|

Demand remains strong among local buyers with landed homes proving to be popular. By Khalil Adis Johor’s property market is finally seeing some signs of recovery, with majority of new launches (604 units) located within the state in the first quarter of 2022, data from the National Property and Information Centre (NAPIC) showed. Of the total of 2,961 units launched across the state of Johor, Melaka, Selangor and Pahang, 164 units (5.6 per cent) were sold. Majority of them (2,657 units or 90.5 per cent) were landed properties while the remaining 279 units (9.5 per cent) were high-rise apartments. Landed homes proved to be popular across these states with 164 units sold (6.2 per cent) out of the 2,657 units launched. What NAPIC’s data suggests While NAPIC’s data did not give a breakdown of the nationalities of buyers, these landed homes are likely snapped up by local buyers. Unfortunately, NAPIC’s data did not provide a breakdown of how many units were sold in Johor out of the 604 units launched. Interestingly, majority of the launches (1,197 units or 40.8 per cent) were priced from RM300,001 to RM500,000. This suggests that developers are targeting mass market local buyers in the low to medium price range. Record HDB and private property prices in Singapore may have spurred buying activity With majority of these launches located in the state of Johor, it is also likely developers are targeting Malaysians working in Singapore who prefer living in landed homes. The city-state has seen record prices in both the HDB and private property markets as well as rental hikes. Government data showed that the Housing and Development Board (HDB) Resale Price Index (RPI) and Urban Redevelopment Authority (URA) Private Property Index (PPI), as of the second quarter of 2022, are now at a record high. For example, HDB’s RPI is now at 163.9 points which is an increase of 2.8 per cent over that in the first quarter of 2022. Meanwhile, the PPI is also at a record high of 180.9 points whereby prices of private residential properties had increased by 3.5 per cent in the second quarter of 2022, compared with the 0.7 per cent increase in the previous quarter. Rentals have also increased in both the public and private housing markets, government data showed. These are among the push factors for Malaysians working in Singapore to look to buying or renting a property in Johor. Lukewarm sentiment among Singaporean and foreign investors Despite this, Singaporean and foreign investors are adopting a “wait-and-see” approach to Johor’s properties. Currently, the minimum purchase price in the state of Johor for foreign purchasers are at RM1 million, Of the 2,936 units launched, only 134 units (6.4 per cent) are priced at above RM1 million. This suggests that demand from Singaporean and foreign investors has remained rather muted. Some of the potential factors that may have deterred buying activity include the negative sentiments arising from the ongoing high profile corruptions cases involving Malaysian politicians, the severe oversupply of residential properties in Johor, crime and safety issues as well as the flip-flop in policies about the Malaysia My Second Home (MM2H) programme. Data from NAPIC showed that Johor has the highest residential overhang in Malaysia with 5,992 unsold units followed by Penang (5,816 units) and Selangor (5,215 units). Johor also has the highest serviced apartment overhang volume in Malaysia with 16,425 unsold units followed by Kuala Lumpur (4,459 units) and Selangor (2,337 units). Since the full opening of borders between Singa[pore and Malaysia on 1 April 2022, Johor has seen traffic congestions at both the Woodlands custom, immigration and quarantine (CIQ) checkpoint and Tuas Second Link. “We are seeing traffic jams across the causeway and the second link as well as long queues at the local eateries with more and more Singaporeans resuming their weekly visits to Johor and Malaysia. The Johor traffic to Singapore is almost back to normal,” economic affairs minister Mustapa Mohamed was reported as saying. However, buying activity among Singaporean and foreign investors has yet to pick up. Iskandar Malaysia continues to attract institutional investors Despite this, institutional investors have continued to invest in Iskandar Malaysia. Government data showed that Iskandar Malaysia has recorded committed investments of RM13.2 billion in the same period out of which RM5.9 billion have been realised. “A total of more than RM10 billion will be generated by foreign investors in this region for the development of data centres,” Prime Minister Datuk Seri Ismail Sabri Yaakob said in a statement. On July 25, the prime minister chaired the Iskandar Regional Development Authority (IRDA) meeting together with Johor's Chief Minister Datuk Onn Hafiz Ghazi. “In total, more than 6,000 people in this region have received direct benefits from the socioeconomic initiatives that have been carried out,” he was reported as saying. Upcoming projects may boost foreign investors’ confidence With border restrictions now eased, two projects could bolster confidence in Johor’s property market.

They include the Johor Bahru – Singapore Rapid Transit System (RTS) Link and Coronation Square. The RTS Link is a 4km cross-border railway shuttle project that will connect via a 25m-high bridge from Woodlands North Station (LRT) in Singapore to the Bukit Chagar Station in Johor Bahru. When completed in 2026, it can serve up to 10,000 commuters during peak periods, for every hour and in each direction. Meanwhile, Coronation Square which is located in the Ibrahim International Business District (IIBD) will be Johor’s equivalent to the KLCC. When completed by 2028, it is expected to create some 60,000 jobs and contribute over RM9 billion to Johor’s economy.

