a development guideline for developers to build such homes at around 800 sq ft but priced below MYR450,000. Meanwhile, Bank Negara’s figures showed that 80 per cent of homes, or 146,196 units priced above RM250,000, remained unsold as of end March 2018. While Bank Negara did not break down the figures according to each state, recent data provided by the Valuation and Property Services Department (JPPH) showed that Kuala Lumpur recorded the third highest number of residential overhang at 5,114 units. So unless the homes are priced below RM250,000, we are likely to see Kuala Lumpur’s housing glut worsen. #3: Boon for first-time homebuyers Bandar Malaysia has been cited by DBKL as a case study for government and private developers in building transit-oriented development (TOD). Bandar Malaysia will house two MRT stations – Bandar Malaysia North and Bandar Malaysia South – which will form part of the alignment for the Sungai Buloh – Serdang – Putrajaya Line (SSP Line). Bandar Malaysia will also possibly serve as the interchange to the MRT Line 3, which has now been postponed. If indeed Bandar Malaysia will build affordable homes according to DBKL’s guidelines, then it will be a boon for first-time homebuyers as the entry price in Kuala Lumpur is easily above RM600,000. It will also mean young Malaysians will no longer have to buy a car first after completing their education and thus improve their chances of getting their home loans approved. Currently, many young Malaysians are trapped in the debt cycle due to various financial commitments such as their National Higher Education Fund (PTPTN), cars, personal and credit cards loans. So while demand is strong, loan rejections remain an issue further worsening the cash flow for developers. #4: Bane for landlords and sellers If indeed 10,000 new housing units will be coming on stream, Bandar Malaysia’s surrounding areas such as Pudu, Brickfields, Cheras, Bandar Tun Razak, Sungai Besi and Taman Desa will be badly affected. As such, landlord and sellers will likely see their asking prices fall even further as consumers will soon have more choices. Landlords will also find difficulty in doing short-term accommodations as the Malaysian government will be regulating this market segment. Therefore, rent-seekers and buyers are the clear winners as they are in the position to haggle for the best price. #5: Sluggish commercial and office market ahead The initial projection for Bandar Malaysia stated that it will have a gross development value (GDV) of RM150 billion.

