|

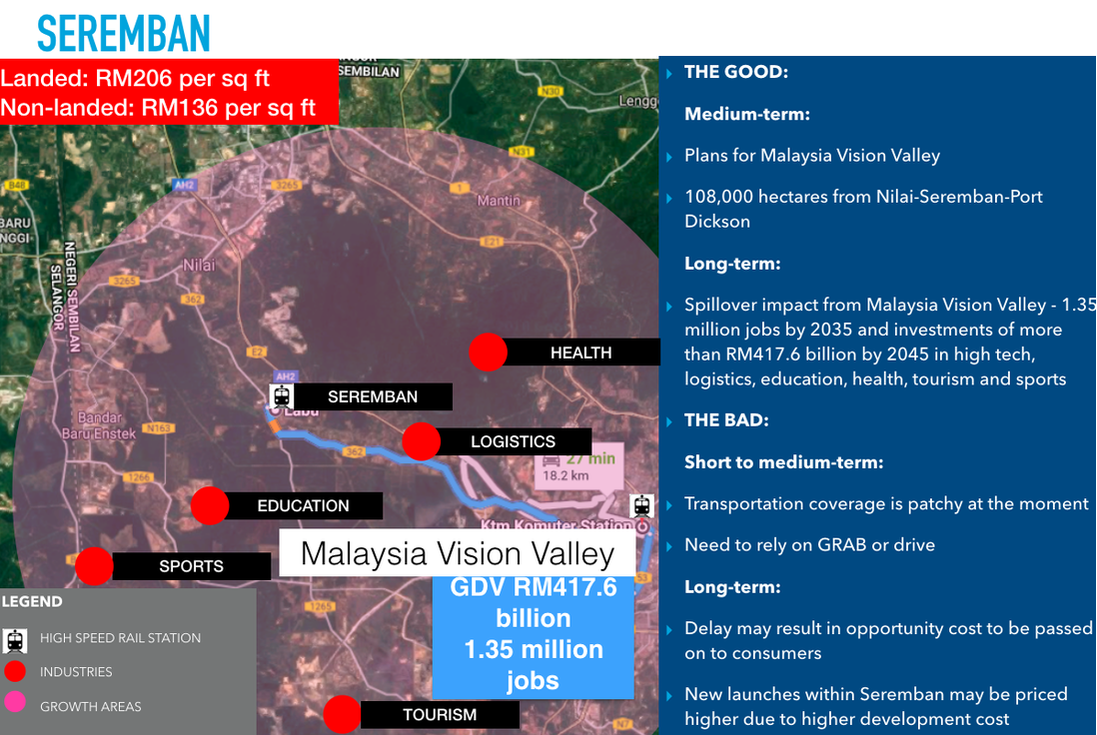

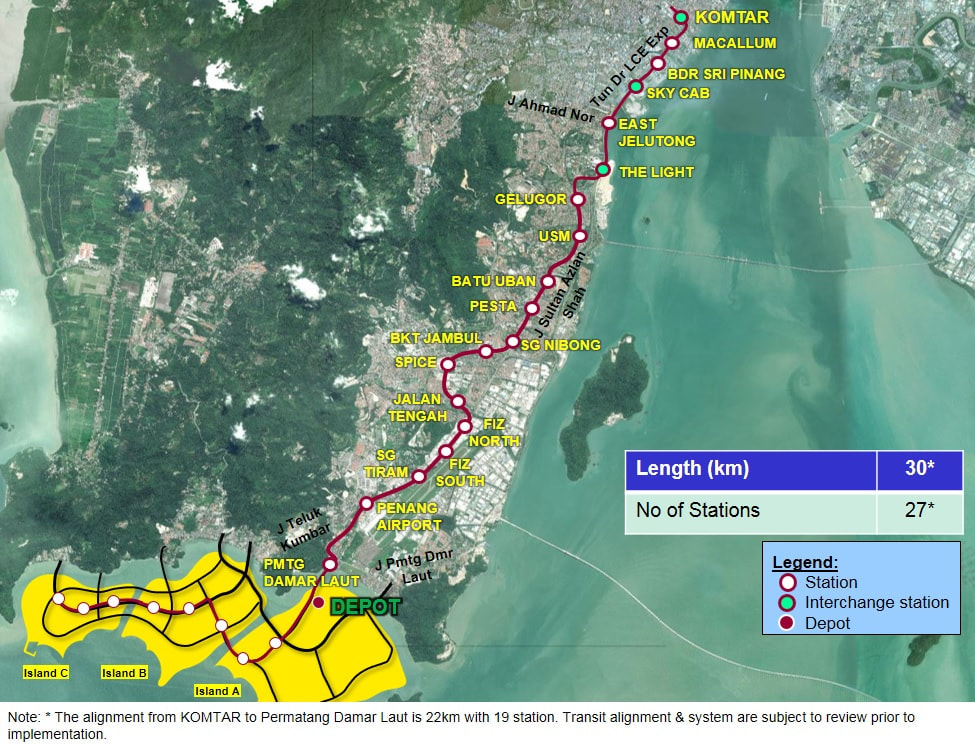

Mass market launches and rental markets in key urban areas are expected to see strong demand in 2024. By Khalil Adis In 2023, the Malaysian property market saw significant trends and developments that have set the stage for the outlook and predictions for 2024. The huge mismatch between what Malaysians can afford to buy versus what developers are building has become increasingly apparent, leading to a shift in consumer behaviour towards renting instead of buying. With affordable housing in short supply, especially in highly urbanised areas like Kuala Lumpur, Johor, Penang, and Selangor, demand for rental properties surged in 2023. This increased demand for rental properties has led to a notable shift in the market dynamics, with renters seeking affordable and well-maintained units in desirable locations. In response to the changing market dynamics, developers in Johor, Selangor and Kuala Lumpur focused on catering to the mass market segment by launching new residential projects priced below RM300,000. These mass-market homes aimed to address the growing demand for affordable housing options among Malaysian buyers. On the other hand, the overhang market in Johor, Selangor, Kuala Lumpur and Penang was dominated by residential properties priced between RM500,000 to RM1 million. This suggests that there is a surplus of mid-range properties in these areas, which may take longer to sell due to affordability constraints and oversupply issues. Johor In Johor, the property market is expected to continue facing challenges in 2024, particularly in areas with a high concentration of oversupply. The mass market segment, which saw an abundance of new launches priced below RM300,000 in 2023, may experience slower growth as developers adjust to the changing demand landscape. However, growth areas such as within Iskandar Malaysia may still present opportunities for investors, especially in well-planned integrated developments that cater to both residential and commercial needs. Selangor Selangor, being one of Malaysia's most populous states and a major economic hub, is expected to maintain its position as a key player in the property market. While the demand for affordable housing is likely to remain strong, developers may shift their focus towards more sustainable and inclusive development strategies. Growth areas such as Cyberjaya, Shah Alam and Subang Jaya are expected to continue attracting interest from both buyers and developers, with a focus on mixed-use developments and transit-oriented projects. Kuala Lumpur In Kuala Lumpur, the property market is expected to see continued interest in high-density urban living, driven by factors such as urbanisation and lifestyle preferences. However, affordability concerns may lead to a greater emphasis on the