|

Allianz Real Estate investment in Ocean Financial Centre is part of its strategy to allocate 5 per cent to 10 per cent of its real estate investments to the Asia-Pacific region. By Khalil Adis #1: Ocean Financial Centre is a 43-storey Grade A office tower The Grade A office tower is located strategically at the intersection of the Raffles Place and Marina Bay financial precincts with retail component on its ground floor and basement level. It is accessible via the Raffles Place MRT station. #2: Singapore’s office market is experiencing strong rental growth While Singapore’s private residential market has been muted by the recent property cooling measures, its office market is doing well. "The Singapore office market is experiencing strong rental growth. From an occupational cost and efficiency perspective it continues to be favourable vis-a-vis other comparable markets like Hong Kong,” said Mr Rushabh Desai, CEO Asia Pacific at Allianz Real Estate,. #3: The divestment is worth S$537.3 million According to Keppel REIT Management Limited, the divestment is part of ongoing portfolio optimisation efforts and presents a unique opportunity to unlock value for its unitholders. The divestment by Keppel REIT of a 20 per cent minority stake in its subsidiary, Ocean Properties LLP which holds Ocean Financial Centre, to Allianz Real Estate has an agreed property value S$537.3 million. This is 16.8 per cent above Keppel REIT’s historical purchase price of S$460.2 million. #4: Divestment has a target completion date by end December 2018 According to Keppel REIT, it currently holds a 99.9 per cent interest in Ocean Financial Centre through Ocean Properties LLP. Keppel REIT said the divestment is expected to be completed by end December 2018 With Allianz now holding a 20 per cent a minority stake in Keppel REIT’s subsidiary, Ocean Properties LLP, will continue to maintain a majority interest in Ocean Financial Centre through its 79.9 per cent interest in Ocean Properties LLP. Additionally, Keppel REIT said it will continue to be the asset manager for Ocean Properties LLP in relation to Ocean Financial Centre. #5: Unitholders of Keppel REIT set to benefit from the divestment According to Tan Swee Yiow, CEO of Keppel REIT Management Limited, the divestment is “in line with our commitment to deliver sustainable total return to unitholders”.

"The partial divestment of Ocean Financial Centre is a unique opportunity for unitholders to realise part of the capital gains from this premium Grade A office building, while maintaining exposure to the strengthening Singapore office market. Despite this being a divestment of a non-controlling stake, the agreed property value reflects the asset's quality and underlying value,” he said in a statement. The divestment will see Keppel REIT realising approximately S$77.1 million of capital gains. This translates to an attractive net asset-level return of 8.3 per cent per annum over the holding period.