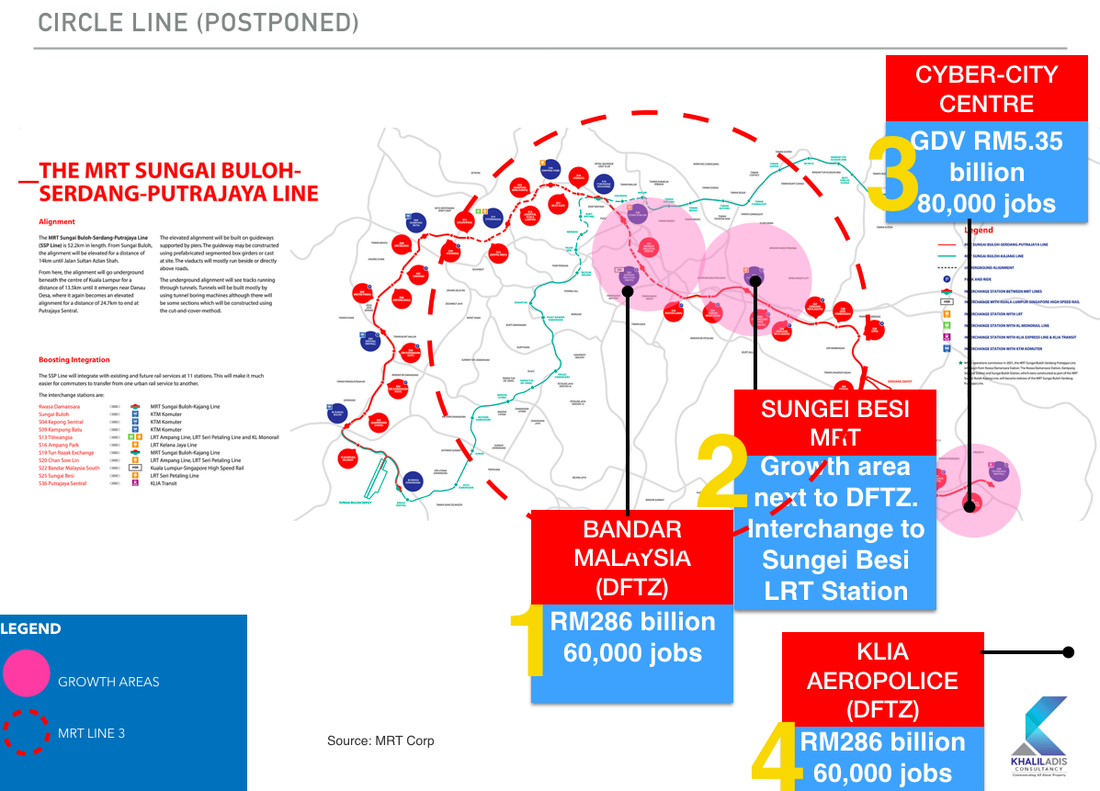

Measuring around 196 hectares, Bandar Malaysia’s master plan indicates that it will be a mixed-use development with commercial and office buildings. With so many mega malls and office buildings in Kuala Lumpur, Bandar Malaysia will add on to more floor space in Kuala Lumpur’s already weak commercial and office markets. Despite this, Bandar Malaysia will likely attract multinational companies to set up their operations here as it is located within the Digital Free Trade Zone (DFTZ). Gear up for a bumpy ride next year in Malaysia’s property market as the number of unsold units continues to rise. Despite the challenges, there are some opportunities for investors and rent-seekers. By Khalil Adis According to the Valuation and Property Services Department’s (JPPH) latest figures, the number of unsold completed residential units rose from 20,304 units to 30,115 units year-on-year as at 30 September 2018. This represents an increase of 48.35 per cent. Meanwhile, the total value was RM19.54 billion, representing a 56.44 per cent rise from RM12.49 billion a year ago. However, if JPPH were to also include serviced apartments and small offices home offices (SoHos), this would bring their overhang value to 40,916 units valued at RM27.38 billion. According to JPPH, Johor has the largest number of unsold completed serviced apartments and SoHo units at 7,714. JPPH notes that it rose a whopping 191 per cent from the 2,647 units recorded a year ago. The overhang in serviced apartments is valued at RM6.16 billion compared with its residential overhang of RM4.44 billion. This means the total overall value of its unsold serviced apartments is 1.5 times that of residential housing. In summary, Johor has the highest number of completed unsold units in Malaysia at 6,053. This is a 55 per cent increase from the 3.901 units a year ago. With an overhang in supply spanning from Johor to Selangor, here are some of the likely property trends to emerge next year. #1: Renter’s market The new supply of the completed units plus the those from existing units will lead to a downward pressure in the rental market causing rentals to fall. This is because rent-seekers will be spoilt for choice while landlords will be fighting for tenants. This will make it ideal for rent-seekers as landlords will most likely be open for price negotiations. Meanwhile, it is bad news for landlords should they be able to find a tenant or not. In the former, the rental will most likely not be able to cover the mortgage resulting in negative cash flow. In the latter, landlords will have to cover the mortgage themselves. Those who cannot will have no choice but the let go of their units. #2: Buyer’s market The property market will also favour buyers as sellers will be desperate to offload their properties, especially those who have multiple units. Therefore, buyers will be in a more stronger position to bargain in a market flooded with so many units. #4: Buy properties in the secondary market If you