|

With 10,000 affordable homes in the pipeline, Bandar Malaysia is both a boon and a bane for Kuala Lumpur’s sluggish property sector. We analyse how this development will impact the market. By Khalil Adis The recent announcement by the Malaysian government that it is reviving the shelved Bandar Malaysia project is a piece of welcome news as it gives some clarity to investors on the status of the Kuala Lumpur-Singapore High Speed Rail (HSR) project. Since winning the 14th general election, Prime Minister Mahathir Mohamad had reviewed several mega infrastructure projects including Bandar Malaysia and the HSR. In the face of the country’s mounting debt, both projects were at first announced as cancelled in May 2018. This prompted Singapore’s Ministry of Transport to issue a statement stating that it “will wait for official communication from Malaysia”. However, the Malaysian government backtracked on this subsequently. Instead, it announced in June 2018 that the project was “postponed”. This created a lot of confusion on both sides of the causeway. After many months of speculation, the market finally received some clarity in September 2018 when representatives from both governments met in Putrajaya. In a joint-statement, both Singapore and Malaysia announced that they had signed an agreement to suspend the project until 31 May 2020 “Malaysia will bear the agreed costs in suspending the HSR Project. If by 31 May 2020, Malaysia does not proceed with the HSR Project, Malaysia will also bear the agreed costs incurred by Singapore in fulfilling the HSR Bilateral Agreement. During the suspension period, Malaysia and Singapore will continue to discuss on the best way forward for the HSR Project with the aim of reducing costs,” the statement read. The HSR project is now expected to commence service by 1 January 2031, instead of the original commencement date of 31 December 2026. With Bandar Malaysia now being revived, we list down the possible implications on Kuala Lumpur’s property market. #1: Boost for the construction sector The construction sector is currently in the doldrums due to the lacklustre property market in Malaysia. Loan rejections from buyers and the demand-supply mismatch mean developers are faced with unsold inventory leading to cash flow problems with contractors. In March, for instance, Bursa listed engineering and construction company, Zeland Berhad filed a statement with the Malaysian stock exchange that it was initiating arbitration proceedings against NRY Architects for RM305.4mil and other contract breaches for the construction of buildings of International Islamic University Malaysia in Kuantan. It also announced that it is claiming RM3.34mil in outstanding payment for construction works from BBCC Development Sdn Bhd located at the former Pudu jail near Hang Tuah monorail station. With Bandar Malaysia now back on track, contractors will be willing to bid at a much lower price to stay afloat amid the challenging market condition. Subcontractors will also benefit. #2: 10,000 new housing units will likely worsen overhang in Kuala Lumpur’s property market Initially, DBKL had announced that Bandar Malaysia will house around 30,000 affordable homes. However, a recent announcement puts the figures to 10,000 units. Kuala Lumpur City Hall (DBKL) had previously indicated that it has set a development guideline for developers to build such homes at around 800 sq ft but priced below MYR450,000. Meanwhile, Bank Negara’s figures showed that 80 per cent of homes, or 146,196 units priced above RM250,000, remained unsold as of end March 2018. While Bank Negara did not break down the figures according to each state, recent data provided by the Valuation and Property Services Department (JPPH) showed that Kuala Lumpur recorded the third highest number of residential overhang at 5,114 units. So unless the homes are priced below RM250,000, we are likely to see Kuala Lumpur’s housing glut worsen. #3: Boon for first-time homebuyers Bandar Malaysia has been cited by DBKL as a case study for government and private developers in building transit-oriented development (TOD). Bandar Malaysia will house two MRT stations – Bandar Malaysia North and Bandar Malaysia South – which will form part of the alignment for the Sungai Buloh – Serdang – Putrajaya Line (SSP Line). Bandar Malaysia will also possibly serve as the interchange to the MRT Line 3, which has now been postponed. If indeed Bandar Malaysia will build affordable homes according to DBKL’s guidelines, then it will be a boon for first-time homebuyers as the entry price in Kuala Lumpur is easily above RM600,000. It will also mean young Malaysians will no longer have to buy a car first after completing their education and thus improve their chances of getting their home loans approved. Currently, many young Malaysians are trapped in the debt cycle due to various financial commitments such as their National Higher Education Fund (PTPTN), cars, personal and credit cards loans. So while demand is strong, loan rejections remain an issue further worsening the cash flow for developers. #4: Bane for landlords and sellers If indeed 10,000 new housing units will be coming on stream, Bandar Malaysia’s surrounding areas such as Pudu, Brickfields, Cheras, Bandar Tun Razak, Sungai Besi and Taman Desa will be badly affected. As such, landlord and sellers will likely see their asking prices fall even further as consumers will soon have more choices. Landlords will also find difficulty in doing short-term accommodations as the Malaysian government will be regulating this market segment. Therefore, rent-seekers and buyers are the clear winners as they are in the position to haggle for the best price. #5: Sluggish commercial and office market ahead The initial projection for Bandar Malaysia stated that it will have a gross development value (GDV) of RM150 billion.