7 Comments

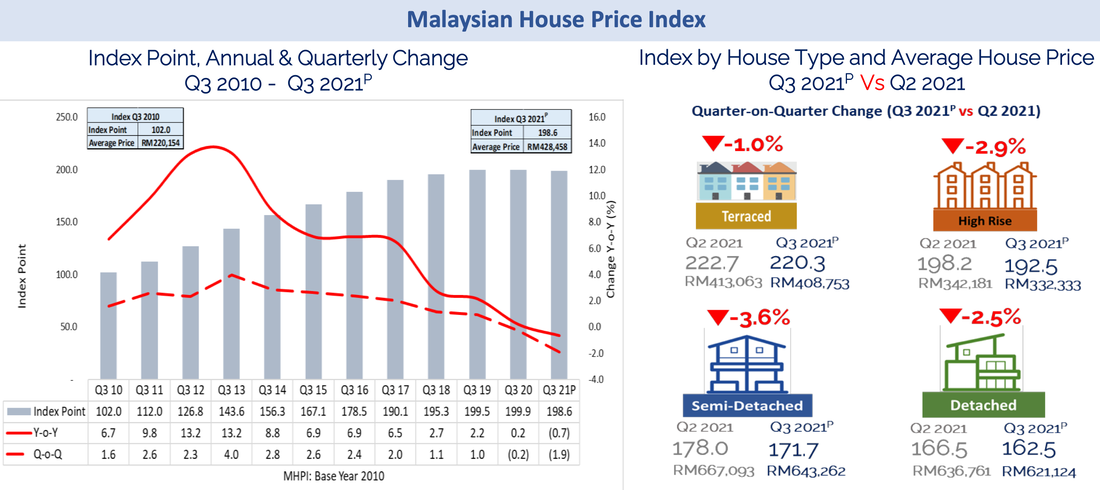

Despite COVID-19 and record housing prices on the island, buying activity in Singapore has remained brisk while Malaysia’s has been somewhat muted. By Khalil Adis Ask any Singaporeans if they will invest in Malaysia right now and most likely they will say no. Instead, Singaporean investors flushed with cash have been busy snapping up properties in the Lion City. Data from the Urban Redevelopment Authority (URA) showed that in the third quarter of 2021, developers sold 3,550 private residential units, compared with the 2,966 units sold in the previous quarter. This figure does not include Executive Condominiums. So what gives? With COVID-19 travel restrictions, it makes sense to buy a property within Singapore. Amid the pandemic, news of Singaporeans having their homes broken into in Johor while they were away plus other developments from across the causeway may have spooked potential investors. From the cancellation of the Kuala Lumpur-Singapore High Speed Rail (KL-Singapore HSR) project to the revision of the Malaysia My Second Home (MM2H) policy, such news is enough to rattle investors’ confidence. After all, if a high-level government-to-government project like the KL-Singapore HSR could be terminated, what more for those involving the private sector like housing? Thus, it came as no surprise that despite its higher property price, buying activity has remained robust within the Lion City with record prices seen in both the HDB and private property markets. Malaysian developers are also closely watching Singapore’s property market. Wanting a slice of the lucrative pie, some are considering launching projects in Singapore but are unsure if Singaporeans will bite. Singapore: Record prices call for curbs to cool the property market When comparing Singapore’s and Malaysia’s property market performances since the pandemic began, they contrast like day and night, as government data showed. While properties in Singapore are notorious for being one of the most expensive in the world, it is also seen as a safe haven for property investment due to its political stability, efficiency and transparency. This may perhaps explain why despite COVID-19, the local property market experienced a bull run. Data from HDB showed that the Resale Price Index (RPI) for the third quarter of 2021 is now 150.6 points - a record high so far. This was an increase of 2.9 per cent over that in the second quarter. Meanwhile, data from the URA, showed that prices of private residential properties increased by 1.1 per cent in the third quarter of 2021, compared with the 0.8 per cent increase in the previous quarter. Similarly, the Private Property Index (PPI) is also at a record high. This had prompted the government to introduce a slew of cooling measures on 15 December 2021. Malaysia: Pandemic fatigue saw lukewarm buying activity but housing prices continued to rise Malaysia is one of the few places in the world where foreigners can own a freehold property. By default, this should make Malaysia a highly sought after investment destination. However, government data showed otherwise. Data from the National Property and Information Centre (NAPIC) showed that the Malaysian House Price Index for the third quarter of 2021 was at 198.6 points. On a year-on-year and quarter-on-quarter comparison, the index declined by 0.7 and 1.9 points respectively. Meanwhile, house prices continued to increase from a median price of RM204,470 recorded in 2009 to RM428,458.42 in the third quarter of 2021. This suggests that while the market has remained somewhat lukewarm, property prices have kept on climbing by a whopping 209.54 per cent in 12 years. So while locals are priced out from the property market and are not buying, foreigners appear to be staying away too. This is despite the strong Singapore dollar versus the Malaysian ringgit. Severe oversupply of residential units in Malaysia It is also worth noting that Malaysia has a severe oversupply problem with 30,358 unsold residential units valued at RM19.80 billion, figures from NAPIC showed. Of this, the majority of them (6,509 units) are located in Johor, just next to Singapore. Nation-wide, the majority of them (10,262 units or 33.8 per cent) are priced between RM500,000 to RM1 million - a price point beyond the reach for most Malaysians. Clearly, majority of the unsold units located in Johor are geared towards foreign buyers. KL-Singapore HSR resumption is needed to bolster confidence While COVID-19 has hampered cross border travel, there appears to be light at the end of the tunnel when both countries officially launched the Malaysia–Singapore land Vaccinated Travel Lane (VTL) scheme on 29 November 2021. Significantly, Malaysian Prime Minister Ismail Sabri is also suggesting reviving the terminated KL-Singapore HSR project during the launch. As a key regional aviation hub, Singapore offers Malaysia direct access to affluent travellers and potential investors. The Lion City also has among the highest concentration of high net worth individuals in the world. With three stops in Johor, it seems almost impossible that the KL-Singapore HSR project could succeed without Singapore’s participation. Look beyond local politics Malaysia will need to look at the bigger picture to see that the KL-Singapore HSR project can enhance cross-border investments that will in turn, solve its housing woes.

Rather than viewing Singapore as a rival, Malaysia should see that the KL-Singapore HSR project is a win-win solution for both countries. The spirit of good neighbourliness and gotong-royong must prevail. After all, when Iskandar Malaysia was first mooted by former Prime Minister Abdullah Badawi, Singapore was meant to complement and not compete with Malaysia. This is something local politicians need to be reminded of time and again. For now, the only investors Malaysia can bank on are the permanent residents that are still holding Malaysian citizenships in Singapore Located within the Eastern Gate Development Zone of Iskandar Malaysia, Bandar Seri Alam boasts a number of good schools and is dubbed the 'City of Knowledge'. By Khalil Adis Bandar Seri Alam is one of Johor's best-kept secrets. Home to 16 educational institutions and located in between Pasir Gudang and Permas Jaya, the township has a growing young population of around 220,000. We list down some of the attractive points about living in Bandar Seri Alam. #1: Located in the growth corridor of Flagship Zone D of Iskandar Malaysia Also known as the Eastern Gate, this is the third phase of Iskandar Malaysia's next growth. There are a few catalytic projects currently happening here, namely Iskandar Halal Park (formerly known as Johor Halal Park) and the Pengerang RAPID Project. First announced on 19 November 2015 by the former Chief Minister of Johor Dato' Khaled Nordin during the Johor Budget 2016, it is part of the state government's effort to promote entrepreneurship in Johor. A 50:50 joint venture collaboration between UMLand and the Johor State Government via Johor Biotechnology & Biodiversity Corporation (J-Biotech), the private-public initiative aims to put it as an international halal park and is one of the catalyst projects in Eastern Iskandar Malaysia. Recently, IHP scored a major coup among when US based-company, Chocolat Moderne from New York, picked JHP as the manufacturing site to set up its first business in Asia. Meanwhile, the Pengerang RAPID Project will be the largest oil & gas hub in Malaysia that will create around 40,000 to 50,000 job creation in the construction industry, 400 jobs for engineers and 4,000 jobs for trained technical. #2: Education is a recession-proof industry One of the attractive factors about Bandar Seri Alam is it is home to a number of higher learning institutions such as Universiti Teknologi Mara campus, Universiti Kuala Lumpur campus, the Masterskill University College of Health Sciences campus as well as international schools. While the Iskandar Puteri/Medini and Johor Bahru/Danga Bay areas boast a number of catalytic industries such as tourism and finance, they are not immune to economic down cycles. Bandar Seri Alam is 100 per cent focussed on education, particularly among the local population. This makes it even more attractive as education in an evergreen industry. One of the oldest and biggest schools in Malaysia, Foon Yew High School is set to open its third campus in Bandar Seri Alam in 2021. #3: Homes are still affordable with the potential for capital appreciation According to data from Brickz, prices of homes here were transacted at a median price of RM320 per sq ft from Jan 2018 to Dec 2018. In comparison, homes in Iskandar Puteri/Medini and Johor Bahru/Danga Bay are priced at around RM900 per sq ft. Being a relatively new township surrounded by various property booster will give room for capital appreciation for homes here. This, plus the price point, make it suitable among first-time homebuyers. #4: Master planned by a reputable developer Bandar Seri Alam is one of United Malayan Land Bhd's signature projects developed by its subsidiary company Seri Alam Properties Sdn Bhd. Thoughtfully developed across 3,762 acres by its subsidiary, Bandar Seri Alam has been planned as a self-contained township with a mix of freehold residential, commercial, industrial and hospitality offerings. At the centre of this township lies a bustling commercial arena with various exciting and attractive retail features and green elements. Some of the world's best brands can be found here including Starbucks, KFC, Burger King and Subway. #5: Growing population Bandar Seri Alam is a thriving township which boasts a population of more than 220,000.

