|

Should you overpay your mortgage? By Khalil Adis I have a confession to make. I have been overpaying my mortgage for two years now. I know, it’s not the norm but I sleep better now knowing I can miss a few months of payment should something unforeseen were to happen. However, I plan to keep at it so that I can finish my mortgage earlier. So how did it all start? It was COVID-19 and the uncertainty surrounding it combined with my commitment to living a debt-free life that spurred me to take the plunge. While we are still battling with COVID-19, l would say, in hindsight, it was the best decision that I had made. The question is should you overpay your mortgage? Well, it depends on your circumstances. The advantages From my personal experience, it is worth it. Firstly, you will be less stressed knowing you are now several months ahead of your mortgage. Being able to sleep easy are just some of the intangible benefits that come with overpaying on your mortgage Secondly, if you do not have any other debts like credit cards, car and renovation loans, you can direct more money each month towards paying the principal while lowering the amount of the interest paid over the mortgage term. Thirdly, from the point above, it enables you to build equity earlier in your property. When you save on interest by making extra payments each month, your home equity savings will start to accrue every month. Thirdly, you can be mortgage-free much earlier than your original mortgage term. Fourthly, with rising inflation and interest rates, you will be able to save on interest by paying more each month. The disadvantages However, there are also some disadvantages. Firstly, some banks may impose a penalty for early payment of your loan during the ‘lock-in’ period. Thus, you should check with your bank if there are any penalties involved. Here are some common examples of bank charges and fees that you may incur: 1. Pre-payment of capital sum Buyers must give 30 days prior written notice or payment in 'interest in lieu' in the minimum of $10,000 and in multiples of $1,000. 2. Pre-payment fee If pre-payment is made within the 'lock-in' period from the date of the first loan disbursement, a pre-payment fee of 1.5 per cent of the ledger balance will be charged. 3. Redemption Borrowers must give 3 months' written notice or payment of 'interest in lieu’. 4. Redemption fee 1.5 per cent of the amount redeemed will be charged if made within the 'lock-in' period from the date of the first loan disbursement date. Secondly, if you have an existing credit card debt that incurs a higher interest rate than your mortgage, then you should not do it. Instead, you should aim to clear your credit card debt first and any other loans that have a higher interest rate. Thirdly, you should not do it if f you do not have at least six months of savings. This is because you may need access to extra cash on hand in case something were to happen. Fourthly, you should not do it if you are currently not investing your money in unit trusts or any other asset class. This is because you may miss out on good investment opportunities that pay a higher rate of return than your mortgage. Conclusion Whether or not you should overpay your mortgage depends on a lot of factors.

I would advise you to do a quick personal finance check and speak to your bank if there are any penalties should you wish to do it.

0 Comments

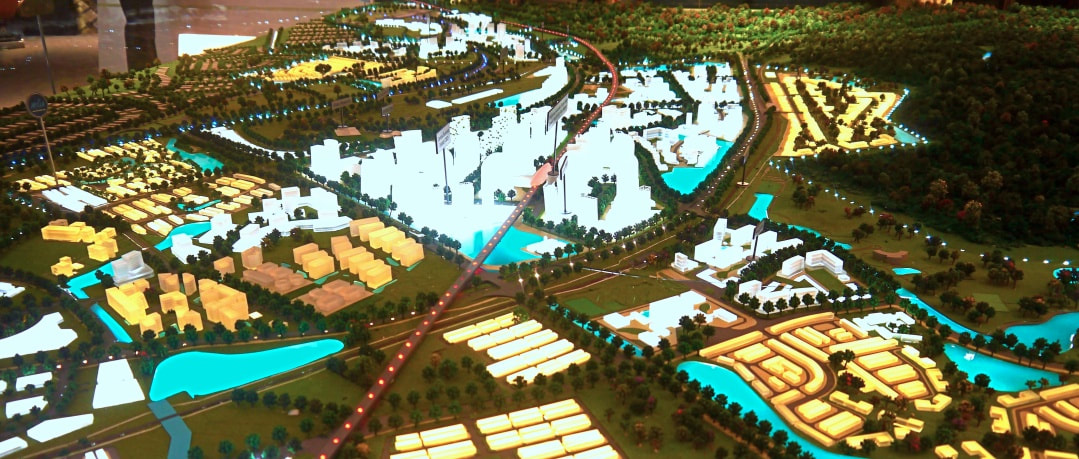

With its experience in green urban design and master planning projects spanning three different continents, PLP Architecture says cities like London and Singapore are witnessing an increase in demand for green spaces while developers are now seeing monetary value in them. By Khalil Adis It took Covid-19 for developers around the world to realise the important connection between buildings and outdoor spaces. That is the observation of Lee Polisano, president and founding partner of London-based PLP Architecture. “What we learnt is that there was an actual preference for people to want to have a much stronger connection to what they did things to outdoor spaces,” said Polisano on the impact of Covid-19 on building design and architecture. Polisano was speaking to reporters at a press conference held at the Four Season Hotel in Singapore where he noted there was a significant shift in terms of urban design pre-Covid-19 to Covid-19 times. This, in turn, he said has had an impact on building materials and incorporating new technology. “Materials that are less effective by bacteria are very, very popular. Touchless technology and buildings have become very, very popular. Dare I say, facial recognition in some places as an enabler has become very, very popular. There are a lot of things that are happening,” he said. Transforming urban areas into green spaces From London to Tokyo, PLP Architecture has designed and delivered a wide range of projects around the world ranging from office to master planning and urban design. So what results are intelligent, ground-breaking and exciting designs through the firm’s profound commitment to social, economic and environmental ideals. One example is the recently opened One Bishopsgate Plaza, in London, United Kingdom. The project marks the completion of a mixed-use master plan that originated with the adjacent Heron Tower to the south. The master plan envisioned a new City of London, moving away from the mono-culture of the office towards a rich aggregate of different uses that brings together hospitality, residential, amenity spaces, new types of retail as well as innovative public realm and place making. Having created some of the greenest buildings on the planet, his architectural firm is now designing and building projects on three continents. Increase in demand for green spaces in London and Singapore With his firm's experience across different continents, Polisano notes that demand for green spaces had increased significantly in certain cities like London and Singapore since Covid-19. “If you take, for example, London’s parks, the realisation rate of London’s parks increased by 200 per cent from pre-Covid times to Covid times. They have impacted the time people want in open spaces. I hear in Singapore, they increased,” said Polisano. Meanwhile, New York City and Tokyo had witnessed a decrease. “In New York City, it actually dropped to under 40 per cent than normal realisation. Tokyo also saw a decrease,” he said. Regeneration project for midtown Tokyo Speaking of Tokyo, Polisano and his team are currently embarking on an urban regeneration project by transplanting their green and sustainable design ideas in the city. Called Tokyo Cross Park, the firm was appointed in March this year as the master designer and placemaking strategist for one of Japan’s largest, greenest post-war urban renewal projects. It is also the architect for two of the four mixed-use towers on the 6.5- hectare site in the prestigious and culturally-significant Uchisaiwaicho 1- Chome district. “We are deeply honoured to be part of this exciting enterprise. Everything that PLP embodies was brought to bear on this project. Through it, we will deliver our commitment to use design and technological innovation to contribute to the flourishing of life and business, and importantly to protect the built environment,” he said. Located a stone throw’s away from the shopping district of Ginza, the multi-year, multi-billion-dollar project will connect the city to the 16-hectare Hibiya public park. It will include four towers, a 31-metre-tall podium and a two-hectare public plaza. When the project is fully completed by 2037, it will create a total of 1.1 million square metres of offices, commercial facilities, hotels and residential units. “The Tokyo Cross Park will become a flagship for sustainable development in Japan and will showcase the possibility of reaching the government’s target of carbon neutrality by 2050,” said Polisano. The regeneration of midtown Tokyo will also see the rebuilding of the Imperial Hotel. This legendary landmark has welcomed royalty, heads of state and international business leaders for over 130 years. Opened in 1890 by Japan’s aristocracy, it was rebuilt for its times in 1922 by American architecture doyen Frank Lloyd Wright before being redeveloped for the third time. Designing Park Nova In Singapore, the firm is responsible for the design of the upcoming garden-inspired, green-clad landmark residential building called Park Nova.

