|

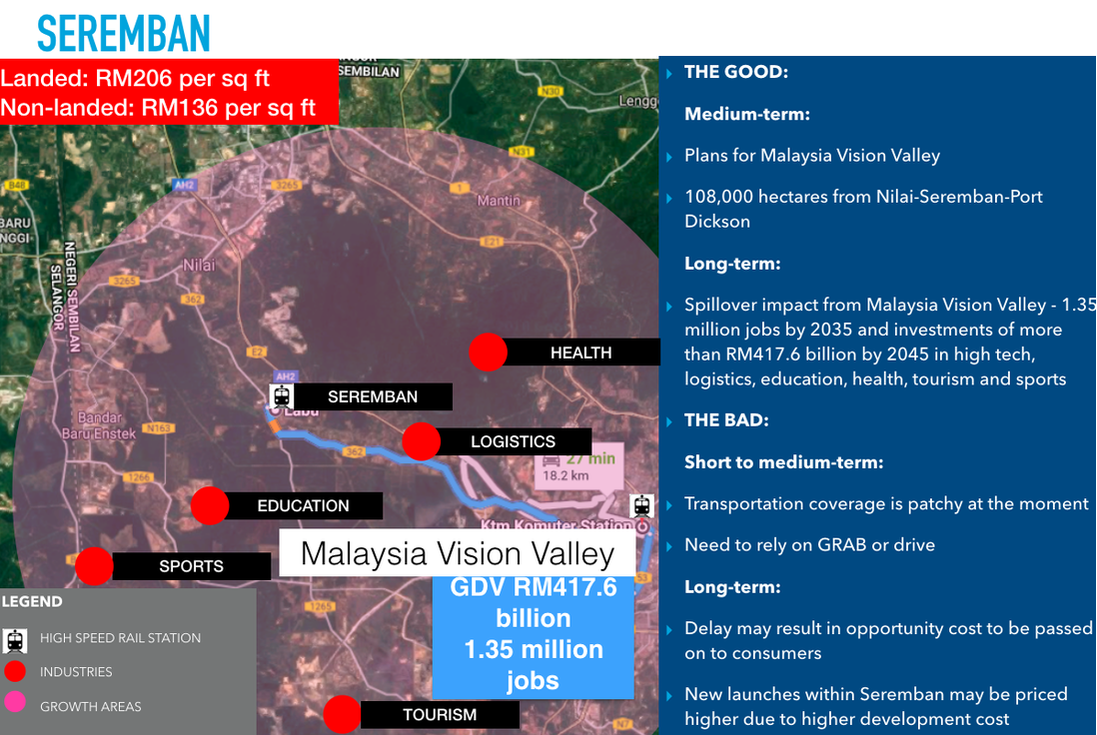

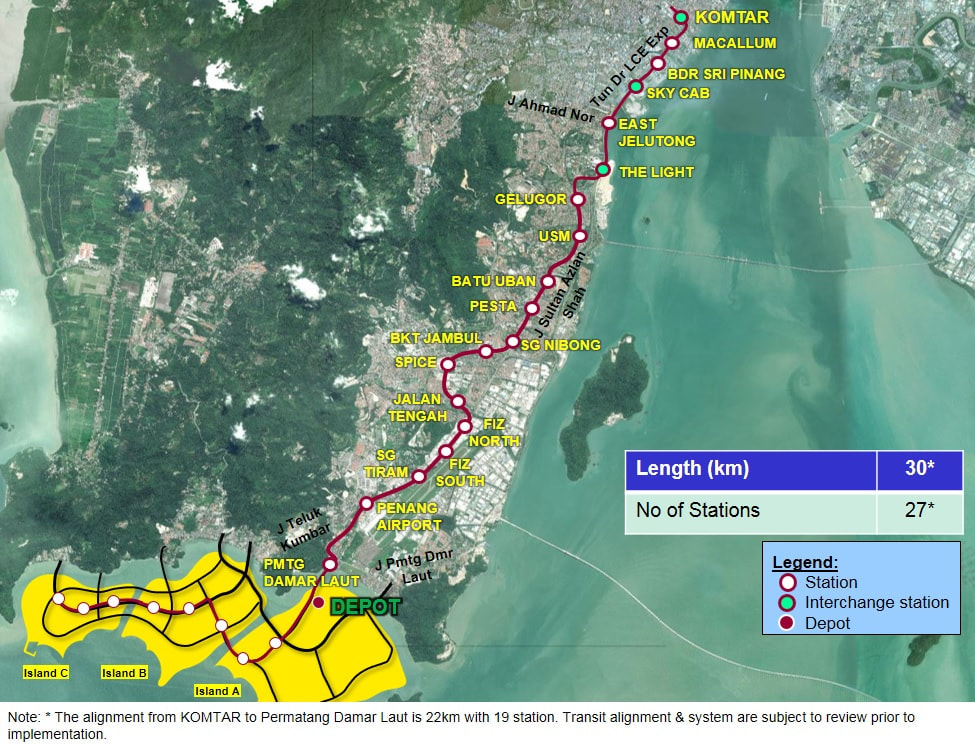

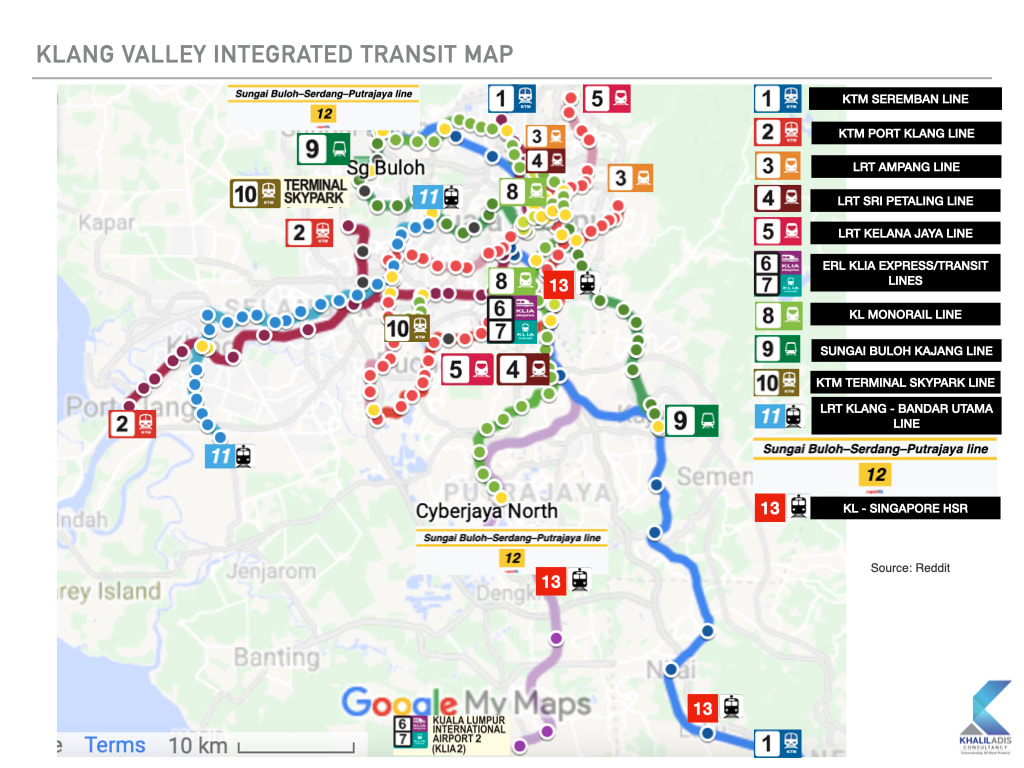

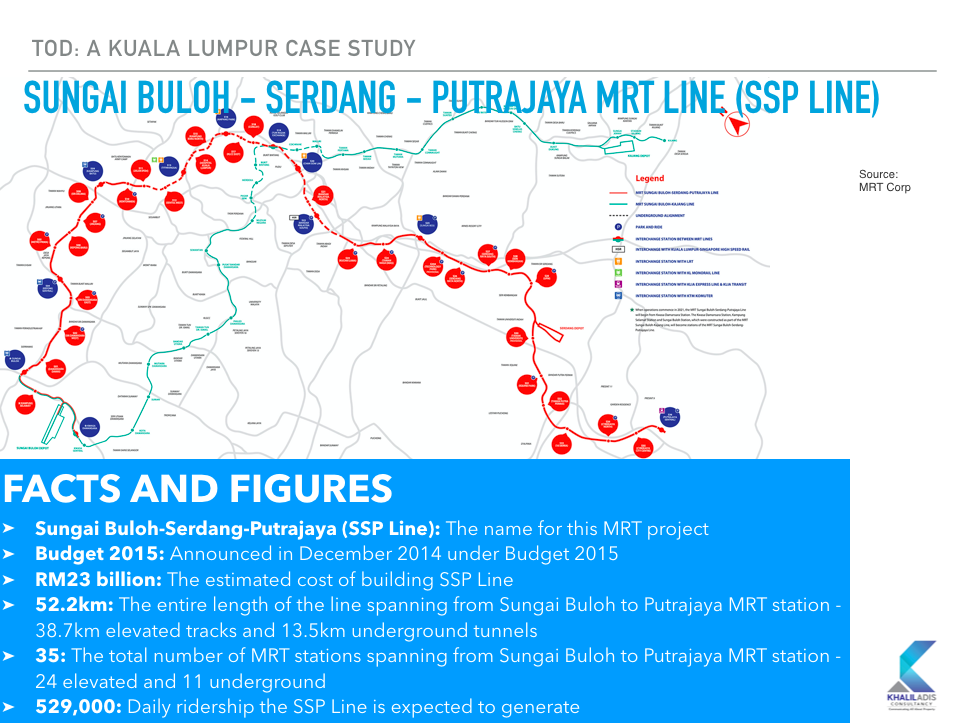

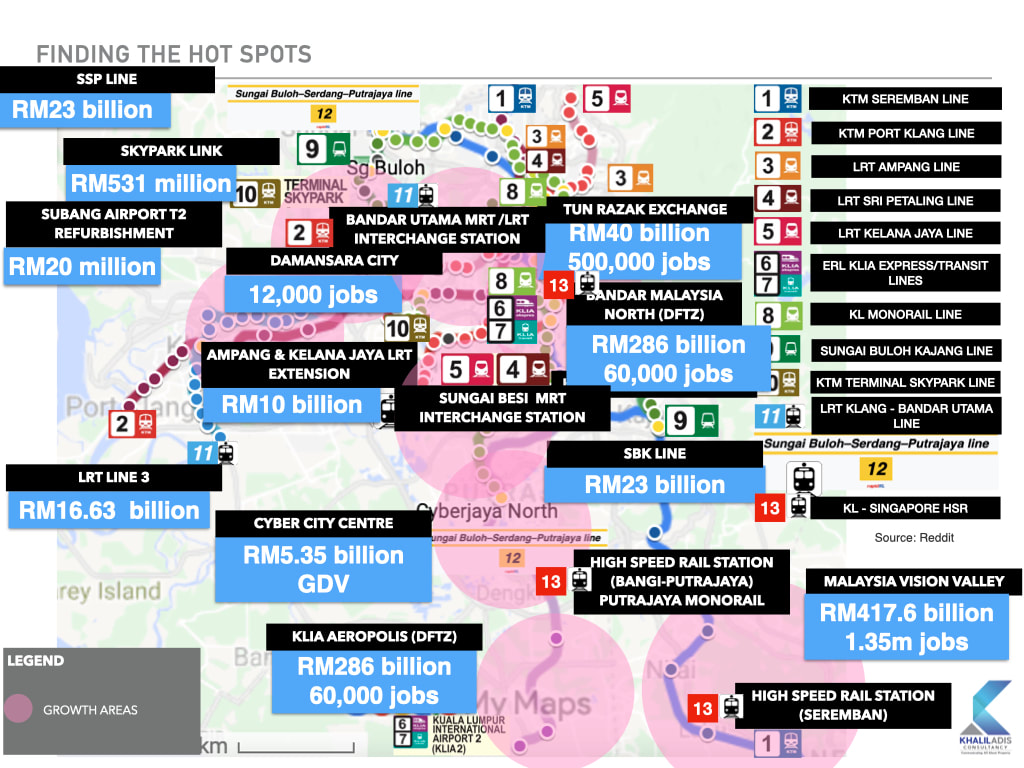

Mass market launches and rental markets in key urban areas are expected to see strong demand in 2024. By Khalil Adis In 2023, the Malaysian property market saw significant trends and developments that have set the stage for the outlook and predictions for 2024. The huge mismatch between what Malaysians can afford to buy versus what developers are building has become increasingly apparent, leading to a shift in consumer behaviour towards renting instead of buying. With affordable housing in short supply, especially in highly urbanised areas like Kuala Lumpur, Johor, Penang, and Selangor, demand for rental properties surged in 2023. This increased demand for rental properties has led to a notable shift in the market dynamics, with renters seeking affordable and well-maintained units in desirable locations. In response to the changing market dynamics, developers in Johor, Selangor and Kuala Lumpur focused on catering to the mass market segment by launching new residential projects priced below RM300,000. These mass-market homes aimed to address the growing demand for affordable housing options among Malaysian buyers. On the other hand, the overhang market in Johor, Selangor, Kuala Lumpur and Penang was dominated by residential properties priced between RM500,000 to RM1 million. This suggests that there is a surplus of mid-range properties in these areas, which may take longer to sell due to affordability constraints and oversupply issues. Johor In Johor, the property market is expected to continue facing challenges in 2024, particularly in areas with a high concentration of oversupply. The mass market segment, which saw an abundance of new launches priced below RM300,000 in 2023, may experience slower growth as developers adjust to the changing demand landscape. However, growth areas such as within Iskandar Malaysia may still present opportunities for investors, especially in well-planned integrated developments that cater to both residential and commercial needs. Selangor Selangor, being one of Malaysia's most populous states