As Iskandar Halal Park and the Pengerang RAPID project are currently being developed, we can expect the population to increase in the next 10 to 15 years as more jobs are being created. As we speak, a new RM500 million Pasir Gudang Hospital will also be constructed as part of the government's announcement under Budget 2016. As the air and sea territorial dispute enters a second week, it could negatively impact investor sentiment in the already lukewarm property market in Iskandar Malaysia. By Khalil Adis The simmering tension brewing in the Straits of Johor between Singapore and Malaysia has now entered its second week. In fact, it is like watching history repeating itself. Growing up during the Lee Kuan Yew era, I recall how both countries would often trade barbs over water to territorial issues. The relationship between both countries is best described as testy then. However, much like brothers and sisters, we would soon kiss and make up. Post the Lee Kuan Yew-Mahathir era, bilateral ties between both countries warmed up significantly under the leadership of Lee Hsien Loong and Mahathir's successors, Abdullah Badawi and Najib Razak. While the later remains highly unpopular among Malaysians, several win-win deals were concluded between both countries which arose from the land swap deal. They included the joint development of DUO in Bugis and Marina One by M + S Pte Ltd (Malaysia and Singapore, in case you don't know) Over in Iskandar Malaysia, Singapore agreed to develop two wellness centre called Afiniti Medini and Avira. Subsequently, CapitaLand invested in A2 Danga Island. Until today, the project has yet to be launched. With bilateral relations going from cold to warm and back again to cold, we analyse how this will impact the property market across the causeway. #1: Investors will likely adopt a ‘wait-and-see' approach to Iskandar Malaysia This is almost similar to the pre-Iskandar Malaysia era under Abdullah Badawi's leadership when the special economic zone was first announced. I recall covering a few stories on Iskandar Malaysia then where I had interviewed several Singaporeans. During that time, many had expressed scepticism on Iskandar Malaysia and avoided buying a property at Horizon Hills. Back then, it was then launched within the minimum investment threshold of RM250,000. However, that changed once the land swap deal was concluded in 2010. As our bilateral ties improved, so did investors' confidence. As a result, properties in Iskandar Puteri and Medini began selling like hot cakes. Meanwhile, units at Horizon Hills was transacted at almost three times the launch price as developments at Legoland Theme Park, EduCity and Puter Harbour were gathering pace. With both countries now embroiled in a maritime dispute, investors are most likely to adopt a similar approach until the issue is resolved #2: Market sentiment in Iskandar Malaysia the most affected July's property cooling measures have made it even more difficult for Singaporeans to buy a private property in the Lion City as the loan-to-value (LTV) limit has been reduced from 80 per cent to 75 per cent if the loan tenure does not exceed 30 years for the first property. Logically, this makes Iskandar Malaysia much more attractive due to its close proximity to Singapore as we share many similar customs, culture and speak similar languages. However, the property market is very much sentiment driven as described above. With Iskandar Malaysia being the closest to Singapore, this will be the property market that will be the most affected. #3: Developers will face an uphill task in marketing their units The property market in Iskandar Malaysia is already facing a challenging time due to the oversupply in the residential sector. According to the first quarter of 2018 data from the National Property and Information Centre (NAPIC), Johor has the second highest number of existing stock of residential units at 795,363 in Malaysia. The current political climate will no doubt be a double whammy for developers who are already struggling to move unsold units in their inventory. With the High Speed Rail project now postponed, only the brand name of the developer will be able to win investors' confidence. As such, developers who have a good reputation among Singaporeans and local buyers will stand to win. Word-of-mouth marketing will be the way forward. #4: Possible spillover impact in tourism and retail sectors The allure of Malaysia is the affordable holiday destination, the many scenic nature and food trails it offers, its close proximity to Singapore and the strength of the Singapore dollar. Thus, December is typically a busy month at the checkpoints as many Singaporeans go for a short break to Johor and beyond. As the tension escalates, Singaporeans are likely to stay away this holiday season unless absolutely necessary. In such a scenario, the tourism and retail sectors in popular malls in Johor Bahru like City Square and KSL will be affected. In addition, many reservist units and national servicemen are being recalled for mobilisation exercises. Many will have no choice but to stay in Singapore. #5: Malaysians will also be affected The current situation affects not just Singaporeans but also Malaysians living in Johor.