0 Comments

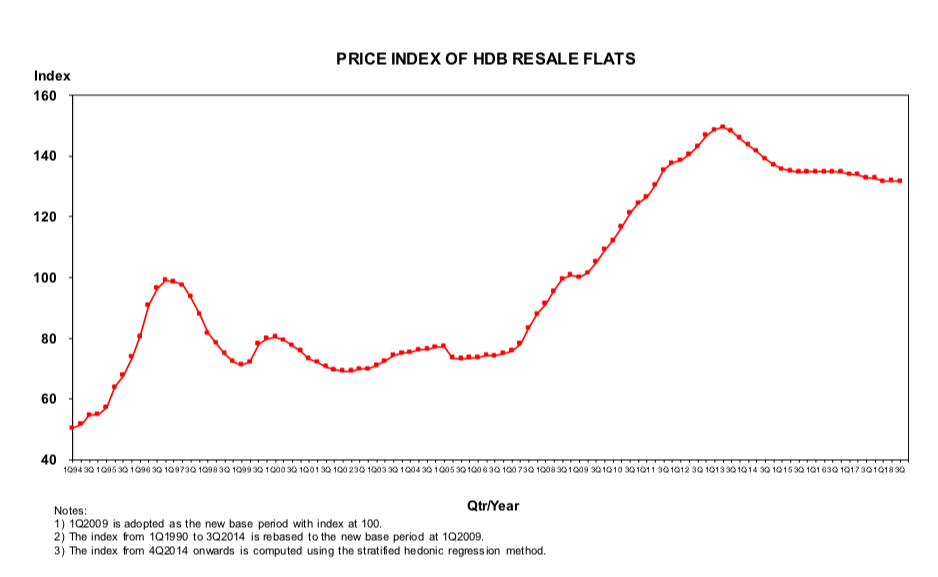

Singapore's private property market experienced robust growth but was muted midway by property cooling measures. We list down the key highlights in our 2018 property market roundups and our outlook for 2019. By Khalil Adis Singapore's private property market saw a steep rebound from the fourth quarter of 2017 after many quarters of decline in its Property Price Index (PPI) since the fourth quarter of 2013. Figures from the Urban Redevelopment Authority (URA) showed that the Lion City's PPI surged by 11.0 points from 138.7 in the fourth quarter of 2017 to 149.7 points in the third quarter of 2018. However, the market softened from July onwards post the new property cooling measures. Here are the top five property market roundups for 2018 and our top five outlooks for 2019. Roundups: #1: En-bloc fever Singapore's property market was off to a fiery start with several collective sales deal that was concluded during the first half of the year. They included the iconic Pearl Bank Apartments which was sold for S$728 million sales to CapitaLand and Park West which was sold for S$840.89 million to SingHaiyi Gold Pte Ltd. Data from Cushman & Wakefield Inc showed that the collective sales market recorded S$3.8 billion of en-bloc transactions in the second quarter. #2: New property cooling measures introduced To douse the red-hot residential property market, the government announced a slew of property cooling measures in July. This included increasing the Additional Buyer's Stamp Duty (ABSD) rates and tightening loan-to-value (LTV) limits on residential property purchases. The new ABSD rates and LTV limits are as above. As a result, the collective sales market declined with S$353 million worth of transactions recorded in the third quarter, data from Cushman & Wakefield Inc showed. #3: Industrial property market picks up steam While Singapore's residential property sector has taken quite a hit, its industrial and commercial property sectors are seeing an uptrend in investment sales. According to data from Cushman & Wakefield Inc, industrial property deals soared 73 per cent to S$1.2 billion in the third quarter while office sales increased by 54 per cent to S$2.1 billion. Meanwhile, Jones Lang Lasalle Singapore, citing data from JTC statistics said islandwide all-industrial rental correction stayed modest at 0.1 per cent quarter-on-quarter for three consecutive quarters since the fourth quarter of 2017, while the second quarter of 2018 all-industrial price index flat-lined for the first time since trending down in the third quarter of 2014. #4: HDB resale values are declining HDB is a hot bread and butter issue among Singaporeans as 80 per cent of the population lives in public housing flat. Public interest in HDB dominated the headlines in 2018 as government officials warned that their values could decline, especially those that are more than 40 years with around 50 years left on their 99-year lease. This marked a stark contrast during Lee Kuan Yew's era when he assured Singaporeans that HDB flats are an asset. Property agents who specialise in HDB flats in mature estates such as Toa Payoh say they are already seeing prices of older resale flats declining as many buyers are staying clear from such properties following the ongoing debate. For example, according to the third quarter data from the HDB in 2018, a 3-bedroom flat in the estate was transacted for S$279, 000. In contrast, the median price during the same period in 2016 was transacted for S$300,000. Having said that, other factors do come into play such as the supply of new Built-to-Order (BTO) flats which has influenced the resale price. However, until the government addresses the uncertainty surrounding older estates, we are likely to see the values declining as it is very much influenced by market sentiment. #5: Widening price gap between a private property and an HDB flat While the private property market has seen the price index picking up by some 11.0 points, the HDB Resale Price Index (RPI) has been on a decline. According to data from the HDB, the RPI has been on a decline since the second quarter of 2013 as it continues to launch BTO flats in the market. This is the biggest price gap in over 10 years and will likely be a contentious issue when the general election is expected to be called in 2019. Predictions: #1: HDB to become a hot-button issue 2019 is expected to be an election year. As such, HDB will be a hot-button issue as 80 per cent of the population lives in HDB flats. As we have discussed above, HDB resale prices are already on the decline while the price gap between a private property and an HDB flat has widened considerably. The government will need to address the ongoing debate on the value of older HDB flats moving forward. #2: Fewer BTO flats to be launched In November, the HDB said it launched 7,214 flats for sale under the Build-To-Order (BTO) and Sale of Balance Flats (SBF) exercise. This comprises 3,802 BTO units and 3,412 SBF units across various towns estates such as Sembawang, Sengkang, Tengah, Yishun and Tampines. However, there will be fewer units being offered in the next BTO launch exercise in February 2019. The HDB said it will offer about 3,100 flats in Jurong West, Kallang Whampoa and Sengkang. #3: A sellers' market With fewer BTO flats on the offering, this could possibly divert some of the buyers to the resale market and prop up the resale prices which have been falling since the second quarter of 2013. As such 2019 could likely be a sellers' market. Sellers should watch the market closely while buyers should opt for a BTO quickly. #4: Five growth areas As outlined in the URA Master Plan 2014, the five growth areas are located at Woodlands Regional Centre, Jurong Lake District, City Centre, Paya Lebar Central and Punggol Digital District. Woodlands Regional Centre will be a transportation hub which will connect the Thomson-East Coast Line (TEL) to the Johor-Singapore Rapid Transit System (RTS) via Woodlands North MRT station. Meanwhile, Jurong Lake District will house the High Speed Rail station linking Singapore to Kuala Lumpur in 90 minutes flat. The development of the project has been postponed to two years and will now commence construction in 2020 instead of 2018. Meanwhile, the express service will only commence by 1 January 2031 instead of 31 December 2026, as originally planned. You can read more about URA Master Plan 2014 here. #5: Opening of TEL will provide a price booster for properties along the line The TEL is a 43km MRT Line that will add 31 new stations to the existing rail network, with 7 interchange stations.

