|

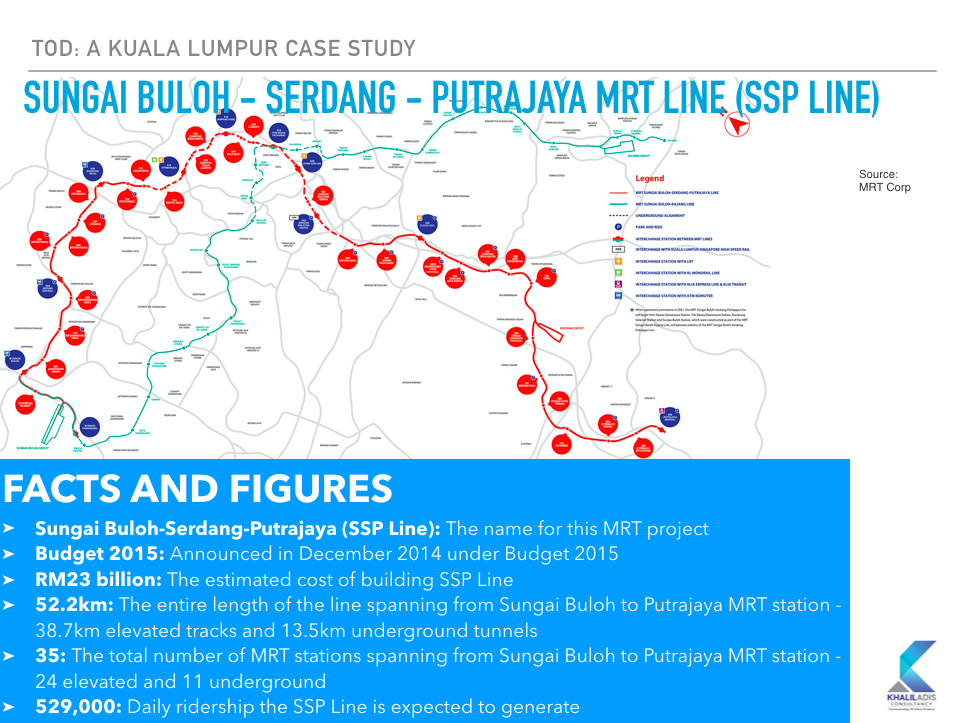

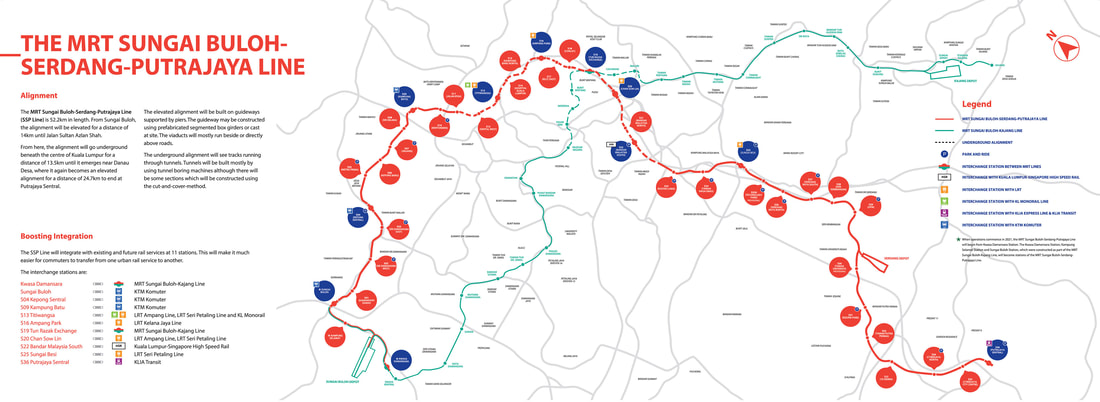

From map reading to identifying growth areas, this easy-to-understand session aims to assist first-time homebuyers looking for homes along the different train lines in KL/Greater KL. By Khalil Adis If you had enjoyed reading 'Property Buying for Gen Y', then you are in for a special treat. For my upcoming talk on January 11 at Havoc Hartanah 10, I will be including new materials that will cover newly completed as well as upcoming train lines in greater detail. Take this as 'Property Buying for Gen Y' part two - this time with more emphasis on one of the 5Cs I had mentioned in my book which is to check for transport masterplan. Here are five things you can expect during my lesson: #1: A combination of 'Property Buying for Gen Y' and 'Connectivity & Your Property' I had spent an enormous amount of time to write, conduct research and take photos for my upcoming book. For this lesson, I will place more emphasis on transportation, specifically the Sungai Buloh - Kajang Line (SBK Line), Sungai Buloh-Serdang-Putrajaya (SSP Line), Ampang LRT Extension Line, Kelana Jaya LRT Extension Line and LRT Bandar Utama-Klang Line (Klang Valley LRT Line 3). We will then dive deep into each line before identifying the growth areas. #2: Learn how to read transportation masterplan This is part of the diving deep process that you will undergo. This is where you will learn some of the key facts and figures of each line. Understanding transportation masterplan is part of the process in one of the 5Cs in my book - check for budget allocation from the government. We will then analyse how such budget allocation will have an impact on property prices