|

The HDB, private property and rental markets will see price stabilisation in 2024 favouring buyers and tenants. By Khalil Adis If 2023 saw the HDB and private resale markets reaching record highs before subduing, then 2024 will likely see a further price correction arising from the property cooling measures, high-interest rates and upcoming supply. Likewise, the red-hot rental market will see further signs of stabilisation in the upcoming year. HDB resale market The HDB Resale Price Index (RPI) reached a record high in the third quarter of 2023 at 178.5 points. According to HDB’s flash estimate, the RPI for the fourth quarter of 2023 is at 180.2 points which is an increase of 1.0 per cent over that in the third quarter. A total of 24,447 flats were offered by HDB in 2023 comprising 22,780 Build-To-Order (BTO) flats and a further 1,500 and 167 flats offered under the Sale of Balance Flats (SBF) exercise and open booking of flats respectively. This new flat supply will likely divert buyers away from the resale market which leads to a corresponding dip in demand in both the resale and rental markets. As demand for resale HDB flats and rental eases, the RPI will likely correct itself to a more sustainable level. Private property market The private property market also witnessed the Private Property Index (PPI) climbing to a record high of 196.0 points in the third quarter of 2023. Meanwhile, the Urban Redevelopment Authority’s flash estimate showed that the PPI increased by 2.7 per cent on a quarter-on-quarter basis in the fourth quarter of 2023, to reach 201.3 points. This brings the price gain for the whole of 2023 to 6.7 points. The property cooling measures implemented in 2023 also affected sales volume as the government increased the Additional Buyer’s Stamp Duty (ABSD) and imposed a 15-month wait-out period for private property owners downgrading to HDB flats. Data from URA showed that sales transaction volume fell by about 27 per cent on a quarter-on-quarter basis for the fourth quarter of 2023. For the whole of 2023, sale transaction volume fell by about 15 per cent compared to 2022. This was the lowest annual sale transaction volume since 2016. Correspondingly, the increase in ABSD for foreigners from 30 per cent to 60 per cent appeared to impact prime areas the most. According to URA’s data, non-landed private properties in the prime areas were the most affected while those that are located in the Outside Central Region (OCR) were the least impacted. For example, the PPI for properties located in the Core Central Region (CCR) remained somewhat flat with a slight dip noted when the cooling measures were announced before rebounding to slightly below the 150-point level. Meanwhile, those that are located in the RCR saw the index strengthening considerably from 2022 to 2023. This implies that this particular segment had remained somewhat resilient despite the property cooling measures. One of the reasons could be that the RCR is relatively affordable making it popular among first-time local private property buyers who will not be impacted by the ABSD. Government ramping up supply in private and HDB markets To further cool the property market, the government is ramping up supply of 5,160 units in the second half of 2023. This will bring the total pipeline supply of private housing to about 59,100 units. According to the URA, of this, 41,900 units will comprise those with planning approval and 17,200 units from Government Land Sale (GLS) sites and awarded en-bloc sites that have not been granted planning approval yet. Overall, a total supply of about 100,000 public and private housing units will be completed between 2023 and 2025. This will likely see a further price correction and promote market stability favouring buyers. Growth areas The growth areas in Singapore have remained unchanged based on URA’s Master Plan 2019. The growth areas are in the Greater Southern Waterfront, Punggol Digital District and Woodlands Regional Centre. Read more about the Greater Southern Waterfront here. Read more about Punggol Digital District here. Read more about Woodlands Regional Centre here. What’s in store for buyers With about 100,000 public and private housing units to be completed between 2023 and 2025, 2024 will shift towards a buyers' market. This is because the incoming supply will ease demand and will likely see a further price correction and promote market stability in the resale market. This will undoubtedly favour buyers. What’s in store for sellers Sellers will likely face a tough time in 2024 as the 100,000 supply of both public and private housing will see buyers buy new launches in both markets. As such, sellers will need to price their houses realistically to continue attracting buyers. We are also likely to see fewer million-dollar HDB flats and those selling with cash-over-valuation (COV). Sellers will need to be pragmatic, moving forward. What’s in store for tenants Tenants, there will be plenty of good deals in the market. As such, 2024 is a good year for you to secure new a home with a fresh new lease at a reasonable price. This is because the incoming supply will impact the rental market resulting in rentals for HDB and private properties coming down. If your lease is expiring this year, it may be a good idea to renegotiate your lease with your landlord at market price. What’s in store for landlords Landlords will have to be realistic in their asking price in 2024 as the rental market is cooling off. Conclusion As Singapore's property market navigates the dynamic landscape of 2024, stakeholders should remain vigilant to the evolving trends.

The delicate balance between supply and demand, coupled with government interventions, will play a pivotal role in shaping the property landscape for buyers, sellers, tenants and landlords alike.

2 Comments

A friend's personal journey of overcoming homelessness with the support of the government. By Khalil Adis Imagine being homeless and not knowing where to turn for help. Recently, a friend of mine, whom I will call Derek, shared his struggles with me, and it struck a chord in my heart. Having personally experienced this, it is a situation I would not wish upon to anyone else. Through Derek's and my journey, it shows that the Singapore government genuinely does care and provides assistance to those in need. Trying to move forward but unable to afford a home Derek's life took a difficult turn after a bitter divorce, leaving him without a place to call home. With no choice but to leave his in-law's house, he had to find a rental room at short notice. Fortunately, Derek did not have the added burden of a shared matrimonial home or children, which made the situation slightly easier. Despite his efforts to move forward, Derek faced another obstacle – he could not afford to buy a home of his own with his current financial situation. Feeling hopeless and at a loss To afford a decent resale 2-room flat, Derek needed an additional $100,000 on top of his cash, CPF, and HDB loan amounting to $200,000. As a second-timer, he did not qualify for CPF Housing Grants that could have helped him. The situation seemed dire and Derek felt like he was running out of options. However, I knew from personal experience that giving up was not the answer. Light at the end of the tunnel I encouraged Derek to reach out to his Member of Parliament (MP) for help. Despite the high cost of living in Singapore, our government genuinely cares about those in need and assists on a case-by-case basis. I had gone through a similar situation before and received the support I needed. Derek took my advice and wrote to his MP, hoping for a glimmer of hope. The government's support and assistance Recently, Derek shared some good news with me – his MP responded and the Housing Development Board (HDB) is looking into increasing his loan quantum. This development means that Derek may soon be able to fulfill his dream of owning a home. Derek's experience serves as a reminder that we should never give up hope, and reaching out to your MP can make a significant difference in your housing situation. Conclusion In Singapore, homelessness is not an outcome that the government wants for its citizens.