and a major economic hub, is expected to maintain its position as a key player in the property market. While the demand for affordable housing is likely to remain strong, developers may shift their focus towards more sustainable and inclusive development strategies. Growth areas such as Cyberjaya, Shah Alam and Subang Jaya are expected to continue attracting interest from both buyers and developers, with a focus on mixed-use developments and transit-oriented projects. Kuala Lumpur In Kuala Lumpur, the property market is expected to see continued interest in high-density urban living, driven by factors such as urbanisation and lifestyle preferences. However, affordability concerns may lead to a greater emphasis on the development of affordable housing and innovative financing solutions. Growth areas within the city centre and its surrounding suburbs, such as KL Sentral, Bangsar and Mont Kiara, are expected to remain attractive to both investors and homebuyers. Penang Penang, known for its rich cultural heritage and vibrant lifestyle, is expected to continue experiencing steady demand for residential properties, particularly in sought-after areas such as George Town, Bayan Lepas, and Tanjung Tokong. However, affordability concerns and oversupply in certain segments may lead to a slowdown in the high-end property market. Developers may focus on niche markets and alternative housing options to cater to changing consumer preferences. The growth areas to watch out for on the main island are mainly along the proposed Bayan Lepas LRT. Growth areas In addition to established urban centres, growth areas such as transit-oriented developments, industrial zones, and emerging satellite towns are expected to attract interest from investors and homebuyers alike. These areas offer opportunities for sustainable development and investment diversification, while also addressing issues such as urban sprawl and congestion. Johor In Johor, the growth areas are primarily located in Iskandar Malaysia, especially in well-planned integrated developments that cater to both residential and commercial needs. One such area is Bukit Chagar which will serve as an interchange station Johor Bahru – Singapore Rapid Transit System (RTS) Link. Slated to commence