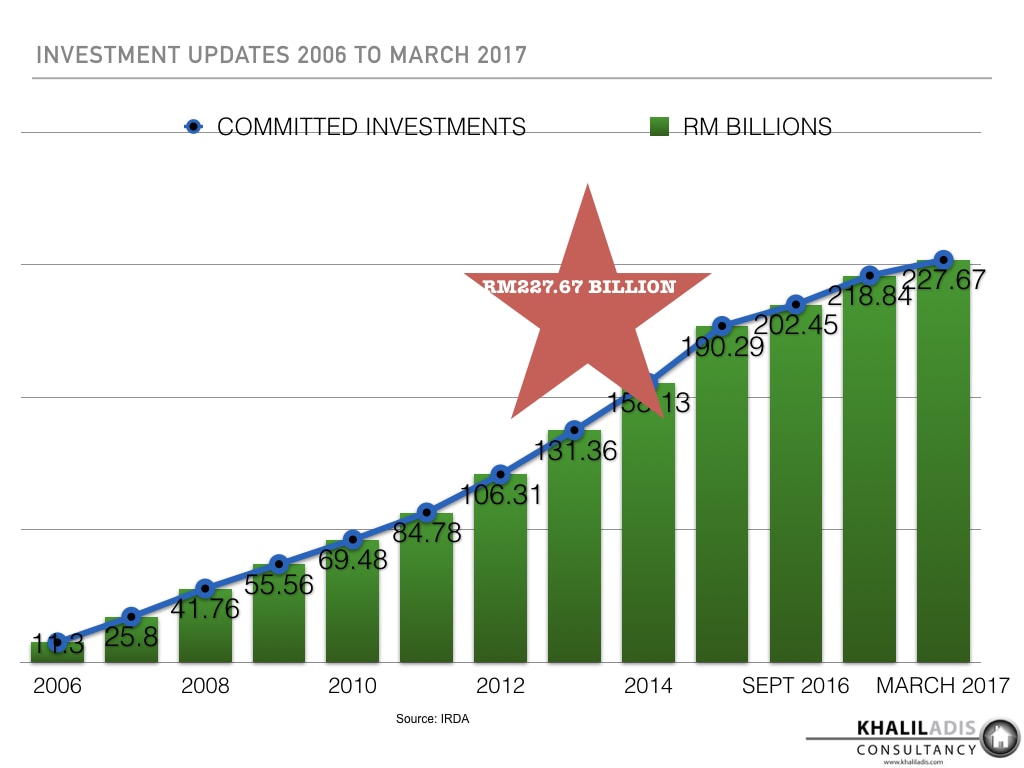

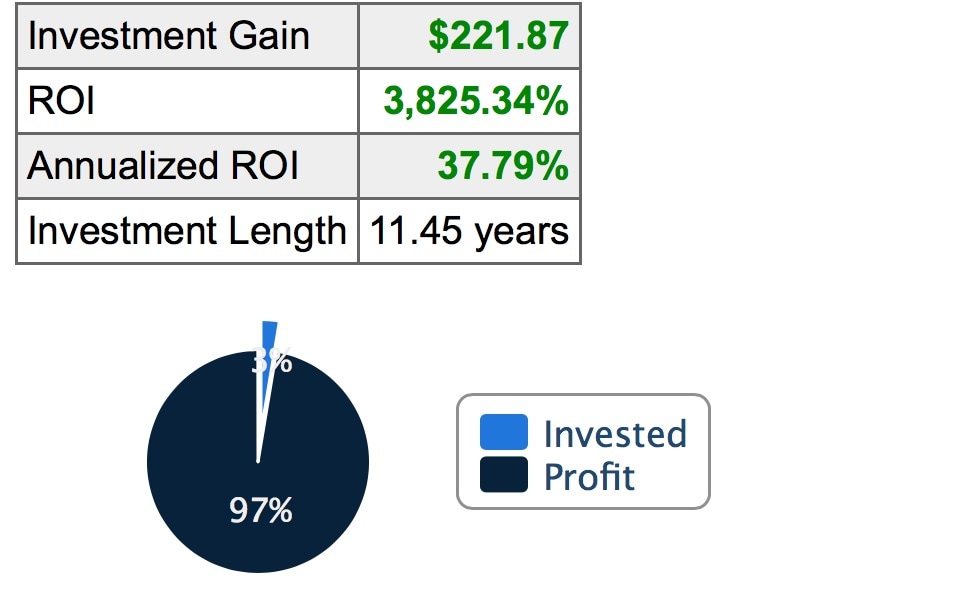

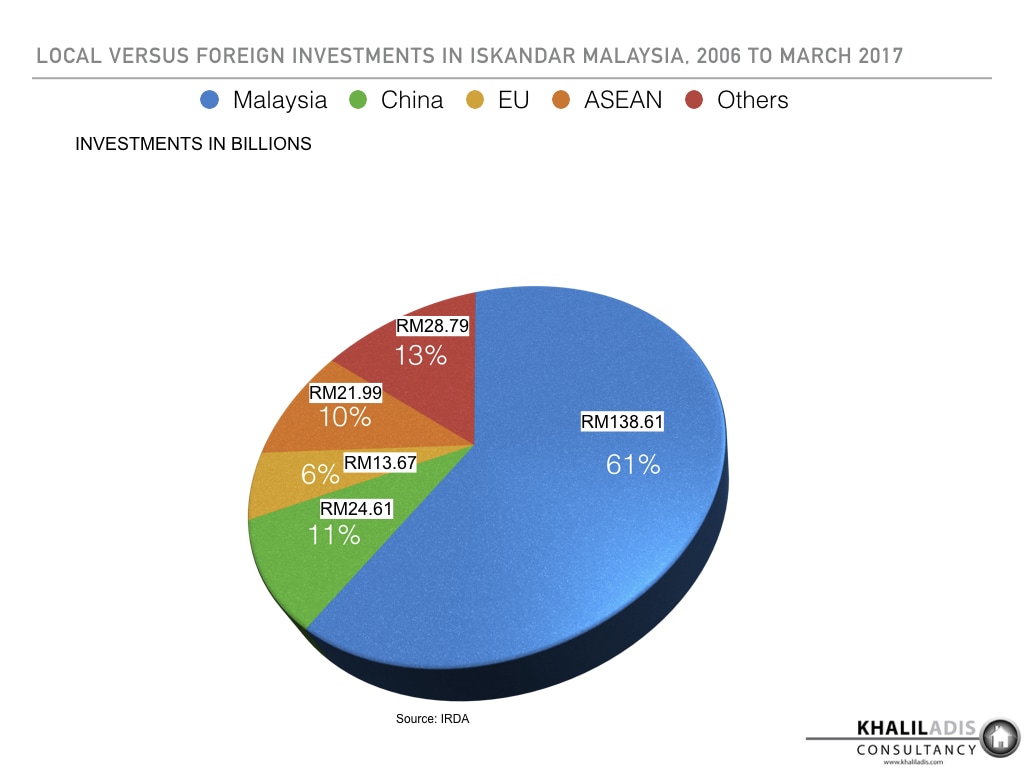

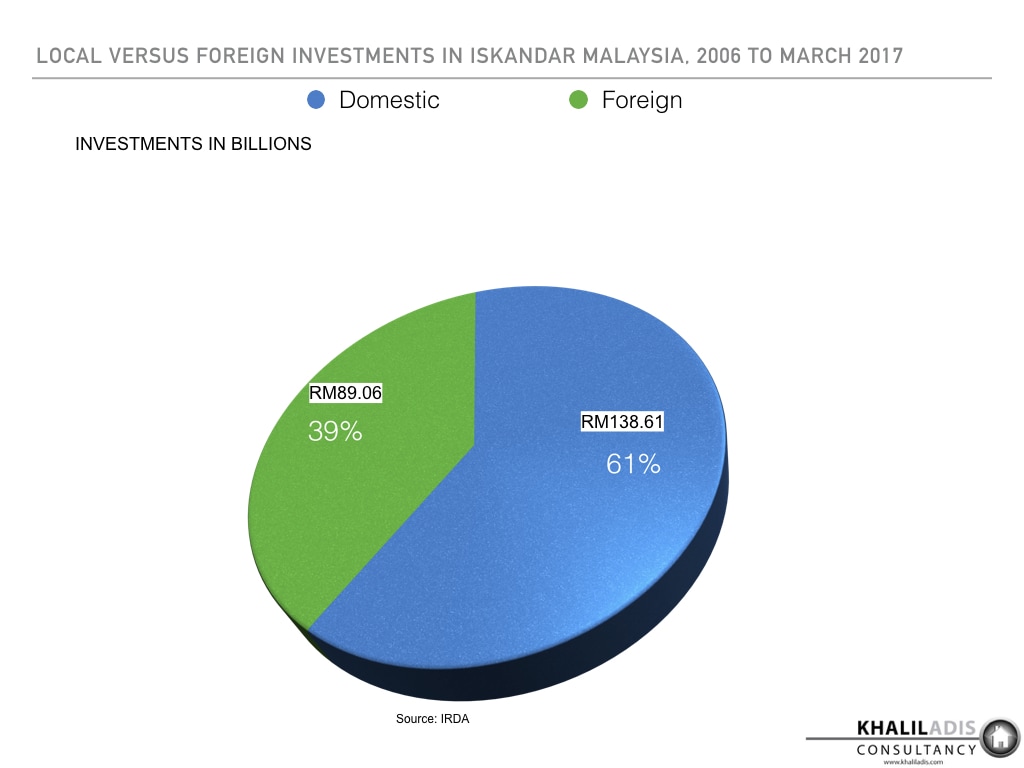

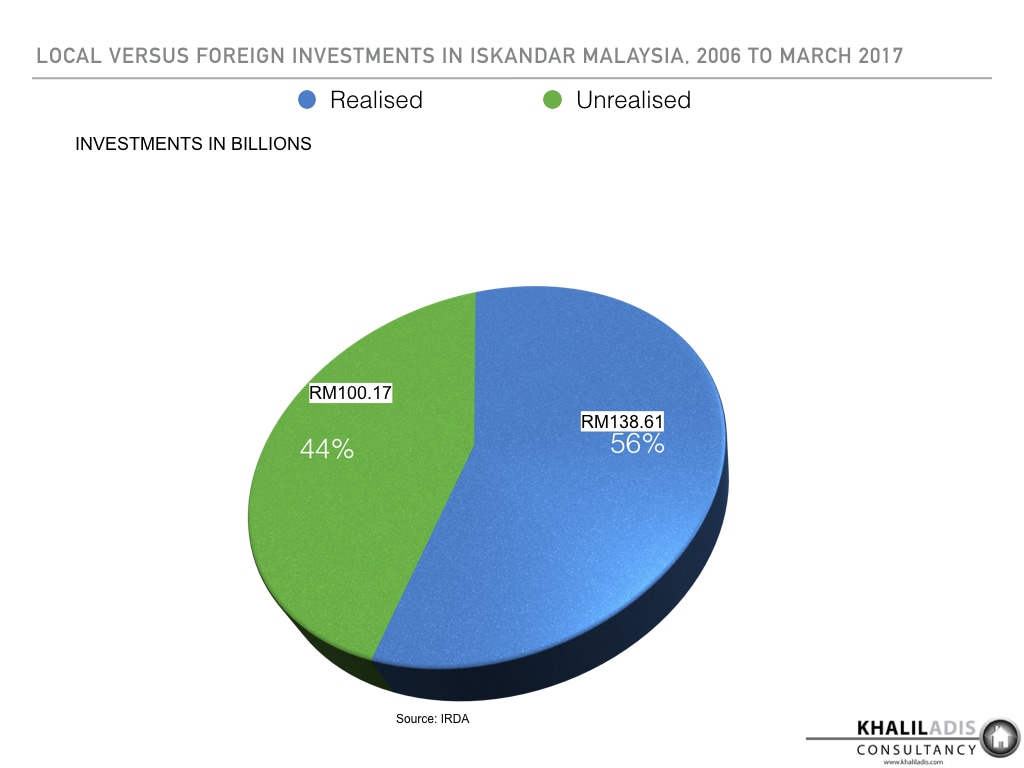

On 21 May, Johor’s Sultan Ibrahim Ibni Sultan Iskandar officiated the grand launch and the opening of sales gallery of Bukit Pelali at Pengerang, a 363-acre project that is Pengerang’s first strata township being developed by Johor-based Astaka Holdings Limited. Iskandar Malaysia, situated within Johor, is the most successful out of the five economic corridors in Malaysia. Photo: Astaka Padu As Iskandar Malaysia surpasses its 10th year as of November 2016, it has continued to defy expectations with these five key achievements By Khalil Adis I recall covering Iskandar Malaysia when it was still very much in its early development stage sometime in 2008 as part of a special feature for Property Report. Hosted by Iskandar Investment Berhad (IIB) and the Iskandar Regional Development Authority (IRDA), I had to wear rubber boots while government officials drove me around in a Land Rover over muddy roads as we cut through dense jungles and oil palm plantations in what is now known as Iskandar Puteri (then called Nusajaya) and Medini. As we passed by what is now known as EduCity and Legoland I was blown away by the massive scale of Iskandar Malaysia’s development. It was, by far, the single largest development that I had covered when reporting on the ground. As I headed back to Singapore to file my story, I called a few of my