|

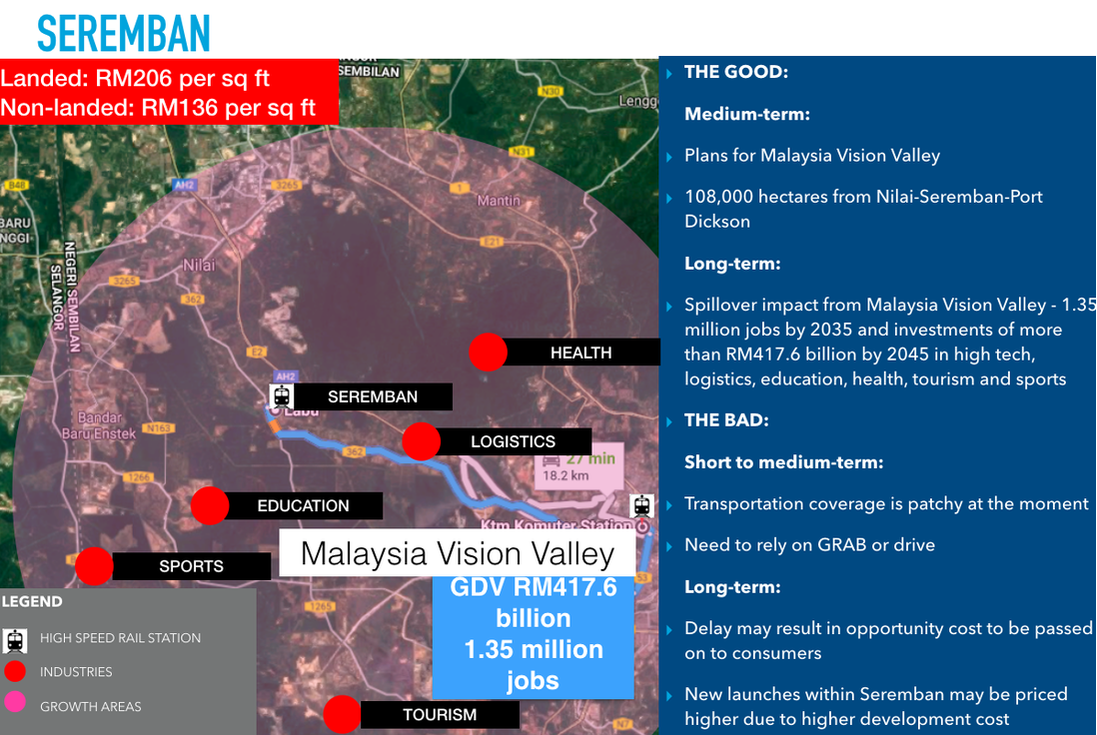

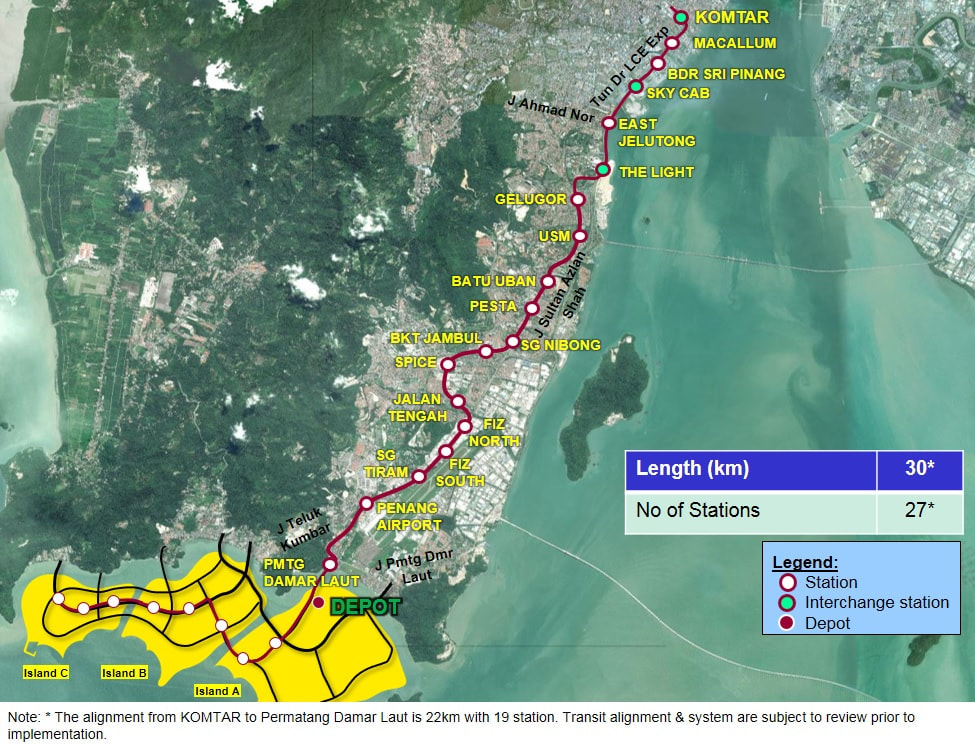

Mass market launches and rental markets in key urban areas are expected to see strong demand in 2024. By Khalil Adis In 2023, the Malaysian property market saw significant trends and developments that have set the stage for the outlook and predictions for 2024. The huge mismatch between what Malaysians can afford to buy versus what developers are building has become increasingly apparent, leading to a shift in consumer behaviour towards renting instead of buying. With affordable housing in short supply, especially in highly urbanised areas like Kuala Lumpur, Johor, Penang, and Selangor, demand for rental properties surged in 2023. This increased demand for rental properties has led to a notable shift in the market dynamics, with renters seeking affordable and well-maintained units in desirable locations. In response to the changing market dynamics, developers in Johor, Selangor and Kuala Lumpur focused on catering to the mass market segment by launching new residential projects priced below RM300,000. These mass-market homes aimed to address the growing demand for affordable housing options among Malaysian buyers. On the other hand, the overhang market in Johor, Selangor, Kuala Lumpur and Penang was dominated by residential properties priced between RM500,000 to RM1 million. This suggests that there is a surplus of mid-range properties in these areas, which may take longer to sell due to affordability constraints and oversupply issues. Johor In Johor, the property market is expected to continue facing challenges in 2024, particularly in areas with a high concentration of oversupply. The mass market segment, which saw an abundance of new launches priced below RM300,000 in 2023, may experience slower growth as developers adjust to the changing demand landscape. However, growth areas such as within Iskandar Malaysia may still present opportunities for investors, especially in well-planned integrated developments that cater to both residential and commercial needs. Selangor Selangor, being one of Malaysia's most populous states and a major economic hub, is expected to maintain its position as a key player in the property market. While the demand for affordable housing is likely to remain strong, developers may shift their focus towards more sustainable and inclusive development strategies. Growth areas such as Cyberjaya, Shah Alam and Subang Jaya are expected to continue attracting interest from both buyers and developers, with a focus on mixed-use developments and transit-oriented projects. Kuala Lumpur In Kuala Lumpur, the property market is expected to see continued interest in high-density urban living, driven by factors such as urbanisation and lifestyle preferences. However, affordability concerns may lead to a greater emphasis on the development of affordable housing and innovative financing solutions. Growth areas within the city centre and its surrounding suburbs, such as KL Sentral, Bangsar and Mont Kiara, are expected to remain attractive to both investors and homebuyers. Penang Penang, known for its rich cultural heritage and vibrant lifestyle, is expected to continue experiencing steady demand for residential properties, particularly in sought-after areas such as George Town, Bayan Lepas, and Tanjung Tokong. However, affordability concerns and oversupply in certain segments may lead to a slowdown in the high-end property market. Developers may focus on niche markets and alternative housing options to cater to changing consumer preferences. The growth areas to watch out for on the main island are mainly along the proposed Bayan Lepas LRT. Growth areas In addition to established urban centres, growth areas such as transit-oriented developments, industrial zones, and emerging satellite towns are expected to attract interest from investors and homebuyers alike. These areas offer opportunities for sustainable development and investment diversification, while also addressing issues such as urban sprawl and congestion. Johor In Johor, the growth areas are primarily located in Iskandar Malaysia, especially in well-planned integrated developments that cater to both residential and commercial needs. One such area is Bukit Chagar which will serve as an interchange station Johor Bahru – Singapore Rapid Transit System (RTS) Link. Slated to commence passenger service by end-2026, the RTS Link can serve up to 10,000 commuters during peak periods, for every hour and in each direction. The RTS Link will also have a spillover impact in the nearby JB Sentral area which is home to malls, hotels and the upcoming Ibrahim International District. Selangor In Selangor, the growth areas are in Southern Kuala Lumpur, particularly, those near high-impact projects and transit-oriented developments along the Putrajaya Line, Kuala Lumpur–Singapore high-speed rail (HSR) and the Malaysia Vision Valley. Nilai and Seremban are areas to watch out for. Nilai is poised for further growth as it is located within the Malaysia Vision Valley. Covering Nilai to Port Dickson, it will have a proposed area of 108,000 hectares. The upcoming industries include high-tech, logistics, education, health, tourism and sports. The Malaysia Vision Valley is expected to create some 1.35 million jobs by 2035 and investments of more than RM417.6 billion by 2045. To support the Malaysia Vision Valley, the Seremban HSR station will be situated in Nilai within the Labu and Kirby estates. Major townships in the vicinity include Bandar Enstek, Bandar Ainsdale Property and S2 Height. Seremban will be an interchange station for the Seremban Komuter Line and KTM Electric Train Service. Kuala Lumpur The growth areas in KL are along the MRT3 Circle Line, namely, Bukit Kiara Selatan, Bukit Kiara, Sri Hartamasa, Mont Kiara, Bukit Segambut, Taman Sri Sinar, Dutamas, Jalan Kuching, Titiwangsa, Kampung Puah, Jalan Langkawi, Danau Kota, Setapak, Rejang, Setiawangsa, AU2, Taman Hillview, Kuchai, Jalan Klang Lama, Pantai Dalam, Pantai Permai and Universiti. Titiwangsa MRT station which will serve as an interchange station with the Ampang and Sri Petaling Line, KL Monorail Line and Putrajaya Line. As the Circle Line is still under construction, this presents a good opportunity for genuine homebuyers to start looking in and around the station. Homes in the secondary market will be the most ideal as they are priced cheaper than new launches. Penang The growth areas in Penang remain unchanged in Batu Kawan and some parts of Seberang Perai. Since the opening of the Second Penang Bridge, Batu Kawan has seen rapid developments from several renowned developers such as EcoWorld and Tropicana as well as the opening of IKEA. While connectivity remains patchy at Batu Kawan, there is a planned Bus Rapid Transit (BRT) system for Batu Kawan as part of the Penang Transport Master Plan. In Seberang Perai, the growth areas will be along the planned Raja Uda-Bukit Mertajam Line to connect the northwestern region to the southeastern region. For those who can afford to buy a property on the main island, areas along the Bayan Lepas LRT line will be the new growth corridor. What’s in store for buyers Buyers in 2024 can expect a more diverse range of options in the property market, with an emphasis on affordability, sustainability, and lifestyle amenities. Innovative financing schemes and incentives may also be introduced to encourage homeownership and address