|

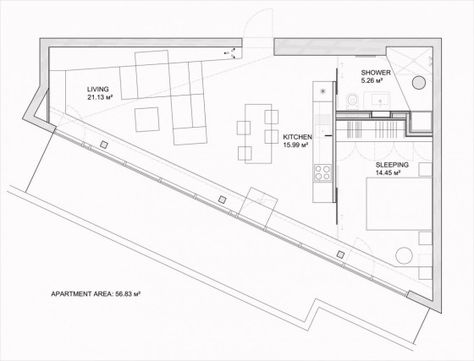

Buying a home will be your single most expensive investment in your life and these are the most common mistakes you should avoid. By Khalil Adis Buying your first home is an exciting experience that will have you go through a range of roller-coaster emotions. From scouting for the right property to securing a loan, the procedures are endless that it is so easy to lose sight of what is important: #1: Buying based on emotions Buying a property based on emotions can cause you to gloss over some of its inherent shortcomings. It is like falling in love in someone gorgeous until they start to open their mouth. The initial phase may elicit a response such as exhilaration over its interior design finishing and then imagining how it would be like to sit in front of that bay window in that sleek glasshouse apartment. However, your emotions can bite you back over the long run as such a home will result in hefty utility bills in the long term. When buying a property, you should make calculated decisions by asking yourself these basic questions: Is the property priced fairly? Do your market research to find out what is the average price per sq ft of the property in the vicinity. This is important as it will ensure your property can have room for capital appreciation in the future. Are there nearby amenities like schools, hospitals and train stations? This will make the area desirable and attract people to want to live, work and play there. As demand increases, it will attract a significant population leading to the capital appreciation of your property. If you want to start a family, these are important considerations. Can the property be rented out or sold in the future? There will be some point in your life that you may end up as a landlord or a seller. Therefore, you must put yourself in the position of a tenant or a buyer by really looking at the property for what it is. As such, check if there any defects that may affect its future rentability or value. It is a good idea to upkeep your property to ensure all the electrical points and sanitary appliances are working while giving it a fresh coat of paint every year. You might also want to look at your interior design, layout and colour schemes and see if they will appeal to potential tenants or buyers. #2: Buying a house facing East-West orientation You should avoid buying a house that is facing the East-West orientation as it is directly exposed to the afternoon sun and therefore increases the heat gain. During night time, the concrete walls will radiate back the heat to your home leading to higher utility bills from your air-conditioning unit. Instead, you should go for a home that is facing North-South orientation. Do also ensure there is cross-ventilation from one end of the house to another to encourage natural air flow. #3: Buying an odd-sized unit An oddly sized unit refers to a layout which has odd corners like a triangle or irregularly shaped like an oval or circle. Such homes have an inefficient layout meaning that it will result in wasted space which cannot be utilised. It is also bad in terms of feng shui should the odd corners have an acute angle as they will collect energy that cannot be dispersed. Instead, you should opt for a regularly shaped unit like a square or rectangle. Remember this golden rule when it comes to a home layout: boring equals good. #4: Buying a common unit versus one that is scarce This is especially applicable for the property market in Malaysia where there is a severe oversupply of homes particularly in Johor and Kuala Lumpur. When buying a home, you should opt for a unit that is scarce. You should first study the development carefully and the unit types that are available. For example, in a project where 4-bedroom greatly outnumber 2-bedroom units, you should opt for the latter. This is because such units will be easier to offload in the resale market should you wish to sell or rent it out in future. Of course, you must take into consideration your family size before making the final decision. #5: Not asking about your prospective neighbours A neighbour can make or break your property.

This is especially true if you are buying a resale home. Recently, a friend confided how he had to move out from his current home to rent another place in eastern Singapore. He had bought the HDB flat from the resale market from an owner who appeared desperate to sell it off. “Don’t tell the neighbour downstairs how much I sold this house,” the owner said ominously. This should have been a red flag. After moving in, he realised his neighbour downstairs would often make a din throughout the entire day. Sometimes, he would have the police knocking on his door as the neighbour had complained about him for no reason. This caused him and his family so much distress that the neighbour’s mom had to come up to explain and apologise for her son’s erratic behaviour. Apparently, her son suffers from a mental illness. After talking to his neighbour, he realised the previous owner was not on good terms with the entire family. This explains their decision to sell the flat. While he now lives a quieter life elsewhere, his tenants are now at the receiving end of the neighbour’s constant abuse. For example, recently, he received a call from the HDB complaining about the apparent noises from his unit. Thankfully, the HDB and the police are aware of his problematic neighbour and have since closed the case. Unfortunately, you cannot choose your neighbours if you had bought a new home directly from the HDB or developer. However, you can mitigate your risks by being a good neighbour. For instance, why not offer a serving of cookies or cakes during your festive celebration? While your actions may not be reciprocated, a friendly hello on your neighbour’s door and offering such goodies will certainly go a long way in making a good first impression last. Neighbours do talk so why not give them something good to talk about?