sources comprising analysts, and markets watchers on what they thought of this special economic zone. “It will fail. Just look at Cyberjaya,” said one. “Another white elephant project,” quipped another. However, that all changed in 2011as bilateral ties between both countries started to warm . That year witnessed Temasek Holdings announcing its investments in two sites in Medini, Iskandar Malaysia, now called Afiniti Medini and Avira. This was followed with another S$3.2 billion worth of investment to build a township development on Danga A2 island in 2013. As bilateral ties began to thaw, so did investors’ confidence. At the peak of the market in 2011, Singaporeans were seen snapping up Iskandar Malaysia properties like hot cakes. With the market now remaining somewhat muted and with concerns of oversupply, market watchers are again writing off Iskandar Malaysia. Whether you like it or not, this “flash in the pan” has indeed come a long way. As Iskandar Malaysia celebrates its tenth year, we look back and list its five major achievements.  Iskandar Malaysia is the best performing economic corridor out of the five in Malaysia with a total cumulative investment of RM227.67 billion as of 31 March 2017. Graphics: Khalil Adis Consultancy Iskandar Malaysia is the best performing economic corridor out of the five in Malaysia with a total cumulative investment of RM227.67 billion as of 31 March 2017. Graphics: Khalil Adis Consultancy #1 RM227.67 billion in total cumulative committed investment as of 31 March 2017 Not bad. Not bad