along the lines. #3: Find the sweet spot in terms of distance to train stations While you may want to buy close to train stations, you also want to be careful not to buy to close, especially for elevated train stations. Also, there are certain requirements that developers will have to adhere to qualify for transit-oriented development (TOD). Learn what the sweet spots are and how they may impact on your resale and rental value. #4: Not all growth areas are created equally During the lesson, we will identify growth areas along the lines. However, not all areas are suitable for you as some are located in mature areas. For example, while Tun Razak Exchange MRT station will serve the upcoming Tun Razak Exchange, the properties around the area will not be affordable for first-time homebuyers. On the other hand, such an area will be suitable for investors looking to buy their second home or for rental income. These are some of the due diligence points we will cover. #5: Identify areas where you can find affordable properties The key to finding affordable properties along the lines mentioned is to identify areas where there are new or upcoming train stations and where the government has announced plans to create upcoming economic zones.

Such areas will have to be away from the city centre but close enough to train stations and dedicated hubs mentioned so you can experience price appreciation over the long-term. Learn where they are along the lines mentioned. Don’t forget to bring your notebook along and ask questions after the lesson. Details of my talk below: Topic: Connecting the dots and finding the hot spots Date: 11 January 2020 Time: 3.30pm Venue: Wisma Sejarah, Jalan Tun Razak, Kuala Lumpur See you there!