Measuring around 196 hectares, Bandar Malaysia’s master plan indicates that it will be a mixed-use development with commercial and office buildings. With so many mega malls and office buildings in Kuala Lumpur, Bandar Malaysia will add on to more floor space in Kuala Lumpur’s already weak commercial and office markets. Despite this, Bandar Malaysia will likely attract multinational companies to set up their operations here as it is located within the Digital Free Trade Zone (DFTZ).

1 Comment

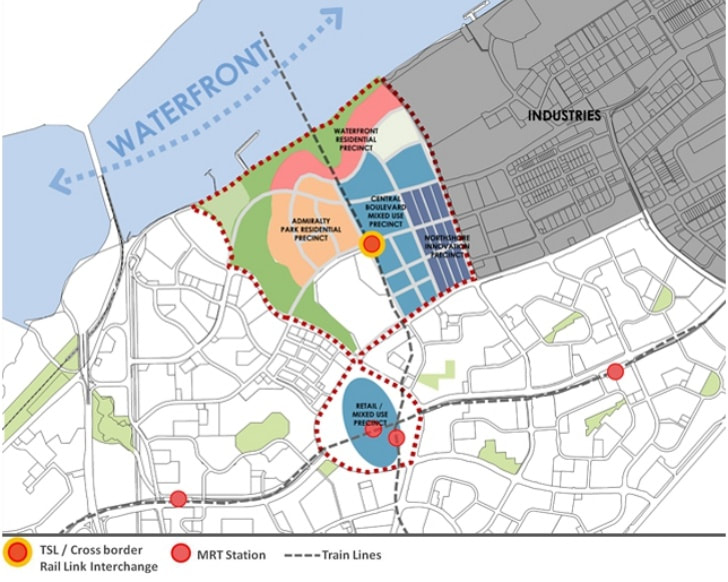

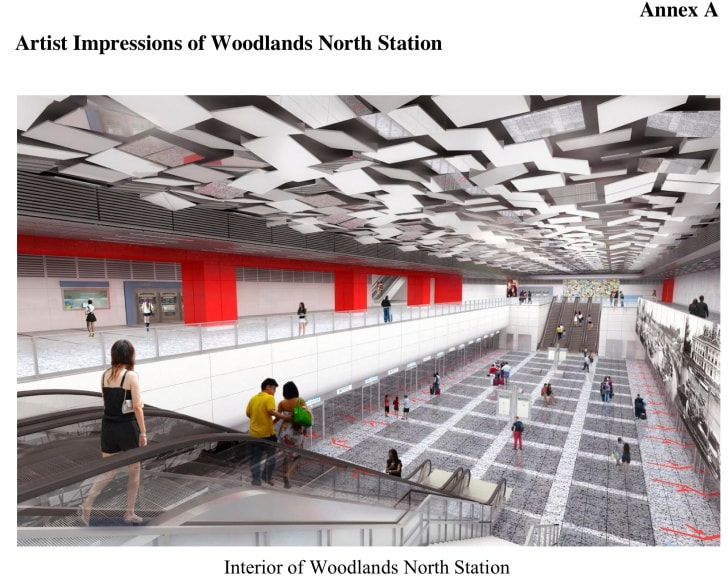

The game-changing project has been hit with a series of delays since the newly minted Pakatan Harapan government took power last May. With the property market in Iskandar Malaysia already in doldrums, we analyse the possible impact this may have on real estate on both sides of the causeway. By Khalil Adis When Pakatan Harapan took power in a landslide victory at the Malaysian general election last May, the ruling coalition government went to work by immediately addressing one of its election manifestos - reviewing major infrastructure projects which involve a foreign country. Singapore was no exception. Iskandar Malaysia, which was already feeling the heat from the sluggish property market, saw the High Speed Rail project at first being cancelled and then postponed. Meanwhile, the controversial Forest City project bordering Singapore was initially announced as off-limits to foreigners but was subsequently changed to build affordable homes for locals. The former is an important impetus that many developers had banked on to move their inventory amid a severe housing glut the state is facing. According to recent data provided by the Valuation and Property Services Department (JPPH), Johor recorded the highest number of residential overhang at 13,767 units followed by Selangor and Kuala Lumpur at 7,233 and 5,114 units respectively. The mismatch in the supply for homes versus what Johoreans can actually afford plus their inability to get financing have further exacerbated the property market situation in Iskandar Malaysia. The only saving grace is the cross-border rail link service linking Woodlands and Johor Bahru. Although not cancelled, the Johor Bahru-Singapore Rapid Transit System (RTS) link project is "not progressing well” as Transport Minister Khaw Boon Wan puts it. Just last week, Acting Transport Minister Dr Vivian Balakrishnan gave an update in Parliament that “further delays” are likely as Malaysia had missed the deadline in confirming its partner three times - first until September 2018, then until December. However, on December 28, Malaysia had asked to be given until February 28 this year to do so. It had missed this deadline as well. As a result, this will delay the opening of the link which was initially scheduled to be ready by December 31, 2024. Some developers, particularly in the JB Sentral area, had banked on the RTS Link, to move their unsold units. With the project now in limbo, here are the possible impacts on the property market both in Singapore and Johor: #1: Possible higher development cost around Woodlands North station In May 