|

A friend's personal journey of overcoming homelessness with the support of the government. By Khalil Adis Imagine being homeless and not knowing where to turn for help. Recently, a friend of mine, whom I will call Derek, shared his struggles with me, and it struck a chord in my heart. Having personally experienced this, it is a situation I would not wish upon to anyone else. Through Derek's and my journey, it shows that the Singapore government genuinely does care and provides assistance to those in need. Trying to move forward but unable to afford a home Derek's life took a difficult turn after a bitter divorce, leaving him without a place to call home. With no choice but to leave his in-law's house, he had to find a rental room at short notice. Fortunately, Derek did not have the added burden of a shared matrimonial home or children, which made the situation slightly easier. Despite his efforts to move forward, Derek faced another obstacle – he could not afford to buy a home of his own with his current financial situation. Feeling hopeless and at a loss To afford a decent resale 2-room flat, Derek needed an additional $100,000 on top of his cash, CPF, and HDB loan amounting to $200,000. As a second-timer, he did not qualify for CPF Housing Grants that could have helped him. The situation seemed dire and Derek felt like he was running out of options. However, I knew from personal experience that giving up was not the answer. Light at the end of the tunnel I encouraged Derek to reach out to his Member of Parliament (MP) for help. Despite the high cost of living in Singapore, our government genuinely cares about those in need and assists on a case-by-case basis. I had gone through a similar situation before and received the support I needed. Derek took my advice and wrote to his MP, hoping for a glimmer of hope. The government's support and assistance Recently, Derek shared some good news with me – his MP responded and the Housing Development Board (HDB) is looking into increasing his loan quantum. This development means that Derek may soon be able to fulfill his dream of owning a home. Derek's experience serves as a reminder that we should never give up hope, and reaching out to your MP can make a significant difference in your housing situation. Conclusion In Singapore, homelessness is not an outcome that the government wants for its citizens.

As Derek's story shows, the government does show compassion and support when individuals find themselves in challenging circumstances. If you are facing similar housing struggles, I urge you not to lose hope and to reach out to your MP for assistance. The government is committed to helping those in need and ensuring that no one is left without a home. That's the beauty of Singapore – a nation that cares for its people, even in times of hardship.

0 Comments

Expect a period of correction for resale HDB flats and private properties which may favour buyers. Meanwhile, the rental market will continue to see strong demand favouring landlords. By Khalil Adis The cooling measures appear to have had an impact on the property market as it is now slowly shifting from a sellers’ to a buyers’ market. Anecdotal evidence on the ground shows that sellers are more realistic in their asking prices while buyers are now able to get homes that are within their budget. One such buyer is Ronald (not his real name) who is currently renting a room with his wife. “We looked around in early November 2022 but prices for 3-room HDB flats that had recently achieved their Minimum Occupation Period (MOP) were not within our budget ranging from $420,000 onwards. Sellers were also not willing to budge on their asking price,” said Ronald. However, in December, Ronald noticed that their asking price had started to come down at around the $400,000 mark based on listings on PropertyGuru. Meanwhile, data from HDB say otherwise, showing that the median resale price for 3-room HDB flats in the third quarter of 2022 has remained somewhat consistent, ranging from $320,000 to $460,000 compared to $320,000 to $436,000 in the second quarter. Sensing the market has turned, Ronald and his wife decided to make an offer for a corner unit in Bukit Panjang at $405,000 which was still lower than the asking price of $410,000. With an estimated monthly mortgage of $1,137, Lee said buying the unit will be a much cheaper option than renting. Ronald is currently paying $1.200 a month for his room rental. Thankfully, his offer was accepted by the seller. “The rent we are paying is currently quite hefty as rents have increased significantly by 20 to 30 per cent. Therefore, buying a house makes much more financial sense for us. Also, I am familiar with the area and it is within walking distance to Senja LRT station with plenty of amenities nearby,” he said. Indeed, according to data from the Urban Redevelopment Authority (URA), rentals of non-landed properties increased by 8.3 per cent in the third quarter of 2022, compared with the 7.1 per cent increase in the previous quarter. Meanwhile, data from HDB showed that the median price for the entire HDB flats for 2-room in the third quarter of 2022 was transacted at a median price of $1,930. “Our completion is expected to be around March and April 2023 which we are looking forward to as we anticipate our rent to increase further. Finally, we are able to have our own home,” he said. Sellers are more realistic Meanwhile, sellers are also willing to accept lower offers as the cooling measures take their bite. One such seller is Siti (not her real name) who has been trying to offload her odd-sized executive HDB flat since July 2022. Marketing her unit has proved to be challenging as her master bedroom comes with odd corners that make the placement of beds and cupboards difficult. Nonetheless, Siti received various offers starting from $660,000 and then $620,000. Subsequently, the sellers backed out due to various reasons. She finally settled for an offer of $615,000. Another seller adjusted their expectations for their 3-room HDB flat from $442,000 to $435,000 after numerous viewings. “We noticed that buyers are now taking time to make an offer,” said the seller who wishes to remain anonymous. HDB’s Resale Price Index (RPI) for the third quarter of 2022 showed that while the index saw an increase, it was slowed than the previous quarter. In the third quarter, the index was 168.1 points which was an increase of 2.6 per cent over that in the second quarter of 2022. This is a slower increase than the 2.8 per cent increase in the second quarter of 2022. Meanwhile, resale transactions rose by 10.7 per cent, from 6,819 cases in the second quarter of 2022 to 7,546 cases in the third quarter of 2022. When compared to the third quarter of 2021, resale transactions in the third quarter of 2022 were 10.5 per cent lower. Predictions for 2023 Looking ahead, the HDB resale market is expected to cool further due to the incoming supply from its Build-To-Order (BTO) exercise.

This will mean buyers can anticipate the prices for HDB resale flats to come down to a more realistic level. According to HDB, in November, it launched 9,655 flats for sale which was by far the largest BTO offering ever in a single launch. Spread across 10 projects in both mature and non-mature estates in Kallang Whampoa, Queenstown, Bukit Batok, Tengah, and Yishun, around 60 per cent (or 5,861 units) are offered in non-mature estates. This makes up almost half the number of flats offered in non-mature estates in the whole of 2022 “The November 2022 BTO launch is the largest BTO sales exercise yet for HDB. The bulk of the almost 10,000 flat supply, or close to 6,000 new flats, are located in non-mature estates (NMEs). This number is in fact bigger than the total flat supply of a typical BTO sales exercise, thus offering a wide range of affordable flats for homebuyers. With 95 per cent of 4-room and larger flats in this bumper crop set aside for first-timer households, and additional ballot chances for them, we encourage first-time applicants to apply for flats in the non-mature estates to increase their chances of securing a new BTO flat,” said HDB’s chief executive officer, Tan Meng Dui. When including the 1,071 units offered under the Sale of Balance Flats (SBF) exercise, a total of 10,726 new flats are offered in the November 2022 sales exercise. Meanwhile, the rental market for both private and HDB properties is expected to heat up further as the incoming supply from private (49,384 units as of the third quarter of 2022) and HDB flats (10,726 units) will take a few years to come on stream. Therefore, tenants may wish to exercise prudence by locking into a 2-year lease to mitigate any price increase. Property prices are expected to correct in the months ahead which may favour buyers. Meanwhile, the rental market is expected to heat up further. By Khalil Adis On 30 September 2022, the Singapore government announced various property cooling measures that are aimed at ensuring prudent borrowing and moderating demand. Indeed, the HDB Resale Price Index (RPI) and Private Property Index (PPI) as of the third quarter of 2022 are now at record highs at 168.1 and 187.8 points respectively. This means that first-time homebuyers are finding both HDB flats and private properties to be severely unaffordable. Meanwhile, potential sellers see this as an opportune time to profit from the red-hot property market. With this in mind, the government has had to intervene to ensure property prices remain affordable and are in tandem with wages. The measures include the following four-pronged approach:

How they may impact you as a consumer: For point 1, you will have to have a higher monthly combined income and pay a higher monthly mortgage and combined income . However, the actual interest rates charged will be determined by the private financial institutions. For point 2, the stress test has been increased to 3 per cent when calculating your monthly mortgage but with a reduced Loan-to-Value (LTV) limit at 80 per cent. This is to ensure your monthly mortgage remains affordable and within the 30 per cent Mortgage Servicing Ratio (MSR). On the overall, with a higher downpayment of 20 per cent, it will result in a lower mortgage payment when compared to an LTV limit of 85 per cent. However, this will not affect the actual HDB concessionary interest rate, which will remain unchanged at 2.6 per cent per annum. For point 3, buyers will need to come up with a higher cash and/or CPF amount (an increase of 5 per cent) to make up the 20 per cent downpayment. For example, for an $500,000 HDB flat, you will need to come up with $100,000 (80 per cent LTV) as opposed to $75,000 (85 per cent LTV). This means an additional cash and/or CPF outlay of $25,000. For point 4, this will mean sellers will have to rent either an HDB flat or private property during the interim period. This will result in increased demand in the rental market which will push asking prices further. According to data from the Urban Redevelopment Authority (URA), rentals of private residential properties had increased by 8.6 per cent in the third quarter to reach 137.9 points from 127.0 points in the second quarter of 2022. Meanwhile, HDB rentals have increased by around 30 per cent. Looking ahead, the rental market is expected to strengthen further which will favour landlords. Summary For buyers who are looking to buy a resale HDB flat or private property, you might want to wait out until their prices correct.

For sellers, you only have a small window period to take advantage of the exuberant market before it cools in the coming months. For landlords, the market will favour you due to increasing demand from existing tenants and ex-private property owners who have already sold their homes. For tenants, you will have to set aside more budget as rentals have now increased by around 30 per cent. Resale private property and HDB flat prices continue to surge ahead as demand outstrips supply. Meanwhile, rentals are also on the rise. By Khalil Adis Like most first-time property buyers in Singapore, Farhan (not his real name) and his wife are frustrated with the long delays in the construction sector brought about by COVID-19. The couple got married in 2018 and booked their HDB flat in 2019. However, when COVID-19 struck, they were informed by HDB there is now a possibility they will have to wait up to seven years for the keys to their flat. Cancelling their HDB flat is also not an option as they stand to lose $1,000 in their option fee. “We are stuck in a catch-22 situation. On the one hand, the waiting time of seven years is too long and we do not want to inconvenience my in-laws. On the other hand, prices of HDB resale flats have gone up so much that we have to factor in the cash-over-valuation (COV) which may be up to $50,000. If we include renovation cost, our first home may set us back by up to $100,000,” said Faris. Construction sector buckled under COVID-19 pressure Indeed, COVID-19 has impacted the construction sector with several contractors going under due to travel restrictions and high construction costs. In August 2021, for instance, Greatearth Corporation and Greatearth Construction were among the several contractors that went bust due to financial difficulties. This has resulted in delays of several Built-To-Order (BTO) projects. To minimise the impact, HDB has rolled out various measures to support the construction industry and minimise delays to its projects. “HDB has been working closely with our building contractors, to secure the necessary resources they need to complete their projects, including manpower and material supply. We have also recently introduced additional assistance measures to ease the financial pressures brought about by the pandemic-induced spikes in construction costs, including both manpower and non-manpower costs,” said HDB in a statement. Faris and his wife are among those affected as they had booked an HDB flat in Woodlands. “We surveyed around Woodlands where the resale HDB prices are within our budget. However, most sellers are now asking for COV of up to $50,000,” said Faris. Strong pent-up demand pushing prices upwards for resale HDB and private properties As demand far outstrips supply, this has resulted in record prices in both the HDB and private property markets, surpassing the record prices seen during the peak in the third quarter of 2013. Data from HDB showed that the Resale Price Index (RPI) for the third quarter of 2021 is now 150.6 points. This is an increase of 2.9 per cent over that in the second quarter. Meanwhile, resale transactions rose by 19.4 per cent from 7,063 cases in the second quarter to 8,433 cases in the third quarter of 2021. When compared to the third quarter of 2020, the resale transactions in the third quarter of 2021 were 8.3 per cent higher. 4-room HDB flats in the central area fetched the highest price on the island, transacting at a median price of $950,000 while those in Sembawang was the lowest (at a median transacted price of $417,000). Woodlands, where Faris and his wife, were on the lookout for a 4-room HDB resale flat, recorded a median price of $420,000 - the second-lowest median price for a 4-room HDB flat on the island. Still, as Faris can attest to, the asking price even in the far-flung area of Woodlands is sky-high. “On hindsight, that cash component could be better utilised for our renovation cost as we do not intend to take a loan. After much discussion, we decided to stay put at my in-laws. Thankfully, they were very understanding,” said Faris. Meanwhile, data from the Urban Redevelopment Authority (URA), showed that prices of private residential properties increased by 1.1 per cent in the third quarter of 2021, compared with the 0.8 per cent increase in the previous quarter. Landed properties saw a higher price increase when compared to non-landed properties. They increased by 2.6 per cent in the third quarter of 2021, compared with the 0.3 per cent decrease in the previous quarter. Meanwhile, prices of non-landed properties increased by 0.7 per cent in the third quarter of 2021, compared with the 1.1 per cent increase in the previous quarter. Rentals for HDB flats and private properties are also on the rise The supply crunch has also seen rentals for HDB flats and condominiums rising.