0 Comments

The federal government mooted project had promised to build 1 million affordable homes by 2020. However, the project was from the beginning mired in controversies. By Khalil Adis Just last week, it was announced in the media that Perbadanan PR1MA Malaysia, a public housing agency which was established under the Barisan Nasional government may be dissolved as it is in a “mess”. The final decision on whether PR1MA projects should be continued is pending a due diligence report, which is expected to be completed end of this month. For years, the PR1MA initiative has received lashbacks from various stakeholders and the general public for its inefficient implementation. I recall researching about PR1MA when I was writing my second book. The 1Malaysia People’s Housing Programme or PR1MA was launched in July 2011 and incorporated under the PR1MA Act in 2012. It became operational in March 2013 and to qualify, applicants will need to have a single or combined household income of between RM2,500 to RM15,000 per month. I couldn’t help thinking how the hoopla around an announced PR1MA initiative usually fizzles out after some time, with no proper project updates disseminated to the public. For instance, under Budget 2016 that the government promised that it will build 5,000 units of houses under PR1MA and 1Malaysia Civil Servants Housing Programme (PPA1M) in 10 locations in the vicinities of light rail transit and monorail stations, including in Pandan Jaya, Sentul and Titiwangsa. However, a quick check on PR1MA’s website does not show any such projects except for one in Brickfields, Fraser Business Park and Bukit Jalil respectively. In addition, my interviews with young Malaysians while taking Grab and Uber show a great mismatch in what the government is saying – where many had said they had applied for the housing scheme, but they have yet to receive any official reply from PR1MA. Here are some circumstances that may have led to PR1MA’s failure #1: Lack of single housing agency to manage the affordable housing market Unlike Singapore which has the Housing & Development Board (HDB) to oversee the affordable housing segment, in Malaysia, there are many agencies rolling it out under the federal and state umbrellas. From federal-led initiatives like PR1MA and Residensi Wilayah (RUMAWIP) to state-led schemes like Rumah Mampu Biaya Johor (RMBJ) and Rumah Selangorku, this not only confuses the public but leads to inefficient use of public resources competing for the same market. What would work in my opinion is to have a single housing agency to streamline the entire process across the nation. This could also allow the agency to gauge demand from the public via available government data. In addition, this will allow them to allocate land according to demand to ensure that they are successfully balloted and fully taken up like the Singapore model. The Ministry of Housing and Local Government had studied the HDB model last year and is reportedly looking to emulate it. #2: Federal versus state government complicates matters While on paper this may sound ideal, it is not so easy in reality as land is a state matter. As such, federal-initiated programmes like PR1MA will likely face bureaucratic red tapes and are less likely to receive priority when applying for the release of state land. YB Zuraida Kamaruddin, Minister of Housing and Local Government (KPKT) recently shared that it is the responsibility of the state governments to offer up their spacious lands for the development of affordable housing. However, as of end-2018, only 27 plot of lands out of the total 127 for affordable housing projects around the country, were supplied by state governments. Let’s not forget that the state and federal governments may have different objectives which can further complicate matters. #3: Costly to acquire land Considering the challenge in securing land from respective state governments, the federal government would have to acquire them from private parties at a hefty cost. As land cost takes up a significant percentage of a project’s cost, this will inevitably drive up the cost of building affordable homes. Thus, it is hardly surprising that previous PR1MA projects were mostly built in undesirable locations, where homebuyer demand is low. #4: Far-flung location with sub-par connectivity Hence why, one of the common grouses about PR1MA is the project’s far-flung location away from the city. With the exception of the homes within KL mentioned above, most of PR1MA’s housing projects are inaccessible and will require applicants to own a car. This then defeats the purpose of building affordable homes as most of the applicants will be financially burdened with the double whammy of a car and home loan. Given Malaysia’s patchy connectivity and lack of seamless connection to public transport, this thus makes some of PR1MA’s projects highly unpopular. #5: Some applicants were left in the dark The applicants are the most important stakeholders for PR1MA. As such, communication ought to be done more diligently. Many young Malaysians I had spoken to said they did not receive any form of acknowledgement on the status of their application. Some have been waiting for more than five years and are still waiting. I had highlighted this at a panel discussion but a representative from PR1MA replied that this wasn’t true. Perhaps, she had reasons to as this was during Najib Razak’s era. Looking back, if this wasn’t the case, surely PR1MA would not be in its current position right now. In addition, it would certainly help if PR1MA were to address these issues head-on to assure applicants. Conclusion Whether or not PR1MA will be dissolved remains to be seen.