development of affordable housing and innovative financing solutions. Growth areas within the city centre and its surrounding suburbs, such as KL Sentral, Bangsar and Mont Kiara, are expected to remain attractive to both investors and homebuyers. Penang Penang, known for its rich cultural heritage and vibrant lifestyle, is expected to continue experiencing steady demand for residential properties, particularly in sought-after areas such as George Town, Bayan Lepas, and Tanjung Tokong. However, affordability concerns and oversupply in certain segments may lead to a slowdown in the high-end property market. Developers may focus on niche markets and alternative housing options to cater to changing consumer preferences. The growth areas to watch out for on the main island are mainly along the proposed Bayan Lepas LRT. Growth areas In addition to established urban centres, growth areas such as transit-oriented developments, industrial zones, and emerging satellite towns are expected to attract interest from investors and homebuyers alike. These areas offer opportunities for sustainable development and investment diversification, while also addressing issues such as urban sprawl and congestion. Johor In Johor, the growth areas are primarily located in Iskandar Malaysia, especially in well-planned integrated developments that cater to both residential and commercial needs. One such area is Bukit Chagar which will serve as an interchange station Johor Bahru – Singapore Rapid Transit System (RTS) Link. Slated to commence passenger service by end-2026, the RTS Link can serve up to 10,000 commuters during peak periods, for every hour and in each direction. The RTS Link will also have a spillover impact in the nearby JB Sentral area which is home to malls, hotels and the upcoming Ibrahim International District. Selangor In Selangor, the growth areas are in Southern Kuala Lumpur, particularly, those near high-impact projects and transit-oriented developments along the Putrajaya Line, Kuala Lumpur–Singapore high-speed rail (HSR) and the Malaysia Vision Valley. Nilai and Seremban are areas to watch out for. Nilai is poised for further growth as it is located within the Malaysia Vision Valley. Covering Nilai to Port Dickson, it will have a proposed area of 108,000 hectares. The upcoming industries include high-tech, logistics, education, health, tourism and sports. The Malaysia Vision Valley is expected to create some 1.35 million jobs by 2035 and investments of more than RM417.6 billion by 2045. To support the Malaysia Vision Valley, the Seremban HSR station will be situated in Nilai within the Labu and Kirby estates. Major townships in the vicinity include Bandar Enstek, Bandar Ainsdale Property and S2 Height. Seremban will be an interchange station for the Seremban Komuter Line and KTM Electric Train Service. Kuala Lumpur The growth areas in