|

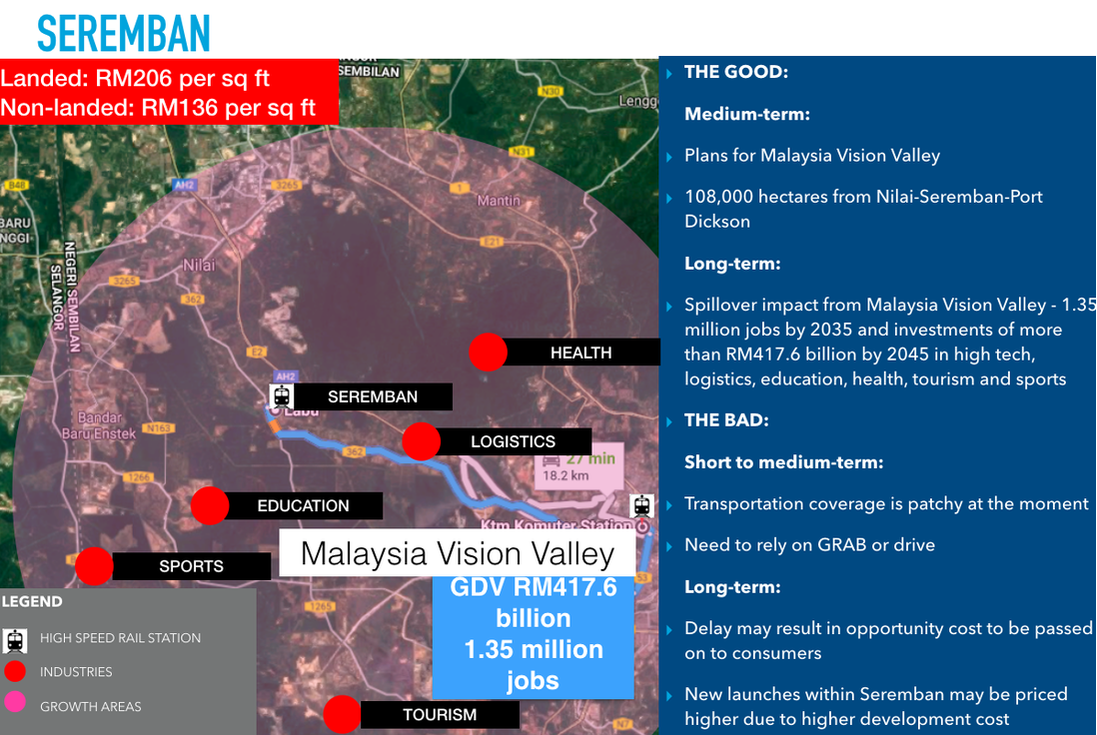

Mass market launches and rental markets in key urban areas are expected to see strong demand in 2024. By Khalil Adis In 2023, the Malaysian property market saw significant trends and developments that have set the stage for the outlook and predictions for 2024. The huge mismatch between what Malaysians can afford to buy versus what developers are building has become increasingly apparent, leading to a shift in consumer behaviour towards renting instead of buying. With affordable housing in short supply, especially in highly urbanised areas like Kuala Lumpur, Johor, Penang, and Selangor, demand for rental properties surged in 2023. This increased demand for rental properties has led to a notable shift in the market dynamics, with renters seeking affordable and well-maintained units in desirable locations. In response to the changing market dynamics, developers in Johor, Selangor and Kuala Lumpur focused on catering to the mass market segment by launching new residential projects priced below RM300,000. These mass-market homes aimed to address the growing demand for affordable housing options among Malaysian buyers. On the other hand, the overhang market in Johor, Selangor, Kuala Lumpur and Penang was dominated by residential properties priced between RM500,000 to RM1 million. This suggests that there is a surplus of mid-range properties in these areas, which may take longer to sell due to affordability constraints and oversupply issues. Johor In Johor, the property market is expected to continue facing challenges in 2024, particularly in areas with a high concentration of oversupply. The mass market segment, which saw an abundance of new launches priced below RM300,000 in 2023, may experience slower growth as developers adjust to the changing demand landscape. However, growth areas such as within Iskandar Malaysia may still present opportunities for investors, especially in well-planned integrated developments that cater to both residential and commercial needs. Selangor Selangor, being one of Malaysia's most populous states and a major economic hub, is expected to maintain its position as a key player in the property market. While the demand for affordable housing is likely to remain strong, developers may shift their focus towards more sustainable and inclusive development strategies. Growth areas such as Cyberjaya, Shah Alam and Subang Jaya are expected to continue attracting interest from both buyers and developers, with a focus on mixed-use developments and transit-oriented projects. Kuala Lumpur In Kuala Lumpur, the property market is expected to see continued interest in high-density urban living, driven by factors such as urbanisation and lifestyle preferences. However, affordability concerns may lead to a greater emphasis on the development of affordable housing and innovative financing solutions. Growth areas within the city centre and its surrounding suburbs, such as KL Sentral, Bangsar and Mont Kiara, are expected to remain attractive to both investors and homebuyers. Penang Penang, known for its rich cultural heritage and vibrant lifestyle, is expected to continue experiencing steady demand for residential properties, particularly in sought-after areas such as George Town, Bayan Lepas, and Tanjung Tokong. However, affordability concerns and oversupply in certain segments may lead to a slowdown in the high-end property market. Developers may focus on niche markets and alternative housing options to cater to changing consumer preferences. The growth areas to watch out for on the main island are mainly along the proposed Bayan Lepas LRT. Growth areas In addition to established urban centres, growth areas such as transit-oriented developments, industrial zones, and emerging satellite towns are expected to attract interest from investors and homebuyers alike. These areas offer opportunities for sustainable development and investment diversification, while also addressing issues such as urban sprawl and congestion. Johor In Johor, the growth areas are primarily located in Iskandar Malaysia, especially in well-planned integrated developments that cater to both residential and commercial needs. One such area is Bukit Chagar which will serve as an interchange station Johor Bahru – Singapore Rapid Transit System (RTS) Link. Slated to commence passenger service by end-2026, the RTS Link can serve up to 10,000 commuters during peak periods, for every hour and in each direction. The RTS Link will also have a spillover impact in the nearby JB Sentral area which is home to malls, hotels and the upcoming Ibrahim International District. Selangor In Selangor, the growth areas are in Southern Kuala Lumpur, particularly, those near high-impact projects and transit-oriented developments along the Putrajaya Line, Kuala Lumpur–Singapore high-speed rail (HSR) and the Malaysia Vision Valley. Nilai and Seremban are areas to watch out for. Nilai is poised for further growth as it is located within the Malaysia Vision Valley. Covering Nilai to Port Dickson, it will have a proposed area of 108,000 hectares. The upcoming industries include high-tech, logistics, education, health, tourism and sports. The Malaysia Vision Valley is expected to create some 1.35 million jobs by 2035 and investments of more than RM417.6 billion by 2045. To support the Malaysia Vision Valley, the Seremban HSR station will be situated in Nilai within the Labu and Kirby estates. Major townships in the vicinity include Bandar Enstek, Bandar Ainsdale Property and S2 Height. Seremban will be an interchange station for the Seremban Komuter Line and KTM Electric Train Service. Kuala Lumpur The growth areas in KL are along the MRT3 Circle Line, namely, Bukit Kiara Selatan, Bukit Kiara, Sri Hartamasa, Mont Kiara, Bukit Segambut, Taman Sri Sinar, Dutamas, Jalan Kuching, Titiwangsa, Kampung Puah, Jalan Langkawi, Danau Kota, Setapak, Rejang, Setiawangsa, AU2, Taman Hillview, Kuchai, Jalan Klang Lama, Pantai Dalam, Pantai Permai and Universiti. Titiwangsa MRT station which will serve as an interchange station with the Ampang and Sri Petaling Line, KL Monorail Line and Putrajaya Line. As the Circle Line is still under construction, this presents a good opportunity for genuine homebuyers to start looking in and around the station. Homes in the secondary market will be the most ideal as they are priced cheaper than new launches. Penang The growth areas in Penang remain unchanged in Batu Kawan and some parts of Seberang Perai. Since the opening of the Second Penang Bridge, Batu Kawan has seen rapid developments from several renowned developers such as EcoWorld and Tropicana as well as the opening of IKEA. While connectivity remains patchy at Batu Kawan, there is a planned Bus Rapid Transit (BRT) system for Batu Kawan as part of the Penang Transport Master Plan. In Seberang Perai, the growth areas will be along the planned Raja Uda-Bukit Mertajam Line to connect the northwestern region to the southeastern region. For those who can afford to buy a property on the main island, areas along the Bayan Lepas LRT line will be the new growth corridor. What’s in store for buyers Buyers in 2024 can expect a more diverse range of options in the property market, with an emphasis on affordability, sustainability, and lifestyle amenities. Innovative financing schemes and incentives may also be introduced to encourage homeownership and address affordability concerns. What’s in store for sellers Sellers may need to adjust their expectations and pricing strategies to align with changing market conditions. Those with properties in oversupplied segments may need to offer incentives or value-added services to attract buyers, while those in high-demand areas may continue to command premium prices. What’s in store for tenants Tenants can expect a more competitive rental market in 2024, particularly in urban areas where demand for rental properties is high. Affordability remains a key concern for tenants, and they may seek out properties with flexible lease terms and inclusive amenities. What’s in store for landlords Landlords may need to be more proactive in managing their rental properties, offering competitive rental rates and investing in property maintenance and upgrades to attract and retain tenants. Those with properties in growth areas may continue to enjoy strong rental yields and capital appreciation. Conclusion Overall, the Malaysian property market is expected to continue evolving in 2024, with a focus on affordability, sustainability, and innovation.

While challenges such as oversupply and affordability concerns may persist, there are also opportunities for growth and investment in emerging sectors and growth areas. By staying informed and adaptable, stakeholders in the property market can navigate these changes and capitalise on new opportunities in the year ahead.