Interestingly, Polisano shared that Park Nova’s design concept was implemented pre-Covid-19. Located in the prime district of Orchard Road, PLP Architecture took inspiration from Park Nova’s lush, green environment to create 54 spacious apartments that seamlessly marry indoor and outdoor spaces. With an increase in demand for green spaces, one of the challenges PLP Architecture had faced is the city’s hot, tropical climate which is applicable also to Malaysia. “I think you have to realise that, for example, to create this kind of space in a European context or North America, the climate allows you to do it more readily year-round than it is here. Here, you got to look at other ways of creating this connection through design. That’s still quite a challenge,” he said. To overcome this challenge, the firm came up with a biophilic concept. This concept could also be replicated in Malaysia. “The whole narrative of Park Nova was creating outdoor spaces garden-like environment which everybody experiences when you move to Singapore for individual apartments. That indoor-outdoor biophilic connection was already there. But now, the influence is quite strong on the creation of outdoor spaces,” said Polisano. Indeed, Park Nova’s design and architecture include a variety of dedicated resident amenity spaces that promote health and well-being while supporting active lifestyles. Sitting on a site area of 43,356 sq ft, this freehold development integrates its outdoor and indoor spaces by incorporating a lap pool, garden seating and outdoor lounge, just to name a few. “What’s interesting about it is that people discounted the value of this kind of space before. I think real estate developers now see there is a monetary value in them as well. It is a win-win for everyone. Unfortunately, it was a hard lesson to learn and a very, very difficult way. It has changed everyone’s lives forever,” he concluded. Technology and finance sectors will dominate the office market, especially for Grade A offices in the CBD. By Khalil Adis For the past year, bank manager, Cheryl, has been working from home for three weeks a month as the default measure kicked in when COVID-19 happened. The experience, she said, was a nice change from the usual office routine. “Working from home has its pros and cons. The most obvious advantage is the flexibility I have especially when I have a pre-school child. I get to send my son and pick him up from school every day. Occasionally, I can whip up a nice dinner when I'm less tied up at work. I also spent less time commuting and more time bonding with my family,” she said. While acknowledging she enjoyed the flexibility, she notes there were some downsides as well. “I tend to overwork. There are occasions I would turn on my laptop when my son is asleep at night or on weekends when he is napping. I was even working when I was feeling under the weather,” she said. Another major drawback she experienced was the reduction in human interactions. "The lack in connection with the team tends to drift professional relationships,” she added. Fast forward a year later, Cheryl is now back in the office after the government announced that starting from 1 January 2022, fully vaccinated employees can return to work. Grade A office rents in the CBD projected to grow by 4.6 per cent With many workers like Cheryl now back in the office, analysts are expecting Singapore’s office market to make a strong recovery in 2022. A report released in February 2022 by Cushman and Wakefield predicts that Grade A office rents in the Central Business District (CBD) will grow. “The Singapore office market bottomed out in 2021 as demand continues to recover amidst a flight to quality. Looking ahead, Singapore’s CBD Grade A office rents are projected to grow by 4.6 per cent year-on-year with vacancy rates tightening to below 4 per cent by end-2022, against a backdrop of projected sustained demand of 0.9 million sq ft (msf) and limited supply of 0.8 msf this year,” said Wong Xian Yang, head of research, Singapore at Cushman & Wakefield. Data from Cushman and Wakefield also showed that Grade A and B office spaces are seeing growths after six consecutive quarters of decline since the first quarter of 2020, although this was still lower than the growth that was recorded before the pandemic began. “CBD Grade A office rents rose by 1.7 per cent quarter-to-quarter in the fourth quarter of 2021, marking three consecutive quarters of growth. For the whole of 2021, CBD Grade A rents grew 2.3 per cent year-on-year to reach $9.81 per sq ft per month, although this remains about 8.0 per cent below pre-pandemic (fourth quarter of 2019) levels,” its report cites. More investment deals expected Shaun Poh, Cushman & Wakefield Singapore’s executive director and head of capital markets said we may see higher office investment deals done with the Singapore market poised to outperform the broad Asia Pacific market this year. “With anticipated strong rental growth, investors looking to deploy capital into safe haven assets with healthy returns will find the Singapore office market appealing,” he said. Poh adds that as the market continues to recover and with limited stocks available for sale, buyers may bite. “Amidst ample liquidity and keen demand, office capital values expected to run up and cap rates could compress further with higher interest rates. Assuming cap rates tighten to 3.10 per cent in 2022 from 3.15 per cent in 2021, CBD Grade A capital values could increase by over 6 per cent this year,” Poh said. Notable lease transactions in 2021 Analysts said with the flight to quality seen last year, several notable tech companies upgraded from Grade B to Grade A CBD offices, totalling around 297,500 sq ft of lettable space. For instance, Lazada and Ali Baba took up some 140,000 sq ft of space at Lazada One followed by KPMG (100,000 sq ft) and Red Hat (57,500 sq ft) at Asia Square Tower 2 and CapitaSpring respectively. “We may see a slower and drawn-out recovery momentum as compared to historical recoveries. While office demand has risen in tandem with a strong economic recovery in 2021, the rise of hybrid work will likely lead to lower structural demand for office space as more people are able to work from home,” its report cites. Increase in leasing interests from finance and technology sectors One agent who does corporate leasing in the CBD said he is seeing an uptick in interests among prospective tenants from the finance and technology sectors. “Traditionally, firms in these sectors would lease co-working spaces. However, post COVID-19, they are now looking for fully fitted COVID-19 safe Grade A office space with a budget ranging from $7.50 to $8.50 per sq ft for a 2-year lease,” said the agent. A human resource executive in the finance industry who is currently occupying a co-working space concurs with this finding. “Initially, we were looking at co-working spaces as they have all the furniture done up. However, we are now exploring offices that are fully fitted out as well. As long as the price is within or budget and within easy access to the MRT stations, we will consider the space,” said the executive who wishes to remain anonymous. Analysts also agree with these findings. Cushman and Wakefield Singapore predicts technology and financial occupiers will continue to be major sources of office demand in 2022. The firm said this is because Singapore is a prominent tech hub globally with 88 of the world’s top 100 technology companies operating in Singapore and 59 per cent of tech multinationals establishing their regional headquarters in Singapore. “As these tech companies grow, their appetite for CBD Grade A office space would expand. However, given limited Grade A spaces within the CBD, some would start exploring city fringe Business Park space, following the likes of Google, Razer and Grab, as they outgrow their current premises. While this could create sizeable pockets of space in the CBD over the mid-term, they could be filled by future demand from future tech firms. Singapore has a vibrant start-up scene with over 4,000 tech startups locally and access to a large concentration of startups in Southeast Asia,” said Mark Lampard, Cushman & Wakefield Singapore’s executive director and head of commercial leasing. Moving forward With working from home no longer the default mode, some employees like Cheryl hopes for some flexibility to be allowed.