1 Comment

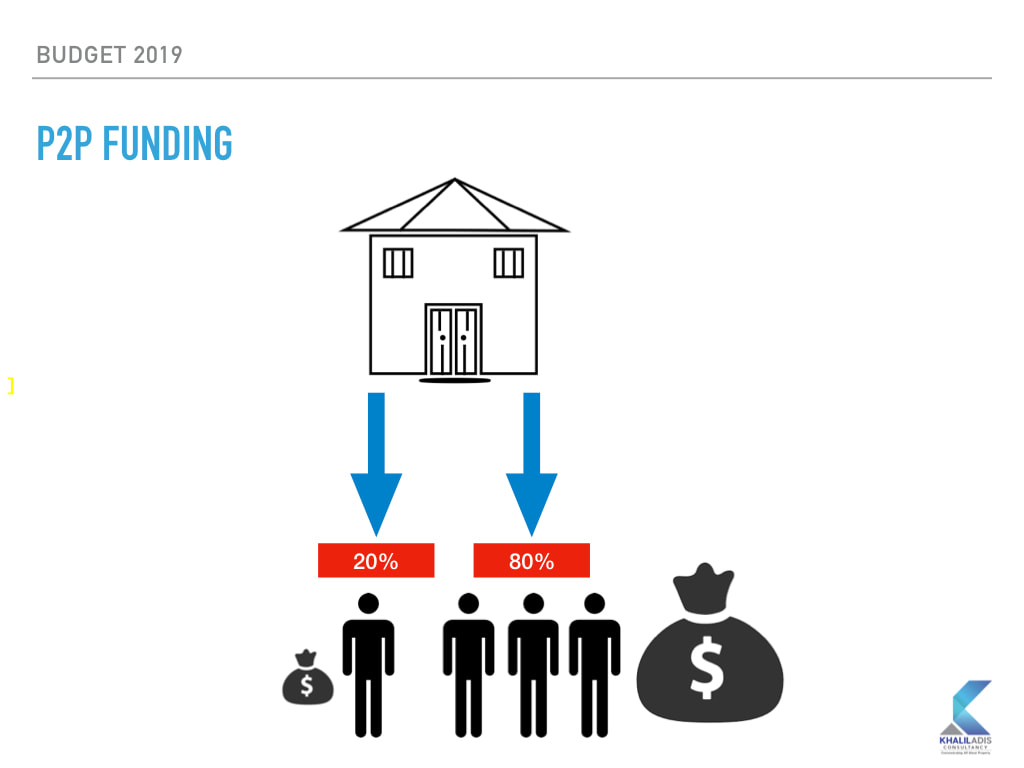

Announced under Budget 2019, first-time homebuyers should take advantage of the schemes that are being rolled out by the federal government. By Khalil Adis In case you had missed the good news that was announced during Budget 2019, there will indeed be more help coming your way if you need help in buying your first home this year. Here are the quick low-down on what the schemes are. #1: P2P (peer-to-peer) Funding What: This is a private sector-driven “Property Crowdfunding” platform to serve as an alternative source of financing for first-time house buyers. It will be regulated by Securities Commission. When: The P2P exchange will go live in the first quarter of 2019. How it works: Interested applicants will need to put a 20 per cent downpayment while the remaining 80 per cent will be funded by investors. Exactly when and how this will be done will be announced closer to the date by the Finance Ministry. Who should apply: Those who have the required 20 per cent downpayment. It is not clear if this is in cash and/or EPF. #2: RM1 billion fund allocated for first-time homebuyers What: This is a special fund for those earning less than RM2,300 a month. The fund can only be used to purchase properties priced up to RM150,000. Bank Negara will be setting up the fund. More details here When: The fund is available for two years until the allocation is spent as of 1 January 2019. You may apply for them at the following banks at a rate of 3.5 per cent: #3: RM25 million fund allocated for first-time home buyers What:

This is a special fund meant for those with a household income of up to RM5,000 The fund provides a mortgage guarantee to enable borrowers to obtain higher financing, including deposit fees. The fund can is for first-time house buyers who are purchasing properties worth up to RM500,000 The fund will also provide a grant stamp duty exemption of up to the first RM300,000 on transfer instruments and loan agreements for two years until Dec 2020. The fund will be run by Cagamas. When: Unfortunately, details are scant. You may check Cagamas Bhd for updates. |

Khalil AdisAn independent analysis from yours truly Archives

July 2023

Categories

All

|

100 Peck Seah Street

|

|

RSS Feed

RSS Feed