0 Comments

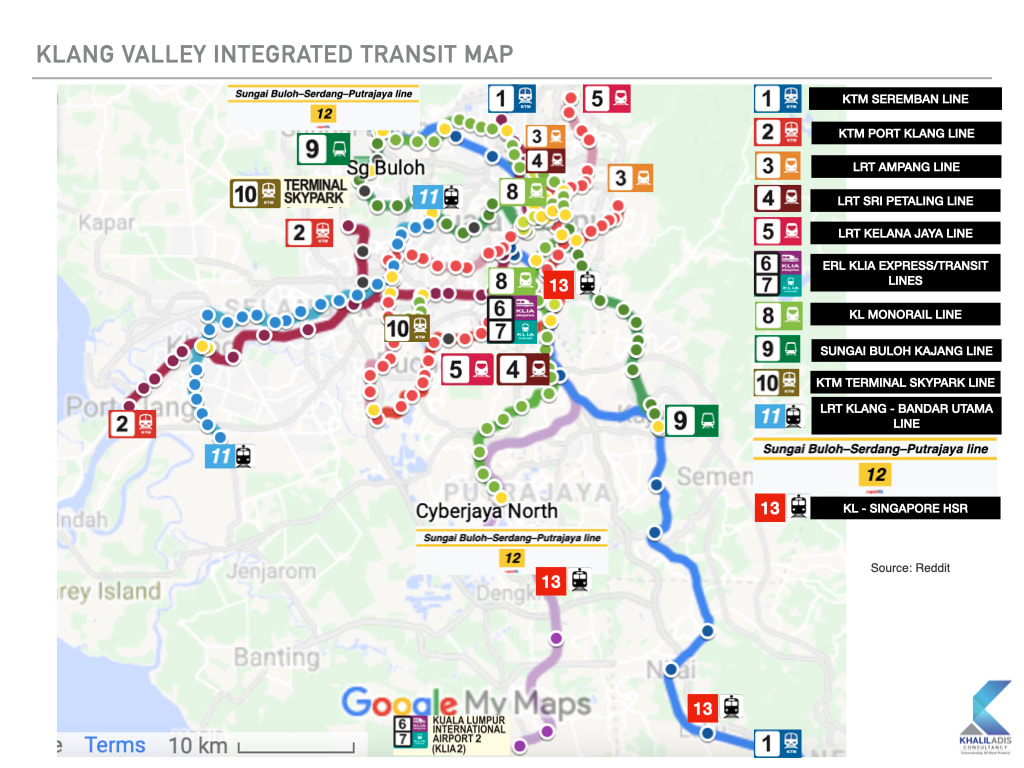

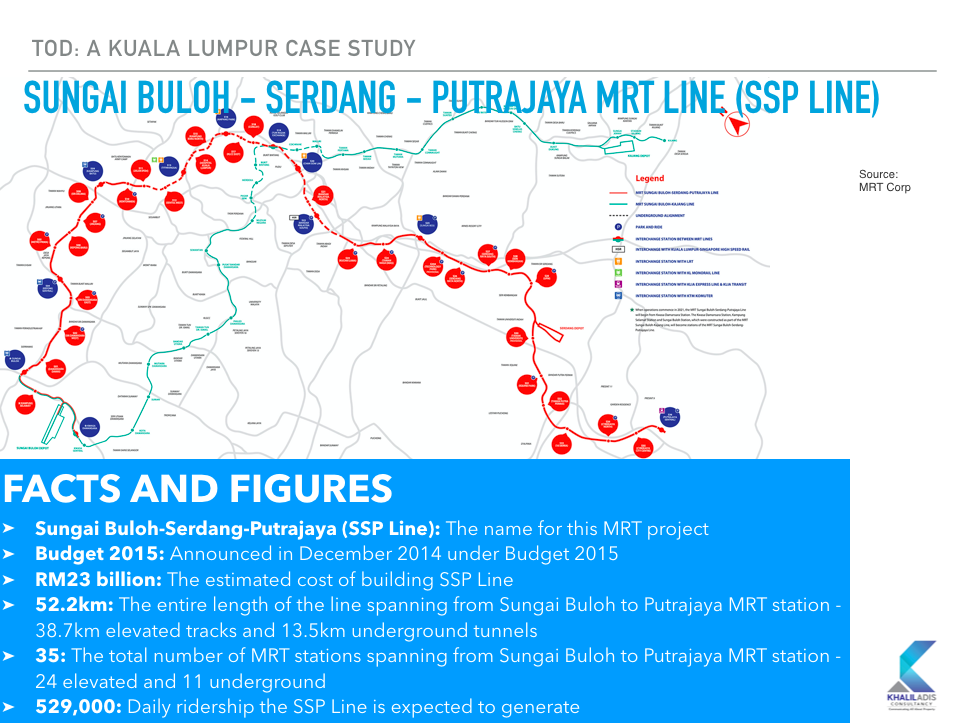

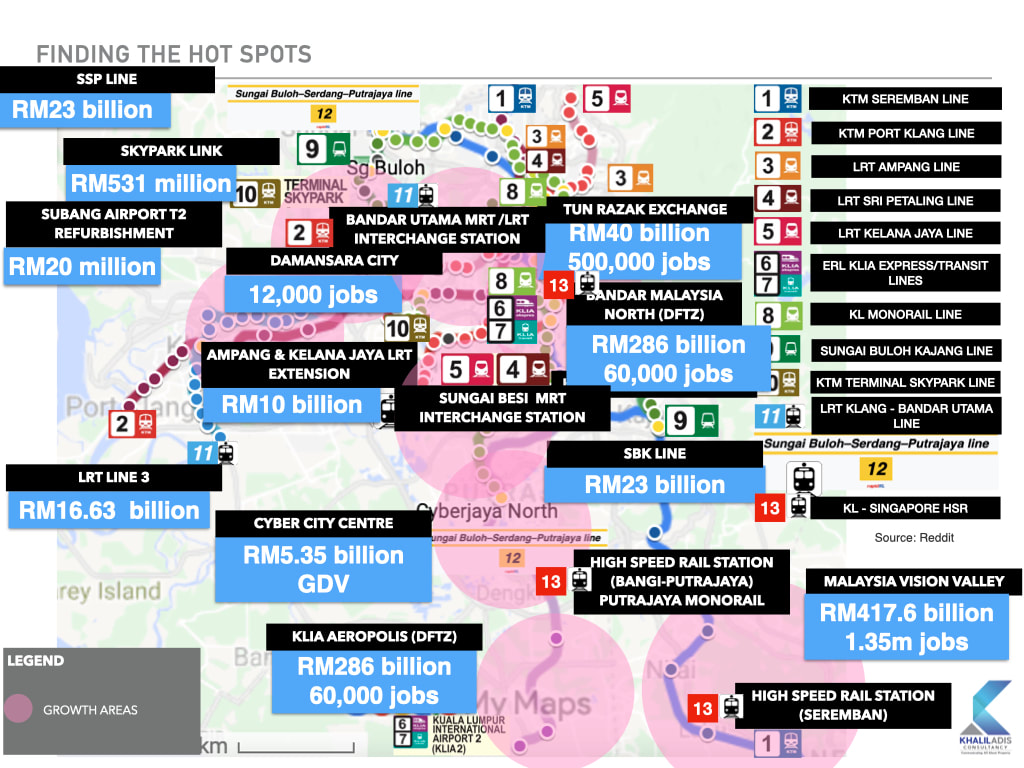

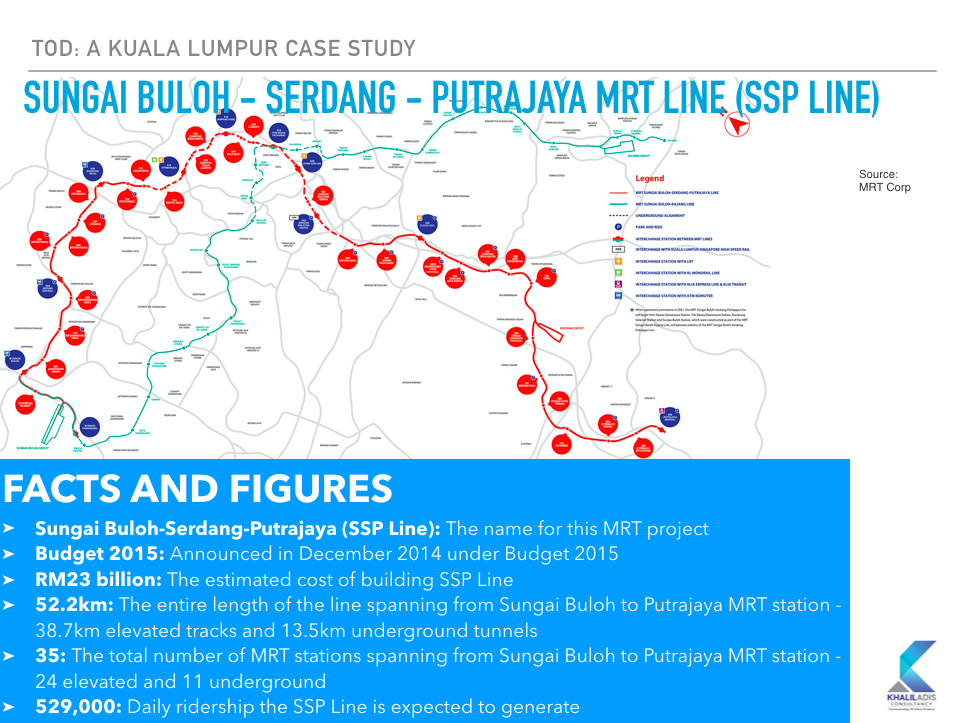

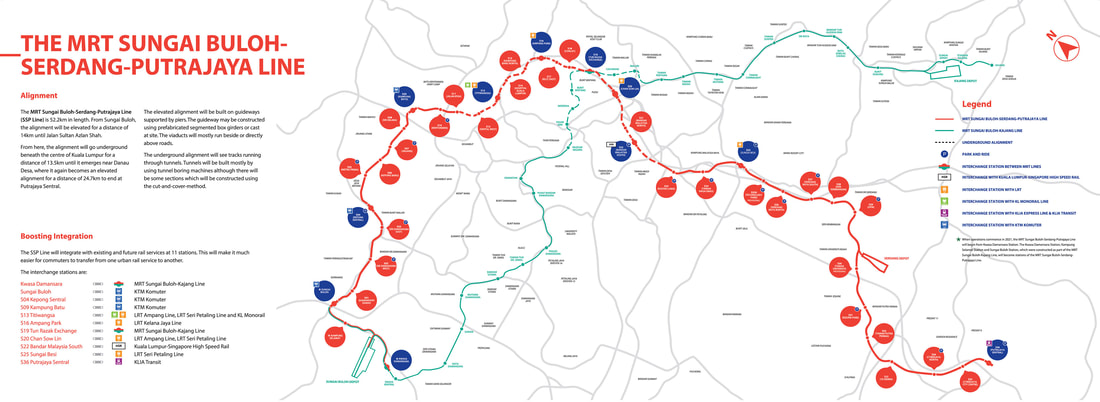

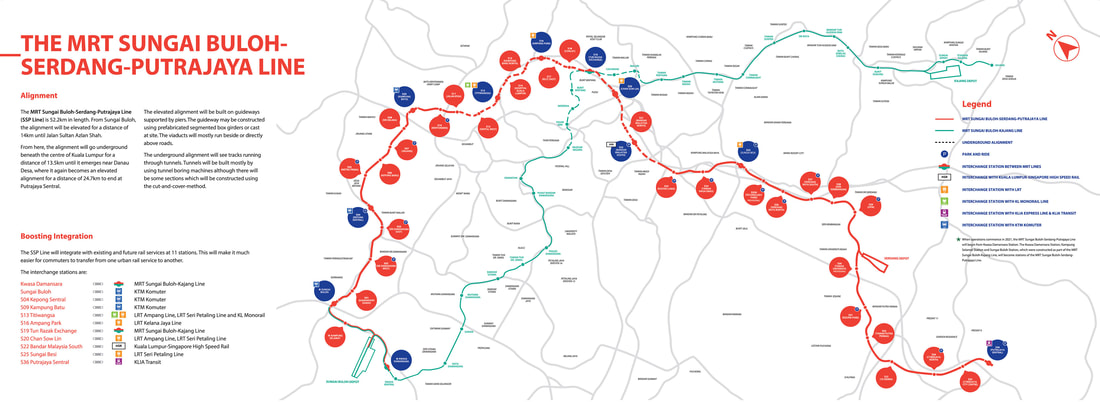

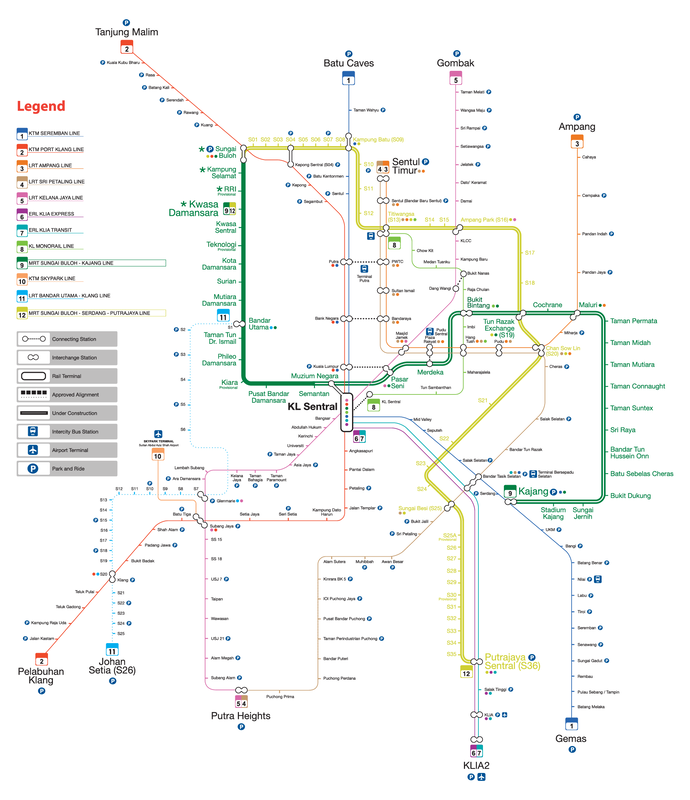

5 things you will learn during my talk at the iProperty Bumiputera Home & Property Fair 20237/5/2023 From map reading to identifying growth areas, this easy-to-understand session aims to assist first-time homebuyers looking for homes along the Sungai Buloh-Serdang-Putrajaya (SSP Line). By Khalil Adis The Malaysian property landscape has undergone significant changes since the Covid-19 pandemic hit. With the completion of iconic projects like the Merdeka 118 Tower and the Sungai Buloh-Serdang-Putrajaya (SSP Line) over the past three years, there are exciting opportunities in the market. However, affordability remains a key concern for first-time homebuyers in Kuala Lumpur and Greater KL. Data from the National Property and Information Centre (NAPIC) reveals that 48.2 per cent of the 8,226 new residential units launched in the third quarter of 2023 were priced below RM300,000. This indicates a strong demand for affordable properties. High-rise developments make up 67.8 per cent of these units, while 32.2 per cent are landed properties. Selangor and Kuala Lumpur accounted for 1,062 and 1,236 units respectively. To address these concerns and help first-time homebuyers make informed decisions, I will be covering one of the 5Cs of property buying - checking for the transport masterplan - in greater detail during my upcoming talk on July 16 at the iProperty Bumiputera Home & Property Fair 2023. Here are five things you can expect to learn: #1: Learn how to do map reading Navigating the Klang Valley and Greater KL areas can be overwhelming for first-time homebuyers. In this talk, we will learn the art of map reading to understand the different train lines that serve these areas. By gaining a grasp of the overall growth areas, we