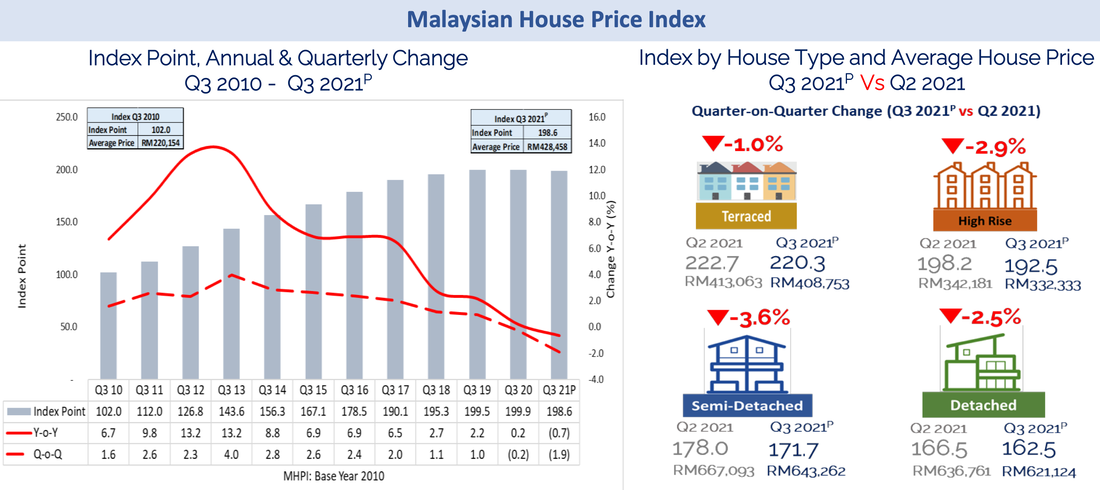

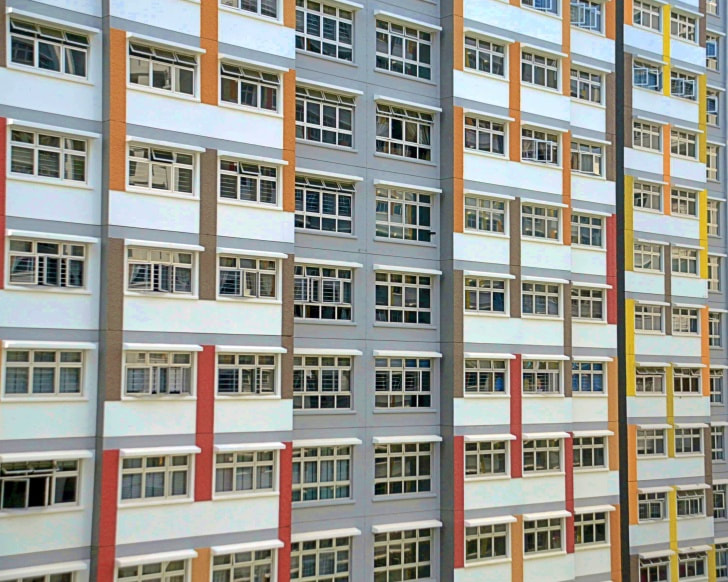

“It will definitely be great if we can have work from home as the norm for at least 25 per cent of the time going forward. This will give flexibility for working parents to attend to their kids as and when it is required. This could also reduce the sick leave rate if employees have the option to work from home,” she said. Meanwhile, analysts say while they remain optimistic, some inherent risks remained. “While the outlook for the Singapore office market looks promising, there are potential downside risks such as new Covid-19 variants which could reverse re-opening of economies and faster than expected rise in interest rates which could derail the recovery of the global economy,” said Lampard. Lampard advised potential tenants to make the best of the office market while they still can. “Notwithstanding these potential downside risks, tenants who are delaying their real estate decision making are advised to fast track their planning to optimise the opportunities available in the office market and ‘catch 22’ before it goes away,” he said Despite COVID-19 and record housing prices on the island, buying activity in Singapore has remained brisk while Malaysia’s has been somewhat muted. By Khalil Adis Ask any Singaporeans if they will invest in Malaysia right now and most likely they will say no. Instead, Singaporean investors flushed with cash have been busy snapping up properties in the Lion City. Data from the Urban Redevelopment Authority (URA) showed that in the third quarter of 2021, developers sold 3,550 private residential units, compared with the 2,966 units sold in the previous quarter. This figure does not include Executive Condominiums. So what gives? With COVID-19 travel restrictions, it makes sense to buy a property within Singapore. Amid the pandemic, news of Singaporeans having their homes broken into in Johor while they were away plus other developments from across the causeway may have spooked potential investors. From the cancellation of the Kuala Lumpur-Singapore High Speed Rail (KL-Singapore HSR) project to the revision of the Malaysia My Second Home (MM2H) policy, such news is enough to rattle investors’ confidence. After all, if a high-level government-to-government project like the KL-Singapore HSR could be terminated, what more for those involving the private sector like housing? Thus, it came as no surprise that despite its higher property price, buying activity has remained robust within the Lion City with record prices seen in both the HDB and private property markets. Malaysian developers are also closely watching Singapore’s property market. Wanting a slice of the lucrative pie, some are considering launching projects in Singapore but are unsure if Singaporeans will bite. Singapore: Record prices call for curbs to cool the property market When comparing Singapore’s and Malaysia’s property market performances since the pandemic began, they contrast like day and night, as government data showed. While properties in Singapore are notorious for being one of the most expensive in the world, it is also seen as a safe haven for property investment due to its political stability, efficiency and transparency. This may perhaps explain why despite COVID-19, the local property market experienced a bull run. Data from HDB showed that the Resale Price Index (RPI) for the third quarter of 2021 is now 150.6 points - a record high so far. This was an increase of 2.9 per cent over that in the second quarter. Meanwhile, data from the URA, showed that prices of private residential properties increased by 1.1 per cent in the third quarter of 2021, compared with the 0.8 per cent increase in the previous quarter. Similarly, the Private Property Index (PPI) is also at a record high. This had prompted the government to introduce a slew of cooling measures on 15 December 2021. Malaysia: Pandemic fatigue saw lukewarm buying activity but housing prices continued to rise Malaysia is one of the few places in the world where foreigners can own a freehold property. By default, this should make Malaysia a highly sought after investment destination. However, government data showed otherwise. Data from the National Property and Information Centre (NAPIC) showed that the Malaysian House Price Index for the third quarter of 2021 was at 198.6 points. On a year-on-year and quarter-on-quarter comparison, the index declined by 0.7 and 1.9 points respectively. Meanwhile, house prices continued to increase from a median price of RM204,470 recorded in 2009 to RM428,458.42 in the third quarter of 2021. This suggests that while the market has remained somewhat lukewarm, property prices have kept on climbing by a whopping 209.54 per cent in 12 years. So while locals are priced out from the property market and are not buying, foreigners appear to be staying away too. This is despite the strong Singapore dollar versus the Malaysian ringgit. Severe oversupply of residential units in Malaysia It is also worth noting that Malaysia has a severe oversupply problem with 30,358 unsold residential units valued at RM19.80 billion, figures from NAPIC showed. Of this, the majority of them (6,509 units) are located in Johor, just next to Singapore. Nation-wide, the majority of them (10,262 units or 33.8 per cent) are priced between RM500,000 to RM1 million - a price point beyond the reach for most Malaysians. Clearly, majority of the unsold units located in Johor are geared towards foreign buyers. KL-Singapore HSR resumption is needed to bolster confidence While COVID-19 has hampered cross border travel, there appears to be light at the end of the tunnel when both countries officially launched the Malaysia–Singapore land Vaccinated Travel Lane (VTL) scheme on 29 November 2021. Significantly, Malaysian Prime Minister Ismail Sabri is also suggesting reviving the terminated KL-Singapore HSR project during the launch. As a key regional aviation hub, Singapore offers Malaysia direct access to affluent travellers and potential investors. The Lion City also has among the highest concentration of high net worth individuals in the world. With three stops in Johor, it seems almost impossible that the KL-Singapore HSR project could succeed without Singapore’s participation. Look beyond local politics Malaysia will need to look at the bigger picture to see that the KL-Singapore HSR project can enhance cross-border investments that will in turn, solve its housing woes.