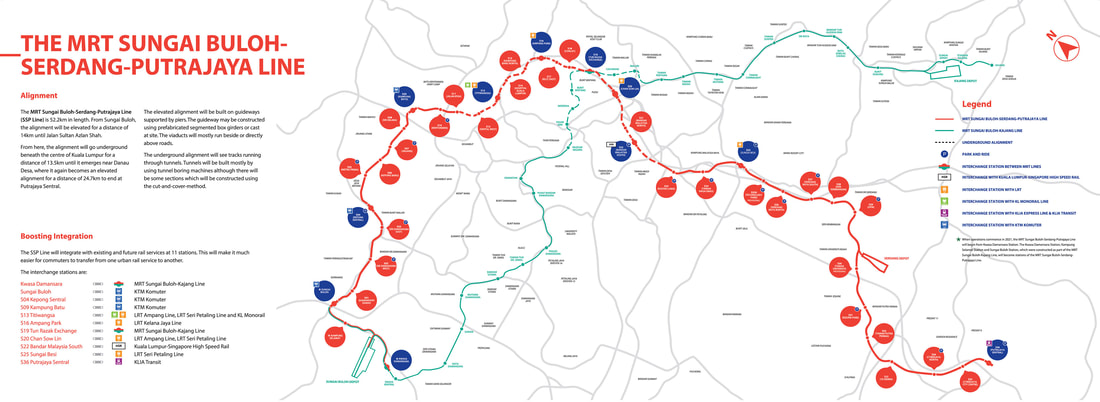

In fact, many brave the causeway in the wee hours every morning just to feed their family back home. As we speak, Johoreans have expressed their concerns that their livelihood in Singapore may be impacted and hope the issue can be resolved amicably. 2018 is a watershed moment for Malaysia's politics and the subsequent impact on the property market. We list down the key highlights in our 2018 property market roundups and our outlook for 2019. By Khalil Adis May 10 2018 was a watershed moment in Malaysia as it marked the first change of government in the country's history. Since 1957, it had enjoyed an uninterrupted reign from the ruling Barisan Nasional (BN) coalition. However, the high cost of living, falling Ringgit, the lack of affordable homes in the market, high unemployment among fresh graduates, the unfettered check on power and the 1MDB scandal proved to be the undoing for BN as Malaysians far and wide casted their protest vote in the ballot box The message from Malaysians is clear - they have had enough and want a new, clean government to lead the way. With the Pakatan Harapan government now in power, all eyes are on the newly elected old Prime Minister Tun Mahathir Mohamad and his team to solve the pressing bread and butter issues. Here are the top five property market roundups for 2018 and our top five outlooks for 2019. Roundups #1: Demand-supply mismatch has resulted in an increasing number of unsold homes According to Bank Negara, 80 per cent of homes or 146,196 units priced above RM250,000 remained unsold as of end March 2018. In comparison, 130,690 units were unsold during the same period last year. "Imbalances observed in the property market continue to persist," Bank Negara had said in a statement. #2: Rent-to-own scheme being rolled out To help ease the entry for the first time property buyers, the private sector has come up with a few initiatives. Some private developers like Ayer Holdings have introduced a ‘Stay & Own' scheme for their Epic Residence and Foreston projects whereby part of the rent will be converted to the downpayment. This not only provides a temporary solution for those who urgently need a home but also a form of security. Meanwhile, Maybank has rolled a similar initiative called HouzKEY which they have called as "a rent-to-own solution that helps you to own your dream home." The scheme involves zero per cent downpayment with the monthly rental forming part of the home financing. #3: Ministry of Housing and Local Government studying Singapore's HDB model In July, Zuraida Kamaruddin, the Minister of Housing and Local Government paid an official visit to Singapore to study the HDB model. Singapore has succeeded to build demand driven homes under its Built-to-Order (BTO) scheme to house 80 per cent of the Singapore population. This is especially useful in Malaysia where there is currently a demand-supply mismatch as in point number one. #4: Malaysia looking into having a single housing government agency In Malaysia, there are so many affordable housing programmes being rolled out by the state and federal governments such as Rumah Milik Mampu, Rumah Selangorku, PR1MA, My First Home, Program Perumaha Rakyat and the list goes on. This confuses the public. The Malaysian government is currently looking into having a single housing agency to streamline the whole process much like the HDB model. If implemented, this could solve the current Malaysian housing woe. #5: More help for the B40, M40 and first-time homebuyers under Budget 2019 More help is on the way for these group of property buyers as announced under Budget 2019. The measures included the Real Estate and Housing Developers' Association (Rehda) agreement to cut prices by 10 per cent for new launches, the exemption of the Real Property Gains Tax (RPGT) for properties that are priced below RM200,000 and the stamp duty exemption for properties priced in the first RM300,000 up to RM500,000 as well as those priced from RM300,000 to RM1 million. Outlook for 2019 #1: Affordable homes to continue driving the market There is currently a strong pent-up demand for affordable homes but where the supply is lacking. As such, the affordable home segment will continue to be in strong demand for 2019. However, there needs to be concerted efforts from both the government and private developers. Under Budget 2019, the federal government has pledged to spend RM1.5 billion on such homes via the 1Malaysia People's Housing (PR1MA) and Syarikat Perumahan Negara Bhd (SPNB). Meanwhile, Rehda has agreed to cut prices as stated above. #2: South KL to be the growth area There are many infrastructure projects and economic drivers that are in the pipeline that will further boost property prices in Southern KL. One such project is Bandar Malaysia will serve as the terminus station for the Kuala Lumpur-Singapore High Speed Rail (KL-Singapore HSR) project linking both cities in 90 minutes flat. The development for the project has been postponed to two years and will now commence construction in 2020 instead of 2018. Meanwhile, the express service will only commence by 1 January 2031 instead of 31 December 2026, as originally planned. Bandar Malaysia has been designated as a site for the Digital Free Trade Zone (DFTZ) initiative by Jack Ma. Home to the Satellite Services Hub, DFTZ is expected to create some 60,000 direct and indirect jobs. It will also possibly serve as the interchange to the MRT Line 3, which has now been postponed. Another economic driver in the vicinity is Tun Razak Exchange (TRX). TRX will be a mixed-use development comprising a Grade A office space as well as residential and commercial precincts. To be developed in several phases over a period of 15 years, the first phase will comprise four investment grade A office towers, a lifestyle retail mall, two 5-star hotels and up to six luxurious residential towers with a target completion date by 2019. In addition, Bandar Malaysia will house two MRT stations - Bandar Malaysia North and Bandar Malaysia South which will form part of the alignment for the Sungai Buloh - Serdang - Putrajaya Line (SSP Line). #3: Properties along Sungai Buloh - Serdang - Putrajaya Line (SSP Line) will be sought after Speaking of the SSP Line, properties along the alignment, particularly those situated in the growth areas of Sungai Besi, Bandar Malaysia and Cyberjaya City Centre are worth looking into. Bandar Malaysia will house two MRT stations as stated above and located a few stops away from Tun Razak Exchange MRT station. Meanwhile, Sungai Besi MRT station is an interchange station to the Sungai Besi LRT station. It will serve as an interchange to the upcoming High Speed Rail station located in Bandar Malaysia, also in Sungai Besi. Last but not least, Cyberjaya City Centre MRT station is a transit-oriented development (TOD) project to be developed by Malaysian Resources Corp Bhd (MRCB). With its experience in building the transport hub in KL Sentral, MRCB will be developing a new city that will be integrated with the MRT station. Phase one is expected to generate a gross development value (GDV) of RM5.35 billion. It will feature a 200,000 sq ft convention centre, a 300- to 400-room business hotel, low and high-rise office buildings and a retail podium. Cyberjaya City Centre will have a development plan spanning 20 years. The MRT station is located just opposite Lim Kok Wing University of Creative Technology. #4: Penang to get a boost from Phase 1 of Penang Transport Master Plan (PTMP) With Lim Guan Eng as Malaysia's Finance Minister, Penang's property market will get a further boost. Just this month, Phase 1 of PTMP was approved. It will comprise the Bayan Lepas Light Rail Transit (LRT) project, Pan Island Link 1 (PIL1) project and several main highways. The proposed Bayan Lepas LRT line will be about 30 km in length with 27 stations running from KOMTAR to the future reclaimed islands in the south. There will be three interchange stations - KOMTAR, Sky Cab Station linking it to the Sky Cab line across the Malacca Straits and The Light Station linking it to the George Town-Butterworth LRT line. The LRT Line will also be integrated with the Sungai Nibong Express Bus Terminal at the Sungai Nibong Station. Meanwhile, PIL 1 is a new 20km highway that will be aligned along the mountainous terrain of the island and will take around 15 minutes from between Gurney Drive to the Second Bridge. There will be six interchanges in all - Dr Lim Chong Eu Expressway (LCE), Awang, Relau, Paya Terubong, Utama and Gurney. #5: Johor Bahru to get a boost from the Rapid Transit System (RTS) Link Meanwhile, over in the southern state of Johor, Iskandar Malaysia's muted property market will get a boost as the RTS Link will commence construction next year.

The RTS Link will link Bukit Chagar station in Johor Bahru to Woodlands North MRT station in Singapore when completed in 2024. There are also plans for a Bus Rapid Transit (BRT) system within Bukit Chagar station to link it to the different areas of Iskandar Malaysia. The BRT will feature a dedicated bus lane with three lines - BRT Line 1 will span from Bukit Chagar to Tebrau, BRT Line 2 from Bukit Chagar to Senai and finally, BRT Line 3 from Bukit Chagar to Iskandar Puteri. However, based on market talk in the ground, there is a possibility that the BRT system will be upgraded to an LRT system instead. Since taking power in May 2018, the newly formed government has announced a slew of policy changes that will impact developments in Iskandar Malaysia. We analyse the impact of its policy changes in Iskandar Malaysia and how they may affect you as a consumer. By Khalil Adis Take a drive around Iskandar Puteri, Danga Bay and Johor Bahru and one cannot help but notice the rapidly changing skyline at this Malaysian state bordering Singapore. Once seen as a buyers’ beware market, Johor has since 2008 rebranded itself as an up and coming economic zone called Iskandar Malaysia which is meant to complement the Lion City. For a while, Singaporeans were afraid of buying Johor properties due to the many horror stories reported in the local press. However, interest surged in 2010 after Singapore and Malaysia agreed to a land swap deal which led to Temasek Holdings and CapitaLand investing in Danga Bay and Medini respectively. The warming bilateral relations, coupled with HDB flats hitting the million dollar mark, saw properties in Iskandar Malaysia being snapped up like hotcakes. However, in the subsequent years, the entry of Chinese property developers like Country Garden, R&F and Greenland raised alarms of a potential oversupply as they appear to be building townships by the thousands. Perhaps, more pronounced, is the development of the controversial Forest City project. The project sparked concerns of environmental damage and land encroachment leading to an official protest from Singapore. As a result, interests in Iskandar Malaysia started to wane as Singaporeans steered clear from the property market. Here are the five impacts post GE-14: Impact 1: No more foreigner only enclave Forest City is currently one of the mega projects under review by the Pakatan Harapan government. Although Forest City is a relatively new entry to the property market, it was granted a special economic zone status much like Medini. This confused the public while many local developers were reportedly not very happy about it. For example, it was not subjected to build a specified number of low-cost homes or to allocate a certain percentage of its development for bumiputras. In addition, there are no caps on foreign ownership but with a minimum price threshold at RM500,000 per strata unit for foreigners. It was also granted a duty-free zone where buyers will automatically be eligible for the Malaysian My Second Home (MM2H) programme. This programme enables foreigners to enjoy a long-stay visa of up to 10 years. However, as of September 2018, MM2H will no longer be granted automatically. In addition, the federal government has said a foreigner-only township is no longer allowed. As it stands, the current entry price for a condominium here averages RM1,400 per sq ft which is way beyond what the locals can afford. For now, the developer is required to build affordable homes for locals. Meanwhile, the minimum purchase price for a foreigner has been reverted to RM 1 million per strata unit. The only thing that remains is its duty-free zone status. Impact 2: Longer development period for Gerbang Nusajaya and Iskandar Puteri This follows the review of another major project which is the High Speed Rail project linking Singapore to Kuala Lumpur. The project was initially cancelled and then postponed. Full service for the line will commence before 1 January 2031. The Iskandar Puteri station will be located close to Motorsports City near East Ledang in Gerbang Nusajaya. In April 2015, Nusajaya’s master developer UEM Sunrise Berhad revealed its comprehensive development plans for Gerbang Nusajaya which will have its own CBD similar to Jurong Lake District. Spread across 4,551 acres of land, this second phase of Nusajaya’s development will be designed with catalytic industries similar to the various economic drivers in Nusajaya and Medini. In anticipation for the High Speed Rail terminus in Gerbang Nusajaya, a number of catalytic developments have been planned. They include Nusajaya Tech Park, a 519-acre integrated eco-friendly tech park and FASTrack Iskandar which is a 300-acre ‘motorsports city’. Gerbang Nusajaya will have a gross development value of RM42 billion and with an estimated 220,000 population upon its completion However, now that the project has been suspended, it will take a longer period for Gerbang Nusajaya, Iskandar Puteri and Medini to experience the expected spillover impact from the High Speed Rail project. Impact 3: Opportunity costs to be passed on to consumers With the delay of the High Speed Rail project, it may even result on the opportunity cost from developers to be passed on to consumers. As such, new launches will likely be priced higher. Developers who are banking on the project will be affected. Impact 4: Correction of prices in the property market The postponement of the projects plus investors sentiments on the perceived oversupply situation have impacted the market. In fact, there is currently a glut in the housing sector in Johor. According to data from the National Housing and Information Centre (NAPIC), Johor has the second highest number of supply of homes in the first quarter of 2018 - 795,363 units. In comparison, Kuala Lumpur trails third with 471,475 units. With the High Speed Rail project as the only property booster at the moment, the property market in Iskandar Malaysia is expected to be muted, moving forward. This will likely impact the prices for current homes For example, the median condominium prices in Iskandar Puteri and Medini were RM900 per sq ft and RM700 per sg ft respectively in 2015 since we first started tracking data based on our on the ground survey. However, the latest data from Brickz showed that the median prices have now corrected to RM515 per sq ft and RM542 per sq ft in Iskandar Puteri and Medini respectively. Likewise, the median condominium prices in Johor Bahru and Danga Bay were RM1,000 per sq ft and RM1,200 per sq ft respectively in 2016. However, the latest data from Brickz showed that the median prices have now corrected to RM662 per sq ft and RM863 per sq ft in Johor Bahru and Danga Bay respectively. Impact 5: Iskandar Halal Park and Pengerang Rapid project still ongoing Iskandar Halal Park and the Pengerang Rapid project were spared from the policy changes.