urgently need a roof over your head, then the secondary market is the way to go as you are buying a completed property. Sellers are also more willing to negotiate on the terms of payment and will likely cut a flexible payment deal via their agents if you do not have a sufficient deposit in hand. In addition, the supply overhang also mean that properties in the secondary market are priced 20 to 30 per cent cheaper than new launches. However, do bear in mind that you need to pay a 10 per cent deposit. #5: Overhang in supply means good deals in the auction market Unfortunately, there will also be distressed properties which will be auctioned off in court. If you are looking for a below market value (BMV) property, then this will present a very good opportunity for you. When buying a BMV, you will need to attend an auction in court and prepare a bank draft in advance to show of interest. This will cost you around 10 per cent of the reserve price. For example, if the property is being auctioned off at RM50,000, you will need to prepare RM5,000 in bank draft. If you have successfully bid for the property, you will need to settle the balance of the payment within 120 days. However, there are a lot of hidden costs, for example, legal, quit rent (cukai pintu), unpaid utilities and maintenance fees, assessments and so on. Perhaps, the biggest risk is this - while the property is legally yours, you may find it hard to evict the tenants or owners. You may have to apply for a court order, through a lawyer, to evict the occupants. This process can take you up to four weeks and costs you between RM1,500 to RM2,000. Even so, there are no guarantees they can be evicted as Malaysian laws favour occupiers. When buying a BMV property, it is best to find out if the property is occupied by tenants or owners. #6: It also means good deals from the primary market Developers have to move their unsold inventory as each unit means added cost for them. As such, developers will be coming up with creative schemes like zero downpayment and such to lure buyers. Speak to a good developer and check if they have a good master plan to ensure your property values are protected. Remember the 5Cs I always talk about? Check against them before you commit to buying a property, #7: More restrictions on Airbnb accommodations Making money from your short stay travellers may prove to be even harder even if the government legalises Airbnb. This is because we are seeing trends of management committees barring Airbnb-type of accommodation due to security and safety issues. So before you decide to list your untenanted unit on Airbnb, it is best to check with your management committee if this is allowed. However, if you happen to own a serviced apartment, this will not be an issue as it falls under a commercial title. #8: Transit-oriented developments (TODs) along SSP Line The Sungai Buloh-Serdang-Putrajaya Line (SSP Line) is one of the few major infrastructure projects that will be continued under the newly elected government.

