|

Cooling measures could be introduced in both the HDB and private property markets to ensure prices remain in tandem with wages. By Khalil Adis Singapore’s HDB and private property markets have defied expectations amid the pandemic soaring by 5.0 per cent and 2.2 per cent respectively for the whole of 2020, data from HDB and URA showed. In the HDB market, the Resale Price Index (RPI) for the fourth quarter of 2020 is 138.1 representing an increase of 3.1 per cent over the third quarter. HDB flats in the resale market saw transactions fall by 1.9 per cent, from 7,787 cases in the third quarter of 2020 to 7,642 cases in the fourth quarter. However, when compared to the fourth quarter of 2019, the resale transactions in the fourth quarter of this year were 20.6 per cent higher. For the whole year of 2020, HDB’s data showed that resale transactions increased by 4.4 per cent from 23,714 cases to 24,748 cases. Meanwhile, the Property Price Index (PPI) for private residential properties increased by 2.1 per cent in the fourth quarter of 2020, compared with the 0.8 per cent increase in the previous quarter. The resale private property market saw an increase in transactions in the fourth quarter of 2020 with 4,249 homes changing hands compared with the 3,467 units transacted in the previous quarter. Market exuberance was seen for the whole of 2020, with 10,729 resale transactions compared with the 8,949 resale transactions in 2019. For the whole of 2020, prices of private residential properties increased by 2.2 per cent, compared with the 2.7 per cent increase in 2019. Islandwide, for the whole of 2020, non-landed properties proved to be far more resilient increasing by 2.5 per cent while landed properties rose by 1.2 per cent. Non-landed properties in the prime areas which are defined by the Core Central Region (CCR) were the worst performing for the entire 2020, decreasing by 0.4 per cent followed by those in the Rest of Central Region (RCR) and Outside Central Region (OCR) which increased by 4.7 per cent and 3.2 per cent respectively. With this in mind, here are the property market outlook and predictions for 2021: #1: Cooling measures may be introduced The pandemic has seen both the HDB and private property markets performing better than expected. If the trend were to continue, property prices could reach an unsustainable level. As such, the government may introduce a slew of cooling measures to ensure property prices are in line with wages so that buying property remains within reach. This is especially so for first-time homebuyers. The cooling measures could include reducing the loan-to-value (LTV) limit, tweaking the Seller’s Stamp Duty and Additional Buyer’s Stamp Duty (ABSD) and revising the Mortgage Servicing Ratio (MSR) and Total Debt Service Ratio (TDSR). #2: Supply glut in the private property market could soften the resale market URA’s data showed that as at the end of the fourth quarter of 2020, there was a total supply of 49,307 uncompleted private residential units (excluding ECs) in the pipeline with planning approvals compared with the 50,369 units in the previous quarter. Of this number, 24,296 units remained unsold as at the end of the fourth quarter, compared with the 26,483 units in the previous quarter. Such unsold units may result in the softening of the resale market as buyers are spoilt for choice. Sellers who are desperate to offload their properties may cut prices in a bid to draw buyers. #3: Buyers’ market especially in the prime areas In such a scenario, the prime areas located within the CCR as well as in Sentosa Cove will be where the good deals are as these areas are price sensitive and volatile during an economic downturn. This is already confirmed in URA’s fourth quarter of 2020 data which showed that the CCR was the only region which recorded a 0.4 per cent price decline. Meanwhile, the suburban areas in the OCR will remain resilient as the homes here are relatively affordable and dominated by local buyers and HDB upgraders. #4: HDB resale market will remain resilient Speaking of HDB, the resale market is expected to continue remaining fairly resilient. This is because HDB flats are seen as an essential need and is home to 80 per cent of the population. The resale market, particular newly MOP-ed flats (those that have already met the 5-year Minimum Occupation Period), will see strong demand. Sengkang and Punggol will be among the popular estates for HDB resale transactions. #5: New BTO launches in mature estates will be oversubscribed According to HDB, it will offer about 3,700 Build-To-Order (BTO) flats in Bukit Batok, Kallang Whampoa, Tengah and Toa Payoh in its February launch.

This includes the new Community Care Apartments in Bukit Batok. In May 2021, HDB will offer another 3,800 BTO flats in Bukit Merah, Geylang, Tengah and Woodlands. The BTO projects in Kallang Whampoa, Toa Payoh, Bukit Merah and Geylang are expected to be eagerly snapped up and oversubscribed as these are mature estates that are located close to the central area.

0 Comments

The COVID-19 pandemic has wreaked havoc in the already muted real estate market. We summarise roundups for 2020 and what market trends to expect in 2021. By Khalil Adis 2020 will go down as an unprecedented year as countries around the world are faced with a global pandemic. Malaysia is no different as the Movement Control Order (MCO) and travel restrictions have adversely affected an already dampened market. According to the National Property and Information Centre (NAPIC), the property market contracted sharply in March and April due to the implementation of the MCO before picking up again in May as restrictions were eased during the Conditional Movement Control Order (CMCO) period. Here are the highlights for 2020: #1:. Steep decline in the volume of property transaction across the board NAPIC’s first half of 2020 data showed that the volume of property transaction declined 27.9% with 115,476 units in the first of the year compared to 160,165 units during the same period last year. Out of this, 75,318 units were those in the residential property sector which recorded a decline of 24.6%. The steepest decline was recorded in the commercial property sector which saw a 37.4% drop followed by the industrial, agricultural and development land and others at 36.9%t, 32.8 per cent and 28.6% respectively. It is hardly surprising that the Bank Negara Malaysia revised the Overnight Policy Rate (OPR) four times in 2020 itself to bring down interest rates in order to encourage consumer spending and to facilitate the application of new loans. #2: Residential overhang continued to increase The COVID-19 pandemic has seen the oversupply situation in the residential property sector worsening. According to data from NAPIC, there was a 3.3% (31,661 units) increase in the overhang in residential properties. Out of this, 31.7% are priced below RM300,000. 53.2% comprises high-rise units followed by landed terraced homes (29%), semi-detached & detached (12.4%), low-cost housing (1.6%) and others (3.8%). High rise units within the price range of RM500,000 to RM700,000 form the bulk of the unsold inventory at 4,144 units. Johor had the highest overhang at 19.5% followed by Selangor at 16.4%. Meanwhile, serviced apartments (which is classified as commercial property by NAPIC) recorded a 26.5% or 21,683 units increase in overhang. 61.8% are priced above RM700,000. A whopping 73.7% are located in Johor followed by 11.6% in Kuala Lumpur. #3: Majority of new launches were in the mass market segment Despite the muted property market, developers continued to launch projects, particularly in the mass market segment. NAPIC’s data showed that 13,294 units of new launches were recorded in the first half of 2020. Of this, 50.1% are priced below RM300,000 while 33.7% are priced between RM300,000 to RM500,000. Landed properties dominate new launches making up 69.7% of the figure while the remaining 30.3% are stratified properties. Negeri Sembilan recorded the most launches in the entire country during the period with 2,797 units. This was not surprising as properties that are located away from Kuala Lumpur and Greater Kuala Lumpur are more affordably priced for local home buyers. #4: Steep decline in office and shopping centre occupancy rates The MCO had a detrimental effect on office and shopping centre occupancy as many Malaysians are forced to work from home. Private office building saw their occupancy rate plunging 74.3% with only 12.70 sq m of space occupied out of the total space of 17.09 sq m. Meanwhile, shopping centres experienced the most decline at 76.7% occupancy rate. Only 9.62 sq m of space were occupied out of the total space of 12.55 sq m. #5: Malaysian House Price Index records first-ever decline, corrected slightly in Q2 2020 The mismatch between what Malaysians can afford versus what is being offered in the market, combined with the pandemic has further worsened the overhang situation resulting in an extremely muted year for developers. According to data from NAPIC, the Malaysian House Price Index stood at 198.3 percentage point in Q2 2020 after hitting a peak of 199.7 percentage point in Q12020 – the 0.7% decline is the first-ever one recorded since 2010. Nevertheless, when compared to Q1 2010 (97.25), the price index recorded an increase of 102.5 to reach 199.7 percentage point during the same period in 2020. This suggests house prices across Malaysia have been skyrocketing over the past 10 years before moderating slightly in the second quarter of 2020. Moving forward, here are the property market trends we can expect in 2021 #1: Affordable homes priced below RM500,000 will rule the market As seen from data from NAPIC, majority of the new launches in the first half of 2020 are mass market homes priced below RM500,000. This trend will likely continue in 2021 especially for homes that are located in Greater Kuala Lumpur. Pricing aside, several Budget 2021 initiatives to further promote homeownership, especially for first-time buyers will spur demand for such homes. For example, the full stamp duty exemption on instruments of transfer and loan agreement for first time home buyers will be extended until 31 December 2025. The stamp duty exemptions for first residential home has been capped for homes priced RM500,000 and below. This exemption is effective for the sale and purchase agreement executed from 1 January 2021 to 31 December 2025. As such, we can expect the mass market segment to pick up momentum. #2: Rent-to-Own Scheme in the private and public housing sectors High house prices in Malaysia has resulted in both the private and public housing sectors to roll out innovative measures to make it easy for first-time home buyers. With developers under pressure to move unsold units, many will likely continue to offer attractive discounts, rent-to-own schemes and zero down payments to draw buyers. Meanwhile, in the public sector, the government will implement a Rent-to-Own Scheme by collaborating with selected financial institutions under Budget 2021. This programme will be implemented until 2022 involving 5,000 PR1MA houses with a total value of more than 1 billion ringgit and is reserved for first-time home buyers. #3: Occupancy rates for office will continue to decline The high daily cases of COVID-19 in the country will have an adverse effect on the office occupancy rate as many companies continue to adopt a work from home policy. As such, we are likely to see their occupancy rates continue to decline until a nationwide vaccination is rolled out. Data from NAPIC showed that as of the first half of 2020, Kuala Lumpur had the highest purpose-built office existing stock at 9,266,687 units followed by Selangor and Putrajaya at 4,030,791 and 2,525,253 units respectively. Meanwhile, there will be an incoming supply of 1,465,441, 244,290 and 208,391 units in Kuala Lumpur, Johor and Selangor respectively. Collectively, this will result in downward pressure for the office market. Landlords are likely to lower their asking price to continue securing tenants. Meanwhile, corporate tenants will be spoilt for choice as there will be many good deals in the market. #4: Uncertain time for shopping centres In Q42020, several COVID-19 cases have been detected at notable shopping centres in Kuala Lumpur/Greater Kuala Lumpur such as at Nu Sentral, 1 Utama, The Gardens Mall (TGM), Mid Valley Megamall (MVM) and Bangsar Shopping Centre.