However, PR1MA is already costing Malaysian taxpayers more than RM8 billion. With 10,000 affordable homes in the pipeline, Bandar Malaysia is both a boon and a bane for Kuala Lumpur’s sluggish property sector. We analyse how this development will impact the market. By Khalil Adis The recent announcement by the Malaysian government that it is reviving the shelved Bandar Malaysia project is a piece of welcome news as it gives some clarity to investors on the status of the Kuala Lumpur-Singapore High Speed Rail (HSR) project. Since winning the 14th general election, Prime Minister Mahathir Mohamad had reviewed several mega infrastructure projects including Bandar Malaysia and the HSR. In the face of the country’s mounting debt, both projects were at first announced as cancelled in May 2018. This prompted Singapore’s Ministry of Transport to issue a statement stating that it “will wait for official communication from Malaysia”. However, the Malaysian government backtracked on this subsequently. Instead, it announced in June 2018 that the project was “postponed”. This created a lot of confusion on both sides of the causeway. After many months of speculation, the market finally received some clarity in September 2018 when representatives from both governments met in Putrajaya. In a joint-statement, both Singapore and Malaysia announced that they had signed an agreement to suspend the project until 31 May 2020 “Malaysia will bear the agreed costs in suspending the HSR Project. If by 31 May 2020, Malaysia does not proceed with the HSR Project, Malaysia will also bear the agreed costs incurred by Singapore in fulfilling the HSR Bilateral Agreement. During the suspension period, Malaysia and Singapore will continue to discuss on the best way forward for the HSR Project with the aim of reducing costs,” the statement read. The HSR project is now expected to commence service by 1 January 2031, instead of the original commencement date of 31 December 2026. With Bandar Malaysia now being revived, we list down the possible implications on Kuala Lumpur’s property market. #1: Boost for the construction sector The construction sector is currently in the doldrums due to the lacklustre property market in Malaysia. Loan rejections from buyers and the demand-supply mismatch mean developers are faced with unsold inventory leading to cash flow problems with contractors. In March, for instance, Bursa listed engineering and construction company, Zeland Berhad filed a statement with the Malaysian stock exchange that it was initiating arbitration proceedings against NRY Architects for RM305.4mil and other contract breaches for the construction of buildings of International Islamic University Malaysia in Kuantan. It also announced that it is claiming RM3.34mil in outstanding payment for construction works from BBCC Development Sdn Bhd located at the former Pudu jail near Hang Tuah monorail station. With Bandar Malaysia now back on track, contractors will be willing to bid at a much lower price to stay afloat amid the challenging market condition. Subcontractors will also benefit. #2: 10,000 new housing units will likely worsen overhang in Kuala Lumpur’s property market Initially, DBKL had announced that Bandar Malaysia will house around 30,000 affordable homes. However, a recent announcement puts the figures to 10,000 units. Kuala Lumpur City Hall (DBKL) had previously indicated that it has set a development guideline for developers to build such homes at around 800 sq ft but priced below MYR450,000. Meanwhile, Bank Negara’s figures showed that 80 per cent of homes, or 146,196 units priced above RM250,000, remained unsold as of end March 2018. While Bank Negara did not break down the figures according to each state, recent data provided by the Valuation and Property Services Department (JPPH) showed that Kuala Lumpur recorded the third highest number of residential overhang at 5,114 units. So unless the homes are priced below RM250,000, we are likely to see Kuala Lumpur’s housing glut worsen. #3: Boon for first-time homebuyers Bandar Malaysia has been cited by DBKL as a case study for government and private developers in building transit-oriented development (TOD). Bandar Malaysia will house two MRT stations – Bandar Malaysia North and Bandar Malaysia South – which will form part of the alignment for the Sungai Buloh – Serdang – Putrajaya Line (SSP Line). Bandar Malaysia will also possibly serve as the interchange to the MRT Line 3, which has now been postponed. If indeed Bandar Malaysia will build affordable homes according to DBKL’s guidelines, then it will be a boon for first-time homebuyers as the entry price in Kuala Lumpur is easily above RM600,000. It will also mean young Malaysians will no longer have to buy a car first after completing their education and thus improve their chances of getting their home loans approved. Currently, many young Malaysians are trapped in the debt cycle due to various financial commitments such as their National Higher Education Fund (PTPTN), cars, personal and credit cards loans. So while demand is strong, loan rejections remain an issue further worsening the cash flow for developers. #4: Bane for landlords and sellers If indeed 10,000 new housing units will be coming on stream, Bandar Malaysia’s surrounding areas such as Pudu, Brickfields, Cheras, Bandar Tun Razak, Sungai Besi and Taman Desa will be badly affected. As such, landlord and sellers will likely see their asking prices fall even further as consumers will soon have more choices. Landlords will also find difficulty in doing short-term accommodations as the Malaysian government will be regulating this market segment. Therefore, rent-seekers and buyers are the clear winners as they are in the position to haggle for the best price. #5: Sluggish commercial and office market ahead The initial projection for Bandar Malaysia stated that it will have a gross development value (GDV) of RM150 billion.

