|

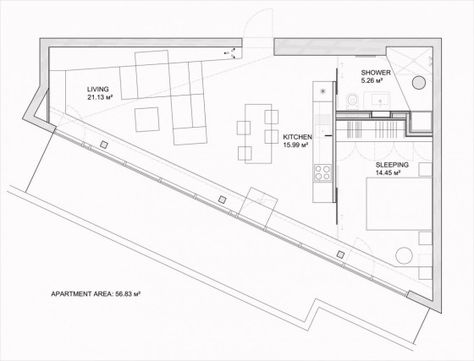

Get rich quick schemes that target the vulnerable should be regulated. By Khalil Adis During an economic downturn, many so-called experts will enter the market with click-bait worthy headline on social media promising massive profits. In fact, I happen to know some of these experts. One of the experts would go on to sell a course that encourages overleveraging. My post is in no way to disparage any experts but to highlight the dangers of overleveraging in the greater public interest. Fake it till you make it Years ago, I was approached by this particular expert who had asked me to help him market his course in Singapore. In return, he had promised a cut from the profits. The expert had also told me how his motto in life was to “fake it till you make it”, as he had put it. Since I was trained in architecture and interior design, I had asked the expert to comment on my interior design floor plan. However, I never received neither his proposal nor feedback. A glamorous new life Recently, I saw on social media that he has reinvented himself with a course that encourages overleveraging. The captions and photos on social media seem to suggest that you too can lead an equally glamorous life as depicted. It got me thinking about his motto and if others understand the dangers of overleveraging. The dangers of overleveraging Overleveraging means to commit yourself to more debts than you can handle. Of late, there was a social media buzz that highlights this danger that apparently led a young man to commit suicide. The young man had apparently bought several properties at a substantial discount and had hoped to generate positive cash flow from the rental. However, in light of the severe oversupply in residential units in Malaysia as well as the very soft market, I am afraid he may have been taken advantage of by unscrupulous developers who are desperate to offload their units. With the current market reality in Malaysia, I doubt his rental can cover his mortgage resulting in negative cash flow. Assuming he has to top up RM1,000 per unit, that works out to RM4,000 per month. Also, there is a possibility that the developer had priced up the unit and then sold it off at a ‘discount’ to make the buyer feel good. However, in the resale market, valuers will take into account the current transacted value of the area and not the selling price from the developer. Let’s do the math. Assuming the developer had priced it at RM1,000 per sq ft and he now wants to sell the unit, valuers will value the property accordingly. Should recent transactions show that units in the area were sold at RM700 per sq ft, he would have to sell it at a loss of RM300 per sq ft. For a 1,000 sq ft unit, that works out to RM300,000! Let’s not even talk about the possible commission the expert may have earned on the side from the units sold as well as from bank referral fees. Ultimately, the one at the losing end is you. A word of caution I would urge consumers to do a lot of research, check the expert’s credentials and analyse if their methods make sense.

You should also conduct your own due diligence by going down on site to study the area to check if there is demand in the rental and resale market for the project that is on offer. Find out what is the resale value current via Brickz and then compare it to how much the developer is selling it. This will give you an estimate on how much the developer had marked up the unit. Also, you should plan your exit strategy should you not be able to get a tenant. Can you do an Airbnb instead? Also ask yourself, “can I afford to take up so much loan?” I would also like to remind consumers not to be easily blinded by the show of material wealth on social media. They are most likely curated image meant to create an illusion that you too can live that ultimate lifestyle. Live within your means, enjoy a good night’s sleep and don’t get trapped in the debt cycle. Remember this, if it is too good to be true, it probably is.