Consumer precaution will trickle into 2021 and this will have an impact on footfall as many stay away from shopping malls while the tourism market continues to suffer due to travel restrictions, further limiting footfalls from tourists and holiday-makers. Similar to the office sector, the shopping centre market will be very challenging. We will likely see the further closure of some outlets resulting in increasing vacancy rates. NAPIC’s data showed that as of the first half of 2020, Selangor had the highest shopping complex existing stock at 3,712,375 units followed by Kuala Lumpur and Johor at 3,131,431 and 2,452,258 units respectively. Meanwhile, there will be an incoming supply of 639,508, 480,125 and 167,779 units in Kuala Lumpur, Selangor and Melaka respectively. This article was first published on iProperty Malaysia. Punggol and Sengkang are tied at the top spot with 116 transactions recorded last month, followed by Yishun and Tampines trailing behind at 80 and 76 transactions respectively. By Khalil Adis Homeowners in Punggol and Sengkang, hold on tight to your HDB flats (until you get a better offer, that is) as they are the most in-demand HDB estates for September 2020, data from HDB showed. According to 4-room transactions captured on HDB's website, Punggol and Sengkang are tied at number one with 116 transactions recorded last month, followed by Yishun and Tampines in the second and third place at 80 and 76 transactions respectively. In terms of the median transacted price, 4-room HDB flats in Punggol fetched far higher prices at $468,514.97 while Sengkang's figures were $436,909.17. Other HDB estates that made the cut included Bukit Panjang, Hougang, Bedok, Jurong West, Woodlands, Pasir Ris and Ang Mo Kio. Of the 11, six (Punggol, Sengkang, Yishun, Bukit Panjang, Jurong West and Woodlands) are non-mature and five (Tampines, Hougang, Bedok, Pasir Ris and Ang Mo Kio) are mature HDB estates. 4-room flats in Woodlands fetched the lowest median average price at $352,380.60 while those in Punggol fetched the highest at $468,514.97, representing a price difference of 32.96 per cent. HDB estate in northern Singapore (Yishun, Bukit Panjang, Woodlands and Ang Mo Kio) proved to be popular, followed by the north-east (Punggol, Sengkang and Hougang), east (Tampines, Bedok, Pasir Ris) and west (Jurong West). Here is the ranking from the most to least popular HDB estates. #1: Punggol and Sengkang Flat Type: 4 Room HDB Town: Punggol Resale Registration Date: Sep 2020 Total number of records found: 116 (Data as at 4 Oct 2020) Median transacted price: $468,514.97 Flat Type: 4 Room HDB Town: Sengkang Resale Registration Date: Sep 2020 Total number of records found: 116 (Data as at 4 Oct 2020) Median transacted price: $436,909.17 Punggol and Sengkang continue to be popular in the resale market as some sellers seek to offload their HDB flats once they have hit the 5-year Minimum Occupation Period (MOP) while buyers are attracted to the relatively new and better-designed flats. Accessible via the North East Line (NEL), LRT and Tampines Expressway (TPE), both estates have a relatively young population. Data from SingStats showed that Punggol and Sengkang had the highest proportion of children aged below 5 years at 9.9 per cent in 2019. Despite falling to the hands of the opposition during the recently concluded general elections Sengkang has not lost its lustre as HDB's data showed. Meanwhile, Punggol is set to welcome the extension of the Cross Island Line (CRL) that will link it to Pasir Ris by 2031. The 7.3 km line will comprise four stations – Punggol, Riviera, Elias and Pasir Ris. Punggol MRT station will be an interchange station to the CRL that will connect residents to the North East Line (NEL) and Punggol Digital District via Punggol Coast MRT station. Rivieria and Pasir Ris MRT stations will be connected to the Punggol LRT line and East West Line (EWL) respectively. #2: Yishun Flat Type: 4 Room HDB Town: Yishun Resale Registration Date: Sep 2020 Total number of records found: 80 (Data as at 4 Oct 2020) Median transacted price: $365,638.15 While Yishun may conjure images of the morbid and macabre, data from HDB showed that it is the second most popular estate on the island in September 2020 with 80 transactions recorded. So what gives? Perhaps, it is the recent rejuvenation programme that Yishun had undergone under the URA's master plan. The estate is now home to the new Yishun Integrated Transport Hub and Northpoint City. Other infrastructure projects in the pipeline include the upcoming $7 to $8 billion North-South Expressway (NSE) by 2023. This will allow residents to travel to the city in just 20 minutes flat. It will also offer better connectivity to neighbourhoods located in the north-south corridor such as Woodlands, Sembawang, Yishun, Ang Mo Kio, Bishan and Toa Payoh. #3: Tampines Flat Type: 4 Room HDB Town: Tampines Resale Registration Date: Sep 2020 Total number of records found: 76 (Data as at 4 Oct 2020) Median transacted price: $444,814.16 Tampines is the top-ranking mature estate ranking third in place. A perennial favourite due to the abundance of shopping malls like Tampines One, Tampines Mall and Century Square, the opening of IKEA Tampines has certainly upped the hip quotient to live within this self-sufficient estate. Served by the East West Line (EWL) and Downtown Line (DTL) via Tampines, Tampines West and Tampines East MRT stations, connectivity will be further enhanced when the Downtown Line (DTL) connects Tampines to the Thomson East Coast Line (TEL) by 2024 via Expo interchange station. Malls aside, Tampines is conveniently located next to Changi Business Park where jobs abound. The business park serves as a hub for data centre, banks and knowledge-intensive industries. #4: Bukit Panjang Flat Type: 4 Room HDB Town: Bukit Panjang Resale Registration Date: Sep 2020 Total number of records found: 65 (Data as at 4 Oct 2020) Median transacted price: $414,172.08 Meaning "long hill" in Malay, Bukit Panjang is a hilly estate that was once only accessible via bus and LRT. However, since the opening of the Downtown Line (DTL), Bukit Panjang is now served by a dedicated MRT line that links it to downtown Singapore in 30 minutes. Comprising a mixture of flats, condominiums and private housing, residents can now enjoy a seamless transfer to the MRT and LRT stations via the Bukit Panjang Integrated Transport Hub within Hillion Mall. Located next to Bukit Timah Hill and the water catchment area of Upper Seletar Reservoir, nature lovers can look forward to the park connectors linking Bukit Panjang Park and Zhenghua Park. #5: Hougang Flat Type: 4 Room HDB Town: Hougang Resale Registration Date: Sep 2020 Total number of records found: 64 (Data as at 4 Oct 2020) Median transacted price: $414,482.05 What's there not to love about the mature estate of Hougang? Known for its rich heritage and delicious hawker fares, Hougang is also home to several good schools such as Montfort Junior School, Holy Innocents' High School, Xinghua Primary School and Xinmin Primary School and Xinmin Secondary School. This has perhaps explained why Hougang is the fifth most transacted HDB estate in September 2020. Hougang is served by Hougang MRT station via the North East Line (NEL). By 2031, this station will be upgraded to an interchange station linking it to the Cross Island Line (CRL) spanning from Jurong Industrial Estate to