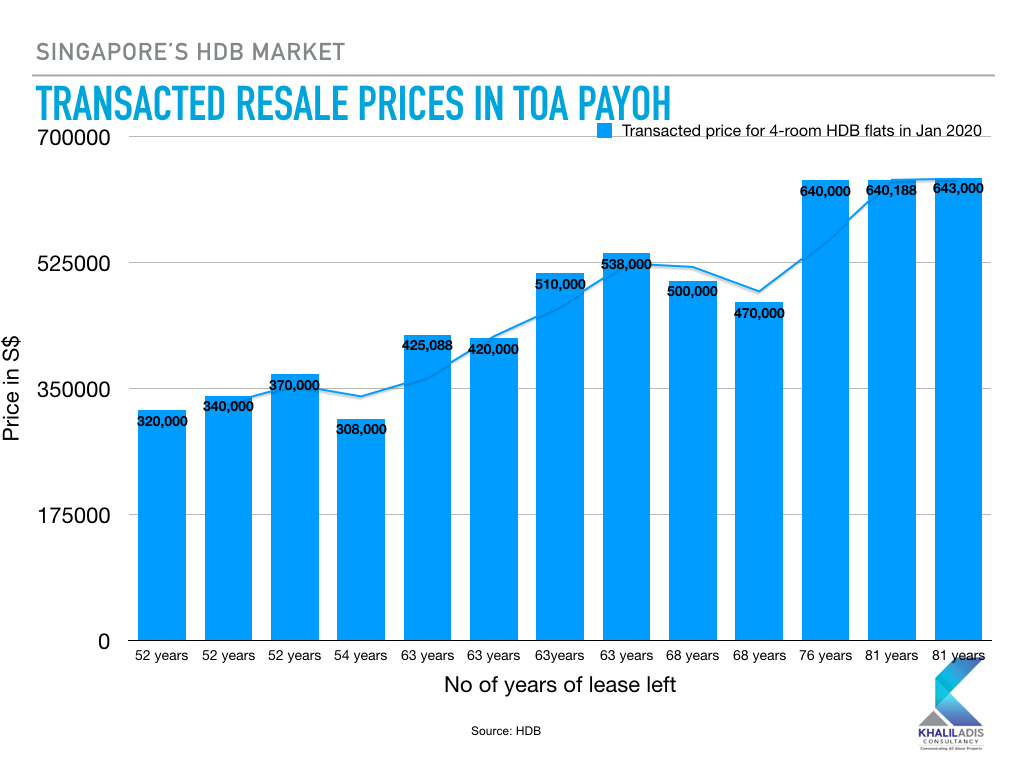

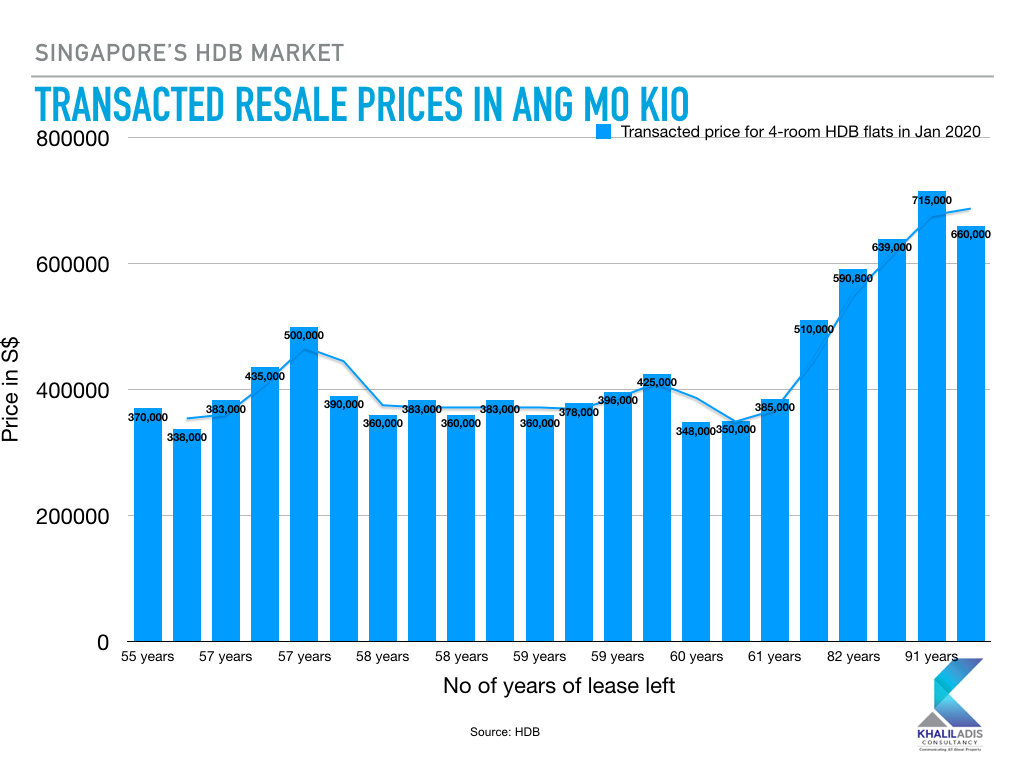

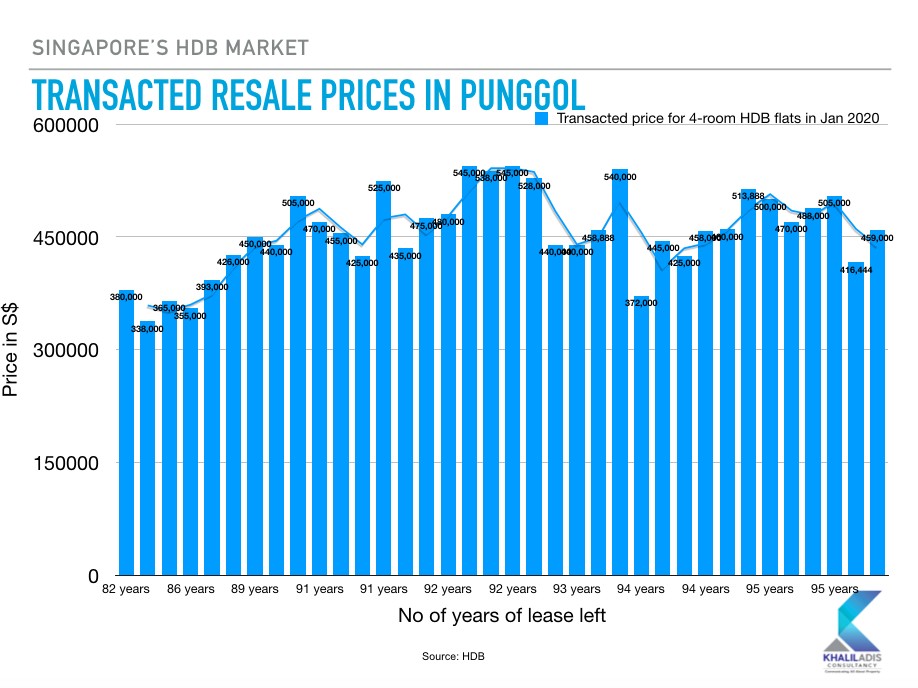

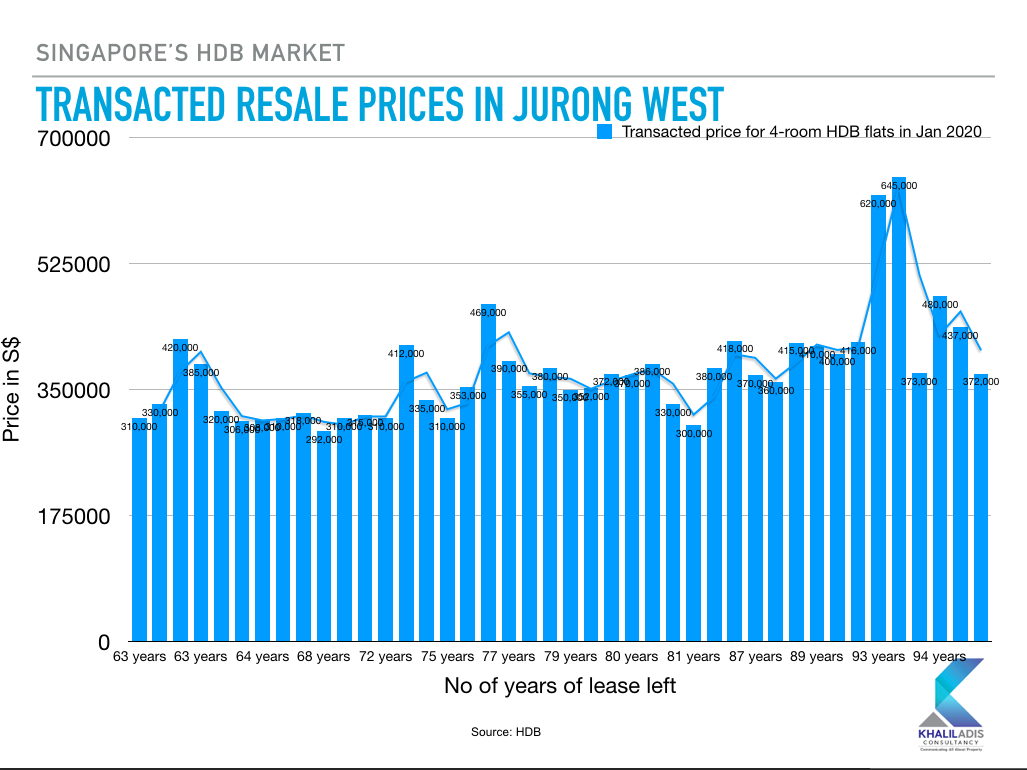

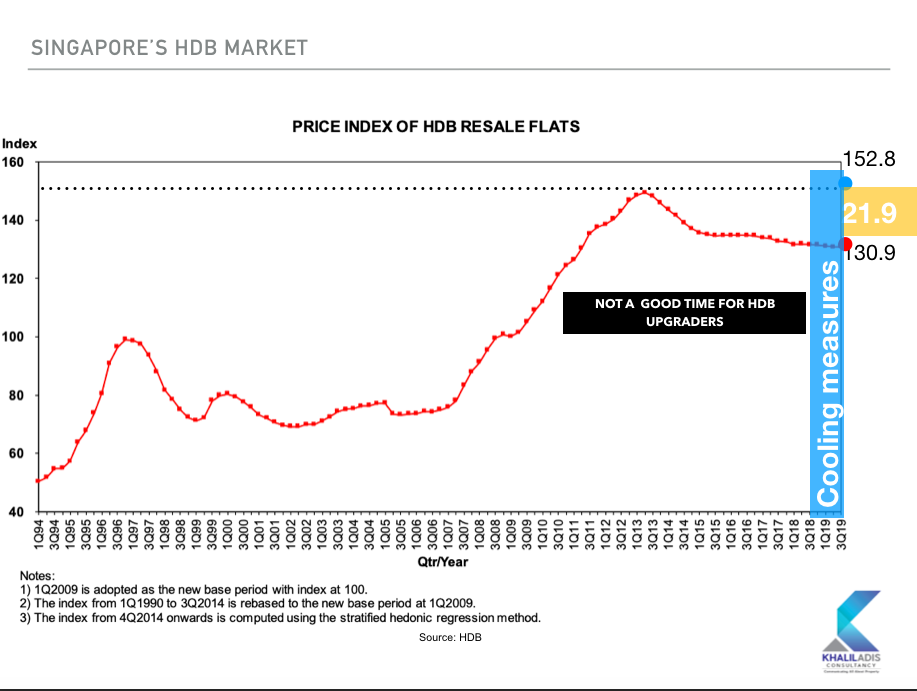

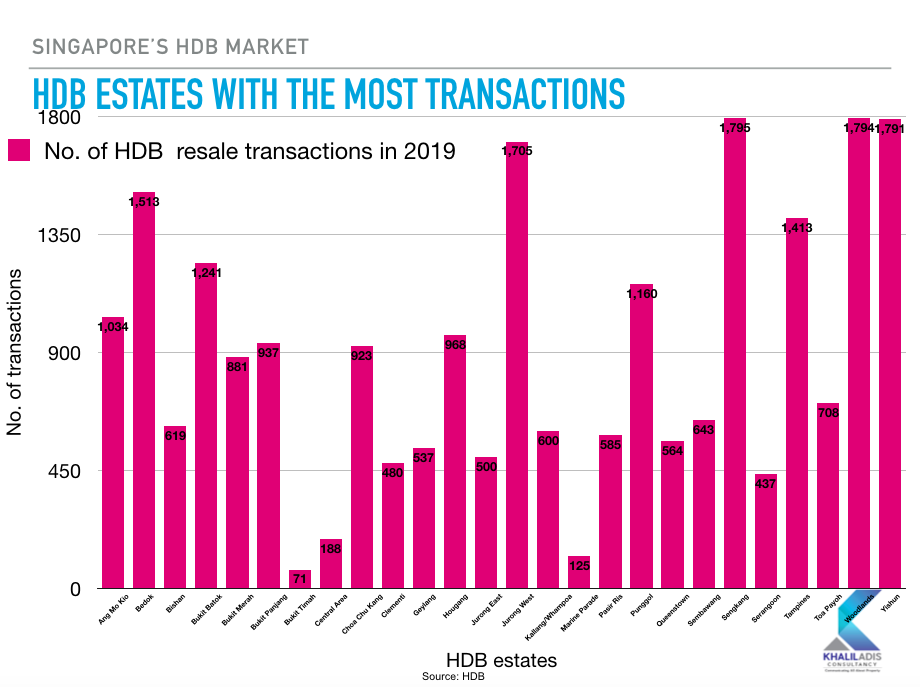

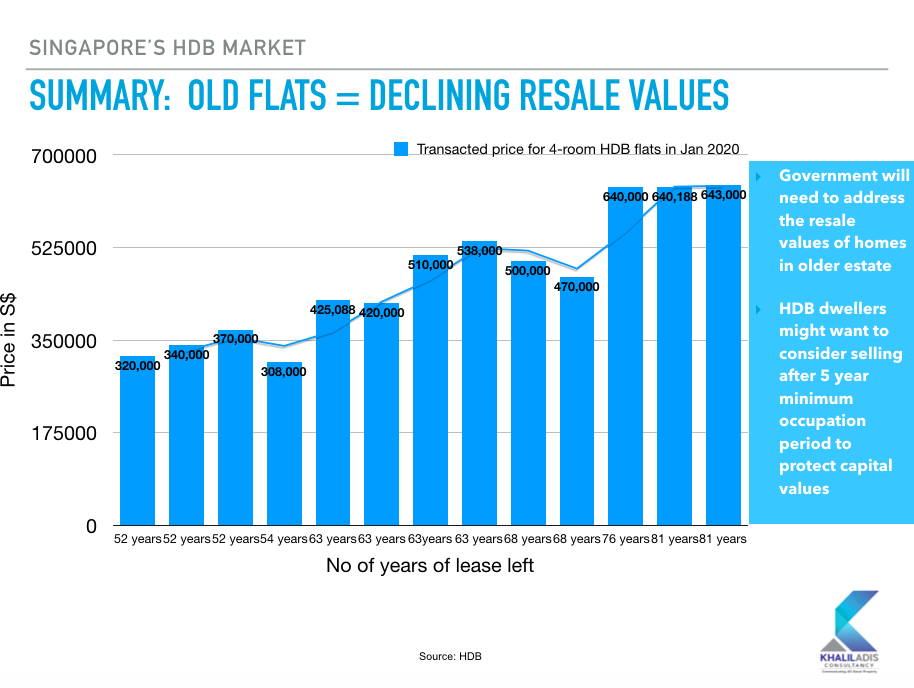

In the past, one can rent a 4-room HDB flat for below $2,000 per month. However, as third quarter data from HDB showed, the median transacted price for 4-room HDB flats in most HDB estates are now above $2,000 per month except for Sembawang ($1,900) and Woodlands ($1,900). In Jurong West, for instance, the median transacted price per month for 4-room HDB flats now stands at $2,150 when it was previously transacted at $2,050 per month in the second quarter of 2021. Meanwhile, in the private property market, URA’s data showed that rentals for private residential properties increased by 1.8 per cent in the third quarter of 2021, compared with the 2.9 per cent increase in the previous quarter. This is also something Ed (not his real name), who is also married, can confirm. He is currently looking for a common room to rent in a condominium was surprised by the high asking price from landlords. “It does not make any sense as people are losing jobs and we do not have many expats coming in yet rentals are going up,” he laments. Ed is also looking to buy an HDB flat but is put off by the high asking price and the long waiting period for BTO flats. “I think I may just rent for one year and wait out till the property market stabilises. However, buying an HDB flat is something definitely on my mind. The timing and pricing are just not right at the moment,” he said. Another couple, Ali and his wife say their landlord is looking to increase their rent for the 2-bedroom condominium they are currently renting in eastern Singapore from $3,000 to $3,200 a month. “Our lease is up for renewal soon. We are still deciding if we should stay put or move on. We love this place as it is close to East Coast Beach. Everywhere else that we looked, landlords are similarly asking for between $3,200 to $3,500,” said Ali. For now, first-time homebuyers like Farhan will have to wait out while rent-seekers like Ed and Ali will have to pay what landlords are currently asking for. Strong correlation seen between transacted property price and remaining lease. By Khalil Adis Since the Lee Kuan Yew era, Singaporeans have been ingrained with the idea that our HDB flat is an asset. While you can make a profit from your HDB flat, this depends on the lease that is remaining on your property. Based on our research and analysis, we found that HDB flats in older estates with a remaining lease of fewer than 60 years saw their property values diminish. Meanwhile, those that have around 80 years of lease left were