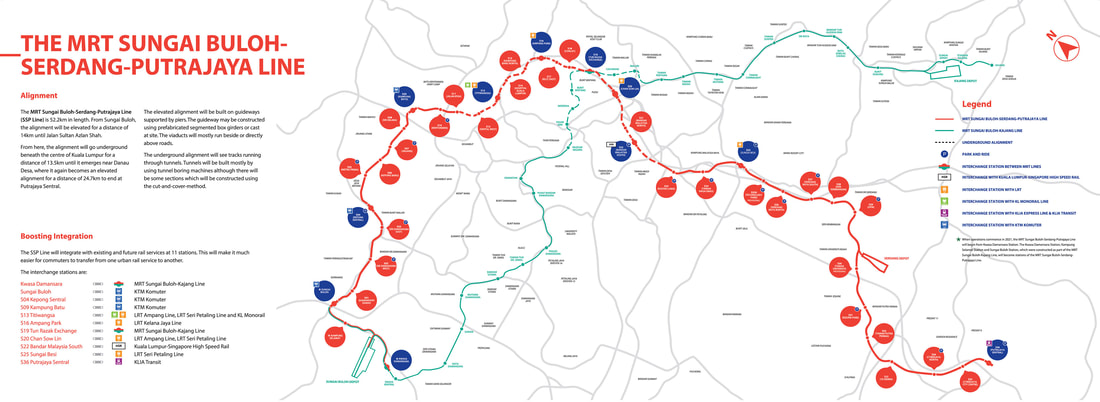

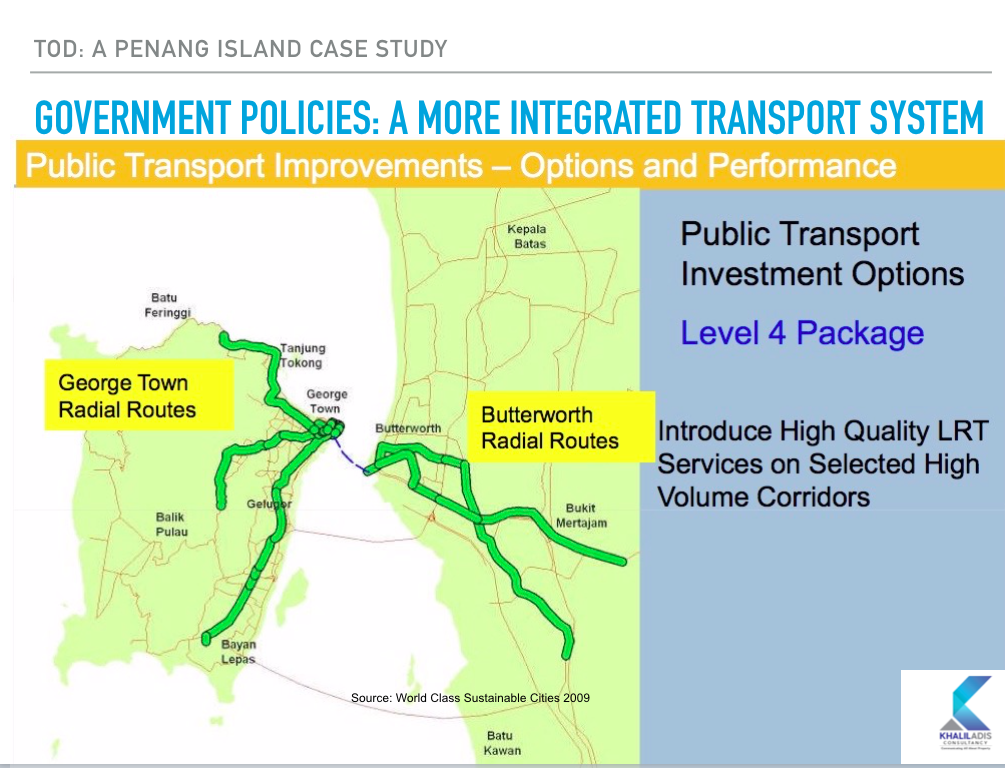

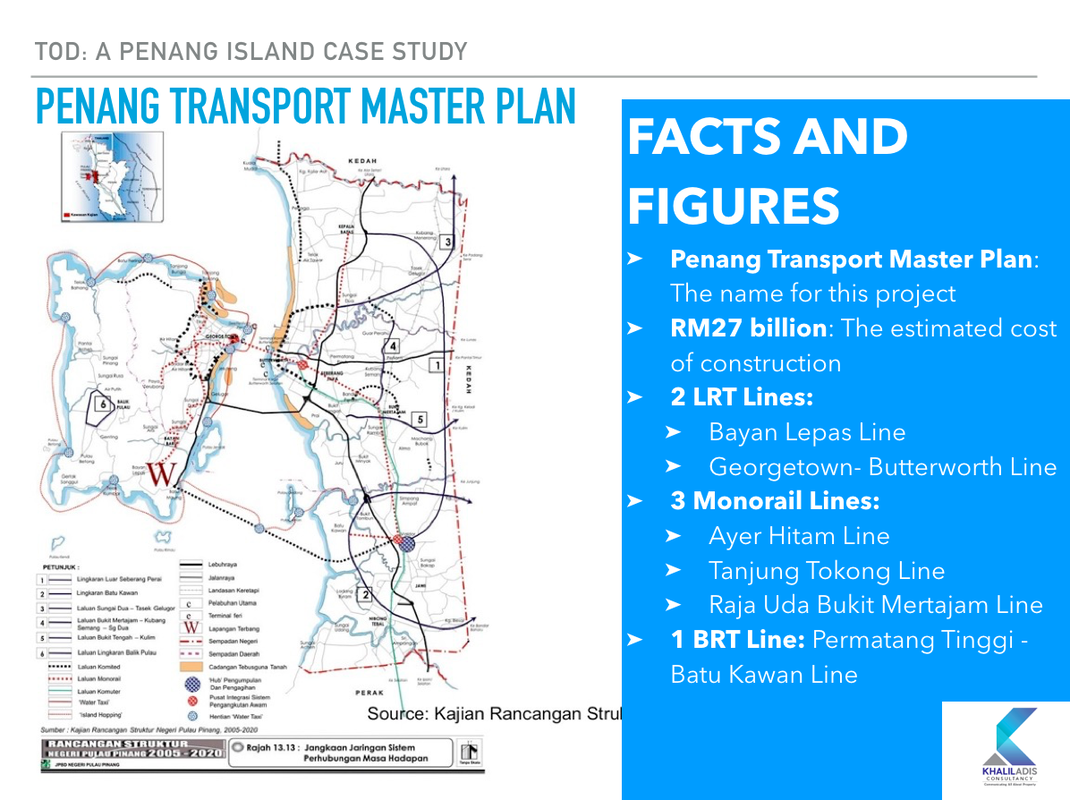

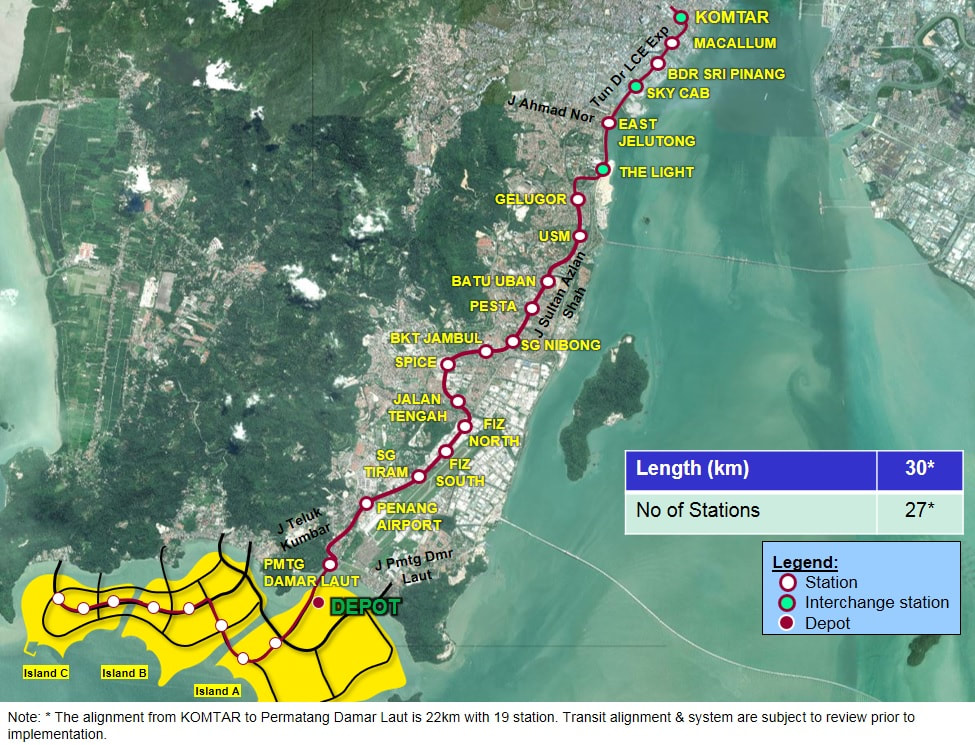

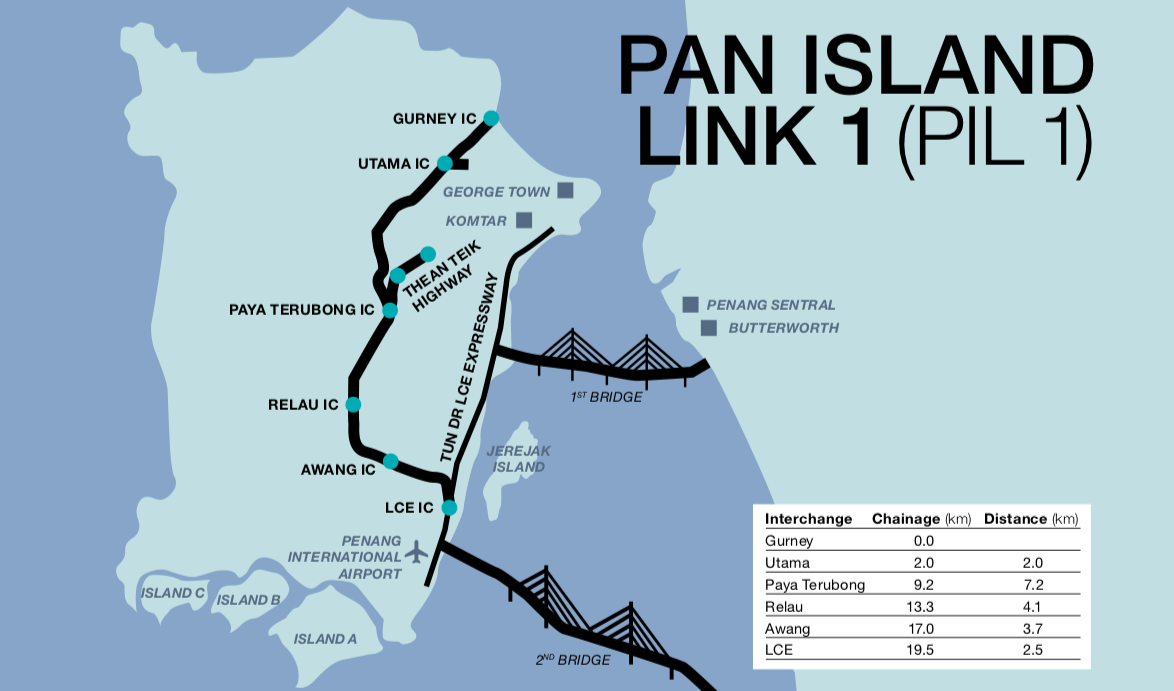

It will link to the East-West Line, North-South Line, North-East Line, Circle Line and the Downtown Line. Spanning from Woodlands North to Sungei Bedok, the line will be opened in stages next year. Stage one will comprise stations from Woodlands North to Woodlands South. As such, properties in the Woodland Regional Centre as highlighted above will be among the first to enjoy the price booster when the stations commence service next year. This will definitely be much to cheer about in the north amid the muted HDB resale market. 2018 is a watershed moment for Malaysia's politics and the subsequent impact on the property market. We list down the key highlights in our 2018 property market roundups and our outlook for 2019. By Khalil Adis May 10 2018 was a watershed moment in Malaysia as it marked the first change of government in the country's history. Since 1957, it had enjoyed an uninterrupted reign from the ruling Barisan Nasional (BN) coalition. However, the high cost of living, falling Ringgit, the lack of affordable homes in the market, high unemployment among fresh graduates, the unfettered check on power and the 1MDB scandal proved to be the undoing for BN as Malaysians far and wide casted their protest vote in the ballot box The message from Malaysians is clear - they have had enough and want a new, clean government to lead the way. With the Pakatan Harapan government now in power, all eyes are on the newly elected old Prime Minister Tun Mahathir Mohamad and his team to solve the pressing bread and butter issues. Here are the top five property market roundups for 2018 and our top five outlooks for 2019. Roundups #1: Demand-supply mismatch has resulted in an increasing number of unsold homes According to Bank Negara, 80 per cent of homes or 146,196 units priced above RM250,000 remained unsold as of end March 2018. In comparison, 130,690 units were unsold during the same period last year. "Imbalances observed in the property market continue to persist," Bank Negara had said in a statement. #2: Rent-to-own scheme being rolled out To help ease the entry for the first time property buyers, the private sector has come up with a few initiatives. Some private developers like Ayer Holdings have introduced a ‘Stay & Own' scheme for their Epic Residence and Foreston projects whereby part of the rent will be converted to the downpayment. This not only provides a temporary solution for those who urgently need a home but also a form of security. Meanwhile, Maybank has rolled a similar initiative called HouzKEY which they have called as "a rent-to-own solution that helps you to own your dream home." The scheme involves zero per cent downpayment with the monthly rental forming part of the home financing. #3: Ministry of Housing and Local Government studying Singapore's HDB model In July, Zuraida Kamaruddin, the Minister of Housing and Local