|

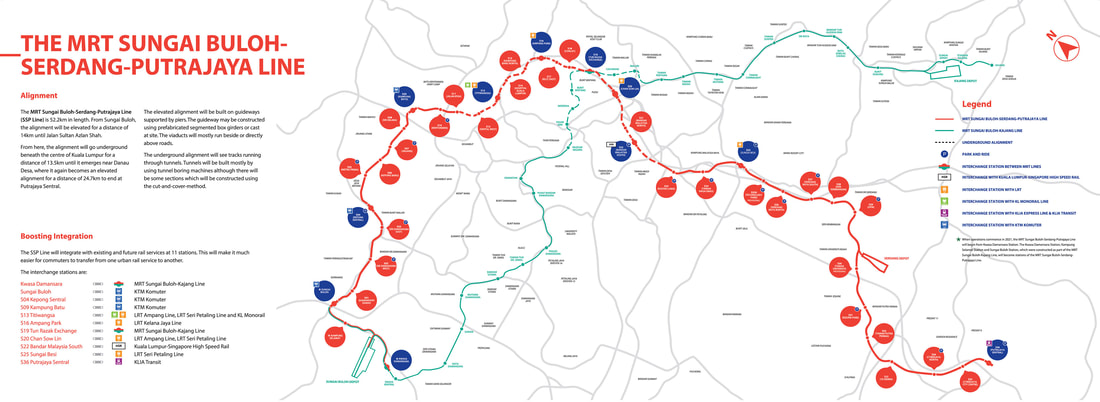

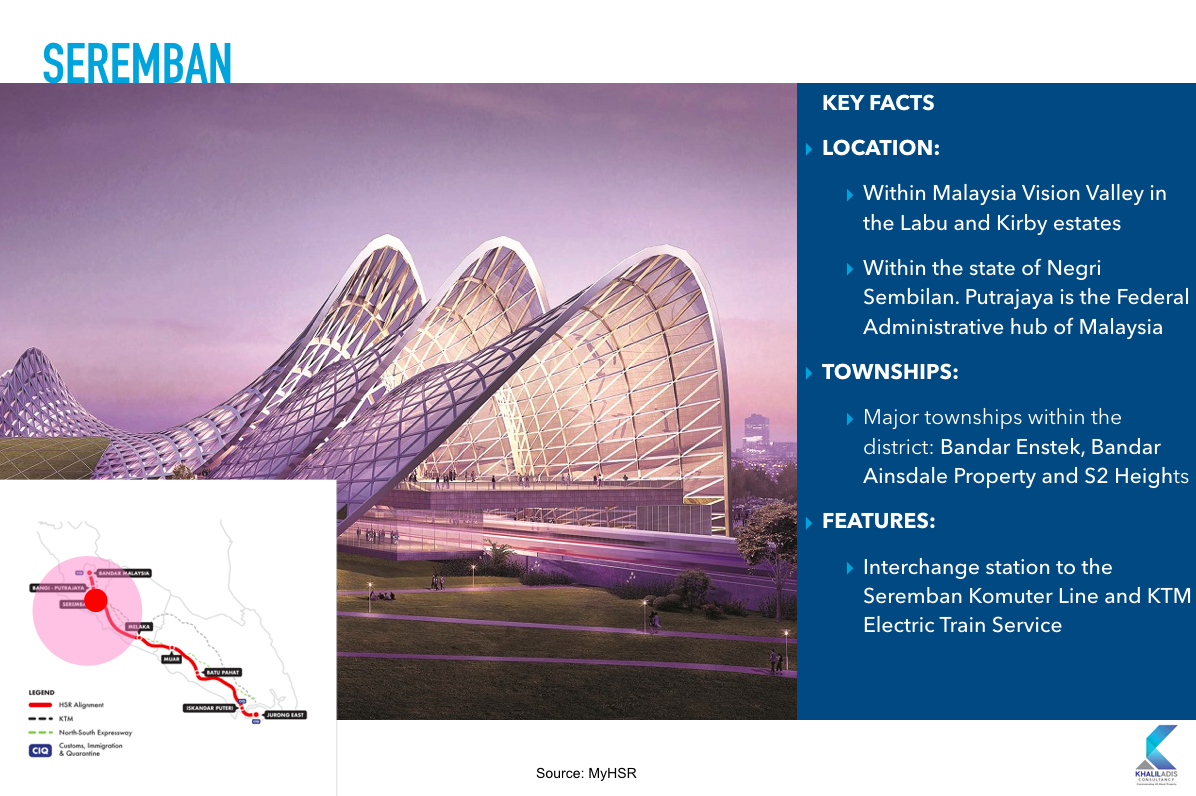

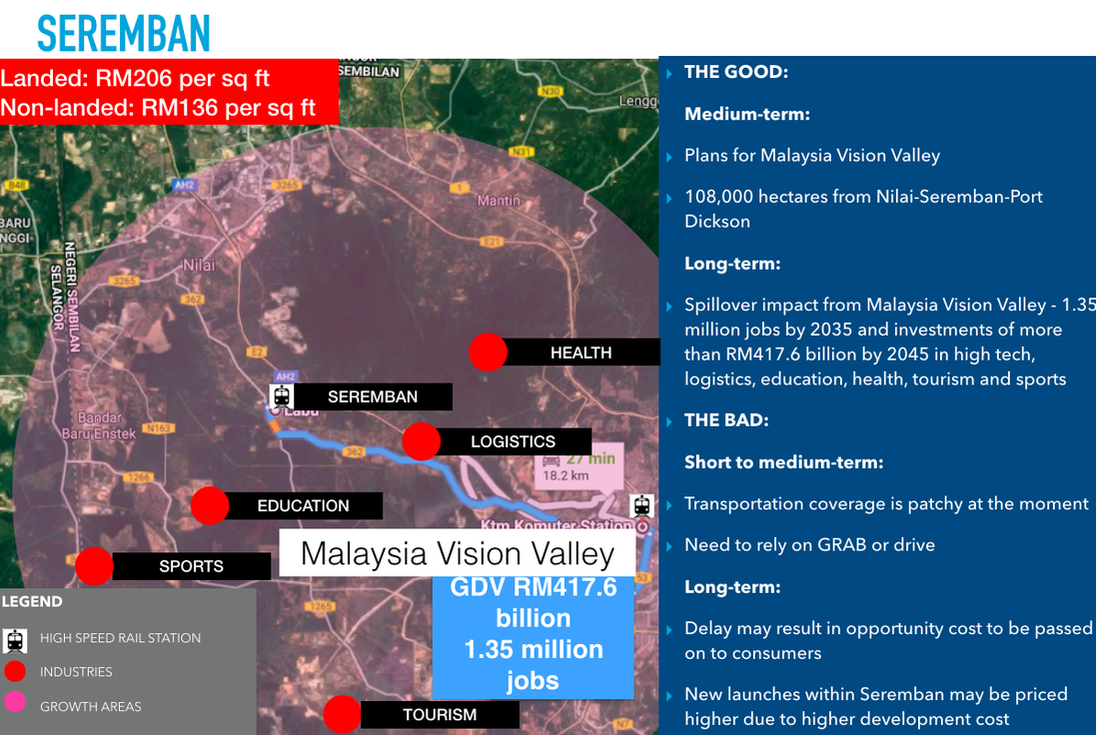

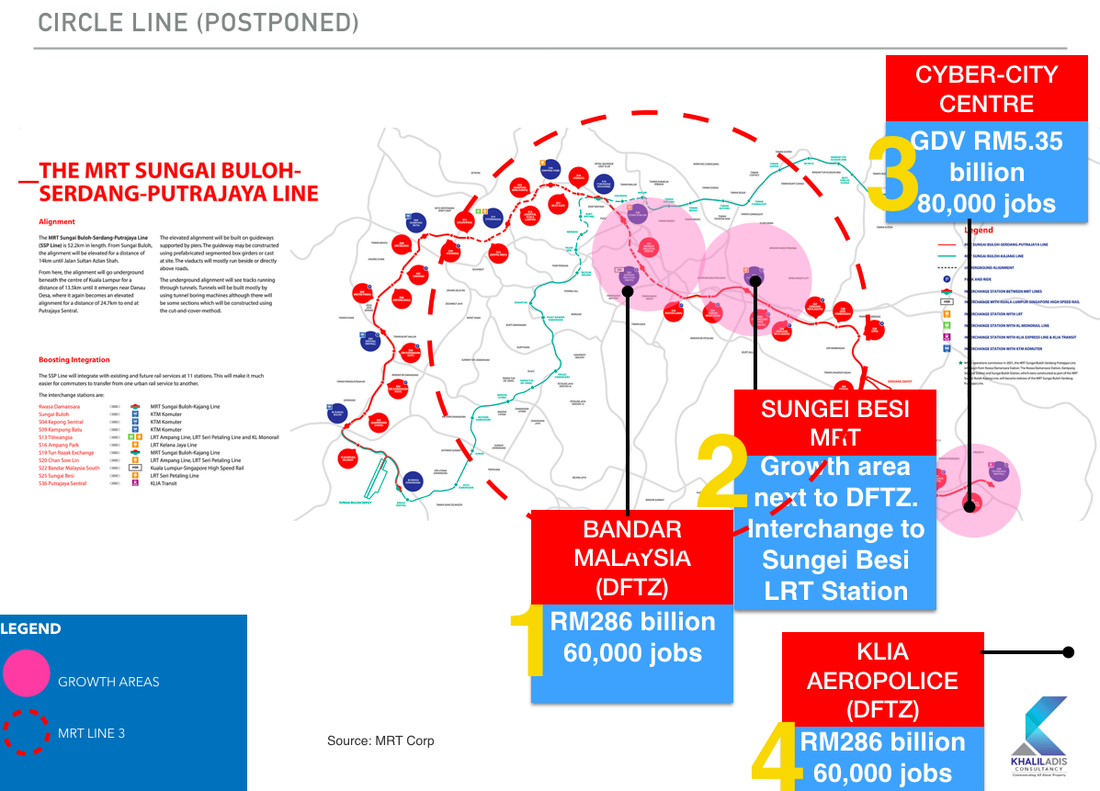

Infrastructure spending along these lines will act as property boosters for selected areas in Kuala Lumpur and Greater Kuala Lumpur By Khalil Adis The last time I was in KL was in January 2020 where I shared the growth areas along the different train lines at Havoc Hartanah. Despite not being able to physically be present in Kuala Lumpur now due to the Restricted Movement Control Order (RMCO), I wish to point out that there are growth area that prospective buyers and investors should watch out for. Here are the eight growth areas along the different train lines ranked from the least to most affordable*: *Note: 1. Property transactions are based on data captured on Brickz. 2. Monthly mortgage is based on a loan tenure of 35 years with an interest rate of 4.25%. 3. Affordability is based on the mortgage servicing ratio (MSR) capped at 30% of a borrower's gross monthly income of RM3,000. 4. A monthly mortgage of above RM900 is considered unaffordable. #1: Pusat Bandar Damansara Median transacted price: RM4,000,000 Monthly mortgage: RM16,484.18 Verdict: Least affordable Dubbed "the Beverly Hills of Malaysia", Damansara Heights is the most desired address in the country. This is a home among Malaysia's who's who and the address for those who have arrived. Pusat Bandar Damansara is also a growth area as it is located next to Damansara City. Comprising Menara Hong Leong, Wisma GuocoLand, DC Residency, DC Mall and Sofitel Kuala Lumpur Damansara, Damansara City is an Entry Point Project (EPP) which the Malaysian government had announced in September 2010 to take Kuala Lumpur to even greater heights under its Economic Transformation Programme (ETP) roadmap. Soon, it will be home to Pavilion Damansara Heights. Set to open its doors come 2020, the mall will feature 1.17 million sq ft of retail therapy. Amenities here are aplenty to cater to the discerning tastes of the affluent. From high-end grocers at Ben's Independent Grocer to organic restaurants, the lifestyle choices to live the good life here are endless. #2: Bandar Utama Median transacted price: RM1,050,000 Monthly mortgage: RM4,327.10 Verdict: Least affordable Bandar Utama needs no introduction. Home to 1 Utama Shopping Centre, The Curve, IKEA, AEON Bandar Utama, One World Hotel and KPMG Tower, this bustling township comprises mainly landed homes making it ideal for those who prefer a low-density living environment. Previously, Bandar Utama was very inaccessible. However, since the commencement of the Sungai Buloh - Kajang Line (SBK Line) on 16 December 2016, accessibility to Bandar Utama has been greatly enhanced. In addition, a new 35-metre pedestrian link-bridge now connects the station's Entrance B to One World Hotel near the newly relocated Zuan Yuan Chinese Restaurant and the Ground Floor of 1 Utama. By November 2023, Bandar Utama MRT Station will serve as an interchange station to the LRT Bandar Utama-Klang Line (Klang Valley LRT Line 3). Costing RM16.63 billion, this 37km line will span from Bandar Utama to Johan Setia station with a total of 19 stations. When completed, it is expected to serve 2 million commuters residing in the Western Corridor of Klang Valley. #3: Subang Jaya Median transacted price: RM585,000 Monthly mortgage: RM4,327.81 Verdict: Medium affordable Before the advent of Transit Oriented Developments (TODs), Sime Darby has been actively promoting this concept in its township development spanning from Subang Jaya to Ara Damansara. Subang Jaya is a bustling township that is served by the Kelana Jaya LRT Extension Line which became fully operational in 2016. This extension is part of the government's initiative to extend public transportation to residents living in the southwestern part of Selangor such as Subang Jaya and to Puchong. Comprising 13 new stations and covering a distance of 17.4 km, this new extension will bring the total length of the Kelana Jaya LRT Line from 29 km to 46.4 km. The LRT extension line spans from Lembah Subang to Putra Heights and costs RM8 billion to construct. Connectivity to the airport was recently enhanced in May 2018 via the Skypark Link service that you can catch from Subang Jaya LRT station to Terminal Skypark station. Costing RM533 million to