As Derek's story shows, the government does show compassion and support when individuals find themselves in challenging circumstances. If you are facing similar housing struggles, I urge you not to lose hope and to reach out to your MP for assistance. The government is committed to helping those in need and ensuring that no one is left without a home. That's the beauty of Singapore – a nation that cares for its people, even in times of hardship. As Singapore's property market continues to reach new heights, investors are eyeing Malaysia as a potential alternative. But is it the answer to Singapore's escalating property prices? Let us find out. By Khalil Adis Singapore's property market has been making waves, with both the HDB and private property sectors hitting record highs in their price indexes. This surge in prices has prompted investors and homebuyers to search for alternatives and Malaysia has emerged as a popular choice. However, before you pack your bags and head south, let us dive into whether Malaysia truly offers a viable solution to Singapore's escalating property prices. The latest data from the Housing & Development Board (HDB) and the Urban Redevelopment Authority (URA) paints an intriguing picture. The HDB Resale Price Index (RPI) and Private Property Index (PPI) for the first quarter of 2023 reached unprecedented levels of 173.6 points and 194.8 points, respectively. These figures indicate a strong demand for properties in Singapore, driving prices to new heights. Analysts say they are witnessing resale transactions decreasing from April to March 2023, which could explain the marginal increase in the RPI. “In April 2023, HDB resale volumes decreased month-on-month by 4.3 per cent, following a 23.7 per cent surge in transaction activities in March,” said Luqman Hakim, chief data & analytics officer at 99.co.. But it is not just rising property prices that pose a concern. Rental rates have also skyrocketed, leaving tenants grappling with the search for affordable accommodations. Rising rentals Take, for instance, Marwani (not her real name), a landlord in Jurong West, who witnessed the rental price of her 4-room flat soar from $1,750 per month in 2021 to a staggering $3,500 per month in 2023—an almost 200 per cent increase! “I am lucky that my tenants have continued to stay on despite the steep increase in rental,” said Marwani. Her agent was the one who negotiated the lease renewal. The private property rental market also experienced a steep climb, with a 7.2 per cent increase in the first quarter of 2023. These exorbitant prices and soaring rentals have left many individuals, like Edward (not his real name), a tenant in Singapore, seriously considering buying a resale HDB flat as a more financially viable option. “I signed a 2-year lease which had averted a rental hike. However, I am pretty sure it will go up next year,” said Edward who lives close to the city centre. Edward believes that owning property might be more cost-effective in the long run, particularly with the prospect of rising rents. “It makes more financial sense to buy now rather than rent as I foresee it will be cheaper to pay my monthly mortgage should my rent increase,” he said. Analysts have also observed this growing trend, noting that tenants are increasingly turning to purchasing resale flats amidst high rental prices. “Resale prices increased by 1.1 per cent compared to March 2023, with 5-room flats rising the most at 1.9 per cent. It is possible that with rent prices remaining high, many tenants are opting to buy resale flats instead. Subsequently, with the revised ABSD rates from 27 April 2023 onwards, there is expectant pressure on rental demand (and prices), prompting spillover demand from tenants as they reinvest and buy HDB resale flats,” said Hakim. With the demand for properties in Singapore remained robust, the government has stepped in to cool the market. The recent increase in Additional Buyers Stamp Duty (ABSD), which affects second-timer Singaporeans and first-time foreign property owners, aims to rein in property speculation. Push factor to Malaysia? With 2-room HDB flats now hovering around the $300,000 mark and million dollar HDB flats becoming this norm, could this push potential biuyers to Malaysia? Not quite. Yusoff (not his real name) is among one of the few Singaporeans who is packing his bags after recently selling his 2-room HDB flat in Woodlands for slightly above $300,000. “My wife recently passed away while my relatives are all in Malaysia. It makes sense for me to retire there,” said Yusoff. Indeed, the first quarter data of 2023 from HDB showed that such flats were transacted at a median price of $330,000, $325,000 and $315,000 in Punggol, Sembawang and Yishun respectively. That is almost enough to buy a private property in Malaysia where the minimum purchase price in most states is at RM1 million, including in Johor. However, not everyone is in the same predicament as Yusoff. Edward, for instance, is staying put. Despite these cooling measures, the idea of buying properties across the causeway in Malaysia may not be as enticing as it seems. “There are many push factors such as the lack of liberal values in a predominantly Muslim country. Also, Malaysia appears to be unstable both politically and economically,” said Edward. While the affordability factor in Malaysia's property market may initially catch the eye of potential buyers, it is worth noting that property overhang for residential properties continues to be a serious issue. Johor, for instance, continues to be the leading state for residential overhang at 5,348 units, the third quarter of 2023 data from the National Property and Information Centre (NAPIC) showed. This would put pressure on the secondary market causing investors to suffer a loss as in the case of Country Garden Danga Bay. Additionally, concerns surrounding political and economic stability in Malaysia may deter investors who prioritise stability and predictability in their investments. Ultimately, while the ABSD increase may lead some investors to explore opportunities outside of Singapore, it seems that the challenges and limitations associated with investing in Malaysia may outweigh the potential benefits. As always, conducting thorough research and seeking expert advice before making any investment decisions is crucial. Conclusion So, is Malaysia truly the solution to escaping Singapore's soaring property prices?