Iskandar Halal Park is part of the state government’s effort to promote entrepreneurship in Johor. Recently, Iskandar Halal Park scored a major coup among when US based-company, Chocolat Moderne from New York, picked Iskandar Halal Park as the manufacturing site to set up its first business in Asia. Meanwhile, the Pengerang Rapid project, with a gross development value of RM70 billion, was affected by the slowdown in the oil and gass sectors. While both projects were spared from major reviews, there has also been a price correction for residential homes located in the Eastern Gate which spans from Pasir Gudang to Pengerang. For example, the median housing prices in Permas Jaya and Pasir Gudang were RM300 per sq ft and RM450 per sq ft respectively in 2016. However, the latest data from Brickz showed that the median prices have now corrected to RM272 per sq ft and RM329 per sq ft in Permas Jaya and Pasir Gudang respectively. Only Pengerang recorded a price increase from RM80 per sq ft in 2016 to RM236 per sq ft in 2018.  One Bukit Senyum is a mixed development which comprises twin towers of service apartments (The Astaka @ One Bukit Senyum), as well as phase two of One Bukit Senyum, which comprises of a shopping mall, grade A office tower, five-star hotel, Johor Bahru City Council’s headquarters, serviced apartments and residences. Photo: Astaka Holdings Limited Conferment of One Bukit Senyum expected to play a key role in Johor’s transformation into a burgeoning metropolis of Malaysia