Changi. Amenities wise, Hougang Central features two shopping centres, namely, Hougang Mall and Kang Kar Mall. #6: Bedok Flat Type: 4 Room HDB Town: Bedok Resale Registration Date: Sep 2020 Total number of records found: 55 (Data as at 4 Oct 2020) Median transacted price: $419,888.73 Bedok is the third mature HDB estate to make the list placing it at number 6. Home to an estimated 289,000 residents, Bedok is the largest planning area on the island offering a mix of HDB flats and private housing options. Accessible by Bedok MRT station on the East West Line (EWL), residents are now served by three more MRT stations namely, Kaki Bukit, Bedok North and Bedok Reservoir via the Downtown Line (DTL). By 2023, Bedok will welcome five more MRT stations via the Thomson East Coast Line (TEL) - Marine Terrace, Siglap, Bayshore, Bedok South and Sungei Bedok. The estate counts Bedok Mall, Bedok Interchange Hawker Centre, Bedok Point, Bedok Public Library and Bedok Polyclinic as among some of the amenities that can be found within the town centre. Food-wise, Bedok Interchange Hawker Centre is a foodie treasure trove known for its delightful but affordable cuisines ranging from chicken rice to Mee Rebus. #7: Jurong West Flat Type: 4 Room HDB Town: Jurong West Resale Registration Date: Sep 2020 Total number of records found: 51 (Data as at 4 Oct 2020) Median transacted price: $397,957.73 Ranking seventh is Jurong West which is home to Nanyang Technological University (NTU) and Jurong Industrial Estate. Currently accessible by MRT via Lakeside, Boon Lay, Pioneer and Joo Koon MRT stations on the East West Line (EWL), Jurong West will get its own dedicated MRT line by 2026. Called Jurong Region Line (JRL), this will be Singapore's seventh MRT line to serve both existing and future development in the western part of Singapore. When opened, it will connect Jurong Lake District to Jurong Industrial Estate, Jurong Innovation District, and the Nanyang Technological University (NTU). Comprising 24 stations over 24 km, JRL will have three interchange stations at Boon Lay, Choa Chu Kang and Jurong East MRT stations. Jurong Town Hall MRT station, in particular, will be an interchange station to the Kuala Lumpur - Singapore High Speed Rail line. #8: Woodlands Flat Type: 4 Room HDB Town: Woodlands Resale Registration Date: Sep 2020 Total number of records found: 47 (Data as at 4 Oct 2020) Median transacted price: $352,380.60 If you are looking for affordable housing options on the island that is in demand, then Woodlands should be on your bucket list. Under URA's Master Plan 2019, Woodlands is set to transform in the next 15 years via Woodlands Regional Centre. When completed, it is poised to take its place as the largest economic hub in northern Singapore. Some of the industry clusters that are envisioned to take shape here include business, industry, research & development, and learning & innovation. As we speak, Woodlands last year witnessed the opening of Woodlands North and Woodlands South MRT stations on the Thomson-East Coast Line (TEL). This is especially good news for those who need to commute to Johor Bahru regularly. When it is ready at the end of 2026, Woodlands North will allow commuters to transfer to the Rapid Transit System (RTS) link. #9: Pasir Ris Flat Type: 4 Room HDB Town: Pasir Ris Resale Registration Date: Sep 2020 Total number of records found: 46 (Data as at 4 Oct 2020) Median transacted price: $448,130.43 Located on the other end of the island, Pasir Ris conjures up images of rustic and laid back Singapore thanks to the numerous chalets and resorts that can be found here. Home to Lorong Halus Wetland and Pasir Ris Beach, the estate is currently served by Pasir Ris MRT station on the East West Line (EWL) that is integrated with the bus interchange. By 2031, however, the MRT station will be upgraded to an interchange station to the Cross Island Line (CRL) linking Pasir Ris to Punggol. Offering a good mix of HDB flats, condominiums and landed homes, Pasir Ris is home to two malls namely, White Sands and Elias Mall. Despite its far-flung location, prices for 4-room HDB flats here are the third most expensive after Punggol and Sengkang reflecting strong demand. #10: Ang Mo Kio Flat Type: 4 Room HDB Town: Ang Mo Kio Resale Registration Date: Sep 2020 Total number of records found: 39 (Data as at 4 Oct 2020) Median transacted price: $407,904.51 Ang Mo Kio is among one of the very first housing estates in Singapore making it the final mature neighbourhood to make it on the top ten list. Known for its delicious hawker food, Ang Mo Kio has a relatively older population with approximately one in five residents were aged 65 years and over in 2019, data from SingStats showed. The heart of Ang Mo Kio lies at its vibrant town centre located just next to the MRT station. Home to Ang Mo Kio Community Library, Ang Mo Kio Polyclinic and Market & Hawker Centre, the town centre has been rejuvenated over the years to cater to the younger generation. A new shopping mall called AMK Hub is now integrated with the transportation hub linking residents from the MRT station to Ang Mo Kio Bus Interchange. To make the transfer a seamless experience, residents can look forward to a wide array of amenities ranging from NTUC FairPrice to banking options at Bank of China and UOB. Meanwhile, further down the road, a new mall called Djitsun Mall offers four levels of dining, retail and edutainment and fitness experience. To meet the demands of the upwardly mobile, a private condominium called Centro Residences has also been built just across AMK Hub. There's more to come that will increase the attractiveness of Ang Mo Kio. Under the URA Draft Master Plan 2019, the estate will be rejuvenated with new housing precincts and amenities while retaining its current charms. In terms of connectivity, Ang Mo Kio will witness the additions of four new stations - Lentor and Mayflower MRT stations on the Thomson East Coast Line (TEL) and Bright Hill and Teck Ghee MRT stations on the Cross Island Line (CRL). Bright Hill will be an interchange station to the TEL and Cross Island Line (CRL). Meanwhile, Ang Mo Kio MRT station will be upgraded to an interchange station to the North South Line (NSL) and Cross Island Line (CRL). Infrastructure spending along these lines will act as property boosters for selected areas in Kuala Lumpur and Greater Kuala Lumpur By Khalil Adis The last time I was in KL was in January 2020 where I shared the growth areas along the different train lines at Havoc Hartanah. Despite not being able to physically be present in Kuala Lumpur now due to the Restricted Movement Control Order (RMCO), I wish to point out that there are growth area that prospective buyers and investors should watch out for. Here are the eight growth areas along the different train lines ranked from the least to most affordable*: *Note: 1. Property transactions are based on data captured on Brickz. 2. Monthly mortgage is based on a loan tenure of 35 years with an interest rate of 4.25%. 3. Affordability is based on the mortgage servicing ratio (MSR) capped at 30% of a borrower's gross monthly income of RM3,000. 