build, the Skypark Link spans some 24km from KL Sentral to Terminal Skypark. #4: Jalan Pudu Median transacted price: RM824,585 Monthly mortgage: RM3,398.15 Verdict: Medium affordable Smacked in between Tun Razak Exchange and Bandar Malaysia, Jalan Pudu is located within KL's "Golden Triangle". The former is almost completed and is served by the Tun Razak Exchange (TRX) MRT station while the latter will be served by Bandar Malaysia (North) MRT station. TRX will be Malaysia's first dedicated financial district with a gross development value (GDV) of RM40 billion and with a total gross floor area of 20 million square feet. This iconic project is part of the Malaysian government's Economic Transformation Programme (ETP) to strengthen Kuala Lumpur as the country's financial capital. Bandar Malaysia will have a gross development value (GDV) of RM150 billion. It will house the High Speed Rail station and two MRT stations - Bandar Malaysia North and Bandar Malaysia South. Bandar Malaysian North will be an MRT station on its own serving the huge mixed-use development. The site area is around 196 hectares and will comprise 27,000 quality and affordable homes. There will also be a dedicated commercial district to support new start-ups as well as small and medium-sized enterprises (SMEs). #5: Cyberjaya Median transacted price: RM512,000 Monthly mortgage: RM2,109.98 Verdict: Medium affordable Located on the southernmost tip of Puchong, Cyberjaya is poised to enjoy the economic spillover benefits from three major government projects - KLIA Aeropolis, Malaysia Vision Valley and Cyber City Centre in Cyberjaya. The growth areas here will be near Sierra and Cyberjaya City Centre MRT stations. Being a relatively new township development, Sierra holds the most promise for capital appreciation of property values as many infrastructure projects (including the Sierra MRT station) are still underway. It also with 10 minutes drive to the bustling township of Puchong where it is home to many mega malls and trendy cafes. Sierra is home to only landed homes at the moment. Meanwhile, Cyberjaya City Centre MRT station is a transit-oriented development (TOD) project to be developed by Malaysian Resources Corp Bhd (MRCB). With its experience in building the transport hub in KL Sentral, MRCB will be developing a new city that will be integrated with the MRT station. Phase one is expected to generate a gross development value (GDV) of RM5.35 billion. It will feature a 200,000 sq ft convention centre, a 300- to 400-room business hotel, low and high-rise office buildings and a retail podium. Cyberjaya City Centre will have a development plan spanning 20 years. The MRT station is located just opposite Lim Kok Wing University of Creative Technology. #6: Sungai Besi Median transacted price: RM510,000 Monthly mortgage: RM2,101.73 Verdict: Medium affordable Sungai Besi is located in a growth area in between Bandar Malaysia and Cyberjaya City Centre. There are still homes in the secondary market priced below RM500,000 here. Home to NSK Kuchai Lama and Terminal Bersepadu Bandar Tasek Selatan, Sungai Besi will be served by the upcoming Sungai Besi MRT station via the Sungai Buloh-Serdang-Putrajaya (SSP Line ). Meanwhile, Sungai Besi LRT station will be upgraded to an interchange station to connect commuters to this MRT station built adjacent to it. When completed, it will also serve as an interchange to the upcoming High Speed Rail station. Sungai Besi is strategically located and is highly accessible up north to downtown KL and down south to Putrajaya and Cyberjaya via the Sungai Besi Highway. #7: Nilai Median transacted price: RM215,000 Monthly mortgage: RM886.03 Verdict: Most affordable Nilai is poised for further growth as it is located within the Malaysia Vision Valley. Covering Nilai to Port Dickson, it will have a proposed area of 108,000 hectares. The upcoming industries include high tech, logistics, education, health, tourism and sports. The Malaysia Vision Valley is expected to create some 1.35 million jobs by 2035 and investments of more than RM417.6 billion by 2045. To support the Malaysia Vision Valley, the Seremban HSR station will be sited in Nilai within the Labu and Kirby estates. Seremban HSR station will also be an interchange station to the Seremban Komuter Line and KTM Electric Train Service. #8: Bandar Baru Nilai Median transacted price: RM166,955