passenger service by end-2026, the RTS Link can serve up to 10,000 commuters during peak periods, for every hour and in each direction. The RTS Link will also have a spillover impact in the nearby JB Sentral area which is home to malls, hotels and the upcoming Ibrahim International District. Selangor In Selangor, the growth areas are in Southern Kuala Lumpur, particularly, those near high-impact projects and transit-oriented developments along the Putrajaya Line, Kuala Lumpur–Singapore high-speed rail (HSR) and the Malaysia Vision Valley. Nilai and Seremban are areas to watch out for. Nilai is poised for further growth as it is located within the Malaysia Vision Valley. Covering Nilai to Port Dickson, it will have a proposed area of 108,000 hectares. The upcoming industries include high-tech, logistics, education, health, tourism and sports. The Malaysia Vision Valley is expected to create some 1.35 million jobs by 2035 and investments of more than RM417.6 billion by 2045. To support the Malaysia Vision Valley, the Seremban HSR station will be situated in Nilai within the Labu and Kirby estates. Major townships in the vicinity include Bandar Enstek, Bandar Ainsdale Property and S2 Height. Seremban will be an interchange station for the Seremban Komuter Line and KTM Electric Train Service. Kuala Lumpur The growth areas in KL are along the MRT3 Circle Line, namely, Bukit Kiara Selatan, Bukit Kiara, Sri Hartamasa, Mont Kiara, Bukit Segambut, Taman Sri Sinar, Dutamas, Jalan Kuching, Titiwangsa, Kampung Puah, Jalan Langkawi, Danau Kota, Setapak, Rejang, Setiawangsa, AU2, Taman Hillview, Kuchai, Jalan Klang Lama, Pantai Dalam, Pantai Permai and Universiti. Titiwangsa MRT station which will serve as an interchange station with the Ampang and Sri Petaling Line, KL Monorail Line and Putrajaya Line. As the Circle Line is still under construction, this presents a good opportunity for genuine homebuyers to start looking in and around the station. Homes in the secondary market will be the most ideal as they are priced cheaper than new launches. Penang The growth areas in Penang remain unchanged in Batu Kawan and some parts of Seberang Perai. Since the opening of the Second Penang Bridge, Batu Kawan has seen rapid developments from several renowned