2012, it was announced that AECOM Technology has been awarded a US$42m contract for the design and engineering study of the RTS Link by Malaysia’s Land Public Transport Commission and Singapore’s Land Transport Authority (LTA). Under the deal, the company will provide an architectural and engineering consultancy study for the proposed RTS Link. Construction is well underway for the Thomson-East Coast MRT Line (TEL) with a plot of land allocated for the link at Woodlands North station. The station is slated to be opened in December this year. The Urban Redevelopment Authority’s (URA) master plan for Woodlands North Coast shows a mixed-use precinct for office and business parks along signature green boulevards within the station’s immediate vicinity. The delay could mean higher development cost for the terminus due to opportunity costs and inflation. #2: Higher fares The higher development cost arising from the construction delay could also mean higher fares for the RTS Link which may be passed on to consumers. However, whether or not this happens, commuters will likely switch to taking the RTS Link across the causeway as it will mean greater convenience as opposed to driving in or taking the bus. For example, commuters need to clear customs and immigration only once when they depart from either Singapore or Malaysia. Using one’s own vehicle or taking the bus will require a two times clearance with the possibility of being stuck in traffic. #3: Potential capital appreciation for existing housing developments near Bukit Chagar RTS station affected The Bukit Chagar RTS station will be located at the open car park next to the Sultan Iskandar Building complex. Surrounding the station are landed terrace homes and condominium towers TriTower Residence and Bukit Chagar Apartments. According to data from Brickz, from May 2017 to Jan 2018, the average per sq ft pricing for the landed homes in the area was RM354 per sq ft. Meanwhile, the average per sq ft transacted pricing for Bukit Chagar Apartments from Mar 2017 to Dec 2017 was RM395 per sq ft. There is no data for TriTower Residence built by SKS Group, formerly known as Maha Builders Group or MB Group. With the delay, the potential capital appreciation arising from the spillover impact from the RTS Link will take a longer period beyond 2024. Despite this, market talk is SKS Group has plans to build a covered link to the Bukit Chagar RTS station. If this is true, investors of TriTower Residence will stand to benefit the most. #4: Developments around JB Sentral affected The delay will also impact surrounding developments in JB Sentral as it will mean longer gestation period for the commercial, property and tourism sectors. The game-changing project could provide a much-needed boost to complement Johor Bahru’s ambitious RM1.8 billion rejuvenation programme that was unveiled by former Malaysian Prime Minister Najib Razak in 2010. This is because it will bring an inflow of investments from Singapore that will benefit the sectors mentioned. Although the Sungai Segget rehabilitation is now completed, the project proved to be quite a letdown. The project was spearheaded by the Iskandar Regional