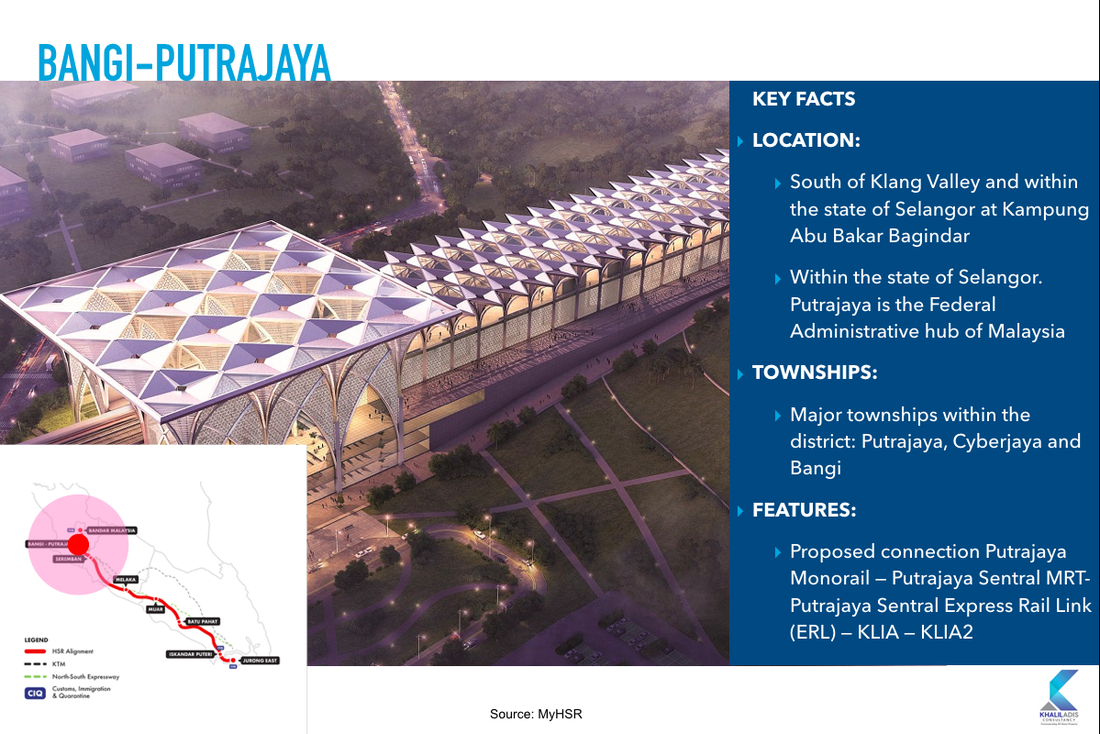

Monthly mortgage: RM688.03 Verdict: Most affordable Bandar Baru Nilai is a growth area as it is located near to upcoming economic drivers in the pipeline that will include the Malaysia Vision Valley, KLIA Aeropolis and Cyberjaya City Centre. It also close to KLIA and KLIA2 that is served by Express Rail Link (ERL) comprising KLIA Express and KLIA Transit. Soon, connectivity will be further enhanced via the Bangi-Putrajaya HSR station. The station will be located in the south of Klang Valley and within the state of Selangor at Kampung Abu Bakar Bagindar. There is also a proposed connection to the Putrajaya Monorail that will connect this station to Putrajaya Sentral MRT station. When completed, it will serve as an interchange station to Putrajaya Sentral Express Rail Link (ERL) and link commuters to KLIA and KLIA2.