KL are along the MRT3 Circle Line, namely, Bukit Kiara Selatan, Bukit Kiara, Sri Hartamasa, Mont Kiara, Bukit Segambut, Taman Sri Sinar, Dutamas, Jalan Kuching, Titiwangsa, Kampung Puah, Jalan Langkawi, Danau Kota, Setapak, Rejang, Setiawangsa, AU2, Taman Hillview, Kuchai, Jalan Klang Lama, Pantai Dalam, Pantai Permai and Universiti. Titiwangsa MRT station which will serve as an interchange station with the Ampang and Sri Petaling Line, KL Monorail Line and Putrajaya Line. As the Circle Line is still under construction, this presents a good opportunity for genuine homebuyers to start looking in and around the station. Homes in the secondary market will be the most ideal as they are priced cheaper than new launches. Penang The growth areas in Penang remain unchanged in Batu Kawan and some parts of Seberang Perai. Since the opening of the Second Penang Bridge, Batu Kawan has seen rapid developments from several renowned developers such as EcoWorld and Tropicana as well as the opening of IKEA. While connectivity remains patchy at Batu Kawan, there is a planned Bus Rapid Transit (BRT) system for Batu Kawan as part of the Penang Transport Master Plan. In Seberang Perai, the growth areas will be along the planned Raja Uda-Bukit Mertajam Line to connect the northwestern region to the southeastern region. For those who can afford to buy a property on the main island, areas along the Bayan Lepas LRT line will be the new growth corridor. What’s in store for buyers Buyers in 2024 can expect a more diverse range of options in the property market, with an emphasis on affordability, sustainability, and lifestyle amenities. Innovative financing schemes and incentives may also be introduced to encourage homeownership and address affordability concerns. What’s in store for sellers Sellers may need to adjust their expectations and pricing strategies to align with changing market conditions. Those with properties in oversupplied segments may need to offer incentives or value-added services to attract buyers, while those in high-demand areas may continue to command premium prices. What’s in store for tenants Tenants can expect a more competitive rental market in 2024, particularly in urban areas where demand for rental properties is high. Affordability remains a key concern for tenants, and they may seek out properties with flexible lease terms and inclusive amenities. What’s in store for landlords Landlords may need to be more proactive in managing their rental properties, offering competitive rental rates and investing in property maintenance and upgrades to attract and retain tenants. Those with properties in growth areas may continue to enjoy strong rental yields and capital appreciation. Conclusion Overall, the Malaysian property market is expected to continue evolving in 2024, with a focus on affordability, sustainability, and innovation.