able to fetch far higher prices. This is according to data captured on HDB’s website. On the other end of the spectrum, HDB flats that are located in newer estates did not see that much price variation. In conducting this study, we had looked into HDB transactions for 4-room flats that were recorded as of 21 January 2020 and then compared it with the remaining lease. The estates chosen included the mature estates of Toa Payoh and Ang Mo Kio as well as the non-mature HDB estates of Punggol and Jurong West. Here are some quick snapshots based on our findings. #1: Toa Payoh: Older HDB flats changed hands at lower prices When it comes to buying an HDB flat, most Singaporeans will prefer to buy in a mature estate such as in Toa Payoh or Ang Mo Kio. However, if you have a flat with a remaining lease of fewer than 54 years this may have an impact on your resale value. According to data captured on HDB’s website, there were 14 transactions for 4-room HDB flats in Toa Payoh during this period. The data showed a strong correlation between the price versus the remaining lease. For instance, older HDB flats (4) with 54 years or less of the remaining lease were transacted at an average price of S$334,500. Meanwhile, newer HDB flats (4) with 76 to 81 years of the remaining lease were transacted at an average price of S$641,062. This represents a price difference of 91.6 per cent. #2: Ang Mo Kio: Newer HDB flats fetched higher selling prices Ang Mo Kio is also another favourite estate among buyers explaining why Built-To-Order (BTO) launches have always been oversubscribed. Like Toa Payoh, Ang Mo Kio also witnessed a strong correlation between price versus the remaining lease. According to data captured on HDB’s website, there were 24 transactions for 4-room HDB flats in the estate during this period. Newer HDB flats (5) with 80 to 91 years of the remaining lease were transacted at an average price of S$622,960. On the other hand, older HDB flats (14) with 59 years or less of the remaining lease were transacted at an average price of S$390,071. This represents a price difference of 59.7 per cent. #2: Punggol: A non-mature estate where capital values experience fewer fluctuations Punggol is a non-mature estate with a relatively young population. While it may seem far-flung, Punggol is among the top ten estates in Singapore where HDB resale homes have changed hands. According to data captured on HDB’s website, there were 36 transactions for 4-room HDB flats in the estate during this period. The remaining lease in Punggol ranges from 82 to 95 years. As such, there is not much price variation as seen in the case of Toa Payoh and Ang Mo Kio. For example, HDB flats (7) with between 82 to 89 years of the remaining lease were transacted at an average price of S$334,500. Meanwhile, newer