By Khalil Adis Iskandar Malaysia’s property market received an added boost with the announcement by Astaka Holdings Limited that it has been granted node status by Malaysia’s Ministry of Finance and Iskandar Regional Development Authority (IRDA). Located in Flagship A of Iskandar Malaysia, the node status refers to a designated area where the developer and promoted businesses can enjoy tax incentives. “The node status accords Phase 2 of the project full income-tax exemption on proceeds from the sale and income derived from the leasing of all non-residential buildings,” said Singapore-listed Astaka Holdings Limited in a statement. One Bukit Senyum is an upcoming RM5.4 billion administrative and commercial hub spanning 11.85 acres. Phase 2 of One Bukit Senyum will include the new headquarters of the Johor Bahru City Council, a five-star hotel, serviced apartments and a premium shopping mall. It will also come with branded residences and serviced residences. “We are honoured that One Bukit Senyum has been awarded node status. This underscores the significance of our project and the trust that the Malaysian federal government and Johor state government have in Astaka,” said Astaka’s executive director and chief executive officer Dato’ Zamani bin Kasim. “Landmark developments such as One Bukit Senyum, that is in Johor Bahru City Centre or Flagship A of Iskandar Malaysia, will attract new investments that in turn, create job and business opportunities for the rakyat. This development will also contribute to efforts to enhance Johor Bahru’s standing as one of the leading growth centres to spur the nation’s drive towards becoming a high-income nation.” said Datuk Ismail Ibrahim, chief executive of IRDA. Astaka Holdings Limited is an award-winning property developer. In 2015, it won Best Condo Development (Malaysia) at the Southeast Asia Property Awards (Malaysia). A study conducted by a researcher at ISEAS – Yusof Ishak Institute shows that the mega project in Iskandar Malaysia has negative effects ranging from ecological damage to environmental pollution. By Khalil Adis The controversial Forest City project appears to have adverse effects on the local community which include reduced fishing income, increased navigational dangers, more shallow and polluted waterways, noise and dust pollution, and dangers from speeding contractors’ and construction heavy vehicles. This is according to a finding released on 22 June by ISEAS – Yusof Ishak Institute. The ambitious 3,425 acres project spanning four different islands has been billed by the developer, Country Garden, as “a role model of a sustainable city smart city well ahead of its time”. However, the Singapore-based research institute’s study shows otherwise highlighting habitat damage and mass fish death, as among the biggest issues. Titled ‘The Socio-Cultural Impacts of Forest City’, the study was conducted by Serina Rahman, a visiting fellow under the Malaysia Programme. According to the study, Forest City “is having a major impact on its neighbouring community, Mukim Tanjung Kupang”. The study is based on the researcher’s extended fieldwork and total immersion in the villages around the Forest City development between 2008 and 2017. Background Forest City is a mixed-use development project by Country Garden Pacific View (CGPV), a joint venture between Country Garden Group and Iskandar Esplanade Danga 88 Sdn Bhd. Located off the Straits of Johor and within view from the Tuas Second Link, Forest City first gained attention sometime in 2014 when local fishermen had complained that it was affecting their livelihood, especially since it is located very near to the delicate Ramsar site. However, it was Singapore’s official protest and clout on the international stage that finally brought the project to a grinding halt. “Given Johor’s close proximity to Singapore, we are naturally concerned about any possible transboundary impacts on Singapore from property development projects that involve reclamation works in the Straits of Johor. There are also international obligations for both Malaysia and Singapore authorities to work closely on such matters. We have asked the Malaysian authorities to provide more information so that we can undertake a study as soon as possible on the impacts of these reclamation works on Singapore and the Straits,” the Ministry of Foreign Affairs said in a statement released on 21 June 2014. The diplomatic spat attracted significant international attention and media coverage forcing both the state and federal governments to take action. The federal government, via the Department of Environment (DOE), then intervened and asked the state government to comply with Malaysia’s commitment to international laws. Following several diplomatic exchange, the project stopped work temporarily in June 2014. This was after Singapore provided evidence at the Malaysia-Singapore Joint Commission on Environment in December 2014. The DOE subsequently issued a letter to Country Garden to do a Detailed Environmental Impact Assessment (DEIA) Report. Interestingly, this was done only after the project had commenced massive land reclamations, contravening international laws. In January 2015, the DOE finally issued a report and set new limits on the developer reducing its size from 1,600 hectare to less than 405 hectare. While this had resulted in a major revamp of the master plan (the initial plan appeared to show part of the island under the Second Link), the study shows the damage has already been done. We dissect the study and list down its key findings: #1 Livelihood of fishermen affected One of the most adverse impact arising from the project is on the livelihood of the local population. Mukim Tanjung Kupang, where Forest City is located at, comprises nine villages whose inhabitants are mainly fishermen. Of this, 250 are registered fishermen while many aren’t. “Many others in the community depend on gleaning in the mangroves, mudflats and intertidal seagrass for their daily meals. These are the fishermen (and women) who are greatly dependent on the natural habitats for their subsistence and survival,” the study shows. Additionally, the DEIA Report showed that the fishermen here earn an average household income figure of RM1,626. This is based on the developer’s finding called ‘Forest City Detailed Environmental Impact Assessment’ report, after the DOE requested the developer to do so. Citing a public dialogue in Kampung Pok that took place in September 2014, the study further mentioned a fisherman, Anuar Musa of Tg Kupang, who said that his income would be affected for the 30-year duration of the project. Additionally, he had said that “no amount of money could compensate him for the shrinking catch that he was seeing ever since reclamation began.” #2 Habitat damage and environmental pollution Forest City is situated very close to the delicate mangroves area located at the Sungai Pulai Ramsar site. Ramsar areas are recognised as wetland areas of international importance. Measuring 9,126 hectare, Sungai Pulai was gazetted as a Ramsar site on 31 January 2003 and is the largest riverine mangrove system in Johor. According to the study, some 2,000 acres of this site are now gone. Instead, it will be converted into three golf courses designed by Jack Nicklaus and an accompanying resort complex. During the public dialogue, other fishermen had reported on mass fish deaths in the area, providing clear evidence on habitat damage. In addition, the clearing of mangroves and secondary forest and the building of the dispersal link have also generated dust and noise pollution. “With access to these roads immediately in front of local villagers’ homes and shops, complaints about the dust have been rife. Houses are reportedly full of dust even when windows and doors are shut, and freshly laundered clothes hung out to dry come back covered in dust. Villagers on motorbikes and bicycles suffer from dust inhalation and particles in their eyes as they ride past these access areas. There have not been any studies or monitoring of local residents’ health issues as a result of the development. A few restaurants and food stalls close to the new dispersal link have shut down because of the pollution,” cites the study. #3 Job displacement among locals While the study did not mention how much their livelihood has been affected, the study suggests there is a possibility their income has been greatly reduced arising from the reported mass fish deaths. “Some former fishermen take on other work to supplement reduced catch and increasing petrol costs, heading back to sea only when there is a guaranteed harvest. Most young men work in the port or in the private sector as lorry drivers, Rubber-Tyre Gantry (RTG) operators, factory workers, security guards, cleaners and other technical jobs,” the study says. Local women are also affected. “Several women supplement family incomes with online sales of cosmetics, baked goods and other items. Some in the community commute to Singapore for work in factories or as cleaners but usually for only short periods of time,” the study cites. #4 Some fishermen received compensation, some did not Additionally, according to a research paper titled ‘The Case of Forest City’ by the Massachusetts Institute of Technology (MIT), “Country Garden was forced to treat those it stood to impact with more care and respect”. This was after the DOE’s intervention and the release of the DEIA Report. “It held several community engagement meetings and gathered input from villagers through a number of local workshops. In addition, a new law was passed that taxed developers for every square foot of reclaimed land and used the proceeds to create a fund for fishermen impacted by the reclamation works. Approximately $30 million was projected to be collected, including from projects already underway. The Johor chief minister championed the program as evidence that Johor was taking care of its fishermen,” MIT’s report cites. ISEAS – Yusof Ishak Institute’s study concurs with this: “Since the stop-work order, there has been visible effort by CGPV staff to engage with the community. Several have proactively asked how else they might be able to support the villagers and meet their needs.” However, it notes that only registered fishermen were eligible for compensation. This compensation was only announced during the public dialogue where RM3 million was handed over from the developer to a group of community and fishermen’s representatives. The first tranche disbursed was RM3,000 per fisherman with an additional RM1,000 given to those who owned boats. This was paid soon after the public dialogue. Subsequently, there were two other disbursements of between RM1,000 to RM3,000 each. “The fishermen who were deemed eligible to receive these funds have been given about RM10,000 (S$3,200) each since the project began. Some of those without licenses but depended on fishing for their livelihoods were deemed ineligible for compensation,” the study cites. According to the study, those awarded compensation were decided upon by the South Johor Fishermen’s Association and the head of each jetty. However, many unregistered fishermen were unable to claim compensation as they, according to the study, “either fish for supplementary incomes or are unable to get fishing licences”. “With fishing licences no longer being issued, this group of fisherfolk are not eligible for compensation, assistance or subsidised petrol,” the study shows. #5 Compensations appear to be reserved for the select few Following the DEIA Report, the developer also started offering various compensation packages for the betterment of the community including employment opportunities. “Aeron Munajat, CGPV’s Head of Corporate Communications revealed that CGPV spent more than RM1 million in 2016 alone supporting school programmes, workshops and courses, as well as contributing to the South Johor Fishermen’s Association, among others,” says the study. As part of the compensation package, the DEIA Report had recommended that a ratio of at least 30 per cent be set aside for locally sourced employees. However, not everyone has equal access to these compensations. “The developer and the project’s proponents’ compensation and local employment efforts have not always reached those who need them most as opportunities are often reserved for the well-connected or appointed village representatives. Other local applicants often lack relevant work experience and face language and cultural barriers,” the study cites. Additionally, the study shows that many villagers do not seem to be aware of the opportunities available. The study notes the following: “Those who proactively asked for jobs were reportedly discouraged by middlemen and agents. Several have complained that opportunities to sell goods to construction workers (within and just outside their quarters) have gone to vendors from outside the community.” Employment opportunities also come in the form of setting up shops. Again, this proves to be problematic. “Others comment that they cannot afford to pay the ‘rental’ rates imposed on those who take up stall spaces,” the study cites. The study also conducted a survey among unemployed residents who have no political or family connections. It said that while many were keen to find work in Forest City, the local villagers experienced a clash of cultures between local and Chinese customs, even among the local Chinese. “Language barriers are often the primary obstacle for the villagers, with many being unable to speak English and even fewer able to speak Mandarin. Even local Chinese villagers have commented that while their children are able to get jobs in the project because of their ability to speak Mandarin, they do experience a great difference in language, work styles and attitudes between mainland and local Chinese,” the study says. Not all is bad Nevertheless, the study notes one positive outcome from Forest City. “Positive feedback on the development does exist, with some shopkeepers reporting better business given increased numbers of people (whether workers, contractors or visitors) to the area. This is corroborated by the number of small businesses that has been set up around the contractors’ quarters’ entrance in Tanjung Kupang. These range from makeshift food and drinks stalls to grocery shops and suppliers of services. There are also a few new hardware supply stores in the vicinity,” the study cites. Conclusion With the project now in full swing, the study suggests the only way to move forward is for the relevant stakeholders to take steps to mitigate and reduce the negative impact on the local community so that they can also benefit from the Forest City project.