Government paid an official visit to Singapore to study the HDB model. Singapore has succeeded to build demand driven homes under its Built-to-Order (BTO) scheme to house 80 per cent of the Singapore population. This is especially useful in Malaysia where there is currently a demand-supply mismatch as in point number one. #4: Malaysia looking into having a single housing government agency In Malaysia, there are so many affordable housing programmes being rolled out by the state and federal governments such as Rumah Milik Mampu, Rumah Selangorku, PR1MA, My First Home, Program Perumaha Rakyat and the list goes on. This confuses the public. The Malaysian government is currently looking into having a single housing agency to streamline the whole process much like the HDB model. If implemented, this could solve the current Malaysian housing woe. #5: More help for the B40, M40 and first-time homebuyers under Budget 2019 More help is on the way for these group of property buyers as announced under Budget 2019. The measures included the Real Estate and Housing Developers' Association (Rehda) agreement to cut prices by 10 per cent for new launches, the exemption of the Real Property Gains Tax (RPGT) for properties that are priced below RM200,000 and the stamp duty exemption for properties priced in the first RM300,000 up to RM500,000 as well as those priced from RM300,000 to RM1 million. Outlook for 2019 #1: Affordable homes to continue driving the market There is currently a strong pent-up demand for affordable homes but where the supply is lacking. As such, the affordable home segment will continue to be in strong demand for 2019. However, there needs to be concerted efforts from both the government and private developers. Under Budget 2019, the federal government has pledged to spend RM1.5 billion on such homes via the 1Malaysia People's Housing (PR1MA) and Syarikat Perumahan Negara Bhd (SPNB). Meanwhile, Rehda has agreed to cut prices as stated above. #2: South KL to be the growth area There are many infrastructure projects and economic drivers that are in the pipeline that will further boost property prices in Southern KL. One such project is Bandar Malaysia will serve as the terminus station for the Kuala Lumpur-Singapore High Speed Rail (KL-Singapore HSR) project linking both cities in 90 minutes flat. The development for the project has been postponed to two years and will now commence construction in 2020 instead of 2018. Meanwhile, the express service will only commence by 1 January 2031 instead of 31 December 2026, as originally planned. Bandar Malaysia has been designated as a site for the Digital Free Trade Zone (DFTZ) initiative by Jack Ma. Home to the Satellite Services Hub, DFTZ is expected to create some 60,000 direct and indirect jobs. It will also possibly serve as the interchange to the MRT Line 3, which has now been postponed. Another economic driver in the vicinity is Tun Razak Exchange (TRX). TRX will be a mixed-use development comprising a Grade A office space as well as residential and commercial precincts. To be developed in