affordability concerns. What’s in store for sellers Sellers may need to adjust their expectations and pricing strategies to align with changing market conditions. Those with properties in oversupplied segments may need to offer incentives or value-added services to attract buyers, while those in high-demand areas may continue to command premium prices. What’s in store for tenants Tenants can expect a more competitive rental market in 2024, particularly in urban areas where demand for rental properties is high. Affordability remains a key concern for tenants, and they may seek out properties with flexible lease terms and inclusive amenities. What’s in store for landlords Landlords may need to be more proactive in managing their rental properties, offering competitive rental rates and investing in property maintenance and upgrades to attract and retain tenants. Those with properties in growth areas may continue to enjoy strong rental yields and capital appreciation. Conclusion Overall, the Malaysian property market is expected to continue evolving in 2024, with a focus on affordability, sustainability, and innovation.

While challenges such as oversupply and affordability concerns may persist, there are also opportunities for growth and investment in emerging sectors and growth areas. By staying informed and adaptable, stakeholders in the property market can navigate these changes and capitalise on new opportunities in the year ahead.

0 Comments

As Singapore's property market continues to reach new heights, investors are eyeing Malaysia as a potential alternative. But is it the answer to Singapore's escalating property prices? Let us find out. By Khalil Adis Singapore's property market has been making waves, with both the HDB and private property sectors hitting record highs in their price indexes. This surge in prices has prompted investors and homebuyers to search for alternatives and Malaysia has emerged as a popular choice. However, before you pack your bags and head south, let us dive into whether Malaysia truly offers a viable solution to Singapore's escalating property prices. The latest data from the Housing & Development Board (HDB) and the Urban Redevelopment Authority (URA) paints an intriguing picture. The HDB Resale Price Index (RPI) and Private Property Index (PPI) for the first quarter of 2023 reached unprecedented levels of 173.6 points and 194.8 points, respectively. These figures indicate a strong demand for properties in Singapore, driving prices to new heights. Analysts say they are witnessing resale transactions decreasing from April to March 2023, which could explain the marginal increase in the RPI. “In April 2023, HDB resale volumes decreased month-on-month by 4.3 per cent, following a 23.7 per cent surge in transaction activities in March,” said Luqman Hakim, chief data & analytics officer at 99.co.. But it is not just rising property prices that pose a concern. Rental rates have also skyrocketed, leaving tenants grappling with the search for affordable accommodations. Rising rentals Take, for instance, Marwani (not her real name), a landlord in Jurong West, who witnessed the rental price of her 4-room flat soar from $1,750 per month in 2021 to a staggering $3,500 per month in 2023—an almost 200 per cent increase! “I am lucky that my tenants have continued to stay on despite the steep increase in rental,” said Marwani. Her agent was the one who negotiated the lease renewal. The private property rental market also experienced a steep climb, with a 7.2 per cent increase in the first quarter of 2023. These exorbitant prices and soaring rentals have left many individuals, like Edward (not his real name), a tenant in Singapore, seriously considering buying a resale HDB flat as a more financially viable option. “I signed a 2-year lease which had averted a rental hike. However, I am pretty sure it will go up next year,” said Edward who lives close to the city centre. Edward believes that owning property might be more cost-effective in the long run, particularly with the prospect of rising rents. “It makes more financial sense to buy now rather than rent as I foresee it will be cheaper to pay my monthly mortgage should my rent increase,” he said. Analysts have also observed this growing trend, noting that tenants are increasingly turning to purchasing resale flats amidst high rental prices. “Resale prices increased by 1.1 per cent compared to March 2023, with 5-room flats rising the most at 1.9 per cent. It is possible that with rent prices remaining high, many tenants are opting to buy resale flats instead. Subsequently, with the revised ABSD rates from 27 April 2023 onwards, there is expectant pressure on rental demand (and prices), prompting spillover demand from tenants as they reinvest and buy HDB resale flats,” said Hakim. With the demand for properties in Singapore remained robust, the government has stepped in to cool the market. The recent increase in Additional Buyers Stamp Duty (ABSD), which affects second-timer Singaporeans and first-time foreign property owners, aims to rein in property speculation. Push factor to Malaysia? With 2-room HDB flats now hovering around the $300,000 mark and million dollar HDB flats becoming this norm, could this push potential biuyers to Malaysia? Not quite. Yusoff (not his real name) is among one of the few Singaporeans who is packing his bags after recently selling his 2-room HDB flat in Woodlands for slightly above $300,000. “My wife recently passed away while my relatives are all in Malaysia. It makes sense for me to retire there,” said Yusoff. Indeed, the first quarter data of 2023 from HDB showed that such flats were transacted at a median price of $330,000, $325,000 and $315,000 in Punggol, Sembawang and Yishun respectively. That is almost enough to buy a private property in Malaysia where the minimum purchase price in most states is at RM1 million, including in Johor. However, not everyone is in the same predicament as Yusoff. Edward, for instance, is staying put. Despite these cooling measures, the idea of buying properties across the causeway in Malaysia may not be as enticing as it seems. “There are many push factors such as the lack of liberal values in a predominantly Muslim country. Also, Malaysia appears to be unstable both politically and economically,” said Edward. While the affordability factor in Malaysia's property market may initially catch the eye of potential buyers, it is worth noting that property overhang for residential properties continues to be a serious issue. Johor, for instance, continues to be the leading state for residential overhang at 5,348 units, the third quarter of 2023 data from the National Property and Information Centre (NAPIC) showed. This would put pressure on the secondary market causing investors to suffer a loss as in the case of Country Garden Danga Bay. Additionally, concerns surrounding political and economic stability in Malaysia may deter investors who prioritise stability and predictability in their investments. Ultimately, while the ABSD increase may lead some investors to explore opportunities outside of Singapore, it seems that the challenges and limitations associated with investing in Malaysia may outweigh the potential benefits. As always, conducting thorough research and seeking expert advice before making any investment decisions is crucial. Conclusion So, is Malaysia truly the solution to escaping Singapore's soaring property prices?