The answer may not be as straightforward as it seems. While Malaysia offers some advantages in terms of affordability, potential buyers need to carefully consider factors such as political stability and the severe oversupply issue which may impact their investment. While resale HDB and private property are now at a record high, they are seeing a slower pace of price increase. By Khalil Adis As we enter the first quarter of 2023, Singapore’s property market is showing signs of resilience and stability after a turbulent few years. With a growing population, an expanding economy and a strong demand for housing, both the HDB and private property markets are expected to continue their upward trajectory. Here is a quick snapshot of what is happening in both the HDB and private property markets. HDB: Resale Price Index (RPI) is now at a record high For many Singaporeans, purchasing an HDB flat remains the most affordable option for homeownership. “I recently bought an HDB flat in Sengkang, and I have noticed that prices have gone up significantly compared to a few years ago. However, it is still affordable compared to private properties,” said one recent buyer, Tan Siew Ling. The HDB Resale Price Index (RPI) has been on a steady increase since 2019, and in the first quarter of 2023, it is expected to rise further. According to the HDB’s flash estimates for first quarter of 2023 data from HDB, the RPI is now at 173.4 point which is an increase of 0.9 per cent over that in the fourth quarter of 2022. “This is a slower increase than the 2.3 per cent increase in the fourth quarter of 2022, and is the smallest quarterly increase compared to the last ten quarters,” said the HDB in its press release. Challenges Nonetheless, the HDB market is not without challenges. For example, the price gap between newly MOP-ed flats and those in older HDB estates vary greatly. One such buyer is Amy and Khai who are finding that newly MOP-ed 3-room HDB flats, priced at more than $400,000, to be beyond their budget. With a combined monthly income of less than $3,000, CPF of around $30,000 and loan of around $180,000, Amy and Khai can only afford to purchase flats in older HDB estates. In the end, they narrowed down their search to a flat in Jurong West to be near their parents to qualify for the Proximity Housing Grant. While the asking price is significantly cheaper at $350,000, it comes with its own set of challenges. For instance, Amy and Khai are subjected to a pro-rated CPF usage since the remaining lease does not cover the age of the youngest buyer up to the age of 95. As Amy’s age is 30 and the remaining lease is 60 years, the couple’s HDB loan and Enhanced Housing Grant had to be pro-rated. Fortunately, with the increase in Family Grant from $50,000 to $80,000, Proximity Housing Grant of $30,000 and Enhanced Housing Grant, the grants went a long way in helping the young couple finance their flat purchase. “Our agent was very helpful in helping us do our financial calculations and recommend properties within our budget. Within one viewing, we decided to make an offer for the flat in Jurong West,” said Khai. “The government has imposed stricter loan-to-value ratios on buyers for HDB flats with a remaining lease of less than 60 years. This has resulted in a slower market for older HDB flats,” said analyst, Lim Hui Shan. Nonetheless, the HDB market is expected to remain stable and resilient. “Resale prices ceased to increase for the first time since June 2020, putting an end to the historic price rally that lasted for 31 consecutive months, as most room types experienced no increases in February 2023 except for 3-room flats. Following the Budget announcements, first-time HDB resale flat buyers can now enjoy higher amount of grants which should ease any concerns on affordability. As such, we expect demand to remain solid for the rest of 2023,” said Pow Ying Khuan, head of research, 99 Group. Private property market: Increase in ABSD has impacted luxury properties The private property market in Singapore has also experienced steady growth over the years.

According to the Urban Redevelopment Authority (URA) flash estimates, the Private Property Index (PPI) has increased by 6.0 points from 188.6 points in fourth quarter of 2022 to 194.6 points in first quarter of 2023. “I recently purchased a condo in Pasir Panjang and I’m really happy with my investment. I feel that the property market in Singapore is relatively stable and resilient,” said one investor, Johnathan Koh. However, the private property market faces its own set of challenges. The government has imposed an increase for the Additional Buyer’s Stamp Duty (ABSD) for foreign buyers (from 20 to 30 per cent) and local buyers (from 12 to 17 per cent) purchasing a second property. Analyst, Cheryl Lim, commented that “the ABSD has affected the demand for private properties, especially for high-end luxury properties. However, there is still demand for affordable and mid-range properties.” Despite the challenges, the private property market is expected to remain stable and continue to see growth in the first quarter of 2023. In conclusion, the Singapore property market remains resilient and stable, with both the HDB and private property markets showing positive signs of growth. Property prices are expected to correct in the months ahead which may favour buyers. Meanwhile, the rental market is expected to heat up further. By Khalil Adis On 30 September 2022, the Singapore government announced various property cooling measures that are aimed at ensuring prudent borrowing and moderating demand. Indeed, the HDB Resale Price Index (RPI) and Private Property Index (PPI) as of the third quarter of 2022 are now at record highs at 168.1 and 187.8 points respectively. This means that first-time homebuyers are finding both HDB flats and private properties to be severely unaffordable. Meanwhile, potential sellers see this as an opportune time to profit from the red-hot property market. With this in mind, the government has had to intervene to ensure property prices remain affordable and are in tandem with wages. The measures include the following four-pronged approach:

How they may impact you as a consumer: For point 1, you will have to have a higher monthly combined income and pay a higher monthly mortgage and combined income . However, the actual interest rates charged will be determined by the private financial institutions. For point 2, the stress test has been increased to 3 per cent when calculating your monthly mortgage but with a reduced Loan-to-Value (LTV) limit at 80 per cent. This is to ensure your monthly mortgage remains affordable and within the 30 per cent Mortgage Servicing Ratio (MSR). On the overall, with a higher downpayment of 20 per cent, it will result in a lower mortgage payment when compared to an LTV limit of 85 per cent. However, this will not affect the actual HDB concessionary interest rate, which will remain unchanged at 2.6 per cent per annum. For point 3, buyers will need to come up with a higher cash and/or CPF amount (an increase of 5 per cent) to make up the 20 per cent downpayment. For example, for an $500,000 HDB flat, you will need to come up with $100,000 (80 per cent LTV) as opposed to $75,000 (85 per cent LTV). This means an additional cash and/or CPF outlay of $25,000. For point 4, this will mean sellers will have to rent either an HDB flat or private property during the interim period. This will result in increased demand in the rental market which will push asking prices further. According to data from the Urban Redevelopment Authority (URA), rentals of private residential properties had increased by 8.6 per cent in the third quarter to reach 137.9 points from 127.0 points in the second quarter of 2022. Meanwhile, HDB rentals have increased by around 30 per cent. Looking ahead, the rental market is expected to strengthen further which will favour landlords. Summary For buyers who are looking to buy a resale HDB flat or private property, you might want to wait out until their prices correct.