4. A monthly mortgage of above RM900 is considered unaffordable. #1: Pusat Bandar Damansara Median transacted price: RM4,000,000 Monthly mortgage: RM16,484.18 Verdict: Least affordable Dubbed "the Beverly Hills of Malaysia", Damansara Heights is the most desired address in the country. This is a home among Malaysia's who's who and the address for those who have arrived. Pusat Bandar Damansara is also a growth area as it is located next to Damansara City. Comprising Menara Hong Leong, Wisma GuocoLand, DC Residency, DC Mall and Sofitel Kuala Lumpur Damansara, Damansara City is an Entry Point Project (EPP) which the Malaysian government had announced in September 2010 to take Kuala Lumpur to even greater heights under its Economic Transformation Programme (ETP) roadmap. Soon, it will be home to Pavilion Damansara Heights. Set to open its doors come 2020, the mall will feature 1.17 million sq ft of retail therapy. Amenities here are aplenty to cater to the discerning tastes of the affluent. From high-end grocers at Ben's Independent Grocer to organic restaurants, the lifestyle choices to live the good life here are endless. #2: Bandar Utama Median transacted price: RM1,050,000 Monthly mortgage: RM4,327.10 Verdict: Least affordable Bandar Utama needs no introduction. Home to 1 Utama Shopping Centre, The Curve, IKEA, AEON Bandar Utama, One World Hotel and KPMG Tower, this bustling township comprises mainly landed homes making it ideal for those who prefer a low-density living environment. Previously, Bandar Utama was very inaccessible. However, since the commencement of the Sungai Buloh - Kajang Line (SBK Line) on 16 December 2016, accessibility to Bandar Utama has been greatly enhanced. In addition, a new 35-metre pedestrian link-bridge now connects the station's Entrance B to One World Hotel near the newly relocated Zuan Yuan Chinese Restaurant and the Ground Floor of 1 Utama. By November 2023, Bandar Utama MRT Station will serve as an interchange station to the LRT Bandar Utama-Klang Line (Klang Valley LRT Line 3). Costing RM16.63 billion, this 37km line will span from Bandar Utama to Johan Setia station with a total of 19 stations. When completed, it is expected to serve 2 million commuters residing in the Western Corridor of Klang Valley. #3: Subang Jaya Median transacted price: RM585,000 Monthly mortgage: RM4,327.81 Verdict: Medium affordable Before the advent of Transit Oriented Developments (TODs), Sime Darby has been actively promoting this concept in its township development spanning from Subang Jaya to Ara Damansara. Subang Jaya is a bustling township that is served by the Kelana Jaya LRT Extension Line which became fully operational in 2016. This extension is part of the government's initiative to extend public transportation to residents living in the southwestern part of Selangor such as Subang Jaya and to Puchong. Comprising 13 new stations and covering a distance of 17.4 km, this new extension will bring the total length of the Kelana Jaya LRT Line from 29 km to 46.4 km. The LRT extension line spans from Lembah Subang to Putra Heights and costs RM8 billion to construct. Connectivity to the airport was recently enhanced in May 2018 via the Skypark Link service that you can catch from Subang Jaya LRT station to Terminal Skypark station. Costing RM533 million to build, the Skypark Link spans some 24km from KL Sentral to Terminal Skypark. #4: Jalan Pudu Median transacted price: RM824,585 Monthly mortgage: RM3,398.15 Verdict: Medium affordable Smacked in between Tun Razak Exchange and Bandar Malaysia, Jalan Pudu is located within KL's "Golden Triangle". The former is almost completed and is served by the Tun Razak Exchange (TRX) MRT station while the latter will be served by Bandar Malaysia (North) MRT station. TRX will be Malaysia's first dedicated financial district with a gross development value (GDV) of RM40 billion and with a total gross floor area of 20 million square feet. This iconic project is part of the Malaysian government's Economic Transformation Programme (ETP) to strengthen Kuala Lumpur as the country's financial capital. Bandar Malaysia will have a gross development value (GDV) of RM150 billion. It will house the High Speed Rail station and two MRT stations - Bandar Malaysia North and Bandar Malaysia South. Bandar Malaysian North will be an MRT station on its own serving the huge mixed-use development. The site area is around 196 hectares and will comprise 27,000 quality and affordable homes. There will also be a dedicated commercial district to support new start-ups as well as small and medium-sized enterprises (SMEs). #5: Cyberjaya Median transacted price: RM512,000 Monthly mortgage: RM2,109.98 Verdict: Medium affordable Located on the southernmost tip of Puchong, Cyberjaya is poised to enjoy the economic spillover benefits from three major government projects - KLIA Aeropolis, Malaysia Vision Valley and Cyber City Centre in Cyberjaya. The growth areas here will be near Sierra and Cyberjaya City Centre MRT stations. Being a relatively new township development, Sierra holds the most promise for capital appreciation of property values as many infrastructure projects (including the Sierra MRT station) are still underway. It also with 10 minutes drive to the bustling township of Puchong where it is home to many mega malls and trendy cafes. Sierra is home to only landed homes at the moment. Meanwhile, Cyberjaya City Centre MRT station is a transit-oriented development (TOD) project to be developed by Malaysian Resources Corp Bhd (MRCB). With its experience in building the transport hub in KL Sentral, MRCB will be developing a new city that will be integrated with the MRT station. Phase one is expected to generate a gross development value (GDV) of RM5.35 billion. It will feature a 200,000 sq ft convention centre, a 300- to 400-room business hotel, low and high-rise office buildings and a retail podium. Cyberjaya City Centre will have a development plan spanning 20 years. The MRT station is located just opposite Lim Kok Wing University of Creative Technology. #6: Sungai Besi Median transacted price: RM510,000 Monthly mortgage: RM2,101.73 Verdict: Medium affordable Sungai Besi is located in a growth area in between Bandar Malaysia and Cyberjaya City Centre. There are still homes in the secondary market priced below RM500,000 here. Home to NSK Kuchai Lama and Terminal Bersepadu Bandar Tasek Selatan, Sungai Besi will be served by the upcoming Sungai Besi MRT station via the Sungai Buloh-Serdang-Putrajaya (SSP Line ). Meanwhile, Sungai Besi LRT station will be upgraded to an interchange station to connect commuters to this MRT station built adjacent to it. When completed, it will also serve as an interchange to the upcoming High Speed Rail station. Sungai Besi is strategically located and is highly accessible up north to downtown KL and down south to Putrajaya and Cyberjaya via the Sungai Besi Highway. #7: Nilai Median transacted price: RM215,000 Monthly mortgage: RM886.03 Verdict: Most affordable Nilai is poised for further growth as it is located within the Malaysia Vision Valley. Covering Nilai to Port Dickson, it will have a proposed area of 108,000 hectares. The upcoming industries include high tech, logistics, education, health, tourism and sports. The Malaysia Vision Valley is expected to create some 1.35 million jobs by 2035 and investments of more than RM417.6 billion by 2045. To support the Malaysia Vision Valley, the Seremban HSR station will be sited in Nilai within the Labu and Kirby estates. Seremban HSR station will also be an interchange station to the Seremban Komuter Line and KTM Electric Train Service. #8: Bandar Baru Nilai Median transacted price: RM166,955