The answer may not be as straightforward as it seems. While Malaysia offers some advantages in terms of affordability, potential buyers need to carefully consider factors such as political stability and the severe oversupply issue which may impact their investment. Demand remains strong among local buyers with landed homes proving to be popular. By Khalil Adis Johor’s property market is finally seeing some signs of recovery, with majority of new launches (604 units) located within the state in the first quarter of 2022, data from the National Property and Information Centre (NAPIC) showed. Of the total of 2,961 units launched across the state of Johor, Melaka, Selangor and Pahang, 164 units (5.6 per cent) were sold. Majority of them (2,657 units or 90.5 per cent) were landed properties while the remaining 279 units (9.5 per cent) were high-rise apartments. Landed homes proved to be popular across these states with 164 units sold (6.2 per cent) out of the 2,657 units launched. What NAPIC’s data suggests While NAPIC’s data did not give a breakdown of the nationalities of buyers, these landed homes are likely snapped up by local buyers. Unfortunately, NAPIC’s data did not provide a breakdown of how many units were sold in Johor out of the 604 units launched. Interestingly, majority of the launches (1,197 units or 40.8 per cent) were priced from RM300,001 to RM500,000. This suggests that developers are targeting mass market local buyers in the low to medium price range. Record HDB and private property prices in Singapore may have spurred buying activity With majority of these launches located in the state of Johor, it is also likely developers are targeting Malaysians working in Singapore who prefer living in landed homes. The city-state has seen record prices in both the HDB and private property markets as well as rental hikes. Government data showed that the Housing and Development Board (HDB) Resale Price Index (RPI) and Urban Redevelopment Authority (URA) Private Property Index (PPI), as of the second quarter of 2022, are now at a record high. For example, HDB’s RPI is now at 163.9 points which is an increase of 2.8 per cent over that in the first quarter of 2022. Meanwhile, the PPI is also at a record high of 180.9 points whereby prices of private residential properties had increased by 3.5 per cent in the second quarter of 2022, compared with the 0.7 per cent increase in the previous quarter. Rentals have also increased in both the public and private housing markets, government data showed. These are among the push factors for Malaysians working in Singapore to look to buying or renting a property in Johor. Lukewarm sentiment among Singaporean and foreign investors Despite this, Singaporean and foreign investors are adopting a “wait-and-see” approach to Johor’s properties. Currently, the minimum purchase price in the state of Johor for foreign purchasers are at RM1 million, Of the 2,936 units launched, only 134 units (6.4 per cent) are priced at above RM1 million. This suggests that demand from Singaporean and foreign investors has remained rather muted. Some of the potential factors that may have deterred buying activity include the negative sentiments arising from the ongoing high profile corruptions cases involving Malaysian politicians, the severe oversupply of residential properties in Johor, crime and safety issues as well as the flip-flop in policies about the Malaysia My Second Home (MM2H) programme. Data from NAPIC showed that Johor has the highest residential overhang in Malaysia with 5,992 unsold units followed by Penang (5,816 units) and Selangor (5,215 units). Johor also has the highest serviced apartment overhang volume in Malaysia with 16,425 unsold units followed by Kuala Lumpur (4,459 units) and Selangor (2,337 units). Since the full opening of borders between Singa[pore and Malaysia on 1 April 2022, Johor has seen traffic congestions at both the Woodlands custom, immigration and quarantine (CIQ) checkpoint and Tuas Second Link. “We are seeing traffic jams across the causeway and the second link as well as long queues at the local eateries with more and more Singaporeans resuming their weekly visits to Johor and Malaysia. The Johor traffic to Singapore is almost back to normal,” economic affairs minister Mustapa Mohamed was reported as saying. However, buying activity among Singaporean and foreign investors has yet to pick up. Iskandar Malaysia continues to attract institutional investors Despite this, institutional investors have continued to invest in Iskandar Malaysia. Government data showed that Iskandar Malaysia has recorded committed investments of RM13.2 billion in the same period out of which RM5.9 billion have been realised. “A total of more than RM10 billion will be generated by foreign investors in this region for the development of data centres,” Prime Minister Datuk Seri Ismail Sabri Yaakob said in a statement. On July 25, the prime minister chaired the Iskandar Regional Development Authority (IRDA) meeting together with Johor's Chief Minister Datuk Onn Hafiz Ghazi. “In total, more than 6,000 people in this region have received direct benefits from the socioeconomic initiatives that have been carried out,” he was reported as saying. Upcoming projects may boost foreign investors’ confidence With border restrictions now eased, two projects could bolster confidence in Johor’s property market.