0 Comments

Despite the tepid HDB resale market, Punggol has bucked the trend with a loft unit at Punggol Sapphire recently changing hands for almost a million dollars. Here are the lowdowns about living in Punggol. By Khalil Adis Punggol has indeed come a long way from being an ‘ulu’ area. Once known as a rural settlement complete with kampungs and farms, Punggol has since 1998 transformed itself from a backwater area to a vibrant, modern yet green satellite district. Amid Punggol’s oasis of calm, you can see LRT trains whirring through the residential areas, passing by the ample lush natural landscape before taking you directly to the heart of the district, Punggol Central. While Punggol’s rustic charms may appeal to outdoor lovers, there are certain downsides about living here. We list them down here: The good: #1: It’s oh so quiet Punggol has an estimated population of 161,570 as of 2018 with a projected 96,000 housing units once the entire "Punggol 21-plus” master plan is completed. Despite its high density, Punggol is surprisingly very quiet at night save for the traffic whizzing by the Tampines Expressway (TPE). This is definitely good news for those wanting some peace and quiet but bad news if you want the buzz of city life. If you still want to move to Punggol, fret not as Waterway Point has all the modern conveniences and amenities for your city living. #2: Well landscaped parks and gardens Nature and outdoor lovers will revel in the many landscaped parks and gardens that Punggol has to offer, including the award-winning My Waterway@Punggol. From the Matilda District, you can enjoy a stroll or jog by the Punggol River before reaching Punggol Dam and Punggol Point. This is part of the comprehensive Park Connector Network (PCN) linking the entire island. The view is awe-inspiring and enough to make even the laziest couch potato get up and explore nature #3: Properties here are in demand. Being a relatively new township development with a young demographic, Punggol has proven to be popular among homebuyers as a few HDB housing projects are now eligible to be sold in the resale market. According to the fourth quarter of 2018 data from the HDB, the Resale Price Index (RPI) fell by 0.2 per cent, from 131.6 points in the third quarter to 131.4 points in the fourth quarter in 2018. For the whole year, the RPI declined by 0.9 per cent in 2018. Despite the lacklustre market, a five-room, loft unit in Punggol Sapphire was sold for S$910,888 in January 2019. This was considered a record for an HDB flat in northeastern Singapore. Additionally, OrangeTee & Tie's research showed that in the third quarter of 2018, Punggol was the fourth most popular area for HDB resale flats with 469 units transacted followed by Jurong West (505 units), Woodland (516 units) and Sengkang (528 units). On the overall, resale statistics from the HDB showed that the median prices of three, four and five-room flats were transacted at S$343,000, S$455,000 and S$445,000 respectively in the fourth quarter of 2018. #4: Comprehensive public transport network Commuting in and around Punggol is very convenient as there is a comprehensive transport network comprising MRT, LRT and buses. In fact, the township has been planned such that each housing estate is located within 300 m away from any LRT station. An exception, however, is the new housing area at the Matilda district. #5: Punggol Digital District Come 2023, a new smart city is set to rise in Punggol called the Punggol Digital District. Housing technology firms involved in key growth fields as well as the new Singapore Institute of Technology Campus, Punggol Digital District will create around 28,000 jobs while providing residents with more lifestyle and dining options. In the pipeline includes the new Punggol Coast MRT Station which will be an extension of the North-East Line. Punggol Digital District will also enjoy enhanced connectivity via the Cross Island Line (CRL) which will link it to Jurong Lake District and Changi by around 2030. Collectively, they will act as property boosters for Punggol. The bad: #6: Lack of good hawker food Food. That’s our favourite national past time that defines if we love or hate or neighbourhood. Having lived in Taman Jurong, I must say I was spoilt for choice with various options of mouth-watering hawker fares such as the famous Boon Lay Power Nasi Lemak. However, the choices have become extremely limited in Punggol unless you are into fast food. While there are coffee shops serving local cuisines, they pale in comparison to the well-established hawker fares that you can find elsewhere. You are better off cooking your own meals. #7: Dust If you hate spring cleaning, be prepared for a rude shock. With many construction works going on, you will find yourself dusting up every single day. Windows, top of shelves, cupboards and other surfaces collect dust easily. This certainly isn’t good news if you are asthmatic or are prone to allergies. If so, you might want to invest in a good ioniser to keep your indoor air free of particles and other irritants. The ugly: #8: Get ready to jostle with the early morning crowd If you think Singaporeans are a kiasu lot, be prepared to see that word taken to new heights when you commute to work in the morning. In fact, many would play ‘musical chairs’ as they hustle for seats at on the MRT. Meanwhile, getting a Grab or taxi would be almost impossible. To get around this, I would leave home by 6 am and get to the office by 7 am. #9: That acrid smell in the air While Punggol may be planned as a green township development, be prepared for a strong burning smell that would emanate from time to time.