For sellers, you only have a small window period to take advantage of the exuberant market before it cools in the coming months. For landlords, the market will favour you due to increasing demand from existing tenants and ex-private property owners who have already sold their homes. For tenants, you will have to set aside more budget as rentals have now increased by around 30 per cent. Demand remains strong among local buyers with landed homes proving to be popular. By Khalil Adis Johor’s property market is finally seeing some signs of recovery, with majority of new launches (604 units) located within the state in the first quarter of 2022, data from the National Property and Information Centre (NAPIC) showed. Of the total of 2,961 units launched across the state of Johor, Melaka, Selangor and Pahang, 164 units (5.6 per cent) were sold. Majority of them (2,657 units or 90.5 per cent) were landed properties while the remaining 279 units (9.5 per cent) were high-rise apartments. Landed homes proved to be popular across these states with 164 units sold (6.2 per cent) out of the 2,657 units launched. What NAPIC’s data suggests While NAPIC’s data did not give a breakdown of the nationalities of buyers, these landed homes are likely snapped up by local buyers. Unfortunately, NAPIC’s data did not provide a breakdown of how many units were sold in Johor out of the 604 units launched. Interestingly, majority of the launches (1,197 units or 40.8 per cent) were priced from RM300,001 to RM500,000. This suggests that developers are targeting mass market local buyers in the low to medium price range. Record HDB and private property prices in Singapore may have spurred buying activity With majority of these launches located in the state of Johor, it is also likely developers are targeting Malaysians working in Singapore who prefer living in landed homes. The city-state has seen record prices in both the HDB and private property markets as well as rental hikes. Government data showed that the Housing and Development Board (HDB) Resale Price Index (RPI) and Urban Redevelopment Authority (URA) Private Property Index (PPI), as of the second quarter of 2022, are now at a record high. For example, HDB’s RPI is now at 163.9 points which is an increase of 2.8 per cent over that in the first quarter of 2022. Meanwhile, the PPI is also at a record high of 180.9 points whereby prices of private residential properties had increased by 3.5 per cent in the second quarter of 2022, compared with the 0.7 per cent increase in the previous quarter. Rentals have also increased in both the public and private housing markets, government data showed. These are among the push factors for Malaysians working in Singapore to look to buying or renting a property in Johor. Lukewarm sentiment among Singaporean and foreign investors Despite this, Singaporean and foreign investors are adopting a “wait-and-see” approach to Johor’s properties. Currently, the minimum purchase price in the state of Johor for foreign purchasers are at RM1 million, Of the 2,936 units launched, only 134 units (6.4 per cent) are priced at above RM1 million. This suggests that demand from Singaporean and foreign investors has remained rather muted. Some of the potential factors that may have deterred buying activity include the negative sentiments arising from the ongoing high profile corruptions cases involving Malaysian politicians, the severe oversupply of residential properties in Johor, crime and safety issues as well as the flip-flop in policies about the Malaysia My Second Home (MM2H) programme. Data from NAPIC showed that Johor has the highest residential overhang in Malaysia with 5,992 unsold units followed by Penang (5,816 units) and Selangor (5,215 units). Johor also has the highest serviced apartment overhang volume in Malaysia with 16,425 unsold units followed by Kuala Lumpur (4,459 units) and Selangor (2,337 units). Since the full opening of borders between Singa[pore and Malaysia on 1 April 2022, Johor has seen traffic congestions at both the Woodlands custom, immigration and quarantine (CIQ) checkpoint and Tuas Second Link. “We are seeing traffic jams across the causeway and the second link as well as long queues at the local eateries with more and more Singaporeans resuming their weekly visits to Johor and Malaysia. The Johor traffic to Singapore is almost back to normal,” economic affairs minister Mustapa Mohamed was reported as saying. However, buying activity among Singaporean and foreign investors has yet to pick up. Iskandar Malaysia continues to attract institutional investors Despite this, institutional investors have continued to invest in Iskandar Malaysia. Government data showed that Iskandar Malaysia has recorded committed investments of RM13.2 billion in the same period out of which RM5.9 billion have been realised. “A total of more than RM10 billion will be generated by foreign investors in this region for the development of data centres,” Prime Minister Datuk Seri Ismail Sabri Yaakob said in a statement. On July 25, the prime minister chaired the Iskandar Regional Development Authority (IRDA) meeting together with Johor's Chief Minister Datuk Onn Hafiz Ghazi. “In total, more than 6,000 people in this region have received direct benefits from the socioeconomic initiatives that have been carried out,” he was reported as saying. Upcoming projects may boost foreign investors’ confidence With border restrictions now eased, two projects could bolster confidence in Johor’s property market.