They include the Johor Bahru – Singapore Rapid Transit System (RTS) Link and Coronation Square. The RTS Link is a 4km cross-border railway shuttle project that will connect via a 25m-high bridge from Woodlands North Station (LRT) in Singapore to the Bukit Chagar Station in Johor Bahru. When completed in 2026, it can serve up to 10,000 commuters during peak periods, for every hour and in each direction. Meanwhile, Coronation Square which is located in the Ibrahim International Business District (IIBD) will be Johor’s equivalent to the KLCC. When completed by 2028, it is expected to create some 60,000 jobs and contribute over RM9 billion to Johor’s economy. The COVID-19 pandemic has wreaked havoc in the already muted real estate market. We summarise roundups for 2020 and what market trends to expect in 2021. By Khalil Adis 2020 will go down as an unprecedented year as countries around the world are faced with a global pandemic. Malaysia is no different as the Movement Control Order (MCO) and travel restrictions have adversely affected an already dampened market. According to the National Property and Information Centre (NAPIC), the property market contracted sharply in March and April due to the implementation of the MCO before picking up again in May as restrictions were eased during the Conditional Movement Control Order (CMCO) period. Here are the highlights for 2020: #1:. Steep decline in the volume of property transaction across the board NAPIC’s first half of 2020 data showed that the volume of property transaction declined 27.9% with 115,476 units in the first of the year compared to 160,165 units during the same period last year. Out of this, 75,318 units were those in the residential property sector which recorded a decline of 24.6%. The steepest decline was recorded in the commercial property sector which saw a 37.4% drop followed by the industrial, agricultural and development land and others at 36.9%t, 32.8 per cent and 28.6% respectively. It is hardly surprising that the Bank Negara Malaysia revised the Overnight Policy Rate (OPR) four times in 2020 itself to bring down interest rates in order to encourage consumer spending and to facilitate the application of new loans. #2: Residential overhang continued to increase The COVID-19 pandemic has seen the oversupply situation in the residential property sector worsening. According to data from NAPIC, there was a 3.3% (31,661 units) increase in the overhang in residential properties. Out of this, 31.7% are priced below RM300,000. 53.2% comprises high-rise units followed by landed terraced homes (29%), semi-detached & detached (12.4%), low-cost housing (1.6%) and others (3.8%). High rise units within the price range of RM500,000 to RM700,000 form the bulk of the unsold inventory at 4,144 units. Johor had the highest overhang at 19.5% followed by Selangor at 16.4%. Meanwhile, serviced apartments (which is classified as commercial property by NAPIC) recorded a 26.5% or 21,683 units increase in overhang. 61.8% are priced above RM700,000. A whopping 73.7% are located in Johor followed by 11.6% in Kuala Lumpur. #3: Majority of new launches were in the mass market segment Despite the muted property market, developers continued to launch projects, particularly in the mass market segment. NAPIC’s data showed that 13,294 units of new launches were recorded in the first half of 2020. Of this, 50.1% are priced below RM300,000 while 33.7% are priced between RM300,000 to RM500,000. Landed properties dominate new launches making up 69.7% of the figure while the remaining 30.3% are stratified properties. Negeri Sembilan recorded the most launches in the entire country during the period with 2,797 units. This was not surprising as properties that are located away from Kuala Lumpur and Greater Kuala Lumpur are more affordably priced for local home buyers. #4: Steep decline in office and shopping centre occupancy rates The MCO had a detrimental effect on office and shopping centre occupancy as many Malaysians are forced to work from home. Private office building saw their occupancy rate plunging 74.3% with only 12.70 sq m of space occupied out of the total space of 17.09 sq m. Meanwhile, shopping centres experienced the most decline at 76.7% occupancy rate. Only 9.62 sq m of space were occupied out of the total space of 12.55 sq m. #5: Malaysian House Price Index records first-ever decline, corrected slightly in Q2 2020 The mismatch between what Malaysians can afford versus what is being offered in the market, combined with the pandemic has further worsened the overhang situation resulting in an extremely muted year for developers. According to data from NAPIC, the Malaysian House Price Index stood at 198.3 percentage point in Q2 2020 after hitting a peak of 199.7 percentage point in Q12020 – the 0.7% decline is the first-ever one recorded since 2010. Nevertheless, when compared to Q1 2010 (97.25), the price index recorded an increase of 102.5 to reach 199.7 percentage point during the same period in 2020. This suggests house prices across Malaysia have been skyrocketing over the past 10 years before moderating slightly in the second quarter of 2020. Moving forward, here are the property market trends we can expect in 2021 #1: Affordable homes priced below RM500,000 will rule the market As seen from data from NAPIC, majority of the new launches in the first half of 2020 are mass market homes priced below RM500,000. This trend will likely continue in 2021 especially for homes that are located in Greater Kuala Lumpur. Pricing aside, several Budget 2021 initiatives to further promote homeownership, especially for first-time buyers will spur demand for such homes. For example, the full stamp duty exemption on instruments of transfer and loan agreement for first time home buyers will be extended until 31 December 2025. The stamp duty exemptions for first residential home has been capped for homes priced RM500,000 and below. This exemption is effective for the sale and purchase agreement executed from 1 January 2021 to 31 December 2025. As such, we can expect the mass market segment to pick up momentum. #2: Rent-to-Own Scheme in the private and public housing sectors High house prices in Malaysia has resulted in both the private and public housing sectors to roll out innovative measures to make it easy for first-time home buyers. With developers under pressure to move unsold units, many will likely continue to offer attractive discounts, rent-to-own schemes and zero down payments to draw buyers. Meanwhile, in the public sector, the government will implement a Rent-to-Own Scheme by collaborating with selected financial institutions under Budget 2021. This programme will be implemented until 2022 involving 5,000 PR1MA houses with a total value of more than 1 billion ringgit and is reserved for first-time home buyers. #3: Occupancy rates for office will continue to decline The high daily cases of COVID-19 in the country will have an adverse effect on the office occupancy rate as many companies continue to adopt a work from home policy. As such, we are likely to see their occupancy rates continue to decline until a nationwide vaccination is rolled out. Data from NAPIC showed that as of the first half of 2020, Kuala Lumpur had the highest purpose-built office existing stock at 9,266,687 units followed by Selangor and Putrajaya at 4,030,791 and 2,525,253 units respectively. Meanwhile, there will be an incoming supply of 1,465,441, 244,290 and 208,391 units in Kuala Lumpur, Johor and Selangor respectively. Collectively, this will result in downward pressure for the office market. Landlords are likely to lower their asking price to continue securing tenants. Meanwhile, corporate tenants will be spoilt for choice as there will be many good deals in the market. #4: Uncertain time for shopping centres In Q42020, several COVID-19 cases have been detected at notable shopping centres in Kuala Lumpur/Greater Kuala Lumpur such as at Nu Sentral, 1 Utama, The Gardens Mall (TGM), Mid Valley Megamall (MVM) and Bangsar Shopping Centre.