While challenges such as oversupply and affordability concerns may persist, there are also opportunities for growth and investment in emerging sectors and growth areas. By staying informed and adaptable, stakeholders in the property market can navigate these changes and capitalise on new opportunities in the year ahead.

0 Comments

The COVID-19 pandemic has wreaked havoc in the already muted real estate market. We summarise roundups for 2020 and what market trends to expect in 2021. By Khalil Adis 2020 will go down as an unprecedented year as countries around the world are faced with a global pandemic. Malaysia is no different as the Movement Control Order (MCO) and travel restrictions have adversely affected an already dampened market. According to the National Property and Information Centre (NAPIC), the property market contracted sharply in March and April due to the implementation of the MCO before picking up again in May as restrictions were eased during the Conditional Movement Control Order (CMCO) period. Here are the highlights for 2020: #1:. Steep decline in the volume of property transaction across the board NAPIC’s first half of 2020 data showed that the volume of property transaction declined 27.9% with 115,476 units in the first of the year compared to 160,165 units during the same period last year. Out of this, 75,318 units were those in the residential property sector which recorded a decline of 24.6%. The steepest decline was recorded in the commercial property sector which saw a 37.4% drop followed by the industrial, agricultural and development land and others at 36.9%t, 32.8 per cent and 28.6% respectively. It is hardly surprising that the Bank Negara Malaysia revised the Overnight Policy Rate (OPR) four times in 2020 itself to bring down interest rates in order to encourage consumer spending and to facilitate the application of new loans. #2: Residential overhang continued to increase The COVID-19 pandemic has seen the oversupply situation in the residential property sector worsening. According to data from NAPIC, there was a 3.3% (31,661 units) increase in the overhang in residential properties. Out of this, 31.7% are priced below RM300,000. 53.2% comprises high-rise units followed by landed terraced homes (29%), semi-detached & detached (12.4%), low-cost housing (1.6%) and others (3.8%). High rise units within the price range of RM500,000 to RM700,000 form the bulk of the unsold inventory at 4,144 units. Johor had the highest overhang at 19.5% followed by Selangor at 16.4%. Meanwhile, serviced apartments (which is classified as commercial property by NAPIC) recorded a 26.5% or 21,683 units increase in overhang. 61.8% are priced above RM700,000. A whopping 73.7% are located in Johor followed by 11.6% in Kuala Lumpur. #3: Majority of new launches were in the mass market segment Despite the muted property market, developers continued to launch projects, particularly in the mass market segment. NAPIC’s data showed that 13,294 units of new launches were recorded in the first half of 2020. Of this, 50.1% are priced below RM300,000 while 33.7% are priced between RM300,000 to RM500,000. Landed properties dominate new launches making up 69.7% of the figure while the remaining 30.3% are stratified properties. Negeri Sembilan recorded the most launches in the entire country during the period with 2,797 units. This was not surprising as properties that are located away from Kuala Lumpur and Greater Kuala Lumpur are more affordably priced for local home buyers. #4: Steep decline in office and shopping centre occupancy rates The MCO had a detrimental effect on office and shopping centre occupancy as many Malaysians are forced to work from home. Private office building saw their occupancy rate plunging 74.3% with only 12.70 sq m of space occupied out of the total space of 17.09 sq m. Meanwhile, shopping centres experienced the most decline at 76.7% occupancy rate. Only 9.62 sq m of space were occupied out of the total space of 12.55 sq m. #5: Malaysian House Price Index records first-ever decline, corrected slightly in Q2 2020 The mismatch between what Malaysians can afford versus what is being offered in the market, combined with the pandemic has further worsened the overhang situation resulting in an extremely muted year for developers. According to data from NAPIC, the Malaysian House