at all considering the federal had initially invested RM5.8 billion while the manufacturing sector contributed some RM5.5 billion during its initial phase in 2006. Since then, investment volumes have grown by leaps and bounds to reach RM227.67 billion as of 31 March 2017. #2 Return of investment (ROI) of 3,825.34% Now, let’s work on the ROI. With an initial investment from the federal government at RM5.8 billion in 2006 and a total cumulative committed investment of RM227.67 billion as of 31 March 2017 over a span of some 11.45 years, this works out to an investment gain of RM221.87 with an ROI of whopping 3,825.34 per cent! In terms of annualised ROI, this works out to 37.79 per cent. This pales in comparison to the paltry 1.0 per cent interest you get when you put your money in your Singapore bank account. #3 The Chinese are coming in a big way with investments of RM24.61 billion Bye-bye Singapore, hello China! Our tiny city-state no longer holds dominance as the single largest foreign investor in Iskandar Malaysia. In fact, for the past three years or so, China has been coming in droves and snapping up land parcels from Tanjung Pelepas all the way to Tebrau. The good - state government coffers stand to benefit which will have an indirect impact on Johoreans. The bad - concerns on the sustainability and the possibility of inducing price volatility in the property market once these mammoth projects are completed. #4 61% of Iskandar Malaysia’s investments are by the domestic market While some analysts have expressed concerns