several phases over a period of 15 years, the first phase will comprise four investment grade A office towers, a lifestyle retail mall, two 5-star hotels and up to six luxurious residential towers with a target completion date by 2019. In addition, Bandar Malaysia will house two MRT stations - Bandar Malaysia North and Bandar Malaysia South which will form part of the alignment for the Sungai Buloh - Serdang - Putrajaya Line (SSP Line). #3: Properties along Sungai Buloh - Serdang - Putrajaya Line (SSP Line) will be sought after Speaking of the SSP Line, properties along the alignment, particularly those situated in the growth areas of Sungai Besi, Bandar Malaysia and Cyberjaya City Centre are worth looking into. Bandar Malaysia will house two MRT stations as stated above and located a few stops away from Tun Razak Exchange MRT station. Meanwhile, Sungai Besi MRT station is an interchange station to the Sungai Besi LRT station. It will serve as an interchange to the upcoming High Speed Rail station located in Bandar Malaysia, also in Sungai Besi. Last but not least, Cyberjaya City Centre MRT station is a transit-oriented development (TOD) project to be developed by Malaysian Resources Corp Bhd (MRCB). With its experience in building the transport hub in KL Sentral, MRCB will be developing a new city that will be integrated with the MRT station. Phase one is expected to generate a gross development value (GDV) of RM5.35 billion. It will feature a 200,000 sq ft convention centre, a 300- to 400-room business hotel, low and high-rise office buildings and a retail podium. Cyberjaya City Centre will have a development plan spanning 20 years. The MRT station is located just opposite Lim Kok Wing University of Creative Technology. #4: Penang to get a boost from Phase 1 of Penang Transport Master Plan (PTMP) With Lim Guan Eng as Malaysia's Finance Minister, Penang's property market will get a further boost. Just this month, Phase 1 of PTMP was approved. It will comprise the Bayan Lepas Light Rail Transit (LRT) project, Pan Island Link 1 (PIL1) project and several main highways. The proposed Bayan Lepas LRT line will be about 30 km in length with 27 stations running from KOMTAR to the future reclaimed islands in the south. There will be three interchange stations - KOMTAR, Sky Cab Station linking it to the Sky Cab line across the Malacca Straits and The Light Station linking it to the George Town-Butterworth LRT line. The LRT Line will also be integrated with the Sungai Nibong Express Bus Terminal at the Sungai Nibong Station. Meanwhile, PIL 1 is a new 20km highway that will be aligned along the mountainous terrain of the island and will take around 15 minutes from between Gurney Drive to the Second Bridge. There will be six interchanges in all - Dr Lim Chong Eu Expressway (LCE), Awang, Relau, Paya Terubong, Utama and Gurney. #5: Johor Bahru to get a boost from the Rapid Transit System (RTS) Link Meanwhile, over in the southern state of Johor, Iskandar Malaysia's muted property market will get a boost as the RTS Link will commence construction next year.