developers such as EcoWorld and Tropicana as well as the opening of IKEA. While connectivity remains patchy at Batu Kawan, there is a planned Bus Rapid Transit (BRT) system for Batu Kawan as part of the Penang Transport Master Plan. In Seberang Perai, the growth areas will be along the planned Raja Uda-Bukit Mertajam Line to connect the northwestern region to the southeastern region. For those who can afford to buy a property on the main island, areas along the Bayan Lepas LRT line will be the new growth corridor. What’s in store for buyers Buyers in 2024 can expect a more diverse range of options in the property market, with an emphasis on affordability, sustainability, and lifestyle amenities. Innovative financing schemes and incentives may also be introduced to encourage homeownership and address affordability concerns. What’s in store for sellers Sellers may need to adjust their expectations and pricing strategies to align with changing market conditions. Those with properties in oversupplied segments may need to offer incentives or value-added services to attract buyers, while those in high-demand areas may continue to command premium prices. What’s in store for tenants Tenants can expect a more competitive rental market in 2024, particularly in urban areas where demand for rental properties is high. Affordability remains a key concern for tenants, and they may seek out properties with flexible lease terms and inclusive amenities. What’s in store for landlords Landlords may need to be more proactive in managing their rental properties, offering competitive rental rates and investing in property maintenance and upgrades to attract and retain tenants. Those with properties in growth areas may continue to enjoy strong rental yields and capital appreciation. Conclusion Overall, the Malaysian property market is expected to continue evolving in 2024, with a focus on affordability, sustainability, and innovation.

While challenges such as oversupply and affordability concerns may persist, there are also opportunities for growth and investment in emerging sectors and growth areas. By staying informed and adaptable, stakeholders in the property market can navigate these changes and capitalise on new opportunities in the year ahead.