can then dive deeper into the newly completed SSP Line. #2: Understand the transportation master plan Get to know the key facts and figures of the SSP Line, such as the budget allocation and the number of stations. Understanding the transportation master plan will enable you to uncover the budget allocation from the federal government. We will analyse how this budget allocation can potentially have a positive spillover impact on properties along the line. #3: Learn where the growth areas are To identify potential growth areas, we will delve into the two other 5Cs - checking for economic drivers and job creation. By studying case studies like the Cyber City Centre and the KLIA Aeropolis Digital Free Trade Zone (DFTZ), we can gain insights into the areas with promising development potential. #4: Find the sweet spot in terms of distance to train stations While it may be tempting to buy a property close to train stations, we need to be cautious not to be too close, especially for elevated train stations. Additionally, developers need to adhere to certain requirements to qualify for transit-oriented development (TOD). Learn about the sweet spots that strike the right balance and how they can impact your property's resale and rental value. #5: Identify affordable properties along the SSP Line Not all affordable areas are equal. To find truly affordable properties, we need to identify areas with new or upcoming train stations and government-announced plans for upcoming economic zones. These areas should be situated away from the city centre but close enough to train stations and dedicated hubs, ensuring long-term price appreciation. Discover the income-to-mortgage ratio and identify areas along the SSP Line that won't burn a hole in your pocket, offering the greatest potential for capital appreciation. iProperty Bumiputera Home & Property Fair 2023 Join me at the iProperty Bumiputera Home & Property Fair 2023 on July 16 to gain valuable insights into the property market and make informed decisions as a first-time homebuyer.