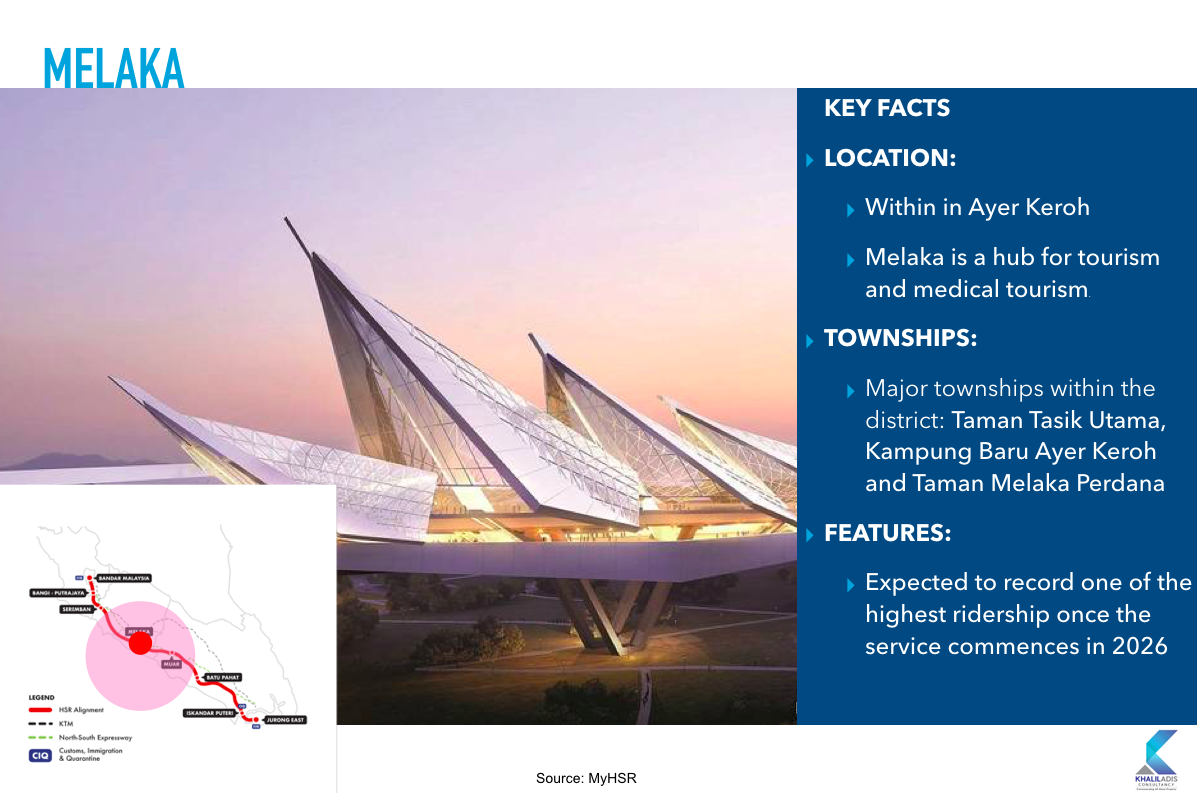

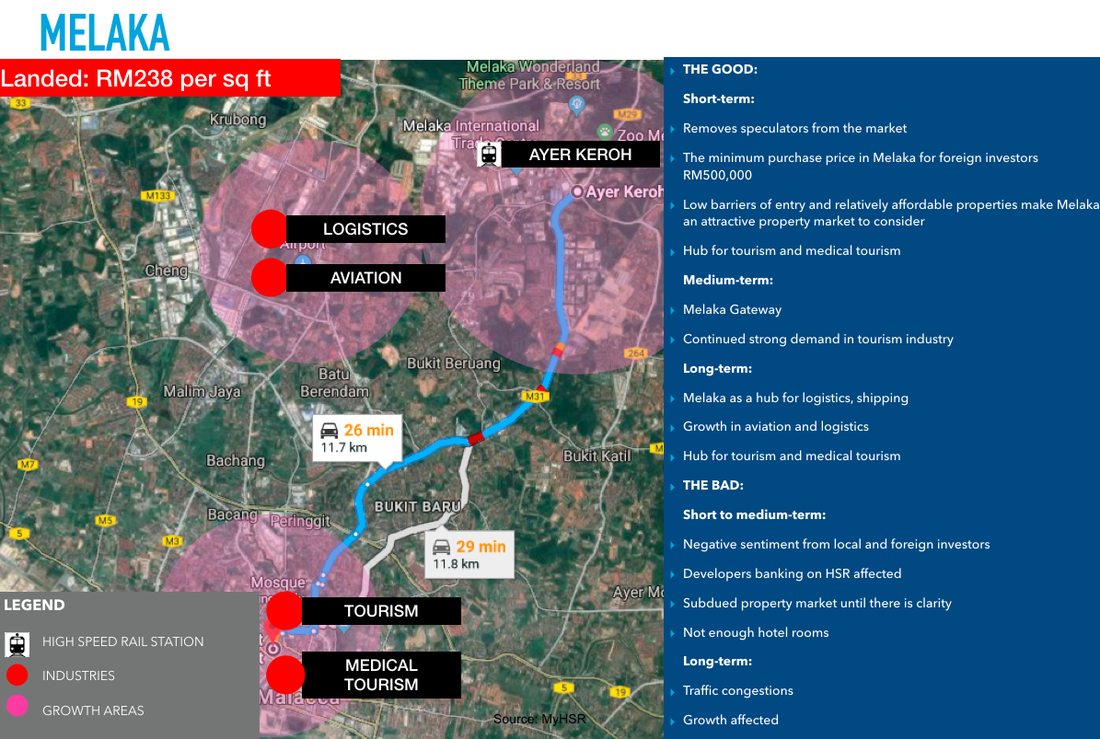

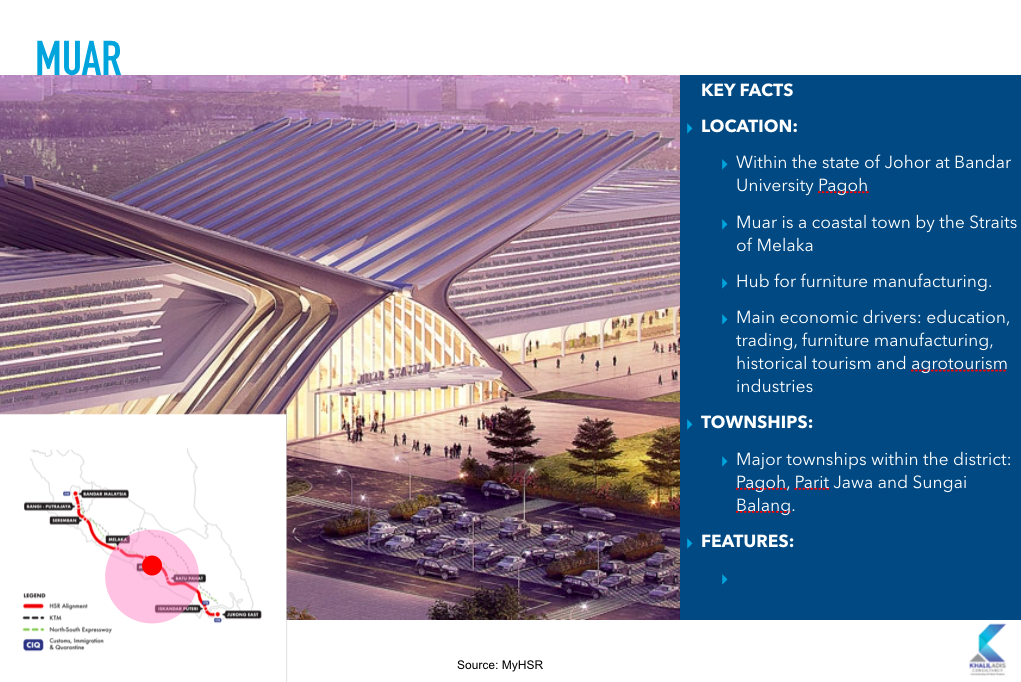

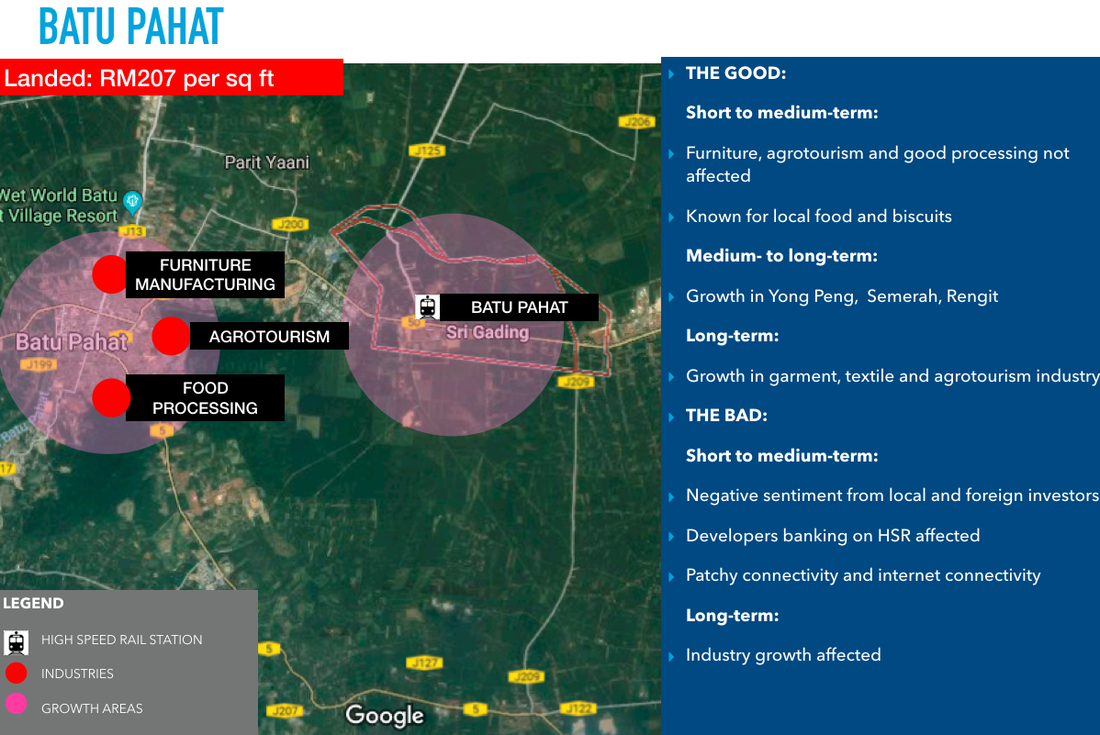

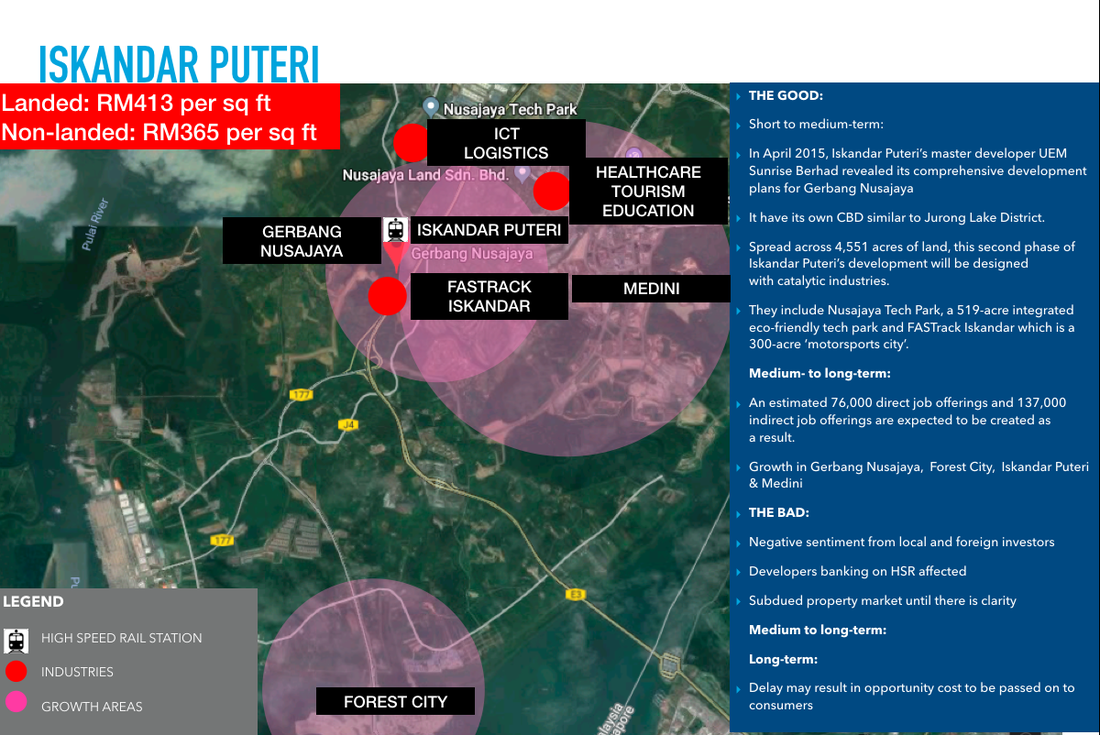

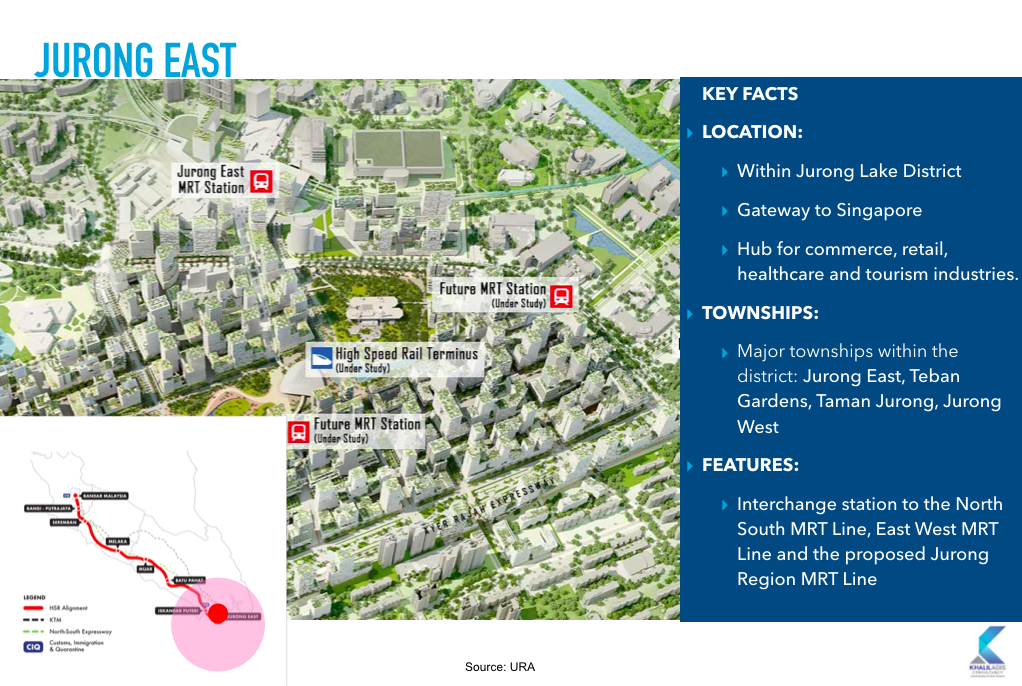

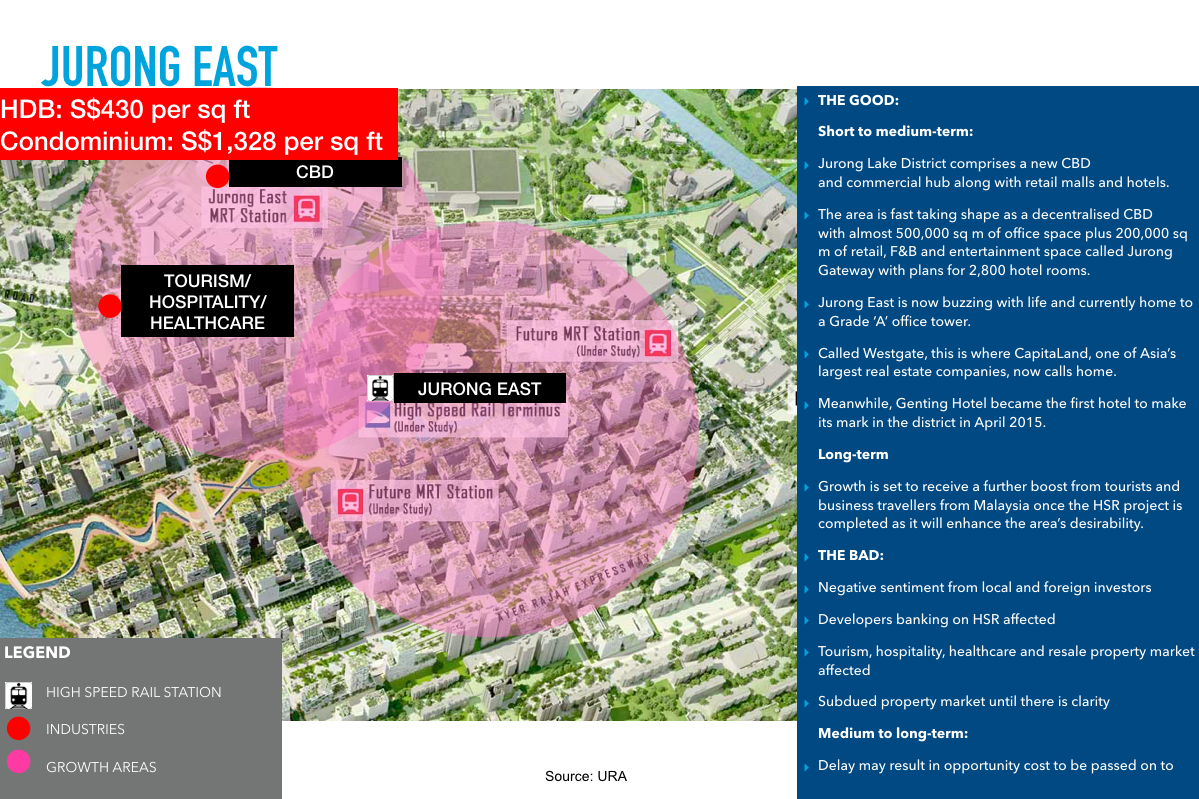

In fact, the project is currently under construction and is fast taking shape. Some developers have already acquired land banks along this line to build TODs. Areas to watch out for include Kwasa Damansara, Kwasa Sentral, Sungai Besi, Bandar Malaysia and Cyberjaya City Centre Is it on of off? We study each station and list down the good and the bad from the possible impact of its postponement in their surrounding areas.   With recent news of the High Speed cancellation, much remains to be seen if Bandar Malaysia will succeed or not. However, Bandar Malaysia North MRT station’s alignment has already been confirmed. Initially, Bandar Malaysia has been planned with a gross development value (GDV) of RM150 billion with a dedicated commercial district to support new start-ups as well as small and medium-sized enterprises (SMEs). In