Monthly mortgage: RM688.03 Verdict: Most affordable Bandar Baru Nilai is a growth area as it is located near to upcoming economic drivers in the pipeline that will include the Malaysia Vision Valley, KLIA Aeropolis and Cyberjaya City Centre. It also close to KLIA and KLIA2 that is served by Express Rail Link (ERL) comprising KLIA Express and KLIA Transit. Soon, connectivity will be further enhanced via the Bangi-Putrajaya HSR station. The station will be located in the south of Klang Valley and within the state of Selangor at Kampung Abu Bakar Bagindar. There is also a proposed connection to the Putrajaya Monorail that will connect this station to Putrajaya Sentral MRT station. When completed, it will serve as an interchange station to Putrajaya Sentral Express Rail Link (ERL) and link commuters to KLIA and KLIA2. A combination of COVID-19, an oversupply in residential properties and a lukewarm economy have made it a buyer’s market. By Khalil Adis Buying a property in Malaysia is a complex process unlike in Singapore. Being a small country, one can rely on the Urban Redevelopment Authority’s (URA) masterplan to check for planning developments that will be taking place in the next 30 to 40 years. In Malaysia, however, such information is scant making property buying an arduous and risky process. When looking to buy a property, you should target the most affordable property but with the greatest potential for capital appreciation. How can you do that? Easy, simply by applying the following 5Cs: #1: Check the masterplan A masterplan would typically define a township’s development in the next one to two decades. It would also showcase the different designated land use and transportation plans within that particular township. An area deemed highly desirable will attract businesses and residents. Think about why properties in KLCC and Bukit Bintang are expensive whereas other areas like Bukit Beruntung are not popular. With this in mind, you should find out as much as possible about your new neighbourhood. #2: Check the transport masterplan Generally, properties close to transportation hubs such as MRT or LRT stations can command a premium of between five and 10 per cent over the long term. This is because people generally want to live close to transportation hubs explaining why Transit Oriented Developments (TODs) have become very popular in KL and Greater KL. This demand translates to an appreciation of one’s property. Are there MRT or LRT stations that are being planned in your area? What about expressways? Study the upcoming Sungai Buloh-Serdang-Putrajaya (SSP Line) and LRT Bandar Utama–Klang Line (Klang Valley LRT Line 3) prior to your property purchase. #3: Check budget allocation from the government Government policies do have an indirect impact on a property. For example, budget allocation for improvements in public infrastructure and new economic drivers will have an impact on new and existing homes in and around the vicinity. So check where the government is building new hospitals and so on. One good example is the development of the Malaysia Vision Valley in Negri Sembilan. #4: Check for economic drivers Have you ever wondered why properties in KLCC are so expensive? This is because it is home to a number of industries such as petrochemical, banking, finance, tourism and so on. The best strategy is to buy in an area that is not yet developed but where there are plans for various economic drivers. A government-mooted economic corridor or a reputable developer that has experience in building townships are great indicators if the area will succeed or not. #5: Check for job creation This is like feeling someone’s pulse.