They include the Johor Bahru – Singapore Rapid Transit System (RTS) Link and Coronation Square. The RTS Link is a 4km cross-border railway shuttle project that will connect via a 25m-high bridge from Woodlands North Station (LRT) in Singapore to the Bukit Chagar Station in Johor Bahru. When completed in 2026, it can serve up to 10,000 commuters during peak periods, for every hour and in each direction. Meanwhile, Coronation Square which is located in the Ibrahim International Business District (IIBD) will be Johor’s equivalent to the KLCC. When completed by 2028, it is expected to create some 60,000 jobs and contribute over RM9 billion to Johor’s economy. Technology and finance sectors will dominate the office market, especially for Grade A offices in the CBD. By Khalil Adis For the past year, bank manager, Cheryl, has been working from home for three weeks a month as the default measure kicked in when COVID-19 happened. The experience, she said, was a nice change from the usual office routine. “Working from home has its pros and cons. The most obvious advantage is the flexibility I have especially when I have a pre-school child. I get to send my son and pick him up from school every day. Occasionally, I can whip up a nice dinner when I'm less tied up at work. I also spent less time commuting and more time bonding with my family,” she said. While acknowledging she enjoyed the flexibility, she notes there were some downsides as well. “I tend to overwork. There are occasions I would turn on my laptop when my son is asleep at night or on weekends when he is napping. I was even working when I was feeling under the weather,” she said. Another major drawback she experienced was the reduction in human interactions. "The lack in connection with the team tends to drift professional relationships,” she added. Fast forward a year later, Cheryl is now back in the office after the government announced that starting from 1 January 2022, fully vaccinated employees can return to work. Grade A office rents in the CBD projected to grow by 4.6 per cent With many workers like Cheryl now back in the office, analysts are expecting Singapore’s office market to make a strong recovery in 2022. A report released in February 2022 by Cushman and Wakefield predicts that Grade A office rents in the Central Business District (CBD) will grow. “The Singapore office market bottomed out in 2021 as demand continues to recover amidst a flight to quality. Looking ahead, Singapore’s CBD Grade A office rents are projected to grow by 4.6 per cent year-on-year with vacancy rates tightening to below 4 per cent by end-2022, against a backdrop of projected sustained demand of 0.9 million sq ft (msf) and limited supply of 0.8 msf this year,” said Wong Xian Yang, head of research, Singapore at Cushman & Wakefield. Data from Cushman and Wakefield also showed that Grade A and B office spaces are seeing growths after six consecutive quarters of decline since the first quarter of 2020, although this was still lower than the growth that was recorded before the pandemic began. “CBD Grade A office rents rose by 1.7 per cent quarter-to-quarter in the fourth quarter of 2021, marking three consecutive quarters of growth. For the whole of 2021, CBD Grade A rents grew 2.3 per cent year-on-year to reach $9.81 per sq ft per month, although this remains about 8.0 per cent below pre-pandemic (fourth quarter of 2019) levels,” its report cites. More investment deals expected Shaun Poh, Cushman & Wakefield Singapore’s executive director and head of capital markets said we may see higher office investment deals done with the Singapore market poised to outperform the broad Asia Pacific market this year. “With anticipated strong rental growth, investors looking to deploy capital into safe haven assets with healthy returns will find the Singapore office market appealing,” he said. Poh adds that as the market continues to recover and with limited stocks available for sale, buyers may bite. “Amidst ample liquidity and keen demand, office capital values expected to run up and cap rates could compress further with higher interest rates. Assuming cap rates tighten to 3.10 per cent in 2022 from 3.15 per cent in 2021, CBD Grade A capital values could increase by over 6 per cent this year,” Poh said. Notable lease transactions in 2021 Analysts said with the flight to quality seen last year, several notable tech companies upgraded from Grade B to Grade A CBD offices, totalling around 297,500 sq ft of lettable space. For instance, Lazada and Ali Baba took up some 140,000 sq ft of space at Lazada One followed by KPMG (100,000 sq ft) and Red Hat (57,500 sq ft) at Asia Square Tower 2 and CapitaSpring respectively. “We may see a slower and drawn-out recovery momentum as compared to historical recoveries. While office demand has risen in tandem with a strong economic recovery in 2021, the rise of hybrid work will likely lead to lower structural demand for office space as more people are able to work from home,” its report cites. Increase in leasing interests from finance and technology sectors One agent who does corporate leasing in the CBD said he is seeing an uptick in interests among prospective tenants from the finance and technology sectors. “Traditionally, firms in these sectors would lease co-working spaces. However, post COVID-19, they are now looking for fully fitted COVID-19 safe Grade A office space with a budget ranging from $7.50 to $8.50 per sq ft for a 2-year lease,” said the agent. A human resource executive in the finance industry who is currently occupying a co-working space concurs with this finding. “Initially, we were looking at co-working spaces as they have all the furniture done up. However, we are now exploring offices that are fully fitted out as well. As long as the price is within or budget and within easy access to the MRT stations, we will consider the space,” said the executive who wishes to remain anonymous. Analysts also agree with these findings. Cushman and Wakefield Singapore predicts technology and financial occupiers will continue to be major sources of office demand in 2022. The firm said this is because Singapore is a prominent tech hub globally with 88 of the world’s top 100 technology companies operating in Singapore and 59 per cent of tech multinationals establishing their regional headquarters in Singapore. “As these tech companies grow, their appetite for CBD Grade A office space would expand. However, given limited Grade A spaces within the CBD, some would start exploring city fringe Business Park space, following the likes of Google, Razer and Grab, as they outgrow their current premises. While this could create sizeable pockets of space in the CBD over the mid-term, they could be filled by future demand from future tech firms. Singapore has a vibrant start-up scene with over 4,000 tech startups locally and access to a large concentration of startups in Southeast Asia,” said Mark Lampard, Cushman & Wakefield Singapore’s executive director and head of commercial leasing. Moving forward With working from home no longer the default mode, some employees like Cheryl hopes for some flexibility to be allowed.