addition, Kuala Lumpur City Hall (DBKL) has said 30, 000 units of homes will be delivered housing some 120, 000 residents within Bandar Malaysia. Whether or not this will go ahead, remains unclear. The only glimmer of hope here is the Digital Free Trade Zone by Jack Ma which so far has not been canned by the new government. #1: Impact: The Bangi-Putrajaya HSR station is located in the south of Klang Valley and within the state of Selangor at Kampung Abu Bakar Bagindar. Putrajaya is the Federal Administrative hub of Malaysia. Major townships include Putrajaya, Cyberjaya and Bangi. There is a proposed connection to the Putrajaya Monorail that will connect this station to Putrajaya Sentral which will serve as an interchange station to the MRT station and the Putrajaya Sentral Express Rail Linl (ERL). The latter links you to KLIA and KLIA2. #2: Impact: The Seremban HSR station is located within the Malaysia Vision Valley area within the state of Negeri Sembilan. Sited within the Labu and Kirby estates, major townships in the vicinity include Bandar Enstek, Bandar Ainsdale Property and S2 Height. Seremban will be an interchange station to the Seremban Komuter Line and KTM Electric Train Service . #3: Impact The Melaka HSR station is located in Ayer Keroh within the state of Melaka. Melaka is a hub for tourism and medical tourism. Major townships in the vicinity include Taman Tasik Utama, Kampung Baru Ayer Keroh and Taman Melaka Perdana. Many Indonesians and Singaporeans flock to hospitals such as Mahkota Medical Centre for medical treatment. #4: Impact The Muar HSR station is located within the state of Johor at Bandar University Pagoh. Muar is a coastal town by the Straits of Melaka that is a hub for furniture manufacturing. Major townships in the vicinity Pagoh, Parit Jawa and Sungai Balang. The main economic drivers here are those in the education, trading, furniture manufacturing, historical tourism and agrotourism industries. #5: Impact The Batu Pahat HSR station is located within the state of Johor at Pura Kencana, Seri Gading. Batu Pahat is a hub for garment and textile factories. Major townships in the vicinity include include Rengit, Yong Peng and Semerah. The main economic drivers here are those in the the furniture manufacturing, food