Don't miss out on this opportunity to learn about navigating the Klang Valley and Greater KL areas, understanding the transport masterplan, identifying growth areas, finding the sweet spot in terms of distance to train stations and discovering affordable properties along the SSP Line. See you there! The COVID-19 pandemic has wreaked havoc in the already muted real estate market. We summarise roundups for 2020 and what market trends to expect in 2021. By Khalil Adis 2020 will go down as an unprecedented year as countries around the world are faced with a global pandemic. Malaysia is no different as the Movement Control Order (MCO) and travel restrictions have adversely affected an already dampened market. According to the National Property and Information Centre (NAPIC), the property market contracted sharply in March and April due to the implementation of the MCO before picking up again in May as restrictions were eased during the Conditional Movement Control Order (CMCO) period. Here are the highlights for 2020: #1:. Steep decline in the volume of property transaction across the board NAPIC’s first half of 2020 data showed that the volume of property transaction declined 27.9% with 115,476 units in the first of the year compared to 160,165 units during the same period last year. Out of this, 75,318 units were those in the residential property sector which recorded a decline of 24.6%. The steepest decline was recorded in the commercial property sector which saw a 37.4% drop followed by the industrial, agricultural and development land and others at 36.9%t, 32.8 per cent and 28.6% respectively. It is hardly surprising that the Bank Negara Malaysia revised the Overnight Policy Rate (OPR) four times in 2020 itself to bring down interest rates in order to encourage consumer spending and to facilitate the application of new loans. #2: Residential overhang continued to increase The COVID-19 pandemic has seen the oversupply situation in the residential property sector worsening. According to data from NAPIC, there was a 3.3% (31,661 units) increase in the overhang in residential properties. Out of this, 31.7% are priced below RM300,000. 53.2% comprises high-rise units followed by landed terraced homes (29%), semi-detached & detached (12.4%), low-cost housing (1.6%) and others (3.8%). High rise units within the price range of RM500,000 to RM700,000 form the bulk of the unsold inventory at 4,144 units. Johor had the highest overhang at 19.5% followed by Selangor at 16.4%. Meanwhile, serviced apartments (which is classified as commercial property by NAPIC) recorded a 26.5% or 21,683 units increase in overhang. 61.8% are priced above RM700,000. A whopping 73.7% are located in Johor followed by 11.6% in Kuala Lumpur. #3: Majority of new launches were in the mass market segment Despite the muted property market, developers continued to launch projects, particularly in the mass market segment. NAPIC’s data showed that 13,294 units of new launches were recorded in the first half of 2020. Of this, 50.1% are priced below RM300,000 while 33.7% are priced between RM300,000 to RM500,000. Landed properties dominate new launches making up 69.7% of the figure while the remaining 30.3% are stratified properties. Negeri Sembilan recorded the most launches in the entire country during the period with 2,797 units. This was not surprising as properties that are located away from Kuala Lumpur and Greater Kuala Lumpur are more affordably priced for local home buyers. #4: Steep decline in office and shopping centre occupancy rates The MCO had a detrimental effect on office and shopping centre occupancy as many Malaysians are forced to work from home. Private office building saw their occupancy rate plunging 74.3% with only 12.70 sq m of space occupied out of the total space of 17.09 sq m. Meanwhile, shopping centres experienced the most decline at 76.7% occupancy rate. Only 9.62 sq m of space were occupied out of the total space of 12.55 sq m. #5: Malaysian House Price Index records first-ever decline, corrected slightly in Q2 2020 The mismatch between what Malaysians can afford versus what is being offered in the market, combined with the pandemic has further worsened the overhang situation resulting in an extremely muted year for developers. According to data from NAPIC, the Malaysian House Price Index stood at 198.3 percentage point in Q2 2020 after hitting a peak of 199.7 percentage point in Q12020 – the 0.7% decline is the first-ever one recorded since 2010. Nevertheless, when compared to Q1 2010 (97.25), the price index recorded an increase of 102.5 to reach 199.7 percentage point during the same period in 2020. This suggests house prices across Malaysia have been skyrocketing over the past 10 years before moderating slightly in the second quarter of 2020. Moving forward, here are the property market trends we can expect in 2021 #1: Affordable homes priced below RM500,000 will rule the market As seen from data from NAPIC, majority of the new launches in the first half of 2020 are mass market homes priced below RM500,000. This trend will likely continue in 2021 especially for homes that are located in Greater Kuala Lumpur. Pricing aside, several Budget 2021 initiatives to further promote homeownership, especially for first-time buyers will spur demand for such homes. For example, the full stamp duty exemption on instruments of transfer and loan agreement for first time home buyers will be extended until 31 December 2025. The stamp duty exemptions for first residential home has been capped for homes priced RM500,000 and below. This exemption is effective for the sale and purchase agreement executed from 1 January 2021 to 31 December 2025. As such, we can expect the mass market segment to pick up momentum. #2: Rent-to-Own Scheme in the private and public housing sectors High house prices in Malaysia has resulted in both the private and public housing sectors to roll out innovative measures to make it easy for first-time home buyers. With developers under pressure to move unsold units, many will likely continue to offer attractive discounts, rent-to-own schemes and zero down payments to draw buyers. Meanwhile, in the public sector, the government will implement a Rent-to-Own Scheme by collaborating with selected financial institutions under Budget 2021. This programme will be implemented until 2022 involving 5,000 PR1MA houses with a total value of more than 1 billion ringgit and is reserved for first-time home buyers. #3: Occupancy rates for office will continue to decline The high daily cases of COVID-19 in the country will have an adverse effect on the office occupancy rate as many companies continue to adopt a work from home policy. As such, we are likely to see their occupancy rates continue to decline until a nationwide vaccination is rolled out. Data from NAPIC showed that as of the first half of 2020, Kuala Lumpur had the highest purpose-built office existing stock at 9,266,687 units followed by Selangor and Putrajaya at 4,030,791 and 2,525,253 units respectively. Meanwhile, there will be an incoming supply of 1,465,441, 244,290 and 208,391 units in Kuala Lumpur, Johor and Selangor respectively. Collectively, this will result in downward pressure for the office market. Landlords are likely to lower their asking price to continue securing tenants. Meanwhile, corporate tenants will be spoilt for choice as there will be many good deals in the market. #4: Uncertain time for shopping centres In Q42020, several COVID-19 cases have been detected at notable shopping centres in Kuala Lumpur/Greater Kuala Lumpur such as at Nu Sentral, 1 Utama, The Gardens Mall (TGM), Mid Valley Megamall (MVM) and Bangsar Shopping Centre.

Consumer precaution will trickle into 2021 and this will have an impact on footfall as many stay away from shopping malls while the tourism market continues to suffer due to travel restrictions, further limiting footfalls from tourists and holiday-makers. Similar to the office sector, the shopping centre market will be very challenging. We will likely see the further closure of some outlets resulting in increasing vacancy rates. NAPIC’s data showed that as of the first half of 2020, Selangor had the highest shopping complex existing stock at 3,712,375 units followed by Kuala Lumpur and Johor at 3,131,431 and 2,452,258 units respectively. Meanwhile, there will be an incoming supply of 639,508, 480,125 and 167,779 units in Kuala Lumpur, Selangor and Melaka respectively. This article was first published on iProperty Malaysia. From map reading to identifying growth areas, this easy-to-understand session aims to assist first-time homebuyers looking for homes along the different train lines in KL/Greater KL. By Khalil Adis If you had enjoyed reading 'Property Buying for Gen Y', then you are in for a special treat. For my upcoming talk on January 11 at Havoc Hartanah 10, I will be including new materials that will cover newly completed as well as upcoming train lines in greater detail. Take this as 'Property Buying for Gen Y' part two - this time with more emphasis on one of the 5Cs I had mentioned in my book which is to check for transport masterplan. Here are five things you can expect during my lesson: #1: A combination of 'Property Buying for Gen Y' and 'Connectivity & Your Property' I had spent an enormous amount of time to write, conduct research and take photos for my upcoming book. For this lesson, I will place more emphasis on transportation, specifically the Sungai Buloh - Kajang Line (SBK Line), Sungai Buloh-Serdang-Putrajaya (SSP Line), Ampang LRT Extension Line, Kelana Jaya LRT Extension Line and LRT Bandar Utama-Klang Line (Klang Valley LRT Line 3). We will then dive deep into each line before identifying the growth areas. #2: Learn how to read transportation masterplan This is part of the diving deep process that you will undergo. This is where you will learn some of the key facts and figures of each line. Understanding transportation masterplan is part of the process in one of the 5Cs in my book - check for budget allocation from the government. We will then analyse how such budget allocation will have an impact on property prices along the lines. #3: Find the sweet spot in terms of distance to train stations While you may want to buy close to train stations, you also want to be careful not to buy to close, especially for elevated train stations. Also, there are certain requirements that developers will have to adhere to qualify for transit-oriented development (TOD). Learn what the sweet spots are and how they may impact on your resale and rental value. #4: Not all growth areas are created equally During the lesson, we will identify growth areas along the lines. However, not all areas are suitable for you as some are located in mature areas. For example, while Tun Razak Exchange MRT station will serve the upcoming Tun Razak Exchange, the properties around the area will not be affordable for first-time homebuyers. On the other hand, such an area will be suitable for investors looking to buy their second home or for rental income. These are some of the due diligence points we will cover. #5: Identify areas where you can find affordable properties The key to finding affordable properties along the lines mentioned is to identify areas where there are new or upcoming train stations and where the government has announced plans to create upcoming economic zones.