The RTS Link will link Bukit Chagar station in Johor Bahru to Woodlands North MRT station in Singapore when completed in 2024. There are also plans for a Bus Rapid Transit (BRT) system within Bukit Chagar station to link it to the different areas of Iskandar Malaysia. The BRT will feature a dedicated bus lane with three lines - BRT Line 1 will span from Bukit Chagar to Tebrau, BRT Line 2 from Bukit Chagar to Senai and finally, BRT Line 3 from Bukit Chagar to Iskandar Puteri. However, based on market talk in the ground, there is a possibility that the BRT system will be upgraded to an LRT system instead. Phase 1 of Penang Transport Master Plan (PTMP) is now approved. Here are the 6 key takeaways11/14/2018 You can soon hop onto the train from Penang International Airport to KOMTAR or take the highway to Gurney Drive in 15 minutes flat. By Khalil Adis With the Phase 1 of Penang Transport Master Plan (PTMP) now approved, the Pearl of the Orient is set to scale to greater heights. Prior to the Malaysian general election, it looked as though the project will never see the light of day as Penang falls under the opposition state of the Democratic Action Party (DAP) while the federal government was run by Barisan Nasional (BN). However, now that its former Chief Minister Lim Guan Eng is the current Finance Minister under the Pakatan Harapan government, the project is finally gaining traction. Here are six interesting facts on Phase 1 of PTMP #1: PTMP exempted from major review It is interesting to note that while other mega-projects such as the East Coast Railway Line (ECRL), High Speed Rail (HSR), Forest City, MRT Circle Line and Light Rail Transit Line 3 (LRT3) were under review, PTMP is the only one that managed to escape unscathed. This is definitely good news for Penangites and for the property market as such infrastructure project will further boost property prices on the main island and on the Seberang Perai and Batu Kawan areas. #2: Phase 1 to comprise an LRT line and several main highways The PTMP estimated cost is around RM46 billion and comprises two LRT Lines - Bayan Lepas Line and Georgetown- Butterworth Line, three Monorail Lines - Ayer Hitam Line, Tanjung Tokong Line and Raja Uda Bukit Mertajam Line and one BRT Line - Permatang Tinggi - Batu Kawan Line. Phase 1 of PTMP will comprise the Bayan Lepas Light Rail Transit (LRT) project, Pan Island Link 1 (PIL1) project and several main highways. #3: Bayan Lepas LRT line to have 27 stations (including three interchange stations) The proposed Bayan Lepas LRT line will be about 30 km in length with 27 stations running from KOMTAR to the future reclaimed islands in the south. The line will pass through important landmarks such as KOMTAR, Bayan Lepas Free Industrial Zone (FIZ) and the Penang International Airport as well as several established and planned residential townships and employment hubs in Jelutong, The Light, Gelugor, Batu Uban, SPICE in Bayan Baru, Sg Tiram and Batu Maung. There will be three interchange stations - KOMTAR, Sky Cab Station linking it to the Sky Cab line across the Malacca Straits and The Light Station linking it to the George Town-Butterworth LRT line. The LRT Line will also be integrated with the Sungai Nibong Express Bus Terminal at the Sungai Nibong Station. #4: Pan Island Line 1 to have six interchanges Meanwhile, the PIL 1 is a new 20km highway to alleviate the heavy traffic load on the Tun Dr Lim Chong Eu Expressway (LCE) and adjacent arterials such as Pengkalan Weld, Jalan Masjid Negeri, Jalan Jelutong and Jalan Sultan Azlan Shah. According to the Penang state government's website, "it is designed with six interchanges to link highly-populated areas and transport hubs on the island from the Second Bridge and the Penang International Airport all the way towards George Town, Paya Terubong, Bayan Baru, and Relau." The six interchanges include LCE interchange, Awang interchange, Relau interchange, Paya Terubong Interchange, Utama Interchange and Gurney Interchange. #5: A travel time of 15 minutes Upon completion, PIL 1 will be aligned along the mountainous terrain of the island and will take around 15 minutes from between Gurney Drive and the airport, compared with the current 45 minutes under normal traffic conditions on the Tun Dr Lim Chong Eu Expressway (LCE). #6: Toll-free Good news for drivers as the the 20km highway will be toll-free with limited points of access.