Development Authority (IRDA) with a reportedly whopping RM20 million consultation fee. The entire cost is an estimated RM57 million. The project was supposed to provide a booster to the nearby malls such as Johor Bahru City Square and KOMTAR JBCC as well as shophouses. It was also supposed to be a tourist attraction much like Clarke Quay as it was modelled after South Korea’s Cheonggyecheon river restoration project in South Korea. This explains why developers like UMLand had acquired land banks near to Jalan Wong Ah Fook for the opening of Suasana Iskandar Malaysia. Given the high cost, naturally, the expectation among stakeholders was high. However, some developers, shop owners and retailers were reportedly not very happy about the way the river cleaning project had turned out. While the river no longer emits an odour, littering is still common. The only saving grace for the river is a miserable small fish pond with a fountain in the middle of it. Surely the river rejuvenation project can do much better. #5: Ibrahim International District as the potential jewel of Johor Delays and disappointments aside, there is a gateway district coming up in Johor Bahru that will mirror the one at Woodlands North station. Called Ibrahim International District, the project is named after the Sultan of Johor. Under his auspices and blessings, His Majesty has set the target of making Johor Baru the second biggest city in Malaysia after Kuala Lumpur. As such, we can be sure the project will receive the state’s 110 per cent commitment to make it shine as the jewel of Johor. With a gross development value of RM3 billion, Ibrahim International District is an ambitious mixed-use development that will comprise six towers -– a hotel, a hotel with residences, an office, medical suites high-rise and two serviced apartment towers and a mall with an estimated gross floor area of 80,000 sq ft. The district is currently under construction. There are plans to build a linkway from Persada Johor to Coronation Square at Ibrahim International District. However, there is no word yet if the district will be connected to the future Bukit Chagar RTS station. If it does, it will enhance property values in the area, albeit beyond 2024. #6: One Bukit Senyum as the current property booster Nevertheless, there is light at the end of the tunnel as the only property booster around JB Sentral is the One Bukit Senyum project by Singapore Exchange-listed Astaka Holdings Limited. Home to the tallest residential towers in Southeast Asia, Astaka, One Bukit Senyum will be Johor Bahru’s new central business district when fully completed in 2021. One Bukit Senyum will be developed in two phases. The first comprises The Astaka, with a total of 438 units. The development, which is Johor’s most luxurious condominium development by far, was completed late last year. Phase two will comprise Johor Bahru City Council’s new headquarters, a 450-room five-star hotel, 1012 residences, 254-key serviced apartments, a 1.5 million square feet shopping mall and a Grade A office building. Conclusion The JB-Woodlands RTS Link is a complicated matter as it involves the state and federal governments.