Rather than viewing Singapore as a rival, Malaysia should see that the KL-Singapore HSR project is a win-win solution for both countries. The spirit of good neighbourliness and gotong-royong must prevail. After all, when Iskandar Malaysia was first mooted by former Prime Minister Abdullah Badawi, Singapore was meant to complement and not compete with Malaysia. This is something local politicians need to be reminded of time and again. For now, the only investors Malaysia can bank on are the permanent residents that are still holding Malaysian citizenships in Singapore As Singapore eases border restrictions, the high-end market could see a return of buying activity judging by two project launches in the prime area. By Khalil Adis If 2021 is the year for HDB resale flats and mass market condominiums, 2022 could finally see Singapore’s high-end market picking up. That is the prediction among property developer TSky Cairnhill Pte Ltd who will officially launch Cairnhill 16 to prospective homebuyers and investors on 27 November 2021. This comes as Singapore eases border restrictions for quarantine-free travel and as the country adjusts to a “new normal” of living with Covid-19. “We believe that demand for Singapore residential property will gradually return as the country remains a safe haven for property investment,” said Edward Ang, executive chairman, Ocean Sky International. As such, next year could possibly see the return of buying activity among wealthy foreign investors in the somewhat lacklustre prime area of Singapore. Located on the former site of Cairnhill Heights at 16 Cairnhill Rise, Cairnhill 16 was sold through a collective sale to TSky in 2018. TSky Cairnhill is owned by TSky Development Pte Ltd, Ocean City Global Limited, Seacare Property Development Pte Ltd and Min Ghee Investment (2018) Pte Ltd. TSky Development is, in turn, a joint-venture between Singapore-listed Tiong Seng Holdings and Ocean Sky International. Two new launches in the CCR in the fourth quarter of 2021 Cairnhill 16, a freehold development, is among one of two noteworthy launches in the fourth quarter of 2021 that are located within the Core Central Region (CCR). The other project is Canninghill Piers, a 99-year-leasehold development located within the Clarke Quay area that is jointly developed by CapitaLand and City Developments Limited (CDL). Both projects start from more than $2,500 per sq ft, the bench mark price for the top-end of the property market, appears to signify that developers are somewhat confident in an upswing in buying activities in the luxury market. Cairnhill 16’s indicative launch prices are expected to start from around $2,789 per sq ft. Nestled within the tranquil Cairnhill area, Cairnhill 16 will feature 39 limited hilltop luxury residences that will be served with private lift access and smart home features. Sited within a 15-storey residential tower at a quiet cul-de-sac, Cairnhill 16 will comprise 13 two-bedroom units, 13 three-bedroom units, 9 three-bedroom plus study units and 4 four-bedroom units. At the media preview, held on 11 November 2021, the developer showcased the high-end finishes prospective buyers can expect as seen at its sales gallery such as imported kitchen cabinets and designer appliances from V-Zug and Grohe. With a minimum ceiling height of 3.6 metres and up to 4.6 metres on the top floor, Cairnhill 16 is all about making a grand entrance. Cairnhill 16's unit sizes will range from 775 sq ft to 1,744 sq ft. The indicative launch prices for a two-bedroom unit will start from $2.2 million while its three-bedroom, three-bedroom plus study and four-bedroom units will start from $2.9 million, $3.6 and $5.7 million respectively. Located within a stone throw’s away from Orchard Road, Newton MRT station, the medical hub of Mount Elizabeth Hospital and Paragon Medical Centre as well as several good schools such as Anglo-Chinese School (Junior) and St Margaret’s Primary School, Cairnhill has always been a perennial favourite among wealthy local and foreign investors who are attracted to its unparalleled location. This is exactly the niche market that TSky Cairnhill Pte Ltd is hoping to bank on. “I am positive on the property market. With our vaccination plans all fully executed and our policy of opening up the borders, this will certainly help. The Cairnhill area has been traditionally known to be an Indonesian area. Of late, we have seen many Chinese buyers come in and regional buyers,” said Ang. With the easing of travel restrictions and the introduction of more Vaccinated Travel Lanes (VTLs) being introduced, Ang is confident many of such buyers will return to the market. “Singapore has positioned itself as a stable and safe haven for investment, whether it is for financial or real estate investment. I think this will attract foreigners to really have the confidence to put their investment dollar in Singapore,” he said. Meanwhile, Canninghill Piers is an integrated development that will start from around $2,721 per sq ft. Located on the former Liang Court site, Canninghill Piers will feature a hotel, commercial units, a serviced residence and two residential towers comprising around 700 apartments. However, unlike Cairnhill 16, Canninghill Piers will enjoy direct connectivity to Fort Canning MRT station linking residents to the Downtown Line (DTL). Buying activity in prime areas have been lagging behind other areas on the island The exodus of expatriates and border closure arising from the pandemic had impacted the high-end market. Meanwhile, other areas on the island continued to remain resilient. Data from the Urban Redevelopment Authority (URA) appears to confirm this. For instance, its third quarter of 2021 data showed that prices of non-landed properties in the Core Central Region (CCR) decreased by 0.5 per cent in the third quarter, compared with the 1.1 per cent increase in the previous quarter. In comparison, prices of non-landed properties in the Rest of Central Region (RCR) increased by 2.6 per cent, compared with the 0.1 per cent increase in the previous quarter. Meanwhile, prices of non-landed properties in the Outside Central Region (OCR) decreased by 0.1 per cent, compared with the 1.9 per cent increase in the previous quarter. This suggests that buying activity in the prime areas of Orchard, Newton and the core city centre had remained somewhat lukewarm. Echoing a similar sentiment is Pek Zhi Kai, executive director, for Tiong Seng Group. “Buying in the luxury market segment, particularly within the Core Central Region, has not been as exciting as the Outside Central Region. That’s why so far the measures that we have heard of largely, they come in the form that public housing remains affordable and mass market housing remains affordable. Whereas, the Core Central Region has been somewhat muted over the last couple of years or so. It is not going to attract that many measures. It is just making sure that this market will still remain buoyant rather than depressed,” he said. Cooling measure unlikely Overall, the Private Property Index (PPI) is now at a record high of 165.1 points with prices of private residential properties increasing by 1.1 per cent in the third quarter of 2021, compared with the 0.8 per cent increase in the previous quarter.