HDB flats (29) with 90 years or more of the remaining lease were transacted at an average price of S$477,002. This represents a price difference of 42.6 per cent. This suggests that newer estates like Punggol may be ideal if you want to protect the capital values of your property. #3: Jurong West: A semi-mature estate with a price gap similar to Punggol Jurong West is a semi-mature area and as such the remaining lease here is between 63 and 94 years. According to data captured on HDB’s website, there were 41 transactions for 4-room HDB flats in the estate during this period. Similar to Punggol, there is not much price variation as seen in the case of Toa Payoh and Ang Mo Kio. For example, HDB flats (11) with less than 70 years of the remaining lease were transacted at an average price of S$328,090. Meanwhile, newer HDB flats (8) with 93 years or more of the remaining lease were transacted at an average price of S$467,875. This represents a price difference of 42.6 per cent. #4: Price gap is widest in Toa Payoh Toa Payoh makes an interesting case study. We decided to zoom into this estate as property agents have long complained that they have had a hard time selling older HDB flats in the area. Our analysis seems to concur with our findings on the ground when speaking to agents as they appear to diminish in value nearing the end of the lease. In the case of Toa Payoh, the price gap is a whopping 91.6 per cent compared to Ang Mo Kio, Punggol and Jurong West at 59.7 per cent and 42.6 per cent respectively. #5: Widening price gap between HDB and private property market According to the third quarter of 2019 data from the HDB and the Urban Redevelopment Authority (URA), the Resale Price Index (RPI) and the Private Property Index (PPI) are at 130.9 and 152,8 percentage points respectively. This means a price gap of 21.9 percentage points. The widening price gap is bad news for HDB upgraders thinking of buying a condominium. As such, this may not be an opportune time for you to do so. Should Singapore enter into a recession this year, we are likely to see the PPI drop further narrowing the price gap between the HDB and private property markets. Good things come to those who wait so wait out. #6: Sengkang is the most popular estate for resale HDB flats in 2019 Rounding of the top 10 HDB estates, Sengkang is the most popular with 1,795 resale transactions recorded in 2019, followed by Woodlands (1,794), Yishun (1,791), Jurong West (1,705), Bedok (1,513), Tampines (1,413), Bukit Batok (1,241), Punggol (1,160), Ang Mo Kio (1,034), Hougang (968) and Bukit Merah (937). #7: Summary: Capital values appear to be better protected in non-mature estates While HDB is an asset, older HDB flats in mature estates will likely see their value decline as the data showed.