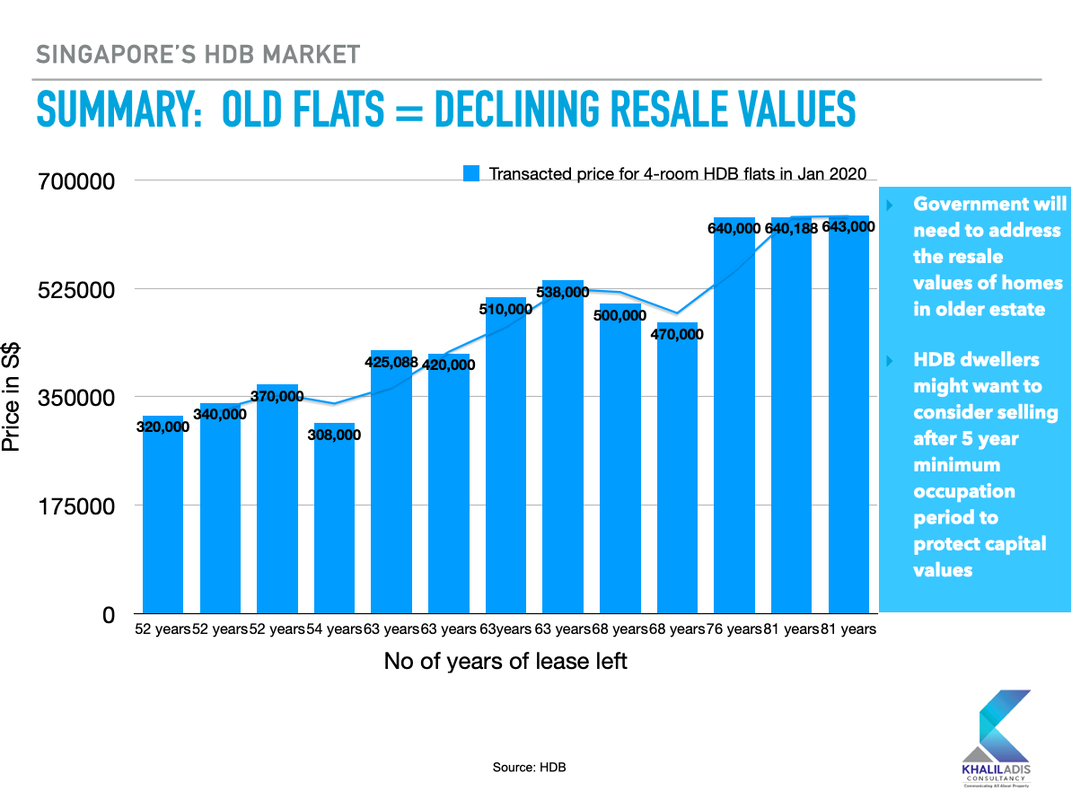

You need to check if the township you are eyeing for is going to be a ghost town or a happening place. If it is the former, perhaps you should stay away. If it is the latter, more and more workers will be drawn there, becoming a magnet for people and a hive of activity. People are the lifeblood of a neighbourhood. As the area becomes highly desirable, people will naturally want to live and work in and around the vicinity. As there is an increase in demand, property prices in that area will also rise. That is how a property appreciates over time. Good luck in your property hunt! A top neighbourhood in the HDB resale market, Sengkang is a good indicator of the changing mood and aspirations of young Singaporeans. By Khalil Adis Having a newly carved GRC and heavy weight political office holders are generally the necessary ingredients to ensure a clean sweep during Singapore's General Election. However, that does not appear to be the case in 2020. As seen during the recently concluded election, even having the labour chief and a Senior Minister of State in the Ministry of Health and the Ministry of Transport could not save Sengkang GRC from its electoral defeat. Helmed by Ng Chee Meng together with Dr. Lam Pin Min, Amrin Amin and Raymond Lye, the election witnessed Sengkang GRC falling into the hands of the relatively young and inexperienced team from The Workers' Party. Comprising He Ting Ru, Jamus Lim, Raeesah Khan and Louis Chua, The Workers' Party emerged victorious with a 52.13 per cent win against the PAP's 47.87 per cent. The rejection of both the NTUC chief and transport minister speaks volume on how the electorate feels about employment and transportation issues. In Sengkang GRC's case, they are both intertwined. Last November, Dr. Lam announced in Parliament the banning e-scooters which saw the livelihoods of many food delivery drivers affected overnight. The ban appeared to be the last straw that broke the camel's back. Despite a closed-door session at Sengkang West constituency with Dr. Lam himself and a S$7 million assistance package, the session was reportedly a tense one. Elsewhere in other constituencies, many PMD riders had also expressed their disappointment with their respective MPs. Meanwhile, the younger team from The Workers’ Party was a breath of fresh air and appeared closer to the ground. They were humble and earnest yet are backed with a strong track record in their respective fields. Jamus Lim, in particular, won over many Singaporeans’ heart during his live televised debate. Even the police report filed against Raeesah Khan could not sway voters' opinion. So what gives? Young neighbourhood As a district, Sengkang has a relatively young population. According to data from SingStats, the total population of Sengkang was 244,600 in 2019. Of this, 159,840 or 65.34 per cent were aged 45 and below. If we were to break this down further, 213,380 or 87.23 per cent live in HDB flats. Of this, the majority of them (99,640 or 46.69 per cent) live in four-room flats. The young population is worried about bread-and-butter issues such as jobs and social mobility. A segment of these HDB dwellers were food delivery drivers trying to supplement their incomes. That is until the ban of e-scooters affected their livelihoods. Amid the COVID-19 pandemic, this has helped further exacerbate the unhappiness on the ground which has perhaps translated to protest votes on the ballot box. The 'Jamus Lim' effect Then, there is also the 'Jamus Lim' effect. A newcomer to the political arena, he mesmerised Singaporeans by being able to hold his own when pitted against the more experienced and senior politician, Dr. Vivian Balakrishan. His message of not wanting to give the PAP "a blank cheque", seemed to resonate with many Singaporeans. He subsequently became a trending topic on social media - a medium that is highly popular among young voters . This, plus the rejection of gutter politics, as seen in the Raeesah Khan case, suggests that young and educated voters appreciate a clean fight and want checks and balances. It also suggests that they are looking beyond municipal issues such as social inequality. Clearly, character assasination and dangling carrots no longer work. Sengkang is the most popular estate for HDB resale flats Politics aside, Sengkang is the most popular HDB estate where 1,795 resale flats changed hands in 2019, according to data from the HDB. This was followed by Woodlands and Yishun at 1,794 and 1,791 transactions respectively. According to HDB's first quarter of 2020 data, resale HDB flats in Sengkang were transacted at a median resale price of S$340,000, S$425,000, S$480,000 and S$565,000 for three-, four- and five-room flats respectively. While there are other attractive mature estates with better amenities such as Toa Payoh and Ang Mo Kio, their resale value have nose-dived in recent years due to their diminishing number of leases left. Meanwhile, the resale value of homes in newer estates like Sengkang appear to be better protected. This has perhaps explained why Sengkang is a popular neighbourhood among young families. The lure of living in Sengkang One such person who is currently looking for a home here is property agent Ady Ahmari. “The flats in Sengkang are younger but cheaper, especially in Anchorvale,” he said. Another reason is their generous sizes which is something he can attest to. The property agent sold a 1,130 sq ft four-room flat in the area two months ago for S$350,000. “The units are very big and comparable to five-room Built-To-Order (BTO) flats which are around 1,184 sq ft,” he said. Perhaps one surprising intangible reason that he is lured to looking for a home here is the parks. “Sengkang has a big garden where my family can enjoy the outdoors,” he said. Indeed, Sengkang Riverside Park is popular among residents here featuring a constructed wetland and is rich in biodiversity. In fact, the Sengkang ActiveSG Gym which is located within Anchorvale Community Club is the only such gym of its kind in Singapore offering a scenic river view of the Sengkang Riverside Park. Amenities aside, Ahmari said having an opposition party there has also influenced his decision. “I need an alternative voice,” he said. Swing towards opposition could be due to declining resale value of HDB homes Homeownership and their property value are closely tied to voters sentiment. Let's look into the case of Toa Payoh HDB estate which falls under the Bishan - Toa Payoh GRC. In the 2015 General Election, the PAP scored a victory with 73.59 per cent of the vote share against the Singapore People's Party (SPP). However, the recently concluded election saw a vote swing of 6.33 per cent towards the SPP at 32.74 per cent. While the PAP won by 67.27 per cent, its support saw a decline of 6.33 per cent. Likewise, in other mature estates such as Ang Mo Kio GRC and Tanjong Pagar GRC, the PAP witnessed a vote swing towards the opposition at 6.72 per cent and 14.58 per cent respectively. Conclusion The endorsement of Sengkang GRC of The Workers' Party is reflective of the changing mood and aspirations of young Singaporeans.