This will likely surge ahead in the fourth quarter of 2021 as borders start to reopen. Moving forward, market watchers say despite the record-breaking index, they do not think the government will likely announce cooling measures. “I think cooling measures may not kick in. I think it will be a more targeted approach whereby housing remains sustainable and within reach for Singaporeans. With this as an end goal, for the current market itself, I don’t necessarily think the cooling measures will be coming in now,” said Pek. Meanwhile, investors say while they welcome the anticipated return of the luxury market, ultimately, they are still looking for the best deals. One such investor is Singaporean James Tan who is watching the market closely. “The price point at above $2,500 per sq ft is similar or almost higher to the level we saw before Covid-19. Although I am looking to pay in cash, I think the price right now is rather high. I may wait further till I see a good deal in the market,” he said. Ang also agrees that the property market has defied expectations despite Covid-19 noting that construction costs had increased significantly “due to rising construction and commodities costs." “In terms of prices, we can see that even during the Covid-19 period, prices have been steadily climbing. We hope that prices will continue to see a steady yet sustainable climb,” he said. Resale private property and HDB flat prices continue to surge ahead as demand outstrips supply. Meanwhile, rentals are also on the rise. By Khalil Adis Like most first-time property buyers in Singapore, Farhan (not his real name) and his wife are frustrated with the long delays in the construction sector brought about by COVID-19. The couple got married in 2018 and booked their HDB flat in 2019. However, when COVID-19 struck, they were informed by HDB there is now a possibility they will have to wait up to seven years for the keys to their flat. Cancelling their HDB flat is also not an option as they stand to lose $1,000 in their option fee. “We are stuck in a catch-22 situation. On the one hand, the waiting time of seven years is too long and we do not want to inconvenience my in-laws. On the other hand, prices of HDB resale flats have gone up so much that we have to factor in the cash-over-valuation (COV) which may be up to $50,000. If we include renovation cost, our first home may set us back by up to $100,000,” said Faris. Construction sector buckled under COVID-19 pressure Indeed, COVID-19 has impacted the construction sector with several contractors going under due to travel restrictions and high construction costs. In August 2021, for instance, Greatearth Corporation and Greatearth Construction were among the several contractors that went bust due to financial difficulties. This has resulted in delays of several Built-To-Order (BTO) projects. To minimise the impact, HDB has rolled out various measures to support the construction industry and minimise delays to its projects. “HDB has been working closely with our building contractors, to secure the necessary resources they need to complete their projects, including manpower and material supply. We have also recently introduced additional assistance measures to ease the financial pressures brought about by the pandemic-induced spikes in construction costs, including both manpower and non-manpower costs,” said HDB in a statement. Faris and his wife are among those affected as they had booked an HDB flat in Woodlands. “We surveyed around Woodlands where the resale HDB prices are within our budget. However, most sellers are now asking for COV of up to $50,000,” said Faris. Strong pent-up demand pushing prices upwards for resale HDB and private properties As demand far outstrips supply, this has resulted in record prices in both the HDB and private property markets, surpassing the record prices seen during the peak in the third quarter of 2013. Data from HDB showed that the Resale Price Index (RPI) for the third quarter of 2021 is now 150.6 points. This is an increase of 2.9 per cent over that in the second quarter. Meanwhile, resale transactions rose by 19.4 per cent from 7,063 cases in the second quarter to 8,433 cases in the third quarter of 2021. When compared to the third quarter of 2020, the resale transactions in the third quarter of 2021 were 8.3 per cent higher. 4-room HDB flats in the central area fetched the highest price on the island, transacting at a median price of $950,000 while those in Sembawang was the lowest (at a median transacted price of $417,000). Woodlands, where Faris and his wife, were on the lookout for a 4-room HDB resale flat, recorded a median price of $420,000 - the second-lowest median price for a 4-room HDB flat on the island. Still, as Faris can attest to, the asking price even in the far-flung area of Woodlands is sky-high. “On hindsight, that cash component could be better utilised for our renovation cost as we do not intend to take a loan. After much discussion, we decided to stay put at my in-laws. Thankfully, they were very understanding,” said Faris. Meanwhile, data from the Urban Redevelopment Authority (URA), showed that prices of private residential properties increased by 1.1 per cent in the third quarter of 2021, compared with the 0.8 per cent increase in the previous quarter. Landed properties saw a higher price increase when compared to non-landed properties. They increased by 2.6 per cent in the third quarter of 2021, compared with the 0.3 per cent decrease in the previous quarter. Meanwhile, prices of non-landed properties increased by 0.7 per cent in the third quarter of 2021, compared with the 1.1 per cent increase in the previous quarter. Rentals for HDB flats and private properties are also on the rise The supply crunch has also seen rentals for HDB flats and condominiums rising.