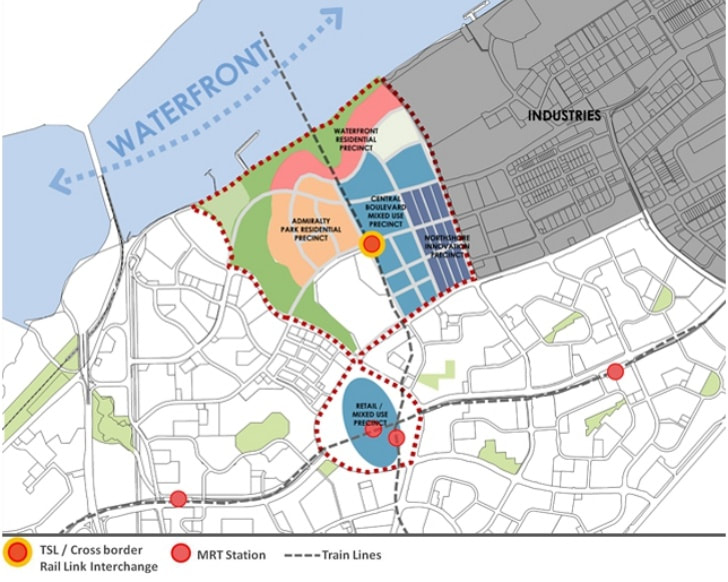

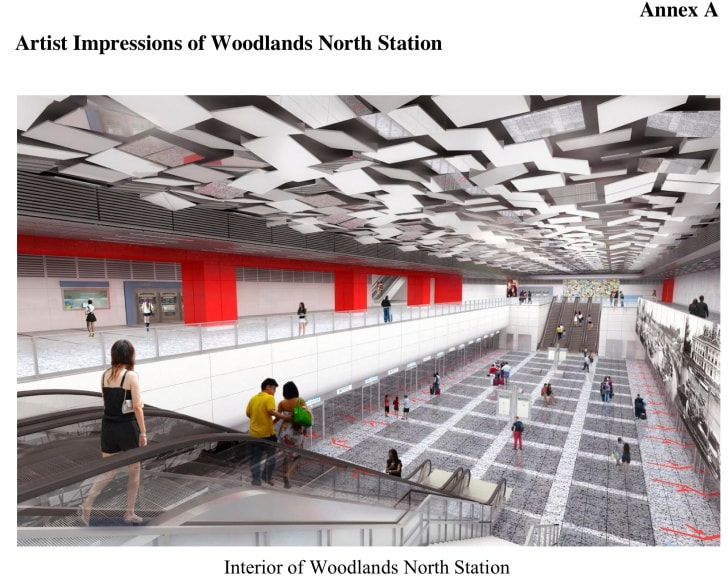

Located just opposite the industrial area of Pasir Gudang, Johor, the smell has become increasingly acrid over the past few days that it will linger from night till dawn. In fact, it can get so bad that you might have to get up in the middle of the night to close the windows. This is something perhaps developers and HDB will not tell you. The game-changing project has been hit with a series of delays since the newly minted Pakatan Harapan government took power last May. With the property market in Iskandar Malaysia already in doldrums, we analyse the possible impact this may have on real estate on both sides of the causeway. By Khalil Adis When Pakatan Harapan took power in a landslide victory at the Malaysian general election last May, the ruling coalition government went to work by immediately addressing one of its election manifestos - reviewing major infrastructure projects which involve a foreign country. Singapore was no exception. Iskandar Malaysia, which was already feeling the heat from the sluggish property market, saw the High Speed Rail project at first being cancelled and then postponed. Meanwhile, the controversial Forest City project bordering Singapore was initially announced as off-limits to foreigners but was subsequently changed to build affordable homes for locals. The former is an important impetus that many developers had banked on to move their inventory amid a severe housing glut the state is facing. According to recent data provided by the Valuation and Property Services Department (JPPH), Johor recorded the highest number of residential overhang at 13,767 units followed by Selangor and Kuala Lumpur at 7,233 and 5,114 units respectively. The mismatch in the supply for homes versus what Johoreans can actually afford plus their inability to get financing have further exacerbated the property market situation in Iskandar Malaysia. The only saving grace is the cross-border rail link service linking Woodlands and Johor Bahru. Although not cancelled, the Johor Bahru-Singapore Rapid Transit System (RTS) link project is "not progressing well” as Transport Minister Khaw Boon Wan puts it. Just last week, Acting Transport Minister Dr Vivian Balakrishnan gave an update in Parliament that “further delays” are likely as Malaysia had missed the deadline in confirming its partner three times - first until September 2018, then until December. However, on December 28, Malaysia had asked to be given until February 28 this year to do so. It had missed this deadline as well. As a result, this will delay the opening of the link which was initially scheduled to be ready by December 31, 2024. Some developers, particularly in the JB Sentral area, had banked on the RTS Link, to move their unsold units. With the project now in limbo, here are the possible impacts on the property market both in Singapore and Johor: #1: Possible higher development cost around Woodlands North station In May 2012, it was announced that AECOM Technology has been awarded a US$42m contract for the design and engineering study of the RTS Link by Malaysia’s Land Public Transport Commission and Singapore’s Land Transport Authority (LTA). Under the deal, the company will provide an architectural and engineering consultancy study for the proposed RTS Link. Construction is well underway for the Thomson-East Coast MRT Line (TEL) with a plot of land allocated for the link at Woodlands North station. The station is slated to be opened in December this year. The Urban Redevelopment Authority’s (URA) master plan for Woodlands North Coast shows a mixed-use precinct for office and business parks along signature green boulevards within the station’s immediate vicinity. The delay could mean higher development cost for the terminus due to opportunity costs and inflation. #2: Higher fares The higher development cost arising from the construction delay could also mean higher fares for the RTS Link which may be passed on to consumers. However, whether or not this happens, commuters will likely switch to taking the RTS Link across the causeway as it will mean greater convenience as opposed to driving in or taking the bus. For example, commuters need to clear customs and immigration only once when they depart from either Singapore or Malaysia. Using one’s own vehicle or taking the bus will require a two times clearance with the possibility of being stuck in traffic. #3: Potential capital appreciation for existing housing developments near Bukit Chagar RTS station affected The Bukit Chagar RTS station will be located at the open car park next to the Sultan Iskandar Building