Such areas will have to be away from the city centre but close enough to train stations and dedicated hubs mentioned so you can experience price appreciation over the long-term. Learn where they are along the lines mentioned. Don’t forget to bring your notebook along and ask questions after the lesson. Details of my talk below: Topic: Connecting the dots and finding the hot spots Date: 11 January 2020 Time: 3.30pm Venue: Wisma Sejarah, Jalan Tun Razak, Kuala Lumpur See you there! Pakatan Harapan witnessed its fourth defeat in the Tanjung Piai recent by-election suggesting Malaysians are not satisfied with the performance of the incumbent government. Against this political backdrop, here are our top five predictions for Malaysia’s property market next year. By Khalil Adis If the recently concluded by-election in Tanjung Piai is anything to go by, the mood on the ground is clear - Malaysians are frustrated with the lack of reforms, election manifestos that were rescinded, high cost of living, in-fighting among its leaders and a society that appears to be increasingly divided along race and religion fault lines. Indeed, the Tanjung Piai by-election witnessed Barisan Nasional candidate Datuk Seri Wee Jeck Seng winning by a landslide with a 15,086-vote majority. In total, he garnered 25,466 votes. In contrast, Pakatan Harapan’s candidate from Bersatu, Karmaine Sardini obtained 10,380 votes. The by-election is particularly significant as Tanjung Piai has a sizable Chinese and Malay voters. Collectively, this does not bode well as the property market is very much sentiment-driven. In addition, the latest trade data from Bank Negara showed that Malaysia’s economic growth had slowed down from 4.9 per cent in the second quarter of 2019 to 4.2 per cent in the third quarter. With a lacklustre economy, a looming global recession and job retrenchments, here are our top five predictions for Malaysia’s property market in 2020. #1: Kuala Lumpur: High-end properties in KLCC will be the first to be affected KLCC is a good barometer of the global economy as it attracts foreign investors, speculators and wealthy locals. It also attracts a sizeable expatriate community who are renting properties here either under a corporate or personal lease. As such, this is the first sector that will be hit once the economy comes to a grinding halt and they are sent packing home. This is because landlords who own high-end properties here are hardly able to cover their mortgage even with such tenants secured, resulting in negative cash flow. Should retrenchments occur, the exodus of the expatriate tenant pool will be a double whammy as landlords are faced with a loss of income and still having to service their mortgage. Those who face difficulties will be forced to offload their properties. Historically, the 2008 crisis witnessed the resale values of properties here declining by around 15 to 20 per cent. One solution for landlords is to convert their homes into Airbnb units. Then and again, the short-term lease market is extremely competitive and no longer as lucrative as before. There is currently a price war among online hotel booking sites and Airbnb resulting in a very low-profit margin for such property owners. #2: Kuala Lumpur: Supply glut makes renting even more attractive According to the first half of 2019 data from the National Property and Information Centre (NAPIC), entire Malaysia has a total of 54,0078 overhang units worth RM37, 229 million. Kuala Lumpur has 4,731 such units worth RM4,599.30 million. With so much supply in the market, those who are struggling to purchase their first home may want to rent instead. Alternatively, you may want to opt for the Rent-To-Own (RTO) scheme. This is specifically for those who are unable to afford the initial 10 per cent deposit and access to financing in purchasing their homes. Here’s how it works, you sign a tenancy agreement with the developer where part of your rental will be converted to your deposit. After five years, the developer will then ask you to sign a Sales & Purchase Agreement. Recently, the government announced that for Budget 2020, it will be collaborating with financial institutions for this scheme for the purchase of first home up to RM500,000 property price. Under this scheme, the applicant will rent the property for up to five years and after the first year, the tenant will have the option to purchase the house based on the price fixed at the time the tenancy agreement is signed. The government will provide stamp duty exemptions on the instruments of transfer between the developer and financial institution, and between financial institutions and the buyer in this scheme. #3: Iskandar Malaysia, Kuala Lumpur and Penang: Flight to safety among Hong Kong investors One man’s loss is another man’s gain. In Malaysia’s case, we have seen Hong Kong investors snapping up medium to high-end properties from Iskandar Malaysia to Penang due to the ongoing unrests happening in Hong Kong. This will also help to reduce the overhang in the property market resulting in improved cash flow among developers. These investors are cash-rich which is music to the ears for property developers. So amid the gloom and doom, the protests in Hong Kong has given a flicker of hope for the real estate sector which has been in the doldrums. The result is a positive trickle-down effect for the Malaysian economy and helping to create jobs in the property, law and finance sectors. #4: Iskandar Malaysia, Kuala Lumpur, Selangor and Penang: Affordable homes will continue to be in demand While the government has announced various initiatives such as Fund for Affordable Homes and Youth Housing Scheme, I believe that young Malaysians should instead focus on buying from private developers through the Home Ownership Campaign (HOC). This is because land is a state matter and the federal government may have difficulty implementing such homes across Malaysia. We have already seen from the previous budgets how homebuyers were left stranded when PR1MA was not able to deliver the 1 million units that were promised. The lack of a single government agency to spearhead the affordable home segment also complicates the matter and may mean one government agency may not be communicating with another. In addition, the limitations that are imposed on low-cost housing built by either the state or federal government may impact your capital appreciation in the future. Private developers are in the business and have to means to deliver such homes. Take advantage of the HOC as you can get a 10 per cent discount for qualified properties that will be matched with stamp duty exemptions. You may also want to apply for a home jointly with your spouse or another single. This will enable you to combine your finances leading to a higher chance of getting your loans approved. This is for those who do not want to take part in the RTO scheme but instead come up with the 10 per cent deposit on your own. When choosing for a home, apply the 5CS. Check the masterplan: A masterplan would typically define a township’s development in the next one to two decades. Check the transport masterplan Generally, properties close to transportation hubs such as MRT or LRT stations can command a premium of between five and 10 per cent over the long term. Check budget allocation from the government Government policies do have an indirect impact on a property. For example, budget allocation for improvements in public infrastructure and new economic drivers will have an impact on new and existing homes in and around the vicinity of an area. So check where the government is building new hospitals or schools. Check for economic drivers You should study an area before buying your property. The best strategy is to buy in an area that is not yet developed but where there are plans for various economic drivers. A government-mooted economic corridor or a reputable developer that has experience in building townships are great indicators if the area will ‘succeed’ or not. Check for job creation This is like feeling someone’s pulse. You need to check if the township you are eyeing is going to be a ghost town or a happening place. If it is the former, perhaps you should stay away. If it is the latter, more and more workers will be drawn there, becoming a magnet for people and a hive of activity. People are the lifeblood of a neighbourhood. As the area becomes highly desirable, people will naturally want to live and work in and around the vicinity. As there is an increase in demand, property prices in that area will also rise. That is how property prices appreciate. #5: Confusing message from the government may result in a “wait-and-see’ situation among foreign investors Recently, the federal government had announced that it was reducing the minimum purchase price from RM1 million to RM600,000 to reduce the overhang in Malaysia’s property market.

To reduce the overhang, Budget 2020 now allows foreigners to buy completed and unsold units that are priced above RM600,000. Subsequently, Housing and Local Government Minister Zuraida Kamaruddin clarified that will be implemented only for a year starting from 2020. However, each state has the right to implement its own minimum purchase price which makes the implementation difficult. In addition, Malaysian My Second Home (MM2H) applicants now can no longer import a car according to MM2H agents who are involved in such applications and will require additional approval from the Housing Ministry This, they said, results in longer processing time and sends a confusing signal to foreign investors on Malaysia’s intention to lure foreign investors. So, except for Hong Kong investors, the rest may likely adopt a wait-and-see” approach until they see some clarity. With 10,000 affordable homes in the pipeline, Bandar Malaysia is both a boon and a bane for Kuala Lumpur’s sluggish property sector. We analyse how this development will impact the market. By Khalil Adis The recent announcement by the Malaysian government that it is reviving the shelved Bandar Malaysia project is a piece of welcome news as it gives some clarity to investors on the status of the Kuala Lumpur-Singapore High Speed Rail (HSR) project. Since winning the 14th general election, Prime Minister Mahathir Mohamad had reviewed several mega infrastructure projects including Bandar Malaysia and the HSR. In the face of the country’s mounting debt, both projects were at first announced as cancelled in May 2018. This prompted Singapore’s Ministry of Transport to issue a statement stating that it “will wait for official communication from Malaysia”. However, the Malaysian government backtracked on this subsequently. Instead, it announced in June 2018 that the project was “postponed”. This created a lot of confusion on both sides of the causeway. After many months of speculation, the market finally received some clarity in September 2018 when representatives from both governments met in Putrajaya. In a joint-statement, both Singapore and Malaysia announced that they had signed an agreement to suspend the project until 31 May 2020 “Malaysia will bear the agreed costs in suspending the HSR Project. If by 31 May 2020, Malaysia does not proceed with the HSR Project, Malaysia will also bear the agreed costs incurred by Singapore in fulfilling the HSR Bilateral Agreement. During the suspension period, Malaysia and Singapore will continue to discuss on the best way forward for the HSR Project with the aim of reducing costs,” the statement read. The HSR project is now expected to commence service by 1 January 2031, instead of the original commencement date of 31 December 2026. With Bandar Malaysia now being revived, we list down the possible implications on Kuala Lumpur’s property market. #1: Boost for the construction sector The construction sector is currently in the doldrums due to the lacklustre property market in Malaysia. Loan rejections from buyers and the demand-supply mismatch mean developers are faced with unsold inventory leading to cash flow problems with contractors. In March, for instance, Bursa listed engineering and construction company, Zeland Berhad filed a statement with the Malaysian stock exchange that it was initiating arbitration proceedings against NRY Architects for RM305.4mil and other contract breaches for the construction of buildings of International Islamic University Malaysia in Kuantan. It also announced that it is claiming RM3.34mil in outstanding payment for construction works from BBCC Development Sdn Bhd located at the former Pudu jail near Hang Tuah monorail station. With Bandar Malaysia now back on track, contractors will be willing to bid at a much lower price to stay afloat amid the challenging market condition. Subcontractors will also benefit. #2: 10,000 new housing units will likely worsen overhang in Kuala Lumpur’s property market Initially, DBKL had announced that Bandar Malaysia will house around 30,000 affordable homes. However, a recent announcement puts the figures to 10,000 units. Kuala Lumpur City Hall (DBKL) had previously indicated that it has set a development guideline for developers to build such homes at around 800 sq ft but priced below MYR450,000. Meanwhile, Bank Negara’s figures showed that 80 per cent of homes, or 146,196 units priced above RM250,000, remained unsold as of end March 2018. While Bank Negara did not break down the figures according to each state, recent data provided by the Valuation and Property Services Department (JPPH) showed that Kuala Lumpur recorded the third highest number of residential overhang at 5,114 units. So unless the homes are priced below RM250,000, we are likely to see Kuala Lumpur’s housing glut worsen. #3: Boon for first-time homebuyers Bandar Malaysia has been cited by DBKL as a case study for government and private developers in building transit-oriented development (TOD). Bandar Malaysia will house two MRT stations – Bandar Malaysia North and Bandar Malaysia South – which will form part of the alignment for the Sungai Buloh – Serdang – Putrajaya Line (SSP Line). Bandar Malaysia will also possibly serve as the interchange to the MRT Line 3, which has now been postponed. If indeed Bandar Malaysia will build affordable homes according to DBKL’s guidelines, then it will be a boon for first-time homebuyers as the entry price in Kuala Lumpur is easily above RM600,000. It will also mean young Malaysians will no longer have to buy a car first after completing their education and thus improve their chances of getting their home loans approved. Currently, many young Malaysians are trapped in the debt cycle due to various financial commitments such as their National Higher Education Fund (PTPTN), cars, personal and credit cards loans. So while demand is strong, loan rejections remain an issue further worsening the cash flow for developers. #4: Bane for landlords and sellers If indeed 10,000 new housing units will be coming on stream, Bandar Malaysia’s surrounding areas such as Pudu, Brickfields, Cheras, Bandar Tun Razak, Sungai Besi and Taman Desa will be badly affected. As such, landlord and sellers will likely see their asking prices fall even further as consumers will soon have more choices. Landlords will also find difficulty in doing short-term accommodations as the Malaysian government will be regulating this market segment. Therefore, rent-seekers and buyers are the clear winners as they are in the position to haggle for the best price. #5: Sluggish commercial and office market ahead The initial projection for Bandar Malaysia stated that it will have a gross development value (GDV) of RM150 billion.