Consumer precaution will trickle into 2021 and this will have an impact on footfall as many stay away from shopping malls while the tourism market continues to suffer due to travel restrictions, further limiting footfalls from tourists and holiday-makers. Similar to the office sector, the shopping centre market will be very challenging. We will likely see the further closure of some outlets resulting in increasing vacancy rates. NAPIC’s data showed that as of the first half of 2020, Selangor had the highest shopping complex existing stock at 3,712,375 units followed by Kuala Lumpur and Johor at 3,131,431 and 2,452,258 units respectively. Meanwhile, there will be an incoming supply of 639,508, 480,125 and 167,779 units in Kuala Lumpur, Selangor and Melaka respectively. This article was first published on iProperty Malaysia. Pakatan Harapan witnessed its fourth defeat in the Tanjung Piai recent by-election suggesting Malaysians are not satisfied with the performance of the incumbent government. Against this political backdrop, here are our top five predictions for Malaysia’s property market next year. By Khalil Adis If the recently concluded by-election in Tanjung Piai is anything to go by, the mood on the ground is clear - Malaysians are frustrated with the lack of reforms, election manifestos that were rescinded, high cost of living, in-fighting among its leaders and a society that appears to be increasingly divided along race and religion fault lines. Indeed, the Tanjung Piai by-election witnessed Barisan Nasional candidate Datuk Seri Wee Jeck Seng winning by a landslide with a 15,086-vote majority. In total, he garnered 25,466 votes. In contrast, Pakatan Harapan’s candidate from Bersatu, Karmaine Sardini obtained 10,380 votes. The by-election is particularly significant as Tanjung Piai has a sizable Chinese and Malay voters. Collectively, this does not bode well as the property market is very much sentiment-driven. In addition, the latest trade data from Bank Negara showed that Malaysia’s economic growth had slowed down from 4.9 per cent in the second quarter of 2019 to 4.2 per cent in the third quarter. With a lacklustre economy, a looming global recession and job retrenchments, here are our top five predictions for Malaysia’s property market in 2020. #1: Kuala Lumpur: High-end properties in KLCC will be the first to be affected KLCC is a good barometer of the global economy as it attracts foreign investors, speculators and wealthy locals. It also attracts a sizeable expatriate community who are renting properties here either under a corporate or personal lease. As such, this is the first sector that will be hit once the economy comes to a grinding halt and they are sent packing home. This is because landlords who own high-end properties here are hardly able to cover their mortgage even with such tenants secured, resulting in negative cash flow. Should retrenchments occur, the exodus of the expatriate tenant pool will be a double whammy as landlords are faced with a loss of income and still having to service their mortgage. Those who face difficulties will be forced to offload their properties. Historically, the 2008 crisis witnessed the resale values of properties here declining by around 15 to 20 per cent. One solution for landlords is to convert their homes into Airbnb units. Then and again, the short-term lease market is extremely competitive and no longer as lucrative as before. There is currently a price war among online hotel booking sites and Airbnb resulting in a very low-profit margin for such property owners. #2: Kuala Lumpur: Supply glut makes renting even more attractive According to the first half of 2019 data from the National Property and Information Centre (NAPIC), entire Malaysia has a total of 54,0078 overhang units worth RM37, 229 million. Kuala Lumpur has 4,731 such units worth RM4,599.30 million. With so much supply in the market, those who are struggling to purchase their first home may want to rent instead. Alternatively, you may want to opt for the Rent-To-Own (RTO) scheme. This is specifically for those who are unable to afford the initial 10 per cent deposit and access to financing in purchasing their homes. Here’s how it works, you sign a tenancy agreement with the developer where part of your rental will be converted to your deposit. After five years, the developer will then ask you to sign a Sales & Purchase Agreement. Recently, the government announced that for Budget 2020, it will be collaborating with financial institutions for this scheme for the purchase of first home up to RM500,000 property price. Under this scheme, the applicant will rent the property for up to five years and after the first year, the tenant will have the option to purchase the house based on the price fixed at the time the tenancy agreement is signed. The government will provide stamp duty exemptions on the instruments of transfer between the developer and financial institution, and between financial institutions and the buyer in this scheme. #3: Iskandar Malaysia, Kuala Lumpur and Penang: Flight to safety among Hong Kong investors One man’s loss is another man’s gain. In Malaysia’s case, we have seen Hong Kong investors snapping up medium to high-end properties from Iskandar Malaysia to Penang due to the ongoing unrests happening in Hong Kong. This will also help to reduce the overhang in the property market resulting in improved cash flow among developers. These investors are cash-rich which is music to the ears for property developers. So amid the gloom and doom, the protests in Hong Kong has given a flicker of hope for the real estate sector which has been in the doldrums. The result is a positive trickle-down effect for the Malaysian economy and helping to create jobs in the property, law and finance sectors. #4: Iskandar Malaysia, Kuala Lumpur, Selangor and Penang: Affordable homes will continue to be in demand While the government has announced various initiatives such as Fund for Affordable Homes and Youth Housing Scheme, I believe that young Malaysians should instead focus on buying from private developers through the Home Ownership Campaign (HOC). This is because land is a state matter and the federal government may have difficulty implementing such homes across Malaysia. We have already seen from the previous budgets how homebuyers were left stranded when PR1MA was not able to deliver the 1 million units that were promised. The lack of a single government agency to spearhead the affordable home segment also complicates the matter and may mean one government agency may not be communicating with another. In addition, the limitations that are imposed on low-cost housing built by either the state or federal government may impact your capital appreciation in the future. Private developers are in the business and have to means to deliver such homes. Take advantage of the HOC as you can get a 10 per cent discount for qualified properties that will be matched with stamp duty exemptions. You may also want to apply for a home jointly with your spouse or another single. This will enable you to combine your finances leading to a higher chance of getting your loans approved. This is for those who do not want to take part in the RTO scheme but instead come up with the 10 per cent deposit on your own. When choosing for a home, apply the 5CS. Check the masterplan: A masterplan would typically define a township’s development in the next one to two decades. Check the transport masterplan Generally, properties close to transportation hubs such as MRT or LRT stations can command a premium of between five and 10 per cent over the long term. Check budget allocation from the government Government policies do have an indirect impact on a property. For example, budget allocation for improvements in public infrastructure and new economic drivers will have an impact on new and existing homes in and around the vicinity of an area. So check where the government is building new hospitals or schools. Check for economic drivers You should study an area before buying your property. The best strategy is to buy in an area that is not yet developed but where there are plans for various economic drivers. A government-mooted economic corridor or a reputable developer that has experience in building townships are great indicators if the area will ‘succeed’ or not. Check for job creation This is like feeling someone’s pulse. You need to check if the township you are eyeing is going to be a ghost town or a happening place. If it is the former, perhaps you should stay away. If it is the latter, more and more workers will be drawn there, becoming a magnet for people and a hive of activity. People are the lifeblood of a neighbourhood. As the area becomes highly desirable, people will naturally want to live and work in and around the vicinity. As there is an increase in demand, property prices in that area will also rise. That is how property prices appreciate. #5: Confusing message from the government may result in a “wait-and-see’ situation among foreign investors Recently, the federal government had announced that it was reducing the minimum purchase price from RM1 million to RM600,000 to reduce the overhang in Malaysia’s property market.

To reduce the overhang, Budget 2020 now allows foreigners to buy completed and unsold units that are priced above RM600,000. Subsequently, Housing and Local Government Minister Zuraida Kamaruddin clarified that will be implemented only for a year starting from 2020. However, each state has the right to implement its own minimum purchase price which makes the implementation difficult. In addition, Malaysian My Second Home (MM2H) applicants now can no longer import a car according to MM2H agents who are involved in such applications and will require additional approval from the Housing Ministry This, they said, results in longer processing time and sends a confusing signal to foreign investors on Malaysia’s intention to lure foreign investors. So, except for Hong Kong investors, the rest may likely adopt a wait-and-see” approach until they see some clarity. Located within the Eastern Gate Development Zone of Iskandar Malaysia, Bandar Seri Alam boasts a number of good schools and is dubbed the 'City of Knowledge'. By Khalil Adis Bandar Seri Alam is one of Johor's best-kept secrets. Home to 16 educational institutions and located in between Pasir Gudang and Permas Jaya, the township has a growing young population of around 220,000. We list down some of the attractive points about living in Bandar Seri Alam. #1: Located in the growth corridor of Flagship Zone D of Iskandar Malaysia Also known as the Eastern Gate, this is the third phase of Iskandar Malaysia's next growth. There are a few catalytic projects currently happening here, namely Iskandar Halal Park (formerly known as Johor Halal Park) and the Pengerang RAPID Project. First announced on 19 November 2015 by the former Chief Minister of Johor Dato' Khaled Nordin during the Johor Budget 2016, it is part of the state government's effort to promote entrepreneurship in Johor. A 50:50 joint venture collaboration between UMLand and the Johor State Government via Johor Biotechnology & Biodiversity Corporation (J-Biotech), the private-public initiative aims to put it as an international halal park and is one of the catalyst projects in Eastern Iskandar Malaysia. Recently, IHP scored a major coup among when US based-company, Chocolat Moderne from New York, picked JHP as the manufacturing site to set up its first business in Asia. Meanwhile, the Pengerang RAPID Project will be the largest oil & gas hub in Malaysia that will create around 40,000 to 50,000 job creation in the construction industry, 400 jobs for engineers and 4,000 jobs for trained technical. #2: Education is a recession-proof industry One of the attractive factors about Bandar Seri Alam is it is home to a number of higher learning institutions such as Universiti Teknologi Mara campus, Universiti Kuala Lumpur campus, the Masterskill University College of Health Sciences campus as well as international schools. While the Iskandar Puteri/Medini and Johor Bahru/Danga Bay areas boast a number of catalytic industries such as tourism and finance, they are not immune to economic down cycles. Bandar Seri Alam is 100 per cent focussed on education, particularly among the local population. This makes it even more attractive as education in an evergreen industry. One of the oldest and biggest schools in Malaysia, Foon Yew High School is set to open its third campus in Bandar Seri Alam in 2021. #3: Homes are still affordable with the potential for capital appreciation According to data from Brickz, prices of homes here were transacted at a median price of RM320 per sq ft from Jan 2018 to Dec 2018. In comparison, homes in Iskandar Puteri/Medini and Johor Bahru/Danga Bay are priced at around RM900 per sq ft. Being a relatively new township surrounded by various property booster will give room for capital appreciation for homes here. This, plus the price point, make it suitable among first-time homebuyers. #4: Master planned by a reputable developer Bandar Seri Alam is one of United Malayan Land Bhd's signature projects developed by its subsidiary company Seri Alam Properties Sdn Bhd. Thoughtfully developed across 3,762 acres by its subsidiary, Bandar Seri Alam has been planned as a self-contained township with a mix of freehold residential, commercial, industrial and hospitality offerings. At the centre of this township lies a bustling commercial arena with various exciting and attractive retail features and green elements. Some of the world's best brands can be found here including Starbucks, KFC, Burger King and Subway. #5: Growing population Bandar Seri Alam is a thriving township which boasts a population of more than 220,000.

