|

With 10,000 affordable homes in the pipeline, Bandar Malaysia is both a boon and a bane for Kuala Lumpur’s sluggish property sector. We analyse how this development will impact the market. By Khalil Adis The recent announcement by the Malaysian government that it is reviving the shelved Bandar Malaysia project is a piece of welcome news as it gives some clarity to investors on the status of the Kuala Lumpur-Singapore High Speed Rail (HSR) project. Since winning the 14th general election, Prime Minister Mahathir Mohamad had reviewed several mega infrastructure projects including Bandar Malaysia and the HSR. In the face of the country’s mounting debt, both projects were at first announced as cancelled in May 2018. This prompted Singapore’s Ministry of Transport to issue a statement stating that it “will wait for official communication from Malaysia”. However, the Malaysian government backtracked on this subsequently. Instead, it announced in June 2018 that the project was “postponed”. This created a lot of confusion on both sides of the causeway. After many months of speculation, the market finally received some clarity in September 2018 when representatives from both governments met in Putrajaya. In a joint-statement, both Singapore and Malaysia announced that they had signed an agreement to suspend the project until 31 May 2020 “Malaysia will bear the agreed costs in suspending the HSR Project. If by 31 May 2020, Malaysia does not proceed with the HSR Project, Malaysia will also bear the agreed costs incurred by Singapore in fulfilling the HSR Bilateral Agreement. During the suspension period, Malaysia and Singapore will continue to discuss on the best way forward for the HSR Project with the aim of reducing costs,” the statement read. The HSR project is now expected to commence service by 1 January 2031, instead of the original commencement date of 31 December 2026. With Bandar Malaysia now being revived, we list down the possible implications on Kuala Lumpur’s property market. #1: Boost for the construction sector The construction sector is currently in the doldrums due to the lacklustre property market in Malaysia. Loan rejections from buyers and the demand-supply mismatch mean developers are faced with unsold inventory leading to cash flow problems with contractors. In March, for instance, Bursa listed engineering and construction company, Zeland Berhad filed a statement with the Malaysian stock exchange that it was initiating arbitration proceedings against NRY Architects for RM305.4mil and other contract breaches for the construction of buildings of International Islamic University Malaysia in Kuantan. It also announced that it is claiming RM3.34mil in outstanding payment for construction works from BBCC Development Sdn Bhd located at the former Pudu jail near Hang Tuah monorail station. With Bandar Malaysia now back on track, contractors will be willing to bid at a much lower price to stay afloat amid the challenging market condition. Subcontractors will also benefit. #2: 10,000 new housing units will likely worsen overhang in Kuala Lumpur’s property market Initially, DBKL had announced that Bandar Malaysia will house around 30,000 affordable homes. However, a recent announcement puts the figures to 10,000 units. Kuala Lumpur City Hall (DBKL) had previously indicated that it has set a development guideline for developers to build such homes at around 800 sq ft but priced below MYR450,000. Meanwhile, Bank Negara’s figures showed that 80 per cent of homes, or 146,196 units priced above RM250,000, remained unsold as of end March 2018. While Bank Negara did not break down the figures according to each state, recent data provided by the Valuation and Property Services Department (JPPH) showed that Kuala Lumpur recorded the third highest number of residential overhang at 5,114 units. So unless the homes are priced below RM250,000, we are likely to see Kuala Lumpur’s housing glut worsen. #3: Boon for first-time homebuyers Bandar Malaysia has been cited by DBKL as a case study for government and private developers in building transit-oriented development (TOD). Bandar Malaysia will house two MRT stations – Bandar Malaysia North and Bandar Malaysia South – which will form part of the alignment for the Sungai Buloh – Serdang – Putrajaya Line (SSP Line). Bandar Malaysia will also possibly serve as the interchange to the MRT Line 3, which has now been postponed. If indeed Bandar Malaysia will build affordable homes according to DBKL’s guidelines, then it will be a boon for first-time homebuyers as the entry price in Kuala Lumpur is easily above RM600,000. It will also mean young Malaysians will no longer have to buy a car first after completing their education and thus improve their chances of getting their home loans approved. Currently, many young Malaysians are trapped in the debt cycle due to various financial commitments such as their National Higher Education Fund (PTPTN), cars, personal and credit cards loans. So while demand is strong, loan rejections remain an issue further worsening the cash flow for developers. #4: Bane for landlords and sellers If indeed 10,000 new housing units will be coming on stream, Bandar Malaysia’s surrounding areas such as Pudu, Brickfields, Cheras, Bandar Tun Razak, Sungai Besi and Taman Desa will be badly affected. As such, landlord and sellers will likely see their asking prices fall even further as consumers will soon have more choices. Landlords will also find difficulty in doing short-term accommodations as the Malaysian government will be regulating this market segment. Therefore, rent-seekers and buyers are the clear winners as they are in the position to haggle for the best price. #5: Sluggish commercial and office market ahead The initial projection for Bandar Malaysia stated that it will have a gross development value (GDV) of RM150 billion.