Nevertheless, it will be a win-win situation for both Singapore and Malaysia to continue with the project as it will mean and inflow of investments, particularly for Johor. It will also ease the daily commute among Johoreans who are working in Singapore. The spirit of good neighbourliness should prevail. Gear up for a bumpy ride next year in Malaysia’s property market as the number of unsold units continues to rise. Despite the challenges, there are some opportunities for investors and rent-seekers. By Khalil Adis According to the Valuation and Property Services Department’s (JPPH) latest figures, the number of unsold completed residential units rose from 20,304 units to 30,115 units year-on-year as at 30 September 2018. This represents an increase of 48.35 per cent. Meanwhile, the total value was RM19.54 billion, representing a 56.44 per cent rise from RM12.49 billion a year ago. However, if JPPH were to also include serviced apartments and small offices home offices (SoHos), this would bring their overhang value to 40,916 units valued at RM27.38 billion. According to JPPH, Johor has the largest number of unsold completed serviced apartments and SoHo units at 7,714. JPPH notes that it rose a whopping 191 per cent from the 2,647 units recorded a year ago. The overhang in serviced apartments is valued at RM6.16 billion compared with its residential overhang of RM4.44 billion. This means the total overall value of its unsold serviced apartments is 1.5 times that of residential housing. In summary, Johor has the highest number of completed unsold units in Malaysia at 6,053. This is a 55 per cent increase from the 3.901 units a year ago. With an overhang in supply spanning from Johor to Selangor, here are some of the likely property trends to emerge next year. #1: Renter’s market The new supply of the completed units plus the those from existing units will lead to a downward pressure in the rental market causing rentals to fall. This is because rent-seekers will be spoilt for choice while landlords will be fighting for tenants. This will make it ideal for rent-seekers as landlords will most likely be open for price negotiations. Meanwhile, it is bad news for landlords should they be able to find a tenant or not. In the former, the rental will most likely not be able to cover the mortgage resulting in negative cash flow. In the latter, landlords will have to cover the mortgage themselves. Those who cannot will have no choice but the let go of their units. #2: Buyer’s market The property market will also favour buyers as sellers will be desperate to offload their properties, especially those who have multiple units. Therefore, buyers will be in a more stronger position to bargain in a market flooded with so many units. #4: Buy properties in the secondary market If you urgently need a roof over your head, then the secondary market is the way to go as you are buying a completed property. Sellers are also more willing to negotiate on the terms of payment and will likely cut a flexible payment deal via their agents if you do not have a sufficient deposit in hand. In addition, the supply overhang also mean that properties in the secondary market are priced 20 to 30 per cent cheaper than new launches. However, do bear in mind that you need to pay a 10 per cent deposit. #5: Overhang in supply means good deals in the auction market Unfortunately, there will also be distressed properties which will be auctioned off in court. If you are looking for a below market value (BMV) property, then this will present a very good opportunity for you. When buying a BMV, you will need to attend an auction in court and prepare a bank draft in advance to show of interest. This will cost you around 10 per cent of the reserve price. For example, if the property is being auctioned off at RM50,000, you will need to prepare RM5,000 in bank draft. If you have successfully bid for the property, you will need to settle the balance of the payment within 120 days. However, there are a lot of hidden costs, for example, legal, quit rent (cukai pintu), unpaid utilities and maintenance fees, assessments and so on. Perhaps, the biggest risk is this - while the property is legally yours, you may find it hard to evict the tenants or owners. You may have to apply for a court order, through a lawyer, to evict the occupants. This process can take you up to four weeks and costs you between RM1,500 to RM2,000. Even so, there are no guarantees they can be evicted as Malaysian laws favour occupiers. When buying a BMV property, it is best to find out if the property is occupied by tenants or owners. #6: It also means good deals from the primary market Developers have to move their unsold inventory as each unit means added cost for them. As such, developers will be coming up with creative schemes like zero downpayment and such to lure buyers. Speak to a good developer and check if they have a good master plan to ensure your property values are protected. Remember the 5Cs I always talk about? Check against them before you commit to buying a property, #7: More restrictions on Airbnb accommodations Making money from your short stay travellers may prove to be even harder even if the government legalises Airbnb. This is because we are seeing trends of management committees barring Airbnb-type of accommodation due to security and safety issues. So before you decide to list your untenanted unit on Airbnb, it is best to check with your management committee if this is allowed. However, if you happen to own a serviced apartment, this will not be an issue as it falls under a commercial title. #8: Transit-oriented developments (TODs) along SSP Line The Sungai Buloh-Serdang-Putrajaya Line (SSP Line) is one of the few major infrastructure projects that will be continued under the newly elected government.

In fact, the project is currently under construction and is fast taking shape. Some developers have already acquired land banks along this line to build TODs. Areas to watch out for include Kwasa Damansara, Kwasa Sentral, Sungai Besi, Bandar Malaysia and Cyberjaya City Centre |

Khalil AdisAn independent analysis from yours truly Archives

July 2023

Categories

All

|

100 Peck Seah Street

|

|

RSS Feed

RSS Feed