0 Comments

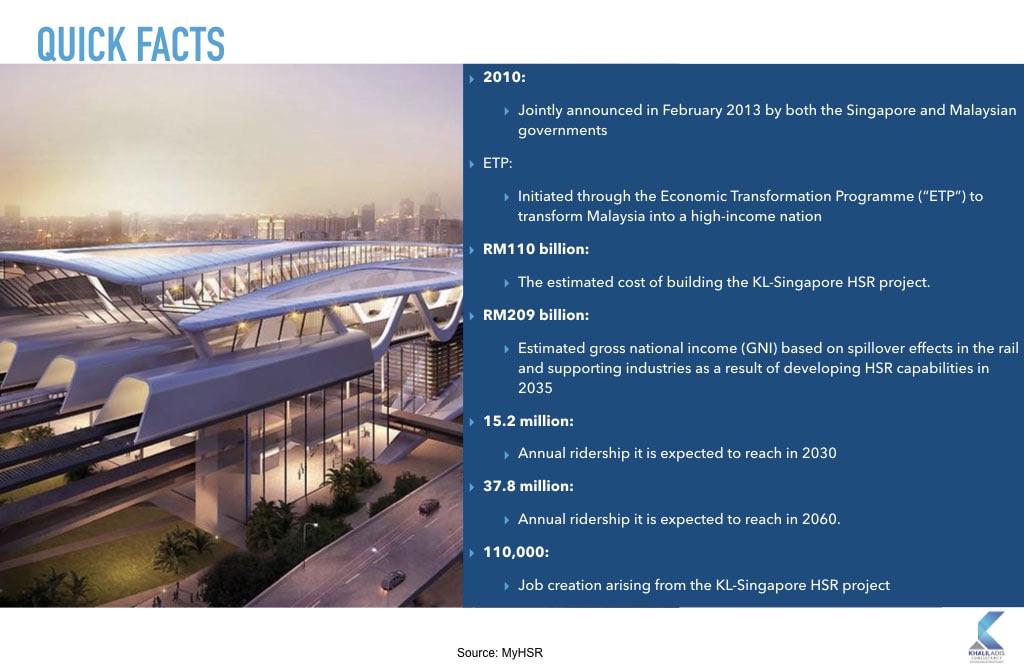

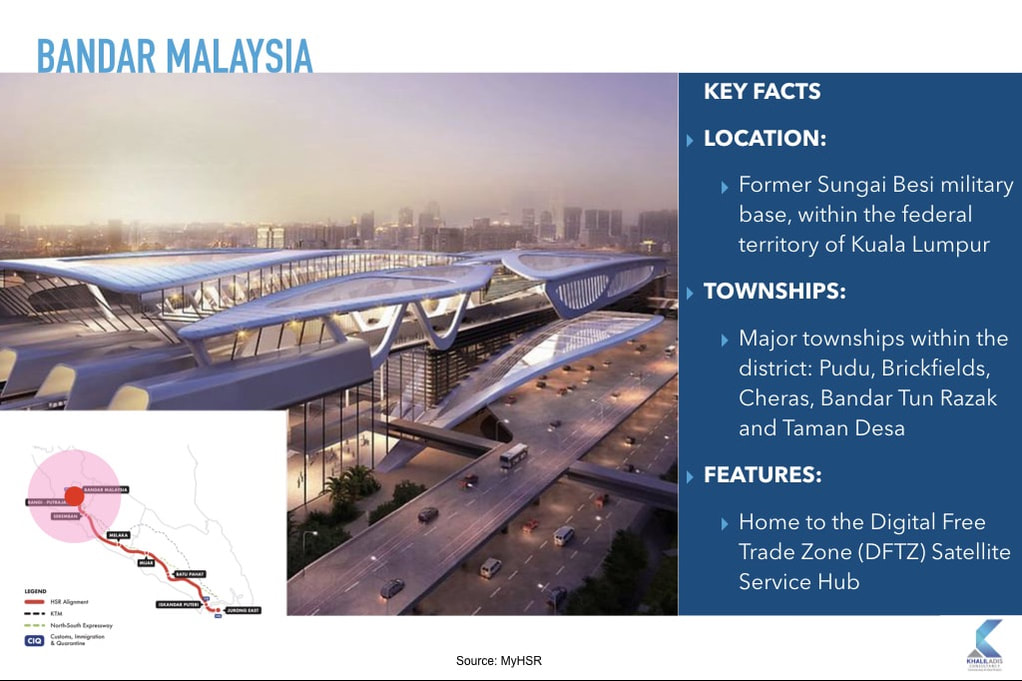

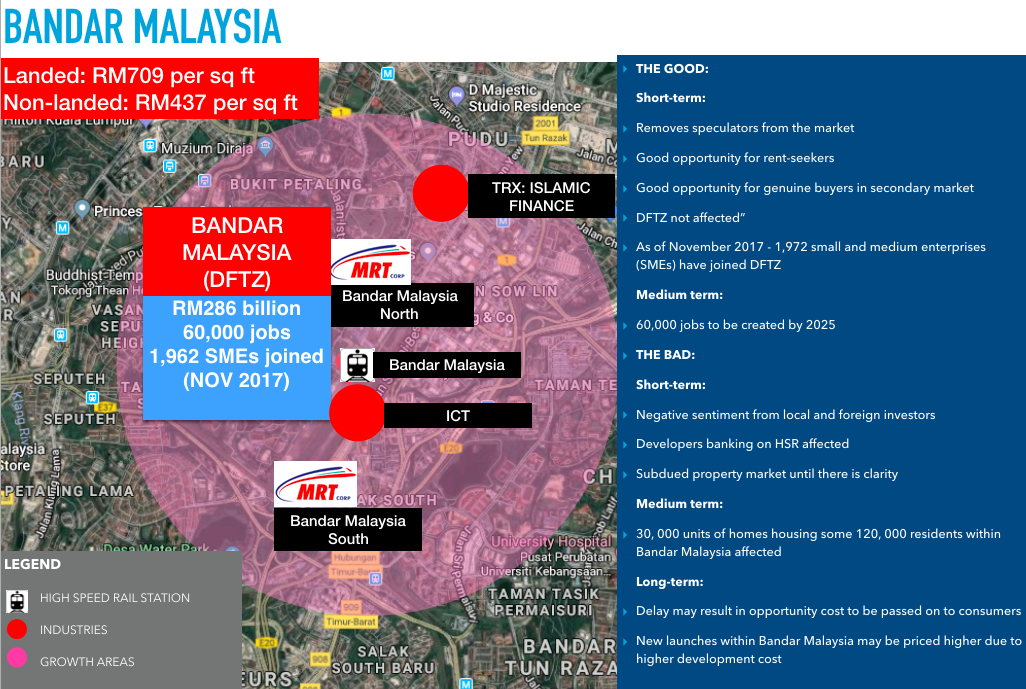

With 10,000 affordable homes in the pipeline, Bandar Malaysia is both a boon and a bane for Kuala Lumpur’s sluggish property sector. We analyse how this development will impact the market. By Khalil Adis The recent announcement by the Malaysian government that it is reviving the shelved Bandar Malaysia project is a piece of welcome news as it gives some clarity to investors on the status of the Kuala Lumpur-Singapore High Speed Rail (HSR) project. Since winning the 14th general election, Prime Minister Mahathir Mohamad had reviewed several mega infrastructure projects including Bandar Malaysia and the HSR. In the face of the country’s mounting debt, both projects were at first announced as cancelled in May 2018. This prompted Singapore’s Ministry of Transport to issue a statement stating that it “will wait for official communication from Malaysia”. However, the Malaysian government backtracked on this subsequently. Instead, it announced in June 2018 that the project was “postponed”. This created a lot of confusion on both sides of the causeway. After many months of speculation, the market finally received some clarity in September 2018 when representatives from both governments met in Putrajaya. In a joint-statement, both Singapore and Malaysia announced that they had signed an agreement to suspend the project until 31 May 2020 “Malaysia will bear the agreed costs in suspending the HSR Project. If by 31 May 2020, Malaysia does not proceed with the HSR Project, Malaysia will also bear the agreed costs incurred by Singapore in fulfilling the HSR Bilateral Agreement. During the suspension period, Malaysia and Singapore will continue to discuss on the best way forward for the HSR Project with the aim of reducing costs,” the statement read. The HSR project is now expected to commence service by 1 January 2031, instead of the original commencement date of 31 December 2026. With Bandar Malaysia now being revived, we list down the possible implications on Kuala Lumpur’s property market. #1: Boost for the construction sector The construction sector is currently in the doldrums due to the lacklustre property market in Malaysia. Loan rejections from buyers and the demand-supply mismatch mean developers are faced with unsold inventory leading to cash flow problems with contractors. In March, for instance, Bursa listed engineering and construction company, Zeland Berhad filed a statement with the Malaysian stock exchange that it was initiating arbitration proceedings against NRY Architects for RM305.4mil and other contract breaches for the construction of buildings of International Islamic University Malaysia in Kuantan. It also announced that it is claiming RM3.34mil in outstanding payment for construction works from BBCC Development Sdn Bhd located at the former Pudu jail near Hang Tuah monorail station. With Bandar Malaysia now back on track, contractors will be willing to bid at a much lower price to stay afloat amid the challenging market condition. Subcontractors will also benefit. #2: 10,000 new housing units will likely worsen overhang in Kuala Lumpur’s property market Initially, DBKL had announced that Bandar Malaysia will house around 30,000 affordable homes. However, a recent announcement puts the figures to 10,000 units. Kuala Lumpur City Hall (DBKL) had previously indicated that it has set a development guideline for developers to build such homes at around 800 sq ft but priced below MYR450,000. Meanwhile, Bank Negara’s figures showed that 80 per cent of homes, or 146,196 units priced above RM250,000, remained unsold as of end March 2018. While Bank Negara did not break down the figures according to each state, recent data provided by the Valuation and Property Services Department (JPPH) showed that Kuala Lumpur recorded the third highest number of residential overhang at 5,114 units. So unless the homes are priced below RM250,000, we are likely to see Kuala Lumpur’s housing glut worsen. #3: Boon for first-time homebuyers Bandar Malaysia has been cited by DBKL as a case study for government and private developers in building transit-oriented development (TOD). Bandar Malaysia will house two MRT stations – Bandar Malaysia North and Bandar Malaysia South – which will form part of the alignment for the Sungai Buloh – Serdang – Putrajaya Line (SSP Line). Bandar Malaysia will also possibly serve as the interchange to the MRT Line 3, which has now been postponed. If indeed Bandar Malaysia will build affordable homes according to DBKL’s guidelines, then it will be a boon for first-time homebuyers as the entry price in Kuala Lumpur is easily above RM600,000. It will also mean young Malaysians will no longer have to buy a car first after completing their education and thus improve their chances of getting their home loans approved. Currently, many young Malaysians are trapped in the debt cycle due to various financial commitments such as their National Higher Education Fund (PTPTN), cars, personal and credit cards loans. So while demand is strong, loan rejections remain an issue further worsening the cash flow for developers. #4: Bane for landlords and sellers If indeed 10,000 new housing units will be coming on stream, Bandar Malaysia’s surrounding areas such as Pudu, Brickfields, Cheras, Bandar Tun Razak, Sungai Besi and Taman Desa will be badly affected. As such, landlord and sellers will likely see their asking prices fall even further as consumers will soon have more choices. Landlords will also find difficulty in doing short-term accommodations as the Malaysian government will be regulating this market segment. Therefore, rent-seekers and buyers are the clear winners as they are in the position to haggle for the best price. #5: Sluggish commercial and office market ahead The initial projection for Bandar Malaysia stated that it will have a gross development value (GDV) of RM150 billion.

Measuring around 196 hectares, Bandar Malaysia’s master plan indicates that it will be a mixed-use development with commercial and office buildings. With so many mega malls and office buildings in Kuala Lumpur, Bandar Malaysia will add on to more floor space in Kuala Lumpur’s already weak commercial and office markets. Despite this, Bandar Malaysia will likely attract multinational companies to set up their operations here as it is located within the Digital Free Trade Zone (DFTZ). The Draft Master Plan 2019 which was announced last week and is fast taking shape to take Singapore ahead into a vibrant yet liveable city. By Khalil Adis A decentralisation strategy to bring jobs closer to homes in the next 10 to 15 years, here are the five growth areas to watch out for: Woodlands Regional Centre: Woodlands Central Key highlights:

Woodlands Regional Centre: Woodlands North Coast Key highlights:

Punggol Digital District  Scaled model of the Punggol Digital District. It will be a hub for innovation with industry clusters such as cyber security, artificial intelligence, data analytics and Internet of things. It will also be a transportation hub linking Punggol Coast MRT station to Jurong Lake District and Changi by around 2030 via the Cross Island Line (CRL). Photo: Khalil Adis Consultancy. Key highlights:

Paya Lebar Central Key highlights:

Jurong Lake District Key highlights:

Greater Southern Waterfront Key highlights:

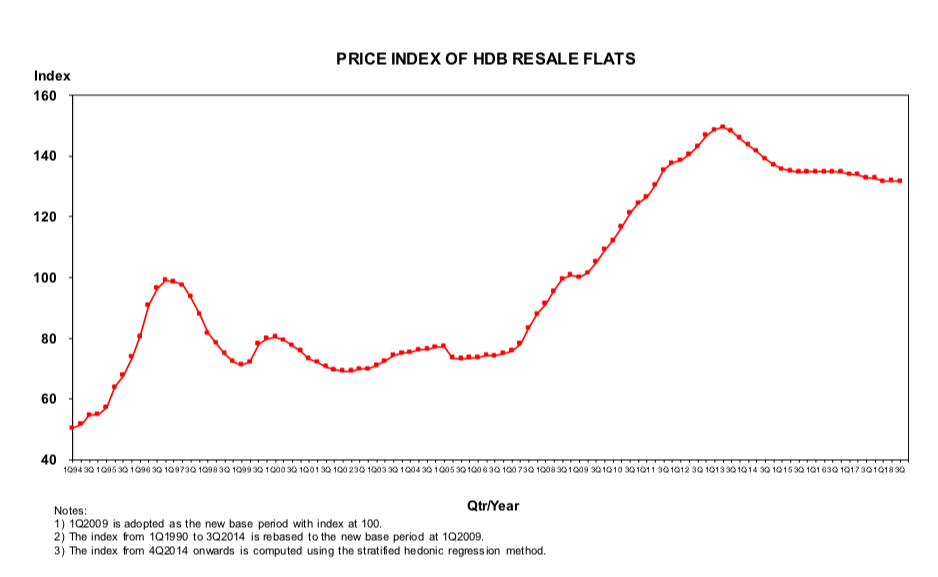

Singapore's private property market experienced robust growth but was muted midway by property cooling measures. We list down the key highlights in our 2018 property market roundups and our outlook for 2019. By Khalil Adis Singapore's private property market saw a steep rebound from the fourth quarter of 2017 after many quarters of decline in its Property Price Index (PPI) since the fourth quarter of 2013. Figures from the Urban Redevelopment Authority (URA) showed that the Lion City's PPI surged by 11.0 points from 138.7 in the fourth quarter of 2017 to 149.7 points in the third quarter of 2018. However, the market softened from July onwards post the new property cooling measures. Here are the top five property market roundups for 2018 and our top five outlooks for 2019. Roundups: #1: En-bloc fever Singapore's property market was off to a fiery start with several collective sales deal that was concluded during the first half of the year. They included the iconic Pearl Bank Apartments which was sold for S$728 million sales to CapitaLand and Park West which was sold for S$840.89 million to SingHaiyi Gold Pte Ltd. Data from Cushman & Wakefield Inc showed that the collective sales market recorded S$3.8 billion of en-bloc transactions in the second quarter. #2: New property cooling measures introduced To douse the red-hot residential property market, the government announced a slew of property cooling measures in July. This included increasing the Additional Buyer's Stamp Duty (ABSD) rates and tightening loan-to-value (LTV) limits on residential property purchases. The new ABSD rates and LTV limits are as above. As a result, the collective sales market declined with S$353 million worth of transactions recorded in the third quarter, data from Cushman & Wakefield Inc showed. #3: Industrial property market picks up steam While Singapore's residential property sector has taken quite a hit, its industrial and commercial property sectors are seeing an uptrend in investment sales. According to data from Cushman & Wakefield Inc, industrial property deals soared 73 per cent to S$1.2 billion in the third quarter while office sales increased by 54 per cent to S$2.1 billion. Meanwhile, Jones Lang Lasalle Singapore, citing data from JTC statistics said islandwide all-industrial rental correction stayed modest at 0.1 per cent quarter-on-quarter for three consecutive quarters since the fourth quarter of 2017, while the second quarter of 2018 all-industrial price index flat-lined for the first time since trending down in the third quarter of 2014. #4: HDB resale values are declining HDB is a hot bread and butter issue among Singaporeans as 80 per cent of the population lives in public housing flat. Public interest in HDB dominated the headlines in 2018 as government officials warned that their values could decline, especially those that are more than 40 years with around 50 years left on their 99-year lease. This marked a stark contrast during Lee Kuan Yew's era when he assured Singaporeans that HDB flats are an asset. Property agents who specialise in HDB flats in mature estates such as Toa Payoh say they are already seeing prices of older resale flats declining as many buyers are staying clear from such properties following the ongoing debate. For example, according to the third quarter data from the HDB in 2018, a 3-bedroom flat in the estate was transacted for S$279, 000. In contrast, the median price during the same period in 2016 was transacted for S$300,000. Having said that, other factors do come into play such as the supply of new Built-to-Order (BTO) flats which has influenced the resale price. However, until the government addresses the uncertainty surrounding older estates, we are likely to see the values declining as it is very much influenced by market sentiment. #5: Widening price gap between a private property and an HDB flat While the private property market has seen the price index picking up by some 11.0 points, the HDB Resale Price Index (RPI) has been on a decline. According to data from the HDB, the RPI has been on a decline since the second quarter of 2013 as it continues to launch BTO flats in the market. This is the biggest price gap in over 10 years and will likely be a contentious issue when the general election is expected to be called in 2019. Predictions: #1: HDB to become a hot-button issue 2019 is expected to be an election year. As such, HDB will be a hot-button issue as 80 per cent of the population lives in HDB flats. As we have discussed above, HDB resale prices are already on the decline while the price gap between a private property and an HDB flat has widened considerably. The government will need to address the ongoing debate on the value of older HDB flats moving forward. #2: Fewer BTO flats to be launched In November, the HDB said it launched 7,214 flats for sale under the Build-To-Order (BTO) and Sale of Balance Flats (SBF) exercise. This comprises 3,802 BTO units and 3,412 SBF units across various towns estates such as Sembawang, Sengkang, Tengah, Yishun and Tampines. However, there will be fewer units being offered in the next BTO launch exercise in February 2019. The HDB said it will offer about 3,100 flats in Jurong West, Kallang Whampoa and Sengkang. #3: A sellers' market With fewer BTO flats on the offering, this could possibly divert some of the buyers to the resale market and prop up the resale prices which have been falling since the second quarter of 2013. As such 2019 could likely be a sellers' market. Sellers should watch the market closely while buyers should opt for a BTO quickly. #4: Five growth areas As outlined in the URA Master Plan 2014, the five growth areas are located at Woodlands Regional Centre, Jurong Lake District, City Centre, Paya Lebar Central and Punggol Digital District. Woodlands Regional Centre will be a transportation hub which will connect the Thomson-East Coast Line (TEL) to the Johor-Singapore Rapid Transit System (RTS) via Woodlands North MRT station. Meanwhile, Jurong Lake District will house the High Speed Rail station linking Singapore to Kuala Lumpur in 90 minutes flat. The development of the project has been postponed to two years and will now commence construction in 2020 instead of 2018. Meanwhile, the express service will only commence by 1 January 2031 instead of 31 December 2026, as originally planned. You can read more about URA Master Plan 2014 here. #5: Opening of TEL will provide a price booster for properties along the line The TEL is a 43km MRT Line that will add 31 new stations to the existing rail network, with 7 interchange stations.

It will link to the East-West Line, North-South Line, North-East Line, Circle Line and the Downtown Line. Spanning from Woodlands North to Sungei Bedok, the line will be opened in stages next year. Stage one will comprise stations from Woodlands North to Woodlands South. As such, properties in the Woodland Regional Centre as highlighted above will be among the first to enjoy the price booster when the stations commence service next year. This will definitely be much to cheer about in the north amid the muted HDB resale market. 