As such, prospective homebuyers might want to think twice before purchasing such flats. On the other hand, the data suggests that the capital values of your HDB flat are better protected in non-mature estates like Punggol and Jurong West. As such, you may want to consider selling your property after five years once you have fulfilled your MOP and then upgrade to private property or downsize according to your lifestyle needs. Having said that, I would like to stress that your HDB flats are for long-term occupation and not for you to make a quick profit. In closing, housing is a delicate issue. The government will need to address their diminishing value sensitively especially to the older generation who are currently living in mature estates. Despite its focus on the digital economy, the budget is a regressive one for both local and foreign buyers By Khalil Adis  A shophouse in Negeri Sembilan with a Malaysian flag. Photo: Khalil Adis Consultancy. A shophouse in Negeri Sembilan with a Malaysian flag. Photo: Khalil Adis Consultancy. Another year, another budget. This year is no different except that they were announced against a backdrop of the ongoing global trade wars and a general slowdown in the global economy. While the Malaysian government has announced several measures to spur its economy specifically in the digital arena, Malaysia is likely to ride through the current economic climate largely unscathed as it has a strong domestic economy, unlike Singapore. As such, I will focus solely on those affecting the property market. From the looks of it, the measures appear to be cosmetic to address the shortcomings and mess left behind by the previous government. Foreigners and Malaysians at the losing end Call it a band-aid if you will but the budget seems regressive by bringing us back to the Budget 2014 and 2016 eras for foreign investors and locals buyers respectively. Let us look back at Budget 2014. During this period, the minimum purchase price for foreigners buying a property in Malaysia was raised from RM500,000 to RM 1 million. This was to prevent a property bubble from forming in the market and thus preventing Malaysians from buying such properties. Well, guess what? The situation got even worse despite this measure as there were no checks and balances in place by the Housing Ministry. As such, developers were at the free reign to build units that local could not buy resulting in a huge glut that we are seeing right now. To reduce the overhang, Budget 2020 now allows foreigners to buy completed and unsold units that are priced above RM600,000. So what happens to foreigners who had bought a property at RM1 million and are now looking to sell? Most probably, due to the current market conditions, they will now be selling at a loss to either a local or a foreign buyer. Also, they will now have to compete directly with the primary market where foreigners can buy at a steep discount of RM400,000 (RM1 million - RM600,000) directly from developers. This mixed signal could potentially deter foreign investors from buying property in Malaysia. Verdict: Foreign sellers: 0, foreign buyers: 1* *it remains to be seen if subsequent budgets will see a change in the minimum purchase price across the various states in Malaysia. Next, let us take a look at Budget 2016 in the affordable housing segment for Malaysian buyers. Previously, under Barisan Nasional, the government had announced that it was building PR1MA homes across various states during Budget 2016. There were also promises to build such homes that are planned around transport hubs and train stations in Kuala Lumpur. Back then, the government had announced that a total of 5,000 units of PR1MA and PPA1M houses will be built in the vicinity of LRT and monorail stations in 10 locations, including Pandan Jaya, Sentul and Titiwangsa. Fast forward four years later, PR1MA has become a massive liability for the government. As we speak, PR1MA is undergoing restructuring and is nowhere close to the lofty 1 million housing units it had previously promised to deliver. Meanwhile, there is still no news on the 5,000 transit-oriented development units (TODs). This leaves Malaysians who are in dire need of affordable homes stranded. From the looks of it, they are now back to square one with another new policy in place to replace the old one. A new budget for local buyers As part of Budget 2020, the government will collaborate with financial institutions in introducing various schemes. The first is the Rent To Own (RTO) financing scheme. This scheme aims to assist those who cannot afford the initial 10 per cent deposit and access to financing in purchasing their homes. This scheme, however, is not new and has been in place among private developers. As such, Malaysian buyers who had hoped for a roof over their heads during Budget 2016 are better off buying from private developers. Verdict: Malaysian buyers: 0, private developers: 1* *Imagine the agony among those who had applied for PR1MA homes and are still waiting. If I were a Malaysia, it seems buying from a private developer is the way to go. *It is an open secret that there are many Malaysians who had previously applied under this scheme are still waiting for their homes. Just speak to any Grab drivers. Conclusion While many other schemes are being rolled out such as Fund for Affordable Home that was launched by Bank Negara Malaysia in January 2019 and the Youth Housing Scheme, they remain under the umbrella of various government agencies.