0 Comments

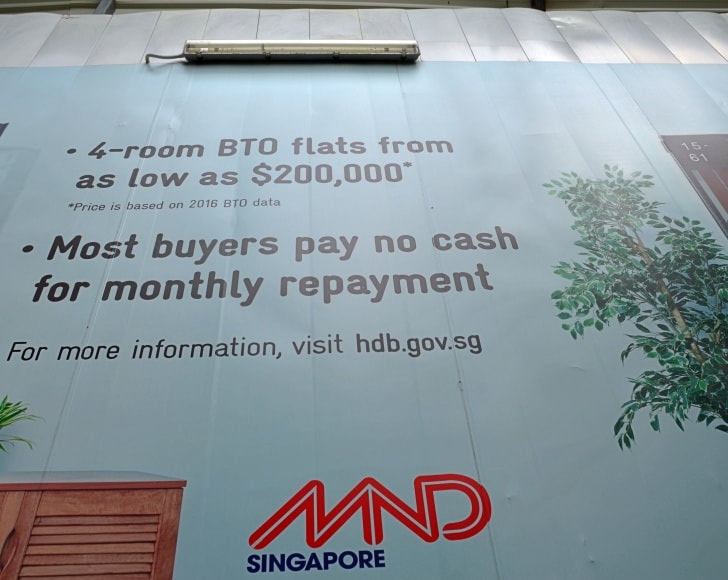

The HDB, private property and rental markets will see price stabilisation in 2024 favouring buyers and tenants. By Khalil Adis If 2023 saw the HDB and private resale markets reaching record highs before subduing, then 2024 will likely see a further price correction arising from the property cooling measures, high-interest rates and upcoming supply. Likewise, the red-hot rental market will see further signs of stabilisation in the upcoming year. HDB resale market The HDB Resale Price Index (RPI) reached a record high in the third quarter of 2023 at 178.5 points. According to HDB’s flash estimate, the RPI for the fourth quarter of 2023 is at 180.2 points which is an increase of 1.0 per cent over that in the third quarter. A total of 24,447 flats were offered by HDB in 2023 comprising 22,780 Build-To-Order (BTO) flats and a further 1,500 and 167 flats offered under the Sale of Balance Flats (SBF) exercise and open booking of flats respectively. This new flat supply will likely divert buyers away from the resale market which leads to a corresponding dip in demand in both the resale and rental markets. As demand for resale HDB flats and rental eases, the RPI will likely correct itself to a more sustainable level. Private property market The private property market also witnessed the Private Property Index (PPI) climbing to a record high of 196.0 points in the third quarter of 2023. Meanwhile, the Urban Redevelopment Authority’s flash estimate showed that the PPI increased by 2.7 per cent on a quarter-on-quarter basis in the fourth quarter of 2023, to reach 201.3 points. This brings the price gain for the whole of 2023 to 6.7 points. The property cooling measures implemented in 2023 also affected sales volume as the government increased the Additional Buyer’s Stamp Duty (ABSD) and imposed a 15-month wait-out period for private property owners downgrading to HDB flats. Data from URA showed that sales transaction volume fell by about 27 per cent on a quarter-on-quarter basis for the fourth quarter of 2023. For the whole of 2023, sale transaction volume fell by about 15 per cent compared to 2022. This was the lowest annual sale transaction volume since 2016. Correspondingly, the increase in ABSD for foreigners from 30 per cent to 60 per cent appeared to impact prime areas the most. According to URA’s data, non-landed private properties in the prime areas were the most affected while those that are located in the Outside Central Region (OCR) were the least impacted. For example, the PPI for properties located in the Core Central Region (CCR) remained somewhat flat with a slight dip noted when the cooling measures were announced before rebounding to slightly below the 150-point level. Meanwhile, those that are located in the RCR saw the index strengthening considerably from 2022 to 2023. This implies that this particular segment had remained somewhat resilient despite the property cooling measures. One of the reasons could be that the RCR is relatively affordable making it popular among first-time local private property buyers who will not be impacted by the ABSD. Government ramping up supply in private and HDB markets To further cool the property market, the government is ramping up supply of 5,160 units in the second half of 2023. This will bring the total pipeline supply of private housing to about 59,100 units. According to the URA, of this, 41,900 units will comprise those with planning approval and 17,200 units from Government Land Sale (GLS) sites and awarded en-bloc sites that have not been granted planning approval yet. Overall, a total supply of about 100,000 public and private housing units will be completed between 2023 and 2025. This will likely see a further price correction and promote market stability favouring buyers. Growth areas The growth areas in Singapore have remained unchanged based on URA’s Master Plan 2019. The growth areas are in the Greater Southern Waterfront, Punggol Digital District and Woodlands Regional Centre. Read more about the Greater Southern Waterfront here. Read more about Punggol Digital District here. Read more about Woodlands Regional Centre here. What’s in store for buyers With about 100,000 public and private housing units to be completed between 2023 and 2025, 2024 will shift towards a buyers' market. This is because the incoming supply will ease demand and will likely see a further price correction and promote market stability in the resale market. This will undoubtedly favour buyers. What’s in store for sellers Sellers will likely face a tough time in 2024 as the 100,000 supply of both public and private housing will see buyers buy new launches in both markets. As such, sellers will need to price their houses realistically to continue attracting buyers. We are also likely to see fewer million-dollar HDB flats and those selling with cash-over-valuation (COV). Sellers will need to be pragmatic, moving forward. What’s in store for tenants Tenants, there will be plenty of good deals in the market. As such, 2024 is a good year for you to secure new a home with a fresh new lease at a reasonable price. This is because the incoming supply will impact the rental market resulting in rentals for HDB and private properties coming down. If your lease is expiring this year, it may be a good idea to renegotiate your lease with your landlord at market price. What’s in store for landlords Landlords will have to be realistic in their asking price in 2024 as the rental market is cooling off. Conclusion As Singapore's property market navigates the dynamic landscape of 2024, stakeholders should remain vigilant to the evolving trends.