on the wave of Chinese investments and their potential repercussions, Iskandar Malaysia is still very much driven by domestic investments. Of the RM227.67 billion in total cumulative committed investment as of 31 March 2017, 61 per cent were driven by the domestic investments. This means, even if a foreign investor were to pull out (as in the case of Dubai’s Mubadala) or during a global economic crisis, Iskandar Malaysia can still hold out on its own due to its sheer domestic investment market size. #5 56% investments worth RM138.61 billion have been realised as of 31 March 2017

Enjoy exploring LEGOLAND MALAYSIA or dining by the waterfront at Puteri Harbour? Perhaps some of you have even used your CPF Medisave for your medical treatment at Gleneagles Hospital Medini. Well, these completed projects that you see right now are just the tip of the iceberg. There’s still the remaining 44 per cent that has yet to come on-stream such as Motorsports City, Gerbang Nusajaya and of course the high-speed rail station. Once completed, all these will create around 257,100 additional jobs by 2030 in Iskandar Puteri, according to DTZ Research. The key takeaway when investing in Iskandar Malaysia is this - you must be in for the long-haul in order to reap fully from your investment. It’s definitely not a market for those hoping to make a quick buck or for the cash-strapped.

0 Comments

Leave a Reply. |

Khalil AdisAn independent analysis from yours truly Archives

July 2023

Categories

All

|

100 Peck Seah Street

|

|

RSS Feed

RSS Feed