processing and agrotourism. However, isnce 20011, there has been a notable growth in small and medium industries such as textiles, garments and electronics. #6: Impact The Iskandar Puteri HSR station is located within Gerbang Nusajaya in the state of Johor It is the gateway to Iskandar Malaysia and covers an area of 1,841-hectare. Gerbang Nusajaya features a number of catalytic developments including Nusajaya Tech Park and FASTrack Iskandar. Major townships in the vicinity include Gerbang Nusajaya, Iskandar Puteri and Medini. This will be the final leg of the Malaysian station before it enters Singapore, terminating at Jurong East. While the station in Nusajaya has not yet been announced, government officials have indicated that it will be located close to Motorsports City near East Ledang. #7: Impact The Jurong East HSR station is located within the Jurong Lake District in Singapore. It is the gateway to Singapore and covers an area of 67-hectare. Jurong Lake District is the hub for commerce, retail, healthcare and tourism industries. Major townships in the vicinity include Jurong East, Teban Gardens, Lakeside and Taman Jurong. Jurong East will be an interchange station to the North South MRT Line, East West MRT Line and the proposed Jurong Region MRT Line. #8: Impact Also known as MRT Line 3, this is the final line that will comprise of a “wheel and spoke” system to connect to MRT Line 1 and SSP. Line 3 is expected to be completed in 2025. Collectively, all three lines will be integrated with the current trains systems forming the Klang Valley Integrated Train System. However, this project has been postponed by the new federal government when it took power in May 2018 owing to budget cuts.

#9: Impact The impact for this postponement will be marginal as this MRT Line will still need to be constructed to connect the SBK Line and SSP Line. We will most likely see speculators staying away from the market. This presents good opportunity for genuine homebuyers to start looking in and around the station. Homes in the secondary market will be the most ideal as they are priced cheaper than new launches. |

Khalil AdisAn independent analysis from yours truly Archives

July 2023

Categories

All

|

100 Peck Seah Street

|

|

RSS Feed

RSS Feed