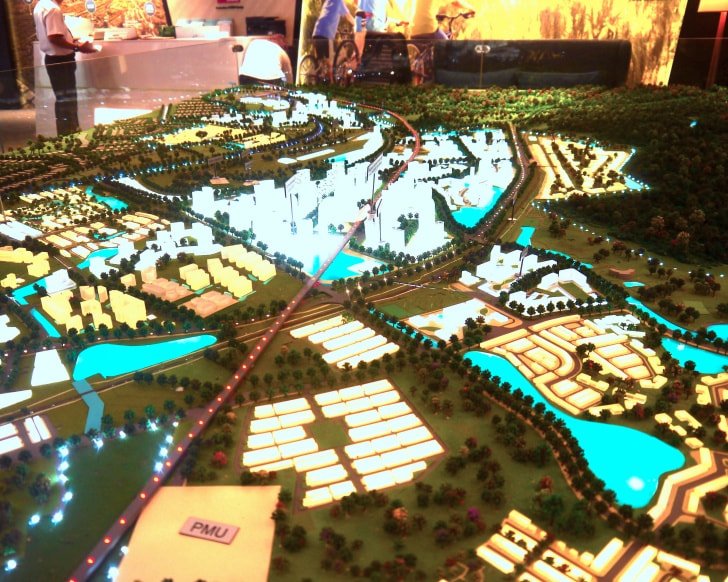

In the past, one can rent a 4-room HDB flat for below $2,000 per month. However, as third quarter data from HDB showed, the median transacted price for 4-room HDB flats in most HDB estates are now above $2,000 per month except for Sembawang ($1,900) and Woodlands ($1,900). In Jurong West, for instance, the median transacted price per month for 4-room HDB flats now stands at $2,150 when it was previously transacted at $2,050 per month in the second quarter of 2021. Meanwhile, in the private property market, URA’s data showed that rentals for private residential properties increased by 1.8 per cent in the third quarter of 2021, compared with the 2.9 per cent increase in the previous quarter. This is also something Ed (not his real name), who is also married, can confirm. He is currently looking for a common room to rent in a condominium was surprised by the high asking price from landlords. “It does not make any sense as people are losing jobs and we do not have many expats coming in yet rentals are going up,” he laments. Ed is also looking to buy an HDB flat but is put off by the high asking price and the long waiting period for BTO flats. “I think I may just rent for one year and wait out till the property market stabilises. However, buying an HDB flat is something definitely on my mind. The timing and pricing are just not right at the moment,” he said. Another couple, Ali and his wife say their landlord is looking to increase their rent for the 2-bedroom condominium they are currently renting in eastern Singapore from $3,000 to $3,200 a month. “Our lease is up for renewal soon. We are still deciding if we should stay put or move on. We love this place as it is close to East Coast Beach. Everywhere else that we looked, landlords are similarly asking for between $3,200 to $3,500,” said Ali. For now, first-time homebuyers like Farhan will have to wait out while rent-seekers like Ed and Ali will have to pay what landlords are currently asking for. A rethink in policy is needed if Malaysia wants to continue attracting foreign investors. By Khalil Adis I recall taking part in an international property expo in London in 2018 whereby the Malaysia My Second Home (MM2H) programme was heavily promoted to encourage British citizens to invest in Malaysia. The expo was held with a Malaysian consulting firm working together with the Tourism Ministry to attract foreign investors to buy a property and retire there. For many British citizens wanting to escape from the cold London weather, Malaysia appears to be the ideal tropical getaway. This is despite Malaysia being half a world away and not as well-known as Singapore. In fact, during my various encounters with locals in London, many are surprised to learn that there are many reputable schools in Malaysia such as Marlborough College Malaysia, University of Reading and Newcastle University of Medicine, just to name a few. Iskandar Malaysia, in particular, piqued their interest, as some had regularly attended the F1 Night Race in the Lion City. Close to Singapore but with a relatively affordable cost of living, many had expressed interest in buying a property in Iskandar Malaysia where they have the option of living in Johor while sending their children for quality education in either Singapore or Iskandar Puteri. Malaysia is seen as attractive due to strength of the British pound versus the ringgit, the affordable property price and one of the few places in the world where foreigners can own freehold property without any restrictions. Sweeping changes Fast forward, three years later, the political landscape in Malaysia has shifted rapidly with three different Prime Ministers within a short span of time. This has no doubt affected investor’s confidence as they try to make sense of what is going on. With a change of government, there has also been various tweaks in policies including for the MM2H. For example, previously, the minimum sum required for a fixed deposit was RM150,000 for those over 50 and RM300,000 for those under 50 years of age. However, this has been increased overnight to RM1 million under the sweeping changes that were announced in August 2021. That is almost a 600 per cent increase. Foreigners must also prove to have liquid assets of between RM500,000 and RM1.5 million, depending on their age, On top of that, they must have a monthly offshore income of at least RM40,000. These policy changes are indeed tone deaf as many livelihoods have been upended since the pandemic started in 2020. Those who have uprooted to Malaysia will have no choice but to leave the country if they cannot fulfil these new requirements. It also reaffirms what investor’s already know - Malaysia is known for its flip-flop policy changes. This may harm the country’s image, investors’ confidence and in turn, affect the property market. Johor is the worst state in supply overhang Even before the pandemic began, Johor was already facing a severe supply glut as Chinese developers began to flood the market notably in Danga Bay, Johor Bahru CBD and Forest City. Still, developers remained optimistic as they continue to bank on the Kuala Lumpur-Singapore High Speed Rail (KL-Singapore HSR) project. With the project now terminated, the overhang situation in Johor will likely worsen. According to data from the National Property Information Centre (NAPIC), as of the first quarter of 2021, Johor had the most number of unsold completed residential housing in the whole country at 6,001 units. This was followed by Selangor and Penang at 3,679 and 4,447 units. Most notably, homes ranging from RM500,000 to RM1 million made up the majority of the total overhang sector in Malaysia with 9,408 units (34.3 per cent) unsold worth a total of RM6.44 billion. The serviced apartment sector in Johor fared even worse with 16,537 unsold units majority of which are within the RM500,000 to RM1 million range. The revised policy changes for the MM2H appears to be the final nail in the coffin for the property market since many developers tie in this programme when marketing their projects overseas. Some developers and stakeholders say the sweeping changes do not make any sense and will likely kill the property market since foreigners are likely to buy unsold homes ranging from the RM500,000 to RM1 million range. Federal government needs to consult with stakeholders Clearly, a rethink in policy is needed if Malaysia wants to continue attracting foreign investors.

Figures from Iskandar Regional Development Authority (IRDA) showed that as of June 2021, Iskandar Malaysia saw the completion of investment projects worth RM7.33 billion between January to April 2021 with 20 per cent involving domestic investors and the other 80 per cent from foreign investors. According to Datuk Ismail Ibrahim, IRDA’s chief executive, the projects that were approved to be developed in the region in 2020 included those from China, Japan and Singapore. Overall, IRDA said Iskandar Malaysia’s total cumulative recorded investment reached RM341.4 billion since 2006 to date with 61 per cent of this has been realised. As we speak, the Sultan of Johor had expressed his displeasure on the flip-flop in policy and requested an immediate review. For this to be effective, the federal government needs to consult with the local authority, developers, MM2H agents, applicants and real estate agencies as they are closer to the ground. They also need to sit down with developers and stakeholders in Iskandar Puteri and Medini as they rely heavily on foreign purchasers and investors, especially those from Singapore. For now, the policy is doing more harm than good. While paying for your property using your CPF Ordinary Account (OA) is the default way to finance your home purchase, there are implications that you need to be aware of. By Khalil Adis Buying a property is perhaps the single big-ticket item that we will possibly purchase in our lifetime. As such, it is no wonder most Singaporeans will use their CPF Ordinary Account (OA) towards their property purchase. It makes sense since we have worked so hard and set aside a tidy sum in our CPF. However, there are implications if you wish to use your CPF OA. Here are six things you need to know before committing. #1: Your CPF OA will be (almost) wiped out when you buy an HDB flat While you can get up to 90 per cent financing when buying an HDB flat, HDB will usually use up your CPF OA towards your flat's purchase. This is to reduce your loan amount and therefore, your monthly mortgage. The good news is you do have the option of keeping $20,000 in your OA to pay for your flat purchase. If you do not have enough, then you will have to pay for it in cash. This is a better option in my opinion which I shall explain later in point number 6. #2: You will be subjected to the MSR and Valuation Limit when buying a resale HDB flat (for HDB loan) If you are taking an HDB loan, do note you will be subjected to the Mortgage Service Ratio (MSR) and Valuation Limit. MSR refers to the portion of a borrower’s gross monthly income that goes towards repaying all property loans. Your MSR is capped at 30 per cent of a borrower's gross monthly income. If your gross monthly income is $5,000, your MSR will be $1,500. Therefore, your monthly mortgage cannot exceed this amount. Your Valuation Limit is the lower of the purchase price or valuation at the time of purchase. Assuming the valuation for the flat and purchase price are the same at $500,000 (which means there is no cash-over-valuation), you can use up to $500,000 in your CPF OA. If you are unable to meet your Basic Retirement Sum (BSR), you will need to pay for your mortgage in cash. You can use CPF's Housing Limit Calculator here. #3: You will be subjected to the MSR, Valuation Limit and Withdrawal Limit when buying a resale HDB flat (for a bank loan) If you are taking a bank loan, do note you will be subjected to the Mortgage Service Ratio (MSR), Valuation Limit and Withdrawal Limit. Assuming the valuation for the flat and purchase price are the same at $500,000 (which means there is no cash-over-valuation), your Valuation Limit is $500,000. For a bank loan, you will be subjected to Withdrawal Limit which is 120 per cent of the Valuation Limit. This means you can use up to $600,000 in your CPF OA towards your flat purchase. If you are unable to meet your BSR, you will need to pay for your mortgage in cash. #4: You will be subjected to the TDSR, Valuation Limit and Withdrawal Limit when buying a private property If you are taking a bank loan, do note you will be subjected to the Total Debt Service Ratio (TDSR), Valuation Limit and Withdrawal Limit. Your TDSR should be less than or equal to 60 per cent. Assuming you have a gross monthly income of $5,000 with a total monthly debt of $1,000, this is your TDSR: $1,000/$5,000 x 100% = 20% Assuming the valuation for the private property and purchase price are the same at $1 million (which means there is no cash-over-valuation), your Valuation Limit is $1 million. For a bank loan, you will be subjected to Withdrawal Limit which is 120 per cent of the Valuation Limit. This means you can use up to $1.2 million in your CPF OA towards your private property purchase. If you are unable to meet your BSR, you will need to pay your mortgage in cash. Do note, your monthly mortgage and monthly debt cannot exceed more than 60 per cent of your TDSR. #5: Pro-rated CPF usage for properties with less than 60 years of lease Why are older HDB flats or private properties seeing their value diminishing? This is because their value will revert to zero towards the end of the lease. They are also subjected to a pro-rated CPF usage if their lease is less than 60 years. This makes them harder to sell as it limits the pool of buyers who can buy such properties. Let us assume the following: Remaining Lease: 50 years Youngest Buyer Age: 35 years old HDB Flat Price: $400,000 The formula to calculate the pro-rated CPF usage is as follows: Remaining Lease of Property – 20 / 95 - Age of Youngest Buyer Using CPF - 20 50 - 20 / 95 - 35 - 20 = 30/40 Valuation Limit = 0.75 CPF Usage = 75% x $400,000 = $300,000 For a bank loan, you will be subjected to Withdrawal Limit which is 120 per cent of the Valuation Limit which is $360,000. #6: CPF amount used with accrued interest needs to be refunded to your Ordinary Account when selling your property Most people prefer to use their CPF OA when paying for their monthly mortgage.