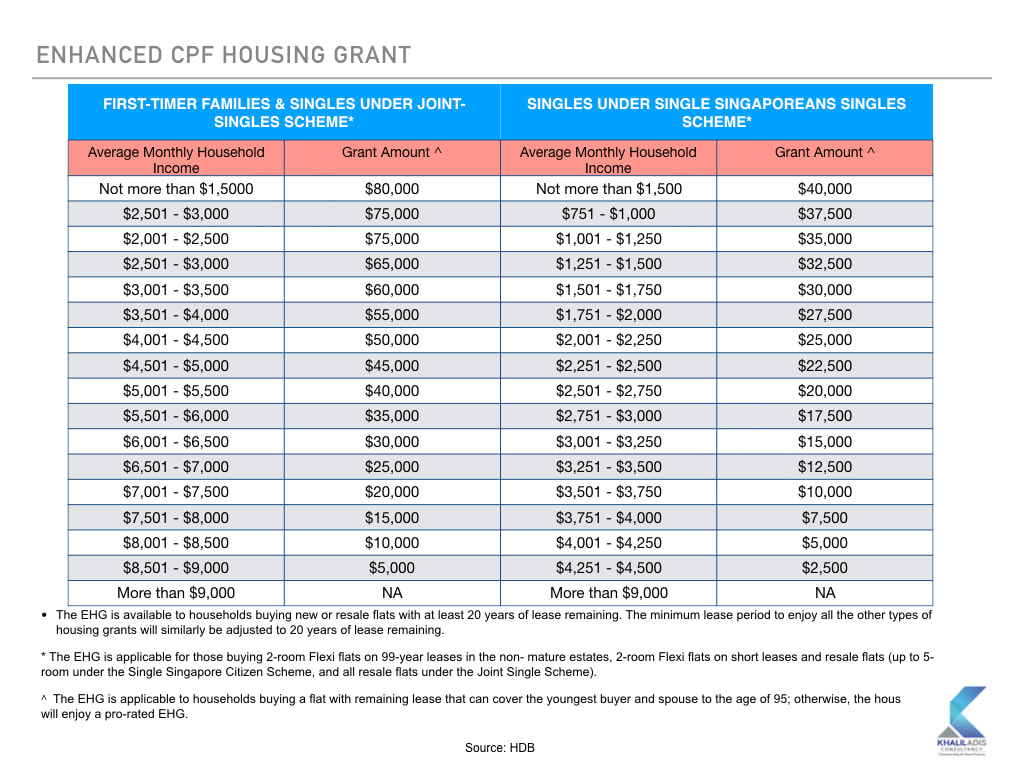

As such, this could be very confusing for the first-time homebuyers who are unsure how to navigate the market. What would work is for Malaysia to streamline them under one single government housing agency just like Singapore’s HDB model. Announced yesterday by Minister for National Development Lawrence Wong, the Enhanced CPF Housing Grant for first-timers and higher income ceilings will provide more flexibility and housing options. We study how this will impact the property market. By Khalil Adis Quick snapshot #1: Who will this benefit the most? First-time homebuyers will benefit the most especially the middle to low-income bracket groups. It will also benefit first-time homebuyers who want to live close to their parents in mature estates. #2: Why now? This is because incomes have been rising since the HDB last reviewed the income ceiling in 2015. As such, the policy has been tweaked to address this. #3: How will this affect the HDB market? The sandwiched class may now opt to buy an HDB flat compared to buying a private property due to the increase in income ceiling and Enhanced CPF Housing Grant as it will mean less cash upfront. This will help to prop up demand for resale HDB flats. It is worth noting that the resale HDB market has been rather muted. As such, we are likely to see an increase in activity particularly for those who want to live close to their parents. #4: How will this affect the private housing market? We may see the sandwiched class now switching to buy from the HDB market and thus ease pressure from the private housing market. As such, we are likely to see the Private Property Index (PPI) see a slight correction in the next quarter. #5: Will this affect HDB prices across the board? It will affect prices in the HDB resale market as buyers are now given more help with the Enhanced CPF Housing Grant. The HDB Resale Price Index has seen a decline since the first quarter of 2013. However, with the increase in income ceiling and Enhanced CPF Housing Grant, we could see more sales activity in the otherwise muted resale market. #6: How will this affect the rental market? The HDB and private property rental market will be very soft as more buyers will be switching to buy rather than rent a property. In the HDB market, the HDB will be launching 15,000 units later this year.

Meanwhile, in the private property market, we have a total supply of 53,696 uncompleted private residential units (including ECs) in the pipeline with planning approvals as at the end of the second quarter of 2019. Also, we have another 4,398 units (including ECs) that will be completed in the remaining second quarters of 2019. This incoming supply, together with the sluggish economy due to the ongoing trade war, will make the rental market extremely soft. Despite the tepid HDB resale market, Punggol has bucked the trend with a loft unit at Punggol Sapphire recently changing hands for almost a million dollars. Here are the lowdowns about living in Punggol. By Khalil Adis Punggol has indeed come a long way from being an ‘ulu’ area. Once known as a rural settlement complete with kampungs and farms, Punggol has since 1998 transformed itself from a backwater area to a vibrant, modern yet green satellite district. Amid Punggol’s oasis of calm, you can see LRT trains whirring through the residential areas, passing by the ample lush natural landscape before taking you directly to the heart of the district, Punggol Central. While Punggol’s rustic charms may appeal to outdoor lovers, there are certain downsides about living here. We list them down here: The good: #1: It’s oh so quiet Punggol has an estimated population of 161,570 as of 2018 with a projected 96,000 housing units once the entire "Punggol 21-plus” master plan is completed. Despite its high density, Punggol is surprisingly very quiet at night save for the traffic whizzing by the Tampines Expressway (TPE). This is definitely good news for those wanting some peace and quiet but bad news if you want the buzz of city life. If you still want to move to Punggol, fret not as Waterway Point has all the modern conveniences and amenities for your city living. #2: Well landscaped parks and gardens Nature and outdoor lovers will revel in the many landscaped parks and gardens that Punggol has to offer, including the award-winning My Waterway@Punggol. From the Matilda District, you can enjoy a stroll or jog by the Punggol River before reaching Punggol Dam and Punggol Point. This is part of the comprehensive Park Connector Network (PCN) linking the entire island. The view is awe-inspiring and enough to make even the laziest couch potato get up and explore nature #3: Properties here are in demand. Being a relatively new township development with a young demographic, Punggol has proven to be popular among homebuyers as a few HDB housing projects are now eligible to be sold in the resale market. According to the fourth quarter of 2018 data from the HDB, the Resale Price Index (RPI) fell by 0.2 per cent, from 131.6 points in the third quarter to 131.4 points in the fourth quarter in 2018. For the whole year, the RPI declined by 0.9 per cent in 2018. Despite the lacklustre market, a five-room, loft unit in Punggol Sapphire was sold for S$910,888 in January 2019. This was considered a record for an HDB flat in northeastern Singapore. Additionally, OrangeTee & Tie's research showed that in the third quarter of 2018, Punggol was the fourth most popular area for HDB resale flats with 469 units transacted followed by Jurong West (505 units), Woodland (516 units) and Sengkang (528 units). On the overall, resale statistics from the HDB showed that the median prices of three, four and five-room flats were transacted at S$343,000, S$455,000 and S$445,000 respectively in the fourth quarter of 2018. #4: Comprehensive public transport network Commuting in and around Punggol is very convenient as there is a comprehensive transport network comprising MRT, LRT and buses. In fact, the township has been planned such that each housing estate is located within 300 m away from any LRT station. An exception, however, is the new housing area at the Matilda district. #5: Punggol Digital District Come 2023, a new smart city is set to rise in Punggol called the Punggol Digital District. Housing technology firms involved in key growth fields as well as the new Singapore Institute of Technology Campus, Punggol Digital District will create around 28,000 jobs while providing residents with more lifestyle and dining options. In the pipeline includes the new Punggol Coast MRT Station which will be an extension of the North-East Line. Punggol Digital District will also enjoy enhanced connectivity via the Cross Island Line (CRL) which will link it to Jurong Lake District and Changi by around 2030. Collectively, they will act as property boosters for Punggol. The bad: #6: Lack of good hawker food Food. That’s our favourite national past time that defines if we love or hate or neighbourhood. Having lived in Taman Jurong, I must say I was spoilt for choice with various options of mouth-watering hawker fares such as the famous Boon Lay Power Nasi Lemak. However, the choices have become extremely limited in Punggol unless you are into fast food. While there are coffee shops serving local cuisines, they pale in comparison to the well-established hawker fares that you can find elsewhere. You are better off cooking your own meals. #7: Dust If you hate spring cleaning, be prepared for a rude shock. With many construction works going on, you will find yourself dusting up every single day. Windows, top of shelves, cupboards and other surfaces collect dust easily. This certainly isn’t good news if you are asthmatic or are prone to allergies. If so, you might want to invest in a good ioniser to keep your indoor air free of particles and other irritants. The ugly: #8: Get ready to jostle with the early morning crowd If you think Singaporeans are a kiasu lot, be prepared to see that word taken to new heights when you commute to work in the morning. In fact, many would play ‘musical chairs’ as they hustle for seats at on the MRT. Meanwhile, getting a Grab or taxi would be almost impossible. To get around this, I would leave home by 6 am and get to the office by 7 am. #9: That acrid smell in the air While Punggol may be planned as a green township development, be prepared for a strong burning smell that would emanate from time to time.