2018 is a watershed moment for Malaysia's politics and the subsequent impact on the property market. We list down the key highlights in our 2018 property market roundups and our outlook for 2019. By Khalil Adis May 10 2018 was a watershed moment in Malaysia as it marked the first change of government in the country's history. Since 1957, it had enjoyed an uninterrupted reign from the ruling Barisan Nasional (BN) coalition. However, the high cost of living, falling Ringgit, the lack of affordable homes in the market, high unemployment among fresh graduates, the unfettered check on power and the 1MDB scandal proved to be the undoing for BN as Malaysians far and wide casted their protest vote in the ballot box The message from Malaysians is clear - they have had enough and want a new, clean government to lead the way. With the Pakatan Harapan government now in power, all eyes are on the newly elected old Prime Minister Tun Mahathir Mohamad and his team to solve the pressing bread and butter issues. Here are the top five property market roundups for 2018 and our top five outlooks for 2019. Roundups #1: Demand-supply mismatch has resulted in an increasing number of unsold homes According to Bank Negara, 80 per cent of homes or 146,196 units priced above RM250,000 remained unsold as of end March 2018. In comparison, 130,690 units were unsold during the same period last year. "Imbalances observed in the property market continue to persist," Bank Negara had said in a statement. #2: Rent-to-own scheme being rolled out To help ease the entry for the first time property buyers, the private sector has come up with a few initiatives. Some private developers like Ayer Holdings have introduced a ‘Stay & Own' scheme for their Epic Residence and Foreston projects whereby part of the rent will be converted to the downpayment. This not only provides a temporary solution for those who urgently need a home but also a form of security. Meanwhile, Maybank has rolled a similar initiative called HouzKEY which they have called as "a rent-to-own solution that helps you to own your dream home." The scheme involves zero per cent downpayment with the monthly rental forming part of the home financing. #3: Ministry of Housing and Local Government studying Singapore's HDB model In July, Zuraida Kamaruddin, the Minister of Housing and Local Government paid an official visit to Singapore to study the HDB model. Singapore has succeeded to build demand driven homes under its Built-to-Order (BTO) scheme to house 80 per cent of the Singapore population. This is especially useful in Malaysia where there is currently a demand-supply mismatch as in point number one. #4: Malaysia looking into having a single housing government agency In Malaysia, there are so many affordable housing programmes being rolled out by the state and federal governments such as Rumah Milik Mampu, Rumah Selangorku, PR1MA, My First Home, Program Perumaha Rakyat and the list goes on. This confuses the public. The Malaysian government is currently looking into having a single housing agency to streamline the whole process much like the HDB model. If implemented, this could solve the current Malaysian housing woe. #5: More help for the B40, M40 and first-time homebuyers under Budget 2019 More help is on the way for these group of property buyers as announced under Budget 2019. The measures included the Real Estate and Housing Developers' Association (Rehda) agreement to cut prices by 10 per cent for new launches, the exemption of the Real Property Gains Tax (RPGT) for properties that are priced below RM200,000 and the stamp duty exemption for properties priced in the first RM300,000 up to RM500,000 as well as those priced from RM300,000 to RM1 million. Outlook for 2019 #1: Affordable homes to continue driving the market There is currently a strong pent-up demand for affordable homes but where the supply is lacking. As such, the affordable home segment will continue to be in strong demand for 2019. However, there needs to be concerted efforts from both the government and private developers. Under Budget 2019, the federal government has pledged to spend RM1.5 billion on such homes via the 1Malaysia People's Housing (PR1MA) and Syarikat Perumahan Negara Bhd (SPNB). Meanwhile, Rehda has agreed to cut prices as stated above. #2: South KL to be the growth area There are many infrastructure projects and economic drivers that are in the pipeline that will further boost property prices in Southern KL. One such project is Bandar Malaysia will serve as the terminus station for the Kuala Lumpur-Singapore High Speed Rail (KL-Singapore HSR) project linking both cities in 90 minutes flat. The development for the project has been postponed to two years and will now commence construction in 2020 instead of 2018. Meanwhile, the express service will only commence by 1 January 2031 instead of 31 December 2026, as originally planned. Bandar Malaysia has been designated as a site for the Digital Free Trade Zone (DFTZ) initiative by Jack Ma. Home to the Satellite Services Hub, DFTZ is expected to create some 60,000 direct and indirect jobs. It will also possibly serve as the interchange to the MRT Line 3, which has now been postponed. Another economic driver in the vicinity is Tun Razak Exchange (TRX). TRX will be a mixed-use development comprising a Grade A office space as well as residential and commercial precincts. To be developed in several phases over a period of 15 years, the first phase will comprise four investment grade A office towers, a lifestyle retail mall, two 5-star hotels and up to six luxurious residential towers with a target completion date by 2019. In addition, Bandar Malaysia will house two MRT stations - Bandar Malaysia North and Bandar Malaysia South which will form part of the alignment for the Sungai Buloh - Serdang - Putrajaya Line (SSP Line). #3: Properties along Sungai Buloh - Serdang - Putrajaya Line (SSP Line) will be sought after Speaking of the SSP Line, properties along the alignment, particularly those situated in the growth areas of Sungai Besi, Bandar Malaysia and Cyberjaya City Centre are worth looking into. Bandar Malaysia will house two MRT stations as stated above and located a few stops away from Tun Razak Exchange MRT station. Meanwhile, Sungai Besi MRT station is an interchange station to the Sungai Besi LRT station. It will serve as an interchange to the upcoming High Speed Rail station located in Bandar Malaysia, also in Sungai Besi. Last but not least, Cyberjaya City Centre MRT station is a transit-oriented development (TOD) project to be developed by Malaysian Resources Corp Bhd (MRCB). With its experience in building the transport hub in KL Sentral, MRCB will be developing a new city that will be integrated with the MRT station. Phase one is expected to generate a gross development value (GDV) of RM5.35 billion. It will feature a 200,000 sq ft convention centre, a 300- to 400-room business hotel, low and high-rise office buildings and a retail podium. Cyberjaya City Centre will have a development plan spanning 20 years. The MRT station is located just opposite Lim Kok Wing University of Creative Technology. #4: Penang to get a boost from Phase 1 of Penang Transport Master Plan (PTMP) With Lim Guan Eng as Malaysia's Finance Minister, Penang's property market will get a further boost. Just this month, Phase 1 of PTMP was approved. It will comprise the Bayan Lepas Light Rail Transit (LRT) project, Pan Island Link 1 (PIL1) project and several main highways. The proposed Bayan Lepas LRT line will be about 30 km in length with 27 stations running from KOMTAR to the future reclaimed islands in the south. There will be three interchange stations - KOMTAR, Sky Cab Station linking it to the Sky Cab line across the Malacca Straits and The Light Station linking it to the George Town-Butterworth LRT line. The LRT Line will also be integrated with the Sungai Nibong Express Bus Terminal at the Sungai Nibong Station. Meanwhile, PIL 1 is a new 20km highway that will be aligned along the mountainous terrain of the island and will take around 15 minutes from between Gurney Drive to the Second Bridge. There will be six interchanges in all - Dr Lim Chong Eu Expressway (LCE), Awang, Relau, Paya Terubong, Utama and Gurney. #5: Johor Bahru to get a boost from the Rapid Transit System (RTS) Link Meanwhile, over in the southern state of Johor, Iskandar Malaysia's muted property market will get a boost as the RTS Link will commence construction next year.