In fact, this seems to be the default way to finance our home purchase. However, there are some repercussions that you need to be aware of. When you sell your property, the CPF amount used with accrued interest needs to be refunded to your CPF OA. As such, this may result in fewer cash proceeds or even a negative sale when you sell your property. Let us assume the following: Property’s selling price: $600,000 Property’s purchase price: $500,000 CPF amount used with accrued interest: $300,000 Outstanding loan:$200,000 Sales proceeds: $600,000 - $300,000 - $200,000 = $100,000 Do note, this does not include your legal/conveyancing fees, agent’s commission and other miscellaneous costs. Conclusion As you can see, paying for your property using your CPF OA may reduce your cash proceeds or even result in a negative sale when deducting all the expenses. They say cash is king. So perhaps paying for your monthly mortgage in cash is not such a bad thing after all. Cooling measures may be implemented if the trend were to continue. Here are 5 things consumers should watch out for. By Khalil Adis Singapore’s property market continued to defy expectations in both the private and public sectors increasing by 3.0 and 3.3 per cent quarter-on-quarter respectively in the first quarter of 2021, data from the Urban Redevelopment Authority (URA) and Housing & Development Board (HDB) showed. Private residential prices soared for the third consecutive quarter growth since the third quarter of 2020 to reach 162.2 percentage points, while resale HDB prices have been on the uptrend since the second quarter of 2020 at 142.2 percentage points. If this trend were to continue, the prices for resale HDB flats may soon hit or surpass the peak that was recorded in the second quarter of 2013. Meanwhile, in the private property sector, the landed property segment has bucked the trend registering a price increase of 6.7 per cent in the first quarter of 20201 compared with the 1.6 per cent decrease in the previous quarter. For the non-landed segment, properties that are located in the Rest of Central Region (RCR) took the lead, increasing by 6.1 per cent followed by those that are located in Outside Central Region (OCR) and Core Central Region (CCR) registering a 1.1 per cent and 0.5 per cent increase respectively. For the rental market, rentals of private residential properties increased by 2.2 per cent in the first quarter of 2021, compared with the 0.1 per cent increase in the previous quarter. Meanwhile, in the HDB rental market, the number of approved applications to rent out HDB flats rose by 26.0 per cent, from the 8,472 cases recorded in the fourth quarter of 2020 to 10,676 cases in the first quarter of 2021. The upbeat market has prompted speculations that property cooling measures may be announced this year should prices continue to reach an unsustainable level. We dissect Singapore’s property market data for the first quarter of 2021 and what they will mean for you as a consumer. #1: Sellers’ market with potentially high cash-over-valuation in the HDB market Built-To-Order (BTO) flats now have a waiting period of up to seven years due to construction delays brought upon by Covid-19. As 80 per cent of Singapore’s population live in HDB flats, the tight supply for new launches will divert potential homebuyers to look for resale HDB flats instead. This explains why the HDB Resale Price Index (RPI) has been on the uptrend for the fourth consecutive quarter. Looking ahead, this could drive up the cash-over-valuation (COV) and may see the RPI surpassing the peak that was recorded in the second quarter of 2013. For prospective home sellers, this could be an opportune time to sell your property. HDB resale flats from newly MOP-ed (met their 5-year Minimum Occupation Period) such as those in Punggol and Sengkang are expected to see brisk demand. We are also likely to see potential homebuyers having to shell out more cash for the COV as demand far outstrips supply. #2: HDB upgraders may want to think twice With the buoyant HDB resale market, many might be thinking of cashing out and moving up the property ladder. However, this may not necessarily mean it is a good time to upgrade to a private property. This is because the RPI and the Private Property Index (PPI) have been on the upward trend and are not likely to see their price gap narrowing anytime soon. HDB’s RPI now stands at 142.2 percentage points while the PPI is at 162.2 percentage points. With the tight supply for new launches in the BTO and private property markets, the price indexes for both HDB and private resale properties are likely to surge ahead in the next quarter. So unless you have sufficient cash and/or CPF to finance your next property purchase, it is best to wait out until the new supply for launches come on stream. For those who will still like to take the plunge, do ensure you do a detailed financial calculation as you will be required to come up with a minimum 5 per cent cash downpayment and another 20 per cent in cash and/or CPF. You will also need to take into account the Buyer’s Stamp Duty, conveyancing and agent’s fee. The Buyer’s Stamp Duty will have to paid for in cash first before you can use your CPF Ordinary Account (OA). Also, for those who are hitting 55-years-old this year, do remember that you will have to set aside a Basic Retirement Sum of $93,000 in your Retirement Account before you can touch the rest of your CPF OA. Should the government impose new cooling measures, it may also impact your ability to obtain financing. Last but not least, when buying a private property, you will be subjected to the Total Debt Service Ratio (TDSR), Valuation Limit and Withdrawal Limit. #3: Bright spots ahead for private properties located in the RCR and OCR Why are private properties that are located in the RCR and suburbs (OCR) doing relatively better when compared to those that are in the central region? This is because the profile of buyers here comprises mainly local and HDB upgraders. As the pandemic has shown, the local market has remained fairly resilient due to the tight supply excess liquidity and changes in employment policies to encourage local businesses to hire Singaporeans first as part of the post-pandemic economic recovery. Meanwhile, properties that are located in the central region have been badly affected due to the exodus of expatriates and the Ministry of Manpower’s tightening their criteria when hiring foreign employees. As such, the pool of potential tenants and prospective homebuyers will likely shift towards the local market. This is good news for prospective sellers and landlords. Meanwhile, potential homebuyers will likely see prices for private resale properties increasing at outside the central region and within the suburbs. However, not all is bad. Those thinking of snapping up prized properties on Sentosa Cove or Orchard Road may find some good deals in the market. #4: Tight supply in new launches may favour landlords The rental index of private residential properties has been on the uptrend since the fourth quarter of 2021, data from URA showed. Rentals for private residential properties increased by 2.2 per cent in the first quarter of 2021, compared with the 0.1 per cent increase in the previous quarter. This may suggest that rent-seekers far outnumber landlords. As of the end of the first quarter of 2021, there was a total supply of 48,139 uncompleted private residential units (excluding ECs) in the pipeline with planning approvals, compared with the 49,307 units in the previous quarter. Of this, 21,602 units remained unsold as at the end of the first quarter of 2021, compared with the 24,296 units in the previous quarter. Rent-seekers who are looking for properties in the RCR and OCR may face stiff competition from both locals and foreign tenants. Meanwhile, private properties that are located in the central area may likely see their asking price being reduced as this market has been severely impacted by Covid-19. This is good news for tenants but not for landlords. #5: HDB landlords may want to revise their rental rate for 2021 Likewise, the HDB rental market has seen a spike in their median rents possibly due to the tight supply of new BTO launches and their relative affordability when compared to the private sector.