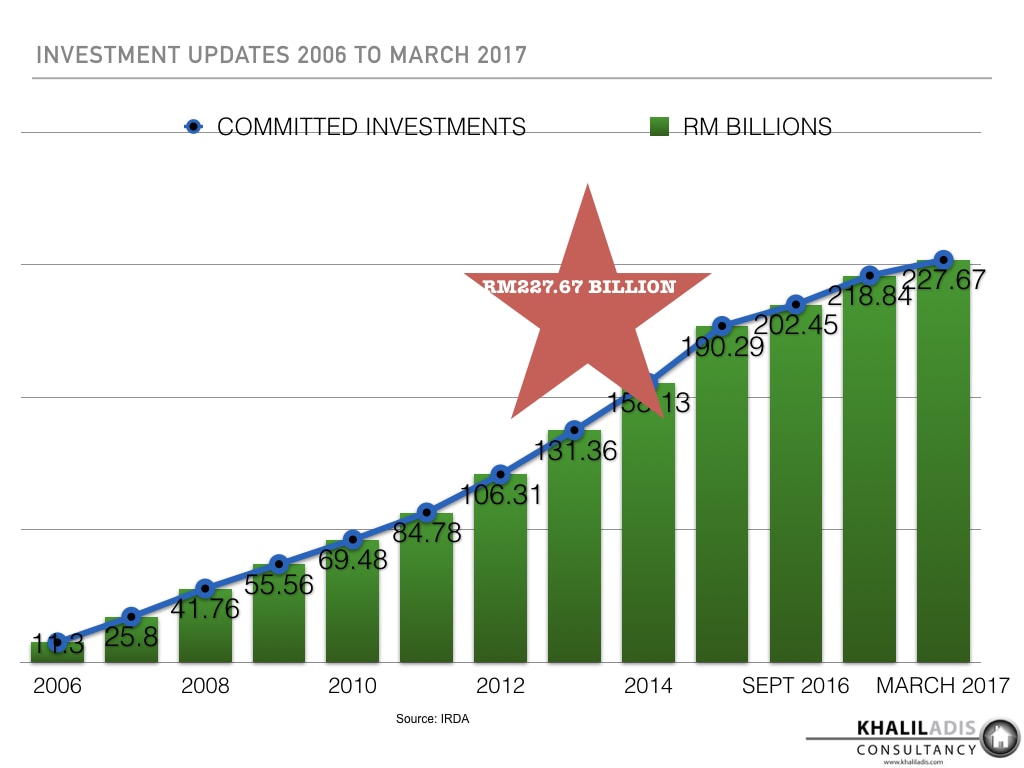

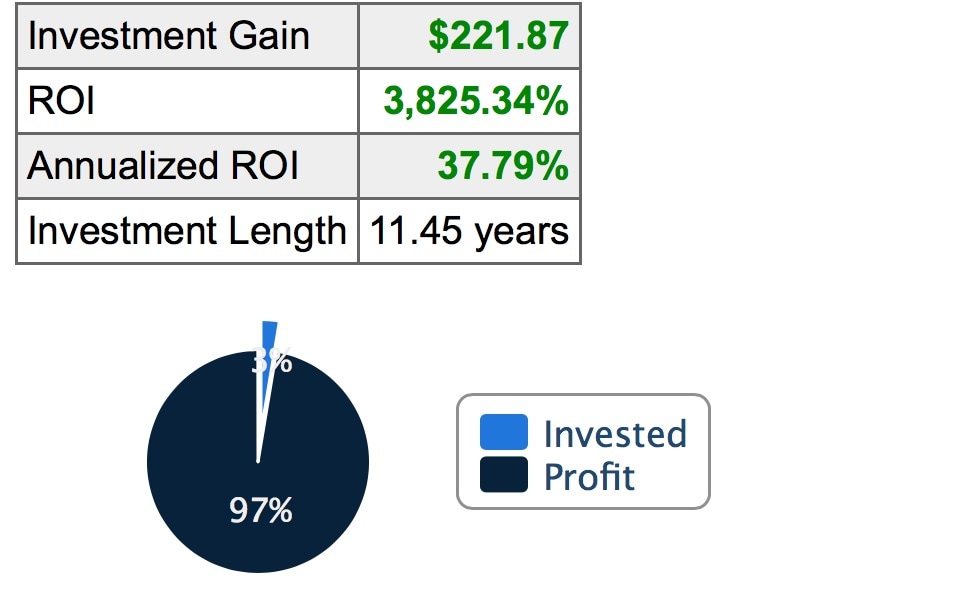

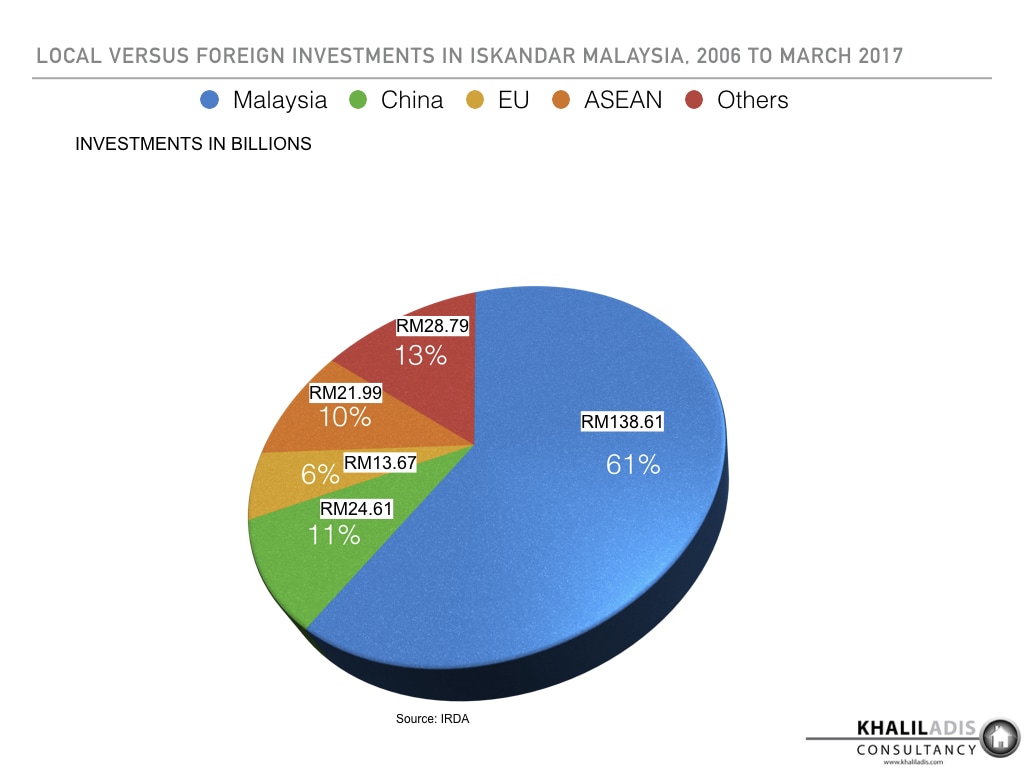

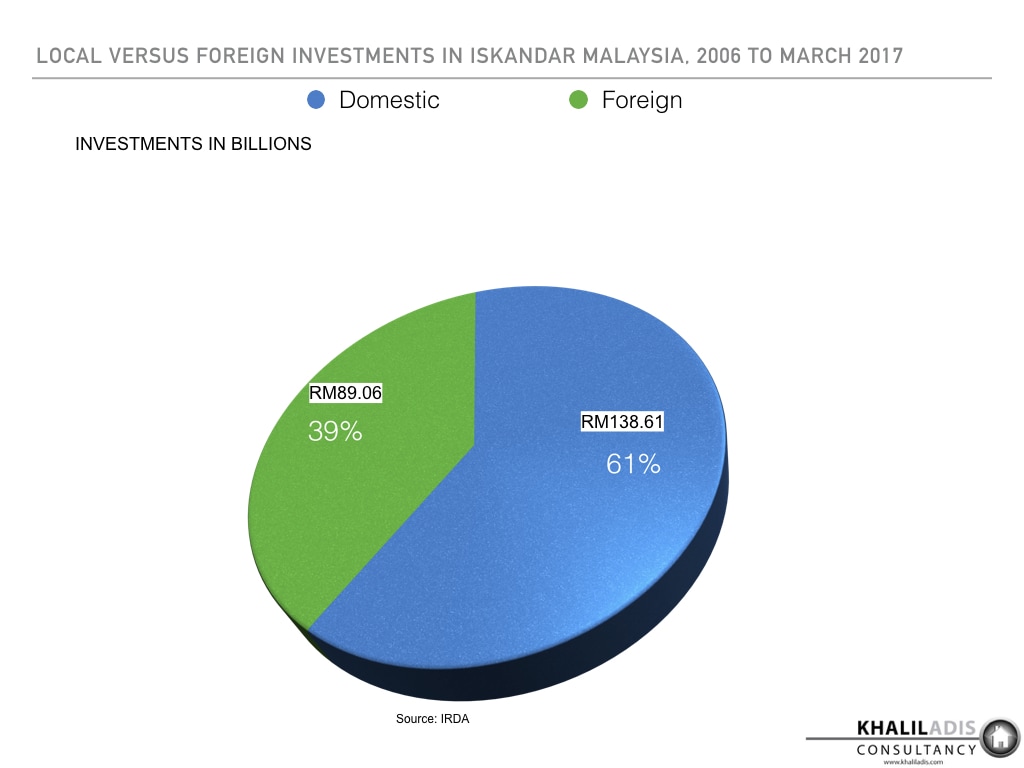

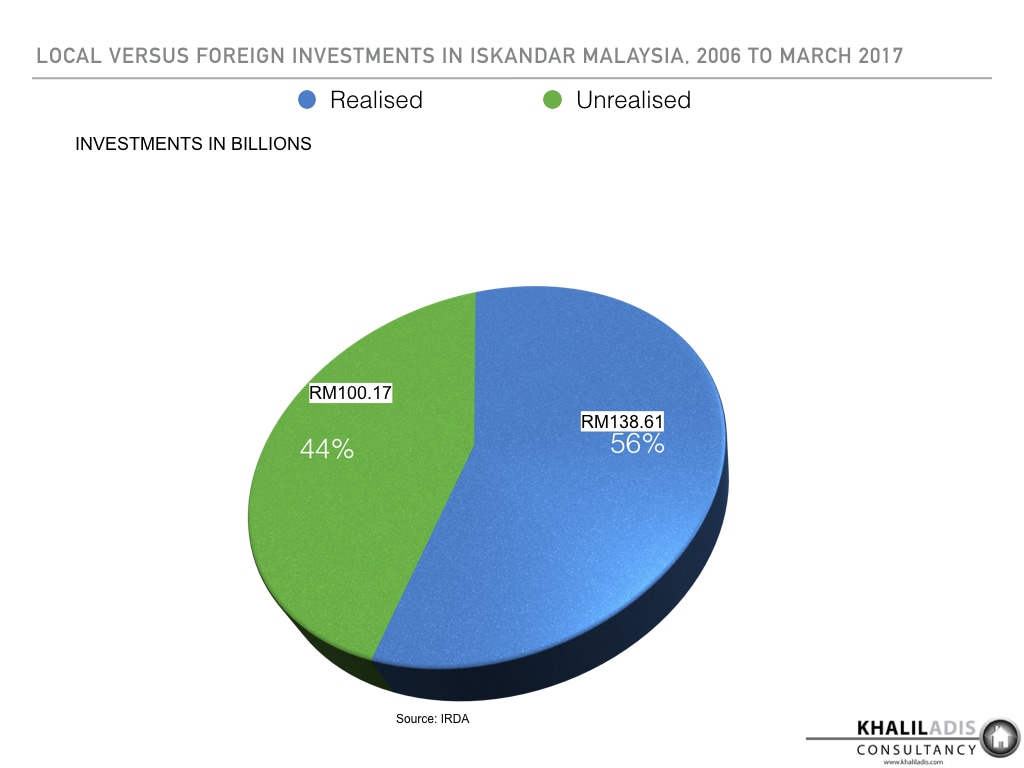

“The key to this are capable and credible expertise providing accurate information and the right advice, and the involvement of all levels of the community in deciding what they need and want, as well as ensuring that compensation offered and provided reaches those who need it the most,” the study concludes.  On 21 May, Johor’s Sultan Ibrahim Ibni Sultan Iskandar officiated the grand launch and the opening of sales gallery of Bukit Pelali at Pengerang, a 363-acre project that is Pengerang’s first strata township being developed by Johor-based Astaka Holdings Limited. Iskandar Malaysia, situated within Johor, is the most successful out of the five economic corridors in Malaysia. Photo: Astaka Padu As Iskandar Malaysia surpasses its 10th year as of November 2016, it has continued to defy expectations with these five key achievements By Khalil Adis I recall covering Iskandar Malaysia when it was still very much in its early development stage sometime in 2008 as part of a special feature for Property Report. Hosted by Iskandar Investment Berhad (IIB) and the Iskandar Regional Development Authority (IRDA), I had to wear rubber boots while government officials drove me around in a Land Rover over muddy roads as we cut through dense jungles and oil palm plantations in what is now known as Iskandar Puteri (then called Nusajaya) and Medini. As we passed by what is now known as EduCity and Legoland I was blown away by the massive scale of Iskandar Malaysia’s development. It was, by far, the single largest development that I had covered when reporting on the ground. As I headed back to Singapore to file my story, I called a few of my sources comprising analysts, and markets watchers on what they thought of this special economic zone. “It will fail. Just look at Cyberjaya,” said one. “Another white elephant project,” quipped another. However, that all changed in 2011as bilateral ties between both countries started to warm . That year witnessed Temasek Holdings announcing its investments in two sites in Medini, Iskandar Malaysia, now called Afiniti Medini and Avira. This was followed with another S$3.2 billion worth of investment to build a township development on Danga A2 island in 2013. As bilateral ties began to thaw, so did investors’ confidence. At the peak of the market in 2011, Singaporeans were seen snapping up Iskandar Malaysia properties like hot cakes. With the market now remaining somewhat muted and with concerns of oversupply, market watchers are again writing off Iskandar Malaysia. Whether you like it or not, this “flash in the pan” has indeed come a long way. As Iskandar Malaysia celebrates its tenth year, we look back and list its five major achievements.  