complex. Surrounding the station are landed terrace homes and condominium towers TriTower Residence and Bukit Chagar Apartments. According to data from Brickz, from May 2017 to Jan 2018, the average per sq ft pricing for the landed homes in the area was RM354 per sq ft. Meanwhile, the average per sq ft transacted pricing for Bukit Chagar Apartments from Mar 2017 to Dec 2017 was RM395 per sq ft. There is no data for TriTower Residence built by SKS Group, formerly known as Maha Builders Group or MB Group. With the delay, the potential capital appreciation arising from the spillover impact from the RTS Link will take a longer period beyond 2024. Despite this, market talk is SKS Group has plans to build a covered link to the Bukit Chagar RTS station. If this is true, investors of TriTower Residence will stand to benefit the most. #4: Developments around JB Sentral affected The delay will also impact surrounding developments in JB Sentral as it will mean longer gestation period for the commercial, property and tourism sectors. The game-changing project could provide a much-needed boost to complement Johor Bahru’s ambitious RM1.8 billion rejuvenation programme that was unveiled by former Malaysian Prime Minister Najib Razak in 2010. This is because it will bring an inflow of investments from Singapore that will benefit the sectors mentioned. Although the Sungai Segget rehabilitation is now completed, the project proved to be quite a letdown. The project was spearheaded by the Iskandar Regional Development Authority (IRDA) with a reportedly whopping RM20 million consultation fee. The entire cost is an estimated RM57 million. The project was supposed to provide a booster to the nearby malls such as Johor Bahru City Square and KOMTAR JBCC as well as shophouses. It was also supposed to be a tourist attraction much like Clarke Quay as it was modelled after South Korea’s Cheonggyecheon river restoration project in South Korea. This explains why developers like UMLand had acquired land banks near to Jalan Wong Ah Fook for the opening of Suasana Iskandar Malaysia. Given the high cost, naturally, the expectation among stakeholders was high. However, some developers, shop owners and retailers were reportedly not very happy about the way the river cleaning project had turned out. While the river no longer emits an odour, littering is still common. The only saving grace for the river is a miserable small fish pond with a fountain in the middle of it. Surely the river rejuvenation project can do much better. #5: Ibrahim International District as the potential jewel of Johor Delays and disappointments aside, there is a gateway district coming up in Johor Bahru that will mirror the one at Woodlands North station. Called Ibrahim International District, the project is named after the Sultan of Johor. Under his auspices and blessings, His Majesty has set the target of making Johor Baru the second biggest city in Malaysia after Kuala Lumpur. As such, we can be sure the project will receive the state’s 110 per cent commitment to make it shine as the jewel of Johor. With a gross development value of RM3 billion, Ibrahim International District is an ambitious mixed-use development that will comprise six towers -– a hotel, a hotel with residences, an office, medical suites high-rise and two serviced apartment towers and a mall with an estimated gross floor area of 80,000 sq ft. The district is currently under construction. There are plans to build a linkway from Persada Johor to Coronation Square at Ibrahim International District. However, there is no word yet if the district will be connected to the future Bukit Chagar RTS station. If it does, it will enhance property values in the area, albeit beyond 2024. #6: One Bukit Senyum as the current property booster Nevertheless, there is light at the end of the tunnel as the only property booster around JB Sentral is the One Bukit Senyum project by Singapore Exchange-listed Astaka Holdings Limited. Home to the tallest residential towers in Southeast Asia, Astaka, One Bukit Senyum will be Johor Bahru’s new central business district when fully completed in 2021. One Bukit Senyum will be developed in two phases. The first comprises The Astaka, with a total of 438 units. The development, which is Johor’s most luxurious condominium development by far, was completed late last year. Phase two will comprise Johor Bahru City Council’s new headquarters, a 450-room five-star hotel, 1012 residences, 254-key serviced apartments, a 1.5 million square feet shopping mall and a Grade A office building. Conclusion The JB-Woodlands RTS Link is a complicated matter as it involves the state and federal governments.