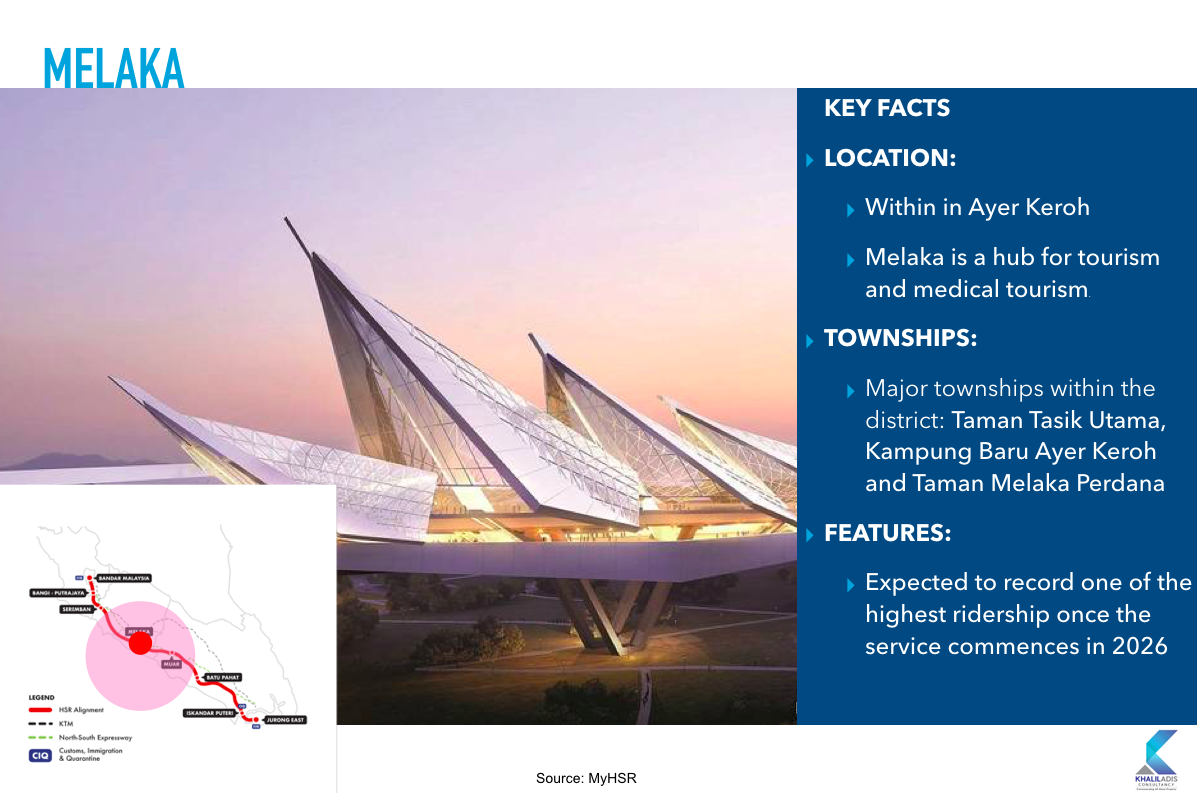

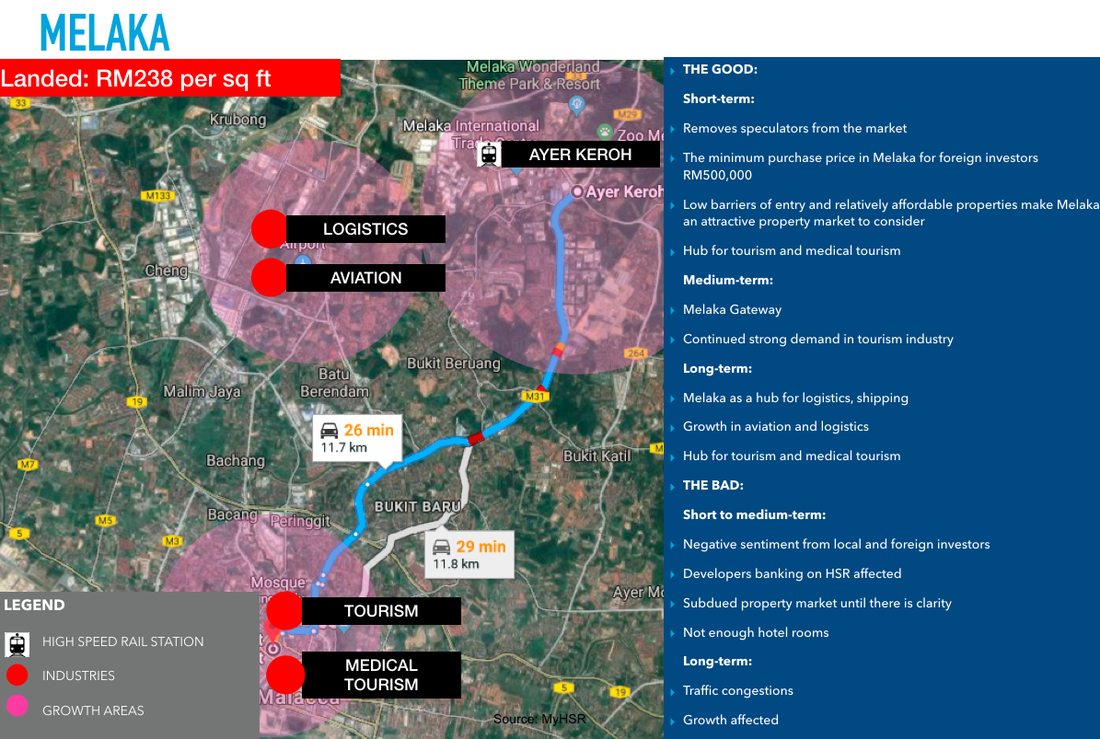

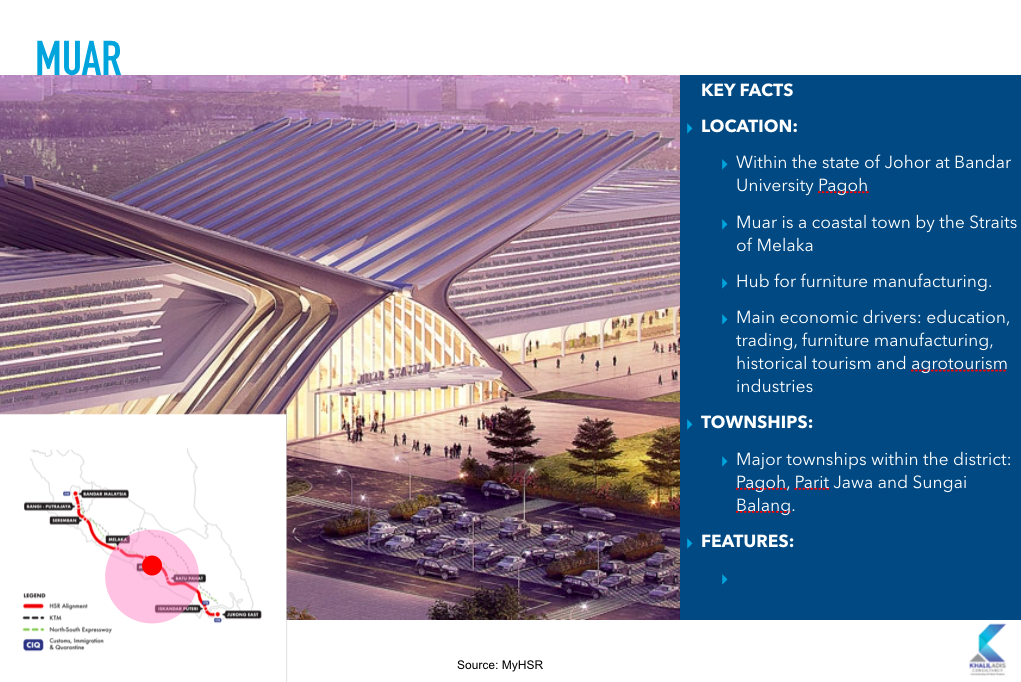

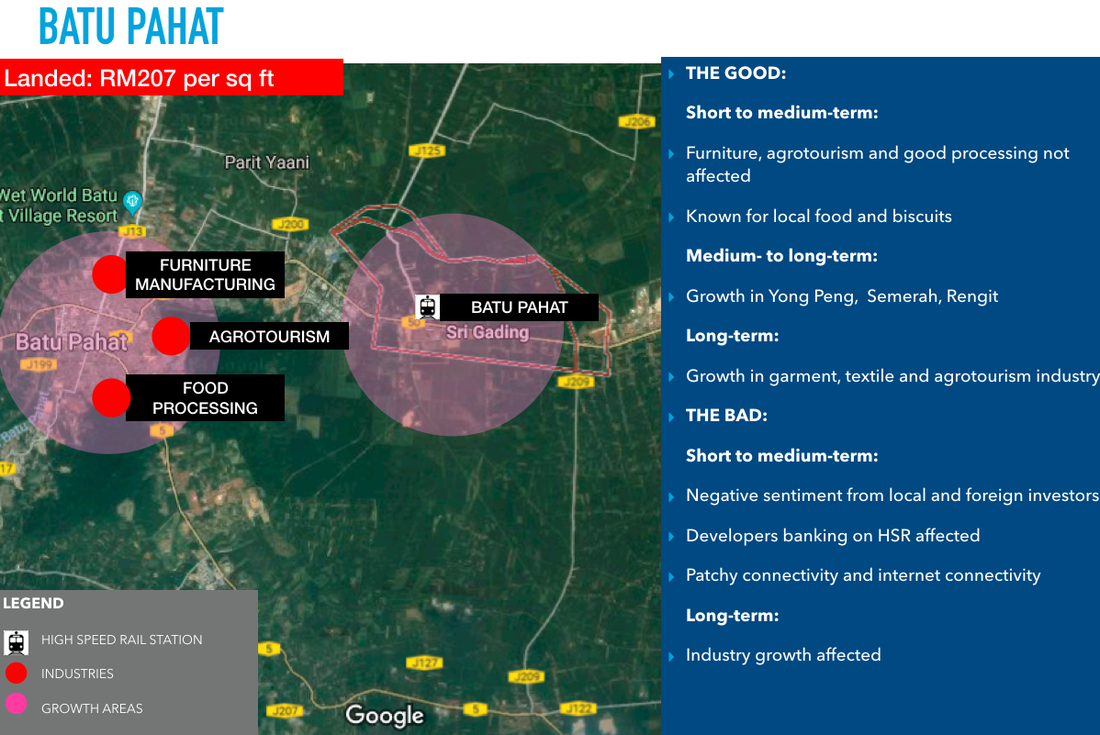

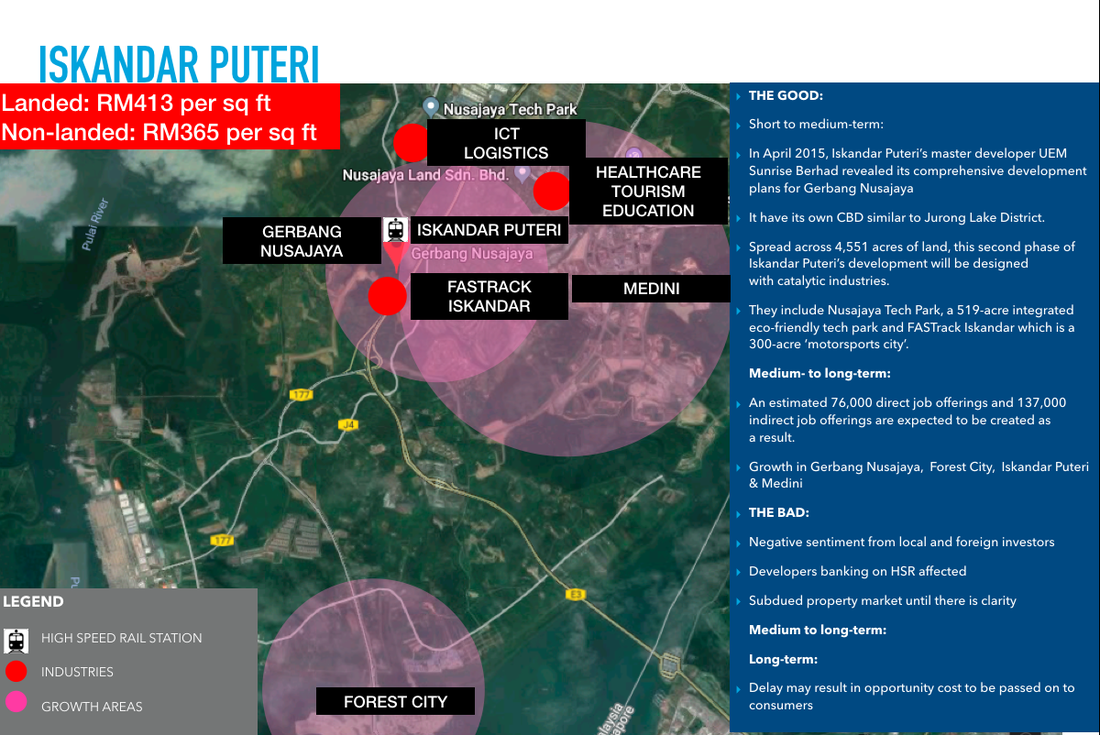

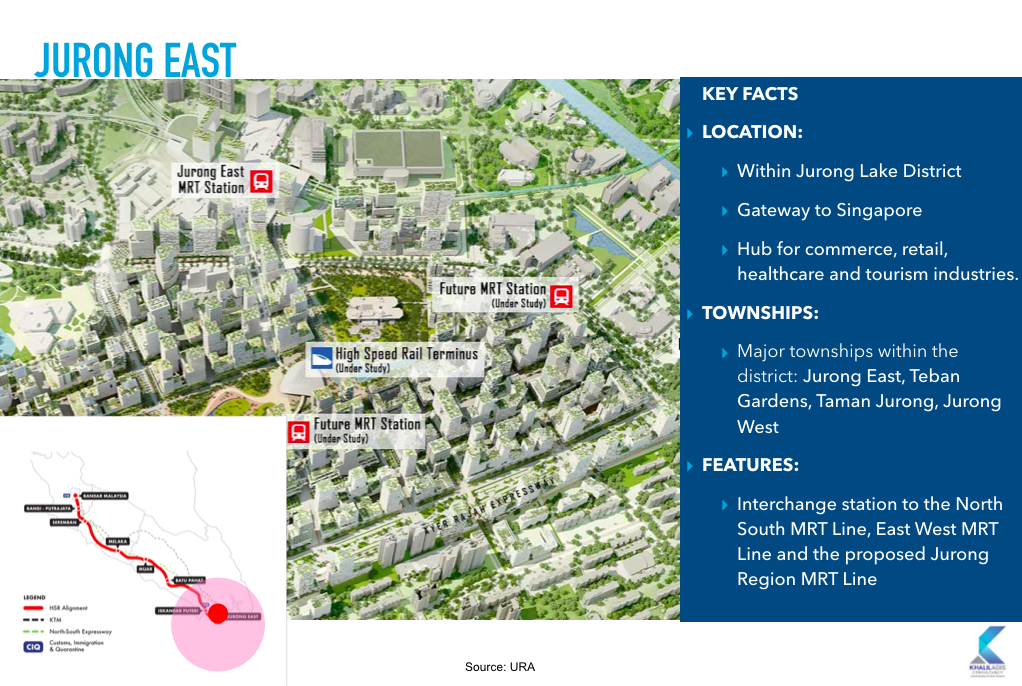

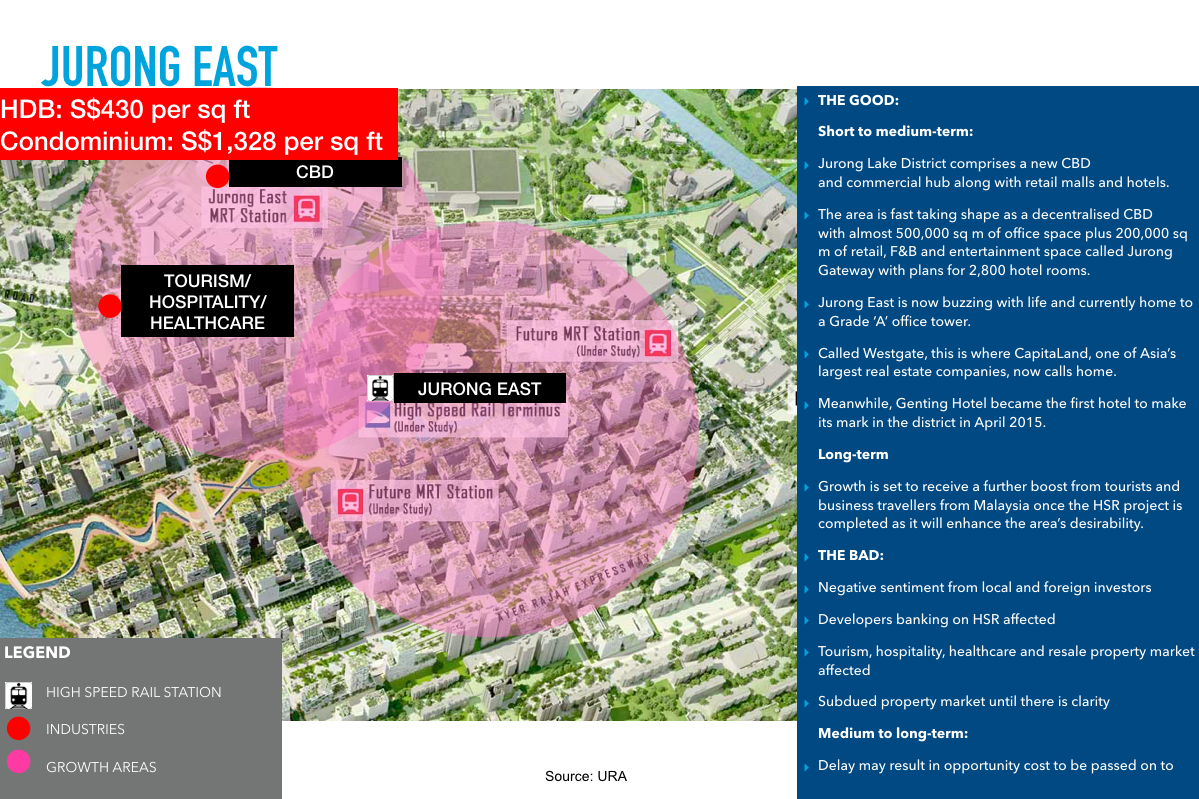

The RTS Link will link Bukit Chagar station in Johor Bahru to Woodlands North MRT station in Singapore when completed in 2024. There are also plans for a Bus Rapid Transit (BRT) system within Bukit Chagar station to link it to the different areas of Iskandar Malaysia. The BRT will feature a dedicated bus lane with three lines - BRT Line 1 will span from Bukit Chagar to Tebrau, BRT Line 2 from Bukit Chagar to Senai and finally, BRT Line 3 from Bukit Chagar to Iskandar Puteri. However, based on market talk in the ground, there is a possibility that the BRT system will be upgraded to an LRT system instead. Is it on of off? We study each station and list down the good and the bad from the possible impact of its postponement in their surrounding areas.   With recent news of the High Speed cancellation, much remains to be seen if Bandar Malaysia will succeed or not. However, Bandar Malaysia North MRT station’s alignment has already been confirmed. Initially, Bandar Malaysia has been planned with a gross development value (GDV) of RM150 billion with a dedicated commercial district to support new start-ups as well as small and medium-sized enterprises (SMEs). In addition, Kuala Lumpur City Hall (DBKL) has said 30, 000 units of homes will be delivered housing some 120, 000 residents within Bandar Malaysia. Whether or not this will go ahead, remains unclear. The only glimmer of hope here is the Digital Free Trade Zone by Jack Ma which so far has not been canned by the new government. #1: Impact: The Bangi-Putrajaya HSR station is located in the south of Klang Valley and within the state of Selangor at Kampung Abu Bakar Bagindar. Putrajaya is the Federal Administrative hub of Malaysia. Major townships include Putrajaya, Cyberjaya and Bangi. There is a proposed connection to the Putrajaya Monorail that will connect this station to Putrajaya Sentral which will serve as an interchange station to the MRT station and the Putrajaya Sentral Express Rail Linl (ERL). The latter links you to KLIA and KLIA2. #2: Impact: The Seremban HSR station is located within the Malaysia Vision Valley area within the state of Negeri Sembilan. Sited within the Labu and Kirby estates, major townships in the vicinity include Bandar Enstek, Bandar Ainsdale Property and S2 Height. Seremban will be an interchange station to the Seremban Komuter Line and KTM Electric Train Service . #3: Impact The Melaka HSR station is located in Ayer Keroh within the state of Melaka. Melaka is a hub for tourism and medical tourism. Major townships in the vicinity include Taman Tasik Utama, Kampung Baru Ayer Keroh and Taman Melaka Perdana. Many Indonesians and Singaporeans flock to hospitals such as Mahkota Medical Centre for