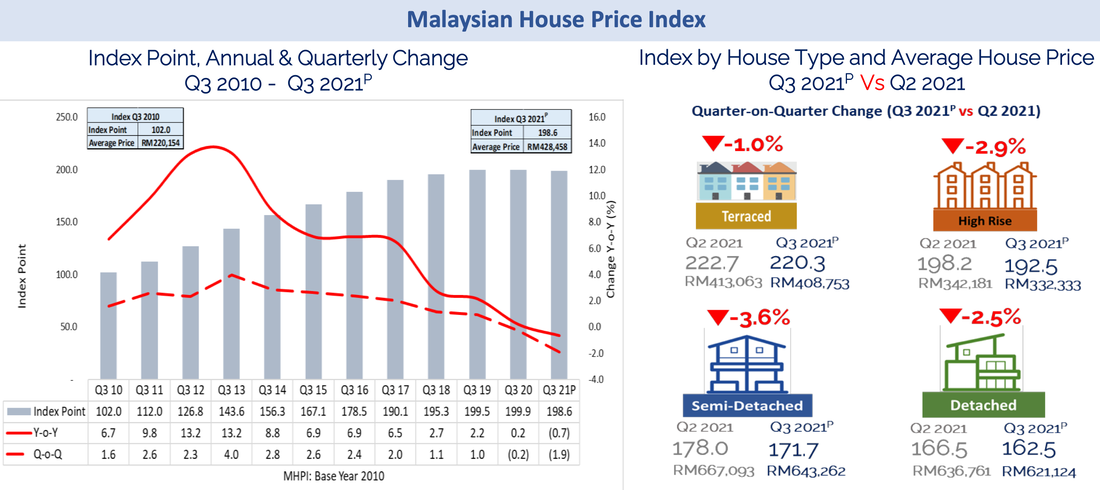

“It will definitely be great if we can have work from home as the norm for at least 25 per cent of the time going forward. This will give flexibility for working parents to attend to their kids as and when it is required. This could also reduce the sick leave rate if employees have the option to work from home,” she said. Meanwhile, analysts say while they remain optimistic, some inherent risks remained. “While the outlook for the Singapore office market looks promising, there are potential downside risks such as new Covid-19 variants which could reverse re-opening of economies and faster than expected rise in interest rates which could derail the recovery of the global economy,” said Lampard. Lampard advised potential tenants to make the best of the office market while they still can. “Notwithstanding these potential downside risks, tenants who are delaying their real estate decision making are advised to fast track their planning to optimise the opportunities available in the office market and ‘catch 22’ before it goes away,” he said Despite COVID-19 and record housing prices on the island, buying activity in Singapore has remained brisk while Malaysia’s has been somewhat muted. By Khalil Adis Ask any Singaporeans if they will invest in Malaysia right now and most likely they will say no. Instead, Singaporean investors flushed with cash have been busy snapping up properties in the Lion City. Data from the Urban Redevelopment Authority (URA) showed that in the third quarter of 2021, developers sold 3,550 private residential units, compared with the 2,966 units sold in the previous quarter. This figure does not include Executive Condominiums. So what gives? With COVID-19 travel restrictions, it makes sense to buy a property within Singapore. Amid the pandemic, news of Singaporeans having their homes broken into in Johor while they were away plus other developments from across the causeway may have spooked potential investors. From the cancellation of the Kuala Lumpur-Singapore High Speed Rail (KL-Singapore HSR) project to the revision of the Malaysia My Second Home (MM2H) policy, such news is enough to rattle investors’ confidence. After all, if a high-level government-to-government project like the KL-Singapore HSR could be terminated, what more for those involving the private sector like housing? Thus, it came as no surprise that despite its higher property price, buying activity has remained robust within the Lion City with record prices seen in both the HDB and private property markets. Malaysian developers are also closely watching Singapore’s property market. Wanting a slice of the lucrative pie, some are considering launching projects in Singapore but are unsure if Singaporeans will bite. Singapore: Record prices call for curbs to cool the property market When comparing Singapore’s and Malaysia’s property market performances since the pandemic began, they contrast like day and night, as government data showed. While properties in Singapore are notorious for being one of the most expensive in the world, it is also seen as a safe haven for property investment due to its political stability, efficiency and transparency. This may perhaps explain why despite COVID-19, the local property market experienced a bull run. Data from HDB showed that the Resale Price Index (RPI) for the third quarter of 2021 is now 150.6 points - a record high so far. This was an increase of 2.9 per cent over that in the second quarter. Meanwhile, data from the URA, showed that prices of private residential properties increased by 1.1 per cent in the third quarter of 2021, compared with the 0.8 per cent increase in the previous quarter. Similarly, the Private Property Index (PPI) is also at a record high. This had prompted the government to introduce a slew of cooling measures on 15 December 2021. Malaysia: Pandemic fatigue saw lukewarm buying activity but housing prices continued to rise Malaysia is one of the few places in the world where foreigners can own a freehold property. By default, this should make Malaysia a highly sought after investment destination. However, government data showed otherwise. Data from the National Property and Information Centre (NAPIC) showed that the Malaysian House Price Index for the third quarter of 2021 was at 198.6 points. On a year-on-year and quarter-on-quarter comparison, the index declined by 0.7 and 1.9 points respectively. Meanwhile, house prices continued to increase from a median price of RM204,470 recorded in 2009 to RM428,458.42 in the third quarter of 2021. This suggests that while the market has remained somewhat lukewarm, property prices have kept on climbing by a whopping 209.54 per cent in 12 years. So while locals are priced out from the property market and are not buying, foreigners appear to be staying away too. This is despite the strong Singapore dollar versus the Malaysian ringgit. Severe oversupply of residential units in Malaysia It is also worth noting that Malaysia has a severe oversupply problem with 30,358 unsold residential units valued at RM19.80 billion, figures from NAPIC showed. Of this, the majority of them (6,509 units) are located in Johor, just next to Singapore. Nation-wide, the majority of them (10,262 units or 33.8 per cent) are priced between RM500,000 to RM1 million - a price point beyond the reach for most Malaysians. Clearly, majority of the unsold units located in Johor are geared towards foreign buyers. KL-Singapore HSR resumption is needed to bolster confidence While COVID-19 has hampered cross border travel, there appears to be light at the end of the tunnel when both countries officially launched the Malaysia–Singapore land Vaccinated Travel Lane (VTL) scheme on 29 November 2021. Significantly, Malaysian Prime Minister Ismail Sabri is also suggesting reviving the terminated KL-Singapore HSR project during the launch. As a key regional aviation hub, Singapore offers Malaysia direct access to affluent travellers and potential investors. The Lion City also has among the highest concentration of high net worth individuals in the world. With three stops in Johor, it seems almost impossible that the KL-Singapore HSR project could succeed without Singapore’s participation. Look beyond local politics Malaysia will need to look at the bigger picture to see that the KL-Singapore HSR project can enhance cross-border investments that will in turn, solve its housing woes.