Iskandar Malaysia is the best performing economic corridor out of the five in Malaysia with a total cumulative investment of RM227.67 billion as of 31 March 2017. Graphics: Khalil Adis Consultancy Iskandar Malaysia is the best performing economic corridor out of the five in Malaysia with a total cumulative investment of RM227.67 billion as of 31 March 2017. Graphics: Khalil Adis Consultancy #1 RM227.67 billion in total cumulative committed investment as of 31 March 2017 Not bad. Not bad at all considering the federal had initially invested RM5.8 billion while the manufacturing sector contributed some RM5.5 billion during its initial phase in 2006. Since then, investment volumes have grown by leaps and bounds to reach RM227.67 billion as of 31 March 2017. #2 Return of investment (ROI) of 3,825.34% Now, let’s work on the ROI. With an initial investment from the federal government at RM5.8 billion in 2006 and a total cumulative committed investment of RM227.67 billion as of 31 March 2017 over a span of some 11.45 years, this works out to an investment gain of RM221.87 with an ROI of whopping 3,825.34 per cent! In terms of annualised ROI, this works out to 37.79 per cent. This pales in comparison to the paltry 1.0 per cent interest you get when you put your money in your Singapore bank account. #3 The Chinese are coming in a big way with investments of RM24.61 billion Bye-bye Singapore, hello China! Our tiny city-state no longer holds dominance as the single largest foreign investor in Iskandar Malaysia. In fact, for the past three years or so, China has been coming in droves and snapping up land parcels from Tanjung Pelepas all the way to Tebrau. The good - state government coffers stand to benefit which will have an indirect impact on Johoreans. The bad - concerns on the sustainability and the possibility of inducing price volatility in the property market once these mammoth projects are completed. #4 61% of Iskandar Malaysia’s investments are by the domestic market While some analysts have expressed concerns on the wave of Chinese investments and their potential repercussions, Iskandar Malaysia is still very much driven by domestic investments. Of the RM227.67 billion in total cumulative committed investment as of 31 March 2017, 61 per cent were driven by the domestic investments. This means, even if a foreign investor were to pull out (as in the case of Dubai’s Mubadala) or during a global economic crisis, Iskandar Malaysia can still hold out on its own due to its sheer domestic investment market size. #5 56% investments worth RM138.61 billion have been realised as of 31 March 2017

Enjoy exploring LEGOLAND MALAYSIA or dining by the waterfront at Puteri Harbour? Perhaps some of you have even used your CPF Medisave for your medical treatment at Gleneagles Hospital Medini. Well, these completed projects that you see right now are just the tip of the iceberg. There’s still the remaining 44 per cent that has yet to come on-stream such as Motorsports City, Gerbang Nusajaya and of course the high-speed rail station. Once completed, all these will create around 257,100 additional jobs by 2030 in Iskandar Puteri, according to DTZ Research. The key takeaway when investing in Iskandar Malaysia is this - you must be in for the long-haul in order to reap fully from your investment. It’s definitely not a market for those hoping to make a quick buck or for the cash-strapped. |

Khalil AdisAn independent analysis from yours truly Archives

July 2023

Categories

All

|

100 Peck Seah Street

|

|

RSS Feed

RSS Feed