Measuring around 196 hectares, Bandar Malaysia’s master plan indicates that it will be a mixed-use development with commercial and office buildings. With so many mega malls and office buildings in Kuala Lumpur, Bandar Malaysia will add on to more floor space in Kuala Lumpur’s already weak commercial and office markets. Despite this, Bandar Malaysia will likely attract multinational companies to set up their operations here as it is located within the Digital Free Trade Zone (DFTZ). With the Chinese New Year approaching, what better way to soak in the festivity than exploring Kuala Lumpur’s historic Chinatown district? By Khalil Adis Whether you love it or hate it, Kuala Lumpur’s Chinatown district has a colourful personality that attracts both Malaysians and tourists alike. While Malaysians lament about the loss of its authenticity and some have chosen to avoid it altogether, this vibrant area has its own quirks that make it oh-so-charming thanks to the many rustic shophouses. Here is a quick guide on exploring Chinatown. #1: Plaza Rakyat LRT station Plaza Rakyat LRT station is an elevated station along the Ampang and Sri Petaling Line. Situated next to a massive proposed mixed-use development that has since been abandoned, the whole area unfortunately reeks of urban decay. Once you exit from the station you will likely come across the occasional beggars and the rancid smell emanating from the air - not for the faint-hearted. Taking the LRT station is ideal if you intend to head to Menara Maybank or to savour the street food at Jalan Sultan as it is located within the vicinity. #2: Pasar Seni MRT station Pasar Seni MRT Station is an underground station that is integrated with the existing Pasar Seni LRT station serving the Kelana Jaya LRT Line. Located in the heritage area of Chinatown, Pasar Seni is located within walking distance to backpackers’ lodges, boutique hotels and the tourist trap flea marts of Petaling Street. There are plans to also connect the station to the iconic Central Market. An added feature is a bus interchange located just above the station that will connect buses from Kuala Lumpur to Petaling Jaya. #3: Petaling Street Petaling Street is a must visit street if you want to buy branded knock-offs ranging from bags to watches. Ironically, while this is the heart of Chinatown, the vendors selling the wares are mostly foreigners comprising Bangladeshi workers. The imitation watches, in particular, are rather pricey and do not last long. You are better off buying the real deal while taking in the rampant piracy that occurs along this stretch. #4: Pasar Karat Known locally as ‘Thieves Market’, Pasar Karat is a treasure trove for antique and trinket lovers as well as the occasional luxury goods that are believed to have been stolen. From Montblanc luggage bags to second-hand electronic goods, Pasar Karat is KL’s version of the now-defunct Singapore’s Sungei Road. Pasar Karat is open in the wee hours of the morning at around 4 am and shuts down by 10 am. Be sure to come early before the goods run out. #5: Food street at Jalan Sultan Located within the Petaling Street enclave, the food street comes alive at night with a serving of local Malay dishes, mamaks as well as Chinese cuisines in a fuss-free alfresco setting. If the dark and dirty alley makes your stomach turn, fret not as you can opt to dine at the slightly upmarket Nando’s or KFC located nearby. #6: Weng Hoa Flower Boutique No 1 Lorong Hang Lekir Off Jalan Hang Lekir 50000 Kuala Lumpur Malaysia Website: www.wenghoa.com/home Opening hours: 8 am to 10 pm Forget overpriced flowers sold at upmarket malls. Instead, head here for fresh plants and roses sold at wholesale prices! There are even ready-made bouquets for you to choose from. Ladies and wedding planners will definitely find delight in the freezer room located at the back of the shop where you can choose from the many arrays of local and exported roses as well as other exotic flowers. In addition, you can buy flower petals and kaffir lime to cleanse your chakras for that montly flower bath ritual. For the freshest produce, head here when the store opens. #7: Central Market Lot 3.04-3.06, Central Market Annexe, Jalan Hang Kasturi, 50050 Kuala Lumpur. Malaysia Website: www.centralmarket.com.my Telephone: 03-2031 0399/5399/7399 Central Market is the place to go to for slightly upmarket goods within an air-conditioned environment. Housed within an art deco facade, Central Market first started out as a wet market in 1888 but has since been repurposed as a one-stop centre for Malaysian batik, souvenirs, collectables and handicraft. From textiles to tableware, the choices are endless. #8 Kasturi Walk Kasturi Walk is located alongside the main Central Market building. This newly transformed, pedestrianised and covered walkway features an al fresco ambience with a wide variety of stalls selling local snacks and exquisite souvenirs. Summary Price: According to Brickz, the median price for office buildings and shophouses here are around RM858 per sq ft and RM1,056 per sq ft respectively.

The good: Buying a property here will mean constant human traffic from both locals and tourists alike as Chinatown is rich in popular tourism landmarks such as Central Market and Petaling Street. The quaint rows of heritage shophouses house hip boutique hotels to quirky cafes and restaurants that attract the cool, creative type. The area is also a haven to some of KL’s famous hawker food such as Shin Kee Beef Noodle near to Central Market and the birthplace of Hokkien mee, Restoran Kim Lian Hee located at the junction of Jalan Petaling and Jalan Hang Lekir. All these attractions make it suited for Airbnb type of accommodations. The bad: If you intend to buy a property here, you are only limited to office buildings or shophouses. Land here is extremely scarce and there are no existing or future residential projects in the pipeline. As such, this area is a no go for most investors unless you are an institutional investor or have deep pockets. Gear up for a bumpy ride next year in Malaysia’s property market as the number of unsold units continues to rise. Despite the challenges, there are some opportunities for investors and rent-seekers. By Khalil Adis According to the Valuation and Property Services Department’s (JPPH) latest figures, the number of unsold completed residential units rose from 20,304 units to 30,115 units year-on-year as at 30 September 2018. This represents an increase of 48.35 per cent. Meanwhile, the total value was RM19.54 billion, representing a 56.44 per cent rise from RM12.49 billion a year ago. However, if JPPH were to also include serviced apartments and small offices home offices (SoHos), this would bring their overhang value to 40,916 units valued at RM27.38 billion. According to JPPH, Johor has the largest number of unsold completed serviced apartments and SoHo units at 7,714. JPPH notes that it rose a whopping 191 per cent from the 2,647 units recorded a year ago. The overhang in serviced apartments is valued at RM6.16 billion compared with its residential overhang of RM4.44 billion. This means the total overall value of its unsold serviced apartments is 1.5 times that of residential housing. In summary, Johor has the highest number of completed unsold units in Malaysia at 6,053. This is a 55 per cent increase from the 3.901 units a year ago. With an overhang in supply spanning from Johor to Selangor, here are some of the likely property trends to emerge next year. #1: Renter’s market The new supply of the completed units plus the those from existing units will lead to a downward pressure in the rental market causing rentals to fall. This is because rent-seekers will be spoilt for choice while landlords will be fighting for tenants. This will make it ideal for rent-seekers as landlords will most likely be open for price negotiations. Meanwhile, it is bad news for landlords should they be able to find a tenant or not. In the former, the rental will most likely not be able to cover the mortgage resulting in negative cash flow. In the latter, landlords will have to cover the mortgage themselves. Those who cannot will have no choice but the let go of their units. #2: Buyer’s market The property market will also favour buyers as sellers will be desperate to offload their properties, especially those who have multiple units. Therefore, buyers will be in a more stronger position to bargain in a market flooded with so many units. #4: Buy properties in the secondary market If you urgently need a roof over your head, then the secondary market is the way to go as you are buying a completed property. Sellers are also more willing to negotiate on the terms of payment and will likely cut a flexible payment deal via their agents if you do not have a sufficient deposit in hand. In addition, the supply overhang also mean that properties in the secondary market are priced 20 to 30 per cent cheaper than new launches. However, do bear in mind that you need to pay a 10 per cent deposit. #5: Overhang in supply means good deals in the auction market Unfortunately, there will also be distressed properties which will be auctioned off in court. If you are looking for a below market value (BMV) property, then this will present a very good opportunity for you. When buying a BMV, you will need to attend an auction in court and prepare a bank draft in advance to show of interest. This will cost you around 10 per cent of the reserve price. For example, if the property is being auctioned off at RM50,000, you will need to prepare RM5,000 in bank draft. If you have successfully bid for the property, you will need to settle the balance of the payment within 120 days. However, there are a lot of hidden costs, for example, legal, quit rent (cukai pintu), unpaid utilities and maintenance fees, assessments and so on. Perhaps, the biggest risk is this - while the property is legally yours, you may find it hard to evict the tenants or owners. You may have to apply for a court order, through a lawyer, to evict the occupants. This process can take you up to four weeks and costs you between RM1,500 to RM2,000. Even so, there are no guarantees they can be evicted as Malaysian laws favour occupiers. When buying a BMV property, it is best to find out if the property is occupied by tenants or owners. #6: It also means good deals from the primary market Developers have to move their unsold inventory as each unit means added cost for them. As such, developers will be coming up with creative schemes like zero downpayment and such to lure buyers. Speak to a good developer and check if they have a good master plan to ensure your property values are protected. Remember the 5Cs I always talk about? Check against them before you commit to buying a property, #7: More restrictions on Airbnb accommodations Making money from your short stay travellers may prove to be even harder even if the government legalises Airbnb. This is because we are seeing trends of management committees barring Airbnb-type of accommodation due to security and safety issues. So before you decide to list your untenanted unit on Airbnb, it is best to check with your management committee if this is allowed. However, if you happen to own a serviced apartment, this will not be an issue as it falls under a commercial title. #8: Transit-oriented developments (TODs) along SSP Line The Sungai Buloh-Serdang-Putrajaya Line (SSP Line) is one of the few major infrastructure projects that will be continued under the newly elected government.