Measuring around 196 hectares, Bandar Malaysia’s master plan indicates that it will be a mixed-use development with commercial and office buildings. With so many mega malls and office buildings in Kuala Lumpur, Bandar Malaysia will add on to more floor space in Kuala Lumpur’s already weak commercial and office markets. Despite this, Bandar Malaysia will likely attract multinational companies to set up their operations here as it is located within the Digital Free Trade Zone (DFTZ).

1 Comment

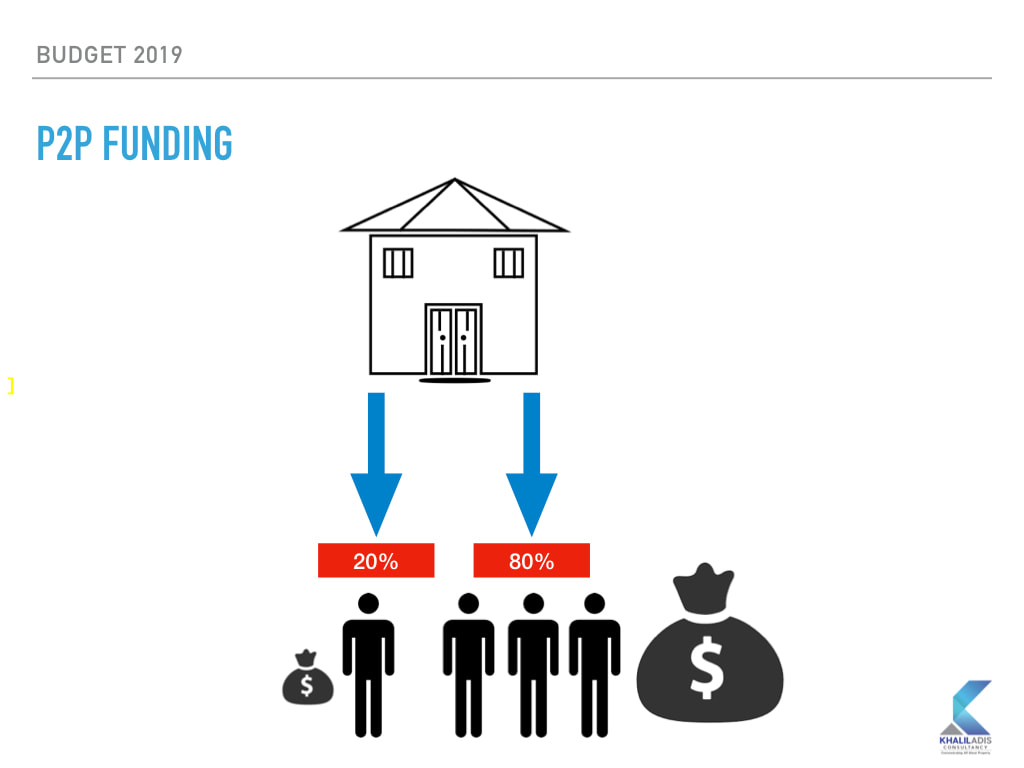

Announced under Budget 2019, first-time homebuyers should take advantage of the schemes that are being rolled out by the federal government. By Khalil Adis In case you had missed the good news that was announced during Budget 2019, there will indeed be more help coming your way if you need help in buying your first home this year. Here are the quick low-down on what the schemes are. #1: P2P (peer-to-peer) Funding What: This is a private sector-driven “Property Crowdfunding” platform to serve as an alternative source of financing for first-time house buyers. It will be regulated by Securities Commission. When: The P2P exchange will go live in the first quarter of 2019. How it works: Interested applicants will need to put a 20 per cent downpayment while the remaining 80 per cent will be funded by investors. Exactly when and how this will be done will be announced closer to the date by the Finance Ministry. Who should apply: Those who have the required 20 per cent downpayment. It is not clear if this is in cash and/or EPF. #2: RM1 billion fund allocated for first-time homebuyers What: This is a special fund for those earning less than RM2,300 a month. The fund can only be used to purchase properties priced up to RM150,000. Bank Negara will be setting up the fund. More details here When: The fund is available for two years until the allocation is spent as of 1 January 2019. You may apply for them at the following banks at a rate of 3.5 per cent: #3: RM25 million fund allocated for first-time home buyers What:

This is a special fund meant for those with a household income of up to RM5,000 The fund provides a mortgage guarantee to enable borrowers to obtain higher financing, including deposit fees. The fund can is for first-time house buyers who are purchasing properties worth up to RM500,000 The fund will also provide a grant stamp duty exemption of up to the first RM300,000 on transfer instruments and loan agreements for two years until Dec 2020. The fund will be run by Cagamas. When: Unfortunately, details are scant. You may check Cagamas Bhd for updates. |

Khalil AdisAn independent analysis from yours truly Archives

July 2023

Categories

All

|

100 Peck Seah Street

|

|

RSS Feed

RSS Feed