Located just opposite the industrial area of Pasir Gudang, Johor, the smell has become increasingly acrid over the past few days that it will linger from night till dawn. In fact, it can get so bad that you might have to get up in the middle of the night to close the windows. This is something perhaps developers and HDB will not tell you. Buying a home will be your single most expensive investment in your life and these are the most common mistakes you should avoid. By Khalil Adis Buying your first home is an exciting experience that will have you go through a range of roller-coaster emotions. From scouting for the right property to securing a loan, the procedures are endless that it is so easy to lose sight of what is important: #1: Buying based on emotions Buying a property based on emotions can cause you to gloss over some of its inherent shortcomings. It is like falling in love in someone gorgeous until they start to open their mouth. The initial phase may elicit a response such as exhilaration over its interior design finishing and then imagining how it would be like to sit in front of that bay window in that sleek glasshouse apartment. However, your emotions can bite you back over the long run as such a home will result in hefty utility bills in the long term. When buying a property, you should make calculated decisions by asking yourself these basic questions: Is the property priced fairly? Do your market research to find out what is the average price per sq ft of the property in the vicinity. This is important as it will ensure your property can have room for capital appreciation in the future. Are there nearby amenities like schools, hospitals and train stations? This will make the area desirable and attract people to want to live, work and play there. As demand increases, it will attract a significant population leading to the capital appreciation of your property. If you want to start a family, these are important considerations. Can the property be rented out or sold in the future? There will be some point in your life that you may end up as a landlord or a seller. Therefore, you must put yourself in the position of a tenant or a buyer by really looking at the property for what it is. As such, check if there any defects that may affect its future rentability or value. It is a good idea to upkeep your property to ensure all the electrical points and sanitary appliances are working while giving it a fresh coat of paint every year. You might also want to look at your interior design, layout and colour schemes and see if they will appeal to potential tenants or buyers. #2: Buying a house facing East-West orientation You should avoid buying a house that is facing the East-West orientation as it is directly exposed to the afternoon sun and therefore increases the heat gain. During night time, the concrete walls will radiate back the heat to your home leading to higher utility bills from your air-conditioning unit. Instead, you should go for a home that is facing North-South orientation. Do also ensure there is cross-ventilation from one end of the house to another to encourage natural air flow. #3: Buying an odd-sized unit An oddly sized unit refers to a layout which has odd corners like a triangle or irregularly shaped like an oval or circle. Such homes have an inefficient layout meaning that it will result in wasted space which cannot be utilised. It is also bad in terms of feng shui should the odd corners have an acute angle as they will collect energy that cannot be dispersed. Instead, you should opt for a regularly shaped unit like a square or rectangle. Remember this golden rule when it comes to a home layout: boring equals good. #4: Buying a common unit versus one that is scarce This is especially applicable for the property market in Malaysia where there is a severe oversupply of homes particularly in Johor and Kuala Lumpur. When buying a home, you should opt for a unit that is scarce. You should first study the development carefully and the unit types that are available. For example, in a project where 4-bedroom greatly outnumber 2-bedroom units, you should opt for the latter. This is because such units will be easier to offload in the resale market should you wish to sell or rent it out in future. Of course, you must take into consideration your family size before making the final decision. #5: Not asking about your prospective neighbours A neighbour can make or break your property.

This is especially true if you are buying a resale home. Recently, a friend confided how he had to move out from his current home to rent another place in eastern Singapore. He had bought the HDB flat from the resale market from an owner who appeared desperate to sell it off. “Don’t tell the neighbour downstairs how much I sold this house,” the owner said ominously. This should have been a red flag. After moving in, he realised his neighbour downstairs would often make a din throughout the entire day. Sometimes, he would have the police knocking on his door as the neighbour had complained about him for no reason. This caused him and his family so much distress that the neighbour’s mom had to come up to explain and apologise for her son’s erratic behaviour. Apparently, her son suffers from a mental illness. After talking to his neighbour, he realised the previous owner was not on good terms with the entire family. This explains their decision to sell the flat. While he now lives a quieter life elsewhere, his tenants are now at the receiving end of the neighbour’s constant abuse. For example, recently, he received a call from the HDB complaining about the apparent noises from his unit. Thankfully, the HDB and the police are aware of his problematic neighbour and have since closed the case. Unfortunately, you cannot choose your neighbours if you had bought a new home directly from the HDB or developer. However, you can mitigate your risks by being a good neighbour. For instance, why not offer a serving of cookies or cakes during your festive celebration? While your actions may not be reciprocated, a friendly hello on your neighbour’s door and offering such goodies will certainly go a long way in making a good first impression last. Neighbours do talk so why not give them something good to talk about? Good news for senior citizens living in HDB flats and SMEs but bad news for landlords By Khalil Adis Finance Minister Heng Swee Keat delivered his Budget 2019 speech on 18 February with a slew of goodies ranging from start-ups to the older generation. We dissect the budget and analyse its impact on the property market. #1: Merdeka Generation Package will help prop up the HDB market The package worth some S$8 billion is for Singaporeans born in the 1950s to thank them for their contributions to Singapore. The package includes the following:

These additional incentives will go a long way to help the elderly. This is because medical treatment can take up a significant portion of one's life savings resulting in some elderly having to sell their HDB flat. Thus, the package will indirectly prop up the HDB market. This is good news as the HDB resale market has softened considerably since the first quarter of 2013. Singaporeans who qualify will receive their Merdeka Generation cards from June 2019. #2: Various incentives for SMEs will boost the commercial property market The government has announced an SME Co-Investment Fund III that will witness it investing S$100 million in small and medium-sized enterprises (SMEs) that are ready to scale up to catalyse private sector funding. In addition, the Enterprise Financing Scheme will offer better support for SMEs to access bank financing and provide enhanced support for companies incorporated for less than five years. Collectively, these measures will indirectly lead to demand for office space among start-ups. Commercial properties that specialise in co-working space will benefit the most as they are conducive for start-ups. One such property is The JTC LaunchPad @ one-north. The budget will not have any significant impact on Grade A office spaces as such market tend to be dominated by multinational companies. #3: Lower Dependency Ratio Ceilings (DRCs) will impact the rental market A lower DRCs in the service sectors will reduce Singapore's dependency on foreign workers from the current 40 per cent to 38 per cent from 1 Jan 2020 3 and 5 per cent from 1 Jan 2021.

In addition, the ratio of S Pass workers will be reduced from the current 15 per cent to 13 per cent from 1 Jan 2020 and 10 per cent from 1 Jan 2021. This will have a significant impact on the HDB rental market and mass market condominiums due to the shrinking tenant pool. As such, landlords will likely need to reduce their rent to continue attracting tenants. Vacancy rates in the heartlands may also rise leading up to 2020 and 2021. Thus, it will be a tenant's market. |

Khalil AdisAn independent analysis from yours truly Archives

July 2023

Categories

All

|

100 Peck Seah Street

|

|

RSS Feed

RSS Feed