Measuring around 196 hectares, Bandar Malaysia’s master plan indicates that it will be a mixed-use development with commercial and office buildings. With so many mega malls and office buildings in Kuala Lumpur, Bandar Malaysia will add on to more floor space in Kuala Lumpur’s already weak commercial and office markets. Despite this, Bandar Malaysia will likely attract multinational companies to set up their operations here as it is located within the Digital Free Trade Zone (DFTZ). Buying a home will be your single most expensive investment in your life and these are the most common mistakes you should avoid. By Khalil Adis Buying your first home is an exciting experience that will have you go through a range of roller-coaster emotions. From scouting for the right property to securing a loan, the procedures are endless that it is so easy to lose sight of what is important: #1: Buying based on emotions Buying a property based on emotions can cause you to gloss over some of its inherent shortcomings. It is like falling in love in someone gorgeous until they start to open their mouth. The initial phase may elicit a response such as exhilaration over its interior design finishing and then imagining how it would be like to sit in front of that bay window in that sleek glasshouse apartment. However, your emotions can bite you back over the long run as such a home will result in hefty utility bills in the long term. When buying a property, you should make calculated decisions by asking yourself these basic questions: Is the property priced fairly? Do your market research to find out what is the average price per sq ft of the property in the vicinity. This is important as it will ensure your property can have room for capital appreciation in the future. Are there nearby amenities like schools, hospitals and train stations? This will make the area desirable and attract people to want to live, work and play there. As demand increases, it will attract a significant population leading to the capital appreciation of your property. If you want to start a family, these are important considerations. Can the property be rented out or sold in the future? There will be some point in your life that you may end up as a landlord or a seller. Therefore, you must put yourself in the position of a tenant or a buyer by really looking at the property for what it is. As such, check if there any defects that may affect its future rentability or value. It is a good idea to upkeep your property to ensure all the electrical points and sanitary appliances are working while giving it a fresh coat of paint every year. You might also want to look at your interior design, layout and colour schemes and see if they will appeal to potential tenants or buyers. #2: Buying a house facing East-West orientation You should avoid buying a house that is facing the East-West orientation as it is directly exposed to the afternoon sun and therefore increases the heat gain. During night time, the concrete walls will radiate back the heat to your home leading to higher utility bills from your air-conditioning unit. Instead, you should go for a home that is facing North-South orientation. Do also ensure there is cross-ventilation from one end of the house to another to encourage natural air flow. #3: Buying an odd-sized unit An oddly sized unit refers to a layout which has odd corners like a triangle or irregularly shaped like an oval or circle. Such homes have an inefficient layout meaning that it will result in wasted space which cannot be utilised. It is also bad in terms of feng shui should the odd corners have an acute angle as they will collect energy that cannot be dispersed. Instead, you should opt for a regularly shaped unit like a square or rectangle. Remember this golden rule when it comes to a home layout: boring equals good. #4: Buying a common unit versus one that is scarce This is especially applicable for the property market in Malaysia where there is a severe oversupply of homes particularly in Johor and Kuala Lumpur. When buying a home, you should opt for a unit that is scarce. You should first study the development carefully and the unit types that are available. For example, in a project where 4-bedroom greatly outnumber 2-bedroom units, you should opt for the latter. This is because such units will be easier to offload in the resale market should you wish to sell or rent it out in future. Of course, you must take into consideration your family size before making the final decision. #5: Not asking about your prospective neighbours A neighbour can make or break your property.