The delicate balance between supply and demand, coupled with government interventions, will play a pivotal role in shaping the property landscape for buyers, sellers, tenants and landlords alike. 5 things you will learn during my talk at the iProperty Bumiputera Home & Property Fair 20237/5/2023 From map reading to identifying growth areas, this easy-to-understand session aims to assist first-time homebuyers looking for homes along the Sungai Buloh-Serdang-Putrajaya (SSP Line). By Khalil Adis The Malaysian property landscape has undergone significant changes since the Covid-19 pandemic hit. With the completion of iconic projects like the Merdeka 118 Tower and the Sungai Buloh-Serdang-Putrajaya (SSP Line) over the past three years, there are exciting opportunities in the market. However, affordability remains a key concern for first-time homebuyers in Kuala Lumpur and Greater KL. Data from the National Property and Information Centre (NAPIC) reveals that 48.2 per cent of the 8,226 new residential units launched in the third quarter of 2023 were priced below RM300,000. This indicates a strong demand for affordable properties. High-rise developments make up 67.8 per cent of these units, while 32.2 per cent are landed properties. Selangor and Kuala Lumpur accounted for 1,062 and 1,236 units respectively. To address these concerns and help first-time homebuyers make informed decisions, I will be covering one of the 5Cs of property buying - checking for the transport masterplan - in greater detail during my upcoming talk on July 16 at the iProperty Bumiputera Home & Property Fair 2023. Here are five things you can expect to learn: #1: Learn how to do map reading Navigating the Klang Valley and Greater KL areas can be overwhelming for first-time homebuyers. In this talk, we will learn the art of map reading to understand the different train lines that serve these areas. By gaining a grasp of the overall growth areas, we can then dive deeper into the newly completed SSP Line. #2: Understand the transportation master plan Get to know the key facts and figures of the SSP Line, such as the budget allocation and the number of stations. Understanding the transportation master plan will enable you to uncover the budget allocation from the federal government. We will analyse how this budget allocation can potentially have a positive spillover impact on properties along the line. #3: Learn where the growth areas are To identify potential growth areas, we will delve into the two other 5Cs - checking for economic drivers and job creation. By studying case studies like the Cyber City Centre and the KLIA Aeropolis Digital Free Trade Zone (DFTZ), we can gain insights into the areas with promising development potential. #4: Find the sweet spot in terms of distance to train stations While it may be tempting to buy a property close to train stations, we need to be cautious not to be too close, especially for elevated train stations. Additionally, developers need to adhere to certain requirements to qualify for transit-oriented development (TOD). Learn about the sweet spots that strike the right balance and how they can impact your property's resale and rental value. #5: Identify affordable properties along the SSP Line Not all affordable areas are equal. To find truly affordable properties, we need to identify areas with new or upcoming train stations and government-announced plans for upcoming economic zones. These areas should be situated away from the city centre but close enough to train stations and dedicated hubs, ensuring long-term price appreciation. Discover the income-to-mortgage ratio and identify areas along the SSP Line that won't burn a hole in your pocket, offering the greatest potential for capital appreciation. iProperty Bumiputera Home & Property Fair 2023 Join me at the iProperty Bumiputera Home & Property Fair 2023 on July 16 to gain valuable insights into the property market and make informed decisions as a first-time homebuyer.

Don't miss out on this opportunity to learn about navigating the Klang Valley and Greater KL areas, understanding the transport masterplan, identifying growth areas, finding the sweet spot in terms of distance to train stations and discovering affordable properties along the SSP Line. See you there! A friend's personal journey of overcoming homelessness with the support of the government. By Khalil Adis Imagine being homeless and not knowing where to turn for help. Recently, a friend of mine, whom I will call Derek, shared his struggles with me, and it struck a chord in my heart. Having personally experienced this, it is a situation I would not wish upon to anyone else. Through Derek's and my journey, it shows that the Singapore government genuinely does care and provides assistance to those in need. Trying to move forward but unable to afford a home Derek's life took a difficult turn after a bitter divorce, leaving him without a place to call home. With no choice but to leave his in-law's house, he had to find a rental room at short notice. Fortunately, Derek did not have the added burden of a shared matrimonial home or children, which made the situation slightly easier. Despite his efforts to move forward, Derek faced another obstacle – he could not afford to buy a home of his own with his current financial situation. Feeling hopeless and at a loss To afford a decent resale 2-room flat, Derek needed an additional $100,000 on top of his cash, CPF, and HDB loan amounting to $200,000. As a second-timer, he did not qualify for CPF Housing Grants that could have helped him. The situation seemed dire and Derek felt like he was running out of options. However, I knew from personal experience that giving up was not the answer. Light at the end of the tunnel I encouraged Derek to reach out to his Member of Parliament (MP) for help. Despite the high cost of living in Singapore, our government genuinely cares about those in need and assists on a case-by-case basis. I had gone through a similar situation before and received the support I needed. Derek took my advice and wrote to his MP, hoping for a glimmer of hope. The government's support and assistance Recently, Derek shared some good news with me – his MP responded and the Housing Development Board (HDB) is looking into increasing his loan quantum. This development means that Derek may soon be able to fulfill his dream of owning a home. Derek's experience serves as a reminder that we should never give up hope, and reaching out to your MP can make a significant difference in your housing situation. Conclusion In Singapore, homelessness is not an outcome that the government wants for its citizens.