medical treatment. #4: Impact The Muar HSR station is located within the state of Johor at Bandar University Pagoh. Muar is a coastal town by the Straits of Melaka that is a hub for furniture manufacturing. Major townships in the vicinity Pagoh, Parit Jawa and Sungai Balang. The main economic drivers here are those in the education, trading, furniture manufacturing, historical tourism and agrotourism industries. #5: Impact The Batu Pahat HSR station is located within the state of Johor at Pura Kencana, Seri Gading. Batu Pahat is a hub for garment and textile factories. Major townships in the vicinity include include Rengit, Yong Peng and Semerah. The main economic drivers here are those in the the furniture manufacturing, food processing and agrotourism. However, isnce 20011, there has been a notable growth in small and medium industries such as textiles, garments and electronics. #6: Impact The Iskandar Puteri HSR station is located within Gerbang Nusajaya in the state of Johor It is the gateway to Iskandar Malaysia and covers an area of 1,841-hectare. Gerbang Nusajaya features a number of catalytic developments including Nusajaya Tech Park and FASTrack Iskandar. Major townships in the vicinity include Gerbang Nusajaya, Iskandar Puteri and Medini. This will be the final leg of the Malaysian station before it enters Singapore, terminating at Jurong East. While the station in Nusajaya has not yet been announced, government officials have indicated that it will be located close to Motorsports City near East Ledang. #7: Impact The Jurong East HSR station is located within the Jurong Lake District in Singapore. It is the gateway to Singapore and covers an area of 67-hectare. Jurong Lake District is the hub for commerce, retail, healthcare and tourism industries. Major townships in the vicinity include Jurong East, Teban Gardens, Lakeside and Taman Jurong. Jurong East will be an interchange station to the North South MRT Line, East West MRT Line and the proposed Jurong Region MRT Line. #8: Impact Also known as MRT Line 3, this is the final line that will comprise of a “wheel and spoke” system to connect to MRT Line 1 and SSP. Line 3 is expected to be completed in 2025. Collectively, all three lines will be integrated with the current trains systems forming the Klang Valley Integrated Train System. However, this project has been postponed by the new federal government when it took power in May 2018 owing to budget cuts.

#9: Impact The impact for this postponement will be marginal as this MRT Line will still need to be constructed to connect the SBK Line and SSP Line. We will most likely see speculators staying away from the market. This presents good opportunity for genuine homebuyers to start looking in and around the station. Homes in the secondary market will be the most ideal as they are priced cheaper than new launches. |

Khalil AdisAn independent analysis from yours truly Archives

July 2023

Categories

All

|

100 Peck Seah Street

|

|

RSS Feed

RSS Feed