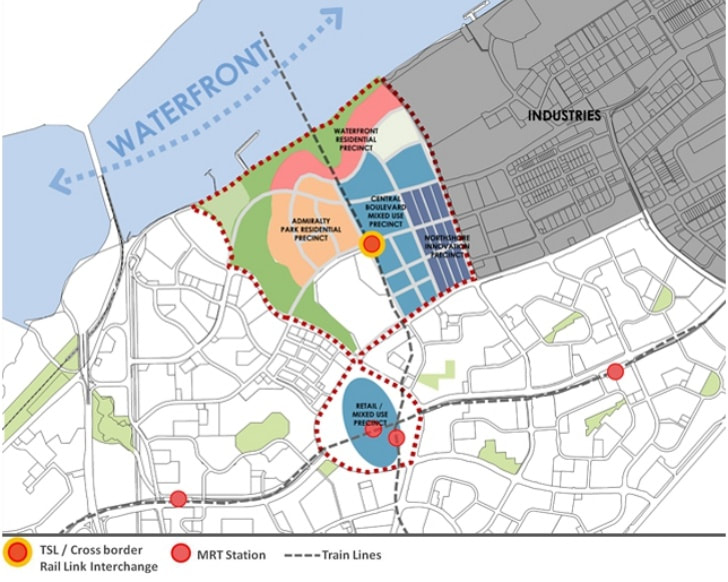

As Iskandar Halal Park and the Pengerang RAPID project are currently being developed, we can expect the population to increase in the next 10 to 15 years as more jobs are being created. As we speak, a new RM500 million Pasir Gudang Hospital will also be constructed as part of the government's announcement under Budget 2016. The game-changing project has been hit with a series of delays since the newly minted Pakatan Harapan government took power last May. With the property market in Iskandar Malaysia already in doldrums, we analyse the possible impact this may have on real estate on both sides of the causeway. By Khalil Adis When Pakatan Harapan took power in a landslide victory at the Malaysian general election last May, the ruling coalition government went to work by immediately addressing one of its election manifestos - reviewing major infrastructure projects which involve a foreign country. Singapore was no exception. Iskandar Malaysia, which was already feeling the heat from the sluggish property market, saw the High Speed Rail project at first being cancelled and then postponed. Meanwhile, the controversial Forest City project bordering Singapore was initially announced as off-limits to foreigners but was subsequently changed to build affordable homes for locals. The former is an important impetus that many developers had banked on to move their inventory amid a severe housing glut the state is facing. According to recent data provided by the Valuation and Property Services Department (JPPH), Johor recorded the highest number of residential overhang at 13,767 units followed by Selangor and Kuala Lumpur at 7,233 and 5,114 units respectively. The mismatch in the supply for homes versus what Johoreans can actually afford plus their inability to get financing have further exacerbated the property market situation in Iskandar Malaysia. The only saving grace is the cross-border rail link service linking Woodlands and Johor Bahru. Although not cancelled, the Johor Bahru-Singapore Rapid Transit System (RTS) link project is "not progressing well” as Transport Minister Khaw Boon Wan puts it. Just last week, Acting Transport Minister Dr Vivian Balakrishnan gave an update in Parliament that “further delays” are likely as Malaysia had missed the deadline in confirming its partner three times - first until September 2018, then until December. However, on December 28, Malaysia had asked to be given until February 28 this year to do so. It had missed this deadline as well. As a result, this will delay the opening of the link which was initially scheduled to be ready by December 31, 2024. Some developers, particularly in the JB Sentral area, had banked on the RTS Link, to move their unsold units. With the project now in limbo, here are the possible impacts on the property market both in Singapore and Johor: #1: Possible higher development cost around Woodlands North station In May 2012, it was announced that AECOM Technology has been awarded a US$42m contract for the design and engineering study of the RTS Link by Malaysia’s Land Public Transport Commission and Singapore’s Land Transport Authority (LTA). Under the deal, the company will provide an architectural and engineering consultancy study for the proposed RTS Link. Construction is well underway for the Thomson-East Coast MRT Line (TEL) with a plot of land allocated for the link at Woodlands North station. The station is slated to be opened in December this year. The Urban Redevelopment Authority’s (URA) master plan for Woodlands North Coast shows a mixed-use precinct for office and business parks along signature green boulevards within the station’s immediate vicinity. The delay could mean higher development cost for the terminus due to opportunity costs and inflation. #2: Higher fares The higher development cost arising from the construction delay could also mean higher fares for the RTS Link which may be passed on to consumers. However, whether or not this happens, commuters will likely switch to taking the RTS Link across the causeway as it will mean greater convenience as opposed to driving in or taking the bus. For example, commuters need to clear customs and immigration only once when they depart from either Singapore or Malaysia. Using one’s own vehicle or taking the bus will require a two times clearance with the possibility of being stuck in traffic. #3: Potential capital appreciation for existing housing developments near Bukit Chagar RTS station affected The Bukit Chagar RTS station will be located at the open car park next to the Sultan Iskandar Building complex. Surrounding the station are landed terrace homes and condominium towers TriTower Residence and Bukit Chagar Apartments. According to data from Brickz, from May 2017 to Jan 2018, the average per sq ft pricing for the landed homes in the area was RM354 per sq ft. Meanwhile, the average per sq ft transacted pricing for Bukit Chagar Apartments from Mar 2017 to Dec 2017 was RM395 per sq ft. There is no data for TriTower Residence built by SKS Group, formerly known as Maha Builders Group or MB Group. With the delay, the potential capital appreciation arising from the spillover impact from the RTS Link will take a longer period beyond 2024. Despite this, market talk is SKS Group has plans to build a covered link to the Bukit Chagar RTS station. If this is true, investors of TriTower Residence will stand to benefit the most. #4: Developments around JB Sentral affected The delay will also impact surrounding developments in JB Sentral as it will mean longer gestation period for the commercial, property and tourism sectors. The game-changing project could provide a much-needed boost to complement Johor Bahru’s ambitious RM1.8 billion rejuvenation programme that was unveiled by former Malaysian Prime Minister Najib Razak in 2010. This is because it will bring an inflow of investments from Singapore that will benefit the sectors mentioned. Although the Sungai Segget rehabilitation is now completed, the project proved to be quite a letdown. The project was spearheaded by the Iskandar Regional Development Authority (IRDA) with a reportedly whopping RM20 million consultation fee. The entire cost is an estimated RM57 million. The project was supposed to provide a booster to the nearby malls such as Johor Bahru City Square and KOMTAR JBCC as well as shophouses. It was also supposed to be a tourist attraction much like Clarke Quay as it was modelled after South Korea’s Cheonggyecheon river restoration project in South Korea. This explains why developers like UMLand had acquired land banks near to Jalan Wong Ah Fook for the opening of Suasana Iskandar Malaysia. Given the high cost, naturally, the expectation among stakeholders was high. However, some developers, shop owners and retailers were reportedly not very happy about the way the river cleaning project had turned out. While the river no longer emits an odour, littering is still common. The only saving grace for the river is a miserable small fish pond with a fountain in the middle of it. Surely the river rejuvenation project can do much better. #5: Ibrahim International District as the potential jewel of Johor Delays and disappointments aside, there is a gateway district coming up in Johor Bahru that will mirror the one at Woodlands North station. Called Ibrahim International District, the project is named after the Sultan of Johor. Under his auspices and blessings, His Majesty has set the target of making Johor Baru the second biggest city in Malaysia after Kuala Lumpur. As such, we can be sure the project will receive the state’s 110 per cent commitment to make it shine as the jewel of Johor. With a gross development value of RM3 billion, Ibrahim International District is an ambitious mixed-use development that will comprise six towers -– a hotel, a hotel with residences, an office, medical suites high-rise and two serviced apartment towers and a mall with an estimated gross floor area of 80,000 sq ft. The district is currently under construction. There are plans to build a linkway from Persada Johor to Coronation Square at Ibrahim International District. However, there is no word yet if the district will be connected to the future Bukit Chagar RTS station. If it does, it will enhance property values in the area, albeit beyond 2024. #6: One Bukit Senyum as the current property booster Nevertheless, there is light at the end of the tunnel as the only property booster around JB Sentral is the One Bukit Senyum project by Singapore Exchange-listed Astaka Holdings Limited. Home to the tallest residential towers in Southeast Asia, Astaka, One Bukit Senyum will be Johor Bahru’s new central business district when fully completed in 2021. One Bukit Senyum will be developed in two phases. The first comprises The Astaka, with a total of 438 units. The development, which is Johor’s most luxurious condominium development by far, was completed late last year. Phase two will comprise Johor Bahru City Council’s new headquarters, a 450-room five-star hotel, 1012 residences, 254-key serviced apartments, a 1.5 million square feet shopping mall and a Grade A office building. Conclusion The JB-Woodlands RTS Link is a complicated matter as it involves the state and federal governments.