As Derek's story shows, the government does show compassion and support when individuals find themselves in challenging circumstances. If you are facing similar housing struggles, I urge you not to lose hope and to reach out to your MP for assistance. The government is committed to helping those in need and ensuring that no one is left without a home. That's the beauty of Singapore – a nation that cares for its people, even in times of hardship. As Singapore's property market continues to reach new heights, investors are eyeing Malaysia as a potential alternative. But is it the answer to Singapore's escalating property prices? Let us find out. By Khalil Adis Singapore's property market has been making waves, with both the HDB and private property sectors hitting record highs in their price indexes. This surge in prices has prompted investors and homebuyers to search for alternatives and Malaysia has emerged as a popular choice. However, before you pack your bags and head south, let us dive into whether Malaysia truly offers a viable solution to Singapore's escalating property prices. The latest data from the Housing & Development Board (HDB) and the Urban Redevelopment Authority (URA) paints an intriguing picture. The HDB Resale Price Index (RPI) and Private Property Index (PPI) for the first quarter of 2023 reached unprecedented levels of 173.6 points and 194.8 points, respectively. These figures indicate a strong demand for properties in Singapore, driving prices to new heights. Analysts say they are witnessing resale transactions decreasing from April to March 2023, which could explain the marginal increase in the RPI. “In April 2023, HDB resale volumes decreased month-on-month by 4.3 per cent, following a 23.7 per cent surge in transaction activities in March,” said Luqman Hakim, chief data & analytics officer at 99.co.. But it is not just rising property prices that pose a concern. Rental rates have also skyrocketed, leaving tenants grappling with the search for affordable accommodations. Rising rentals Take, for instance, Marwani (not her real name), a landlord in Jurong West, who witnessed the rental price of her 4-room flat soar from $1,750 per month in 2021 to a staggering $3,500 per month in 2023—an almost 200 per cent increase! “I am lucky that my tenants have continued to stay on despite the steep increase in rental,” said Marwani. Her agent was the one who negotiated the lease renewal. The private property rental market also experienced a steep climb, with a 7.2 per cent increase in the first quarter of 2023. These exorbitant prices and soaring rentals have left many individuals, like Edward (not his real name), a tenant in Singapore, seriously considering buying a resale HDB flat as a more financially viable option. “I signed a 2-year lease which had averted a rental hike. However, I am pretty sure it will go up next year,” said Edward who lives close to the city centre. Edward believes that owning property might be more cost-effective in the long run, particularly with the prospect of rising rents. “It makes more financial sense to buy now rather than rent as I foresee it will be cheaper to pay my monthly mortgage should my rent increase,” he said. Analysts have also observed this growing trend, noting that tenants are increasingly turning to purchasing resale flats amidst high rental prices. “Resale prices increased by 1.1 per cent compared to March 2023, with 5-room flats rising the most at 1.9 per cent. It is possible that with rent prices remaining high, many tenants are opting to buy resale flats instead. Subsequently, with the revised ABSD rates from 27 April 2023 onwards, there is expectant pressure on rental demand (and prices), prompting spillover demand from tenants as they reinvest and buy HDB resale flats,” said Hakim. With the demand for properties in Singapore remained robust, the government has stepped in to cool the market. The recent increase in Additional Buyers Stamp Duty (ABSD), which affects second-timer Singaporeans and first-time foreign property owners, aims to rein in property speculation. Push factor to Malaysia? With 2-room HDB flats now hovering around the $300,000 mark and million dollar HDB flats becoming this norm, could this push potential biuyers to Malaysia? Not quite. Yusoff (not his real name) is among one of the few Singaporeans who is packing his bags after recently selling his 2-room HDB flat in Woodlands for slightly above $300,000. “My wife recently passed away while my relatives are all in Malaysia. It makes sense for me to retire there,” said Yusoff. Indeed, the first quarter data of 2023 from HDB showed that such flats were transacted at a median price of $330,000, $325,000 and $315,000 in Punggol, Sembawang and Yishun respectively. That is almost enough to buy a private property in Malaysia where the minimum purchase price in most states is at RM1 million, including in Johor. However, not everyone is in the same predicament as Yusoff. Edward, for instance, is staying put. Despite these cooling measures, the idea of buying properties across the causeway in Malaysia may not be as enticing as it seems. “There are many push factors such as the lack of liberal values in a predominantly Muslim country. Also, Malaysia appears to be unstable both politically and economically,” said Edward. While the affordability factor in Malaysia's property market may initially catch the eye of potential buyers, it is worth noting that property overhang for residential properties continues to be a serious issue. Johor, for instance, continues to be the leading state for residential overhang at 5,348 units, the third quarter of 2023 data from the National Property and Information Centre (NAPIC) showed. This would put pressure on the secondary market causing investors to suffer a loss as in the case of Country Garden Danga Bay. Additionally, concerns surrounding political and economic stability in Malaysia may deter investors who prioritise stability and predictability in their investments. Ultimately, while the ABSD increase may lead some investors to explore opportunities outside of Singapore, it seems that the challenges and limitations associated with investing in Malaysia may outweigh the potential benefits. As always, conducting thorough research and seeking expert advice before making any investment decisions is crucial. Conclusion So, is Malaysia truly the solution to escaping Singapore's soaring property prices?