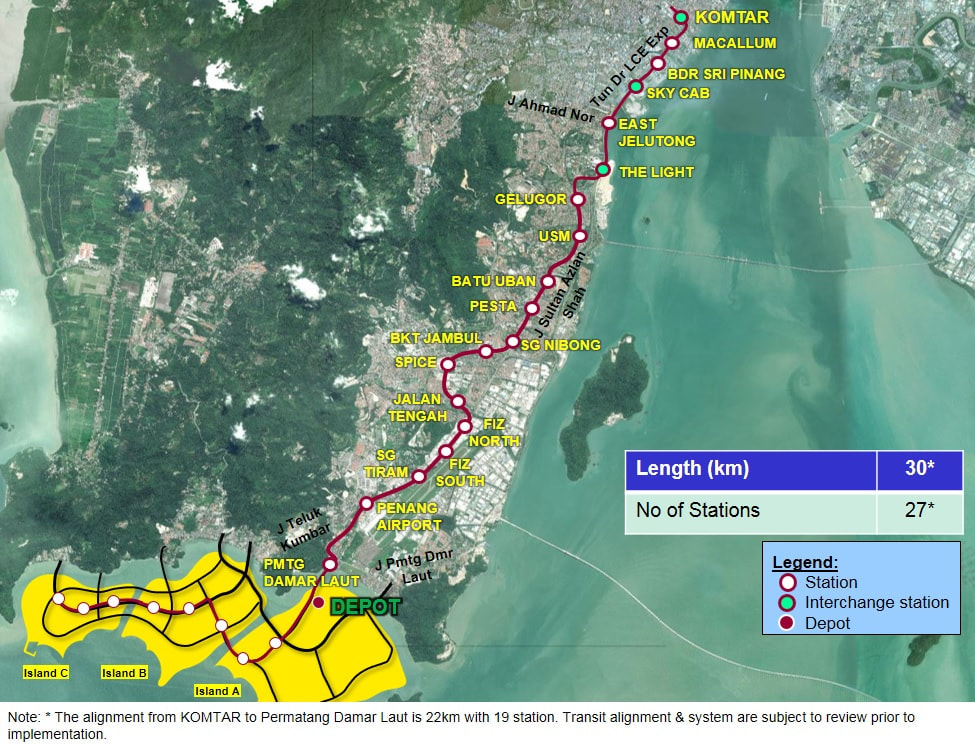

In fact, the project is currently under construction and is fast taking shape. Some developers have already acquired land banks along this line to build TODs. Areas to watch out for include Kwasa Damansara, Kwasa Sentral, Sungai Besi, Bandar Malaysia and Cyberjaya City Centre 2018 is a watershed moment for Malaysia's politics and the subsequent impact on the property market. We list down the key highlights in our 2018 property market roundups and our outlook for 2019. By Khalil Adis May 10 2018 was a watershed moment in Malaysia as it marked the first change of government in the country's history. Since 1957, it had enjoyed an uninterrupted reign from the ruling Barisan Nasional (BN) coalition. However, the high cost of living, falling Ringgit, the lack of affordable homes in the market, high unemployment among fresh graduates, the unfettered check on power and the 1MDB scandal proved to be the undoing for BN as Malaysians far and wide casted their protest vote in the ballot box The message from Malaysians is clear - they have had enough and want a new, clean government to lead the way. With the Pakatan Harapan government now in power, all eyes are on the newly elected old Prime Minister Tun Mahathir Mohamad and his team to solve the pressing bread and butter issues. Here are the top five property market roundups for 2018 and our top five outlooks for 2019. Roundups #1: Demand-supply mismatch has resulted in an increasing number of unsold homes According to Bank Negara, 80 per cent of homes or 146,196 units priced above RM250,000 remained unsold as of end March 2018. In comparison, 130,690 units were unsold during the same period last year. "Imbalances observed in the property market continue to persist," Bank Negara had said in a statement. #2: Rent-to-own scheme being rolled out To help ease the entry for the first time property buyers, the private sector has come up with a few initiatives. Some private developers like Ayer Holdings have introduced a ‘Stay & Own' scheme for their Epic Residence and Foreston projects whereby part of the rent will be converted to the downpayment. This not only provides a temporary solution for those who urgently need a home but also a form of security. Meanwhile, Maybank has rolled a similar initiative called HouzKEY which they have called as "a rent-to-own solution that helps you to own your dream home." The scheme involves zero per cent downpayment with the monthly rental forming part of the home financing. #3: Ministry of Housing and Local Government studying Singapore's HDB model In July, Zuraida Kamaruddin, the Minister of Housing and Local Government paid an official visit to Singapore to study the HDB model. Singapore has succeeded to build demand driven homes under its Built-to-Order (BTO) scheme to house 80 per cent of the Singapore population. This is especially useful in Malaysia where there is currently a demand-supply mismatch as in point number one. #4: Malaysia looking into having a single housing government agency In Malaysia, there are so many affordable housing programmes being rolled out by the state and federal governments such as Rumah Milik Mampu, Rumah Selangorku, PR1MA, My First Home, Program Perumaha Rakyat and the list goes on. This confuses the public. The Malaysian government is currently looking into having a single housing agency to streamline the whole process much like the HDB model. If implemented, this could solve the current Malaysian housing woe. #5: More help for the B40, M40 and first-time homebuyers under Budget 2019 More help is on the way for these group of property buyers as announced under Budget 2019. The measures included the Real Estate and Housing Developers' Association (Rehda) agreement to cut prices by 10 per cent for new launches, the exemption of the Real Property Gains Tax (RPGT) for properties that are priced below RM200,000 and the stamp duty exemption for properties priced in the first RM300,000 up to RM500,000 as well as those priced from RM300,000 to RM1 million. Outlook for 2019 #1: Affordable homes to continue driving the market There is currently a strong pent-up demand for affordable homes but where the supply is lacking. As such, the affordable home segment will continue to be in strong demand for 2019. However, there needs to be concerted efforts from both the government and private developers. Under Budget 2019, the federal government has pledged to spend RM1.5 billion on such homes via the 1Malaysia People's Housing (PR1MA) and Syarikat Perumahan Negara Bhd (SPNB). Meanwhile, Rehda has agreed to cut prices as stated above. #2: South KL to be the growth area There are many infrastructure projects and economic drivers that are in the pipeline that will further boost property prices in Southern KL. One such project is Bandar Malaysia will serve as the terminus station for the Kuala Lumpur-Singapore High Speed Rail (KL-Singapore HSR) project linking both cities in 90 minutes flat. The development for the project has been postponed to two years and will now commence construction in 2020 instead of 2018. Meanwhile, the express service will only commence by 1 January 2031 instead of 31 December 2026, as originally planned. Bandar Malaysia has been designated as a site for the Digital Free Trade Zone (DFTZ) initiative by Jack Ma. Home to the Satellite Services Hub, DFTZ is expected to create some 60,000 direct and indirect jobs. It will also possibly serve as the interchange to the MRT Line 3, which has now been postponed. Another economic driver in the vicinity is Tun Razak Exchange (TRX). TRX will be a mixed-use development comprising a Grade A office space as well as residential and commercial precincts. To be developed in several phases over a period of 15 years, the first phase will comprise four investment grade A office towers, a lifestyle retail mall, two 5-star hotels and up to six luxurious residential towers with a target completion date by 2019. In addition, Bandar Malaysia will house two MRT stations - Bandar Malaysia North and Bandar Malaysia South which will form part of the alignment for the Sungai Buloh - Serdang - Putrajaya Line (SSP Line). #3: Properties along Sungai Buloh - Serdang - Putrajaya Line (SSP Line) will be sought after Speaking of the SSP Line, properties along the alignment, particularly those situated in the growth areas of Sungai Besi, Bandar Malaysia and Cyberjaya City Centre are worth looking into. Bandar Malaysia will house two MRT stations as stated above and located a few stops away from Tun Razak Exchange MRT station. Meanwhile, Sungai Besi MRT station is an interchange station to the Sungai Besi LRT station. It will serve as an interchange to the upcoming High Speed Rail station located in Bandar Malaysia, also in Sungai Besi. Last but not least, Cyberjaya City Centre MRT station is a transit-oriented development (TOD) project to be developed by Malaysian Resources Corp Bhd (MRCB). With its experience in building the transport hub in KL Sentral, MRCB will be developing a new city that will be integrated with the MRT station. Phase one is expected to generate a gross development value (GDV) of RM5.35 billion. It will feature a 200,000 sq ft convention centre, a 300- to 400-room business hotel, low and high-rise office buildings and a retail podium. Cyberjaya City Centre will have a development plan spanning 20 years. The MRT station is located just opposite Lim Kok Wing University of Creative Technology. #4: Penang to get a boost from Phase 1 of Penang Transport Master Plan (PTMP) With Lim Guan Eng as Malaysia's Finance Minister, Penang's property market will get a further boost. Just this month, Phase 1 of PTMP was approved. It will comprise the Bayan Lepas Light Rail Transit (LRT) project, Pan Island Link 1 (PIL1) project and several main highways. The proposed Bayan Lepas LRT line will be about 30 km in length with 27 stations running from KOMTAR to the future reclaimed islands in the south. There will be three interchange stations - KOMTAR, Sky Cab Station linking it to the Sky Cab line across the Malacca Straits and The Light Station linking it to the George Town-Butterworth LRT line. The LRT Line will also be integrated with the Sungai Nibong Express Bus Terminal at the Sungai Nibong Station. Meanwhile, PIL 1 is a new 20km highway that will be aligned along the mountainous terrain of the island and will take around 15 minutes from between Gurney Drive to the Second Bridge. There will be six interchanges in all - Dr Lim Chong Eu Expressway (LCE), Awang, Relau, Paya Terubong, Utama and Gurney. #5: Johor Bahru to get a boost from the Rapid Transit System (RTS) Link Meanwhile, over in the southern state of Johor, Iskandar Malaysia's muted property market will get a boost as the RTS Link will commence construction next year.