Yes, they want a strong and capable government. However, they also want a government who listens to them and not one who bulldozes through policies. Some of these policies include the India-Singapore Comprehensive Economic Cooperation Agreement (CECA) which they believe have contributed to social inequalities (CECA became a hot-button national topic last year when Erramalli Ramesh was caught on video verbally abusing a Singaporean security guard at a condominium). They also want a government that does not resort to hitting below-the-belt when it comes to their political opponents. While the PAP has retained power in many estates, the vote swing towards the opposition could also suggest that older voters want the diminishing value of their homes addressed. As one elderly person that I spoke to puts it: “This is not what was promised by Lee Kuan Yew”. 9After a two month lockdown, Singapore is slowly easing its Circuit Breaker measure under Phase Two which began after June 18 at 2359 hours. Taken between 10.30am to 9pm on June 26, the Lion City is slowly buzzing back to life as it readies itself for its most challenging general election to be called on July 10. According to the Ministry of Health, the city-state recorded a total of 43,661 COVID-19 cases as of 28 June. By Khalil Adis As Malaysia eases its Movement Control Order (MCO), the Malaysian property market is set for a major reboot as COVID-19 will forever change the way the industry operates. Here are our top eight predictions. By Khalil Adis  Malaysia is expected to enter a recession this year. Photo: Khalil Adis Consultancy. Malaysia is expected to enter a recession this year. Photo: Khalil Adis Consultancy. The Malaysian economy has bucked the trend growing by 0.7 per cent in the first quarter of 2020 from the 3.6 per cent growth in the previous quarter, data from the Department of Statistics Malaysia (DOSM) showed. However, the coronavirus pandemic has wreaked havoc in the job market with the unemployment rate increasing to 3.5 per cent compared to the 3.2 per cent recorded in the previous quarter. "The increase in the unemployment rate was mainly attributed to the adverse impact of the Movement Control Order (MCO) on the labour market," said chief statistician Dato' Sri Dr. Mohd Uzir Mahidin Meanwhile, employed persons in Malaysia increased to 1.6 per cent to 15.24 million persons in the first quarter of 2020. The DOSM noted that the highest unemployment rate in Malaysia was in 1986 at 7.4 per cent. Meanwhile, Bank Negara's Economic and Monetary Review 2019 stated that Malaysia's GDP growth is projected to be between -2.0 per cent to 0.5 per cent this year. Noting that 2020 is "an exceptionally challenging year for the global economy", Bank Negara said global growth is expected to contract. "While the Movement Control Order and measures to promote social distancing will dampen economic activity temporarily, they are necessary to contain the spread of the virus," Bank Negara said in a statement. In terms of the construction sector, DOSM's data showed that it contracted 7.9 per cent from 1.0 per cent in the preceding quarter. This is the lowest growth since the second quarter of 1999. Moving forward, Dato' Sri Dr. Mohd Uzir Mahidin predicted that Malaysia is projected to record an unemployment rate of between 3.5 per cent and 5.5 per cent this year due to the impact from COVID-19 With the World Health Organization warning that COVID-19 "may never go away", a new normal in the property sector will emerge influencing how Malaysians will live, work and play. Here are our top eight predictions arising from COVID-19: #1: Property market will be extremely muted in 2020 The uncertainty arising from COVID-19 will have an impact on consumer spending. Malaysia is expected to enter a recession this year resulting in job losses. As such, consumers will prefer to hold on to cash amid the uncertainties ahead. This will likely worsen the supply glut that Malaysia is already experiencing at the moment. According to data from the National Property and Information Centre (NAPIC), as of 2019, Malaysia has an existing stock of 5,727,814 residential units. In addition, it has an incoming supply and planned supply of 443,161 units and 441,309 units respectively bringing the total supply to a whopping 6,612,284 units. Developers with unsold inventory, especially in the medium to high-end segment, will be faced with a double whammy. They either have to drop prices to entice local buyers or continue to bleed as border controls imposed in the country means foreign investors are not allowed to enter Malaysia to view properties. Either way, the prognosis does not look very good for the market. Developers with strong branding, cash flow and who are offering affordable homes for locals will come out as winners amid this pandemic. As we speak, some developers are currently rolling out Ramadan and Hari Raya packages with a low deposit of RM1,000 to continue enticing buyers. However, whether or not buyers will be able to get a bank loan is another matter altogether. #2: Office space demand will decrease As businesses cut costs and working from home becomes the new norm, we can also expect a glut in office space supply to increase, particularly for Grade 'A' office. According to data from NAPIC, as of 2019, Malaysia has an existing stock of 2, 549 office buildings with 22, 590, 473 sq m of space. As more companies adopt the remote working model for good, existing office buildings will need to reconfigure their current space to factor in social distancing requirements. Operators of coworking spaces and landlords will thus need to refurbish existing office spaces to continue attracting tenants. New health requirements such as temperature takings and hand sanitisers may also translate to higher operating costs. Meanwhile, developers with incoming and planned office supply in the pipeline will need to go back to the drawing board to redesign their office plans resulting in reduced floor density. Data from NAPIC showed that Malaysia has an incoming and planned office supply of 51 buildings (2, 378, 131 sq m) and 15 buildings (398, 944) respectively as of 2019. This sector will face downward pressure in their asking prices as more companies adopt a work from home policy. Overall, the vacancy rate across Malaysia is expected to increase, further exacerbating the supply glut in the office market. Developers who have already secured corporate tenants for upcoming office buildings in Kuala Lumpur such as Tun Razak Exchange (TRX) and Merdeka 118, before COVID-19 struck, are likely to emerge stronger from the crisis. #3: Construction costs will increase due to late delivery of projects The MCO restrictions have resulted in construction delays across all sectors of the property market. During the MCO, construction sites were closed while materials which were sourced from overseas were impacted from the shut down of the global supply chain. With the MCO now eased, construction has now restarted but with temperature screenings, staggered working hours and social distancing in place. With construction now delayed by two to three months and with new safety requirements, we can expect construction costs to increase. This will likely be passed on to consumers. Whether or not such new projects can attract buyers with a higher per sq ft price remains to be seen due to the uncertainty in the economy and the job market. Buyers with cash in hand may instead look to the secondary market where prices are more realistic. #4: Tourism, food & beverage, transportation, travel, retail and hotel industries will be adversely affected The MCO has seen a knock-off effect on the tourism, food & beverage, travel, retail and hotel sectors due to international and local travel restrictions. According to the Malaysian Association of Hotels (MAH), approximately 15 per cent of hotels in the country may have to shut down their operations. Data from NAPIC showed that as of 2019, Malaysia has an existing stock of 3,404 hotels with 266, 972 rooms. Several of these hotels, located in tourism hot spots such as Kuala Lumpur, Ipoh and Melaka, have now ceased operations or are in the process of being auctioned off. With a planned and incoming supply of 114 hotels with 24,161 rooms and 74 hotels with 14,810 rooms respectively, we can expect demand for the hotel sector to remain muted. As it is, hotel operators are already facing stiff competition face from owners of Airbnb units. So, until a vaccine is found, the hotel and Airbnb sectors will continue to bleed. For hotels that are in the planned and incoming supply, they are faced with a dire situation to continue operations but where demand from tourists are far and few between. It remains to be seen whether the construction of such hotels will continue or if they will be cancelled altogether. Either way, they will be likely operating in the red. The only exception is hotels which have been gazetted as quarantine areas. For Airbnb owners, you might want to convert your units to long-term leases or student accommodations in the time being. #5: Retail sector will see many businesses cease operations While shopping centres can now operate, the damage is already done. The MCO that kicked in on March 18 means that businesses are greatly impacted as malls are forced to closed. Combined with running overheads such as cleaning costs, rent, wages, refurbishing damaged goods and other operating costs, shop owners are under great financial stress to either continue operation or wind down their business for good. Either way, human traffic will not return to normal due to social distancing requirements. As such, we can expect small to medium retail outlets and F&B outlets, particularly those leasing spaces at high-end malls to shutter. Instead, they will switch to online shopping. #6: Digital-related, food, healthcare, pharmaceutical and wellness sectors will thrive Digital-related sectors such as online shopping, delivery, technology and website hosting will thrive amid the pandemic as working from home now becomes the new norm. Developers and agents will need to adapt to changing market situation via contactless procedures such as conducting online viewings and meetings to close sales. For instance, online property portals such as iProperty.com are coming up with innovative ways to help their clients sell property online. In a post-pandemic world, Zoom meetings have now become ubiquitous. This is also an ideal time for individuals to start a side hustle such as small home-based business selling cookies online to supplement their income COVID-19 also means increased demand for food, healthcare, pharmaceutical and wellness industries. On March 27 2020, the Malaysian government announced a second stimulus package to combat COVID-19. For instance, an extra RM500 million has been allocated to purchase medical equipments, such as ventilators, personal protective, lab and ICU equipments. Meanwhile, another RM1 billion is allocated for the purchase of medical equipment and expertise from private healthcare services. #7: Tenants from healthcare industry will drive the rental market With RM1.5 billion in total allocated to support the healthcare sector, this presents good news for investors who are holding on to vacant Airbnb units or landlords who are located close to such industries to seek out such tenants. Having said that, the rental market in Malaysia is very soft at the moment so the rental income may or may not cover your mortgage. As data from NAPIC showed earlier, Malaysia has an existing stock of 5,727,814 residential units as of 2019. This will increase in 2020 arising from the supply from incoming and planned units. While some investors may have to top up cash, having a negative cash flow is better than leaving your units untenanted. Investors should seize this opportunity. #8: 2020 is about business consolidation As long as there is no vaccine found, business activities will never return to normal.