This is especially true if you are buying a resale home. Recently, a friend confided how he had to move out from his current home to rent another place in eastern Singapore. He had bought the HDB flat from the resale market from an owner who appeared desperate to sell it off. “Don’t tell the neighbour downstairs how much I sold this house,” the owner said ominously. This should have been a red flag. After moving in, he realised his neighbour downstairs would often make a din throughout the entire day. Sometimes, he would have the police knocking on his door as the neighbour had complained about him for no reason. This caused him and his family so much distress that the neighbour’s mom had to come up to explain and apologise for her son’s erratic behaviour. Apparently, her son suffers from a mental illness. After talking to his neighbour, he realised the previous owner was not on good terms with the entire family. This explains their decision to sell the flat. While he now lives a quieter life elsewhere, his tenants are now at the receiving end of the neighbour’s constant abuse. For example, recently, he received a call from the HDB complaining about the apparent noises from his unit. Thankfully, the HDB and the police are aware of his problematic neighbour and have since closed the case. Unfortunately, you cannot choose your neighbours if you had bought a new home directly from the HDB or developer. However, you can mitigate your risks by being a good neighbour. For instance, why not offer a serving of cookies or cakes during your festive celebration? While your actions may not be reciprocated, a friendly hello on your neighbour’s door and offering such goodies will certainly go a long way in making a good first impression last. Neighbours do talk so why not give them something good to talk about? 2018 is a watershed moment for Malaysia's politics and the subsequent impact on the property market. We list down the key highlights in our 2018 property market roundups and our outlook for 2019. By Khalil Adis May 10 2018 was a watershed moment in Malaysia as it marked the first change of government in the country's history. Since 1957, it had enjoyed an uninterrupted reign from the ruling Barisan Nasional (BN) coalition. However, the high cost of living, falling Ringgit, the lack of affordable homes in the market, high unemployment among fresh graduates, the unfettered check on power and the 1MDB scandal proved to be the undoing for BN as Malaysians far and wide casted their protest vote in the ballot box The message from Malaysians is clear - they have had enough and want a new, clean government to lead the way. With the Pakatan Harapan government now in power, all eyes are on the newly elected old Prime Minister Tun Mahathir Mohamad and his team to solve the pressing bread and butter issues. Here are the top five property market roundups for 2018 and our top five outlooks for 2019. Roundups #1: Demand-supply mismatch has resulted in an increasing number of unsold homes According to Bank Negara, 80 per cent of homes or 146,196 units priced above RM250,000 remained unsold as of end March 2018. In comparison, 130,690 units were unsold during the same period last year. "Imbalances observed in the property market continue to persist," Bank Negara had said in a statement. #2: Rent-to-own scheme being rolled out To help ease the entry for the first time property buyers, the private sector has come up with a few initiatives. Some private developers like Ayer Holdings have introduced a ‘Stay & Own' scheme for their Epic Residence and Foreston projects whereby part of the rent will be converted to the downpayment. This not only provides a temporary solution for those who urgently need a home but also a form of security. Meanwhile, Maybank has rolled a similar initiative called HouzKEY which they have called as "a rent-to-own solution that helps you to own your dream home." The scheme involves zero per cent downpayment with the monthly rental forming part of the home financing. #3: Ministry of Housing and Local Government studying Singapore's HDB model In July, Zuraida Kamaruddin, the Minister of Housing and Local Government paid an official visit to Singapore to study the HDB model. Singapore has succeeded to build demand driven homes under its Built-to-Order (BTO) scheme to house 80 per cent of the Singapore population. This is especially useful in Malaysia where there is currently a demand-supply mismatch as in point number one. #4: Malaysia looking into having a single housing government agency In Malaysia, there are so many affordable housing programmes being rolled out by the state and federal governments such as Rumah Milik Mampu, Rumah Selangorku, PR1MA, My First Home, Program Perumaha Rakyat and the list goes on. This confuses the public. The Malaysian government is currently looking into having a single housing agency to streamline the whole process much like the HDB model. If implemented, this could solve the current Malaysian housing woe. #5: More help for the B40, M40 and first-time homebuyers under Budget 2019 More help is on the way for these group of property buyers as announced under Budget 