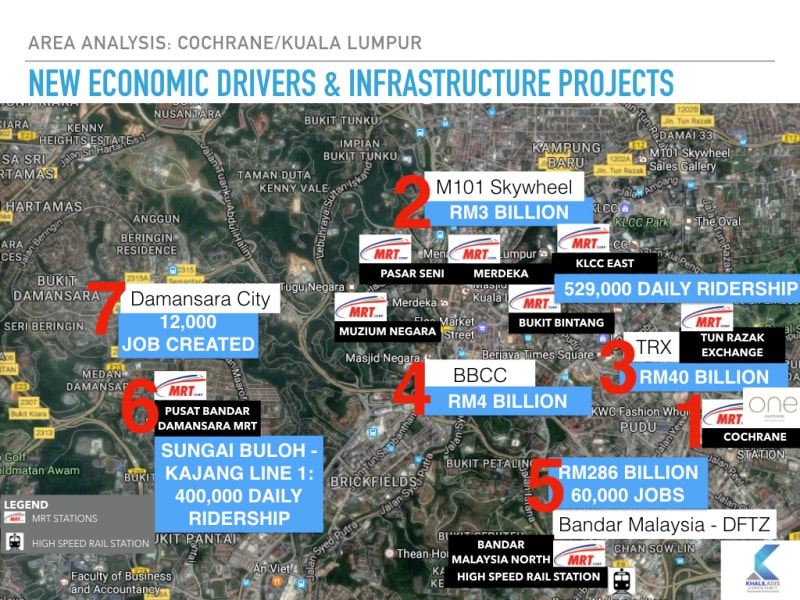

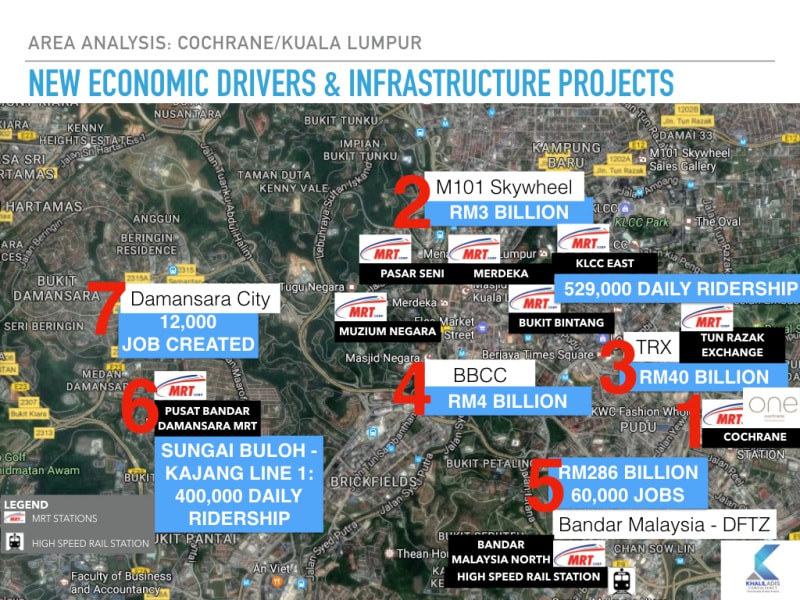

The RTS Link will link Bukit Chagar station in Johor Bahru to Woodlands North MRT station in Singapore when completed in 2024. There are also plans for a Bus Rapid Transit (BRT) system within Bukit Chagar station to link it to the different areas of Iskandar Malaysia. The BRT will feature a dedicated bus lane with three lines - BRT Line 1 will span from Bukit Chagar to Tebrau, BRT Line 2 from Bukit Chagar to Senai and finally, BRT Line 3 from Bukit Chagar to Iskandar Puteri. However, based on market talk in the ground, there is a possibility that the BRT system will be upgraded to an LRT system instead. Located slightly away from the hustle and bustle of KLCC and Bukit Bintang but still within the Golden Triangle, Cochrane is a growth area just south of Kuala Lumpur. By Khalil Adis Mention Cochrane and the first thing that comes to mind is IKEA Cheras and MyTOWN Shopping Centre. Previously an area dedicated for government quarters comprising mainly landed terraces and semi-D types, Cochrane, upon redevelopment is now slowly buzzing with life since the opening of Cochrane MRT station last year. For the longest time, this part of KL has been largely ignored as a property investment destination, save for the local attractions such as the Pudu Wet Market and Flea Market. However, all that changed when the construction of Sungai Buloh-Kajang (SBK Line) was announced in September 2010 under Budget 2011. Costing an estimated RM23 billion with 51km of train track and 31stations developments in this part of Cheras suddenly started gaining momentum when Cochrane MRT station was confirmed. First was the opening IKEA Cheras by the Ikano Group in November 2015 followed by the opening of MyTOWN Shopping Centre by Boustead Ikano Sdn Bhd in the first quarter of 2017. Quality condominium developments are a rare find here with recent launches in the area being One Cochrane. Located just next to the upcoming dedicated financial district of Tun Razak Exchange (TRX) and the recently completed vibrant entertainment enclave of TREC, Cochrane is set to become one of KL’s hottest areas as it is just a stone throw’s away from the future Bandar Malaysia project which is currently being reviewed. We list down eight things we love about living in Cochrane. #1: Located just next to Cochrane MRT station One Cochrane is located just next door to Cochrane MRT station at approximately 150 metres away. With a daily ridership of 400,000 that the SBK Line is expected to generate, this will not only mean easy access for homeowners but also a ready catchment pool among investors from the potential tenants commuting within KL and Greater KL. #2: SBK Line as a property booster MRT Corporation Sdn Bhd, the developer and asset owner of the Mass Rapid Transit project, envisages that the SBK Line is expected to raise the overall property values in the Klang Valley by around RM300 million per annum. As One Cochrane is located just next to the MRT station, the impact will be felt even greater as it is surrounded by other property boosters such as IKEA Cheras and MyTOWN Shopping Centre. As such, we can expect the property prices in the near future to hover at around RM1,400 per sq ft and beyond, similar to Bukit Bintang’s average per sq ft price. #3: Direct access to IKEA Cheras and MyTOWN Shopping Centre Speaking of IKEA Cheras and MyTOWN Shopping Centre, did you know a new underground link has been opened since last year? During our recent site visit, we were pleased to see that IKEA Cheras and MyTOWN Shopping Centre are now directly connected to Cochrane MRT station making shopping and taking the MRT a breeze. Previously, commuters had to exit from the station and then jaywalk across Jalan Cochrane just to get to them. IKEA Cheras boasts 56 showrooms, a 780-seat restaurant and over 1,700 parking bays in two underground carparks while MyTOWN Shopping Centre is a 1.1 million sq ft lifestyle shopping haven with five floors of retail space. Some of MyTOWN Shopping Centre’s anchor tenants include Uniqlo and Parkson, ensuring there is something for everyone to enjoy. #4: Located within the growth area in Southern KL That’s not all. Cochrane is surrounded by various iconic projects that will further boost property prices in the area. With Tun Razak Exchange (TRX) and TREC just one stop away via the Tun Razak Exchange MRT station and Bandar Malaysia just four stops away via the upcoming Sungai Buloh-Serdang-Putrajaya (SSP Line), Cochrane is set to enjoy the spillover impact from the two MRT lines as well as the iconic TREC and Bandar Malaysia projects. #5: Party away at TREC  Entertainment options are aplenty at the hip and happening entertainment enclave located at TREC. Photo: Khalil Adis Consultancy Entertainment options are aplenty at the hip and happening entertainment enclave located at TREC. Photo: Khalil Adis Consultancy Letting your hair down is now a breeze as Cochrane is located next door to TREC. TREC which stands for “Taste, Relish, Experience, Celebrate” feature a variety of different styles, atmospheres and moods in five separate zones offering casual and fine dining, quirky and independent cafes, wine bars, pubs, lounges and clubs, including Zouk KL, Velvet Underground and Phuture. Costing RM323.6 million to develop, TREC is expected to create over 1,500 jobs and estimated to add RM143 million to the local economy annually. #6: Next door to the financial district of Tun Razak Exchange (TRX) TRX will be a mixed-use development comprising a Grade A office space as well as residential and commercial precincts. To be developed in several phases over a period of 15 years, the first phase will comprise four investment grade A office towers, a lifestyle retail mall, two 5-star hotels and up to six luxurious residential towers with a target completion date by 2019. When fully completed by 2027, TRX is expected to raise the country’s Gross National Income per capita to USD15,000 and investments of US$444 billion by 2020. Some 500,000 jobs will be created directly and indirectly once TRX is completed. In addition, Tun Razak Exchange MRT station will serve some 3.3 million workers providing further potential quality tenants for investors. #7: Hop on to the High Speed Rail nearby Bandar Malaysia will serve as the terminus station for the Kuala Lumpur-Singapore High Speed Rail (KL-Singapore HSR) project linking both cities in 90 minutes flat. The development for the project has been postponed to two years and will now commence construction in 2020 instead of 2018. Meanwhile, the express service will only commence by 1 January 2031 instead of 31 December 2026, as originally planned. #8: Next door to the Digital Free Trade Zone (DFTZ)  As of November 2017 - 1,972 small and medium enterprises (SMEs) have joined DFTZ. Image: Khalil Adis Consultancy As of November 2017 - 1,972 small and medium enterprises (SMEs) have joined DFTZ. Image: Khalil Adis Consultancy Bandar Malaysia has been designated as a site for the Digital Free Trade Zone (DFTZ) initiative by Jack Ma. Home to the Satellite Services Hub, DFTZ is expected to create some 60,000 direct and indirect jobs. It will also possibly serve as the interchange to the MRT Line 3, which has now been postponed. Last but not least: Two stops away to the shopping belt of Bukit Bintang With the completion of the SBK Line, you no longer have to endure the traffic congestions along Jalan Bukit Bintang. All you have to do is hop onto the MRT where you can enjoy some of the best things that life has to offer at Pavilion KL, Lot 10, Fahrenheit and Starhill Gallery just two stops away at Bukit Bintang MRT station. From shopping for luxury timepieces to enjoying street food at Jalan Alor, those dreaded traffic jams are now over. So #jomnaikMRT! Investment talk by Khalil AdisDetails below:

Date: 29 September 2018 Time: 11 am Venue: One Cochrane Sales Gallery, Jalan Cochrane, Lot 1246, 55100 Kuala Lumpur, Malaysia RSVP here *First 10 to RSVP will receive a copy of Khalil Adis's best-selling book 'Property Buying for Gen Y |

Khalil AdisAn independent analysis from yours truly Archives

July 2023

Categories

All

|

100 Peck Seah Street

|

|

RSS Feed

RSS Feed