According to data from HBD, in the first quarter of 2021, the median rents for HDB flats, in general, have seen an increase across the board when compared to the fourth quarter of last year. For landlords that are renewing their lease for 2021, this may be a good time to renegotiate your tenancy agreement with your tenants. Meanwhile, tenants may have to increase their budget slightly in light of the exuberant rental market. The iconic project would have benefitted both countries since Malaysia and Singapore are historically intertwined By Khalil Adis Since Malaysian Prime Minister Muhyiddin Yassin rose to power in 2020, the local political landscape has shifted rapidly. On the one hand, it has deeply polarised Malaysians in what they perceive as a ‘back-door government’. On the other hand, it has caused seasoned investors and political watchers do a double-take to decipher what is really going on. Against a backdrop of a pandemic, reports of political infighting, defections and ongoing corruption court cases from the previous administration, Malaysia’s political landscape appears to be a fractured one. From across the pond though, it looks like Malaysia has it all - a warm, tropical climate, rich in natural resources, a melting pot of different races and cultures and one of the very few countries where you can own freehold property. However, a quick glance on social media shows that Malaysians are tired about the constant politicking which they feel have hindered the country’s progress. Foreign direct investment affected by pandemic So how has Malaysia fared so far? Figures from the Malaysian Investment Development Authority (MIDA) showed that in 2020, net foreign direct investment (FDI) fell 56 per cent to US$3.4 billion in 2020 due to the Covid-19 pandemic. Meanwhile, Malaysia’s net FDI inflows stood at RM13.9 billion representing a decline from RM31.7 billion in 2019. "Malaysia’s lower net FDI inflows in 2020 is not necessarily an unfavourable sign, when taking into consideration the global investment landscape and the uncertainties that prevailed during the year," said MIDA in its report. While Malaysia’s FDI last year was affected by the pandemic, the lack of political will to see through certain projects may affect investors’ confidence. KL-Singapore HSR project One such example is the cancellation of the Kuala Lumpur-Singapore High Speed Rail (KL-Singapore HSR) project. Malaysia and Singapore have since the dawn of time been historically intertwined. Since many Singaporeans have relatives living in Malaysia and vice versa, the KL-Singapore HSR project would have provided immense benefits as it will allow the flow of goods and investments especially in the hard to reach cities like Seremban, Ayer Keroh, Muar and Batu Pahat. It would also have provided a much-needed boost for the already muted property market in Iskandar Malaysia by tapping onto Singapore’s position as an international aviation hub and among those living in Kuala Lumpur. Over in Seremban, the upcoming Malaysia Vision Valley would have benefitted from the train service since transportation connection over there is patchy at the moment. Spanning from Nilai to Port Dickson and with a proposed area of 108,000 hectares, the Malaysia Vision Valley will see the development of high tech, logistics, education, health, tourism and sports industry. Should the KL-Singapore HSR project proceed, the Malaysia Vision Valley would be able to tap onto local talents from Kuala Lumpur and from the international market in Singapore. Likewise, it would have resulted in the flow of investments and skilled workforce to Bandar Malaysia, Singapore and vice versa. Sadly, this was not to be. History repeating itself? Looking back, one cannot help but feel that the KL-Singapore HSR project’s fate echoes eerily similar to the previous scenario in the 1980s and 1990s which had deterred Singaporeans from investing in Johor. Similarly, Iskandar Malaysia started out full of promises in 2008 until interest somehow fizzled out sometime in 2016. Once an investors’ darling, Iskandar Malaysia is now facing a severe housing supply glut which has been further exacerbated by the Movement Control Order (MCO) and travel restrictions. Meanwhile, Medini, a dedicated special economic zone continues to be a ghost town when night falls. One source who was involved in the joint-venture project between Singapore and Malaysia had complained about the lack of progress and the lack of political will to make things happen. Adding to the complication is the powers of the state versus the federal government since land in a state matter. Such bureaucratic red tapes is bound to create frustration. The source has since left. It is worth noting that in July 2019, Pinewood Group pulled out of Iskandar Malaysia Studios (IMS) officially ending their 10-year partnership by mutual agreement with the local partners. A glimmer of hope The only saving grace right now is the Johor Bahru – Singapore Rapid Transit System (RTS) Link. Slated to commence passenger service by end-2026, the project will link Woodlands North MRT station to Bukit Chagar. Still, the expected economic spillover impact from the RTS Link is minute when compared to the KL-Singapore HSR project. Last month, the World Bank Group said Malaysia will need to relook at some of its policies and to rebuild them towards attracting more quality investments into the country that at the same time would provide more jobs for the people. “There should also be a more coordinated promotion effort to get a higher return of investment and finally, it is important to have continuity in policy and direction as well as structural reforms,” Richard Record, the World Bank Group’s lead economist was reported as saying. This was in response to a question on how Malaysia could attract more FDI to catch up with countries in the region. Perhaps, one day, when travel restrictions are lifted, Malaysia will revisit the feasibility of implementing the KL-Singapore HSR project once again. |

Khalil AdisAn independent analysis from yours truly Archives

July 2023

Categories

All

|

100 Peck Seah Street

|

|

RSS Feed

RSS Feed