Nevertheless, it will be a win-win situation for both Singapore and Malaysia to continue with the project as it will mean and inflow of investments, particularly for Johor. It will also ease the daily commute among Johoreans who are working in Singapore. The spirit of good neighbourliness should prevail. Buying a home will be your single most expensive investment in your life and these are the most common mistakes you should avoid. By Khalil Adis Buying your first home is an exciting experience that will have you go through a range of roller-coaster emotions. From scouting for the right property to securing a loan, the procedures are endless that it is so easy to lose sight of what is important: #1: Buying based on emotions Buying a property based on emotions can cause you to gloss over some of its inherent shortcomings. It is like falling in love in someone gorgeous until they start to open their mouth. The initial phase may elicit a response such as exhilaration over its interior design finishing and then imagining how it would be like to sit in front of that bay window in that sleek glasshouse apartment. However, your emotions can bite you back over the long run as such a home will result in hefty utility bills in the long term. When buying a property, you should make calculated decisions by asking yourself these basic questions: Is the property priced fairly? Do your market research to find out what is the average price per sq ft of the property in the vicinity. This is important as it will ensure your property can have room for capital appreciation in the future. Are there nearby amenities like schools, hospitals and train stations? This will make the area desirable and attract people to want to live, work and play there. As demand increases, it will attract a significant population leading to the capital appreciation of your property. If you want to start a family, these are important considerations. Can the property be rented out or sold in the future? There will be some point in your life that you may end up as a landlord or a seller. Therefore, you must put yourself in the position of a tenant or a buyer by really looking at the property for what it is. As such, check if there any defects that may affect its future rentability or value. It is a good idea to upkeep your property to ensure all the electrical points and sanitary appliances are working while giving it a fresh coat of paint every year. You might also want to look at your interior design, layout and colour schemes and see if they will appeal to potential tenants or buyers. #2: Buying a house facing East-West orientation You should avoid buying a house that is facing the East-West orientation as it is directly exposed to the afternoon sun and therefore increases the heat gain. During night time, the concrete walls will radiate back the heat to your home leading to higher utility bills from your air-conditioning unit. Instead, you should go for a home that is facing North-South orientation. Do also ensure there is cross-ventilation from one end of the house to another to encourage natural air flow. #3: Buying an odd-sized unit An oddly sized unit refers to a layout which has odd corners like a triangle or irregularly shaped like an oval or circle. Such homes have an inefficient layout meaning that it will result in wasted space which cannot be utilised. It is also bad in terms of feng shui should the odd corners have an acute angle as they will collect energy that cannot be dispersed. Instead, you should opt for a regularly shaped unit like a square or rectangle. Remember this golden rule when it comes to a home layout: boring equals good. #4: Buying a common unit versus one that is scarce This is especially applicable for the property market in Malaysia where there is a severe oversupply of homes particularly in Johor and Kuala Lumpur. When buying a home, you should opt for a unit that is scarce. You should first study the development carefully and the unit types that are available. For example, in a project where 4-bedroom greatly outnumber 2-bedroom units, you should opt for the latter. This is because such units will be easier to offload in the resale market should you wish to sell or rent it out in future. Of course, you must take into consideration your family size before making the final decision. #5: Not asking about your prospective neighbours A neighbour can make or break your property.

This is especially true if you are buying a resale home. Recently, a friend confided how he had to move out from his current home to rent another place in eastern Singapore. He had bought the HDB flat from the resale market from an owner who appeared desperate to sell it off. “Don’t tell the neighbour downstairs how much I sold this house,” the owner said ominously. This should have been a red flag. After moving in, he realised his neighbour downstairs would often make a din throughout the entire day. Sometimes, he would have the police knocking on his door as the neighbour had complained about him for no reason. This caused him and his family so much distress that the neighbour’s mom had to come up to explain and apologise for her son’s erratic behaviour. Apparently, her son suffers from a mental illness. After talking to his neighbour, he realised the previous owner was not on good terms with the entire family. This explains their decision to sell the flat. While he now lives a quieter life elsewhere, his tenants are now at the receiving end of the neighbour’s constant abuse. For example, recently, he received a call from the HDB complaining about the apparent noises from his unit. Thankfully, the HDB and the police are aware of his problematic neighbour and have since closed the case. Unfortunately, you cannot choose your neighbours if you had bought a new home directly from the HDB or developer. However, you can mitigate your risks by being a good neighbour. For instance, why not offer a serving of cookies or cakes during your festive celebration? While your actions may not be reciprocated, a friendly hello on your neighbour’s door and offering such goodies will certainly go a long way in making a good first impression last. Neighbours do talk so why not give them something good to talk about? Gear up for a bumpy ride next year in Malaysia’s property market as the number of unsold units continues to rise. Despite the challenges, there are some opportunities for investors and rent-seekers. By Khalil Adis According to the Valuation and Property Services Department’s (JPPH) latest figures, the number of unsold completed residential units rose from 20,304 units to 30,115 units year-on-year as at 30 September 2018. This represents an increase of 48.35 per cent. Meanwhile, the total value was RM19.54 billion, representing a 56.44 per cent rise from RM12.49 billion a year ago. However, if JPPH were to also include serviced apartments and small offices home offices (SoHos), this would bring their overhang value to 40,916 units valued at RM27.38 billion. According to JPPH, Johor has the largest number of unsold completed serviced apartments and SoHo units at 7,714. JPPH notes that it rose a whopping 191 per cent from the 2,647 units recorded a year ago. The overhang in serviced apartments is valued at RM6.16 billion compared with its residential overhang of RM4.44 billion. This means the total overall value of its unsold serviced apartments is 1.5 times that of residential housing. In summary, Johor has the highest number of completed unsold units in Malaysia at 6,053. This is a 55 per cent increase from the 3.901 units a year ago. With an overhang in supply spanning from Johor to Selangor, here are some of the likely property trends to emerge next year. #1: Renter’s market The new supply of the completed units plus the those from existing units will lead to a downward pressure in the rental market causing rentals to fall. This is because rent-seekers will be spoilt for choice while landlords will be fighting for tenants. This will make it ideal for rent-seekers as landlords will most likely be open for price negotiations. Meanwhile, it is bad news for landlords should they be able to find a tenant or not. In the former, the rental will most likely not be able to cover the mortgage resulting in negative cash flow. In the latter, landlords will have to cover the mortgage themselves. Those who cannot will have no choice but the let go of their units. #2: Buyer’s market The property market will also favour buyers as sellers will be desperate to offload their properties, especially those who have multiple units. Therefore, buyers will be in a more stronger position to bargain in a market flooded with so many units. #4: Buy properties in the secondary market If you urgently need a roof over your head, then the secondary market is the way to go as you are buying a completed property. Sellers are also more willing to negotiate on the terms of payment and will likely cut a flexible payment deal via their agents if you do not have a sufficient deposit in hand. In addition, the supply overhang also mean that properties in the secondary market are priced 20 to 30 per cent cheaper than new launches. However, do bear in mind that you need to pay a 10 per cent deposit. #5: Overhang in supply means good deals in the auction market Unfortunately, there will also be distressed properties which will be auctioned off in court. If you are looking for a below market value (BMV) property, then this will present a very good opportunity for you. When buying a BMV, you will need to attend an auction in court and prepare a bank draft in advance to show of interest. This will cost you around 10 per cent of the reserve price. For example, if the property is being auctioned off at RM50,000, you will need to prepare RM5,000 in bank draft. If you have successfully bid for the property, you will need to settle the balance of the payment within 120 days. However, there are a lot of hidden costs, for example, legal, quit rent (cukai pintu), unpaid utilities and maintenance fees, assessments and so on. Perhaps, the biggest risk is this - while the property is legally yours, you may find it hard to evict the tenants or owners. You may have to apply for a court order, through a lawyer, to evict the occupants. This process can take you up to four weeks and costs you between RM1,500 to RM2,000. Even so, there are no guarantees they can be evicted as Malaysian laws favour occupiers. When buying a BMV property, it is best to find out if the property is occupied by tenants or owners. #6: It also means good deals from the primary market Developers have to move their unsold inventory as each unit means added cost for them. As such, developers will be coming up with creative schemes like zero downpayment and such to lure buyers. Speak to a good developer and check if they have a good master plan to ensure your property values are protected. Remember the 5Cs I always talk about? Check against them before you commit to buying a property, #7: More restrictions on Airbnb accommodations Making money from your short stay travellers may prove to be even harder even if the government legalises Airbnb. This is because we are seeing trends of management committees barring Airbnb-type of accommodation due to security and safety issues. So before you decide to list your untenanted unit on Airbnb, it is best to check with your management committee if this is allowed. However, if you happen to own a serviced apartment, this will not be an issue as it falls under a commercial title. #8: Transit-oriented developments (TODs) along SSP Line The Sungai Buloh-Serdang-Putrajaya Line (SSP Line) is one of the few major infrastructure projects that will be continued under the newly elected government.