This it to ensure certainty in speed and travel time over the entire length of the highway. The alignment along the mountainous terrain also avoids the possibility of congestions caused by future developments. Funding will be from the sale of reclaimed land owned by the Penang state government A cautionary property tale of joint tenancy, abuse and escaping to a safe haven. By Khalil Adis As I watched Incident in a Ghostland last night from the comfort and safety of my home, I cannot help but notice some parallels between the characters and myself. This psychological horror drama thriller film tells a story of how a mom and her two daughters were ambushed in their home by murderous intruders. One of her daughters, Beth, conjured up a dream while being physically abused by her sadistic captors in a bid to escape her trauma. Still being held captive by the intruders, she would go on to write a bestselling book of the same title in the imaginary world that she had created. For me, however, the abuse that my mom and I had encountered was not a work of fiction. As a way to deal with it, I wrote a book called Property Buying for Gen Y which would then go on to become a bestseller and was a turning point in my career. While my story is nothing like Incident in a Ghostland, the physical, psychological and emotional scars still remain until today. History of abuse It is hard to believe a family member that I initially grew up with can turn out to be so abusive. My parents had divorced and as a result, we were living with our guardians. My mom and I lived with an uncle while the other family member, was sent to live with another uncle, owing to her very difficult behaviour. We then got a flat together in Taman Jurong where I was living my mom and this other family member when I was around 18-years-old. I remember thinking - “Finally! We have a place to call our own.” However, little did I know this family member would turn out to become a monster. The first instance of abuse occurred when I was kicked out of home at 21-years-old. I recall having my bag thrown out of the house and living temporarily at the police station where I was posted at for my national service. Back then, I did not know any property laws and did not know any better. I then rented a place for a while near to Admiralty MRT station. To pay for my rent, I would give tuition. The subsequent abuse happened in 2014 when the family member came back with her family after having lived overseas. My mom and I were on the constant receiving end of abuse, bullying and threats to kick us out of our family home. Mind you, I was paying for the mortgage and taking care of my mom. Things got so bad that my mom and I had to lodge a police report and sought help from my MP Tharman Shanmugaratnam. Thankfully, I now have my own home and a safe place for my mom and I away from the abuser. I subsequently dedicated Property Buying for Gen Y to my MP. Complications of joint tenancy While you can walk away from a relationship, it is not so straightforward when it comes to property matters with a family member. This is especially so if the property is held jointly as in the case of my mom and this family member. Under a joint tenancy agreement, two individuals agree to jointly hold a property. While this is the most common method of ownership as it is less costly, a joint tenancy exposes one family member to the financial risks, liabilities and other problems created by the other family member. In my case, since moving to another country, this family member has not been paying for her mortgage since 2011. My uncle had intervened with the agreement that I pay for the mortgage until I got my own home. However, once I received the keys to my home, the other family member became uncontactable. The HDB subsequently contacted us and told us this family member cannot pay for the house and wants my mom to take over the mortgage. As a result, my mom now bears the burden. We then decided to put up the home for rental as my mom is not working and is ill. The rental income is now helping to cover the mortgage as well as for my mom’s savings. We also paid the other family member her portion less expenses. However, the constant threats from the abuser still remain. If you are among the unlucky few who happen to own a property jointly with a toxic family member, this is what you should do. #1: Have proper documentation Having a problematic joint tenant will likely end up in a legal battle. Therefore, you need to have proper documentation in case it does end up in court. This includes whatever payments that you have been paying for the upkeep of the home, property tax and so on. Other useful documents including emails detailing a pattern of abuse, police reports and other documents to show that the other party has not been paying their home mortgage. Having all these documents will help bolster your case should it end up in court. #2: Speak to a lawyer When it comes to a joint tenancy agreement, the right of survivorship means that the other family member takes control of the whole property when the other party passes away, This can be very problematic when you are dealing with a family member who has not been paying and is abusive. Speak to a lawyer on what your options are so that you are fully prepared should a death occur in your family. #3: Do not react An abusive person needs to be in control and instigating a fight is one such way of doing so. While it can be very difficult to not react when the other person is shouting and accusing, you need to realise that the other person is not acting rationally By not reacting, you have taken away their power to push your buttons. Stay cool and take the high road all the way. #4: Minimise contact By minimising contact with the abuser, you are ensuring your own safety and that things do not escalate out of control. Focus only on the points concerning the house and steer clear from any arguments. Do not get sucked into the drama. #5: Learn to forgive No matter what has happened, each person deserves to be happy. When I speak about forgiveness, it is not for the other person but more for yourself. By learning to forgive, the other person no longer holds any power on you. I remember how empowering it was when I moved to my own home as the other family member now can no longer bully my mom and I. You have the right to be treated with respect, to be safe and to have a wonderful life away from the abuser. Seek help The Ministry of Social and Family Development defines violence as physical injury, direct or indirect threats, sexual assault, emotional and psychological torment, damage to property, social isolation or any behaviour which causes a person to live in fear.