Price Index stood at 198.3 percentage point in Q2 2020 after hitting a peak of 199.7 percentage point in Q12020 – the 0.7% decline is the first-ever one recorded since 2010. Nevertheless, when compared to Q1 2010 (97.25), the price index recorded an increase of 102.5 to reach 199.7 percentage point during the same period in 2020. This suggests house prices across Malaysia have been skyrocketing over the past 10 years before moderating slightly in the second quarter of 2020. Moving forward, here are the property market trends we can expect in 2021 #1: Affordable homes priced below RM500,000 will rule the market As seen from data from NAPIC, majority of the new launches in the first half of 2020 are mass market homes priced below RM500,000. This trend will likely continue in 2021 especially for homes that are located in Greater Kuala Lumpur. Pricing aside, several Budget 2021 initiatives to further promote homeownership, especially for first-time buyers will spur demand for such homes. For example, the full stamp duty exemption on instruments of transfer and loan agreement for first time home buyers will be extended until 31 December 2025. The stamp duty exemptions for first residential home has been capped for homes priced RM500,000 and below. This exemption is effective for the sale and purchase agreement executed from 1 January 2021 to 31 December 2025. As such, we can expect the mass market segment to pick up momentum. #2: Rent-to-Own Scheme in the private and public housing sectors High house prices in Malaysia has resulted in both the private and public housing sectors to roll out innovative measures to make it easy for first-time home buyers. With developers under pressure to move unsold units, many will likely continue to offer attractive discounts, rent-to-own schemes and zero down payments to draw buyers. Meanwhile, in the public sector, the government will implement a Rent-to-Own Scheme by collaborating with selected financial institutions under Budget 2021. This programme will be implemented until 2022 involving 5,000 PR1MA houses with a total value of more than 1 billion ringgit and is reserved for first-time home buyers. #3: Occupancy rates for office will continue to decline The high daily cases of COVID-19 in the country will have an adverse effect on the office occupancy rate as many companies continue to adopt a work from home policy. As such, we are likely to see their occupancy rates continue to decline until a nationwide vaccination is rolled out. Data from NAPIC showed that as of the first half of 2020, Kuala Lumpur had the highest purpose-built office existing stock at 9,266,687 units followed by Selangor and Putrajaya at 4,030,791 and 2,525,253 units respectively. Meanwhile, there will be an incoming supply of 1,465,441, 244,290 and 208,391 units in Kuala Lumpur, Johor and Selangor respectively. Collectively, this will result in downward pressure for the office market. Landlords are likely to lower their asking price to continue securing tenants. Meanwhile, corporate tenants will be spoilt for choice as there will be many good deals in the market. #4: Uncertain time for shopping centres In Q42020, several COVID-19 cases have been detected at notable shopping centres in Kuala Lumpur/Greater Kuala Lumpur such as at Nu Sentral, 1 Utama, The Gardens Mall (TGM), Mid Valley Megamall (MVM) and Bangsar Shopping Centre.

Consumer precaution will trickle into 2021 and this will have an impact on footfall as many stay away from shopping malls while the tourism market continues to suffer due to travel restrictions, further limiting footfalls from tourists and holiday-makers. Similar to the office sector, the shopping centre market will be very challenging. We will likely see the further closure of some outlets resulting in increasing vacancy rates. NAPIC’s data showed that as of the first half of 2020, Selangor had the highest shopping complex existing stock at 3,712,375 units followed by Kuala Lumpur and Johor at 3,131,431 and 2,452,258 units respectively. Meanwhile, there will be an incoming supply of 639,508, 480,125 and 167,779 units in Kuala Lumpur, Selangor and Melaka respectively. This article was first published on iProperty Malaysia. |

Khalil AdisAn independent analysis from yours truly Archives

July 2023

Categories

All

|

100 Peck Seah Street

|

|

RSS Feed

RSS Feed