In fact, the project is currently under construction and is fast taking shape. Some developers have already acquired land banks along this line to build TODs. Areas to watch out for include Kwasa Damansara, Kwasa Sentral, Sungai Besi, Bandar Malaysia and Cyberjaya City Centre JB is taking the word ‘hipster' up a few notches and giving Kampong Glam a serious run for its money. By Khalil Adis When the Singapore authorities announced in October that Blu Jaz Cafe's entertainment licence is cancelled, it marked another dent for the entertainment industry in the hip Kampong Glam enclave. Home to Zam Zam Restaurant, the historic Sultan mosque, bars and restaurants, Kampong Glam is a popular hangout destination among locals and tourists alike. However, since the banning of shisha in July 2016, the area has lost its lustre as many businesses were affected. One in particular, called Cafe Le Caire, was a popular watering hole but is now no longer in operation. What still remains are the textile and carpet shops. With one less entertainment outlet in Singapore, JB's heritage area is fast coming up as a viable alternative. Once associated with sleaze, Jalan Dhoby is now home to a number of hip establishments which are popular among the young and the young-at-heart. In addition, the shophouses are decorated with funky street art almost reminiscent of Georgetown's. With two weeks shy of 2019, here are our top picks to explore within JB's heritage area. #1: Restoran Hua Mui No.131, Jalan Trus, Johor Bahru, 80000 Johor Bahru, Malaysia Restoran Hua Mui serves a good mix of Western and local dishes and is popular among Johoreans and Singaporeans. Unfortunately, it gets especially busy during lunchtime and that is when service standards drop. I would recommend coming here to have your breakfast instead before exploring the rest of the heritage area. The chicken and eggs sandwiches come highly recommended with a dollop of Lingham's Chilli Sauce. #2: Explore the pre-war shophouses at Jalan Trus Located at the intersection of Jalan Dhoby and Jalan Trus, the shophouses were built during the 1800s but has now been given a new lease of life thanks to the creative facade treatment. There is also a shop here that sells vintage clothing and apparels. Whichever you decide to check out, the shophouses here will certainly appeal to photography buffs and those looking to update your #ootd Instagram shots. Who knows? You might just find an outfit at the boutique here! #3: Hiap Joo Bakery 13, Jalan Tan Hiok Nee, Johor Bahru, 80000 Johor Bahru, Malaysia Hiap Joo Bakery is one of JB's best-kept secrets that it reportedly counts the Sultan of Johor as one of its fans. Renowned for their coconut buns and freshly made banana cakes, many locals make a beeline for them in the morning. In fact, their coconut and kaya buns are so popular that they usually run out by noon. What makes Hiap Joo Bakery authentic is its old-school method of cake-baking which it inherited from its former British owner. All the cakes and buns are baked in a classic wooden kiln which leaves them with a unique charcoal aftertaste. If you still can't get enough of its freshly made cakes and buns, fret not! You can buy its very own kaya spread to savour it from the comfort of your home. #4: IT Roo Cafe 17, Jalan Dhoby, Johor Bahru, 80000 Johor Bahru, Johor, Malaysia For lunch, just head to IT Roo Cafe located just around the corner. Touting itself as having "the best chicken chop in town", you can choose to have it either grilled or fried with a choice of mushroom or black pepper sauce. The dish comes complete with a serving of coleslaw and fries. Aside from its signature dish, IT Roo Cafe also serves up popular local dishes like fried rice and noodles. Be sure to arrive early as it can be difficult to get a seat during the lunch hour. #5: Chaiwala & Co. Container Cafe Lot 2180 Jalan Tan Hiok Nee, Johor Bahru, 80000 Johor Bahru Johor, Malaysia Owned by a former sailor, Chaiwala gets its namesake from a disused shipping container which has become its signature look. In fact, it has spawned a number of copycats within its immediate vicinity making it a draw among photographers and hipsters alike. Some of its signature drinks include Thai milk tea and Vietnamese coffee served hot or chilled. You can even customise your drinks with a base comprising either tea, milk tea, coffee, fresh milk or smoothie with a range of flavours. The only drawback is there is no wifi here so it is best to stick to taking your Instagram shots. #6: Cafe Al-Fayeed Off Jalan Pahang, Johor Bahru, 80000 Johor Bahru, Johor, Malaysia Fancy a serving of shisha? Well, look no further than Cafe Al-Fayeed which is also located within walking distance. Prepared by tattoed servers with technicoloured dyed hair, there are many flavours to choose from with an option to have it served with ice at just RM11! Cafe Al-Fayeed also serves up popular side dishes such as fries to go along with your shisha. For those who prefer a heartier portion, the cafe also offers a wide selection of Western and local dishes at very reasonable prices. Music can get a tad bit loud with popular hip-hop tunes and EDM club bangers blaring from the speakers. #7: Santai2 Ok, we don't really have a specific address here but it will be hard to give this wellness establishment a miss as it is housed within a red-hot container along Jalan Dhoby. Offering foot massage and traditional Malay urut, Santai2 is a welcome respite after all those walking. Foot massage starts from around RM45 while a full body traditional Malay urut is priced from RM65. Both male and female therapists are available. #8: Pasar Karat Jalan Segget, Bandar Johor Bahru, 80000 Johor Bahru, Johor, Malaysia Stock up on those pomades in various fragrances or shop for handphone covers at this night market located just a stone throw's away from the heritage area.

Pasar Karat, which means rusty market, comes alive from 7 pm onwards and attracts a strong Johorean crowd. Selling just about anything from exotic pets to Malay kuehs, the night market gets especially busy during Ramadan as many would throng the market as they gear up for Hari Raya Aidilfitri. |

Khalil AdisAn independent analysis from yours truly Archives

July 2023

Categories

All

|

100 Peck Seah Street

|

|

RSS Feed

RSS Feed