Rather than viewing Singapore as a rival, Malaysia should see that the KL-Singapore HSR project is a win-win solution for both countries. The spirit of good neighbourliness and gotong-royong must prevail. After all, when Iskandar Malaysia was first mooted by former Prime Minister Abdullah Badawi, Singapore was meant to complement and not compete with Malaysia. This is something local politicians need to be reminded of time and again. For now, the only investors Malaysia can bank on are the permanent residents that are still holding Malaysian citizenships in Singapore As Singapore eases border restrictions, the high-end market could see a return of buying activity judging by two project launches in the prime area. By Khalil Adis If 2021 is the year for HDB resale flats and mass market condominiums, 2022 could finally see Singapore’s high-end market picking up. That is the prediction among property developer TSky Cairnhill Pte Ltd who will officially launch Cairnhill 16 to prospective homebuyers and investors on 27 November 2021. This comes as Singapore eases border restrictions for quarantine-free travel and as the country adjusts to a “new normal” of living with Covid-19. “We believe that demand for Singapore residential property will gradually return as the country remains a safe haven for property investment,” said Edward Ang, executive chairman, Ocean Sky International. As such, next year could possibly see the return of buying activity among wealthy foreign investors in the somewhat lacklustre prime area of Singapore. Located on the former site of Cairnhill Heights at 16 Cairnhill Rise, Cairnhill 16 was sold through a collective sale to TSky in 2018. TSky Cairnhill is owned by TSky Development Pte Ltd, Ocean City Global Limited, Seacare Property Development Pte Ltd and Min Ghee Investment (2018) Pte Ltd. TSky Development is, in turn, a joint-venture between Singapore-listed Tiong Seng Holdings and Ocean Sky International. Two new launches in the CCR in the fourth quarter of 2021 Cairnhill 16, a freehold development, is among one of two noteworthy launches in the fourth quarter of 2021 that are located within the Core Central Region (CCR). The other project is Canninghill Piers, a 99-year-leasehold development located within the Clarke Quay area that is jointly developed by CapitaLand and City Developments Limited (CDL). Both projects start from more than $2,500 per sq ft, the bench mark price for the top-end of the property market, appears to signify that developers are somewhat confident in an upswing in buying activities in the luxury market. Cairnhill 16’s indicative launch prices are expected to start from around $2,789 per sq ft. Nestled within the tranquil Cairnhill area, Cairnhill 16 will feature 39 limited hilltop luxury residences that will be served with private lift access and smart home features. Sited within a 15-storey residential tower at a quiet cul-de-sac, Cairnhill 16 will comprise 13 two-bedroom units, 13 three-bedroom units, 9 three-bedroom plus study units and 4 four-bedroom units. At the media preview, held on 11 November 2021, the developer showcased the high-end finishes prospective buyers can expect as seen at its sales gallery such as imported kitchen cabinets and designer appliances from V-Zug and Grohe. With a minimum ceiling height of 3.6 metres and up to 4.6 metres on the top floor, Cairnhill 16 is all about making a grand entrance. Cairnhill 16's unit sizes will range from 775 sq ft to 1,744 sq ft. The indicative launch prices for a two-bedroom unit will start from $2.2 million while its three-bedroom, three-bedroom plus study and four-bedroom units will start from $2.9 million, $3.6 and $5.7 million respectively. Located within a stone throw’s away from Orchard Road, Newton MRT station, the medical hub of Mount Elizabeth Hospital and Paragon Medical Centre as well as several good schools such as Anglo-Chinese School (Junior) and St Margaret’s Primary School, Cairnhill has always been a perennial favourite among wealthy local and foreign investors who are attracted to its unparalleled location. This is exactly the niche market that TSky Cairnhill Pte Ltd is hoping to bank on. “I am positive on the property market. With our vaccination plans all fully executed and our policy of opening up the borders, this will certainly help. The Cairnhill area has been traditionally known to be an Indonesian area. Of late, we have seen many Chinese buyers come in and regional buyers,” said Ang. With the easing of travel restrictions and the introduction of more Vaccinated Travel Lanes (VTLs) being introduced, Ang is confident many of such buyers will return to the market. “Singapore has positioned itself as a stable and safe haven for investment, whether it is for financial or real estate investment. I think this will attract foreigners to really have the confidence to put their investment dollar in Singapore,” he said. Meanwhile, Canninghill Piers is an integrated development that will start from around $2,721 per sq ft. Located on the former Liang Court site, Canninghill Piers will feature a hotel, commercial units, a serviced residence and two residential towers comprising around 700 apartments. However, unlike Cairnhill 16, Canninghill Piers will enjoy direct connectivity to Fort Canning MRT station linking residents to the Downtown Line (DTL). Buying activity in prime areas have been lagging behind other areas on the island The exodus of expatriates and border closure arising from the pandemic had impacted the high-end market. Meanwhile, other areas on the island continued to remain resilient. Data from the Urban Redevelopment Authority (URA) appears to confirm this. For instance, its third quarter of 2021 data showed that prices of non-landed properties in the Core Central Region (CCR) decreased by 0.5 per cent in the third quarter, compared with the 1.1 per cent increase in the previous quarter. In comparison, prices of non-landed properties in the Rest of Central Region (RCR) increased by 2.6 per cent, compared with the 0.1 per cent increase in the previous quarter. Meanwhile, prices of non-landed properties in the Outside Central Region (OCR) decreased by 0.1 per cent, compared with the 1.9 per cent increase in the previous quarter. This suggests that buying activity in the prime areas of Orchard, Newton and the core city centre had remained somewhat lukewarm. Echoing a similar sentiment is Pek Zhi Kai, executive director, for Tiong Seng Group. “Buying in the luxury market segment, particularly within the Core Central Region, has not been as exciting as the Outside Central Region. That’s why so far the measures that we have heard of largely, they come in the form that public housing remains affordable and mass market housing remains affordable. Whereas, the Core Central Region has been somewhat muted over the last couple of years or so. It is not going to attract that many measures. It is just making sure that this market will still remain buoyant rather than depressed,” he said. Cooling measure unlikely Overall, the Private Property Index (PPI) is now at a record high of 165.1 points with prices of private residential properties increasing by 1.1 per cent in the third quarter of 2021, compared with the 0.8 per cent increase in the previous quarter.