2019. The measures included the Real Estate and Housing Developers' Association (Rehda) agreement to cut prices by 10 per cent for new launches, the exemption of the Real Property Gains Tax (RPGT) for properties that are priced below RM200,000 and the stamp duty exemption for properties priced in the first RM300,000 up to RM500,000 as well as those priced from RM300,000 to RM1 million. Outlook for 2019 #1: Affordable homes to continue driving the market There is currently a strong pent-up demand for affordable homes but where the supply is lacking. As such, the affordable home segment will continue to be in strong demand for 2019. However, there needs to be concerted efforts from both the government and private developers. Under Budget 2019, the federal government has pledged to spend RM1.5 billion on such homes via the 1Malaysia People's Housing (PR1MA) and Syarikat Perumahan Negara Bhd (SPNB). Meanwhile, Rehda has agreed to cut prices as stated above. #2: South KL to be the growth area There are many infrastructure projects and economic drivers that are in the pipeline that will further boost property prices in Southern KL. One such project is Bandar Malaysia will serve as the terminus station for the Kuala Lumpur-Singapore High Speed Rail (KL-Singapore HSR) project linking both cities in 90 minutes flat. The development for the project has been postponed to two years and will now commence construction in 2020 instead of 2018. Meanwhile, the express service will only commence by 1 January 2031 instead of 31 December 2026, as originally planned. Bandar Malaysia has been designated as a site for the Digital Free Trade Zone (DFTZ) initiative by Jack Ma. Home to the Satellite Services Hub, DFTZ is expected to create some 60,000 direct and indirect jobs. It will also possibly serve as the interchange to the MRT Line 3, which has now been postponed. Another economic driver in the vicinity is Tun Razak Exchange (TRX). TRX will be a mixed-use development comprising a Grade A office space as well as residential and commercial precincts. To be developed in several phases over a period of 15 years, the first phase will comprise four investment grade A office towers, a lifestyle retail mall, two 5-star hotels and up to six luxurious residential towers with a target completion date by 2019. In addition, Bandar Malaysia will house two MRT stations - Bandar Malaysia North and Bandar Malaysia South which will form part of the alignment for the Sungai Buloh - Serdang - Putrajaya Line (SSP Line). #3: Properties along Sungai Buloh - Serdang - Putrajaya Line (SSP Line) will be sought after Speaking of the SSP Line, properties along the alignment, particularly those situated in the growth areas of Sungai Besi, Bandar Malaysia and Cyberjaya City Centre are worth looking into. Bandar Malaysia will house two MRT stations as stated above and located a few stops away from Tun Razak Exchange MRT station. Meanwhile, Sungai Besi MRT station is an interchange station to the Sungai Besi LRT station. It will serve as an interchange to the upcoming High Speed Rail station located in Bandar Malaysia, also in Sungai Besi. Last but not least, Cyberjaya City Centre MRT station is a transit-oriented development (TOD) project to be developed by Malaysian Resources Corp Bhd (MRCB). With its experience in building the transport hub in KL Sentral, MRCB will be developing a new city that will be integrated with the MRT station. Phase one is expected to generate a gross development value (GDV) of RM5.35 billion. It will feature a 200,000 sq ft convention centre, a 300- to 400-room business hotel, low and high-rise office buildings and a retail podium. Cyberjaya City Centre will have a development plan spanning 20 years. The MRT station is located just opposite Lim Kok Wing University of Creative Technology. #4: Penang to get a boost from Phase 1 of Penang Transport Master Plan (PTMP) With Lim Guan Eng as Malaysia's Finance Minister, Penang's property market will get a further boost. Just this month, Phase 1 of PTMP was approved. It will comprise the Bayan Lepas Light Rail Transit (LRT) project, Pan Island Link 1 (PIL1) project and several main highways. The proposed Bayan Lepas LRT line will be about 30 km in length with 27 stations running from KOMTAR to the future reclaimed islands in the south. There will be three interchange stations - KOMTAR, Sky Cab Station linking it to the Sky Cab line across the Malacca Straits and The Light Station linking it to the George Town-Butterworth LRT line. The LRT Line will also be integrated with the Sungai Nibong Express Bus Terminal at the Sungai Nibong Station. Meanwhile, PIL 1 is a new 20km highway that will be aligned along the mountainous terrain of the island and will take around 15 minutes from between Gurney Drive to the Second Bridge. There will be six interchanges in all - Dr Lim Chong Eu Expressway (LCE), Awang, Relau, Paya Terubong, Utama and Gurney. #5: Johor Bahru to get a boost from the Rapid Transit System (RTS) Link Meanwhile, over in the southern state of Johor, Iskandar Malaysia's muted property market will get a boost as the RTS Link will commence construction next year.