The answer may not be as straightforward as it seems. While Malaysia offers some advantages in terms of affordability, potential buyers need to carefully consider factors such as political stability and the severe oversupply issue which may impact their investment. While resale HDB and private property are now at a record high, they are seeing a slower pace of price increase. By Khalil Adis As we enter the first quarter of 2023, Singapore’s property market is showing signs of resilience and stability after a turbulent few years. With a growing population, an expanding economy and a strong demand for housing, both the HDB and private property markets are expected to continue their upward trajectory. Here is a quick snapshot of what is happening in both the HDB and private property markets. HDB: Resale Price Index (RPI) is now at a record high For many Singaporeans, purchasing an HDB flat remains the most affordable option for homeownership. “I recently bought an HDB flat in Sengkang, and I have noticed that prices have gone up significantly compared to a few years ago. However, it is still affordable compared to private properties,” said one recent buyer, Tan Siew Ling. The HDB Resale Price Index (RPI) has been on a steady increase since 2019, and in the first quarter of 2023, it is expected to rise further. According to the HDB’s flash estimates for first quarter of 2023 data from HDB, the RPI is now at 173.4 point which is an increase of 0.9 per cent over that in the fourth quarter of 2022. “This is a slower increase than the 2.3 per cent increase in the fourth quarter of 2022, and is the smallest quarterly increase compared to the last ten quarters,” said the HDB in its press release. Challenges Nonetheless, the HDB market is not without challenges. For example, the price gap between newly MOP-ed flats and those in older HDB estates vary greatly. One such buyer is Amy and Khai who are finding that newly MOP-ed 3-room HDB flats, priced at more than $400,000, to be beyond their budget. With a combined monthly income of less than $3,000, CPF of around $30,000 and loan of around $180,000, Amy and Khai can only afford to purchase flats in older HDB estates. In the end, they narrowed down their search to a flat in Jurong West to be near their parents to qualify for the Proximity Housing Grant. While the asking price is significantly cheaper at $350,000, it comes with its own set of challenges. For instance, Amy and Khai are subjected to a pro-rated CPF usage since the remaining lease does not cover the age of the youngest buyer up to the age of 95. As Amy’s age is 30 and the remaining lease is 60 years, the couple’s HDB loan and Enhanced Housing Grant had to be pro-rated. Fortunately, with the increase in Family Grant from $50,000 to $80,000, Proximity Housing Grant of $30,000 and Enhanced Housing Grant, the grants went a long way in helping the young couple finance their flat purchase. “Our agent was very helpful in helping us do our financial calculations and recommend properties within our budget. Within one viewing, we decided to make an offer for the flat in Jurong West,” said Khai. “The government has imposed stricter loan-to-value ratios on buyers for HDB flats with a remaining lease of less than 60 years. This has resulted in a slower market for older HDB flats,” said analyst, Lim Hui Shan. Nonetheless, the HDB market is expected to remain stable and resilient. “Resale prices ceased to increase for the first time since June 2020, putting an end to the historic price rally that lasted for 31 consecutive months, as most room types experienced no increases in February 2023 except for 3-room flats. Following the Budget announcements, first-time HDB resale flat buyers can now enjoy higher amount of grants which should ease any concerns on affordability. As such, we expect demand to remain solid for the rest of 2023,” said Pow Ying Khuan, head of research, 99 Group. Private property market: Increase in ABSD has impacted luxury properties The private property market in Singapore has also experienced steady growth over the years.

According to the Urban Redevelopment Authority (URA) flash estimates, the Private Property Index (PPI) has increased by 6.0 points from 188.6 points in fourth quarter of 2022 to 194.6 points in first quarter of 2023. “I recently purchased a condo in Pasir Panjang and I’m really happy with my investment. I feel that the property market in Singapore is relatively stable and resilient,” said one investor, Johnathan Koh. However, the private property market faces its own set of challenges. The government has imposed an increase for the Additional Buyer’s Stamp Duty (ABSD) for foreign buyers (from 20 to 30 per cent) and local buyers (from 12 to 17 per cent) purchasing a second property. Analyst, Cheryl Lim, commented that “the ABSD has affected the demand for private properties, especially for high-end luxury properties. However, there is still demand for affordable and mid-range properties.” Despite the challenges, the private property market is expected to remain stable and continue to see growth in the first quarter of 2023. In conclusion, the Singapore property market remains resilient and stable, with both the HDB and private property markets showing positive signs of growth. While recent official visits from both Singapore’s and Malaysia’s foreign ministers will see both sides committed to completing the Johor Bahru–Singapore Rapid Transit System (RTS Link) and improve connectivity, more needs to be done to resolve its chronic property overhang. |

Khalil AdisAn independent analysis from yours truly Archives

July 2023

Categories

All

|

100 Peck Seah Street

|

|

RSS Feed

RSS Feed