Nevertheless, it will be a win-win situation for both Singapore and Malaysia to continue with the project as it will mean and inflow of investments, particularly for Johor. It will also ease the daily commute among Johoreans who are working in Singapore. The spirit of good neighbourliness should prevail. Buying a home will be your single most expensive investment in your life and these are the most common mistakes you should avoid. By Khalil Adis Buying your first home is an exciting experience that will have you go through a range of roller-coaster emotions. From scouting for the right property to securing a loan, the procedures are endless that it is so easy to lose sight of what is important: #1: Buying based on emotions Buying a property based on emotions can cause you to gloss over some of its inherent shortcomings. It is like falling in love in someone gorgeous until they start to open their mouth. The initial phase may elicit a response such as exhilaration over its interior design finishing and then imagining how it would be like to sit in front of that bay window in that sleek glasshouse apartment. However, your emotions can bite you back over the long run as such a home will result in hefty utility bills in the long term. When buying a property, you should make calculated decisions by asking yourself these basic questions: Is the property priced fairly? Do your market research to find out what is the average price per sq ft of the property in the vicinity. This is important as it will ensure your property can have room for capital appreciation in the future. Are there nearby amenities like schools, hospitals and train stations? This will make the area desirable and attract people to want to live, work and play there. As demand increases, it will attract a significant population leading to the capital appreciation of your property. If you want to start a family, these are important considerations. Can the property be rented out or sold in the future? There will be some point in your life that you may end up as a landlord or a seller. Therefore, you must put yourself in the position of a tenant or a buyer by really looking at the property for what it is. As such, check if there any defects that may affect its future rentability or value. It is a good idea to upkeep your property to ensure all the electrical points and sanitary appliances are working while giving it a fresh coat of paint every year. You might also want to look at your interior design, layout and colour schemes and see if they will appeal to potential tenants or buyers. #2: Buying a house facing East-West orientation You should avoid buying a house that is facing the East-West orientation as it is directly exposed to the afternoon sun and therefore increases the heat gain. During night time, the concrete walls will radiate back the heat to your home leading to higher utility bills from your air-conditioning unit. Instead, you should go for a home that is facing North-South orientation. Do also ensure there is cross-ventilation from one end of the house to another to encourage natural air flow. #3: Buying an odd-sized unit An oddly sized unit refers to a layout which has odd corners like a triangle or irregularly shaped like an oval or circle. Such homes have an inefficient layout meaning that it will result in wasted space which cannot be utilised. It is also bad in terms of feng shui should the odd corners have an acute angle as they will collect energy that cannot be dispersed. Instead, you should opt for a regularly shaped unit like a square or rectangle. Remember this golden rule when it comes to a home layout: boring equals good. #4: Buying a common unit versus one that is scarce This is especially applicable for the property market in Malaysia where there is a severe oversupply of homes particularly in Johor and Kuala Lumpur. When buying a home, you should opt for a unit that is scarce. You should first study the development carefully and the unit types that are available. For example, in a project where 4-bedroom greatly outnumber 2-bedroom units, you should opt for the latter. This is because such units will be easier to offload in the resale market should you wish to sell or rent it out in future. Of course, you must take into consideration your family size before making the final decision. #5: Not asking about your prospective neighbours A neighbour can make or break your property.