The RTS Link will link Bukit Chagar station in Johor Bahru to Woodlands North MRT station in Singapore when completed in 2024. There are also plans for a Bus Rapid Transit (BRT) system within Bukit Chagar station to link it to the different areas of Iskandar Malaysia. The BRT will feature a dedicated bus lane with three lines - BRT Line 1 will span from Bukit Chagar to Tebrau, BRT Line 2 from Bukit Chagar to Senai and finally, BRT Line 3 from Bukit Chagar to Iskandar Puteri. However, based on market talk in the ground, there is a possibility that the BRT system will be upgraded to an LRT system instead. Housing affordability remains a serious issue as there are still many Malaysians who cannot afford to buy a home. To solve this, Malaysia can take a cue from Singapore's public housing scheme which houses 80 per cent of its population. By Khalil Adis Ask any young Malaysians and chances are many are still unsure if they can buy their first home. Their lack of knowledge, financial literacy, inability to get a loan and the lack of supply of such homes across Malaysia are further exacerbating the Malaysian housing issue. From Johor to Kuala Lumpur, there is currently a demand-supply mismatch whereby most new launches in the market are priced above RM500,000. This is far beyond what the average Malaysian can afford. According to the first quarter of 2018 data from the National Property and Information Centre (NAPIC), Selangor has the highest number of existing stock of residential units followed by Johor and Kuala Lumpur at 1,516,960, 795,363 and 471,475 units respectively. With Budget 2019 to be announced in November, perhaps the Malaysian government can take a cue from Singapore how the city-state is able to house 80 per cent of its population. Step 1: Have a single affordable housing agency In Singapore, there is only one government agency called the Housing & Development Board (HDB) which is tasked to provide affordable housing for every Singaporean. In comparison, in Malaysia, there are so many affordable housing programmes being rolled out by the state and federal governments such as Rumah Milik Mampu, Rumah Selangorku, PR1MA, My First Home, Program Perumaha Rakyat and the list goes on. This confuses the public. The government should consolidate the affordable housing segment under one single government agency much like the HDB model. Recently, Zuraida Kamaruddin, the Minister of Housing and Local Government, was in Singapore to study the HDB model. By having it under one government agency umbrella, this will enable the federal government to better gauge demand from the public. This leads to the next point. Step 2: Build demand-driven homes In Singapore, the HDB builds homes that are demand-driven called the Built-to-Order (BT0) scheme. The public is then invited to apply for the various homes that are on offer in different parts of Singapore. By doing so, this enables the HDB to gauge demand from the public and allocate homes using a balloting system. The balloting system will then inform applicants of the status of their application. If Malaysia were to follow such a system, this will help to solve the current demand-supply mismatch in the market and build homes according to demand. Step 3: Introduce grants and subsidies In Singapore, a first-time applicant can enjoy a housing grant called the Additional CPF Housing Grant (AHG) and Special CPF Housing Grant (SHG) of up to S$40,000 depending on one's household income. To qualify for the AHG, applicants must apply for a 2-room flat or larger with an income ceiling of S$5,000 per month, Applicants must also be employed at the time of application and be at least in employment for the past one year during the housing application. On top of that applicants must not be an owner of any other properties in Singapore or overseas. Applicants can also qualify for additional grants under the SHG here or if they live close to their parents. By introducing such grants, it lowers the entry price to buy a home. Likewise, if similar grants are introduced in Malaysia, it will mean more Malaysians can afford to buy their first home. You can read more about the scheme here: Think about it. Step 4: Introduce housing loans direct from the housing ministry In Singapore, most Singaporeans will opt to get a loan directly from the HDB which gives a concessionary interest rate at 2.6 per cent. This means, regardless of the economy, the interest rate will remain the same unlike taking a bank loan. In addition, the HDB is more compassionate if say, one is unable to service their loans. The HDB will still require you to pay your monthly mortgage but will work out a plan that will ensure you will still have a roof over your head. However, banks are less forgiving when you take a bank loan and will not hesitate to repossess your flat if you do not pay your mortgages on time. In Malaysia, applicants must apply for a bank loan. However, due to non-payment of PTPTN as well as bad credit, some applicants find their loans being rejected. Perhaps, a way to get around it is to have a housing loan disbursed by the housing ministry with its own set of rules similar to the HDB. Step 5: Introduce a rent-to-own scheme (for those who can't afford downpayment) While there is no rent-to-own scheme in Singapore, this mode of housing ownership is getting popular in Malaysia. For example, Ayer Holding introduced a ‘Stay & Own' scheme for their Epic Residence and Foreston projects whereby part of the rent will be converted to the downpayment. This not only provides a temporary solution for those who urgently need a home but also a form of security You can read more about the scheme here: If you are completely clueless about buying your first home and need some pointers, this workshop is for you! The method of delivery will be very light-hearted but with the main points covered. Sign up here

|

Khalil AdisAn independent analysis from yours truly Archives

July 2023

Categories

All

|

100 Peck Seah Street

|

|

RSS Feed

RSS Feed