This will likely surge ahead in the fourth quarter of 2021 as borders start to reopen. Moving forward, market watchers say despite the record-breaking index, they do not think the government will likely announce cooling measures. “I think cooling measures may not kick in. I think it will be a more targeted approach whereby housing remains sustainable and within reach for Singaporeans. With this as an end goal, for the current market itself, I don’t necessarily think the cooling measures will be coming in now,” said Pek. Meanwhile, investors say while they welcome the anticipated return of the luxury market, ultimately, they are still looking for the best deals. One such investor is Singaporean James Tan who is watching the market closely. “The price point at above $2,500 per sq ft is similar or almost higher to the level we saw before Covid-19. Although I am looking to pay in cash, I think the price right now is rather high. I may wait further till I see a good deal in the market,” he said. Ang also agrees that the property market has defied expectations despite Covid-19 noting that construction costs had increased significantly “due to rising construction and commodities costs." “In terms of prices, we can see that even during the Covid-19 period, prices have been steadily climbing. We hope that prices will continue to see a steady yet sustainable climb,” he said. Resale private property and HDB flat prices continue to surge ahead as demand outstrips supply. Meanwhile, rentals are also on the rise. By Khalil Adis Like most first-time property buyers in Singapore, Farhan (not his real name) and his wife are frustrated with the long delays in the construction sector brought about by COVID-19. The couple got married in 2018 and booked their HDB flat in 2019. However, when COVID-19 struck, they were informed by HDB there is now a possibility they will have to wait up to seven years for the keys to their flat. Cancelling their HDB flat is also not an option as they stand to lose $1,000 in their option fee. “We are stuck in a catch-22 situation. On the one hand, the waiting time of seven years is too long and we do not want to inconvenience my in-laws. On the other hand, prices of HDB resale flats have gone up so much that we have to factor in the cash-over-valuation (COV) which may be up to $50,000. If we include renovation cost, our first home may set us back by up to $100,000,” said Faris. Construction sector buckled under COVID-19 pressure Indeed, COVID-19 has impacted the construction sector with several contractors going under due to travel restrictions and high construction costs. In August 2021, for instance, Greatearth Corporation and Greatearth Construction were among the several contractors that went bust due to financial difficulties. This has resulted in delays of several Built-To-Order (BTO) projects. To minimise the impact, HDB has rolled out various measures to support the construction industry and minimise delays to its projects. “HDB has been working closely with our building contractors, to secure the necessary resources they need to complete their projects, including manpower and material supply. We have also recently introduced additional assistance measures to ease the financial pressures brought about by the pandemic-induced spikes in construction costs, including both manpower and non-manpower costs,” said HDB in a statement. Faris and his wife are among those affected as they had booked an HDB flat in Woodlands. “We surveyed around Woodlands where the resale HDB prices are within our budget. However, most sellers are now asking for COV of up to $50,000,” said Faris. Strong pent-up demand pushing prices upwards for resale HDB and private properties As demand far outstrips supply, this has resulted in record prices in both the HDB and private property markets, surpassing the record prices seen during the peak in the third quarter of 2013. Data from HDB showed that the Resale Price Index (RPI) for the third quarter of 2021 is now 150.6 points. This is an increase of 2.9 per cent over that in the second quarter. Meanwhile, resale transactions rose by 19.4 per cent from 7,063 cases in the second quarter to 8,433 cases in the third quarter of 2021. When compared to the third quarter of 2020, the resale transactions in the third quarter of 2021 were 8.3 per cent higher. 4-room HDB flats in the central area fetched the highest price on the island, transacting at a median price of $950,000 while those in Sembawang was the lowest (at a median transacted price of $417,000). Woodlands, where Faris and his wife, were on the lookout for a 4-room HDB resale flat, recorded a median price of $420,000 - the second-lowest median price for a 4-room HDB flat on the island. Still, as Faris can attest to, the asking price even in the far-flung area of Woodlands is sky-high. “On hindsight, that cash component could be better utilised for our renovation cost as we do not intend to take a loan. After much discussion, we decided to stay put at my in-laws. Thankfully, they were very understanding,” said Faris. Meanwhile, data from the Urban Redevelopment Authority (URA), showed that prices of private residential properties increased by 1.1 per cent in the third quarter of 2021, compared with the 0.8 per cent increase in the previous quarter. Landed properties saw a higher price increase when compared to non-landed properties. They increased by 2.6 per cent in the third quarter of 2021, compared with the 0.3 per cent decrease in the previous quarter. Meanwhile, prices of non-landed properties increased by 0.7 per cent in the third quarter of 2021, compared with the 1.1 per cent increase in the previous quarter. Rentals for HDB flats and private properties are also on the rise The supply crunch has also seen rentals for HDB flats and condominiums rising.

In the past, one can rent a 4-room HDB flat for below $2,000 per month. However, as third quarter data from HDB showed, the median transacted price for 4-room HDB flats in most HDB estates are now above $2,000 per month except for Sembawang ($1,900) and Woodlands ($1,900). In Jurong West, for instance, the median transacted price per month for 4-room HDB flats now stands at $2,150 when it was previously transacted at $2,050 per month in the second quarter of 2021. Meanwhile, in the private property market, URA’s data showed that rentals for private residential properties increased by 1.8 per cent in the third quarter of 2021, compared with the 2.9 per cent increase in the previous quarter. This is also something Ed (not his real name), who is also married, can confirm. He is currently looking for a common room to rent in a condominium was surprised by the high asking price from landlords. “It does not make any sense as people are losing jobs and we do not have many expats coming in yet rentals are going up,” he laments. Ed is also looking to buy an HDB flat but is put off by the high asking price and the long waiting period for BTO flats. “I think I may just rent for one year and wait out till the property market stabilises. However, buying an HDB flat is something definitely on my mind. The timing and pricing are just not right at the moment,” he said. Another couple, Ali and his wife say their landlord is looking to increase their rent for the 2-bedroom condominium they are currently renting in eastern Singapore from $3,000 to $3,200 a month. “Our lease is up for renewal soon. We are still deciding if we should stay put or move on. We love this place as it is close to East Coast Beach. Everywhere else that we looked, landlords are similarly asking for between $3,200 to $3,500,” said Ali. For now, first-time homebuyers like Farhan will have to wait out while rent-seekers like Ed and Ali will have to pay what landlords are currently asking for. |

Khalil AdisAn independent analysis from yours truly Archives

July 2023

Categories

All

|

100 Peck Seah Street

|

|

RSS Feed

RSS Feed