This is especially true if you are buying a resale home. Recently, a friend confided how he had to move out from his current home to rent another place in eastern Singapore. He had bought the HDB flat from the resale market from an owner who appeared desperate to sell it off. “Don’t tell the neighbour downstairs how much I sold this house,” the owner said ominously. This should have been a red flag. After moving in, he realised his neighbour downstairs would often make a din throughout the entire day. Sometimes, he would have the police knocking on his door as the neighbour had complained about him for no reason. This caused him and his family so much distress that the neighbour’s mom had to come up to explain and apologise for her son’s erratic behaviour. Apparently, her son suffers from a mental illness. After talking to his neighbour, he realised the previous owner was not on good terms with the entire family. This explains their decision to sell the flat. While he now lives a quieter life elsewhere, his tenants are now at the receiving end of the neighbour’s constant abuse. For example, recently, he received a call from the HDB complaining about the apparent noises from his unit. Thankfully, the HDB and the police are aware of his problematic neighbour and have since closed the case. Unfortunately, you cannot choose your neighbours if you had bought a new home directly from the HDB or developer. However, you can mitigate your risks by being a good neighbour. For instance, why not offer a serving of cookies or cakes during your festive celebration? While your actions may not be reciprocated, a friendly hello on your neighbour’s door and offering such goodies will certainly go a long way in making a good first impression last. Neighbours do talk so why not give them something good to talk about? |

Khalil AdisAn independent analysis from yours truly Archives

July 2023

Categories

All

|

100 Peck Seah Street

|

|

RSS Feed

RSS Feed