Forget about whatever business plans that you have planned in 2019. Instead, brace yourself for a long, cold, winter ahead. Consolidation will be the new normal for this year as many developers and industry players will focus on conserving cash. Leveraging on digital technology will be the new norm. We can expect pay cuts, hiring freezes and retrenchments as businesses cut losses on non-revenue generating departments. We have already seen certain developers doing this and establishing working from home permanently. This is the time to learn a new skill, read books and focus on self-development to continue staying relevant in your respective fields. As morbid as it may seem, estate planning is crucial and timely especially since we are in the middle of a pandemic. By Khalil Adis Death is a taboo topic that no one likes to talk about. However, it is important to discuss it with our family members as we never know what might happen to us, especially since we are faced with rising COVID-19 cases worldwide. Even if we eventually emerge victorious against this disease, at least we have made the necessary preparations should something untoward happen to us. Also, it prevents any family disputes on how your assets will be given away upon your death. Before going in-depth with this article, I wish to state that different laws apply to Muslims and non-Muslims. For today’s article, I will concentrate solely on Muslims. I recently spoke to a lawyer and an HDB officer. These are my findings that I would like to share with readers. Muslims For Muslims in Singapore, you are permitted to make a will under Section 111 of the Administration of Muslim Law Act (AMLA) to dispose of your assets upon death. However, your will (or wasiat) must comply with the conditions of, and is subject to the restrictions imposed by the school of Muslim law professed by you. Section 112 of the AMLA states that the distribution of a Muslim’s estate must be according to the Muslim law. Under this section, the assets of a deceased Muslim who was domiciled in Singapore at the time of their death shall be distributed in accordance with the principles of Muslim law and Malay custom (where applicable). In this case, the distribution of assets will be distributed through the principles of Faraid. Faraid generally applies to your assets which have not been given away under your will to your heirs or beneficiaries. However, Faraid does not apply to the following excluded assets: Property held under a joint tenancy Under a joint tenancy, the right of survivorship means the surviving joint-owner gets 100 per cent ownership of the property. For instance, if you own the property with your husband or wife, your husband or wife gets 100 per cent of the property depending on who is the surviving party. Let’s say, you pass on, then your share cannot be distributed to your heirs or beneficiaries under Faraid. This is the position that is taken by the Majlis Ugama Islam Singapura (MUIS) and by the civil law courts in Singapore under the 2019 ruling. You can read more about it here Nominated Central Provident Fund (CPF) monies If you have made a nomination for your CPF monies to your wife, then the monies must be distributed to her only. Nominated life insurance policy benefits/payouts Likewise, if you have nominated your wife to receive your insurance policy benefits/payouts upon your death, then only she is entitled to receive the policy benefits/payouts. You heirs or beneficiaries do not get anything. Harta sepencarian or assets jointly acquired by a deceased Muslim Harta sepencarian has its origins in Malay customs. Section 112 (3) states that a Muslim who dies intestate (without a will), the court may make an order for the division of the harta sepencarian or jointly acquired property in such proportions as to how the court may deem fit. Again, your heirs or beneficiaries are not eligible for this. Assets given away under a will Assets that are given away under your will must be given away to the beneficiary or beneficiaries. Your heirs and other beneficiaries are not eligible if they are not named in the will. What if I am a Muslim and I die without a will? In this scenario, Section 112 (1) states that your estate and effects shall be distributed according to the Muslim law as modified, where applicable, by Malay custom. Also section Section 112 (2) states that this section shall apply in cases where a person dies partly intestate (partly without a will) as well as in cases where he dies wholly intestate (without any will). This means the principles of Faraid will apply to all your assets except for a property that is held under joint tenancy. For example, your CPF monies and life insurance policy benefits/payouts will be distributed under the principles of Faraid to your heirs and beneficiaries. What if am a Muslim and my property is held under tenancy-in-common? Under tenancy-in-common, both parties hold a percentage of shares in the property (for example, 50 per cent - 50 per cent). Upon your death, your share will be distributed according to your will. If you do not have a will, then the principles of Faraid apply. This means your share will be distributed according to Islamic laws to your heirs or beneficiaries. What if I am a single Muslim and I am the sole owner of my property? This will apply for those of you who had bought a flat under the Singles Scheme. If you did not make a will, then Section 112 of the AMLA applies. This means that the distribution of your estate must be made according to Muslim law through the principles of Faraid. If you had made a will, then there will be an executor of your estate and your property may be inherited by your beneficiary. For the avoidance of doubts, you should speak with a private solicitor. What if I have an outstanding loan? HDB flat owners are protected under the Home Protection Scheme (HPS) which is administered by the CPF Board.

Under this scheme, you and your family are protected from losing your HDB flat in the event of death, terminal illness or total permanent disability before your mortgage is paid up. You can read more about it here. However, this only applies if you are paying your mortgage via your CPF savings. If you are paying cash to service your mortgage, the HPS is optional. According to the CPF Board, in this scenario, you are "strongly encouraged to apply for an HPS cover if you are an owner of the flat and if you do not have adequate financial protection for your share of outstanding housing loan". Your eligibility for HPS coverage is subject to approval and you being in good health. If you are the sole owner or if you did not make a will and if your property is to be sold on the market, the proceeds will be used to clear the remaining loan balance before your beneficiary receives the cash proceeds from the sales. If you are the sole owner, paying by cash and if you had made a will, then your beneficiary or beneficiaries will then need to service your remaining loan. Again, please speak to a private solicitor for the execution of your estate. With the virus now declared a global pandemic, it is as though we are forced us to slow down and reflect on what really matters. By Khalil Adis I woke up today feeling like the universe had pressed a reset button forcing the entire world to slow down. This came amid the rising number of COVID-19 infections outside Singapore. It all started from a nightmare I had over the weekend where I had dodged several black coloured snakes. I think they were meant to symbolise the coronavirus. Meanwhile, next door, I could hear my mother coughing loudly the entire night. I wondered if she had caught the virus and if so, will she survive? I had read that the elderly are particularly susceptible to the virus and the fatality rate is high. I also wondered if I had enough resources as a caregiver should she fall ill. It’s funny how it is usually the unmarried child who ends up taking care of their parents while their married siblings are noticeably absent. Then, it got me thinking if I had saved enough for my retirement and what will happen to me upon death. In introspective mode As morbid as it may seem, COVID-19 had forced me into a period of introspection. I found myself asking questions I never did. For a while, I was going through life on an autopilot mode, especially in this age of social media where everything seemed so fast-paced. As a result, I would often write articles in listicle format as readers nowadays want bite-sized news as opposed to analytical pieces. It’s a recurring problem fellow journalists had also complained about as they are increasingly being replaced by content marketers for ‘click-bait contents’. It felt as though we were not making an emotional connection with our readers. Yet, amid COVID-19, here I am writing on my blog as to how I would usually write in my journal entries. A global pandemic Last week, the World Health Organization (WHO) officially declared COVID-19 as a pandemic. Everything now appears to have ground to a screeching halt with the restricted movement order that kicked in on Wednesday in Malaysia and containment efforts within Singapore. The Singapore government on Sunday announced a new 14-day stay-home notice that will take effect from 11.59 pm on March 16 for all travellers with a recent travel history to ASEAN countries, Japan, Switzerland or the United Kingdom. This comes as Singapore and Malaysia are reporting a daily spike in new infections. Meanwhile, for the first time in Singapore’s history, Friday’s prayers were cancelled islandwide amid new clusters of infections that were linked to the Sri Petaling mosque outbreak last week. It will continue to be closed till March 26. It’s a strange feeling passing by mosques that remained closed. All these new measures will definitely have an impact on the economy and especially for small businesses. In the property market, events are now either being postponed or cancelled. My developer clients are now working from home. This will not bode well for Singapore and Malaysia as both countries are facing a supply glut in residential properties. It is as though the entire world is forced to slow down and connect with each other on a humane level. Moving forward My friends and relatives had previously admonished me for writing about what I go through saying it may not be good for business.

Somehow, during a time of crisis, sharing about our personal struggles seemed relevant as they make us more relatable as a human being. Do I worry about business amid COVID-19? Yes, of course. On a side note, as much as I would like to launch my book, this is very much dependent on getting sponsors on board. With the lull property market and developers cutting back on their marketing budget, it does appear challenging. It also does not help that Malaysian developers generally prefer to meet in person and do not respond well over e-mail. However, I now see it as a blessing amid what the world is going through at the moment - it is not a good time. Nevertheless, I do hope the book will see the light of day as it contains nuggets of useful information on the various train lines in Malaysia since I started researching about them in 2008. I wished a similar property guide book was written in Singapore when the city-state started building its MRT system in the 1980s. In the meantime, let us stay healthy, remain calm and vigilant during this difficult period. |

Khalil AdisAn independent analysis from yours truly Archives

July 2023

Categories

All

|

100 Peck Seah Street

|

|

RSS Feed

RSS Feed