My mom and I have experienced some of those forms of abuse described. While it is hard to believe that your own flesh and blood can turn their back against you, family violence is very real. In closing, it is my hope by sharing this cautionary tale that others in a similar situation will be spared the agony of what my mom and I have had to endure. If you have a family member who is abusive or know a family who is being abused, do not hesitate to call the authorities. You can find out more at Break The Silence. By Khalil Adis During the previous few budgets by the Barisan Nasional administration, there were a lot of motherhood statements on providing affordable homes under the PR1MA scheme. However, if you were to ask any young Malaysians, many will tell you that the access to affordable housing remains a faraway dream. Back in 2016 when I was briefly staying in Kuala Lumpur, I would often have a small talk with the Uber and Grab drivers on my journey, asking them whether they had already bought a home. Most often than not, all of them would reveal the same tragic tale. Yes, they applied for their PRIMA homes a few years ago, but the approval has yet to be announced. This sad reality remains until today. Some of the major stumbling blocks that contribute to the lack of home ownership among Malaysians are the inability to get loans. This is possible due to bad credit, non-payment of PTPTN or having insufficient cash for the down payment. Perhaps, more alarmingly, is the shortage of affordable homes in the market combined with the people having insufficient knowledge on how to go doing so. While I noted that the Ministry of Urban Wellness and Housing under the newly minted Pakatan Harapan government has recently conducted an official visit to Singapore to study our public housing model under the Housing & Development Board (HDB), more needs to be done. Here are my budget wishlists to solve the current housing crisis. Education programme to help first-time homebuyers  The recently concluded Jom Cari Rumah event is an example of an education programme for those wanting to buy a property. Photo: Khalil Adis Consultancy The recently concluded Jom Cari Rumah event is an example of an education programme for those wanting to buy a property. Photo: Khalil Adis Consultancy There is currently a lack of awareness and financial literacy on the steps toward housing ownership. As a result, many young Malaysians are ill-equipped on the know-how on buying their first home. The school will be a great place to start educating them on the importance of financial literacy as this will improve their chances of buying their first home while empowering them on the basics of home ownership. One housing body to gauge demand from the public There is currently a demand-supply mismatch in the country as there is no central governing body to estimate demand for homes. This leads to issues whereby states like Johor and Kuala Lumpur are facing a massive glut in the medium to luxury end of the market. On the other hand, the strong pent-up demand for affordable housing is still unresolved. Besides, the various affordable housing programmes rolled out by the state and federal governments confuse the public. As a suggestion, the Malaysian government can emulate the Singapore model whereby affordable homes are being implemented under one single government agency – the HDB. This will allow the government to gauge demand accurately and to build housing accordingly based on the HDB’s Built-to-Order (BTO) scheme. Different levels of housing affordability threshold for the various states Last but not least, there needs to be a different level of affordability in the different states in Malaysia rather than a one blanket definition of say, less than RM500,000, for affordable housing. This is because the cost of living and the median income differs significantly from state to state. According to the Department of Statistics Malaysia, the median income in 2016 for fairly urbanised states like Kuala Lumpur, Putrajaya and Selangor are RM9,073, RM8,275 and RM7,225 respectively. On the other end of the spectrum, the median income in less urbanised states like Kelantan, Kedah and Pahang are RM3,079, RM3,811 and RM3,979 respectively. From here, the state government should work backwards to determine the price of affordable housing based on the gross income not exceeding 30% of one’s mortgage. This will better address and target the needs of Malaysians in each state. This article was first published by StarProperty.my If you are completely clueless about buying your first home and need some pointers, this workshop is for you! The method of delivery will be very light-hearted but with the main points covered. Sign up here

|

Khalil AdisAn independent analysis from yours truly Archives

July 2023

Categories

All

|

100 Peck Seah Street

|

|

RSS Feed

RSS Feed